Privatization of Highway Public Corporations in Japan by Koji Ishimaru

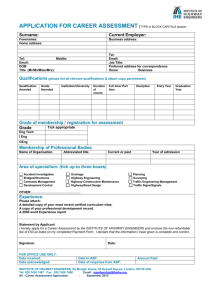

advertisement