N M. ' A

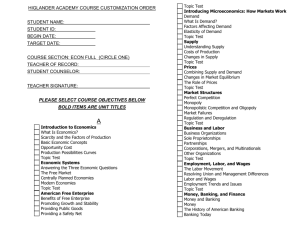

advertisement