Document 11243640

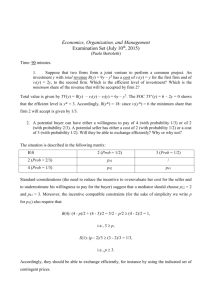

advertisement