Document 11163261

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium IVIember Libraries

http://www.archive.org/details/extremalquantitiOOcher

HB31

^

I

A

Massachusetts Institute of Technology

Department of Economics

Working Paper Series

EXTREMAL QUANTILES AND VALUE-AT-RISK

Victor

Chemozhukov

Songzi

Du

Working Paper 07-01

May 24, 2006

Room

E52-251

50 Mennorial Drive

Cannbridge, MA 021 42

This paper can be downloaded without charge from the

Social Science Research Network

Paper Collection

http://ssrn.com/abstract=956433

at

„

.

Massachusetts Institute of Technology

Department of Economics

Working Paper Series

EXTREMAL QUANTILES AND VALUE-AT-RISK

Victor

Chemozhukov

Songzi

Du

Working Paper 07-0'

May 24, 2006

Room

E52-251

50 Memorial Drive

Cambridge,

MA 021 42

This paper can be downloaded without charge from the

Social Science Research Network Paper Collection at

http://ssrn.com/abstract=956433

VASSACHUSETTS INSTH-UTE

OF TECHMOLOGV

j

JAN

1

8 2007

;J8RAR!ES

EXTREMAL QUANTILES AND VALUE-AT-RISK

VICTOR CHERNOZHUKOV AND SONGZI DU

Abstract. This

article looks at the

nomics, in particular value-at-risk.

theory and empirics of extremal quantiles in eco-

The theory

of extremes has gone through remarkable

developments and produced valuable empirical findings

cussion,

we put a

in the last

20 years.

particular focus on conditional extremal quantile models

which have applications

in

many

areas of economic analysis.

Examples

In the dis-

and methods,

of applications

include the analysis of factors of high risk in finance and risk management, the analysis

of socio-economic factors that contribute to extremely low infant birthweights, efficiency

analysis in industrial organization, the analysis of reservation rules in economic decisions,

and inference

Key Words:

JEL:

Date:

We

May

in structural auction models.

Extremes, Quantiles, Regiession, Value-at-risk, Extremal Bootstrap

C13, C14, C21, C41, C51, C53

24,

2006

.

thank Emily Gallagher, Greg Fischer, and Raymond Guiteras

for their help

and valuable comments.

extrea1al quantiles and value-at-risk

Introduction

1.

Some Basics. Let a real random

Fyd/) = Prob[Y < y]- A r-quantile

Fy^{t)] — T for some r G (0,1).^ The

is

is

Y

variable

1.1.

probability index r,

1

of

Y

have a continuous distribution function

number Fy

the

is

quantile function

Fy

<

viewed as a function of

the inverse of the distribution function Fy(j/).

The

quantile function

therefore a complete description of the distribution.

Let

X

be a vector of regressor variables.

conditional distribution function of

variable

Y

Y

= Prob[Y <

Let Fy-(y|x)

=

given A'

The

x.

< Fy

as a function of x

(r|x)jA

is

regression function

=

—

x]

The

t.

measure the

to

(r|a") is

is

the

effect of covariates

or a conditional r-quantile will be referred to as extremal

<

.15, or high,

>

r

.85.

number

The main

random

Fy'^{T\x) such

Without

use of the quantile

on outcomes, both

To

center and in the upper and lower tails of an outcome distribution.

either low, r

denote the

conditional quantile function Fy^{t\x) viewed

called the r-quantile regression function.

Fy

y\x]

conditional r-quantile of a

with a continuous conditional distribution function

that Prob[Y

is

such that Prob[Y

(t)

(t),

in the

this effect, a quantile

whenever the probability index r

loss of generality,

we

focus the discussion

on the low quantiles.

1.2.

Examples

as a Motivation. There are

many

applications of extremal quantiles in

economics, particularly of extremal conditional quantiles. Here we give a sample of these

applications as a motivation for

Example

1.

what

follows.

Conditional Value- at- Risk.

or explain very low conditional quantiles

Fy

^(t|A) of an institution's portfoho return, F,

tomorrow, using today's available information,

Typically, extremal quantiles

Fy ^(rjA) with

at-risk analysis is a daily activity for

Value-at-risk analysis seeks to forecast

r

=

X

(Chernozhukov and Umantsev 2001).

0.01

and

r

=

0.05 are of interest. Value-

banking and other financial institutions, as required by

the Securities and Exchange Commission and the Basle Committee on Banking Supervision.

As a

ized

risk

measure, value-at-risk

by Roy

(1952), in

is

motivated by the

the probability of the risk of a large loss

monly used

safety-first decision principle formal-

which one makes optimal decisions subject to the constraint that

in real-life financial

is

kept small. This and similar measures are com-

management, insurance, and actuarial science (Embrechts,

Kliippelberg, and Mikosch 1997).

Example

birthweights,

Determinants of Very Low Birthweights.

we may be interested in how smoking, absence of

2.

In the analysis of infant

prenatal care, and other

types of maternal behavior affect various birthweights (Abrevaya 2001). Of special interest,

however, are the very low quantiles, since low birthweights have been linked to subsequent

health problems. Chernozhukov (2006) provides an empirical study of extreme birthweights.

^More

generally, let Fy- '(r)

=

inf{i/

:

Fy(y) > t}.

VICTOR CHERNOZHUKOV AND SONGZI DU

2

Example

other factors,

of firms, the

important form of efficiency

economics industrial organization and regulation

production frontiers (Timmer 1971).

efficiency or

An

Probabilistic Production Frontiers.

3.

analj'sis in the

X, we

most

is

the determination of

Given cost of production and possibly

are interested in the highest production levels that only a small fraction

efficient firms,

can attain. These (nearly)

efficient

production levels can be

formally described by extremal quantile regression function, Fy^{t\X)

e

>

0;

so only an e-fraction of firms produce Fy7^(rjX) or more.

for

t G

[1

-

e,

and

1)

The models and methods

discussed in this article are highly pertinent for inference on the probabilistic frontiers.

Example 4- (S,s)-Rules and Other Approximate Reservation Rules in Economic Decisions. A related example is that of (5, s)-adjustment models, which arise as

optimal policies in many economic models (Arrow, Harris, and Marschak 1951). For example, the capital stock Z is adjusted up to the level S once it has depreciated to some low

level s. In terms of an econometric specification, we may think that the observed capital

stock satisfies the equation Z,; = s(X,) +

where Xi are covariates, and Vi is a disturbance

that is positive most of the time, i.e. Prob{vi > 0) is close to 1. Once the capital stock

Zj reaches the critical level, i.e. Zi < s(A',:), it is adjusted in the next period. We assume,

as in Caballero and Engel (1999), that when the disturbance Vi = Z, — s(A'j) is negative,

1',,

it

captures unobserved heterogeneity and small decision mistakes that are independent of

observed covariates Xj.^ In a given cross-section or time

series,

quently, so in fact data at or below the lower adjustment

band

small probability Prob{v,,

The lower-band

tion

up

<

hence

0);

adjustment

s(A'i) will

F^HtIX) = s{X) + F'^t)

will

occur infre-

be observed with a

e {0,Prob{v <

for r

0)].

function s{X) therefore coincides with the lower conditional quantile func-

to an additive constant.

A

similar

argument works

the upper-band function

for

S{X).

Example

price

5.

Structural Auction Models. In the standard specification of the

procurement auction where bidders hold independent valuations, the winning

Bi, satisfies the equation Bi

function and

/3(n.()

>

1

is

~

c(Xj)/?(r?,,)

-f-

>

e,, Cj

0,

a mark-up that approaches

approaches infinity (Donald and Paarsch 2002).

By

some small negative value

so that,

when

where

1

c(A'",;)

as the

is

it is

number

realistic to let

of bidders, n^,

is

the extreme

the disturbance

Cj

negative, these disturbances capture small

decision mistakes that are independent of included explanatory variables.

the quantile function satisfies

bid,

the efficient cost

construction, c(A'j)/?(?ii)

conditional Cjuantile function. In empirical analysis,

take

first-

In this case

Fg\T\X,n) = C{X)P{n) + F~\t), for r G (0, F[e <

make inference on c{X) and f3{n).

0]).

Quantile regression methods can be emploj^ed to

In this example, Z, could be any

monotone transformation

transformation gives an accelerated failure time model

for

of the stock variable.

the capital stock.

explore such specifications for empirical (S,s) models in detail.

For instance, the log

Caballero and Engel (1999)

EXTREMAL QUANTILES AND VALUE-AT-RISK

Organization of the Article. The

1.3.

rest of the article

is

3

organized as follows. Section 2

describes the basic model of extremal quantiles and extremal conditional quantiles. Section

and inference theory. Section 4 reviews the key empirical

3 describes basic estimation theory

applications and provides an illustrative example. Section 5 concludes.

Basic Models of Extremal Quantiles

2.

A Basic

2.1.

Model

sume that the

means that

of Extremal Quantiles. Towards discussing inference methods,

Y

distribution function of the response variable

behave approximately

tails

like

has Pareto-type

power functions.

Such

tails,

as-

which

prevalent in

tails are

economic data, as discovered by the prominent Italian econonometrician Vilfredo Pareto

Pareto-type

1895.''

tails

encompass or approximate a

in

rich variety of tail behavior, includ-

ing that of thick-tailed and thin-tailed distributions, having either

bounded

unbounded

or

support, and their mathematical theory in connection to extreme value theory has been

developed by Gnedenko (1943) and de Haan (1970).

F

Consider a random variable

end-point of the support of

the support of

Y

is

Fy7^(0)

has lower end-point Fj^{0)

function

Fu and

its

Y

U

and define a random variable

— oo, and U =

is

> — oo. The

= — oc>

— Fy

^(0),

if

,

ii

the lower

the lower end-point of

distribution function of U, denoted by

=

or Fj"'(0)

quantile function

1'

U = Y

as

The assumption

0.

Fy then

that the distribution

exhibit Pareto-type behavior in the tails can be

FJ^

formally stated as the following two equivalent conditions:

some

for

real

number

F~^{0), and L{t)

is

<^

Fuiii)

-

Fy\T)

-

7^ 0,

asu\Fj\0),

L{u)-ir'^^

asr\0,

L(r)T--'

where L{u)

The

A

^

<^

defined in (2.1) and (2.2)

absolute value

distribution

<

and a

|^|

Fy with

of the

EV

a nonparametric, slowly-varying function at

is

called the

is

support point

t

if

^

>

<^

1),

tlie

while setting

i^

extreme value (EV) index.

=

\

EV

and many

index ^

yields the

—

>

For example, the

others.

A

notation a

function u

1-^

~

6

means that ajh

L(u)

is

if

include stable

t-

Yjv and exhibits a wide range

Cauchy

distribution which has heavy

=

30 yields approximately the normal distribution which

—

1

^See Pareto (1964).

The

of

logarithmic function.

Distributions with ^

0.

distributions,

of tail behavior. In particular, setting v

=

and

The prime examples

index ^ measures heavy-tailedness of distributions.

distribution with u degrees of freedom has the

(with

— L

0.^

Pareto-tj^ae tails necessarily has a finite lower support point

infinite lower

distributions, Pareto distributions,

tails

(2.2)

a nonparametric slowly-varying function at

slowly-varying functions are the constant function L{y)

The number

(2.1)

'

>

as appropriate hmits are tal;en.

said to be slowly-varying at

if

limits [iO/iln^Ol

=

1

for ^i^Y

"t-

>

0.

VICTOR CHERNOZHUKOV AND SONGZI DU

4

has light

tails

(with

—

(,

On

1/30).

the other hand, distributions with

<

<,

include the

uniform, exponential, Weibull distributions, and others.

The assumption

variation assumption, as

Fu

tion

commonly done

is

=

It

extreme value theory.

m>

any

m

m~'^'^, for any

regular variation of quantile function

for

in

Distribution func-

said to be regularly varying at FJ" (0) with index of regular variation

is

lim \^-i,g>(Ft/(ym)/F[,i(y))

771"'',

be equivalently cast in terms of the regular

of Pareto-type tails can

Fj^

>

This condition

0.

equivalent to the

is

with index -^. limT\Q{Fy^ {Tm) / Fy^

at

=

(^

distribution functions. These distributions functions have exponentially light

in

this case explicitly.

(^,

including at ^

approximated by the case of

2.2.

A Basic

Model

^

chief examples.

that

it

=

tails,

0,

«

0.

inference theory for the case of

for

x'f3(T).

every x in the support of X.

aU r e

I=

Y

(O,??],

given

some

=

i^

we

statistics are

can be adecjuately

classical linear

X = x:

r?

G

This linear functional form

(2.3)

(0, 1],

is

flexible in the sense

has good approximation properties. Given the original regressor A'*, the

regressors

with the

simplify exposition,

of Extremal Conditional Quantiles. Consider the

Fy\T\x)

for

To

However, since the limit distribution of main

=

functional form for the conditional quantile function of

and

=

{t})

corresponds to the class of rapidly varying

normal and exponential distributions being the

continuous

if

0.

should be mentioned that the case of

do not discuss

—1/4

final set of

X to be used in estimation can be formed as a vector of approximating functions.

X may include power functions, splines, and other transformations of A'*.

For example,

The

linear functional

The

(2005).

following

form also provides computational convenience.

model

for the tails

The main assumption

is

and

its

generalizations were developed in Chernozhukov

that the response variable Y, transformed by

regression line, has regularly varying tails with

suppose there exists an auxiliary parameter

conditional end-point

or

— oo

a.s.

and

its

/i^

EV

index

c^.

some

auxiliary

Indeed, in addition to (2.3),

such that the disturbance

U = Y — X'P^

conditional quantile function F^^(t|x) satisfies

the following tail-equivalence relationship as r

\

0,

uniformly

for

x in the support of X:

F^\t\x)^F-\t\x)-x'i3,-^F~\t),

where F^^

is

(2.4)

a quantile function such that

F-Hr)^L{T)T-^,

where L{t)

is

has

"

.

a nonparametric slowly-varjdng function at

type behavior on the conditional law, while equation

0.

Equation

(2.5)

imposes Pareto-

(2.4) requires this behavior to hold

uniformly across conditioning values. Since this assumption only affects the

covariates to impact the extremal quantiles

(2..5)

and the central quantiles very

tails, it

allows

differently; the

EXTREMAL QUANTILES AND VALUE-AT-RISK

impact of covariates on extremal quantiles

approximated by

is

5

which could

(3^,

differ

sharply

from, for example, the impact on the median given by /3(l/2). Chernozhidrav (2005) provides

further generalizations of this model.

3.

Basic Estimation Methods

Estimates based on sample quantiles. Given

3.1.

T

observations {Yt,t

=

1,

...,T}, the

r-sample quantile can be obtained by solving the following optimization problem:

r

V

Fy' (r) e arg min

where Pt{u) =

Rubin (1964).

(r

—

< 0))u

\{u

Sample quantiles are

extreme order sequence

tT —

and

>

oo,

if

-

(3)

(3.6)

,

the asymmetric absolute deviation function of Fox and

also order statistics,

The sequence

quantile.

is

pr [Yt

and we

will refer to

T)

of quantile index-sample size pairs (r,

r

and a central

\

and rT

orrfer

-^ k

sequence

if

>

r

0,

is

tT

as the oi^der of r-

will

be said to be an

an intermediate order sequence

fixed

and

T—

oo.

>

Each

\

r

if

different type of

the sequence leads to different asymptotic approximations to the finite-sample distributions

of

sample quantiles. Extreme order sequences lead to non-normal (extreme- value)

butions (EV) that approximate the

finite

sample distributions of extremal (high and low)

much better than the normal distributions do. In

work much better than the normal distribution if tT < 30.

quantiles

3.1.1.

Extreme Order Quantiles. Consider an extreme-order

classical result

r

—

k/T, as

T

on the limit distribution

distri-

particular,

seciuence.

of order statistics:

for

EV

The

distributions

following

any integer

A:

>

is

1

the

and

—^ oo.

AriFyHr) - Fy^r)) -, T'^ -

fc-«,

(3.7)

+ 4,

(3..

/here

At^I/F^Hi/T),

and

(£'i,£^2!

)

is

Tfc

-

£!

+

...

an independent and identically distributed sequence of standard exponen-

tial variables.

Result (3.7) was obtained by Gnedenko (1943) under the assumption that Yi,Y2,--.

a sequence of independently and identically distributed

(3.7)

(i.i.d.)

random

variables.

is

Result

continues to hold for stationary weakly-dependent series, provided the probability

of extreme events occurring in clusters

is

negligible relative to the probability of a single

extreme event (Meyer 1973). The results have been generalized to more general time

processes (Leadbetter, Lindgi'en, and Rootzen 1983).

series

VICTOR CHERNOZHUKOV AND SONGZI DU

6

Result (3.7) gives an extreme value (EV) distribution as an approximation to the

sample distribution of Fj7^(r). The

EV

EV

the definition of the

distribution, are

distribution of the k-th order statistic

The EV

distribution

is

The

classical result

constant

make

At

is

is

characterized by the

is

known

if

(^

<

gamma random

as

may have

and has

L = {Fy\2T) -

Another way

to

~

One way

Lt~^ then one can estimate

,

F,Ti(r)))/(2-«

-

overcome the aforementioned

Zt{t)

m

>

1

up

to order

mk

At

distribution only depends on the

The

1/.J if

\

0.

problem

is

to

For instance,

methods described below and

is

to consider the asymptotics

mk

'

(3-9)

.

k

EV

index

(3.10)

.

,

it is

^,

completely a function of data. The limit

and

its

quantiles can be easily calculated

by simulation.

and tT —>

oo,

^ AT{Fy\T) -

Fy'ir))

-, A^

(o,

^,J\^, ^

(3.11)

,

Haan

where

At

gives a

normal asymptotic approximation to the finite-sample distribution of sample

defined as in (3.10).

This

result,

obtained by Dekkers and de

Fy^{t). The main condition for application of this distribution is that tT

samples, we may interpret this as requiring that tT > 30 at the minimum.

The normal approximation

better, because

As

under further regularity conditions,

Zt{t)

is

EV

>

^

Intermediate Order Quantiles. Consider next an intermediate order secjuence.

3.1.2.

ways

limit

variable.

an integer.

is

feasible in that

is

this

consistently.

^^ff

r~? — ~S'^

r"

->,

^

Fy\viT) ~ Fy\T)

r

The

gamma

i^,

Chernozhukov (2006):

^r=-^-T

analytically or

variables.

overcome

to

infeasibility

= AT(Fy\r) - FyHr))

such that

Here, the scaling factor

of

At

^ using

•^

for

entering

l)r-f).

of self-normalized extreme order quantiles, as in

where

index

F/j,

not feasible for purposes of inference on Fy^lr), since the scahng

additional strong assumptions in order to estimate

suppose that FJ" ^(r)

EV

significant (median) bias.

moments

finite

not easily estimable consistently.

is

Variables

therefore a transformation of a

not symmetric and

moments

distribution has finite

L by

distribution

can be estimated by one of the methods described below.

vifhich

finite-

it

(3.11)

does not

approximation (3.11) once k

is

fail

large.

is

(1989),

cjuantile

-^ oo. In finite

convenient, but extreme approximation (3.9)

when tT

-^ k

<

oo and

it

is al-

coincides with the normal

EXTREMAL QUANTILES AND VALUE-AT-RISK

3.1.3.

many

Extremal Bootstrap. In

cases

it is

following approach. Consider the sample of

7

convenient to implement inference using the

i.i.d.

variables:

{Yu...,Yt)-(^^,-J-^],

where

{S\,...,8t)

ated in this

an

is

way have

(3.12)

sequence of standard exponential variables.® Variables gener-

i.i.d.

quantile function:

Fy\r)^tMl^J^n^,

Observe that Fy7 ^(r)

—

1/.^

~

t~^/^, so condition (2.1)

the finite-sample distributions of Zt{t)

tribution of Zt{t) for the case

EV

the

limit (3.9)

when

and the normal

satisfied.

is

— AriFy^ {t) —

limit (3.11)

simulation can be done using the following algorithm:

< B, draw

suitable estimate

2.

^.

{Yi,...,Yt) as

Compute

for the case

the statistic ZT^iir)

=

AriFy'^

Use quantiles of the simulated sample {ZT,i{T),i < B)

EV

(3.27) holds exactly.

{t)

—

Fy^{t)).

for inference purposes.

statistics,

including estimators

index and extrapolation estimators.

Another method, developed

normalized quantile

However,

when

according to (3.27), replacing ^ with a

i.i.d.

This scheme could be used to estimate distributions of other

of the

dis-

we reproduce both

under extreme and intermediate sequences,

good finite-sample performance

The

i

propose to estimate

Fy^{t)) by the finite-sample

also guarantee

For each

We

the data follow (3.27). In this way,

and

1.

(3.13)

.

it

in

Chernozhukov (2006),

This method

statistic.

is

less

under more general conditions.

applies

is

based on subsampling the

self-

accurate than the extremal bootstrap.

It

should be noted, that the canonical

(nonparametric) bootstrap does not work in these settings (Bickel and R'eedman 1981).

3.1.4.

Confidence Intervals for

of Zt{t) be denoted by c{a).

Fy [t) and Bias Correction for Fy (r). Let the

The estimates of c{a) can be obtained using

a-quantile

either

EV

approximation, normal approximation, or the extremal bootstrap, also having replaced

with a suitable estimate. Denote the resulting estimates by

c{a.).

Then, the median

<^

bias-

corrected estimate and a%-confidence region for Fy'^{T) can be constructed as

.,.,.) -

Yj, defined in this

and Gumbell

3^

and

P,.M-31^.f.-(.)-^

(3.14)

way, follows generalized extreme value distribution, which nests the Frechet, Weibull,

distributions.

There are other

by uniform variables {Ui, ...,Ut)

,

in

possibilities, for

which case

Yt follows

example,

(fi,

...,

ifr) in (3.27)

can be replaced

the generalized Pareto distribution.

VICTOR CHERNOZHUKOV AND SONGZI DU

EstimMors of

due to Pickands

EV Index ^.

3.1.5.

tli.e

tor,

(1975), relies

There are two principal estimators. The

on the ratio of sample quantile spacings:

= -\n

^

estima-

first

In 2,

(3.15)

Fy\2T)-Fy'{T))

such that T

—

and tT ^> oo

>

T—

as

Another estimator, developed by

^

>

^

and tT —* oo

as

oo.

Under further

Hill (1975),

is

a

moments

T—

>

oo.

power law to the

Under further

tail data.

estimator:^

,3,,,

This estimator

The estimator can be motivated by a maximum

0.

regularity conditions,

£LmV^,-W)-

,-,

such that r

>

is

applicable only for the case of

likelihood

method that

fits

an exact

regularity conditions,

v^{i-o^dj^{o,e)

(3.18)

The methods for choosing r are described in Embrechts, Kliippelberg, and Mikosch

(1997). The variance of estimators decreases as r increases, but the bias (relative to the

true

£,)

goes up.

Another view on the choice of r

approximations, not

literal

is

descriptions of the data.

the following: statistical models are

In practice,

threshold r reflects that power laws with different values of ^

Therefore,

if

the interest

lies

in

making inference on Fy^{t)

fit

for a particular r,

sonable to use ^ constructed using the same r or most similar

that t'T

The

>

r'

£^

on the

tail regions.

it

seems rea-

subject to the condition

30.^

limit results

alternative,

dependence of

better different

above can be used for the construction of confidence regions.

we can apply extremal bootstrap

the quantiles of

Zj--

to statistic

Zt = \/tT(^ —

cj)

As an

to estimate

Given the estimated a-cjuantiles c{a), we can construct the median

bias-corrected estimate and Q%-confidence regions for

3.1.6.

Extrapolation Estimators.

cisely,

the following strategy

is

When

^.

very extreme ciuantiles cannot be estimated pre-

sensible: estimate less

extrapolate these estimates using the assumptions on

extreme

tail

ciuantiles reliably,

behavior stated

earlier.

and then

Dekkers

and de Haan (1989) developed the following extrapolation estimator:

F-\r,)

=^ldl^l^\F-'C2r) - Fy\T)\ + Fy^r),

Notation (i)- means (i)_

= —x

if

x

<

and [x)-

=

if

x

>

0.

o

The

latter condition requires that a sufficient

sample be available to estimate

^.

(3.19)

EXTREMAL QUANTILES AND VALUE-AT-RISK

where

Another useful estimator, which

Te <^ t.

is

vahd only

for the case of ^

>

0, is

the

following:

FyHre) = ire/Tr^-Fy\T),

where

Tg

<C

The above

r.

(3.20)

estimators have good properties provided the quantities on the

right-hand side of (3.19) and (3.20) are well estimated, which requires that

and that the

3.2.

1,

model be a good approximation of the underlying true

tail

Estimates based on sample regression quantiles. Given

,T},

the quantile regression estimate of Fy7^(r|a:)

Fy\T\x)=x'f3{T),

arg

/?(r) =.

is

large,

T observations

{Yt,Xt,t

—

given by:

T

min

tT be

tail.

pr {Yt

~ X[p)

(3.21)

,

where Pt(u) = (t - l{u < 0))u. Quantile regxession was introduced by Laplace (1818) for

the median case. Koenker and Bassett (1978) extended this formulation to other quantiles.

3.2.1.

Extreme Order Asymptotics. Chernozhukov (2005) derives asymptotic distributions

of regression quantiles under extreme order sequences. Consider the canonically-normalized

QR statistic

Zrik)

=

and the self-normalized

At{iS{t)

QR

-

/?(t)),

where

At = l/F-\l/T),

statistic

-,

ZT{k)=AT{l3{T)-i3{T)), where >^T

where TT{m. -

1)

>

d.

The

(3.22)

first statistic

(3.23)

X'iPimr) - P{t))

uses an infeasible canonical normalization, while

the second statistic uses a feasible normalization.

Then

as

rT —

>

A;

>

and

T

^ oo

ZT{T)^dZ^\k)-k~^,

(3.24)

Z<xi{k)

=

Zoo{k)

~ —argmin ~kE[xrz + Y^\xlz +

kE[Xrz + J2\xlz-T-'

argmin

r;'

{^

<

0)

(e>o)

i=l

where {ri,r2,...} :=

variables that

is

{^i,!?! +£'2,...}

independent of {Xi,

Zt{t)

The

results hold

and {81,82,

X-y, ...}.

}

is

an

Further, for any

iid

m

sequence of exponential

such that

k{m —

VkZ^{k)

E[X]'{ZUr,zk)-Z^\k)y

under the assmnption that the data come from either an

I)

>

d,

(3.25)

i.i.d.

sequence

or a stationary weakly-dependent sequence with extreme events satisfying a non-clustering

condition.

VICTOR CHERNOZHUKOV AND SONGZI DU

10

Related results

normalized statistics

for canonically

for the case

where

tT —

as

'

T—

>

oo

have been obtained by Knight (2001) and Portuoy and Jureckova (1999).

3.2.2.

Intermediate Order' Asymptotics. Chernozhukov (2005) shows that under intermedi-

ate order sequences, as r

\

and tT ^>

oo,

ZT{r)=AT{p{T)-P{T))-^,Af(^0,[E(XX')l'j--^l^-^y

where

At

is

(3.26)

defined as in (3.23). Like the result under extreme order sequences, this result

holds under the assumption that the data

come

either

from an

i.i.d.

sequence or from

a stationary weakly-dependent sequence with extreme events satisfying a non-clustering

condition.

3.2.3.

Extremal Bootstrap. In practice,

it is

convenient to implement inference by construct-

ing a bootstrap model that approximates the

model under the assumptions

tail

features of the true conditional quantile

of Section 2.2; then using this

butions of estimators of extreme quantiles and

tail

model

to simulate the distri-

parameters.

Consider the sample

where

(i?i, ...,£^r) is

an

i.i.d.

fixed set of observations

on

('f^^,X, V

^

{{Y,,X,),...,iYr,Xr))

....

{^l^^X^

(3.27)

,

sequence of standard exponential variables and (Xi,...,X7')

regi'essors that

we

have. Variable Yt generated in this

is

way has

the conditional quantile function

,,,.

,_i,

Fy^\T\X^)

Yt \- '---'

=

,.,..

.

X[(3{t)

'-<.-v-

hind

'

_^

^^''^

where,(r).(bMl^llI:i=-I,0,...,0)\

Observe that Fy [T\Xi)

—

1/^

~

t~^/^, so the model satisfies conditions (2.4) and

as does the true conditional quantile

the finite-sample distributions of Zt{t)

of Zt{t) in the case

the

EV

when data

(2.5),

model under our assumptions. Hence we can estimate

— Aj-{p{r)—P{T))

follows (3.27).

by the finite-sample distribution

In this simple way,

we can

replicate

both

approximation (3.26) and the normal approximation (3.24) and also guarantee good

finite-sample performance for the case

when

the model (3.27) holds.

The simulation can be

done using the following algorithm:

1.

For each

^.

2.

i

< B, draw data

Compute

according to (3.27), replacing ^ with a suitable estimate

the statistic Zt,i{t)

Use the empirical distribution

= At{P{t) —

of the simulated

P{t)).

sample (Zy

j(r),

i

< B)

for inference.

EXTREMAL QUANTILES AND VALUE-AT-RISK

11

This method can also be used to estimate distributions of estimators of the

EV

index and

extrapolation estimators described below.

As mentioned

before, there

another inference method proposed by Chernozhukov (2006)

is

which uses subsampling to estimate the distribution of self-normalized

method

less

is

accurate than the extremal bootstrap, but

it

statistic

applies under

Zt{t). This

more general

conditions.

3.2.4.

Confidence Intervals and Bias Corrected Estimates. Suppose we are interested in the

parameter

tp' (3{t)

for

some non-zero vector

Let the a-quantile of

)/'•

4''

Zt{t) be denoted by

Having replaced ^ with a suitable estimate, the estimates of c(q) can be obtained using

either EV approximation, normal approximation, or the extremal bootstrap. Denote the

c{a).

resulting estimates

by

The median-bias

cla).

corrected estimator and the Q;%-confidence

interval for 4''(3{t) can be constructed as

c(l/2)

^'/3(7

3. 2. .5.

At

Estimators of the

Pickands and

i'Pir)

EV Index ^.

The

Hill estimators.

The

first

At

tT

is

- a/2)

(3.29)

At

following estimators are regression analogs of the

estimator takes the form

In 2,

Fy\2T\X)

X

A>'P{t)

Fy'MX)-Fy\2r)\X)

^^-In

where

cjl

g(«/2)

and

the average value of

-^ DO

A'j.

(3.30)

Fy\T)\X)

Under additional

and

regularity conditions, as r

^

(3.31)

(2(2f-l)ln2)2^

The second

estimator, which

regularity

applicable

when

^

>

0,

takes the form:

Y:UHyt/Fy\r\Xt))Tt

conditions, as r \

and tT —

i

Under additional

is

=

>

(3.32)

oo

v^(e-o-d^v-(o.s^').

The

limit results

native approach

is

above can be used

(3.3.3)

for the construction of confidence regions.

to apply extremal bootstrap to statistic

Then we can

the quantiles of this statistic.

Zt

?(l/2)

^-^

,

- a.nd

^/^

alter-

to estimate

use estimated a-quantiles c{a) for constructing

the median bias-corrected estimate and a%-confidence regions for

e

'tT{^

An

?_ ?(l-Q./2) ^

TTT

^:

c{a/2)

v^

(3.34)

VICTOR CHERNOZHUKOV AND SONGZI DU

12

By analogy with

Extrapolation Estimators.

3.2.6.

estimators for

where

Tg <Si r.

Fy

where

(Te|x),

Fy\Te\x)

=

Fy\Te\x)

=

a very low value, can be constructed as

r^ is

^

the unconditional case, the extrapolation

~

^

^^'^^l

\Fy\mT\x) - Fy'{T\x))] + FyHrlx),

{Te/T)-^Fy'{T\x)

Note that the estimator

(3.36)

(^

is

>

(3.35)

(3.36)

0),

valid only in the case ^

given for the unconditional case apply here as well. Also,

>

0.

The comments

we can construct confidence regions

Fy ^(Te|x) based on extrapolation estimators. This can be done by applying the extremal

bootstrap to statistic Zt = ATiFy\Te\x)-Fy\Te\x)) where At = s/rf / X' (p{2T)-d{T)).

for

4.

4.1.

A

Empirical Applications: an Overview and an Illustration

Simple Overview. The

following review

is

not exhaustive by any means;

aims

it

to provide only a few quintessential references.

Extremal Unconditional Quantiles. As mentioned in Section

4.1.1.

come and wealth data

in 1895

2,

Pareto analyzed

and suggested that power laws accurately describe the

intail

data.

Pareto's discovery, although remarkably simple, had a profound elTect on both em-

pirics

and the theory

of extremes.

Zipf (1949), Mandelbrot (1963),

Fama

(1965), Praetz

(1972), Sen (1973), Jansen and de Vries (1991), Longin (1996), among others, gave

fur-

ther empirical evidence on the nature and prevalence of Pareto-type laws in economic data,

including city

incomes, and financial returns.

should be mentioned that

It

The

sizes,

theoretical

work

this aspect, the

in

many

of the early studies were highly informal in nature.

extreme value theory has opened paths

our knowledge, the

first

highly rigorous analysis of the

Jansen and de Vries (1991) estimate the

between

at-risk,

,^

=

for better analysis.

study of Jansen and de Vries (1991) can be singled out as

1/5 and ^

=

1/3.

EV

tail

Pi-om

gave, to

it

properties of financial returns.

indices for various

primary U.S. stocks to be

Using quantile extrapolation estimators to estimate value-

they also conclude that the 1987 market crash was not an

outlier.

Rather

it

was a

rare event, the magnitude of which could have been predicted using prior data. This study

stimulated numerous other studies that rigorously document the

tail

properties of economic

data (Embrechts, Kluppelberg, and Mikosch 1997).

4.1.2.

Extremal Conditional QuantUes. There has been considerably

tional methods.

will see active

of the topics

development

and

less

work on condi-

However, following recent theoretical advances we expect that

directions.

in the near future.

In

what

follows,

we merely

this area

highlight

some

EXTREMAL QUANTILES AND VALUE-AT-RISK

In

what might be the earhest example

13

of conditional quantile analysis, Quetelet (1871)

Remarkably, Quetelet's work

fitted various conditional quantile curves to age-height data.

included tabulations of very high and very low quantiles of heights as a function of age.

There

is

a great potential for the applications of extremal quantile regression methods in

similar problems. In a recent study,

Chernozhukov (2006) estimates the impact

and maternal behavior on extremely low birthweights

He

finds that the

1500 grams sharply

smoking

care

is

in the U.S., focusing

impact of these variables on birthweights

differs

in the

of

smoking

on black mothers.

ranges between

from their impact on the central birthweights.

and

2.50

For instance,

not correlated with extremal birthweights, while quality of prenatal medical

is

strongly linked to extremal birthweights.

Chu

Aigner and

(1968),

Timmer

and Aigner, Amemiya, and Poirier (1976)

(1971),

neered a large empirical literature on production frontiers.

A

pio-

major problem of the sub-

sequent empirical hterature has been the lack of statistical methods for construction of

The new methods

rehable estimates and confidence regions.

discussed in Section 3 solve

the problem, and should improve the rigor of the empirical work in this area.

There

is

a considerable appeal for the use of extremal conditional cjuantile methods in

An

auction models.

(2002),

who

important study that

illustrates the potential

analyze an empirical structural auction model.

support function of bids using extreme order

statistics for

is

by Donald and Paarsch

They estimate the

each covariate

cell,

conditional

then project

the estimated function onto a lower dimensional structural function implied by the model

via a minimum-distance method.

A

generalization of this approach

is

to

employ extremal

quantile regression for estimation of the (approximate) support function in the

Value-at-risk

tile

is

another potentially important area of applications of the extremal quan-

Chernozhukov and Umantsev (2001) apply these methods to the problem

regression.

forecasting value-at-risk of a major U.S.

quantiles, using

gions, using

An

some

of the

We

main questions

some

in

Chernozhukov

(2006).

The

consider a problem of forecasting conditional

of the questions asked in

Chernozhukov and Umantsev (2001)

with an improved methodology. To implement the analysis, we use algorithms written

R

re-

section below

of this study.

Example. Here we

revisit

of

company. They estimate extremal conditional

both ordinary and extrapolation methods, and implement confidence

Illustrative

value-at-risk.

oil

subsampling methods described

briefly revisits

4.2.

first stage.

language that rely on Koenker's (2006) quantreg package as the basic platform.

in

The

algorithms as well as the data set can be downloaded from www.mit.edu/~vchern/EQR/.

A

detailed description of the data set

The

given in Chernozhukov and

Umantsev

(2001).

use of near-extreme quantile regression for estimation of approximate support functions allows the

researcher to discard

Section

is

1.

some

outliers that

do not conform the model,

in the spirit of the discussion given in

VICTOR CHERNOZHUKOV AND SONGZI DU

14

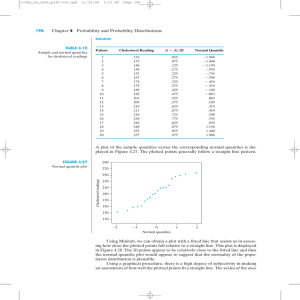

We

estimate the following conditional quantile function for various low values of

Fy^\T\Xt)

where

Yt

We

Dow

first

graph of

X[(3{t)

=

/?o(r)

+

/3i(t)Xu

+ /?2(r)X,,2 + [h{T)Xt^z.

(4.37)

the daily (log) return on the stock of Occidental Petroleum, Xt^\

is

return on spot

on the

=

oil price,

Xt,2

—

Yt-i

is

the lagged

own

and Xt^z

return,

is

r:

is

the lagged

the lagged return

Jones Industrial Index. There are 2527 observations in the sample.

estimate and plot the function

(r, i) i-^

X[(3{t) in

shown

gives a

good picture

this function,

in Figure

1

,

time, indicating dates where the predicted risk

what causes these

is

(r, t)

space, with r

<

.2.5.

The

of the evolution of risk over

Let us next determine

especially high.

risk fluctuations.

0.25

Figure

Table

1

1.

The

fit

X[i3{t) as a function of time

reports the estimates of the coefficients of the model (4.37).

reports median bias-corrected estimates and

90%

primary determinant of the high

is

risk levels

is

The

table also

confidence regions, which were obtained

using the extremal bootstrap approach described in Section

larger

and

t

the market.

3.

The

The

results

show that the

further in the tail

the magnitude of the point estimate of the coefficient on the

the confidence region for this coefficient excludes zero even at r

=

DJI

.001.

we

go. the

return. Moreover,

EXTREMAL QUANTILES AND VALUE-AT-RISK

Table

1.

Estimate

Coefficients

Estimation Results

r

Lag Return

Oil Price

90%

Bias-Corrected

-0.08

Intercept

15

=

Conf. Region

.001

-0.08

[-0.11,-0.06]

0.12

0.01

[-0.19, 0.63]

-0.05

-0.05

[-0.42, 0.11]

0.71

0.73

DJI Return

r

—

[

0.05, 1.08]

.01

Intercept

-0.05

-0.05

[-0.05,-0.04]

Lag Return

-0.04

-0.06

[-0.16, 0.12]

Oil Price

-0.05

-0.06

[-0.17, 0.02]

0.49

0.50

DJI Return

r

=

[

0.24, 0.65]

.05

Intercept

-0.03

-0.03

[-0.03,-0.02]

Lag Return

-0.03

-0.04

[-0.10, 0.04]

Oil Price

0.01

0.01

[-0.04, 0.06]

DJI Return

0.29

0.30

[0.17, 0.38]

We next characterize

the estimates of

the

tail

EV index ^

90%

bias-corrected estimates, and

approach described

properties of the conditional quantile model. Table 2 reports

obtained using estimator (3.32).

The

table also reports

confidence regions, which were obtained using the nested

in Sections 3.2.3

and

3.2.5.

The

bias-corrected estimates tend to be

stable with respect to the start of the tail determined by probability index r.

of Table

2,

we

take \

«

1/4 to be the estimate of the

Table

r

=

T=

T

T

=

2.

Estimation Results

EV

for

EV

Index

90%

Bias-Correct. Estimate

0.24

0.22

[0.08, 0.34]

.01

0.23

0.17

[0.05, 0.25]

.025

0.32

0.24

[0.14, 0.30]

.05

0.35

0.23

[0.16, 0.27]

We

EV

index,

Fy^ (.0001[Xf) only once per about 30

Conf. Region

we can now estimate very extreme

set the risk level at

r

=

the basis

<^

Estimate

Having characterized the

On

index.

.005

extrapolation methods.

median

quantiles using

.0001, so that the return falls

years, a very rare,

below

extreme event. The extrapolated

estimates of .0001-quantile are obtained using equation (3.36) with r

=

.05

and ^

=

1/4.

VICTOR CHERNOZHUKOV AND SONGZI DU

16

The

resulting extrapolation

Fy^ {.000l\Xt) sharply

fit

The reason

obtained by quantile regression.

data that

likely contains

for this

simple: the ordinary

fit

fit

X[I3{t)

uses sample

no observations on the extreme events defined above. In sharp

contrast, the extrapolated

uses the

fit

tail

model and a

tail

model

reliably estimated conditional .05-

The

quantile to predict the magnitude of such events.

depends on whether the

is

from the ordinary

differs

quality of this prediction clearly

accurate.

is

Extrapolalated vs Ordinary Estimates of

Cond

Quantiles

in

o

d

1

I

1

"

M

"

i\

0)

M

c

'.

'

\

'

§

j_

2

d

j/ Y

' "x

I

5

o

q

'

B

N

'

\^

'/\'

'

I

V

'

A

I

/

*

\

^

'

\/

/

/

I

^

\

-'

'-y\j\-f\

1

1

'

1

'

'

'',

'

1

'l

1

g

'

Mr

1

11

1

I'll

^

5

''

1

'

\

\l

1

I

1

1l

c

ll

1

o

OJ

d

I

1

1

1

2480

2490

2500

2510

—

ordinary

- - -

extrap

fit

fit

2520

time

Figure

2.

Extrapolated and Ordinary Estimates of the Conditional .0001-Quantile.

5.

This

article

Conclusion

examines the theory and empirics of extremal quantiles

in economics.

The

theory of extremes provides a set of apphcable methods that have generated numerous

valuable empirical findings. There

conditional quantile methods.

for further empirical

The

is

equally promising scope for the use of the extremal

latter

methods are new - there are great opportunities

and theoretical developments.

Refere.nces

Abrevaya,

"The effect of demographics and maternal behavior on the distribution of birth

J. (2001):

outcomes," Empirical Economics, 26(1), 247-259.

EXTREMAL QUANTILES AND VALUE-AT-RISK

17

"On the estimation of produclion frontiers:

J., T. Amemiya, AND D. J. PoiRiER (1976):

likelihood estimation of the parameters of a discontinuous density function," Internal. Econom.

AlGNER, D.

maximum

Rev., 17(2), 377-396.

AlGNER, D.

J.,

AND

S. F.

Chu

Econom.ic Review, 58, 826-839.

Arrow, K., T. Harris, and J.

(1968):

"On Estimating the Industry Production Function," American

Marschak

(1951):

"Optimal Inventory Policy," Econornetrica,

19,

205-

272.

BiCKEL,

9,

P.,

and

D.

Freedman

(1981):

"Some Asymptotic Theory

for

the Bootstrap," Annats of Statistics,

1196-1217.

"Explaining Investment Dynamics in U.S. Manufacturing: a

R., and E. Engel (1999):

Generalized (S,s) Approach," Econornetrica, 67(4), 783-826.

Chernozhukov, V. (2005): "Extremal quantile regression," Ann. Statist., 33(2), 806-839.

(2006): "Inference for Extremal Conditional Quantile Models, with an Application to Birthweights,"

MIT, Department of Economics, Working Paper.

Chernozhukov, V., AND L. Umantsev (2001): "Conditional Value-at-Risk; Aspects of Modehng and

Estimation," Empirical Econoraics, 26(1), 271-293.

DE Haan, L. (1970): On Regular Variation and Its Applications to the Weak Convergence. Mathematical

Centre Tract 32, Mathematical Centre, Amsterdam, Holland.

Dekkers, a., and L. de Haan (1989): "On the estimation of the extreme- value index and large quantile

estimation," Ann. Statist, 17(4), 1795-1832.

Donald, S. C, and H. J. Paarsch (2002): "Superconsistent estimation and inference in structural

econometric models using extreme order statistics," J. Econometrics, 109(2), 305-340.

Embrechts, p., C. Kluppelberg, and T. Mikosch (1997): Modelling extremal events, vol. 33 of Applications of Mathematics. Springer- Verlag, Berlin.

Fama, E. F. (1965): "The Behavior of Stock Market Prices," Journal of Business, 38, 34-105.

Fox, M., and H. Rubin (1964): "Admissibility of quantile estimates of a single location parameter," Ann.

Math. Statist, 35, 1019-1030.

Gnedenko, B. (1943): "Sur la distribution limite du terme d' une serie aletoire," Ann. m.ath., 44, 423-453.

Hill, B. M. (1975): "A simple general approach to inference about the tail of a distribution," Ann. Statist.,

3(5), 1163-1174.

Jansen, D. W., and C. G. de Vries (1991): "On the Frequency of Large Stock Returns: Putting Booms

and Busts into Perspective," Review of Economics and Statistics, 73, 18-24.

Knight, K. (2001): "Limiting distributions of linear programming estimators," Extremes, 4(2), 87-103

Caballero,

(2002).

KoENKER,

Koenker,

R. (2006): Quantreg: Quantile Regression. R package version 3.90, http://www.r-project.org.

R., and G. S, Bassett (1978): "Regression Quantiles," Econometnca, 46, 33-50.

Laplace, P.-S. (1818): Theorie analytique des probabilites. Editions Jacques Gabay (1995), Paris.

Leadbetter, M. R., G. Lindgren, and H. Rootzen (1983): Extremes and related properties of random

sequences and processes. Springer- Verlag, New York-Berlin.

LONGIN, F. M. (1996): "The Asymptotic Distribution of Extreme Stock Market Returns," Journal of

Business, 69(3), 383-408.

Mandelbrot, M. (1963): "The Variation of Certain Speculative Prices," Journal of Business, 36,

Meyer, R. M. (1973): "A poisson-type limit theorem for mixing sequences of dependent "rare"

394-419.

events,"

Ann. Probability, 1, 480-483.

Pareto, v. (1964): Cours d'economie politique. Droz, Geneve.

Pickands, III, J. (1975): "Statistical inference using extreme order statistics," Ann. Statist, 3, 119-131.

Portnoy, S., and J. Jureckova (1999): "On extreme regression quantiles," Extremes, 2(3), 227-243

(2000).

Praetz, V. (1972): "The Distribution of Share Price Changes," Journal of Business, 45(1), 49-55.

QuETELET, a. (1871): Anthropometrie. Muquardt: Brussels.

Roy, a. D. (1952): "Safety First and the Holding of Assets," Econornetrica, 20, 431-449.

Sen, a. (1973): On Economic Inequality. Oxford University Press.

Timmer, C. p. (1971): "Using a Probabilistic Frontier Production Function to Measure Technical

ciency," Journal of Political Economy, 79, 776-794.

ZiPF, G. (1949): Human Behavior and the Principle of Last Effort. Cambridge, MA: Addison- Wesley.

Effi-

GOO^

3^1