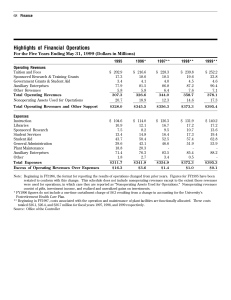

Highlights of Financial Operations

advertisement

Boston College Fact Book: 1998 - 1999 Highlights of Financial Operations For the Five Years Ending May 31, 1998 (Dollars in Millions) Operating Revenues Tuition and Fees Sponsored Research & Training Grants Government Grants & Student Aid Auxiliary Enterprises Other Revenues Total Operating Revenues Nonoperating Assets Used for Operations Total Operating Revenues and Other Support Expenses Instruction Libraries Sponsored Research Student Services Student Aid General Administration Plant Maintenance Auxiliary Enterprises Other Total Expenses Excess of Operating Revenues Over Expenses 1994 1995 1996* 1997** 1998** $ 185.7 14.8 3.3 73.2 5.2 $ 202.9 17.3 3.4 77.9 5.8 $ 216.6 18.6 4.1 81.5 5.8 $ 228.3 18.5 4.0 86.8 6.4 $ 239.8 19.6 4.5 87.2 7.6 282.2 307.3 326.6 344.0 358.7 17.3 20.7 18.9 12.3 14.6 $299.5 $328.0 $345.5 $356.3 $373.3 $ 95.1 10.2 7.2 12.3 38.8 35.7 17.7 67.1 9.7 $ 104.6 10.9 7.5 13.4 43.7 39.6 18.8 71.4 1.8 $ 114.0 12.1 8.2 14.8 50.4 43.1 20.3 76.3 2.7 $ 126.3 16.7 9.5 16.4 52.5 46.6 83.5 3.4 $ 131.9 17.2 10.7 17.3 57.4 51.9 85.4 0.5 $293.8 $311.7 $341.9 $354.9 $372.3 $5.7 $16.3 $3.6 $1.4 $1.0 Note: Beginning in FY1996, the format for reporting the results of operations changed from prior years. Figures for FY1994 and 1995 have been restated to conform with this change. This schedule does not include nonoperating revenues except to the extent those revenues were used for operations, in which case they are reported as “Nonoperating Assets Used for Operations.” Nonoperating revenues consist of gifts, investment income, and realized and unrealized gains on investments. * FY1996 figures do not include a one-time curtailment charge of $8.3 resulting from a change in accounting for the University’s Postretirement Health Care Plan. ** Beginning in FY1997, costs associated with the operation and maintenance of plant facilities are functionally allocated. These costs totaled $26.1 million and $26.4 million for FY1997 and FY1998, respectively. Source: Office of the Controller