BARRON'S

May 11, 2009

May 11, 2009

BARRON'S

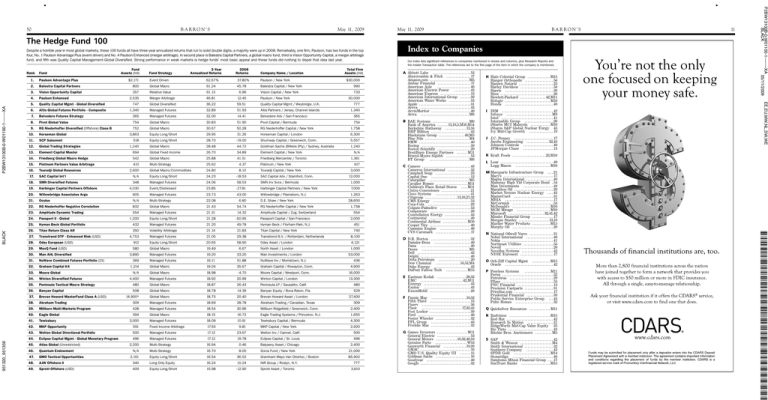

The Hedge Fund 100

Despite a horrible year in most global markets, these 100 funds all have three-year annualized returns that run to solid double digits; a majority were up in 2008. Remarkably, one firm, Paulson, has two funds in the top

four, No. 1 Paulson Advantage Plus (event-driven) and No. 4 Paulson Enhanced (merger arbitrage). In second place is Balestra Capital Partners, a global macro fund, third is Vision Opportunity Capital, a merger arbitrage

fund, and fifth was Quality Capital Management-Global Diversified. Strong performance in weak markets is hedge funds’ most basic appeal and these funds did nothing to dispel that idea last year.

BLACK

Fund

Assets (mil)

Fund Strategy

1.

Paulson Advantage Plus

2.

3.

4.

Paulson Enhanced

5.

Quality Capital Mgmt - Global Diversified

6.

Altis Global Futures Portfolio - Composite

1,340

7.

Belvedere Futures Strategy

365

8.

Pivot Global Value

754

Global Macro

9.

RG Niederhoffer Diversified (Offshore) Class B

752

Global Macro

3-Year

Annualized Returns

2008

Returns

Company Name / Location

Total Firm

Assets (mil)

$2,171

Event Driven

62.67%

37.80%

Paulson / New York

Balestra Capital Partners

800

Global Macro

61.24

45.78

Balestra Capital / New York

990

Vision Opportunity Capital

357

Relative Value

61.13

6.96

Vision Capital / New York

733

2,535

Merger Arbitrage

46.81

12.45

Paulson / New York

747

Global Diversified

36.22

59.51

Quality Capital Mgmt / Weybridge, U.K.

777

Managed Futures

32.89

51.93

Altis Partners / Jersey, Channel Islands

1,340

Managed Futures

32.00

14.41

Belvedere Adv / San Francisco

30.83

51.90

Pivot Capital / Bermuda

30.67

50.28

RG Niederhoffer Capital / New York

1,758

10.

Horseman Global

11.

SCP Sakonnet

12.

Global Trading Strategies

13.

Element Capital Master

694

14.

Friedberg Global Macro Hedge

542

15.

Platinum Partners Value Arbitrage

410

16.

Touradji Global Resources

17.

SAC Capital Int’l

18.

SMN Diversified Futures

19.

Harbinger Capital Partners Offshore

20.

$30,000

30,000

365

754

3,863

Equity Long/Short

29.95

31.26

Horseman Capital / London

6,300

518

Equity Long/Short

28.70

-19.00

Shumway Capital / Greenwich, Conn.

5,557

Global Macro

28.48

44.72

Goldman Sachs JBWere (Pty) / Sydney, Australia

1,240

Global Fixed Income

26.70

34.89

Element Capital / New York

Global Macro

25.88

41.51

Friedberg Mercantile / Toronto

Multi-Strategy

25.62

4.37

Platinum / New York

Touradji Capital / New York

1,240

2,600

Global Macro/Commodities

24.80

8.10

N/A

Equity Long/Short

24.23

-18.53

SAC Capital Adv / Stamford, Conn.

N/A

1,361

617

3,000

12,000

348

Managed Futures

24.06

58.53

SMN Inv Svcs / Bermuda

4,030

Event/Distressed

23.85

-27.81

Harbinger Capital Partners / New York

7,000

Willowbridge Associates Argo

905

Managed Futures

23.73

43.00

Willowbridge / Plainsboro, N.J.

1,263

21.

Oculus

N/A

Multi-Strategy

22.08

6.80

22.

RG Niederhoffer Negative Correlation

832

Global Macro

21.43

54.74

RG Niederhoffer Capital / New York

23.

Amplitude Dynamic Trading

554

Managed Futures

21.31

14.32

Amplitude Capital / Zug, Switzerland

24.

Passport II - Global

1,200

Equity Long/Short

21.28

-50.95

Passport Capital / San Francisco

2,000

25.

Hyman Beck Global Portfolio

432

Managed Futures

21.20

49.78

Hyman Beck / Florham Park, N.J.

451

26.

Titan Return Class AR

27.

Transtrend DTP - Enhanced Risk (USD)

28.

29.

30.

Man AHL Diversified

31.

NuWave Combined Futures Portfolio (2X)

32.

Graham Capital K4

33.

Moore Global

D.E. Shaw / New York

1,000

28,600

1,758

554

350

Volatility Arbitrage

21.14

21.83

Titan Capital / New York

4,753

Managed Futures

21.05

29.38

Transtrend B.V. / Rotterdam, Netherlands

Odey European (USD)

912

Equity Long/Short

20.65

58.90

Odey Asset / London

4,121

MaxQ Fund (USD)

580

Global Macro

19.49

6.67

North Asset / London

1,000

3,890

Managed Futures

19.20

33.20

Man Investments / London

369

Managed Futures

19.11

51.88

NuWave Inv / Morristown, N.J.

1,214

Global Macro

19.04

35.67

Graham Capital / Rowayton, Conn.

N/A

Global Macro

18.98

-4.70

Moore Capital / Westport, Conn.

4,400

740

8,100

53,000

436

4,900

16,000

34.

Winton Diversified Futures

Managed Futures

18.92

20.99

Winton Capital / London

35.

Peninsula Tactical Macro Strategy

480

Global Macro

18.87

26.43

Peninsula LP / Sausalito, Calif.

36.

Banyan Capital

508

Global Macro

18.78

14.39

Banyan Equity / Boca Raton, Fla.

37.

Brevan Howard MasterFund Class A (USD)

14,900*

Global Macro

18.75

20.40

Brevan Howard Asset / London

38.

Abraham Trading

Managed Futures

18.69

28.78

Abraham Trading / Canadian, Texas

39.

Millburn Multi-Markets Program

428

Managed Futures

18.54

30.96

Millburn Ridgefield / Greenwich, Conn.

2,400

40.

Eagle Global

394

Global Macro

18.15

16.72

Eagle Trading Systems / Princeton, N.J.

1,655

41.

Tewksbury

Managed Futures

18.09

10.91

Tewksbury Capital / Bermuda

4,300

42.

MKP Opportunity

591

Fixed Income Arbitrage

17.55

9.81

MKP Capital / New York

2,920

43.

Welton Global Directional Portfolio

500

Managed Futures

17.12

23.67

Welton Inv / Carmel, Calif.

500

44.

Eclipse Capital Mgmt - Global Monetary Program

496

Managed Futures

17.12

19.78

Eclipse Capital / St. Louis

496

45.

Atlas Global (Unrestricted)

2,200

Multi-Strategy

16.94

0.46

Balyasny Asset / Chicago

2,400

N/A

Multi-Strategy

16.70

8.00

Soros Fund / New York

21,000

Equity Long/Short

16.54

36.52

Grantham Mayo Van Otterloo / Boston

85,902

309

3,000

46.

Quantum Endowment

47.

GMO Tactical Opportunities

48.

AJW Offshore II

340

Long Only Equity

16.24

10.24

NIR Group / Roslyn, N.Y.

49.

Sprott Offshore (USD)

409

Equity Long/Short

15.98

-12.90

Sprott Asset / Toronto

2,161

13,300

480

529

27,400

309

777

3,610

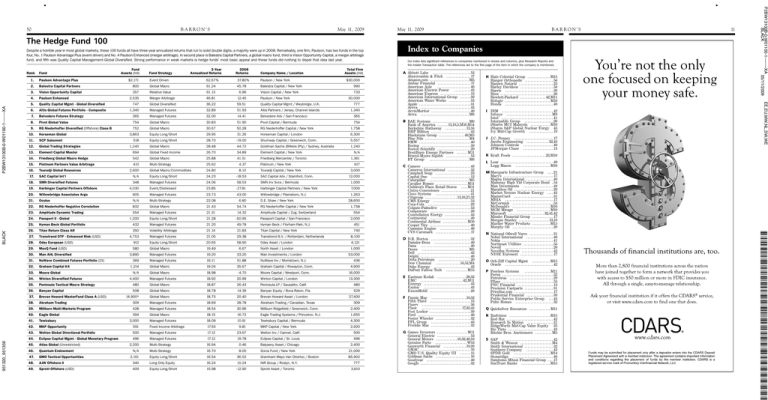

A Abbott Labs . . . . . . . . . . . . . . . . . . . . . . . . . 53

Abercrombie & Fitch . . . . . . . . . . . . . . . . 17

Amazon.com . . . . . . . . . . . . . . . . . . . . . . . . . . M5

Ambac Financial . . . . . . . . . . . . . . . . . . . . . . 17

American Axle

. . . . . . . . . . . . . . . . . . . . . . 40

American Electric Power . . . . . . . . . . . 43

American Express . . . . . . . . . . . . . . . . . . . . 13

American International Group . . . . . . . 32

American Water Works . . . . . . . . . . . . . . 53

Apple . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Areva . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

ArvinMeritor . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Aviva . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . M6

B BAE Systems . . . . . . . . . . . . . . . . . . . . . . . . M6

Bank of America . . . . . . . 13,16,5,M10,M14

Berkshire Hathaway . . . . . . . . . . . . . . 13,16

BHP Billiton . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Blackstone Group . . . . . . . . . . . . . . . . . 40,M5

Blue Nile . . . . . . . . . . . . . . . . . . . . . . . . . . . . . M4

BMW . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Boeing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Boston Scientific . . . . . . . . . . . . . . . . . . . . . . 20

BreitBurn Energy Partners . . . . . . . M11

Bristol-Myers Squibb . . . . . . . . . . . . . . . . 53

BT Group

. . . . . . . . . . . . . . . . . . . . . . . . . . M6

C Cameco . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Cameron International . . . . . . . . . . . . . . . 32

Campbell Soup . . . . . . . . . . . . . . . . . . . . . . . 23

Capital One . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Caterpillar . . . . . . . . . . . . . . . . . . . . . . . . . . M5

Cavalier Homes . . . . . . . . . . . . . . . . . . . . . M11

Children’s Place Retail Stores . . . . M11

Cintra Concesiones . . . . . . . . . . . . . . . . . . . 21

Cisco Systems . . . . . . . . . . . . . . . . . . . . . . . 41

Citigroup . . . . . . . . . . . . . . . . . . . . . 13,16,21,32

CMS Energy . . . . . . . . . . . . . . . . . . . . . . . . . 53

Coca-Cola . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Colgate-Palmolive . . . . . . . . . . . . . . . . . . . . 53

Compuware . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Constellation Energy . . . . . . . . . . . . . . . . . 43

Continental . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Continental Airlines . . . . . . . . . . . . . . . . M10

Cooper Tire . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Cummins Engine . . . . . . . . . . . . . . . . . . . . 40

CVS Caremark . . . . . . . . . . . . . . . . . . . . . . . 17

D D.R. Horton . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Daimler-Benz . . . . . . . . . . . . . . . . . . . . . . . . 40

Dana . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Deere . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . M5

Dell . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Delphi . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Delta Petroleum . . . . . . . . . . . . . . . . . . . . . 20

Dow Chemical . . . . . . . . . . . . . . . . 16,53,M4

Duke Energy . . . . . . . . . . . . . . . . . . . . . . . . 43

DuPont Fabros Tech . . . . . . . . . . . . . . M15

E Eastman Kodak . . . . . . . . . . . . . . . . . . . 20,32

EMC . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,M11

Entergy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Exelon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

ExxonMobil . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

F Fannie Mae . . . . . . . . . . . . . . . . . . . . . . . 16,32

Fifth Third . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Fiserv . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Fluor . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,32,43

Foot Locker . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Ford . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Foster Wheeler . . . . . . . . . . . . . . . . . . . . . . . 32

FPL Group . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Freddie Mac . . . . . . . . . . . . . . . . . . . . . . . . . . 32

G Gamco Investors . . . . . . . . . . . . . . . . . . . . M11

General Electric . . . . . . . . . . . . . . . . . . . . . . 53

General Motors . . . . . . . . . . . . . . 16,32,40,53

Genuine Parts . . . . . . . . . . . . . . . . . . . . . W53

Genworth Financial . . . . . . . . . . . . . . . 19,39

GMAC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

GMO U.S. Quality Equity III . . . . . . . 15

Goldman Sachs . . . . . . . . . . . . . . . . . . . . . . . 16

Goodyear . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Google . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

H Hain Celestial Group . . . . . . . . . . . . . . . M15

Hanger Orthopedic . . . . . . . . . . . . . . . . . . . 56

Hansen Natural . . . . . . . . . . . . . . . . . . . . . . . 23

Harley Davidson . . . . . . . . . . . . . . . . . . . . . . 58

Harris . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Hess . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Hewlett-Packard . . . . . . . . . . . . . . . . . 42,M11

Hologic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . M10

Honda . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

I IBM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Infosys . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . M9

Intel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Interpublic Group . . . . . . . . . . . . . . . . . . . 20

iShares MCI Malaysia . . . . . . . . . . . . . M10

iShares S&P Global Nuclear Enrgy 43

Ivy Mid-Cap Growth . . . . . . . . . . . . . . . . 19

J J.C. Penney . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Jacobs Engineering . . . . . . . . . . . . . . . 32,43

Johnson Controls . . . . . . . . . . . . . . . . . . . . 40

JPMorgan Chase . . . . . . . . . . . . . . . . . . . . 13

K Kraft Foods . . . . . . . . . . . . . . . . . . . . . . 23,M10

L Lear . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Legg Mason . . . . . . . . . . . . . . . . . . . . . . . M10

M Macquarie Infrastructure Group . . . . 21

Macy’s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Magna International . . . . . . . . . . . . . . . . . . 40

Mainstay High Yld Corporate Bond . 54

Man Investments . . . . . . . . . . . . . . . . . . . . 49

Marathon Oil . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Market Vectors Nuclear Energy . . . . 43

MasterCard . . . . . . . . . . . . . . . . . . . . . . . . . . 31

MBIA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

McCormick . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

McDonald’s . . . . . . . . . . . . . . . . . . . . . . . . . M10

MGM Mirage . . . . . . . . . . . . . . . . . . . . . . M10

Microsoft . . . . . . . . . . . . . . . . . . . . . . . . 32,41,42

Mizuho Financial Group . . . . . . . . . . . . . . 17

Morgan Stanley . . . . . . . . . . . . . . . . . . . . 13,16

Mueller Water Products . . . . . . . . . . . . M15

Murphy Oil . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

N National Oilwell Varco . . . . . . . . . . . . . . . . 31

Nobel International . . . . . . . . . . . . . . . . . . 40

Nokia . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Northeast Utilities . . . . . . . . . . . . . . . . . . . . 53

Novell . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Novellus Systems . . . . . . . . . . . . . . . . . . . . . 42

NYSE Euronext . . . . . . . . . . . . . . . . . . . . . . 17

O Och-Ziff Capital Mgmt . . . . . . . . . . . . M15

Oracle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

P Peerless Systems

. . . . . . . . . . . . . . . . . M11

Perini . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Petrobras . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Pfizer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

PNC Financial . . . . . . . . . . . . . . . . . . . . . . . . 13

Precision Castparts . . . . . . . . . . . . . . . . . . . 31

Priceline.com . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Prudential Financial . . . . . . . . . . . . . . . . . . 39

Public Service Enterprise Group . . . 43

Pulte Homes . . . . . . . . . . . . . . . . . . . . . . . . . 32

Q Quicksilver Resources . . . . . . . . . . . . . . M11

R Radvision . . . . . . . . . . . . . . . . . . . . . . . . . . . M15

Red Hat . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Research In Motion . . . . . . . . . . . . . . . . . 31

RidgeWorth Mid-Cap Value Equity 23

Rio Tinto . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Ritchie Bros. Auctioneers . . . . . . . . . . . M5

S SAP . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Smith & Wesson . . . . . . . . . . . . . . . . . . . . . M4

Smith International . . . . . . . . . . . . . . . . . . . 32

Southern Company . . . . . . . . . . . . . . . . . . 43

SPDR Gold . . . . . . . . . . . . . . . . . . . . . . . . M14

Stoneridge . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Sumitomo Mitsui Financial Group . . . . 17

SunTrust Banks . . . . . . . . . . . . . . . . . . . M15

P2BW13100B-0-W01100-1-------

951320_951359

Fund

Our index lists significant references to companies mentioned in stories and columns, plus Research Reports and

the Insider Transaction table. The references are to the first page of the item in which the company is mentioned.

EE,EU,MW,NL,SW,WE

P2BW13100B-0-W01100-1--------XA

Rank

Index to Companies

11

P2BW13100B-0-W01100-1--------XA

BLACK

05/11/2009

50

May 11, 2009

Rank

WHAT IT MEANS TO LEAD :

KNOWING THAT

SMALL BUSINESS IS A

BIG COMPONENT OF

A HEALTHY ECONOMY.

Fund

Assets (mil)

Fund Strategy

3-Year

Annualized Returns

51

2008

Returns

Total Firm

Assets (mil)

Company Name / Location

50.

Eckhardt Trading (Standard)

$347

Managed Futures

15.88%

13.15%

Eckhardt Trading / Chicago

$640

51.

Millburn Diversified

1,321

Managed Futures

15.49

22.78

Millburn Ridgefield / Greenwich, Conn.

2,400

3,084

52.

QFS Global Macro

418

Global Macro

15.48

21.16

QFS Asset / Greenwich, Conn.

53.

Tell

609

Global Macro

15.27

11.38

Tell Invs / Malta

54.

Aspect Diversified (USD)

4,239

Managed Futures

15.25

25.44

Aspect Capital / Rockville, Md.

4,239

55.

Capula Global Relative Value

3,691

Global Fixed Income

14.90

9.46

Capula Inv / London

4,000

56.

GMO Mean Reversion

2,308

Global Macro

14.87

18.42

Grantham Mayo Van Otterloo / Boston

57.

Quantitative Global

1,200

Managed Futures

14.79

11.94

Quantitative Inv / Charlottesville,Va.

58.

Elliott Mgmt

Multi-Strategy

14.44

-3.10

Elliott / New York

12,800

59.

Aviva G7 Fixed Income (Tranche 1 - GBP)

Fixed Income Arbitrage

14.02

13.21

Aviva Investors / London

72,658

60.

Brookdale Int’l

597

Equity Market Neutral

13.90

1.18

61.

DigiLog Capital Full Portfolio

338

Managed Futures

13.88

15.20

62.

Sunrise Capital Expanded Diversified

894

Managed Futures

13.80

29.90

Sunrise Capital Partners / Solana Beach, Calif.

1,043

63.

Stratus Fund 2X

Multi-Strategy

13.75

14.51

Capital Fund / Paris

2,500

64.

Owl Creek II LP

770

Event Driven Value

13.68

-7.93

Owl Creek Asset / New York

4,466

65.

Crabel Capital Multi-Product

817

Multi-Strategy

13.51

-0.77

Crabel Capital / Milwaukee

1,075

66.

EMF Fixed Income

350

Fixed Income Arbitrage

13.43

21.97

EMF Financial Products / New York

350

67.

Trafalgar Catalyst Series B (USD)

552

Event Driven

13.23

4.83

Trafalgar Asset Managers / London

1,900

68.

King Street Capital

Distressed Securities

12.00

3.71

69.

Libra

966

Equity Long/Short

11.92

-8.56

Libra Adv / New York

70.

Argonaut Global Macro

408

Global Macro

11.58

12.67

Argonaut Capital / New York

470

71.

AM Master III

640

Volatility Strategy

11.32

9.74

AM Inv Partners / New York

807

72.

Cazenove Euro Equity Absolute Return Class A (Euro)

Cazenove Capital / London

15,782

73.

Sola

74.

12,800

697

1,624

11,300

N/A

85,902

3,260

Weiss Asset / Boston

994

Digilog Capital / Chicago

477

King Street Capital / New York

15,500

1,078

411

Equity Long/Short

11.28

11.58

Credit Long/Short

11.17

-19.03

YA Off-Shore Global

749

Equity Long/Short

11.14

3.26

75.

Prologue (Master Fund)

600

Global Fixed Income

10.95

18.86

76.

Halcyon Off-Shore Asset-Backed Value

560

Distressed Asset-Backed Securities 10.78

-5.30

77.

Boronia Diversified

2,341

Managed Futures

10.63

4.25

78.

Discovery Global Opportunity

1,340

Global Multi Asset

10.48

-33.30

79.

Stillwater Asset Backed Offshore

329

Asset-Based Lending

10.38

9.61

Stillwater Capital / New York

80.

New Castle Market Neutral Master

345

Equity Market Neutral

10.25

3.01

New Castle / New York

81.

Restoration Offshore

432

Distressed Securities

10.10

9.11

Restoration Capital / New York

615

82.

Brownstone Partners Catalyst Master

325

Distresseed Credit

10.08

6.97

Brownstone Asset / New York

345

83.

Criterion Capital Partners

436

Equity Long/Short

9.91

-18.60

Criterion Capital / San Francisco

737

84.

HT Asian Catalyst

371

Asian Emerging Markets

9.85

5.13

for qualified small businesses to get credit, we have a number of programs

85.

Galleon Buccaneers

480

US Equity Long/Short

9.84

-9.40

86.

Pershing Square Int’l

2,963

Equity Long/Short

9.72

tailored specifically to their needs. Whether it’s discounted lending rates for

87.

Rotella Polaris (Diversified)

457

Managed Futures

9.69

88.

MKP Credit

1,062

Structured Credit

89.

Cura Fixed Income Arbitrage Master

Fixed-Income Arbitrage

90.

Chesapeake Capital (Diversified Program)

1,124

91.

Torrey Pines

92.

93.

1.2 billion. That’s a big number for business. And it’s just the start. To make it easier

$

equipment purchases or capital for expansion, we can help. At PNC, we know

economic growth is the result of vibrant communities. In our opinion, there’s

nothing bigger. To learn more, visit pnc.com/tolead.

*Includes new and renewed loans to businesses up to $30 million in annual sales size in the first quarter 2009. All loans subject to credit approval and require automatic payment from a PNC Bank Business Checking account. Other fees

and charges may apply. ©2009 The PNC Financial Services Group, Inc. All rights reserved.

Solus Alternative Asset / New York

4,400

Yorkville Adv / Jersey City, N.J.

975

Prologue Capital / London

600

Halcyon Asset / New York

8,300

Boronia Capital / Sydney, Australia

2,134

Discovery Capital / South Norwalk, Conn.

1,916

900

1,020

HT Capital / Hong Kong

468

Galleon / New York

4,000

-11.90

Pershing Square Capital / New York

5,123

16.02

Rotella Capital / Seattle

647

9.62

0.22

MKP Capital / New York

2,920

9.40

6.57

Cura Capital / New York

Managed Futures

9.37

15.39

476

Equity Long/Short

9.31

-7.70

Torrey Pines Capital / San Diego

Sandler Associates

308

Equity Long/Short

9.30

-2.42

Sandler Capital / New York

Castle Creek Arbitrage

472

Convertible Arbitrage

9.29

-1.88

Castle Creek Arbitrage / Chicago

94.

Caxton Global

N/A

Global Macro

9.05

12.90

Caxton Associates / New York

8,000

95.

Galleon Int’l

630

Multi-Strategy

8.58

-20.10

Galleon / New York

4,000

96.

York Credit Opportunities

2,500

Distressed Securities

8.54

-14.67

97.

Galtere Int’l Master

1,090

Global Macro

8.36

-1.82

98.

Wharton Asian Arbitrage

507

Arbitrage

8.33

-8.09

Wharton Inv Adv / Hong Kong

99.

Ascend Partners II

877

Equity Long/Short

8.30

-3.04

Ascend Capital / San Francisco

1,900

Tiedemann Falconer Partners

432

Equity Long/Short

TIG Adv / New York

2,000

100.

388

8.25

6.11

BARCLAYHEDGE FUND INDEX

-0.98%

-21.63%

STANDARD & POOR’S 500

-8.34%

-37.00%

*Fund assets as of Feb. 2009.

495

Chesapeake Capital / Richmond, Va.

1,328

513

1,000

484

York Capital / New York

8,700

Galtere / New York

1,500

645

Sources: CASAM CISDM; BarclayHedge; Bloomberg

P2BW13100A-0-W01000-1--------XA

EE,EU,MW,NL,SW,WE

Fund

BARRON'S

4,000

In the first quarter, PNC generated $1.2 billion

in business loan volume.*

P2BW13100A-0-W01000-1--------XA

BLACK

05/11/2009

May 11, 2009

BLACK

P2BW13100A-0-W01000-1------

BARRON'S

951319_951360

10