Document 11171617

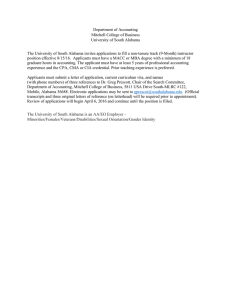

advertisement