Catalyst or Crutch? The Role of Privatized Land

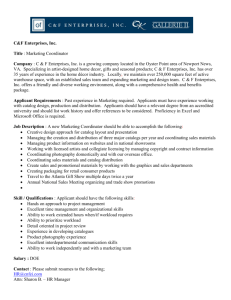

advertisement