A Political Economy Theory of Partial Decentralization

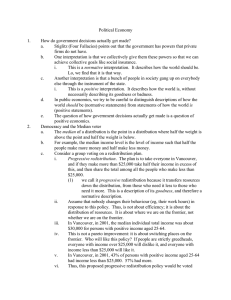

advertisement