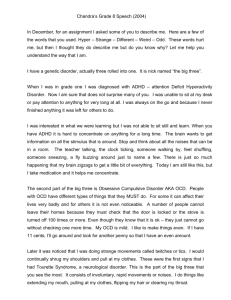

A MA W^^\ Sehes

advertisement