The Dynamics of Art Demand: The Interaction Between Monetary and Non-Pecuniary

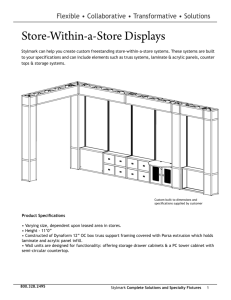

advertisement