Nonprofit Disease Foundation Investments in Biotechnology... Venture Philanthropy

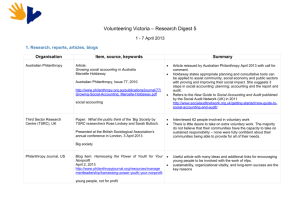

advertisement