Clockwork of an American Mind J.P. of

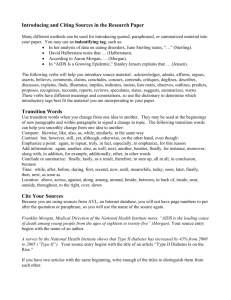

advertisement