Pass-Through in a Concentrated Industry: Empirical Evidence and Regulatory Implications

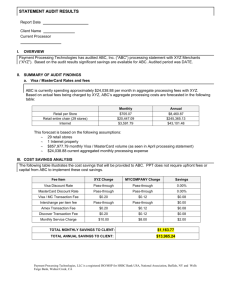

advertisement