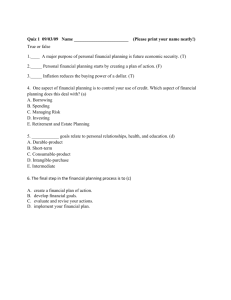

Chapter 4: Managing Your Money Lecture notes Math 1030 Section C

advertisement

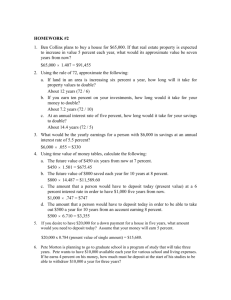

Chapter 4: Managing Your Money Lecture notes Math 1030 Section C Section C.1: The Savings Plan Formula The savings plan formula Suppose you want to save money for some reason. You could deposit a lump sum of money today and let it grow through the power of compounding interest. But what if you don’t have a larger lump sum to start such an account? For most people, a more realistic way to save is by depositing smaller amounts on a regular basis (savings plan). We have the following savings plan formula: h (nY ) i 1 + APR − 1 n A = PMT × APR n where A = accumulated savings plan balance P M T = regular payment (deposit) amount AP R = annual percentage rate (as a decimal) n = number of payment periods per year Y = number of years Ex.1 Suppose you deposit $100 into your savings plan at the end of each month. Further, suppose that your plan pays interest monthly at an annual rate of AP R = 12%, or 1% per month. What is your balance at the end of 3 months? 1 Chapter 4: Managing Your Money Lecture notes Math 1030 Section C Ex.2 Retirement plan. At age 30, Michelle starts an IRA (Individual Retirement Account) to save for retirement. She deposits $100 at the end of each month. If she can count on an AP R of 6%, how much will she have when she retires 35 years later at age 65? Compare the IRA’s value to her total deposits over this time period. 2 Chapter 4: Managing Your Money Lecture notes Math 1030 Section C Section C.2: Planning Ahead with Savings Plans Planning ahead with savings plans Most people start savings plans with a particular goal in mind, such as saving enough for retirement. For planning ahead, the important question is this: Given a financial goal (the total amount A desidered after a certain amount of years), what regular payments are needed to reach the goal? Ex.3 College savings plan at 7%. You want to build a $100, 000 college fund in 18 years by making a regular, end-of-month deposits. Assuming an AP R of 7%, calculate how much you should deposit monthly. How much of the financial value comes from actual deposits and how much from interest? 3 Chapter 4: Managing Your Money Lecture notes Math 1030 Section C Ex.4 A confortable retirement. You would like to retire 25 years from now, and you would like to have a retirement fund from which you can draw an income of $50, 000 per year, forever!! How can you do it? Assume a constant APR of 9%. You can achieve your goal by building a retirement fund that is large enough to earn $50, 000 per year from interest alone. In that case, you can withdraw the interest for your living expenses while leaving the principal untouched. The principal will then continue to earn the same $50, 000 interest year after year. What balance do you need to earn $50, 000 annually from interest? Let’s assume you will try to accumulate this balance of A = $556, 000 by making regular, monthly deposits into a saving plan. 4 Chapter 4: Managing Your Money Lecture notes Math 1030 Section C Section C.3: Total and Annual Return Definition of total and annual return In examples so far, we have assumed that you get a constant interest rate for a long period of time. In reality, interest rates usually vary over time. Consider an investment that grows from an original principal P to a later accumulated balance A. The total return is the relative change in the investment value: (A − p) p The annual return is the annual percentage yield (APY) that would give the same overall growth. The formula is ( Y1 ) A −1 annual return = p where Y is the investment periods in years. total return = Ex.5 Consider a case in which you invest a starting principal of $1, 000 and it grows to $1, 500 in 5 years. Although the interest rate may have varied during the 5 years, we can still describe the change in both total and annual terms: 5 Chapter 4: Managing Your Money Lecture notes Math 1030 Section C Ex.6 Mutual fund gain. You invest $3000 in the Clearwater mutual fund. Over 4 years, your investment grows in value to $8400. What are the total and annual returns for the 4-year period? 6 Chapter 4: Managing Your Money Lecture notes Math 1030 Section C Ex.7 Investment loss. You purchased shares in NewWeb.com from $2000. Three years later, you sold them for $1100. What were your total and annual return on this investment? 7