Document 11199497

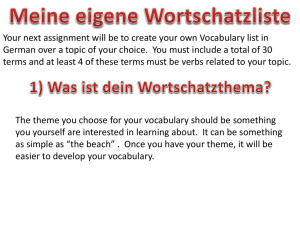

advertisement