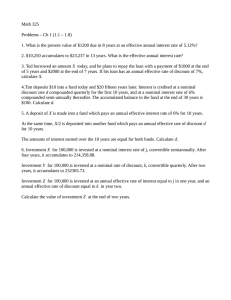

APPLICATION OF VALUATION-BY-COMPONENTS TO RISK MEASUREMENT

advertisement