PERIscope Continental Consumers and their Food Understanding attitudes in France,

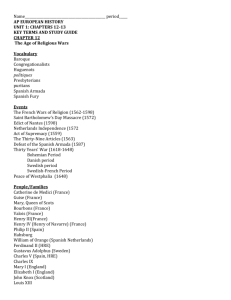

PERIscope

Continental Consumers and their Food

Understanding attitudes in France,

Germany, Spain, The Netherlands and Sweden

Introduction (1)

PERIscope is Bord Bia’s biennial study that has been tracking the

Irish, British and Northern Irish consumer since 2001. In 2006

Bord Bia expanded this study to include consumer views from five

Continental European countries.

– France

– Spain

– Sweden

– The Netherlands

– Germany

Continental PERIscope provides a detailed perspective on how consumers view food related issues and report their behaviours.

The 2008 study expands on the first study undertaken in 2006 and allows us to compare and contrast between countries but also over time. Where possible we have included the Irish, British and

Northern Ireland data to highlight differences between the markets.

The study findings are presented in six booklets, first an analysis and comparison of all countries and then separately findings for each of the individual countries.

Introduction (2)

A large quantitative study was undertaken through on-line panels of households, thereby effectively and efficiently drawing a nationally representative sample of households across all five countries.

Quotas were set against age, gender, region and social class, additional weighting was applied to ensure a fully representative sample.

Although social class by country is outlined within the profile of sample, its definition differs between countries and therefore is not directly comparable, e.g. the French classing system is based on whether the work is derived from the land, from manufacturing or from service.

The research was conducted amongst a representative sample of adults aged 18+ in France, Germany, Spain, Sweden and the Netherlands.

A sample size of 1,000+ was obtained for each region to ensure comparable statistically robust data at a national level.

Fieldwork was conducted on behalf of Bord Bia by during May and June 2008.

The sample

Sample profile – gender

%

2008

(Base: All Adults 18+)

% % % %

Male

48

52

49 50 49

2007

(Base: All Adults 15+)

% % %

50 48 48

Female 52

48

51 50 51

France Germany Netherlands Spain Sweden

50

52 52

ROI NI Britain

Sample profile – age

18-24

25-34

%

12

18

35-44 19

45-54 18

2008

(Base: All Adults 18+)

% % %

11 10

13

17

17

20

20 21

19

16

19

15

18

16

%

11

17

55+ 33

36

33 33

38

France Germany Netherlands Spain Sweden

2007

(Base: All Adults 15+)

% % %

19

21

14

17

21 16

18

19

19

17

15

15

34

26

29

ROI NI Britain

Sample profile – social class

%

2008

(Base: All Adults 18+)

% % % %

ABC1 38

43 42

34

59

2007

(Base: All Adults 15+)

% % %

39

48

54

C2DE 62

57 58

66

41

61

52

46

France Germany Netherlands Spain Sweden

* Definitions of social grade vary between countries and are not directly comparable

ROI NI Britain

Sample profile – household composition

Single

%

15

Dual

36

2008

(Base: All Adults 18+)

% % %

7

22 21

31

37

43

%

20

43

2007

(Base: All Adults 15+)

% % %

14

18 17

23

26

34

63

56

49

3+

49

35

42

62

37

France Germany Netherlands Spain Sweden ROI NI Britain

Sample profile – work status

%

2008

(Base: All Adults 18+)

% % % %

Working full time

Working part time

Student

Other*

42

46

43

53

66

7

7 13

8

21

7

9

9

44

33

29 29

France Germany Netherlands Spain

16

3

15

Sweden

* Other includes housewife, retired, unemployed

2007

(Base: All Adults 15+)

% % %

51

49

40

10

6

33

11

5

35

13

7

40

ROI NI Britain

Current Climate

This section gives a general overview of each of the five countries included in the study in terms of key indicators of economic standpoint and grocery environment.

The figures relate to year end 2007 and are included to contextualise what consumers are facing in each of the countries included in Continental

PERIscope.

France

GDP growth:

Inflation:

Unemployment:

Grocery growth (value):

Supermarket/hypermarket*:

Hard Discounter*:

Average basket size total grocery**:

All year ending 2007

All year ending 2007

Source: Europanel

**Spend per trip

2.0%

2.5%

8.3%

3.0%

79.6%

5.4%

€30.1

Sweden

GDP growth:

Inflation:

Unemployment:

Grocery growth (value):

Supermarket/hypermarket*:

Hard Discounter*:

Average basket size total grocery**:

All year ending 2007

All year ending 2007

Source: Europanel

**Spend per trip

2.5%

2.0%

4.0%

1.3%

66.3%

4.7%

€23.0

Spain

GDP growth:

Inflation:

Unemployment:

Grocery growth (value):

Supermarket/hypermarket*:

Hard Discounter*:

Average basket size total grocery**:

All year ending 2007

All year ending 2007

Source: Europanel

*share of all FMCG categories

3.8%

4.2%

8.3%

5.3%

60.3%

3.4%

€18.2

Germany

GDP growth:

Inflation:

Unemployment:

Grocery growth (value):

Supermarket/hypermarket*:

Hard Discounter*:

Average basket size total grocery**:

All year ending 2007

All year ending 2007

Source: Europanel

**Spend per trip

2.5%

2.1%

8.7%

1.5%

52.0%

26.5%

€12.2

The Netherlands

GDP growth:

Inflation:

Unemployment:

Grocery growth (value):

Supermarket/hypermarket*:

Hard Discounter*:

Average basket size total grocery**:

All year ending 2007

All year ending 2007

*share of all FMCG categories

2.7%

1.6%

4.5%

1.3%

66.7%

16.9%

€10.2

Emerging themes

§

Cooking styles

§

Healthy living

§

Food values

§

Grocery shopping & food choices

§

Eating out & alcohol patterns

Cooking Styles

Top 10 attitudes to food

Meat, dairy and fruit and vegetables are all important to European diets. Foods that are easy to prepare and low in fat are appealing to all adults.

• Try to eat a lot of fruit and vegetables.

• Dairy foods are an important part of my diet (lower within

Netherlands).

• It is important to spend time over dinner as a family.

• I like to try new foods.

• I enjoy eating out.

• I think frozen food is as good as fresh in terms of quality (lower within

Sweden and Ireland).

• Meat is an important part of my diet.

• I tend to pick foods that are easy to prepare (lower within Netherlands and Germany).

• I try to eat foods that are low in fat (lower within Sweden & Ireland).

• I like to have ample time to cook/prepare meals (lower within France,

Germany and Ireland).

Time pressured lifestyles

Convenience remains a strong factor in food choice where we see across all countries that adults are often too busy to cook, dinner is often a last minute choice and there is a greater tendency to pick foods that are quick to cook.

There is evidence of a time short society – although there is an effort to become healthier in eating patterns there is also a demand for quick meal solutions.

In particular French adults report higher usage of convenience meals and ready to eat foods, however, levels remain lower than those amongst Irish and UK consumers.

Cooking – A chore or a creation

Irish and UK adults lag behind their mainland European neighbours in regard to cooking expertise, their skill set falls more into “simple dinners”.

The Dutch and Swedish in particular enjoy “dinner party” style cooking – ideal for “premium” or “ connoisseur” new/alternative produce/sauces/ accompaniments. They are also not afraid to try new tastes – in line with openness to advanced cooking skills.

French and Spanish are more passionate about cooking (more so than any other country). Fun in cooking is experienced by the Germans, Dutch and

Swedish. Those who feel cooking is important because eating well is important are the French and Irish.

Whilst the Irish see cooking as important, they show a low skill set and find it boring whilst our European neighbours are more engaged with cooking and a love of food. The Spanish seek natural, fresh and quality foods while the French want taste but time short options.

Cooking from scratch or using meal components

Those who enjoy cooking and showed greater cooking expertise are also more likely to cook from scratch:

– Spanish showing highest incidence – 63% Daily

– Dutch – 48% Daily

– French – 44% Daily

Cooking methods used vary by each counties cultural background, whilst the Dutch, French and Germans stir fry a lot, the Spanish boil (also stir fry) and the Swedish fry. Steaming is popular in France, and there is increased ownership of a steamer in Spain by younger adults perhaps an emerging health trend for Spain.

There is general agreement across all counties that meal times are important to families, to eat dinner together as a family.

The French & Spanish find it most difficult in getting everyone around the table (the Spanish due to the larger size household).

The Sunday dinner is more likely to occur in Spanish, Irish & UK households.

Importance factors when eating or preparing food in the home

→

France

Taste →

→

Sweden

Taste

Quality

→

Spain

Quality →

Germany

Taste

Netherlands

→ Value for

Money

→ Healthiness → Quality → Healthiness → Quality

→ Enjoyment

→ Ease of

Preparation

→ Freshness → Healthiness → Freshness

→ Freshness → Healthiness → Taste → Freshness → Taste

Continental Europeans have greater cooking skills

2008

(Base: All Adults 18+) France Sw eden Spain Germ any Netherlands Ireland

6

Can’t boil an egg

Can cook basic snacks

Can cook a simple dinner

Would be confident I could produce a good

Sunday dinner

Would enjoy having a dinner party where I do all the cooking

41

18

31

44

32 44

27

26

33

35

28

14

French and Spanish most passionate

2008

(Base: All Adults 18+) France Sw eden Spain Germ any Netherlands Ireland

10

40

A chore, something that has to be done

Important because eating well is important

31

Good fun at times

28

A passion, I love food

54

36

51

40

33

23

14

21

17 18

19

8

2008

(Base: All Adults 18+)

I like to try new foods

96%

90%

Spain, Germany Average 92% Sweden

Enjoy cooking and creating great meals

2008

(Base: All Adults 18+)

France 83%

Sweden

Spain

Germany

Netherlands

Ireland

67%

85%

80%

82%

59%

Often make extra effort for a special meal

2008

(Base: All Adults 18+)

France 83%

Sweden

Spain

Germany

Netherlands

Ireland

83%

85%

72%

87%

60%

I tend to pick foods that are quick to cook

2008

(Base: All Adults 18+)

89%

77%

Spain Average 82% France

2008

(Base: All Adults 18+)

I’m too busy to cook as often as I would like

67%

60%

Netherlands Average 63% France, Spain

Dinner is often a last minute choice

2008

(Base: All Adults 18+)

87%

75%

Sweden Average 82% France

On the go food used more in France, Ireland and UK

2008

(Base: All Adults 18+)

% Applies

2007

(Base: All Adults 15+)

Buy hot food from deli counters

Buy prepared sandwiches/ rolls from deli counter

49

46

45 38

39 29

35

29

47

49

55

53

71

72

57

57

France Sweden Spain Germany Netherlands ROI NI Britain

Ready meals an option when time is short

2008

(Base: All Adults 18+) % Agree Slightly

/Strongly

A good substitute for home cooking when time is limited

Taste great 35

78

21

55 58

51

49

44

Something I always have at home

Have poor quality ingredients

Good value for money

France

22

40

26

26

30

21

Sweden

40

25

Spain

29

40

28

26

19

16

51

Germany

36 21

Netherlands

Fresh ready meals favoured over frozen, frozen appeals for storage

Taste 52

Fresh Frozen

Better Better

14

2008

(Base: All Adults 18+)

% Agree Slightly

/Strongly

59

Fresh Frozen

Better Better

7 30

Fresh Frozen

Better Better

15

39

Fresh Frozen

Better Better

18 46

Fresh Frozen

Better Better

10

Quick to Cook 19 47 37 21 17 31 23 38 24 31

Value for Money 35 28 29 22 19 24 19 28 32 13

Easy to Store 12 63 19 41 8 50 11 60

10 63

For all the

Family

37

France

15 35

Sweden

8 18

Germany

17 26

Spain

16 26 12

Netherlands

Fresh ready meals seen as healthier

Healthier

Ingredients

47

Fresh Frozen

Better Better

16 45

2008

(Base: All Adults 18+)

Fresh Frozen

Better Better

5

Fresh Frozen

Better Better

29 14

% Agree Slightly

/Strongly

Fresh Frozen

Better Better

35 21

Fresh Frozen

Better Better

35 12

Low in Salt 38 13 24 6 18 13 22 14 28 11

Lower in Fat 34 14 26 8 21 14 21 15 24 8

Less

Preservatives

53

Less Additives

50

18 39 16

France

15 38 10

Sweden

30 23 37 26 37 15

30

Spain

21 36 21 35

Germany Netherlands

13

Using meal components/ ready prepared ingredients

2008

(Base: All Adults 18+)

France

5

Spain

4

Germ any Netherlands

5

11

% Applies

Sw eden

6

Ireland

6

37

Daily

37

44 44

53

36

Weekly

Monthly

24

21

26

16

23

Less often / never

25

33 34

27

31 32

17

Often eat ready prepared / convenience meals

2008

(Base: All Adults 18+)

France

% Agrees strongly/slightly

Sweden 45%

58%

Spain

Germany

Netherlands

Ireland

52%

51%

49%

64%

Use a lot of ready to eat foods

2008

(Base: All Adults 18+)

France

% Agrees strongly/slightly

Sweden

Spain

Germany

Netherlands

Ireland

56%

42%

39%

46%

49%

47%

%

I add sauces and dressing to food

2008

(Base: All Adults 18+)

% % %

% Applies

%

2007

(Base: All Adults 15+)

% % %

84

65

86 88 88

77

87 86

France Sweden Spain Germany Netherlands ROI NI Britain

Responsibility for meal preparation varies across countries

%

2008

(Base: All Adults 18+)

% % % %

2007

(Base: All Adults 15+)

% % %

Always prepare own meal

57

47

45

52

55

39 40

46

Sometimes prepare own meal

27

Someone else prepares meal

Other

14

2

France

38

12

3

Sweden

33

32

28

20

2

Spain

13 13

3 4

Germany Netherlands

20

29

21

36

5

ROI

29

2

NI

29

4

Britain

Dinner with the family is important across all countries

% Applies

2008

(Base: All Adults 18+)

Important to eat dinner together as a family

Hard to get household together for mealtimes

69

Usually have

Sunday dinner

France

60

93

Sweden

45

56

95

Spain

66

69

87

48

Germany

56

87

48

48

Netherlands

88

Healthy Living

Consumers moving towards healthier lifestyle

Perceived good health is highest amongst the Dutch, ROI & UK where adults are more likely to say they are very healthy compared to their continental neighbours.

The move to a healthier lifestyle among consumers across the countries is becoming evident:

– Sugary foods are being avoided (range 70% – 84% applies).

– Eating more low fat foods (Ireland and Britain lower, Spain and France highest).

– Including more hi-fibre foods.

– Cutting back on consumption of convenience/ready meals – this is most evident in Netherlands, Spain and Sweden.

Consumers moving towards healthier lifestyle

When trying to become healthier, the Spanish are most receptive towards

“lower cholesterol” products, other countries would increase the intake of these type of products but not to the same extent.

The Swedish are least inclined towards vitamin and mineral enriched products – a split between those that would eat more of and less of.

Fish has a huge “health” appeal across continental Europe, Ireland also shows a high rating of fish but not as dramatic as other countries.

There is a varied reaction to carbohydrates such as bread, cereals, pasta, etc. in terms of whether they contribute to a healthy diet or not.

Respondents in Germany & Netherlands would heavily support consumption of these, Spain to a lesser extent and all others remain split.

For milk & dairy, France, Germany, Netherlands & Spain are in favour of eating more of while Sweden, ROI & UK are unsure.

Consumers linking food and wellness

There is cross country agreement of with the following statements:

– Good food can enhance body and mind.

– To be healthy, it is important to eat properly.

– I think diet and lifestyle are more important than medication in preventing heart disease.

– A good diet can help your mental health.

All countries agree that frying and using a microwave are the least healthy methods of cooking food.

Steaming (popular amongst the French) and stir-frying (popular in France,

Germany and Netherlands) are both seen as healthy methods.

Ownership of kitchen utensils perhaps reflects the more to healthier diets with a decline in ownership of deep fat fryers, most notable among

Swedish, Spanish and Dutch adults. There is also Increasing ownership of an electric juicer, especially in Spain.

ROI & UK claim to have healthier diets

%

Very healthy

(72)

5

2008

(Base: All Adults 18+)

% % %

(73)

8

(82)

10 (74)

7

%

(75)

6

2007

(Base: All Adults 15+)

% % %

(75)

21

(68)

22

(73)

17

Fairly healthy 67 65

72

67

69

54

46

56

France Germany Netherlands Spain Sweden ROI NI Britain

Eating healthier

France Sweden

% claiming to eat healthier nowadays

Spain Germany Netherlands

Spanish more likely to increase consumption of lower cholesterol products

2008

(Base: All Adults 18+)

% Applies

2007

(Base: All Adults 15+)

Eat more or less of if trying to become more healthy

Products which claim to lower Ø

More blood pressure/ cholesterol

Ø

Less

33

67

31

69

20

80

28

72

27

73

28

72

17

83

31

69

Products enriched with

Ø

More vitamins and

Less minerals

33

France

67

Sweden

56

44

Spain

31

69

32

68

30

70

Germany Netherlands

28

ROI

72

18

NI

82

31

69

Britain

Claimed increases of fish consumption

Eat more or less of if trying to become more healthy

2008

(Base: All Adults 18+)

2007

(Base: All Adults 15+)

Fish

Ø

More

Ø

Less

7

93

7

Meat

Ø

More

41 50

Ø

Less

France

59

Sweden

50

93

5

95

10

90

9

91

18

34 26 34

Spain

66 74 66

Germany Netherlands ROI

48

37

82

9

91

17

NI

56

44

38

Britain

46

83

Polarised views of cereals

2008

(Base: All Adults 18+)

2007

(Base: All Adults 15+)

Bread/Cereals/Pasta/Rice/Potatoes

Ø

More 55 47

Ø

Less 45 53

Milk & Dairy

Ø

More

Ø

Less 23

France

77 47

Sweden

53

34

23

Spain

66

77

28

19

Germany

72

81

17

83

76

38

47

50

24

Netherlands ROI

35

47

51

47

46

38

41

NI

52

Britain

44

Frying and microwaving seen as worst for health

Ranking Methods of

Cooking – Healthiness I

1 = Best for Health

8 = Worst for Health

Boiled

Oven baked

Uncooked

Fried

Microwaved

Steamed

Stir fry/wok

4.1

4.3

3.3

6.7

1.5

4.9

3.5

4.1

4.7

3.4

5.4

2.2

5.7

2.8

2008

(Base: All Adults 18+)

3.5

4.5

4.0

6.0

2.3

5.5

2.3

2.6

3.8

4.0

6.4

1.7

5.2

4.4

3.3

4.2

3.7

6.3

2.0

5.5

3.3

France Germany Netherlands Spain Sweden

Stir-frying popular in France, Germany and Netherlands

Cooking Methods Used

Boiled

Oven baked

Uncooked

Fried

Microwaved

Steamed

Stir fry/wok

Other

2008

(Base: All Adults 18+)

% % % %

9

17 18

22

15

15 13

12

14

6

11 11

12

13 14 15

14

18

9 10

5

10

12

11

23 19

24

16

2 3 3

France Germany Netherlands Spain

%

15

17

11

24

13

5

11

4

Sweden

Healthy trends in kitchen equipment?

% ownership microwave

2008

France

92

Sweden

91

Spain Germany Netherlands

91 80 90 deep fat fryer 2008

2006 steamer 2008

2006 electric juicer

59

59

46

50

34

24

41

52

87

18

50

60

46

18

69

36 n/a

11 n/a

24

71

81

9

14

29 wok

2008

2006

39

30

45

52

17

20

42 n/a

74

74

Avoid sugary foods & sweets

% Agree strongly/slightly

France vs. 2006

-1

Sweden

+1

Spain

-2

Germany na

Netherlands

+5

Try to eat foods low in fat

% Agree strongly/slightly

France vs. 2006

+3

Sweden

-9

Spain

---

Germany na

Netherlands

-4

Try to eat high fibre foods

% Agree strongly/slightly

France vs. 2006

+4

Sweden

-10

Spain

+2

Germany na

Netherlands

---

If the label says ‘Low Fat’ or ‘Reduced

Fat’ then the product will always be a healthy choice

% Agree strongly/slightly

2006

2008 vs. 2006

France Sweden

Spain Germany Netherlands

Concerned about my children being obese

% Agree strongly/slightly

France Sweden

Spain Germany Netherlands

Conscious of controlling my children’s intake of sugary or fatty foods

% Agree strongly/slightly

93%

83%

Netherlands Average 88% France

I would take my child to see a

GP/nutritionist if he/she was showing signs of being overweight.

% Agree strongly/slightly

France 76%

54% Sweden

Spain

Germany

Netherlands

63%

84%

34%

* Base: Those with children

I would like manufacturers to help me eat healthily.

% Agree strongly/slightly

France vs. 2006

-1

Sweden

+4

Spain

---

Germany Netherlands na +3

Healthier foods are always more expensive

% Agree strongly/slightly

France vs. 2006

+5

Sweden

-1

Spain

+5

Germany Netherlands na +4

There are not enough product options for people who suffer food intolerances.

% Agree strongly/slightly

2006

2008

France Sweden

Spain Germany Netherlands

Strong links with food and mental wellness

% Agree /

Strongly Agree

Good food can enhance body and mind

A good diet can help your mental health

I consider what I eat to be really important for my mental wellbeing

I eat to enrich/enhance mental alertness & spiritual wellbeing

France

88

81

74

75

Sweden

86

80

69

81

Spain Germany

Netherlands

83

79

74

73

82

80

63

88

80

72

60

61

Dutch becoming more convinced…

% Agree strongly/slightly

A good diet can help your mental health

I eat to enrich/enhance mental alertness & spiritual wellbeing

I consider what I eat to be really important for my mental wellbeing

Grocery Shopping & Food Choices

Grocery shopping

Local food

Environmental and ethical choices

Labelling

Grocery shopping attitudes

Attitudes to shopping are similar across the countries however, there are some notable differences:

Shopping is often planned around the weekly menu. Consumers shop in the same store but look for the best value by opting for private label brands and taking advantage of sales and promotions.

Price is important in all countries particularly for the Netherlands where quality of fresh food is less important than price. Spanish, Swedish and Irish consumers place a premium on quality of fresh food.

Dutch consumers are more price sensitive and have the highest level of interest in sales and promotions.

Impulse purchasing is strongest among Swedish and Irish consumers and weakest among the Spanish.

Spanish and Swedish are more likely to rate branded products as superior to private label brands (the Dutch favour private label potentially from the financial perspective).

Pester power from children is more evident among French and German consumers.

Buying Local

• For the majority of consumers in all countries," local” refers to the province or the county in which they live. The French have a more mixed response citing province, farmers markets and close proximity to where I live.

• Local food is most important to the French, Spanish and Irish (almost six in ten scoring it very/fairly important). The Dutch are strongly indifferent to local food with one third rating it neither/nor and a fifth scoring it as not at all important.

• Similarly the Dutch show the lowest levels of purchasing frequency – local food is really not something that the Dutch take time to seek out or purchase where as the Spanish are conscious of buying local, on average they buy weekly with a fifth buying daily.

• The French, Germans and Swedish on average buy local weekly.

Environmental terminology

• Awareness levels for environmental terms differs across countries. The majority of countries are not aware of food miles; of those that are aware, they predominantly relate it to “distance food has to travel from producer to shop”.

• There is much greater awareness of the term sustainability and it has some impact on the way consumers purchase their food. Sustainability impacts on almost half of all Swedish shoppers choices and over a third of French shoppers choices.

• Firstly all countries understand sustainability to mean “Meeting the needs of present without compromising future generations needs” and secondly

“production practices that have no future effect on the environment”.

• The Spanish are most aware of the term “carbon footprint” ( 67%) while only

39% of Dutch adults have ever heard of it. One quarter of all Spanish, German and Swedish adults claim that carbon footprints impact on their shopping choices.

Food labelling

• European adults find it difficult to understand labelling and the nutrition claims on food. They would also like manufcaturers to help them eat more healthy.

• There is a greater incidence of “always checking” for country of origin with the majority citing they want to know where their food comes from, this is quite strong amongst the Swedes with almost half always checking country of origin. The French & Spanish are most likely to check for a quality symbol.

• A large proportion of Dutch adults do not look for either a quality symbol or for country or origin.

• Fresh as a label component is very important with an average of nine in ten adults across the countries stating they think it is very important. The highest ratings of fresh being very important are amongst Irish & Swedish adults.

• Natural as a label component achieves a marginally lower score on importance, except for the Spanish where natural is very important.

French & German shop less frequently

Frequency of Grocery Shopping

Daily

Several times a week

%

3

30

%

8

2008

(Base: All Adults 18+)

%

14

%

3

42

42

63

Weekly

54

41

38

Monthly/

Less often

13

France

24

4

Sweden

6

Spain

14

Germany

%

12

55

30

3

Netherlands

Joint responsibility for shopping more across Continent

Responsibility for Grocery Shopping

%

2008

(Base: All Adults 18+)

% % % %

2007

(Base: All Adults 15+)

% % %

Mainly responsible

54

51

46

50

59

41

47

45

Jointly responsible

40

41

44

40

32

Someone else responsible

6

France

8

Sweden

10

Spain

10 9

Germany Netherlands

16

18 21

43

35 34

ROI NI Britain

Definition of local food

France Sweden Spain Germany

Netherlands

1 st

2 nd

Available in farmers’ markets

Made within the province in which I live

Made within the province in which I live

Made within the county in which I live

Made within the province in which I live

Made within the county in which I live

Made within the province in which I live

Made within a 20km radius of where I live

Made within a

20km radius of where I live

Made within the county in which I live

I like to know the area where my food comes from.

% Agree strongly/slightly

72%

63%

70%

69%

France Sweden

21%

Spain Germany Netherlands

Food produced locally results in higher quality products.

% Agree strongly/slightly

58%

59%

56%

53%

26%

France Sweden

Spain Germany Netherlands

Local food is fresher and more nutritious.

% Agree strongly/slightly

60%

55%

53%

51%

22%

France Sweden

Spain Germany Netherlands

I am more confident in the safety of food produced in my local area.

% Agree strongly/slightly

56%

52%

48%

47%

20%

France Sweden Spain Germany

Netherlands

Buying local is important…except for the Dutch

% Agree strongly/slightly

France Sweden Spain Germany

+15% very / fairly neither

/ nor not very

/ not at all

Netherlands

+10%

Spanish lead the way in purchasing…

% applies France Sweden daily several times a week weekly monthly less often/ never

2%

16%

31%

30%

20%

2%

19%

23%

32%

31%

Spain

20%

Germany

3%

Netherlands

2%

28%

28%

17%

6%

22%

34%

24%

17%

9%

16%

20%

52%

I am more conscious of environmental issues in my choice of products today

% Agree strongly/slightly

France Sweden

Spain Germany Netherlands

Prefer to buy from companies aware of environmental issues

% Agree strongly/slightly

France Sweden

Spain Germany Netherlands

% Agree strongly/slightly

For environmental reasons I select food

with

recyclable packaging

For environmental reasons I select food

with

minimal packaging

France Sweden

Spain Germany Netherlands

Low awareness of food miles

France Sw eden

% applies

Spain Germ any Netheralands

Never heard of it before today

Heard of it but don’t consider it important

It’s a fad

Sometimes buy food with low food miles

Actively try to buy low-miles food

68

5

12

7

8

61

69 68 68

5

11

13

10

4

8

9

10

7

11

7

7

7

10

7

8

But good understanding of food miles

% applies

France Sweden

Spain

Distance food has to travel from producer to shop

An indication of environmental impact

39

61

28

72

25

75

Germany

26

74

Netherlands

34

66

Higher awareness of carbon foot print but little impact

France Sw eden Spain

% applies

Germ any Netheralands

27 27

38

51

Never heard of it before today

Heard of it but don’t consider it important

It’s a fad

Sometimes buy food with low carbon footprint

Actively try to buy low carbon foot print food

53

12

19

10

7

10

15

12

12

20

25

17

11

22

14

16

10

30

13

15

14

Also good understanding of carbon footprint

% applies

%

France Sweden Spain Germany Netherlands

20

Measure of environmental impact

Amount of carbon dioxide omitted before product reaches market

Individuals effect on environment by consumption of products

22

58

19

43

38

19

14

67

15

15

70

21

25

54

Much greater awareness & impact of sustainability

France Sw eden Spain Germ any Netheralands

% applies

11

23

27 27

38

28

Never heard of it before today

20

20

30

Heard of it but don’t consider it important

22

26

9

It’s a fad 25

22

13

14

Sometimes buy food with sustainability features

21

Actively try to buy food with sustainability features

26

17

16

15

14

11 10

14

And understanding…

% applies

Meeting needs of present without compromising future generations needs

Production practices that have no effect on the environment

Ensuring future generations have what we have today

22%

40%

31%

38%

27%

17%

27%

45%

20%

25%

52% 35%

26%

12% 28%

Irish least likely to buy fair-trade

% applies

I try to buy Fairtrade when available

Try to buy organic where possible

72 74 61 74 63

France

65

Sweden

75

Spain

72 77 55 n/a

Germany Netherlands

ROI

45

Find it difficult to understand the labelling on food

% agree strongly / slightly

77%

70%

78%

75%

64%

France Sweden

Spain Germany Netherlands

Always check the nutritional labelling

% agree strongly / slightly

71%

67%

82%

64%

70%

France Sweden

Spain Germany Netherlands

Often find it difficult to understand nutritional claims on packaging

% agree strongly / slightly

78%

74%

80%

67%

62%

France Sweden

Spain Germany Netherlands

Spanish and French most likely to check for a symbol of quality

% % % % % % % %

9

14

12

Always check 23

19 20

27

10

40

52

62

51

63

66

Sometimes check

62

58

50

39

Never check

15

18

France Sweden

36

15

19

Spain Germany Netherlands

27

ROI NI Britain

Dutch and British consumers least concerned about origin

% % % % % % % %

12 12 11

26

Always check

33

30 31

47

39

49

56

46

Sometimes check

51

Never check

55

57

45

16

France

8

Sweden

39

15

12

Spain Germany Netherlands

28

ROI

32

50

NI Britain

‘Fresh’ important to include on labels – especially in

Sweden and Ireland

%

(92)

%

(93)

%

(91)

%

(88)

%

(90)

%

(93)

%

(84)

%

(87)

31

Very important 55

66 62

55

53

59 69

Fairly important 36

27

29 29

35

France Sweden Spain Germany Netherlands

53

34

24

ROI NI Britain

Natural important too

Very important

%

(85)

%

(83)

%

(90)

43

43

59

%

(77)

%

(71)

34 23

%

(87)

% %

47

(80)

25

(75)

31

43

48

Fairly important 42

40

31

France Sweden Spain Germany Netherlands

40

55

44

ROI NI Britain

Awareness of food terms vary

Functional foods

Ethical/fair-trade products

Irradiated foods

36

Glycemic index 38

Glycemic loading of a serving of food

30

France

65

93

37

Sweden

59

% Aware

76

60

72

23

Spain

31

27

87

72

45

32

74

66

15

35

35

19

Germany

11

Netherlands

75

Germans least likely to buy fair-trade

% agree strongly / slightly

72

I try to buy Fairtrade when available

74 74 61 63

Try to buy organic where possible

France

65

Sweden

75

Spain

77

Germany

72 55

Netherlands

When I shop the first thing I look for is price

% agree strongly / slightly

France

58% vs. 2006

+1

Sweden 46%

Spain

Germany

Netherlands

46%

54%

53%

+6

+7 na

-2

The most important thing when grocery shopping is price

% agree strongly / slightly

France

Sweden 37%

50% vs. 2006

---

+4

Spain

Germany

35%

24%

+10 na

Netherlands 45%

-2

Dutch are bargain hunters…

% agree strongly / slightly

France

Watch for announcements for sales or promotions on grocery

Buy on impulse if I think its cheap

Compare price between outlets to see where I can buy cheapest food even if

I need to travel

Quality of fresh food is more important than price

I will pay more a bit more for grocery shopping to get superior customer service

72%

45%

44%

52%

23%

Sweden

62%

59%

31%

64%

29%

Spain

66%

17%

53%

69%

38%

Germany

Netherlands

77%

45%

35%

55%

28%

81%

39%

38%

47%

18%

Private labels are just as good as branded

% agree strongly / slightly

63%

51%

56%

68%

67%

France Sweden Spain Germany Netherlands

I think frozen is as good as fresh

% agree strongly / slightly

91%

85%

62%

87%

91%

76%

France Sweden Spain Germany Netherlands ROI

Products in the chilled cabinets are always fresher

% agree strongly / slightly

81%

69%

64%

78%

75%

73%

France Sweden Spain Germany Netherlands ROI

I much prefer to buy products from the chilled cabinet

% agree strongly / slightly

89%

79%

74%

82% 82%

70%

France Sweden Spain Germany Netherlands ROI

Multi vs. smaller packs

% applies

2008

(Base: All Grocery Shoppers)

Where possible I buy multi packs

89 89 66 83 75

I buy food in smaller packs because it means less waste

France

72

Sweden

55

Spain

48 49 52

Germany Netherlands

Eating out & alcohol patterns

Eating Out and alcohol patterns

There is a higher incidence amongst the Spanish, Swedish and Irish for having eaten out in the past 7 days. Although there is a decrease for Spain in the incidence of eating out, it is still a very large part of their culture.

The main reasons for eating out more:

– A treat/something different.

– Don't want to wait for something to cook.

– Chance to meet up with friends.

– Too tired to make something at home (longer working days).

– More choice of places.

Amongst those surveyed, the Swedes and the French have the highest incidence of drinking alcohol. The Spanish and Dutch claim to drink alcohol on a daily basis more often than the other countries surveyed.

Swedes and French highest incidence of drinking alcohol

% drink alcohol

81%

65%

74% 78%

84%

France

Sweden

70%

ROI

Spain

77%

NI

Germany

72%

Britain

Netherlands

Spanish and Dutch more frequent daily alcohol drinkers

% applies

%

Monthly

25

% %

18

%

14

%

35

25

53

50

Weekly

49

Daily+

18

France

31

14

Germany

24

Netherlands

28

Spain

44

5

Sweden

Spanish and Dutch more frequent daily alcohol drinkers

% applies

%

Monthly

25

Weekly

49

Daily+

18

France

%

35

44

5

Sweden

%

14

53

28

Spain

% %

24

25

50

31

14

Germany

18

Netherlands

% applies

Always drink alcohol when having dinner at a restaurant

France Sweden

Spain Germany Netherlands

% applies

I am drinking more alcohol at home these days

France Sweden

Spain Germany Netherlands

% applies

I often have a drink at lunchtime

France Sweden

Spain Germany Netherlands

I often have a drink when dining at home on weekday

% applies

France Sweden

Spain Germany Netherlands

I often have a drink when dining at home on weekend

% applies

France Sweden

Spain Germany Netherlands

Eating out in pubs/restaurants/cafes more popular amongst Spanish, Irish and Swedish

Meals Eaten Out in last 7 Days

2008

(Base: All Adults 18+)

2007

(Base: All Adults 15+)

Meals or snacks on premises of pub/ restaurant/cafe

Takeaway meals eaten off the premises where they were prepared

Meals or snacks delivered to your home

France

47

32

15 14

Sweden

58

42

Spain

27

27

68

18

49

36

14

43

27

Germany Netherlands ROI

24

43

63

Main reasons for eating out

France

Chance to meet up with friends.

A treat/something different.

More choice of places to eat out locally.

Don’t want to wait for something to cook.

Working day is longer.

Germany

Don’t want to wait for something to cook.

Chance to meet up with friends.

Just feel like a treat/ something different.

More choice of places to eat out locally.

Working day is longer.

Spain

Just feel like a treat/ something different.

Chance to meet up with friends.

Staying out for the evening.

Working day is longer.

Sweden

Too tired to make something at home.

Chance to meet up with friends.

More choice of places to eat out locally.

Just feel like a treat/ something different.

Netherlands

Just feel like a treat/ something different.

Chance to meet up with friends.

More choice of places to eat out locally.

Too tired to make something at home.

Ireland

Too tired to make something at home.

Chance to meet up with friends.

Just feel like a treat/ something different.

More choice of places to eat out locally.