MANAGING MONEY

advertisement

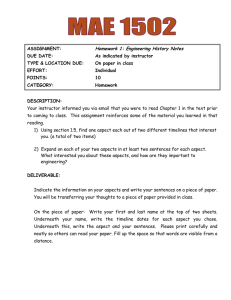

MANAGING MONEY Analysing commodities trends is just one Aspect of Capital success Aspect Capital is best known for its commodities hedge funds. While this sector is a central pillar of the firm’s trading strategy, there are other strings to the Aspect bow, as Solomon Teague discovered The commodities trading firm had two of the hedge fund industry’s three most famous initials. While Aspect Capital was established by the ‘A’ and ‘L’ of the AHL hedge fund programme – now the pride and joy of Man Group – the London systematic trading manager has added many other luminaries to these two founders. To Michael Adam and Martin Lueck was added Anthony Todd, Aspect Capital’s third cofounder, and Eugene Lambert. Aspect’s first fund was Aspect Diversified. The systematic trend-follower is still the firm’s flagship product, and its success lies not just in its algorithmic trading system, says Todd, but also in the company’s dedication to improving the efficiency of its operation. Aspect’s raison d’être is efficiency and anonymity in the market. While many of its competitors in the markets it trades are busy looking for cheap securities, researching intrinsic value and second-guessing the market, Aspect’s 52person research team are more concerned with analysing the firm’s own technology systems, searching for potential improvements in all areas of its operations. EFFICIENCY “We’re always thinking about ways to exploit market behaviour more efficiently,” explains Todd. “It’s almost like any other industry, whether you’re in chemical industry, the pharmaceuticals industry or the computer industry: you can deliver a competitive advantage through efficient investment in R&D.” With about 65 projects planned or currently underway, the research department’s aim is to save the company money in areas from reducing 26 | HEDGE FUNDS REVIEW | September 2005 Anthony Todd Eugene Lambert trading costs to spotting new relationships between assets and improving the algorithms to reflect these. Todd fondly refers to the team as “probably one of the largest R&D teams of any hedge fund in Europe.” The R&D department’s work focuses on two areas: ‘foundation research’ is long-term research, conducted over a period of months to years, looking for big breakthroughs in the business but with an uncertain outcome. At the other end of the spectrum, its attention centres on delivering small incremental improvements to the business: less sexy, but with a higher probability of success. “One improvement we are making right now includes better deployment of electronic trading platforms to reduce our transaction costs, to reduce our slippage costs,” Todd says. “My confidence in our ability to do that is incredibly high – almost 100%. And the impact of doing that is translated immediately into improved performance. Now we’re looking at how we roll our contracts, there’s work we can do there to improve that process and that can add tens of basis points to what we do with a very high probability of a positive outcome,” he adds. “If you have a range of different projects running simultaneously in a research environment, you have to accept some will work out and some won’t, but if you have the high-probability ones running alongside the longer-term, less-certain ones, that to me is a very competitive approach.” The research team itself has recently been the subject of an overhaul designed to improve performance. “Until a year or two ago, we used to run our research along product lines. In the middle of last year, we changed it and started to run our research on theme-based lines, because there can be little pieces of work that cover all our products. You lose that benefit if you look at things from a product perspective,” says Todd. “If you have a very efficient R&D, you have significant resource,” he adds. “With the market insight we have with Michael Adam and Martin Lueck, I think we can deliver a significant competitive edge.” ANONYMITY Operating a company the size of Aspect poses its own challenges. With approximately $2.6bn assets under management, $1.8bn of this in its Diversified Fund, it is a significant player in markets it trades, yet anonymity is crucial to its competitiveness. “The type of investment approach we use is called an analogue position function, in other words a continuous position function, continually adjusting its position in the market,” Todd elaborates. “We don’t let large orders loose into the www.hedgefundsreview.com MANAGING MONEY market, but trickle small orders into the market very efficiently, 24 hours a day with the aim of having minimal visibility, being unpredictable and incurring minimal transaction costs. Central to this is that in the commodities sector – perhaps more than any other – you have to be very conscious of liquidity. However, that approach does enable us to have quite a significant allocation to commodities – and the commodities sector is very diverse.” Commodities make up 30% of Aspect’s overall investments, and a 37% risk allocation of its flagship Diversified Fund portfolio. However, calling Aspect a ‘commodities house’ is not quite accurate, Todd notes. The Diversified Fund is also invested in bonds, with a 20% risk allocation, stock indices at 12%, currencies at 19% and interest rates at 12%. of other managed futures managers'. If you look at others, the classic long-established ones are long-term trend followers. At the other end of the spectrum are short-term day traders. We are in the responsive end, but not quite day traders: we don’t change our positions in a matter of a few days, it takes a matter of a few weeks.” On average, Aspect holds positions for a few months, unlike long-term trend followers for whom it is many months or years. At the moment, there is no significant difference between the average time different assets are held, but recent research on sector-specific models is exploring the optimum time for holding different assets, and could change that. NOTHING IS CERTAIN Earlier this year, almost all economists were forecasting a further decline in the dollar. There was FOCUS ON RISK practically unanimity that the dollar was going “Our risk allocation is pretty static,” explains to collapse. Guess what? It’s been one of the Todd. “It changes as we add new markets, and strongest performing currencies this year,” says changes according to liquidity. Over the course Todd. It explains his belief in the advantage of of the last few months, we’ve identified a number systematic trend-followers over and above macro of new markets to add and developed our conplayers and other specialists who try to anticitinuous position function, hence we now have a pate market moves. bigger weighting to agriculturals and to the comIt’s not the only example. “I was recently modities sector in general. But it doesn’t change looking at a forecast on where the Chinese yuan month by month.” will be trading in a year’s time. There’s a 30% While some argue the pitfalls of trading too spread between the optimistic and pessimistic wide a range of sectors, Aspect’s agnosticism economists,” he continues. “We say the price is regarding asset price fundamentals and intrinsic the best determinant, and apply sophisticated value means it can operate across a diverse range statistical models to analyse the price and work of asset classes without spreading itself too out where it will head.” thinly. In fact, there are some surprising relationThis is especially advantageous in times as ships between assets that become evident when uncertain and transitional as these. Many factors you study a broad range of assets, Todd says, are currently conspiring to cloud the judgement another product of Aspect’s R&D work. of economists, vying to dominate the actions of “You have to monitor a wide range of markets investors. The threat of terrorism, economic data at different time frames 24 hours a day because of various shades, the Chinese currency revaluayou don’t know when something will crop up,” tion and the death of Saudi Arabia’s King Fahd explains Todd. “There are markets where we have all contributed to the uncertainty currently have made no money for 10 years, but we are endemic in the markets. still in them. Who’s to say we won’t make a huge Much was made, for example, of the doubt amount of money in them over the next 10?” surrounding the China currency revaluation and Involvement in a broad range of assets maxthe impact it would have on the markets. The imises the chance that when something trends, answer, it turned out, was very little, certainly in Aspect will be there to capitalise. Todd notes the the short term. While everyone had their eyes on reverse is also true: trading only in areas that the dollar (which was expected to fall in wake of have previously proved fruitful is no guarantee the announcement) and oil prices, it was the bond of success. markets that were most lively in July. “Think about where inflation was and where “At the same time as that news came out, you bond yields and short-term interest rates were were getting strong economic news from both in 1989 compared to where they are today. There the US and Europe. At Greenspan’s congreshas been an unbelievable sional testimony on bull-market in bonds’ 20 July, he immedishort-term interest rates ately got up and spoke “You have to monitor a wide range over that period. Does about his commitment that mean that sector will to increase interest of markets at different time frames be more profitable for the rates further,” Todd next five to 10 years?” explains. 24 hours a day because you don’t With its attention “Until that point, always fixed on a broad people thought he know when something will crop up” range of markets, its might moderate the trading system analyses pace of interest rate ANTHONY TODD price movements and increases. That combirelationships, searching nation of news drove for trends. Its orders bond yields higher and reflect sophisticated interpretations of the meanhigher. Of all the trends that have emerged from the ings of price movements. last month, it’s really the bond one that has legs.” “There’s a big difference between a market that The equity markets have also been vibrant, goes up in a straight line and then collapses, and with Asian markets setting the standard. Todd a market that gradually goes up and then gradusays both the Hang Seng and the KOSP have ally down. Our systems will react in different made impressive gains, from which Aspect has ways to the two different moves,” Todd says. “Our profited. “Asia always tends to be a geared play systems are very responsive compared to those on the world economy,” he notes. www.hedgefundsreview.com FUNDAMENTALS Name of manager: Full name of fund: Address of manager: Aspect Capital Ltd Aspect Diversified Nations House 103 Wigmore Street London W1U 1QS Phone contact for further information: +44 (0)20 7170 9700 Launch date of fund: December 1998 Present size of portfolio: $1671m including segregated accounts (as at end July 2005) Is the fund open or closed to new investors: Open Target annualised return: Strong absolute performance over the medium term Target annualised volatility:16% Avge annualised volatility 17.9% (as at end July 2005) Geographic focus: Global managed futures Administrator: Bisys Hedge Fund Services (Ireland) Ltd Prime broker: Fimat International Banque SA (UK Branch) Auditor: KPMG Initial fee: N/A Management fee: 2% Performance fee: 20% Is there a high watermark for performance fee?: Yes Is the fund listed: Euro class is Dublin-listed Domicile: Offshore, Cayman Islands Share classes/currencies: US dollar, euro, yen, Australian dollar Minimum investment: $100,000 Lock-in period: N/A Redemption period: Monthly on 14 business days’ written notice Envisioned capacity before soft/hard close: $8bn Can the investment be accessed through segregated account as well as existing portfolio? Yes, min. $10m Strong trends in May and June delivered Aspect returns of 9% over the two months, mostly made in the bonds markets. It then lost 0.8% in July – a challenging environment, especially for trend-followers, which, by definition, struggle when trends stop, until they have a chance to adjust their positions to reflect new realities. Despite the difficulties in predicting what the next trends will be, Todd is certain opportunities will present themselves amid the cacophony of world political and economic events. “It’s a powerful cocktail and it will power some interesting trends for the rest of the year. But whatever direction they will be, we will identify them and make money for our clients.” Any investment in Aspect Capital is speculative and subject to the risk of loss as well as other risk. This is a reprint of an article published in Hedge Funds Review in September 2005 September 2005 | HEDGE FUNDS REVIEW | 27