Date:11/11/2015 To:BOSTON COLLEGE STUDENTS

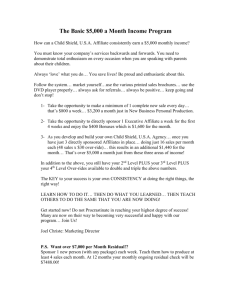

advertisement