Document 11231950

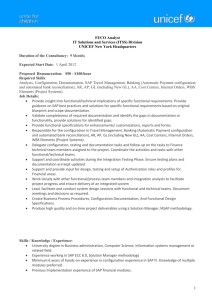

advertisement