An Empirical Study of

Subordination Levels in Commercial Mortgage Backed Securities

by

Romina Padhi

Bachelor of Arts in Economics, University of Mumbai, 1997

Masters in Business Administration, University of Mumbai, 2000

Submitted to the Department of Architecture

in Partial Fulfillment of the Requirement for the Degree of Master of Science

in Real Estate Development

at the

Massachusetts Institute of Technology

September 2005

© 2005 Romina Padhi. All Rights Reserved.

The author hereby grants MIT permission to reproduce and to distribute publicly paper and

electronic copies of this thesis document in whole or in part.

Signature of Author

………………………………………………………………………

Department of Architecture

August 5, 2005

Certified by

………………………………………………………………………

Brian Anthony Ciochetti

Professor of the Practice of Real Estate, Thesis Supervisor

Accepted by

………………………………………………………………………

David Geltner

Chairman, Interdepartmental Degree Program in Real Estate Development

An Empirical Study of

Subordination Levels in Commercial Mortgage Backed Securities

by

Romina Padhi

Submitted to the Department of Architecture

on August 5, 2005 in Partial Fulfillment of the Requirements

for the Degree of Master of Science in Real Estate Development

ABSTRACT

The CMBS market has been in existence since the mid 1980s; however, it was during the mid

1990s that the market began to grow. A combination of favorable interest rate environment, entry

of new players in the market and the amount of demand for commercial real estate assets, led to

a record US CMBS issuance in 2004, with the 2005 outlook being even better. However, the

subordination or credit enhancement level of these securities has been on a downward trend since

1995. The thesis attempts to analyze the risk factors such as loan to value ratio, debt service

coverage ratio, floating versus fixed rate, large and conduit deal types, as well as diversification

factors (property type and geographic location), and their impact on subordination levels.

Finally, market forces such as spreads on CMBS are also analyzed for their influence on

subordination levels.

For the analysis, data were collected on 430 commercial mortgage backed securities issued from

1995 through mid 2005. The information was obtained from Trepp, which tracks all the

commercial mortgage backed securities issued in the market. The trend in subordination levels of

each of the tranches or bond classes was analyzed over the period of study and a quantitative

regression analysis was performed to analyze the influence of the above mentioned factors on the

subordination levels.

The results indicate that the loan to value ratio, interest rate type (fixed versus floating) and the

deal type (conduit and large loans) have a significant impact on the subordination levels. Also,

certain other market factors, including the spread differential between CMBS and corporate

bonds, strong property market performance, increased liquidity and increased number of

investors may also have influence the subordination levels of these securities.

Thesis Supervisor: Brian Anthony Ciochetti

Title: Professor of the Practice of Real Estate

2

Acknowledgement

I would like to thank Don Belanger of CSFB for his help in compiling the data used for the

regression analysis. His insights and valuable comments are appreciated. I would like to thank

my advisor, Tony Ciochetti, who has been a guiding factor for this thesis. His wisdom and inputs

on various aspects of the thesis were truly inspirational.

3

TABLE OF CONTENTS

ABSTARCT ………………………………………………………………………

2

ACKNOWLEDGEMENT ………………………………………………………..

3

Chapter 1 – INTRODUCTION

1.1

Scope of Research ………………………………….………………………

5

1.2

History and Background of CMBS …………….…………………………..

6

1.3

CMBS and Subordination Levels ………………….………………………

8

1.4

CMBS Rating Methodology ……………………………………………….

12

1.5

Summary …………………………………………………………………...

16

Chapter 2 – LITERATURE REVIEW

2.1

Mortgage Default and Loss Severity Research …………………………….

17

2.2

Real Estate Diversification Research ……………………………………...

25

2.3

Summary ……………………………………………………………………

28

Chapter 3 – DATA AND METHODOLOGY

3.1

The Data ……………………………………………………………………

30

3.2

Methodology ………………………………………………………………..

33

Chapter 4 – DATA ANALYSIS

4.1

Subordination Levels ……………………………………………………….

36

4.2

Discussion of Regression Results …………………………………………..

38

4.3

Other Factors affecting Subordination Levels ……………………………...

42

4.4

Summary ……………………………………………………………………

45

Chapter 5 – CONCLUSION ………………………………………………………..

48

BIBLIOGRAPHY …………………………………………………………………..

50

APPENDIX …………………………………………………………………………

53

4

Chapter 1

INTRODUCTION

1.1 Scope of Research

While the US commercial mortgage backed securities (CMBS) market has been in existence

since the mid 1980s, it has emerged as an important sector since 1996 and has grown

tremendously since then; with US issuance growing from $26 billion in 1996 to $93 billion in

2004. The CMBS sector has developed a broad investor base and a liquid secondary market.

These securities have provided an attractive higher yield alternative to traditional corporate

bonds, asset backed securities, and residential mortgage backed securities. From the investor’s

perspective, CMBS are desirable as a security because risk is spread among different investors

and tranches, and these assets are more liquid than owning a whole loan. The popularity of

CMBS is also a function of the unique risk / return characteristics that these complex securities

offer, particularly the lower rated tranches that exhibit both debt and equity like characteristics.

With the development of the market, the structure of CMBS transactions has become

increasingly important. The primary structure of CMBS involves a senior – subordinate structure

that gives cash flow priority to the senior classes and shifts the default risk down the structure to

the lower classes. These classes satisfy the demand of various classes of investors. The lower

bond classes provide credit support to the higher rated tranches; this is referred to as the

subordination or the credit enhancement level, which is determined for each bond class. A lot of

research has been done on the pricing of these securities, how prepayments affects these

securities and on the default of such securities. However, there exists minimal literature on the

subordination levels in CMBS, which is a structural aspect of the transaction and plays an

important role in determining how defaults and losses affect each of the bond classes.

Subordination levels have fallen dramatically from the levels of 1995 / 1996 when they used to

be in the range of 30% - 35% for the highest rated class (AAA) to as low as 12% - 15% in 2005.

This thesis examines the trend in subordination levels of CMBS from 1995 to 2005 and the

impact of specific risk and diversification factors as well as some deal specific characteristics

(such as floating rate versus fixed, or large loans) and some market factors (yield spreads

5

between CMBS and corporate bonds) on subordination levels. This is an interesting area as there

hardly exists any research in this area, though there are a few papers in the working. The analysis

is based on a sample of CMBS deals or transactions from 1995 to mid-2005. The data, sourced

from Trepp LLC, presents a summary of every deal issued including the features of the bond

class, the details of the loans in the underlying pool, and the credit characteristics of the

transaction. This thesis examines specific factors such as loan to value ratio, debt service

coverage ratio, property type diversity, geographic location diversity, floating rate, and large

loans, that may provide an explanation for this trend.

The balance of this chapter provides background information on the CMBS market, the structure

of the security and the subordination levels, how these credit enhancement levels are determined

by rating agencies. Chapter 2 presents a literature review of the relevant research. Chapter 3

presents a description of the data as well as the methodology used in analyzing the data. Chapter

4 discusses the results of the data analysis. The thesis will close with the interpretation and

implications of the results.

1.2 History and Background of CMBS

The CMBS market has grown dramatically from its modest beginnings in the mid 1980s.

Issuance, liquidity and the number of investors have all increased dramatically since and reached

record levels in 2004, with 2005 expected to be an even better year. Last year the global CMBS

issuance crossed the $100 billion mark for the first time in the decade plus history of the market.

This year, it is expected to cross the $200 billion mark (US Issuance = $72 billion in the first half

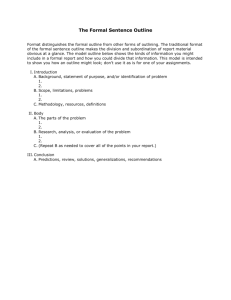

of 2005). The following graph depicts the explosion taking place in the US CMBS market.

According to the Commercial Mortgage Alert1, loan demand continues to be fueled by low

interest rates and rising property values. In fact, borrowers are currently financing securitized

mortgages, indicating that the benefit of taking out larger loans with lower coupons exceeds the

defeasance costs associated with prepayments. Global capitalization of CMBS currently exceeds

$500 billion.

1

Commercial Mortgage Alert, July 1, 2005

6

Annual US CMBS Issuance

$100.00

$93.11

$90.00

$77.85

$74.33

$80.00

$72.11

$67.15

$ Billion

$70.00

$56.57

$60.00

$50.00

$36.79

$40.00

$26.37

$30.00

$20.00

$52.07

$46.89

$15.75

$10.00

2004

1H 2005*

Year

2003

2002

2001

2000

1999

1998

1997

1996

1995

$-

Source: Commercial Mortgage Alert, July 2005

* CMBS issuance for 1st half of 2005 (January to June)

During the 1980s, a strong economy, the deregulation of the financial services industry, and

preferential tax treatment led to an explosion in the level of capital flows into the commercial

real estate markets. The real estate boom in the 1980s led to extreme overbuilding, which finally

caused the bubble to burst in the 1990s.

During the 1980s, primary sources of real estate funding included tax shelter syndicates, savings

institutions, commercial banks, and life insurance companies. The Tax Reform of 1986 and the

major devaluation of commercial property values in the early 1990s resulted in sizeable losses

and led to a major retrenchment of lending activity by the traditional sources of financing.

The largest factor contributing to the development of the CMBS market was the creation of the

Resolution Trust Corporation (RTC). The RTC was created by the Congress to bail out the ailing

thrift industry. The RTC would liquidate the assets, mostly mortgages, it acquired from insolvent

thrifts as quickly and efficiently as possible. To “monetize” its investment, the RTC issued

approximately $15 billion multifamily and mixed property CMBS.

7

Issuance has grown tremendously since 1993 and contribution from the RTC has fallen since.

Witnessing the success of RTC in CMBS, many insurance companies, pension funds and

commercial banks began to use the CMBS market as a source of restructuring their balance

sheets. Non-RTC issuance began to build in the mid-to-late 1990s and could be classified into

two broad categories – securitization of existing loan portfolios and securitization of new loans

originated for the purpose of contributing to the underlying pool. Existing portfolio securitization

consisted of both performing and non-performing loans, and thus, provided an exit strategy not

just for the RTC but also for some insurance companies and pension funds that used it to liquefy

their portfolios. The CMBS market was used as a means of liquidity for disposing the unwanted

assets, to receive better regulatory treatment for holding securities in lieu of whole loans, or to

raise capital for underwriting more loans.

The total of commercial mortgages outstanding measured approximately 14.4% of gross

domestic product, well above the long term average of 11.2%. A study2 on conduit diversity

indicates that diversity has increased slightly. However, the largest deals were not necessarily the

most diverse. Some transactions have become large by adding more loans (more diversity), while

others have become large by adding larger loans (less diversity).

1.3 CMBS Structure and Subordination Levels

A CMBS transaction is formed when an issuer places commercial mortgages into a trust, which

then issues classes of bonds backed by the interest and principal of the underlying pool of

mortgages. The basic building block of the CMBS structure is a mortgage that was written to

finance a commercial purchase of property or to refinance a prior commercial mortgage. Each of

the bond classes in a CMBS issue reflects a different risk – return profile. The objective of

creating such a structure is to shift the investment risk from the highest rated class down to the

lowest ranked class.

There are many types of CMBS. A CMBS transaction can be backed by a pool of mortgages

(conduit) or by a single asset. However, when underwriting a single property, the risk of

2

Moody’s Special Report, US CMBS 1Q 2005: Another warning light on the Credit Dashboard, April 28, 2005

8

unanticipated events that could affect the property’s cash flow is high. This is in contrast to

pooled transactions, in which the diversification of properties and leases mitigates this risk.

CMBS is very different from residential mortgage backed securities (RMBS) as there are certain

aspects of the underlying pool that require different considerations in creating CMBS versus

RMBS. First, prepayment terms differ; while residential mortgages permit prepayment without

penalty, commercial mortgages usually require penalties or defeasance for prepayment. Second,

in CMBS, even an imminent default has consequences as the special servicer (defined on Page

11) has wide discretion in modifications in such circumstances. Finally, a major distinction

between CMBS and RMBS deals is the role of the junior bond class buyers. In CMBS, no deal

occurs without first finding a buyer for the subordinate classes. This provides an extra layer of

security for the senior buyer, particularly because the buyers of the junior classes tend to be

knowledgeable real estate investors.

The majority of CMBS transactions utilize a senior / subordinate structure, whereby the cash

flow generated by the pool of underlying commercial mortgages is used to create distinct classes

of securities. In such a structure, the lower priority classes provide credit enhancement for the

senior securities. For example, credit support for Class A is the sum of classes B, C and D, and

the credit support for class B is the sum of classes C and D. The credit support for a class must

be fully extinguished before any default loss can affect the class. Thus, with subordination, the

greater the credit support the higher rating the class receives. The most junior class has no credit

support and is usually unrated. Traditionally, the lower rated (below BBB) and unrated classes

are either privately placed or retained by the issuer, although this is slowly changing as the

market matures and become comfortable with the characteristics of CMBS.

Shown below is a simple diagrammatic representation of the senior / subordinate structure of a

CMBS issue (based on the 2004 subordination levels). Credit support is the buffer or cushion

from losses that each tranche requires for a specific rating category. For example, in the above

structure 19.22% credit support at the ‘AAA’ level, the pool would have to suffer 19.22% of the

loan balance before the ‘AAA’ certificates would be impacted. Similarly, the pool would have to

9

suffer losses that exceed 2.66% of the loan balance before the ‘BB’ certificates would be

impacted.

Table 1

Class

(% Subordination)

AAA

(19.22%)

AA

(12.23%)

A

(8.39%)

BBB

(4.77%)

BB

(2.66%)

B

(1.55%)

UR (unrated)

(0%)

Source: Data from Trepp LLC (based on average 2004 deal structures)

The CMBS tranches retire sequentially beginning with the highest rated bond paying off first.

Thus, any return of principal caused by amortization, prepayment or default is used to repay the

highest rated tranche. Interest on principal outstanding will be paid to all the tranches, based on

their outstanding face or nominal value, or is accrued for the lower rated classes and used to pay

down the senior classes more quickly. The coupon rate of the security is always less than or

equal to the lowest interest rate on any individual mortgage in the collateralized pool. This

ensures that there is enough interest available to pay all the investors.

10

An important structural feature of CMBS transactions is the presence of the master and special

servicers. Master servicers manage the routine, day-to-day administration functions required by

all structured securities or collateralized transactions, while the special servicers are used to

handle delinquent loans and workout situations.3 In case of a delinquency that results in

insufficient cash to make all scheduled payments, the transaction’s servicer advances both

interest and principal. This process continues till such time that the amounts are deemed

unrecoverable. Often, the servicer’s interests are aligned with that of the CMBS investors as

servicers now invest tin the non-rated and subordinate tranches of the deals they service. Losses

arising from loan defaults will be charged against the principal balance of the lowest rated

tranche and move upwards. The total loss charged includes the amount previously advanced as

well as the actual loss incurred in the sale of the loan’s underlying property.

A unique feature of the senior / subordinate structure is that the credit enhancement can grow

over time. As principal is paid to the senior classes first, if no losses occur, these classes will pay

down faster than the mezzanine4 or B-pieces5. This results in increasing the amount of

subordinate classes as a percentage of the entire deal and thus, provides a higher credit

enhancement of the remaining senior classes.

Rating agencies play an important role in the CMBS market. The role of a rating agency is

primarily to provide a third – party opinion on the quality of each bond class in the CMBS

structure as well as the requisite amount of credit enhancement or subordination level to achieve

the desired rating level. In essence, rating agencies help in deciding the appropriate structure for

the deal. Subordination levels are set to attain AAA credit rating on the senior class. This is the

highest rating possible, signifying that the bonds are deemed to have minimal credit risk. This

makes the AAA tranche most attractive to investors. According to Standard and Poor’s, the

credit rating assigned to a CMBS transaction is “an opinion on the ability of the collateral to pay

interest on a timely basis and to repay principal by the rated final distribution date, according to

3

Frank Fabozzi, The Handbook of Commercial Mortgage Backed Securities

Mezzanine Bonds: Non-senior securities receiving investment grade ratings

5

B-piece: Non-investment grade bonds

4

11

the terms of the transaction. The rating does not reflect the impact of prepayment or any other

factors that may affect investors’ yields”.6

The credit risk is assessed by determining the probability of default and the severity of loss given

default occurs. The credit risk captures the uncertainty in the timing and the magnitude of cash

flow receipts created by a borrower’s default option. Since default generally results from a low

collateral asset value, the risk lies in the volatility of the value of the security’s collateral i.e. the

underlying real estate. Thus, the loan to value ratio as well as the debt service coverage ratio of

the underlying pool of loans, among many other parameters, is also evaluated. If the target level

of such parameters is not attained, the bond gets a lower rating. It is also important to estimate

losses in the event a loan defaults and is foreclosed or restructured. The severity of loss should

equal the property sale proceeds plus the property revenue, less principal owed upon default,

foregone interest and expenses.

1.4 CMBS Rating Methodology

According to a report by Moody’s on rating of conduit transactions7, the credit enhancement

needed to achieve a rating level for a proposed securitization typically depends on the expected

frequency, severity, and timing of future losses. An estimation of frequency and severity of

losses is usually based on a statistical analysis of historical performance data for assets like

residential mortgages, which can be homogeneous in character and, for which historical data is

available. However, commercial mortgages are not uniform in character, and relevant historical

loss information is limited. As a result, Moody’s analyzes the fundamental real estate credit risk

of each asset to estimate the frequency and severity of losses within the legal and structural

framework of structured finance. Moody’s reviews the portfolio diversification aspects of a pool,

which have an impact on the volatility of expected loss for the pool, in turn affecting the level of

credit enhancement needed for the rated bonds. In the case of non-recourse lending, which is

typical of U.S. conduits, the default probability is assumed to be highly dependent on the debtservice coverage ratio (DSCR), and the loan to value ratio (LTV) associated with the underlying

mortgage loan. DSCR is the main driver of frequency of loss, while LTV is the main determining

6

7

Standard & Poor’s Structured Finance CMBS Property Evaluation Criteria

Moody’s Approach to Rating US Conduit Transactions, September 2000

12

factor for the expected severity of loss. Moody’s believes that the stability of cash flows and

asset values of the major property types, ranked in order from best to worst, is as follows:

multifamily, anchored retail, industrial, unanchored retail, office, and hotel.

Moody’s also considers several portfolio characteristics, in addition to those of the underlying

collateral. One such characteristic is the portfolio diversity; which could be by property type,

geographic location, economic diversity and loan concentration. Moody’s views portfolios with

multiple property types and geographic locations as more stable. Different property types have

different risk profiles and market dynamics. Thus, property type diversification mitigates the

expected losses in a pool, whether a pool of loans or a loan secured by a pool of properties.

Geographic diversification helps mitigate the risk of single market declines, and serves to

smooth the variability around an expected loss. It helps offset the impact to a pool from a

regional downturn.

For rating large loan CMBS transactions, the focus is on the credit characteristics of the asset, the

structural features of the transaction, and the impact of diversification in a cross-collateralized

pool situation. Moody’s considers the going-in and the balloon loan to value ratio and the actual

and stressed debt service coverage ratios, in addition to the structural and legal issues. Large

loans are typically pooled with other loans to reduce concentration risk. If a deal has eight to ten

loans, the diversification benefit can be significant. Even though the expected loss for an

underlying single loan does not change, the volatility of the expected loss for the pool is reduced

due to higher diversity.

Moody’s rating approach compares the credit risk inherent in the underlying asset with the credit

protection offered by the structure. The credit risk of the underlying asset is determined primarily

by two factors: the frequency of default, which is largely driven by DSCR and the LTV of the

underlying loan, which impacts the severity of loss in the event of default. The structure’s credit

enhancement is quantified by the maximum loss of value on the asset the securities are able to

withstand under various stress scenarios without causing an increase in the expected loss for

various rating levels.

13

Diversity is usually beneficial for the senior classes of bonds but may hurt the lowest rated class,

all else being equal. Also, as more loans are pooled, there is a greater likelihood of the pool

experiencing a defaulted loan. Since these transactions are tranched the increased likelihood of

default is disproportionately concentrated in the junior most classes.

To determine the appropriate credit enhancement, S&P8 first adjusts the cash flow of the

underlying pool of properties to derive an estimate of the stabilized net cash flow that the

property can be expected to sustain over the life of the securitized transaction. Sustainable net

cash flow is derived by making adjustments to the property’s current revenues (typically trailing

12 months) and current expenses to produce the net operating income. These adjusted cash flows

are used as the basis for modeling credit support for the transaction. The loss model measures the

default frequency for each loan and the severity of loss that can be expected as a result of a

default.

The amount of recommended credit support is a function of the aggregate characteristics of the

loan pool and will depend on the projected losses for each loan during various economic stress

environments. Since the ‘AAA’ rating category is highest, the ‘AAA’ loss assumptions and

related credit support should be sufficient to survive the worst possible economic stress.

Conversely, the assumptions and the resulting credit support for a ‘B’ rating are less severe.

Fitch’s model9 to determine the appropriate subordination levels for any given pool consists of

three main components – default probability, loss severity, and pool composition factors. Fitch

begins by calculating the debt service coverage ratio and loan to value ratio assuming an “AA”

stress environment reflective of the real estate environment of the early 1990s. The default

probability and loss severity assumptions, based on the DSCR and LTV for each loan, are

adjusted for certain property and loan features to determine the credit enhancement based on

individual loan characteristics. Finally, the composition of the pool is analyzed to identify any

concentration risks, and the structure and the parties to the transaction are evaluated and

incorporated into the ratings.

8

9

Based on Standard and Poor’s CMBS Property Evaluation Criteria

Fitch Ratings Commercial Mortgage Criteria Report – Rating Performing Loan Pools

14

Table 2

Fitch Model Overview

Default Probability

X

Loss Severity

=

Base Subordination

Base Subordination

X

Pool Composition

Factors

=

Final Subordination

The default frequency of a specific loan is a function of its respective DSCR and LTV. The loss

severity is the sum of the principal balance that may be lost during the liquidation and

foreclosure period, accrued interest on the defaulted mortgage balance, as well as legal and other

costs associated with the foreclosure and liquidation of the asset.

Thus, the credit enhancement is a function of the default probability and loss severity, in addition

to other pool composition factors.

Subordination Level = ƒ (default probability, loss severity, pool composition factors)

The foreclosure frequency at each rating category is multiplied by the loss severity at each rating

category to provide the required credit support at each rating category. When determining the

losses associated with any loan, the analysis incorporates the amount of amortization that has

occurred by the assumed default date; the presence of additional debt; the quality of the real

estate; the property type; the loan structure; whether the property is located in a judicial

foreclosure10 or power-of-sale state11; and the availability of credit for the related asset type, or

other factors that may affect liquidity and credit and thereby heighten or reduce the risks of

potential losses associated with any loan. Thus, while the default frequency of two loans within

the same property type with the same DSCR and LTV is the same, the losses associated with

each of these two loans may differ, based on their individual characteristics as outlined above.

Other factors are also considered in deriving credit support or subordination levels, which may

affect the final levels that are recommended for the pool. For instance, environmental and

property condition, seismic reports, underwriting standards and the lending environment in

10

Judicial foreclosure necessitates that the court order the foreclosure and supervise both the process and ultimate

distribution of funds.

11

This is associated with a deed of trust mortgage instrument that allows an independent party (attorney or trustee)

to conduct the sale in the event of foreclosure.

15

which the loans were originated are also factored into the recommendations. Additionally, the

absence of reserves, cash management, and other structural features may adversely affect the

overall sizing of the transaction.

1.4 Summary

With the CMBS market outperforming expectations, the outlook still continues to be positive for

the future. Market factors such as low interest rates, the entry of an increasing number of

investors and the tightening spreads continue to make CMBS a competitive alternate to whole

loans and other investments.

The objective of this thesis is to investigate the risk and diversification factors as well as other

pool characteristics such as pool type, interest rate type and market factors such as the spread

differential between CMBS and corporate bonds that affect subordination, and if they are

significant in explaining the change in subordination levels of CMBS.

16

Chapter 2

LITERATURE REVIEW

Since subordination levels are determined by the probability of default and loss severity of the

loans, it is important to look at factors that impact these very aspects. Thus, the relevant research

includes studies on the default and loss severity characteristics of commercial mortgages. The

default and loss severity study of mortgages is relevant as subordination levels are based on the

probability of loss (due to default) of the mortgages in the underlying pool and the severity of

loss, once a loan defaults. There is extensive literature on defaults of commercial mortgages and

a few on the loss severity of commercial mortgages. Mortgage defaults have an impact on the

credit risk of the mortgages, which my affect the subordination levels of the CMBS transaction.

Also, as an attempt is being made to understand any diversification benefits that may affect

subordination, studies on diversification benefits in real estate are also discussed. However, due

to the relatively adolescent nature of the CMBS market, there have been few studies directly on

the topic of subordination.

2.1 Mortgage Default and Loss Severity Research

Default risk affects CMBS in different ways. Subordinate classes absorb losses first and they are

generally most vulnerable to default. Interest only bond holders are subject to risk in that any

decrease in the notional principal balance results in the loss of interest income without any

compensating prepayment penalties. Mezzanine class investors are generally protected against

any principal losses but need to understand their exposure to extension risk, which is the risk that

balloon loans will not be able to pay off their principal balance at maturity. Finally, even the

senior class investors are exposed to default risk. CMBS with lower quality collateral have

greater cash flow risk.

One of the most important aspects in assessing default risk in a CMBS transaction is the debt

service coverage ratio (DSCR), which is the ratio of the available income from the property to its

required debt service. The closer the DSCR is to one, the higher is the chance that the property

income may fail to cover the mortgage payments. Some of this is alleviated by reserves which

cover periods when income is interrupted or expenses are unusually high.

17

Another important aspect is the loan to value ratio (LTV), which is the ratio between the loan

balance and the value of the property. In theory, the LTV should be more important than DSCR

because a borrower should default only if the property value is less than that of the loan. Even if

the DSCR falls below one, the borrower should be able to sell the property for more than the

value of the loan and will not default. While LTV is an indication of the borrower’s incentive to

support the debts service, the DSCR is an indicator of the property’s ability to do so.

There have been several studies that have examined the relationship between default of

commercial mortgages and the LTV and DSCR. A brief summary of findings and conclusions of

the studies are discussed below.

The incidence of default rises with the LTV12; thus, holding all other factors constant, the

probability of default for a loan increases as the LTV increases. However, the increases are not

equal. For example, an increase in original LTV from 60% to 70% resulted in a 50% increase in

the probability of default from 0.54% to 0.80%. An increase in original LTV from 50% to 60%

increased the probability of default by 0.18%; and an increase in LTV from 80% to 90% drove

up the probability of default by 0.58%.

Unlike the LTV, the probability of default decreases with corresponding increases in DSCR.

However, studies have shown that the relationship between DSCR and probability of default is

weaker than the relationship between LTV and probability of default. One explanation for the

above is that borrowers have an incentive to negotiate the payment rescheduling and the debt

restructuring with the lenders, but the incentive wanes quickly when the LTV is greater than

100%.

Vandell, Barnes, Hartzell, Kraft and Wendt (1993) were the first to use loan level commercial

mortgage data from a life insurance company and the results confirm the effect of loan terms and

property value trends affecting default. Ciochetti, Deng, Gao and Yao (2002) used a similar data

12

Frank Fabozzi, The Handbook of Mortgage Backed Securities

18

set and applied the competing risk framework developed by Deng, Quigley and Van Order

(1996, 2000) in the residential mortgage market to commercial mortgages.

According to a study of defaults and loss severity in CMBS by Fitch Investors Service (1996),

commercial mortgages with relatively little excess cash flow after servicing loan payments are

more likely to default. DSCR is among the most significant variables in commercial mortgage

default and loss severity. According to Pamela Dillon, Fitch found that loans with low DSCR

had relatively higher annual rates of default. The study found significantly different average

default rates and loss severity experience among different bands of DSCR. At one end, loans

with DSCR below 0.5 showed annual default rates of 7.1% and average loss of 55.3% while the

default rate for loans with a DSCR of 2.1 was just 1.8% with a loss of 12.8%. However, when

the property’s income falls below the debt service, borrowers temporarily support the payments

if the property is viewed as having a long term ability to pay the debt service.

In another study of CMBS monitored by Fitch, Dillon and Belanger found significantly higher

defaults and loss severities for floating rate compared with fixed rate loans, despite a period of

“relatively stable and low interest rates”. The average annual default rate in the 1996 study was

6.7% for balloon loans, 2.4% for fully amortizing loans. The severity of loss was 31.1% for fixed

rate loans and 41.2% for floating rate loans, with no information on whether these were balloon

or non-balloon loans.

A study by FITCH on default rate of commercial mortgages (1991 to 1997) by property type

reported that loans secured by warehouses had the lowest annual default rate at 2.5%, followed

by multifamily properties at 3.9%. The default rates for these property types were considerably

lower than all other property types. The reason could be attributed to the fungibility and low

capital cost of warehouse space and the very slow obsolescence and stability of multifamily

properties. The default rate for the lodging sector was 4.2%, while office and retail properties

had the highest default rates at 4.8% and 4.9%. Office properties have high capital costs relating

to tenant improvement, leasing commissions, replacement reserves, etc, which may cause added

stress on the property during times of significant tenant roll. The high retail default rates could be

attributed to a significant percentage of unanchored retail and retail strip centers, which are more

19

volatile and subject to risk than malls and anchored community centers that were prevalent in the

thrift loan portfolios. The loss by property type also varies with multifamily properties at 46%.

This could be due to the fact that many of the loss observations were high leverage loans from

RTC/thrift transactions, several of which were concentrated in real estate depressed areas such as

California. These rates have changed since then but do give an insight into the importance of

diversification in a CMBS pool of mortgages. The study also revealed that loans with low

DSCRs, floating rate loans, and balloon loans had relatively higher annual rates of default.

A study by Ciochetti13 (1997) showed that state foreclosure laws appeared to impact the

performance of the assets, measured by net loss recovery. The data consisted of loans originated

by fourteen life insurance companies between 1986 and 1995. The net loss recovery over the

period averages 69%. The study finds significant evidence that the jurisdictional foreclosure

method is strongly related to not only mortgage loss recovery, but the level of foreclosure cost

and imputed interest as well. Loans foreclosed judicially have average recoveries that are 11%

lower than loans foreclosed through power-of-sale. Additionally, judicially foreclosed loans have

foreclosure costs nearly double, and total foreclosure costs nearly 50% greater, than for nonjudicially foreclosed loans.

According to Fitch14, another variable that may explain loss severity is the method of loan

resolution in each state. Foreclosures handled judicially take longer, on average, and result in

higher losses than non-judicial foreclosures, which take place in power-of-sale states. The

method of loan resolution had significant impact on loss severity, but very little discernible

impact on average annual default. Power-of-sale states had an average annual default rate of

4.2%, while judicial states had an average annual default rate of 4.4%, with the results not be

statistically significant.

Archer et al. (2001) point out that the downside of applying contingent claims modeling to

commercial mortgages is that variables such as LTV and DSCR are endogenous to the loan

origination process. Lenders often decide on the LTV and DSCR based on the risk associated

13

14

Brian A Ciochetti, Loss Characteristics of Commercial Mortgage Foreclosures, Real Estate Finance, Spring 97

Faboozi, Frank, The Handbook of Commercial Mortgage Backed Securities

20

with a particular loan as opposed to applying a single LTV or DSCR across all loans. If this is

the case, it is difficult to observe an empirical relationship between default and LTV and DSCR.

The results of the study by Ambrose and Sanders (2003) confirm that default and prepayment are

directly affected by changes in the economic environment, specifically by the future expectations

of interest rate. Also, mortgages with higher LTV at origination are more likely to prepay, but

the study doesn’t find a statistical relationship between LTV and the hazard of default.

Researchers, Rod Dubitsky and Kumar Neelakantan (2001) found that current LTV, rather than

original LTV, is a much more significant indicator of loss severity. The data suggest that when

adjusted for other factors, higher current LTV at payoff experience a higher loss severity.

Dubitsky credited the fact that low original LTV loans tend to prepay in full out of delinquency

as one of the reasons for the lack of significance of original LTV in explaining loss severity. In

summation, CSFB says that other things being equal, pools with lower average current loan

balance, greater seasoning, and higher current LTV loans would be expected to have higher loss

severity.

A study by Ciochetti et al (2003) used the proportional hazards model to understand commercial

mortgage defaults. The results of the study indicate that contemporaneous loan to value ratios are

of less importance than contemporaneous debt service coverage ratios in explaining commercial

mortgage defaults, though both these factors are of considerable significance in explaining the

quarter-to-quarter variations in default rates. Both the LTV and DSCR may change over time –

the first due to change in investors’ risk preferences and the latter due to decrease in rents or

increase in vacancy rates. The results from the model do confirm that the contemporaneous

DSCR is negatively correlated with default, while the contemporaneous LTV has a positive nonlinear relationship with commercial mortgage default. The study also evidences a greater

increase in default with a decrease in DSCR than with an increase in the LTV; thus implying that

the ability to meet the debt service obligations is the most relevant measure of commercial

mortgage default.

An analysis on loss severity by Pendergast and Jerkins of RBS Greenwich Capital (2003)

analysis the performance of 33,666 loans with an original balance of $185 billion securitized in

21

fixed rate conduit and fusion CMBS transactions issued from 1995 through 2001. They examine

the impact of property types, year of origination (vintage), loan size, loan to value ratio, and loan

liquidation on CMBS loss severity. They mention that the most compelling result of the study is

that the loan size matters – larger loans ($20 - $30 million) that have been liquidated during the

period of the study have lower loss severities than the smaller loans ($2 - $3 million) that have

been liquidated.

To study the impact of loan to value ratio on loss severity, the 194 loans that were liquidated

were also broken into various LTV buckets. According to the study, the 70% to 80% LTV bucket

experienced the highest percentage of liquidated loans at 44%. However, it should also be noted

that 50% of all the loans in the study fall in the LTV bucket of 70% to 80%. Loans with higher

original LTV, in general, experienced higher loss severities, though there were some exceptions.

Loans in the 60% - 70% LTV range experienced a weighted average loss severity of 41.2% but

the loans with an LTV in the >90% range experienced a weighted average loss severity of 74%.

At the same time, loans in the <60% range had a relatively high loss severity of 50%. The reason

for such exceptions is that the study is based on original LTV, as recent appraisals were not

available to determine the LTV just prior to disposition of the loan. However, LTV does seem to

impact the loss severity to a certain extent.

A subsequent study by Titus and Betancourt (2003) researched losses incurred on liquidated

loans in non-agency CMBS transactions from 1993 through 2002. The results of the study

indicate a cumulative loss severity of 40.11% over the nine year period. Also, the degree of loss

severity is directly related to the condition of the property markets. Loss severities increased in

the more recent years of study as the property market fundamentals had deteriorated. An

econometric analysis was performed to examine factors affecting loss severity. The results show

a statistically significant relationship between loss severity and the length of time to liquidate an

asset. However, the relationship between the loans in the study and the original debt service

coverage ratio and the original loan to value ratio were found to be statistically insignificant.

This result is consistent with earlier studies that suggest contemporaneous LTV and

contemporaneous DSCR as having greater explanatory power for delinquency and default.

22

The study by Chen and Deng (2004) states that the loan’s current equity share (calculated as one

minus LTV) has a dominant effect on the probability of the underlying collateral value dropping

below the critical value and hence, to default. The study also expects the net operating cash flows

(as evidenced by DSCR) to have a negative relationship with foreclosure. The study reveals that

the two loan specific financial variables, LTV and DSCR, are not significant, with LTV having

the correct sign and DSCR having the incorrect sign. Chen and Deng attribute this to some errors

in variable problem. Since both variables are largely estimated from market level indices, they

may not reflect the true financial conditions of the properties. They state that both LTV and

DSCR in their model are imperfect (noisy) measures of financial characteristics of an individual

property.

In their analysis, there appears to be big differences between what they refer to as “bad” loans

and “good” loans in terms of average LTV and market occupancy rates. The differences in

DSCR are also as expected, but not as pronounced as in LTV. Higher LTV leads to more

defaults, which is what the option pricing theory suggests and appears to conform to the findings

of Chen and Deng.

The pool level weighted average LTV and DSCR is analyzed for the data, over time. However, it

should be kept in mind that the weighted average statistics can be deceiving. For instance, two

deals may have the DSCR below 1.00 and one of the deals has loans with LTVs above 100%.

The lower quality of these pools is usually recognized by the rating agencies in the form of

higher subordination. Since loan in conduit pools are not cross-collateralized, defaults are

expected in such pools. While the AAA tranche may not experience losses due to adequate

subordination, there still exists a great average life uncertainty associated with such pools. This is

because recoveries from foreclosures are first paid to the senior classes. Thus, it becomes

difficult to predict when the AAA bond holder receives the principal. Thus, investors in the AAA

class from a low quality pool need extra spread to compensate for the average life uncertainty.

A Moody’s report (2004) analyzes the relationship between loan delinquency and leverage.

Delinquencies are found to be higher among loans with higher leverage, and the slope of the

increase is non-linear, rising sharply and by multiples at certain levels. The same holds true with

23

respect to the DSCR. While, even among the best cohorts, delinquency is never zero, loans with

a DSCR greater than 1.70 and LTV lower than 50% have very low delinquency rates (less than

1%). High leverage loans (greater than 90%) begin to separate from the pack as early as the first

full year of life, experiencing delinquency at two to three times the rate of the lower LTV loans.

The predictive power of initial DSCR varies with time. In the initial years, it matters a lot when

coverage is low. However, by seven to eight years into the life of the loan, the initial DSCR is

not strongly consistent with performance.

A recent study by Downing and Wallace (2005), based on Monte Carlo simulations of expected

defaults, indicate that the optimal subordination levels lie below those currently seen in the

market. One interpretation of this result is that in the absence of a track record of performance of

securitized commercial mortgages, subordination levels in the early years of CMBS were

conservative and high.

Several studies by been conducted by Esaki on commercial mortgage defaults. The first study

included loans from 1972 through 1997; the subsequent study added three more years of data

through 2000. The latest study (2005) includes loans through 2002. The addition of the new

loans alters the previous conclusion (1972 – 2000) slightly. In the past, all investment grade bond

classes of CMBS were well protected from the magnitude of losses experienced by the life

insurance company loans. The second study revealed that with the reduction in subordination

levels, some of the BBB classes would be vulnerable to a downturn of the magnitude of the late

1980s and the early 1990s. The latest study suggests that a greater proportion of the BBB classes

are now vulnerable to a downturn of the magnitude on the late 1980s and early 1990s. The loss

on the worst cohort, 1986, exceeds the average BBB subordination level on conduit and fusion

CMBS transactions being issued today, and may also result in default of some A tranches.

However, it is still below the lowest credit support levels for the AAA bond classes. Since BBB

subordinations are about 5%, most investment grade CMBS are still protected against the

average loss of origination cohorts of the last 30 years.

The results show an average lifetime cumulative default rate (based on loan balances) for cohorts

with at least ten years of seasoning decreased from 20.5% to 19.6% over 2000 to 2002. The 1986

24

cohort of originations continues to be the worst cohort in the past 30 years with nearly 33% of

the total loan balance eventually defaulting. The average loss severity on liquidated loans was

approximately 33%. The loans (as in the earlier study) are geographically well diversified, with

the largest in the West (23%) and Northeast (22%). Highest default rates were in the South

Central Region (25%) with the lowest in the West (10%).

According to a Moody’s study15, across all asset types, default rates increase progressively as

contemporaneous DSCR declines. Above a DSCR of 1.30, little variance in default rate occurs;

default would occur only under extraordinary circumstances. Default rates begin to accelerate at

a DSCR in the range of 1.20 to 1.30, a baseline commonly used for loan origination; implying

that the probability of default is not zero even if the loan has a currently adequate DSCR. As the

DSCR decreases, the probability of default progressively increases. The study states that default

probability almost doubles when the contemporaneous DSCR from 1.0 to 0.80 to 0.90. These

levels are likely to indicate a profound change in the property level conditions.

Thus, a review of the above literature indicates that the debt service coverage ratio and the loan

to value ratio just prior to the loan defaulting are important indicators of default probability.

Additionally, the average loan size also seems to have an effect on the default and loss severity

of commercial mortgages. These factors will be studied and analyzed in the thesis.

2.2 Real Estate Diversification Research

The two sources of risk relating to the underlying pool of loans are the prepayment risk and the

default or delinquency risk. Diversification of the underlying collateral is one of the ways to

mitigate default risk. CMBS with better diversification in the underlying pool of loans have less

exposure to economic events that affect particular regions or property types.

CMBS investors focus on a number of portfolio issues, especially those involving the

composition of the total collateral pool. The benefits of the CMBS structure derive from an

ability to make the real estate investments without risks associated with the direct mortgage or

equity placements (i.e. diversification by property type, geographic location, loan size, borrower,

15

Moody’s Special Report, US CMBS: DSCR Migration and Contemporaneous Probability of Default, June 7, 2005

25

etc.). This study focuses on the two aspects of diversification namely property type and

geographic location.

One of the factors considered when analyzing the risk of CMBS deal is the diversification of the

underlying pool of mortgages across space. The rationale for this “spatial diversification” is that

the default risk of the underlying mortgages is reduced if the loans are made on properties in

different regions of the country. Most benefits come from geographic diversification, since

regional recessions are more common than national recessions, and national recessions tend to

affect regions differently. The diversified portfolio of the loans can spread the risk across many

economies as opposed to having the entire portfolio of loans subject to an idiosyncratic risk

factor. For instance, the impact of a collapse in the Houston real estate market (which may lead

to higher defaults of loans) will be lessened if the commercial property markets remain strong in

New York, Seattle and Chicago. According to FITCH, geographic diversity within a pool is a

positive attribute that lessens some of the risk of regional economic and business cycle stress.

In a study of defaults by region by Ciochetti (2003), the Southwest (mostly Texas) accounts for

most of the foreclosed loans between 1986 and 1991. The Northeast moved in the opposite

direction – only six loans had been foreclosed between 1986 and 1989. However, this number

peaked in 1992 due to rising costs of living, and the economic weakness in the early 1990s.

Thus, the presence of geographic diversification is important in a CMBS pool.

In addition to spatial diversification, CMBS pools can be diversified across property types.

Rating agencies tend to assign a lower credit enhancement or subordination level to deals that

contain diversification across property types since a pool that is diversified across residential,

office, hotel, retail and industrial will most likely avoid the potential of a national glut in any one

of the sectors. Also, it is not possible to predict with certainty as to which property type will

enjoy the best performance going forward, and it is better to be adequately diversified. Different

property types vary widely in their default performance reflecting degrees of volatility in each

property type’s income and value. The property types in order of most to least stable are regional

malls, multifamily, anchored community shopping center, industrial / warehouse, unanchored

community shopping center, office and finally hotel.

26

A study by Grissom et al. (1987) studies the effects of portfolio diversification on the reduction

of unsystematic real estate investment risk by examining calculated returns of actual real estate

assets in two geographically different markets. Ex post data were collected from 170 different

income properties in two Texas markets between 1975 and 1983: Houston (40 assets) and Austin

(130). To test for the effects of portfolio diversification, 4 types of assets in each market are

identified: apartments, offices, industrial properties, and shopping centers. The empirical results

indicate that the variance of returns of real estate portfolios decreases rapidly with diversification

into a larger number of assets, across property types, and across markets. The average reduction

of total unsystematic risk is 92.5% for diversification across markets and 97.8% for

diversification across assets. The study concludes that diversification may be even more effective

for real estate assets than for common stocks.

A study by Laura Quigg (1997) indicates that the benefits of property type diversification are not

as great as geographic diversification since the performance of different property type trends

tends to be more highly correlated than that of properties in different locations. Multifamily is

diversified in that tenants comprise of different economic and demographic backgrounds, so a

100% multifamily can still be considered diverse. For other property types, there is a benefit to

mixing property types, because it gives a variety in tenant base as well as other factors that affect

property performance.

A study by Taylor and Fuchs (2004) assessed the impact of geographical dispersion on risk in

multifamily mortgages by generating different random portfolios for a given number of

apartment loan assets. All assets are granted equal weight and all have similar loan

characteristics, i.e., DSCR of 1.25 and LTV of 80%, 10-year maturity and extended lockout

provisions. The portfolio’s degree of diversification is subject to the randomness of the metros

selected for inclusion.

The Diversification Ratio (DR), defined as the ratio of unexpected loss for a diversified portfolio

over the unexpected losses for the same portfolio given no credit for diversification (i.e. ignoring

potential benefits flowing from diversification), is then calculated for each portfolio. For

27

example, a DR of .6 would indicate that unexpected losses for a particular portfolio are reduced

40% through diversification. The results show that as the number of assets or metros grow the

DR declines more or less monotonically with marked reduction in the dispersion of observed

DRs. Incremental additions (of assets) to the portfolio initially reap large diversification benefits,

but there is a substantial marginal utility to each incremental addition. The simulations used in

the study appear to indicate that the vast majority of diversification benefit is obtained by

portfolios consisting of 14-15 assets. Additional assets continue to yield benefits, but at a

declining rate. The risk mitigation benefits of maintaining a diversified portfolio are very

attractive. Simulations show unexpected loss calculations for a diversified portfolio are 55% of

those of the same portfolio assuming no diversification benefits.

The study also extends this analysis to geographically focused portfolios such as census regions,

and results show that loan portfolios concentrated in any particular region also reap

diversification effects. From highest diversification benefits to lowest, the regional results are:

the South (.48); Midwest (.51); Northeast (.60); and West (.64). Some of these portfolios offer

relatively more diversification than a randomly selected national portfolio, some less. The

difference among regional DRs including the number of metros represented in the region, the

overall market condition or credit performance of those metros and/or the observed correlation of

the real estate markets within each region.

A review of the above studies indicates that diversification in a pool of mortgages helps mitigate

risk associated, and thus an optimum diversification is always beneficial. Thus, the thesis will

also attempt to look at the impact of pool level diversification on subordination levels.

2.3 Summary

The above referenced research tends to indicate that the current / contemporaneous loan to value

ratio and the current / contemporaneous debt service coverage ratio provide significant

explanatory power for defaults and loss severity. Also, the average loan size (large versus small

loans) seems to have an impact on default and hence needs to be considered for their possible

impact on subordination levels. And finally, the impact of pool diversification will also be

analyzed.

28

However, in addition to the above variables, other market forces may be playing an important

role in determining the subordination levels. Thus, the thesis will also attempt to analyze factors

such as spread differential between corporate bonds and CMBS, and the additional liquidity and

flow of investors into the CMBS market that may have affected the subordination levels.

29

Chapter 3

DATA AND METHODOLOGY

The objective of this chapter is to discuss the data and variables used in analyzing the trend in the

subordination levels over time. The subordination levels of all the rated tranches of a CMBS

transaction have been considered in the analysis.

3.1 The Data

Data were collected on commercial mortgage backed securities issued between 1995 and mid2005. This reflects a decade of transactions in the CMBS market, thus enabling an analysis of the

credit enhancement levels for a reasonable time frame. However, the universe of data has been

narrowed to exclude FNMA, Freddie Mac and other Government Sponsored Enterprise (GSE)

securities, due to the implied government support embedded in the subordination levels of such

deals. Similarly, there are certain deals that have an implicit support of other government

agencies, and the deals do not reflect any required subordination level. Such deals have also not

been considered in the analysis. Thus, the final data set consists of 430 commercial mortgage

backed securities issued in the past decade.

Prior to collecting the data, the data fields that were thought to be most relevant in explaining the

subordination levels were established. This includes the risk factors – loan to value ratio, the debt

service coverage ratio, interest rate type (floating rate versus fixed rate deals), deal type (conduit,

large loans); and diversification factors – property type diversification and geographic location

diversification. Additionally, the spreads between corporate bonds and CMBS, and the increased

liquidity and demand for CMBS will be examined. The dependent variable is the subordination

level of each bond class in the transaction.

The data for this thesis was collected from Trepp LLC. Trepp, LLC, is the leading provider of

CMBS and commercial real estate information, analytics and technology to the investment

management industry. Trepp meets the needs of both the primary and secondary market with a

host of innovative products and services designed specifically for CMBS and commercial

mortgage participants. A summary of every deal issued is available through the Trepp database.

30

It provides information summary information of the bond classes i.e. coupon rate and type,

current rating, original rating, etc. It also provides information on the pool characteristics in

terms of concentration of specific property types, of geographic locations, or metropolitan

statistical area (MSA), etc. Other additional information include details of the top loans in the

pool, details of delinquent loans in the pool, if any, top tenants in the properties in the underlying

mortgages, information on defeased loans, if any and the collateral summary.

Some of the descriptive statistics of the data are discussed below. From Table 3, the steady

increase in the number of deals issued is evident, indicating the growth in the CMBS market.

Table 4, further shows the classification of deals as per the deal type. The category “others”

includes deals that are classified as “miscellaneous” (typically loans on golf courses, car garages,

etc.) and credit tenant loans (as the name suggests, properties with a credit tenant makes up most

of the underlying pool of mortgages).

Table 4

Table 3

Year

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Total

# of deals

15

24

37

45

44

36

41

38

52

66

32

430

Year

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Total

Conduit

8

19

25

36

36

31

36

33

40

55

28

347

Large Loan

2

2

5

2

2

0

1

2

10

10

4

40

Deal Type

Seasoned Franchise Loan

4

0

3

0

3

0

0

4

1

2

1

2

2

0

1

0

1

1

0

0

0

0

16

9

Others

1

0

4

3

3

2

2

2

0

1

0

18

In terms of fixed versus floating rate deals, there are a total of 396 fixed rate CMBS deals and 34

floating rate deals in the entire data set. The year wise break-up is given below. This shows an

increasing number of floating rate deals in the recent years. This could be due to the low interest

rate environment.

31

Table 5

Year

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Fixed

15

22

36

45

44

36

40

36

41

55

26

Floating

0

2

1

0

0

0

1

2

11

11

6

The following table shows the trend in the weighted average loan to value ratio and the weighted

average debt service coverage ratio of the CMBS transactions from 1995 through mid 2005.

Table 6

Year

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Avg. WALTV Avg. WADSCR

65.62

1.45

66.89

1.46

67.43

1.47

68.33

1.51

68.76

1.45

67.28

1.40

67.82

1.44

66.91

1.81

62.51

2.73

64.65

2.26

65.48

1.84

Out of the 430 CMBS transactions considered, 354 were diversified while 76 were nondiversified. Additionally, of the 32 CMBS deals that had a AAA subordination level of more

than 35%, 19 were not diversified (Exhibit 1). The basis used for diversification is that the deal

should consist of at least three property types with not more that 50% concentration in any one

property type.

The information used specifically for the analysis of subordination includes, first and foremost,

the subordination levels of every bond class of every deal. Additionally, information on the

32

weighted average loan to value ratio and the weighted average debt service coverage ratio is used

for the analysis. The deal type and the coupon type (fixed or floating) are also used.

3.2 Methodology

The objective of this thesis is to analyze the trend in subordination levels for all bond classes

over the past decade. The underlying hypothesis is that the reason for lower subordination levels

in recent years is that the loans in the underlying pool may have become less risky. Risk

attributes of a loan could be considered as a function of the loan to value ratio and the debt

service coverage ratio.

Subordination Level = ƒ (Risk factors)

= ƒ (loan to value ratio, debt service coverage ratio, interest rate

type, deal type)

Another hypothesis is that the underlying pools of loans have become more diversified over the

years, hence reducing the risk in the transaction. Standard linear regression has been used to

analyze the data with subordination levels as the dependent variable and the variables described

below as the independent or explanatory variables. Based on the review of the literature and the

factors that affect default probability and loss severity, the specific variables that used for

analysis of the subordination levels are described below.

The variable used for loan to value ratio is the WALTV. This is the weighted average loan to

value ratio of the pool of mortgages just prior to being securitized. The expected result for this

variable is that a positive relationship exists between the loan to value ratio and the subordination

levels. This is because, a higher loan to value ratio implies a higher risk of the loan, which would

then impact the bond classes. Thus, a higher subordination level would be required for the

different tranches to account for the higher risk in the underlying pool of loans.

Subordination level = α + β (weighted average loan to value ratio)

The variable used for debt service coverage ratio is WADSCR. This is the weighted average debt

service coverage ratio of the pool of mortgages in the transaction prior to being securitized. The

expected relationship between subordination levels and debt service coverage ratio is an inverse

33

relationship. The higher the debt service coverage ratio, the lower the risk associated with the

loans, and thus, lower is the subordination or credit support levels required for a specific bond

class.

Subordination level = α - β (weighted average debt service coverage ratio)

To analyze the diversity in the pool of mortgages in each deal, both property type and geographic

diversification are considered. The model has been set up such that if a specific deal has

mortgages on more than three property types with no more than a 50% concentration in any one

property type, and is in at least four large cities across the United States, then the underlying pool

can be referred to as diverse. A dummy variable, DDiverse, has been created such that if a

specific CMBS transaction is diverse, the dummy variable attributed is 1 else it is 0. The

expected relationship between diversity and subordination levels is also expected to be an

inverse relationship. The greater the diversity is a pool, the lower the risk due to the spread

across property types and geographies and thus, lower is the required subordination level.

Subordination level = α - β (diversity)

Conduit deals may have a lower subordination with respect to other deal types, such as franchise

loans16, or miscellaneous loans (which may include properties like golf courses or garages). A

dummy variable, DConduit, has been created to check if, in fact, conduit deals would indicate a

lower subordination level as opposed to the other deal types. The intuition for such a relationship

to exist is that conduit deals typically include loans on regular properties such as office,

multifamily, etc. as opposed to more exotic and maybe, riskier properties such golf courses, etc.

Thus is a specific deal is a conduit deal, then the dummy variable is 1 else it is 0. The expected

relationship is a negative or inverse relationship, because conduit deals imply lower risk and

thus, lower subordination levels.

Subordination level = α - β (Conduit deal)

Another variable that may affect subordination levels is the nature of the coupon i.e. fixed or

floating. A floating rate deal, just like any floating rate mortgage, is assumed to have a higher

16

An example of a franchise loan is a retail property that is owned by a auto dealership of say, Toyota. They may

also include properties that are restaurants or gas stations.

34

risk than a fixed rate deal. This is because, there is a degree of uncertainty associated with the

movement in future interest rates that might impact the performance of the mortgages, and thus,

their mortgage backed securities adversely. Such risk may be mitigated by a higher subordination

structure for a deal. To examine this effect, a dummy variable DFloating, has been created such

that deals that have a floating rate have a dummy variable of 1 and fixed rate deals have a

dummy variable of 0. The expected relationship is that subordination levels should be higher for

the floating rate deals.

Subordination level = α + β (floating rate)

Apart from the independent variables specified above pertaining to the risk associated with the

loans, there may be other factors that may affect the subordination level for a particular deal in a

particular year. For instance, since the data is time series, in that subordination levels have been

considered over the past decade, time needs to be controlled for. This is because, arguably, other

factors specific to the real estate cycle, or investment climate for other investments such as

stocks and bonds, interest rates, etc may have also impacted the subordination levels. Thus, a

dummy variable has been created for the year to control for the influence of time on the

subordination levels. The dummy variables for the years are DNUM(yr) i.e. DNUM96, and so

on. The analysis is on the CMBS transactions from 1995 through 2005. The year 1995 is the

omitted variable; and if a deal pertains to a specific year, the dummy variable is 1 else it is 0. For

instance, for the year 2003, all deals (data points) in the year 2003 have a dummy variable equal

to 1 and all deals in the years other than 2003 have a dummy variable equal to 0.

Similarly, since the thesis analyzes the change in subordination levels of all the bond classes, a

dummy variable is created for the bond classes. All bond classes are compared to the AAA bond

class which is the omitted variable in the regression. The dummy variable, D(tranche), with the

values of 0 / 1 are used for the analysis.

The following chapter discusses the results and the interpretation of the regression results. The

spread differential between CMBS and corporate bonds is not used in the regression but is

analyzed in the following chapter.

35

Chapter 4

DATA ANALYSIS

The objective of the thesis is look at possible explanations for falling subordination levels in

CMBS. The hypothesis is that the risk of the loans in the mortgage pools has gone down, thus

giving room for lower subordination levels. Specifically, the proxy used to indicate if a loan is

risky or not is the loan to value ratio and the debt service coverage ratio. These variables have

been considered as they emerged as two important factors after a review of the default and loss

severity literature on commercial mortgages. Pool level diversification has also been considered

as increased diversification helps to mitigate risk. The relationship between the subordination

levels and all the independent variables explained in Chapter 3 is discussed below.

4.1 Subordination Levels

The first task in the analysis was to examine the subordination levels over the past decade for all

the tranches in the commercial mortgage backed securities issued in this period. The average

subordination level was calculated for each of the bond classes.

A significant change in the structure of the AAA tranches has taken place since late 2004. CMBS

issuers have started carving the senior triple-A tranches of many offerings into “super-senior”

and, more recently, “super-duper” tranches that have higher credit support levels than the ratings

agencies have reached for traditional senior tranches (sample deal in Exhibit 2). Thus, the AAA

tranche of the CMBS deal is further split into “super-duper AAA”, “super-senior AAA” and the

“regular AAA tranches”. The regular AAA tranches have a subordination level in the range of