w H 1 HB31

advertisement

3 9080 02898 0834

HB31

.M415

'

i;i:v|.'

Hiii

H

1

1

w

^

1

i!^

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium IVIember Libraries

http://www.archive.org/details/optimalsavingsdiOOfarh

NBER WORKING PAPER SERIES

OPTIMAL SAVINGS DISTORTIONS WITH RECURSIVE PREFERENCES

Emmanuel

Farhi

Ivan Weming

Working Paper 13720

http://www.nber.Org/papers/w 1 3720

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge,

MA 02 138

January 2008

We thank George-Marios Angeletos, Narayana Kocherlakota, Andy Atkeson and Martin Schneider

for useful

comments and

insightful discussions. All remaining errors are our

own. The views expressed

herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of

Economic Research.

© 2008 by Emmanuel Farhi and Ivan Weming. All rights reserved. Short sections of text, not to exceed

two paragraphs, may be quoted without explicit permission provided that full credit, including © notice,

is

given to the source.

Optimal Savings Distortions with Recursive Preferences

Farhi and Ivan Weming

Emmanuel

NBER Working Paper No.

13720

January 2008

JEL No. HO

ABSTRACT

This paper derives an intertemporal optimality condition for economies with private information, focusing

on a

class

of recursive preferences.

a risk-free asset market,

Our

we

By comparing

it

to the situation

where agents can

recursive preferences are

homogeneous and

satisfy a

balanced growth condition, while allowing

us to separate the role of risk aversion and intertemporal elasticity of substitution.

quantitative exercises that disentangle the respective roles played

optSimal distortions and the implied welfare gains.

Emmanuel

Farhi

Harvard University

Department of Economics

Littauer Center

Cambridge,

MA 02138

and NBER

efarhi@harvard.edu

Ivan

Weming

Department of Economics

MIT

50 Memorial Drive, E5 1-25 la

02142-1347

Cambridge,

MA

and

NBER

iweming@mit.edu

freely save in

derive the optimal savings distortions necessary for constrained optimality.

We perform some

by these two parameters play

in

With

unfettered access to a risk-free asset, agents can perform the following variation to

consumption plans. At any point

their

by one unit and increase

it

can lower their current consumption

in time, individuals

in all future periods

and contingencies by a constant absolute

amount, equal to the net rate of return. At a market equilibrium, individuals find themselves

at

an optimum within

this class of variations.

The corresponding

optimality condition

is

the

familiar intertemporal Euler equation.

Instead, a planner

may

have on work

must consider the response that any change

effort, if

the latter

is

in the

consumption plan

not fully under her control due to private information.

In general, there exists a class of variations available to the planner on the agent's consumption

such that incentives and work

planner finds the

The

effort are preserved.

optimum within

At the

constrained-efficient allocation, the

this class of variations.

variations available to the planner do not always, or even typically, coincide with those

available to agents in a free market equilibrium. Difference in these sets of variations leads to

optimality conditions that are potentially incompatible. Distortions on savings

required to implement the constrained

The first

optimum with an

point emphasized by this paper

is

may

then be

asset market.

that the particular form that the set of allowable

variations for the planner takes, depends critically on preferences.

We

begin by showing that

there exists a particular class of preferences for which the set of variations available to the

planner actually coincides with that available to agents in a free market.

As a

result, the

constrained efficient allocation requires no distortions on agents' savings.

The

preferences

required for this result feature no income effects on work effort and constant absolute risk

aversion.

This particular result demonstrates that the form of the discrepancy between the

constrained-optimum and the market equilibrium

is

likely to

depend, in general, on preference

assumptions.

Next, we propose a class of homogeneous preferences with a balanced growth condition on

work

effort that delivers

consumption

for the

a simple and intuitive class of variations. The allowable variations on

planner in this case are as follows. At any point in time, the planner can

lower the agent's current consumption and increase

by a constant proportional amount.

it

in all future periods

This type of variation

through the asset market, which opens up the possibility

improvements.

The optimal

is

and contingencies

not available to the agent

for the

planner to find Pareto-

savings distortions are dictated by the difference between the

absolute and proportional variations on consumption available to the agent and planner,

respectively.

Proportional changes in consumption leave incentives unaltered precisely because preferences are homogeneous and satisfy a balanced growth condition.

and

plausibility of these variations

is

We believe that the simplicity

a desirable feature of the preferences we propose. They

lead to simple intuitions, transparent theoretical results and a tractable framework for quantitative analysis.

Within

this class of variations the resulting optimality condition

is

extremely simple.

It

requires that the ratio of current utility to lifetime utility always equal the ratio of current

consumption to the expected present discounted value of

simple optimality condition the Golden Ratio.

It

lifetime consumption.

We

term

this

can also be stated as a Modified Inverse

Euler equation in a form that resembles the standard Inverse Euler equation that was derived

as a necessary condition for optimality for the variations considered in Farhi

and Werning

(2006).

These preferences have three advantages.

First,

they are flexible enough to allow us to

study the respective impact of two crucial parameters: the coefficient of relative risk aversion

and the intertemporal

separability of consumption

Second, although they feature non-

elasticity of substitution.

and work

effort,

these preferences call for no savings distortions

- just as the separable preferences studied in the

in the absence of recurring uncertainty

lit-

erature on the Inverse Euler equation. Third, they lead to a very clean separation result for

welfare gains between an idiosyncratic part and an aggregate part.

Towards the end of the paper, we perform some quantitative welfare exercises that compute

the gains from optimal savings distortions.

We

follow Farhi

and Werning

(2006),

where we

developed a new approach to analyze the welfare gains from distorting savings and moving

away from

letting individuals save freely.

consumption and work

effort,

and

attention to the case of geometric

main goal

and the

is

The method

forgoes a complete solution for both

focuses, instead, entirely

on consumption.

We

random walk consumption and constant work

our

restrict

effort.

Our

to isolate and compare the effects that the intertemporal elasticity of substitution

coefficient of relative risk aversion

size of the intertemporal

wedge and the

Thus, although we borrow from Farhi and Werning

welfare gains from optimal distortions.

(2006), the focus in that paper

have on the

was on the generality

in

terms of the stochastic process

the baseline allocation of consumption. Instead, our focus here

is

on a

for

set of stylized baseline

allocations that allow us to clearly separate the impact of different preferences assumptions.

Welfare gains depend crucially on four factors: the concavity of the production function,

the coefficient of relative risk aversion 7, the intertemporal elasticity of substitution p~^ and

the variance of consumption growth a^

As

in Farhi

.

and Werning (2006), we

find that gains are decreasing in the concavity of the

production function. In partial equilibrium with a linear production function, gains can be

extremely large.

By

contrast, for

hypothesis of a geometric

an endowment economy welfare gains are zero under our

random walk consumption

process. For the intermediate case of a

neoclassical production function, welfare gains are greatly mitigated.

The steady state

of the optimal allocation with saving distortions feature lower capital

and

a higher interest rate then the corresponding steady state of the market equilibrium, where

the precautionary savings motive

is

The

at work.

variance of consumption growth and the

coefficient of relative risk aversion control the strength of this

interest rate increase

and the decrease

motive and hence both the

between the baseline steady state and the

in capital

optimal steady state. The intertemporal elasticity of substitution on the other hand controls

the speed of the transition: the higher p~^, the faster the transition, and the higher the welfare

The

gains.

configuration of these three parameters influences greatly the magnitude of the

welfare gains.

2

Constrained Efficiency

In this section

we

present a two period

Free Savings

vs.

economy

to introduce the basic concepts

set the

Against this background, in the next section we turn to an

stage for the rest of the paper.

horizon economy with recursive preferences.

infinite

Consider a simple economy with two periods

but at the beginning of period

values

and

and p{s)

is

—

1

in the second.

Let

=

0, 1.

There

is

no uncertainty at

5

is

si

=

s.

cq

denote consumption in the

a state Si G

the probability of outcome

and consumes and works

(ci(s), Yi(s))

t

t

realized;

we assume S

is finite,

The agent consumes

t

with

=

#5

in the first period

first

period and

denote consumption and output as a function of the realized state in the second

period.

We

adopt a general specification of preferences and denote the agent's

over allocations by f/(co, Ci(-),Fi(-)). Thus,

As

Yi{-) as inputs.

special

benchmark

U

case,

utility functional

takes a scalar qj and two functions Ci(-) and

one can assume the state

si

determines the

worker's productivity and that the worker has an expected utility function n(co,Ci,ei) over

consumption

in

both periods and work

effort 61(5)

=

Yi{s)/s.

Then

U{co,Ci{-),Yi{-))

=

E[u{co,Ci{s),ei{s))].

Technology

is

linear

Co

for

some

q

>

0.

Here,

R=

1/q

+ q^Ci{s)p{s) <q^ei{s)p{s)

is

the rate of return between periods

(1)

and

1.

—

Free Savings

2.1

First-best.

At

The first-best

allocation simply maximizes utility subject only to technology equation (1).

this allocation the first-order conditions for

consumption are given by

Uco{Co,Ci{-),Yi{-))=

/i,

=

9P(s)/i,

^ci(5)(co,Ci(-),Fi(-))

where

/x is

the multiplier on the resource constraint.

The

first-order conditions for

consumption

can be combined into the following generalized Euler equation:

-^E

g^

^ci(5)(co,ci(-),Fi(-))

f/co(co,Ci(-),Fi(-))

In the expected utility case this equation specializes to the familiar Euler equation

1

= RE

"uci(co,ci(s),ei(s))"

(3)

'

_Uco{co,Ci{s),ei{s))_

Competitive equilibrium with free savings.

tains in a free market

The Euler equation equation

economy where individuals have

For example, suppose that agents

live in

(2) also ob-

access to saving at rate of return R.

an incomplete market

setting, facing the

budget

constraints

Co

Then the

savings

fci

All

<

0,

ci{s)

<

Yi{s)

+

(4a)

+

Rki

first-order conditions for the agent's utility

delivers equation equation (2).^

More

(4b)

S.

maximization problem with respect to

Note that the budgets constraints equation (4a)-

equation (4b) imply the resource constraint equation

A general set-up.

Vs G

(1).

under what conditions does equation

generally,

(2)

hold? Consider

the abstract optimization problem of maximizing utility U{co,ci{-),Yi{-)) subject to

(co,Ca(-),Fi(-))e.F

some constraint

for

with J^

^

=

set J-. This nests as special cases

both the

Tfh defined by the resource constraint equation

planning problem

—and the agent's optimization

if we assume that there are some taxes and transfers that

we impose Ci(s) < T{yi{s),s)-\-Yi{s) + Rki in the second period.

Indeed, this result holds more generally, even

are a function of output or the state, so that

(1)

first-best

market setting

in the free

—with T = Tjra defined by the budget constraints equation (4a)-

equation (4b). Suppose that starting from any aUocation

define simple variations that maintain the allocation in

(co-gA,ci(-)

for all

A in neighborhood of A =

0.

ing (increasing) consumption in the

That

is,

+

y(s)/s,

effort

Property equation

is

(5)

is

maintained for

Note that the same output allocation F(s),

states

all

s.

holds for both the first-best planning problem and the agent's op-

More

assume that

Let r

s

E S

=

(2)

By

telling the truth

is

denoted by a*{s)

=

s for all s

{ci{a{s)),Yi{a{s))) in state

s.

E

E

denote the set of

S.

An

agent using strategy

A

E

s

S and

assign con-

loss in generality,

one can

<t

The

states of the world

truth-telling strategy

e S obtains

is

=

{c'({s),Y^{s))

Incentive-compatibility can be expressed as

The second-best planning problem corresponds

(6).

satisfied.

mapping true

all strategies.

U{co,c,{-),Y,{-))>U{co,cU-),Y,^{-))

and equation

an

satisfied at

optimal.

a{s) denote a reporting strategy for the agent,

S. Let

is

it

the revelation principle, the best the

second period accordingly. Without

in the

E

must be

E S from the agent regarding

to request a report r

into reports r

whenever

generally,

Consider next a private-information setting,

observed only by the agent.

sumption and output

(5)

period, while increasing (decreasing) consumption in

first

Second-best with private information.

planner can do

possible to

T:

optimum, then the generalized Euler condition equation

s is

it is

a feasible allocation can be perturbed by decreas-

timization problem in a free-market setting.

where the state

^

A,ri(-))e.F,

parallel across all states s in the second period.

and hence

Y^-)) e

(cq, ci(-),

second-best

VaeE.

to the case where

optimum maximizes

(6)

T = J-sb defined by equation (1)

utility subject to selecting

an allocation

in Tsb-

In this general context, typically property equation (5) with Tsb

however, provides an example where

Proposition

1.

it

Lei ?7(co,Ci(-), Yi(-))

ond argument. Then property equation

The next

fails.

proposition,

holds.

=

U{cq,Ci{-)

— v{Yi{-),-))

where

U

monotone

in its sec-

(5) holds for J^sb for all feasible allocations {co,Ci{-),Yi{-))

^sbProof.

The

result follows

by noting that incentive compatibility equation

if

c{s)

-

v{Y{s),s)

>

c{r)

-

v{Y{r),s)

Vr, s

E

S,

(6)

holds

if

and only

E

which

is

independent of

cq

and invariant to the operation of exchanging

A

c(-) for c(-) 4-

for

D

any A.

If

it is

property equation

without

(5)

holds for

A

all

(not just in a neighborhood around

loss of generality to allow agents to freely save, in

can allow the agent to

select the value for

of preferences identified

A

in this variation.

of the quasi-linear specification c

As a

(co

first

Y^

v{Y\

s) is

is

-I-

A,Yi(-)).

1/g.

The economic

invariant to A.

is

Proposition

the case for

1

(5) is as follows.

freely,

interpretation

(5)

s,

(5) holds.

Any direct mechanism

an ex-post menu

In each state

menu, {d[,Y^). Property equation

guarantee that this

2.2

follows that, for the class

that there are no income effects on work effort.

An equivalent way of postulating property equation

— 9A,ci(r) + A,yi(r)) essentially offers the agent

this

It

period do not then affect the choice between work effort and earnings.

to the loci of points (ci(-)

on

—

R=

then

the sense that the planner

they do not disturb incentive compatibility and property equation

result,

0)

by the proposition, the planner can allow the agent to save

without distortions, at the technological rate of return

Savings from the

A=

in

each state s equal

the agent selects an optimal point

then amounts to assuming that this optimum

then identifies the largest class of preferences that can

all feasible

allocations.

Distorted Savings

From the

previous subsection,

we know that the

variations that result from free savings

do

not generally preserve incentive compatibility. In this situation, what can we say about the

desirability of free savings?

A

Lagrangian approach.

We

approach

The

first is

this question in

two complementary ways.

to attach Lagrange multiplier ii{a)

on the incentive

constraints equation (6), leading to an optimality condition that includes the effect that

may have on

the incentive constraints:

-E/^('^)(-5^^o(co,Ci(a(-)),ri(a(-)))

•

if all

+

5]t/,,(,)(co,Ci(a(-)),Fi(a(-))))

the incentive constraints are slack, so that

this expression boils

down

jj,{a)

to the Euler equation equation (2).

tion equation (2) will typically not hold. Indeed,

if

are nonzero, then one can sign the intertemporal

=

for all

<t

€ S, then

Otherwise, the Euler equa-

one signs the term —qUco{co, Ci(a(-)),

'^ses^ci{s){co,c-i{a{-)),Yi{a{-))) for different strategies

a and

=0.

J

s&s

\

o-ei;

Note that

A

yi(cr(-)))-|-

characterizes which multipliers

wedge required

in the Euler equation.

Another

Feasible variations.

line of attack

to find a different variation, that does pre-

is

serve incentive compatibility, without changing

work

This leads to an intertemporal

effort.

optimality condition that does not involve Lagrange multipliers.

optimality condition with the Euler equation equation

The

idea

is

this

(2).

to find a variation function 5(A,s) on consumption in the second period that

depends on the realized state

s so that:

(co

in a

One can then compare

neighborhood of

A=

0.

+ A,ci(-) +

(5(A,-),ri(-))e^,

(7)

At an optimum we must then have that

t/co(co, ci(-), ei(-))

+ J2 ^ci(«)(^' ci(-), ei(-)) ^^(0, s) =

(8)

•

s&S

For example, with expected

feasible

is

utility

and u(co,ci,ei)

=

u{co,ci)

—

h{ei) a variation that

is

to set 5(A,s) so that

fi{co

where ^(A)

is

+

A,ci{s)

+ 5{A,s))=u{co,Ciis))+A{A)

Vs e 5

(9)

such that

^(A + <5(A,5))p(5) =

0.

(10)

ses

This variation

shifts utility in

a parallel way across states s E S.

It

preserves incentive

compatibility because these parallel shifts cancel each other out on both sides of equation

At an optimum A'{0)

=

so that

uj^o^

d

dA

It

(6).

'

'

'

(11)

Ue,(co,Ci(5))

then follows that

1

=

E ?#^pw.

(12)

^«ci(Co,Ci(s))

which

is

known

as the Inverse Euler equation.

compatible with the Euler equation equation

By

(3),

Jensen's inequality, this condition

except in the special case where there

is inis

no

uncertainty in the marginal rate of substitution ratio Uco{cq, Ci{s))/uci{co-, Ci(s))- Without uncertainty the optimality of no intertemporal distortions follows from Atkinson-Stiglitz's (1976)

result

on uniform taxation, which requires separability between consumption and

assumed

in this case.

effort, as

Logarithmic balanced-growth preferences.

esting special case with several advantages

u(co,Ci)

=

+

log(co)

is

Within

this class of preferences,

an

inter-

the logarithmic balanced growth specification

/31og(ci). In this case the variations induce parallel multiplicative shifts

over second-period consumption:

S{A,s)

for

If

some 5(A).

Intuitively, incentives are

consumption

is

=

6iA)c,is),

provided by proportional rewards and punishments.

down by a constant

scaled up or

(13)

it

does not change the incentives for work

effort.

In this case, unlike the preference class described in Proposition

work

effort are nonzero.

1,

income

effects for

Proportional variations are feasible precisely because of the balanced

growth condition, that implies that income and substitution exactly cancel each other.

This logarithmic case seems economically appealing, because of the primitives and the

simple proportional variations

expected

utility case

permits.

it

condition.

u(c)

It

is

consumption, as

=

c^~"/(l

—

=

u{co)

+ Pu{ci)h{ei)

This class of preferences also

a).

easily verified that

in

simple generalization of this case,

is

to the

where

u(co, Ci, ei)

and where

One

(14)

satisfies

a balanced growth

once again the feasible variations are proportional in

equation (13).

In the next section

we extend

this class to

an

infinite

horizon economy. Preferences that

lead to the feasibiUty of proportional variations turn out to be very tractable. In particular,

they lead to a very simple optimality condition. Within a class of baseline allocations, the

optimum

3

is

easily identified

and

its

welfare improvements quantified.

Recursive Preferences

We now

turn to an infinite horizon and introduce a class of recursive preferences that are

homogeneous

in the

consumption process and separate

elasticity of substitution as in (Epstein

assumed

and

Zin, 1989).

risk aversion

from the intertemporal

Consumption and work-effort are not

to be separable, but satisfy a balanced-growth condition.

For this class of preferences, we provide simple variations on consumption that maintain

incentive compatibility.

affect incentives.

The

variations involve proportional shifts in consumption that do not

Both the homogeneity and the balanced-growth

are crucial for this result.

specification

on preferences

Based on these variations we derive the intertemporal optimaUty condition

the section.

this way,

The condition

is

shown

at the

end of

to be incompatible with allowing agents to freely save. In

an intertemporal wedge on savings

form of distortions on savings are required

some

is

present at the optimal allocation. Thus,

in

any tax implementation of the optimum. In

the next section we explore the welfare gains from adhering to this condition for some simple

cases.

Our

preferences do not satisfy the separability condition required for Atkinson-Stiglitz's

uniform taxation theorem. Despite

this, it is

optimal in the absence of uncertainty to set the

intertemporal distortions to zero. Thus, for these preferences, optimal distortions in savings

arise

from ongoing idiosyncratic uncertainty, just as

in the additively separable expected-utility

case that leads to the Inverse Euler condition.

Moral Hazard

3.1

We

build on the following simple static moral-hazard model. At the beginning of the period,

the agent

s

is

first

exerts effort a, which

is

not observable by the planner.

The

state of nature

then realized from the distribution P{s\a). The planner observes s and gives the agent

consumption

c{s).

The

agent's expected utility

is

given by

E[U{c{s)h{a))\a].

We

suppose the agent's

utility

U{c)

dard balanced- growth assumption,

is

a power function. This specification

for

which income and substitution

equivalent reformulation of the agent's objective

satisfies

the stan-

effects cancel out.

An

is

U{Ch{a))

where

C=

CE[c{s)\a]

=

U-^{E[U{c{s))\a])

represents the certainty-equivalent obtained from the

random consumption

For our dynamic setting, we proceed analogously.

chooses effort at-i, then the state

sumption

c(5*). Effort affects

with

=

/i(0)

1.

5* is

realized

At the

St

and lowers

Preferences are given by the recursion

=

Cis*)h{a{s'-'))

10

start of period

and observed and the planner

the distribution of state

Va{s'-')

c{s).

utility

t

the worker

allocates con-

by a factor

h{at)

<

1

where

C{s')

= CE

[W{c{s')Ms'))

a{s'-'),s'-']

I

(15)

,

represents lifetime-certainty-equivalent consumption, with

CE =

is

(16)

the certainty equivalent function and.

=

W{c,v)

is

R-^¥.R

u-\{l-(3)u{c)

+ (5u{v))

(17)

a time aggregator, mapping current consumption and future utility into a constant-consumption

equivalent.

With

this representation of preferences,

static setting.

By

in the following,

c

=

one can easily see the analogy with the simple

a change of variables, however, the same preferences can be represented

more convenient, way. For any given

effort

plan a

=

{a(s*)},

an allocation

{c(s*)} implies a process for lifetime utility {va{s*)} that solves

Va{s')

=

W{c{s')Xnh{a{s'))va{s'+')\a{s'),s'])

Incentive compatibility of

c,

\/t,sK

(18)

v and a* requires a* to maximize initial lifetime utility

Va'iso)

>

Vo.

Va{So)

(19)

Since preferences are recursive, this implies that a* maximizes continuation utility after any

history

Va'{s')>Va{s*)

Otherwise, a plan that follows a* up to

s*

and

That

after s*

would be preferable to

a*.

\/a,t,s\

(20)

and then switches to the actions prescribed by a

is.

at

Bellman's Principle of Optimality applies to

the agent's dynamic program.

We now

bility.

consider variations in the consumption process that maintain incentive compati-

After history

s'^

the consumption sequence

not affect incentives. At

affected in period r

and

s'^

we

shift

is

just shifted proportionally,

and

this

does

consumption to compensate, so that incentives are not

earlier periods.

The key property we use

is

homogeneity of W(c,

v')

and of CE.

Proposition

2.

Assume u{x) = x^'P/ {I — p) and R{x)

11

=

x^~'' / {1

— j)

with p,j

>0. Suppose

that

c,

V and a* satisfy conditions (18) and (19). Fix a history

A c{s'^)

c{s')

=

for

there exists a

A

=

fort>

{ A'c(s*)

.

Consider the variation:

s^

T and

s* y- s'^

otherwise

c(5*)

Then for any A'

s*

s'^

such that

v and a* satisfy conditions (18) and (19).

c,

Proof. Let v be such that

Va{s^)

=

A'va{s^)

for

i

> T and

5* >-

s'^

Va{s*)

=

Va{s*)

foT

t

>

s*

^

s'^

so that condition equation (18) with c

is

met

T and

for all 5*

with

t

>

t with

s*

^

s'^.

Now

set

A

so

that

va'isn

so that Va'

at

s'^

{s'^)

=

=

Va' {s'^).

W {Ac{s'),A'CE[h{a*{s-'))v,,{s^-^')

Using recursion equation

\

a*{s^),s^])

(18), the inequality

.

equation (20) evaluated

implies

CE

[h{a*{s^))va'{s^^')

> CE

a*{s^),s^]

I

[h{a{s^))va{s^+')

\

a{s^),s^]

,

so that

Va'is^)

=

W{Acis'),A'CE[h{a*{s^))va^{s^^')

a*{sn,s^])

I

>W {Ac{s'),A'CE[hia{s^))va{s^^')

\

a{sn,s^])

=

i).(s^).

Hence, we have that

Va{s'')

a*

is

<

Va'is'')

=

Va'{s'')

for all a.

optimal from period r onward and delivers the same continuation

utility as previously.

For any plan a define an alternative plan a that switches to a* from period r onward:

a(s*)

=

a(5*) for

i

<

r and a{s^)

Va{So)

That

is

is,

<

=

>

t.

^a(-So)

<

a*(s*) for

Va{So)

=

a dominates a and yields the same

dominated by the recommended action

a*

t

The

result

^a* (^o)

utility as

=

above implies that

Va'{so)-

without the variation, which in turn

which also yields the same

variation. This estabUshes that a* remains incentive compatible.

12

(21)

utility as after the

D

A

Private Information:

3.2

Here we build on Mirrlees'

Dynamic Mirrleesian Economy

static private information model.

the agent privately observes productivity

consumption

gives the agent

At the beginning of the period,

The agent then makes a

0.

c{r) as function of the report.

The

report r and the planner

agent's expected utility

is

¥.[U{c{r)h{r,e))\a].

where r

=

a{6)

is

We

the agent's reporting strategy.

a power function. This specification

which income and substitution

suppose the agent's

utility

U{c)

is

the standard balanced-growth assumption, for

satisfies

effects cancel out.

For our djoiamic setting, we assume the following structure of uncertainty. At the beginning of the period a state

9t is

a

it

realized

finite

and publicly observed by the agent and planner. Then

of values. After observing the shock

to the planner.

by

realized

and observed only by the agent. To simplify we assume that

number

histories

St is

z*

=

We

collect the variables

Sj

and

the agent makes a report

dt

observed by the planner by

zt

=

r^

{st,rt)

9t

take on

regarding

and

their

(s*,r*).

For any reporting strategy a

v,{z\9')

where

Zt+i

We

let

=

=

W {c{z')XE[h{z'^\e,^,)v,{z'-^\e'+')

a* denote the truth- telling strategy

of the next result

Proposition

(c, h,

3.

is

Assume u{x) =

v) satisfying (22)

and

cr^{z*

x^~''/{l

—

=

{ A'c(2*)

c{z*)

Then for any A'

there exists a

on s\ the realization of

We

9t

p)

,

9^)

=

is

9t.

Incentive compatibihty requires

Va.

and R{x)

(23), fix a history z^

c(2*)

=

(22)

,

(23)

in the appendix.

A c{z-')

u{x)

at+,,z\e'])

(5^+1,0-^+1(2;*, 61*+^)).

Va'{zo,9o)>v,{zo^9o)

The proof

\

A

such that

for

=

x^~"'/{l

and consider

2*

=

—

7).

For any

allocation

the following variation:

r

fort>T

and

z* >- z''

otherwise

(c, h,

v) satisfy (22)

and (23)

independent and identically distributed; or

if:

(h)

(a) Conditional

p

—

I

so that

\ogx.

do not impose restrictions on the stochastic process

13

for the observable state St-

Re-

garding the unobservable shock, the requirement in part

and can,

for productivity,

requirement does ensure

in particular,

is

(a)

does not restrict the process

accommodate any degree

What

of persistence.

that the states that affect the evolution of shocks are observable,

that there are no hidden states. Although this implies that the observable state

the sense that Pr(s*+",6I*+"|5*,6'*)

ficient statistic for (s*,6'*), in

allocations typically

depend on the history

may

False past reports

vant.

this

9^

=

s* is

Pr(s*+",6'*+"|s*), optimal

In this way, the history of reports r*

.

a suf-

is rele-

then affect the allocation the agent receives, but do not affect

the planner's capacity to predict the agent's future productivity. This tractability allows us

to find variations that maintain incentive compatibility.

=

In the logarithmic case, p

0,

the crucial property

H/(Ac,

=

Hence, setting A^~^(A')^

reporting strategy.

As a

1 in

result,

that

Ai-^(A')^H/(c,t;').

the variations does not affect the utility delivered by any

no assumption on the structure of uncertainty

is

required.

The Intertemporal Optimality Condition: The Golden Ratio

or The Modified Inverse Euler Equation

3.3

Let us say that an allocation

E Yl'tLo 9*Q

any

AV) =

is

and

is

efficient if

it

minimizes the present value of consumption

delivers a given lifetime utility level in

efficient allocation

an incentive compatible way. Then

cannot be improved by the variations above. That

is,

these variations

cannot reduce the discounted value of consumption.

Fix a node

at all

s'^

.

Increase consumption at s^ proportionally by A, and increase consumption

nodes that follow

it,

s* >- s'^,

proportionally by A'. This variation

propositions above. Indexing the variation by A' and solving for

constant,

we

permitted by the

A = 5(A')

that keeps utility

consider the minimization

min

j

(5(A')c(r )

first-order necessary

and

+

A'

^

q'c{s') Pr[5*|a*, J"]

t>T,S^

\

The

is

J

sufficient condition for optimality is

ct

(1-/3Mq)

Y.7=o'i'^A(^+s]

u{vt)

Thus, optimality requires the ratio of current to lifetime

equated to the ratio of current consumption with

14

(24)

.

j

its

simply

utility

(25)

(1

—

(3)u{cf,) / u{vt)

expected present value

to be

q/ X^^q 9*^Et['^+s]-

Rearranging, the ratio of current consumption and utility must be equated to the ratio of the

present value of consumption with lifetime utility:

Ct

(26)

{1-I3)u{ct)

u{vt)

Both conditions formalize the optimality of a form of consumption smoothing.

We

call

them

the Golden Ratio conditions.

The next

for

result reexpresses the optimality condition

above

in

a way that

is

more

suitable

comparison with the optimality condition - the Euler equation - that results when agents

can save freely at the interest rate q~^

We

.

call this

condition the Modified Inverse Euler

equation.

Proposition

4. Define

ht+iVt+i

Xt+l

(27)

CEt[ht+iVt+iY

At the optimum in (24) the following condition

(a)

holds:

i-p u'{ct)

%.

1

u'{(h+\)

/?

(h) If agents

(28)

'-t+i

can borrow and save freely at the interest rate q

then the allocation must satisfy

^,

the following Euler equation:

x:

'^'

(29)

u'[c,)

Savings will generally be distorted at the optimal allocation, since the Modified Inverse

Euler equation and the Euler equation are incompatible. Thus, in any implementation of the

planner's optimum, agents cannot be allowed to borrow and save freely at the interest rate

l/q.

Suppose that the optimality condition equation

T by solving

for the factor (1

replaced with (1

—

—

(28) holds. Define the intertemporal

r) required so that the Euler equation (29) holds

wedge

when \/q

is

r)/g:

1

-

T

=

E;

„P-7 u'{ct+\

't+\

%

1-p

(30)

u'{ct+x)

u'ict)

so that

r

= —Gov

u'{ct.+1)

u'{c,)

1-p

-X.*+i

u'ict)

Importantly, the intertemporal wedge r

1-7

^t+\

is

(31)

xl-fu'{c,^,)

zero whenever there

is

no uncertainty. For the case

of certainty, Atkinson-Stiglitz's uniform-taxation result requires preferences to be separable

15

between consumption and

However, in our recursive specification preferences are not

leisure.

Interestingly, despite this, the absence of resolution of uncertainty

separable.

between two

periods implies that there should be no intertemporal distortion on savings there.

In other

words, although the separibility conditions required by Atkinson-Stiglitz are violated, their

uniform commodity taxation result holds under certainty with our preferences. Thus, optimal

distortions can be entirely attributed to ongoing idiosyncratic uncertainty, just as in the

additively separable expected-utility case that leads to the Inverse Euler equation (Golosov

et al, 2003).

Note that

on savings

is

=

7

if

positive.

>

0.

We

shall

0,

guaranteeing that the intertemporal distortion

Another interesting case

=

baseline allocation, so that q+i

r

>

one gets that r

1

£t+iCf

when q

is

is

a geometric random walk at the

then follows that

It

study this case in more detail

in the

Vf is

proportional to q, and

next section.

Constant Absolute Risk Aversion Preferences

3.4

In this subsection,

risk aversion the

we show that

for a particular class of preferences

optimal distortion on savings

convenient specification of preferences

is

zero.

with constant absolute

In a static moral-hazard setting, a

is

E[Uic-h{a))\a]

where U{x)

= — e"'*^

is

(32)

exponential. Equivalently, one can express ex ante utility as

CE[c-h{a)\a]

In our

R{x)

—

dynamic

—e'''^

setting,

we

v')

—

u~^ {{1

5.

=

W {c{s')XEK{s'+') - hia{s'))

— P)u{c) + Pu{v')) and CE = R~^ER.

inequalities (19) as before.

Proposition

generalize this specification as follows.

Let u{x)

= — e~^^

and

and consider the recursion

v^{s')

where W{c,

(33)

Assume

The next proposition

u{x)

=

is

—e~^^ and R{x)

16

proved

\

a{s'),s'])

Incentive compatibility requires

in the

= — e~"*'^.

(34)

appendix.

Suppose we have

c,

v and a*

.

satisfying conditions (18)

and

(19).

Fix a history

c(s^)

=

c(5*)

{ c{s^)

+A

for

+

fort

A'

A

there exists a

As above, we say that an

Consider the variation:

.

=

s*

>

5^

T and

s*

s^

>>-

otherwise

c(s*)

Then for any A'

s'^

such that

c,

v

and

a* satisfy conditions (18)

and

(19).

is efficient if it

minimizes the present value of con-

Y,q'c{s')Y>x[s'\a*]

(35)

allocation

sumption

required to deliver a given lifetime utihty level in an incentive compatible way.

efficient allocation

cannot be improved by the variations above.

That

is,

Then any

these variations

cannot reduce the net present value of consumption.

Indexing the variation at any node by A' and solving for

can write the minimization subproblem as

freely at a

market

Proposition

and save

6.

The optimum

in (24) corresponds to the

u'[ct)

tion

CARA

the worker could save and borrow

=

economy where agents can borrow

The following Euler equation

^u'(CE(ct+i

-

holds:

(36)

ht)).

coincide.

Welfare Gains; Quantitative Explorations

In this section,

Section

3.

The

we

investigate the welfare gains from the optimal savings distortions derived in

analysis proceeds along the lines of Farhi

case where the baseline allocation features a geometric

work

and

preferences under consideration, the constrained-optimality condi-

and the Euler equation

4

if

we

interest rate q~^

freely at the interest rate q~^.

Hence, for the

that keeps utility constant

in (24). In this case, the first-order necessary

with the condition obtained

sufficient condition coincides

A

effort

is

constant.

The

settings.

Assumption

The baseline allocation {ct.ht]

geometric random walk Ct+i

(2006).

We focus

on the

random walk consumption process while

analysis in this section covers both to the private-information

and moral-hazard

1.

and Werning

=

is

such that

ht

=

h

is

constant and

Ct

is

a

Qet+i with St+i identically and independently distributed over

time.

17

—

Partial equilibrium

4.1

Let us

first

assume that there

R=

with a gross rate of return

The

if

the baseline allocation

random

also a pure geometric

a pure geometric

random

walk.

Suppose that Assumption

7.

is

then the cost minimizing allocation attainable through our variations

ht is constant,

Proposition

is

q~^.

following proposition shows that

walk and

is

a linear technology to transfer resources from period to period

is

obtained by multiplying {q}

1

holds.

Then

the cost minimizing allocation

{q}

by a deterministic drift g~^:

ct

= ag~%

with

g

=

'

^-')

(qp-'E[s] (E [c^"^])

and a

1

where 3

=

is

such that

q

attainable from the baseline allocation through our varia-

Ct

also follows a geometric

random walk, but with a

stead of E[£:] for the baseline allocation. This

condition

— a necessary and

when

h^

=

Cj.

Note that

>

1

and vice

drift

/3

p =

dh}~f.

ensures that the constrained-optimality

within our class of variations

factor.

It is

This

roles in this

compounded with

effect is

also useful to note that

if

^

>

1.

versa.

Increasing g while maintaining the value of qE[e\

effective discount factor

/3

different drift ^~^E[£:] in-

and h}~P play exactly similar

his constant, h acts as a discount

to produce an effective discount factor

then a

new

sufficient condition for optimality

holds at the optimal allocation

formula:

qg-p^e]

pih}'^.

Hence the optimal allocation

tions

-

(3.

is

exactly equivalent to decreasing the

In other words, the higher g, the lower the effective discount factor

that makes the constrained-optimality condition hold.

Note

also that given qE\£\

elasticity of substitution

discount factor

/3

and

parameter

g,

p.

the intercept

The

a depends only on the intertemporal

risk aversion

parameter 7 only

shifts

the effective

required for the constrained-optimality condition to hold.

Economists are used to thinking of the discount factor as a primitive of the model, and

as the equilibrium interest rate as an outcome. However, contrary to interest rates, discount

factors are not directly observable. In fact,

comes from equilibrium values of

Q,

we

most of the evidence concerning discount factors

interest rates.

Therefore, in the formula for the intercept

prefer to think of the equilibrium interest rate q as the primitive

effective discoimt factor

(3

and to solve

for the

that makes the constrained-optimality condition hold given g and

qne\.

18

We

Intertemporal wedge.

can compute the optimal wedge

in closed form:

— Cov{£,£~^)

^

^

Note that the wedge

and

is

is

E[e]E[£-T]

always positive.

by

entirely determined

that the origin of the wedge

7, that

is

magnitude

Its

example

by the agent's attitude toward

is

independent of p

is

This highlights

risk.

the combination of two factors: the riskiness of tomorrow's

consumption from today's perspective and the agent's

would be no reason to

in this

distort savings

Absent shocks, there

risk aversion.

and the Euler equation would

hold.

Similarly,

if

the

agent were risk neutral, there would be no reason to distort savings and the wedge would also

be

zero.

We

can re-express the wedge using the formalism of cumulants:

generating function of log

(e)

of log(e)

is

moments, as we see from the

notation

is

standard, with

be the moment

:

m{9)

The nth cumulant

m

let

=

given by

=

«;„

=

^^(0).

log E[s']

Cumulants are

=

^2, «3

=

denoting the conditional

mean

of log(£)

first four:

/xi

=

log £;[exp(^ log (e))]

ki

^1, K2

A*3)

1^4

closely related to

=

fJ-4

—

and ^„,

The

3(//2)^-

n >

for

1

,

denoting the nth central conditional moment.

Using this notation we derive a formula that

ties

the wedge to the higher order

moments

or cumulants of log(e):

00

- log(l -

r)

=

m(l)

+ m(-7) - m(l -

7)

= J^ «„/n!

(1

+

(-7)"

-

(1

-

7)")

n=2

In the lognormal case, which

n >

3

log(e):

we explore below, the higher cumulants

and we obtain a closed form

-log(l

-r) =

for the

«;„

of log(£:) are zero for

wedge which depends only on the variance

a"^

of

7a2.

Outside of the lognormal case, higher cumulants are non-zero and higher moments of the

distribution of consumption growth rates affect the wedge. For example,

impact of skewness

K3.

The contribution

negative skewness - K3 - decreases the wedge

Welfare gains.

computed

The

costs k

term to the wedge

of this

if

7

<

1

is

we can analyze the

given by K3

and increases the wedge

Hence

"''

^

if

7

>

1.

and k of the baseline and the optimal allocations are

to be

-

k

=

ac

l-qg-'ne\

19

easily

and

k

^—

=

-

1

qE[e]

Combining these two expressions, we can derive the

cost allowed

relative reduction in expected discounted

by our variations.

Proposition

8.

Suppose that Assumption

holds.

1

Then

the relative expected discounted cost

reduction achieved by going from the baseline allocation to the optimal allocation

k

~k

By

is

_ fl-qg-PE[s]\^^ fl-qg-'E[e]y-^^

1-9E[5]

V

;

V

1-qE[£]

homogeneity, the ratio of the cost of the optimal allocation to the cost of the baseline

does not depend on the current

or in other words, given gE[e], ^

the variations.

It is

consumption

level of

is

c.

Given the cost of the baseline allocation,

a sufficient statistic for the welfare gains attainable through

some comparative

therefore instructive to perform

statics

with respect to

9-

Given qE[e] and

g,

the relative expected cost reduction depends only on the intertemporal

elasticity of substitution

parameter

p.

that given g and gE[£], the intercept

=

At ^

1,

the reduction in cost

This

a direct consequence of the fact noted above

is

a does not depend on

is 0.

This

the risk aversion parameter.

because in this case, the constrained-optimality

is

condition holds at the baseline allocation. Moreover, a Taylor expansion around g

that the cost reduction

When

zero at the

first

k

1

^

order in g and increasing in g

qE[e]

is like

taking the effective discount factor to

0.

reveals

:

Yir^Ekl-

Taking g to

In that case, the optimal allocation for

1 is

In the limit where p goes to

Ct

=

1,

we

for

i

>

1

and

cq

=

cq.

get

,= -E[e]and. = ^3r^,

which

I

,,2

,

g goes to infinity on the other hand, the cost reduction goes to

infinity

A_i =

is

=

is

.-.

exactly the expression derived in Farhi and Werning (2006).

Euler at the baseline.

in the interesting case

Given the importance of ^f we now investigate

,

where the Euler equation holds

20

its

main determinants

at the baseline allocation.

That the

.

Euler equation holds at the basehne means that

-7

which can be re-expressed as

The

fiq-^h'-P^. [£-^] (E [e^-^]

effective discount factor

/3,

=

/3

/3

Knowing

^

7-£

=

1

=

(38)

can then be determined:

^

(5h}

)

5(E[£^])-^(E[ei-^])^

the sufficient statistic g for the welfare gains in formula (37) can be derived

using the formula in Proposition

(7).

Proposition

holds

9. //

Assumption

1

and

the Euler equation holds at the baseline allocation,

then

J

g=lE[e]E[e-^]{E[s'-''])-y.

The optimal change

wedge

in drift

g

is

reflects the strength of the

for inceased

more agents

r:

=

g

{1

—

t)~^^'^.

The

precautionary savings motive: the higher the wedge, the

The higher the intertemporal

larger the gains from frontloading consumption.

substitution, the

wedge

positively related to the

elasticity of

are willing to accept reductions in consumption in the future

consumption today. The two

combined determine the optimal change

effects

in

drift g.

When

e

is

~

lognormally distributed loge

N{fi,a'^), then the

wedge

from the baseline allocation g and the welfare gains can be computed

and the variance

CoroUciry

1.

cr^

of

in

r,

the change in drift

terms of the mean

/x

consumption growth:

Suppose that £

is

lognormally distributed loge

~

N{^,al), then r and g are

given by

T

=

I

—

r

^. ,^

E[e]E [e-f]

,

=

—

1

exp

^

L

— 7(T.ej ~

70",

i

'

e

and

=

exp

(

As we already

discussed, the

magnitude of the shocks

cr^.

When shocks are lognormal,

wedge

is

~

—a^

\P

I

V

—

1 H

<T^.

P

increasing in the degree of risk aversion 7

Moreover, 7 and

a'^

affect the

wedge

in a

in the

complementary way.

the formula takes the remarkably simple form r

21

and

= 1 —exp [— 7(t^]

.

The

crucial

parameter g

associated with

is

-cr^.

The higher the variance

and

of the shocks,

the higher risk aversion, the higher the required change in drift g between the baseline and

p~\ the

the optimum. Similarly, the higher the intertemporal elasticity of substitution

higher

9-

Intuitively, this

different dates

can be seen by taking the limit as p goes to

become

perfect substitutes.

Note however

the limit,

since the required change in drift g goes to

)~^

that in this case, the intercept a converges to 1 — g (E [£""'•']

E [e^~^].

when p goes

Intuitively,

it is

to 0,

best to deliver

lim -

is

it

optimal to front-load consumption more and more.

The

is

non

trivial.

~

+ -~

1 -

+ (l-27)f

-

l-q 3Xp

'p

+

1

Indeed,

we

have:

7cr;

qe^'

i_

gains are increasing in the intertemporal elasticity of substitution p~^: intuitively, as

consumption

at different dates

become more

substitutable,

it

becomes

easier to

compensate

the agent for a decrease in the drift in consumption in order to lower his exposure to

fact,

we can

k

this

risk.

In

derive a simple formula for small a^:

'-1 +

From

In

in the first period so that agents are entirely

cost reduction

1-- qexp p

=

0,

consumption

all

shielded from consumption risk.

The

so that consumption at

The Euler equation and the optimality condition

are incompatible in the limit where p goes to

infinity.

0,

formula

it

77^^-4

p

apparent that at the

is

first

(39)

'

qei^)^

(1

relevant order, risk aversion

and the

in-

2

tertemporal elasticity of substitution enter the formula for the gains only through ^.

Quantitative exploration.

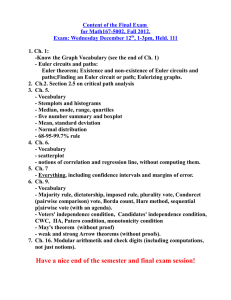

Figure

1

and 2 plot the reciprocal of the

relative cost reduction

using equation equation (37) as a measure of the relative welfare gains as a function of a|.

The

figures use

0.007.

The

an

emxpirically relevant range for

value of gE[e]

In figure

1,

cr^

which

is

taken to vary between

and

set to 0.97.

is

the intertemporal elasticity of substitution p~^

is

set to 1

and the

different

curves correspond to different values of the relative risk aversion coefficient 7 ranging from

1

to 3 in increments of 0.5.

The

gains are increasing in 7;

10%

Increasing 7 by

is

exactly

equivalent to increasing a^ by 10%.

In Figure 2, the relative risk aversion coefficient

7

is

set to 1,

and the

different curves

correspond to different values of the intertemporal elasticity of substitution p"^ ranging from

0.5 to 1 in increments of 0.1.

equivalent to increasing

a'^

The

gains are increasing in

by 5%.

22

p~\

Increasing p~^ by

10%

is

roughly

Figure

and

1:

Welfare gains as a function of a^. Baseline consumption

The Euler equation

a ranging from 1 to 3.

ht is constant.

values of

Two

lessons

holds.

emerge from our simple

The

is

a geometric random walk

correspond to different

different curves

First, welfare gains

exercise.

range from small to

potentially large. Second, they depend a lot on three parameters of the model: 7, p

and

The

play an

coefficient of relative risk aversion

7 and the variance of consumption growth

cr^

a'^.

especially important role over the range consistent with the available empirical evidence con-

cerning these two parameters.

but

its

The intertemporal

influence over the empirically relevant range

because the range for this parameter

than 7 and a^ as can be seen from

4.2

Up

to

elasticity of substitution p^^

is

is

somewhat

less

is

important,

dramatic. This

is

both

smaller and because p~^ enters with a smaller power

(39).

General equilibrium

now we have

of the results

restricted the analysis to partial equilibrium. Alternatively, one can think

we have derived

of return to capital. In Farhi

so far as applying to

an economy facing some given constant rate

and Werning (2006), we argue that neglecting general equiHbrium

effects magnifies the welfare gains

from reforming the consumption allocation. Here we explore

the joint influence of risk aversion and the intertemporal elasticity of substitution on general

equilibrium welfare gains.

Planning problem.

problem,

it

allocations

is

q

Consider a baseline allocation {ct,ht}.

useful to introduce the following notation:

let

In order to setup the planning

T{{ct,ht},A_i) be the

attainable through our variations from the baseline allocation {A_iCi,

that the shifted allocation {A-iCt,ht}

utility increased

is

incentive compatible

by a multiplicative factor A_i to the agent.

23

and

/i^}.

set of

Note

delivers a value lifetime

In general equilibrium, the

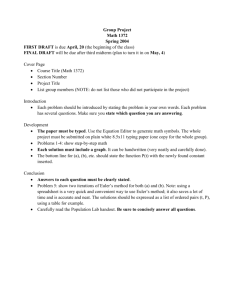

Figure

2:

Welfare gains as a function of

walk and h-t is constant. The

from 0.5 to 0.9.

cr?

when

baseline consumption is a geometric random

correspond to different values of p~^ ranging

different curves

planning problem can be set-up as

W{Ko) =

max

vq

(40)

{ct,Kt^i}

subject to

ht {{1

Vt

i-p

r,i.-Tni-'

- ,3)cl-' +

13

for f

{E[vl--;'])

=

0,1,..

{ci}GT({Q,M,A_i),

Kt+i

+ E[q] <

F{Kt, Nt)

+

(1

-

S)Kt for

t

=

0, 1,

...

Ko = Ko.

Necessary and

c?

sufficient conditions for this

course,

allocation

Et

FK{Kt.Nt)

+ {l-5)

and A_i

is

the

maximand

in

(

=

E[ct],

where the superscript

i

-^Kt+i

for i

=

0, 1,

[Uviri])'-'

we have W{Kq) — A-it-F where

W

is

the welfare achieved at the baseUne

40).

Note that we can always decompose q

Cf

are:

Vt+l

=

(ih'-"

Of

problem

=

(^^Ct

with the property that

stands for idiosyncratic.

deterministic parallel shifts in consumption,

we have

24

that

E[cJ]

=

1

and

Since our variations allow for

{q} G T({ct,

/?t}.

A_i)

for

some

A_i

if

and only

The

if

{5j}

G T({cJ,

ht},

A_i).

analysis of this planning problem

tackled in

is

full

generality in Farhi

where we also explore non geometric random walk baseline

(2006),

and Werning

allocations:

we provide

cases where (40) can be separated into two different planning problems, one involving only

the idiosyncratic part of the allocation

instead,

we focus on the

cj

and the other only the aggregate part

Ct-

special case were the baseline allocation features geometric

walk consumption with constant

Here

random

ht-

Geometric random walk with constant hf

Suppose that the baseline allocation features

geometric random walk consumption with constant ht and constant aggregate consumption:

=

Ct+i

where

St+i

Ct£t+i

and

ht

=

h,

independently and identically distributed across agents and time and with

is

E[£i+i] =1. In other words.

Assumption

holds and E[e] =1.

1

Define

l3e

Proposition 10. Suppose

=

f3{E [e^-^])^ and

that

= Ctc\ where Ct and A_i

CRRA preferences:

Assumption

4 = h'-^P,.

holds and E[e] =1.

1

The solution

to

(40)

is

are the solutions of the standard neoclassical growth model with

Ct

1

-

= (l-4)

^

P

max

^ {Ct,Kt+i}

TPl^

(41)

subject to

Kt+i

+ Ct<

F{Kt, Nt)

+

(1

-

5)Kt

for t

=

0, 1,

...

Ko = Ko.

The property

relies crucially

we saw

that the idiosyncratic component of the baseline allocation

on the assumption of geometric random walk with constant

above, the planner only wants to affect the drift of {c]}, which

case of an

is

endowment economy where

1

=

is

ht-

Intuitively, as

impossible in the

E[cJ].

In the case where the baseline allocation

is

a geometric random walk with constant

can therefore

restrict

welfare gains

come from modifying the aggregate component

our attention to the aggregate part of the allocation:

Euler equation at the baseline.

already optimal

Suppose that

we

the potential

of the allocation.

in addition, the baseline allocation repre-

sents a steady state where the Euler equation holds.

25

all

ht,

p-i

p-i

0.5

=

p-'

0.75

=

l

6WpE

SWge

fss

SWpE

5Wge

rss

5WpE

SWge

rss

0.09%

0.34%

1.07%

0.10%

0.69%

6.53%

12.33%

0.38%

0.79%

3.82%

5.28%

7.03%

0.10%

0.37%

0.75%

3.82%

4.55%

3

3.82%

4.55%

5.28%

1.56%

2

2.02%

3.62%

7=1

7 =

7 =

=

5.15%

9.85%

Table

Let qss

=

—

(1

we can

that case,

S

+

5.28%

Welfare Gains.

1:

FpciKss, Nss))~

5.28%

be the inverse of the steady state

interest rate.

In

derive as above an expression for P^:

4 = qss (E [s-^])-' E [e^-]

(E [s]r'

=

qss (E

[e])'

J^_

E E

[e]

That the baseline allocation

is

[£-T]

a steady state implies in particular that E[£] =1.

We

can

therefore simplify the formula for $^:

Pe

The optimal

rate qss

When

terms of

e is

//

lognormally distributed logs

and

E [g^-^]

E [e] E [e-r]

'

= 4-

a^.

We

~

N{fj,,a'^),

then we can compute P^ and qss in

get the remarkably simple formula:

qss

is,

qss

allocation will eventually reach a steady state where the inverse of the interest

given by qss

is

=

=

Pe

=

qss exp (-70"e)

Equation (42) shows that the new interest rate

is

Kss < Kss) by

The

a factor given by exp

(70-^).

(42)

higher than the initial interest rate (that

higher risk aversion and the variance

of consumption growth, the higher the increase in steady state interest rates,

and the higher

the reduction in steady state capital stock. Because the baseline allocation has no trend, the

intertemporal elasticity of substitution does not affect the level of the

The only thing our

variations allow in this case

is

7 and the variance

As we

of

consumption growth

is

a'^

by the

controlled only by the relative risk

a'^.

just discussed, the coefficient of relative risk aversion

sumption growth

interest rate q^g.

to correct the externality created

precautionary savings motive, the intensity of which

aversion

new

7 and the variance of con-

control the decrease in capital between the baseline steady state

and the

optimal steady state. The intertemporal elasticity of substitution, on the other hand, controls

the speed of the transition: the higher p~^, the faster the transition, and the higher the welfare

gains.

26

We now

F{K,N) = K^N^-"" +

function

of

compute the welfare gains

consumption growth

computations: a^

rss

=

Qss

~

^

~

=

(1

-

in general equilibrium for the neoclassical

5)K.

at the highest

We

a =

set

0.36, S

end of the values we used

3.07%.

—

1,

2

—

0.5, 0.75

and

our partial equilibrium

fixed at rss, the welfare gains in general equilibrium

and

SWpE

SWge and

if

— and three different

the interest rate were

the interest rate fss at the

state for the optimal allocation.

important general lesson from this exercise, as pointed out

is

1

For each configuration of these

3.

parameters, we report the welfare gains in partial equilibrium

(2006),

in

set the variance

We take the initial interest rate at the baseline allocation to be

We perform the computations of welfare gains for three different

values for the relative risk aversion coefficient 7

An

We

.09.

0.007.

values of the intertemporal elasticity of substitution p~^

new steady

=

production

in Farhi

that taking into account the concavity of the production function

into account general equilibrium effects

and Werning

— that

is,

taking

— greatly mitigates the welfare gains. This because

of the consumption process —the optimal policy

is

in general equilibrium, reducing the drift

under partial equilibrium

—yields lower and lower gains as consumption and capital go down

over time and the equilibrium interest rate increases.

As a consequence,

it is

optimal to reduce

the drift differential. Eventually, under the optimal allocation, the drift differential goes to

and the economy reaches the new steady

state with a higher interest rate

and a lower

capital

stock.

Even though the

partial equilibrium welfare gains can

equilibrium welfare gains never go above 0.79%.

The

7

=

3.

the general

=

1

and the highest value

of the

For those parameter values, the new interest rate

substantially higher than the initial interest rate: rss

this large difference in interest rates

,

highest gains are reached for the highest

value of the intertemporal elasticity of substitution p~^

relative risk aversion coefficient

be as high as 12.33%

and therefore

=

5.28% whereas rss

=

is

3.07%. Despite

in steady state capital stocks, the general

equilibrium welfare gains are moderate at 0.79%.

5

Conclusion

This paper studied constrained

focused on

how

efficient allocations in private

information economies.

We

the optimal savings distortions featured in those allocations depend on indi-

viduals' preferences.

We

introduced a recursive class of preferences that allowed a separation

of risk aversion from intertemporal substitution,

and derived general

results

on the nature of

optimal distortions.

We

then performed a quantitative investigation

consumption

allocations.

We

for

a class of geometric random walk

showed that savings distortion depend only on

27

risk aversion

and

.

the variance of the shocks to consumption. However, the welfare gains from these distortions

depend on both parameters, although we found greater

The purpose

of the quantitative exercise

was to

limited in terms of the consumption allocations

we undertake a comprehensive exploration

it

sensitivity to risk aversion.

illustrate the role preferences,

but

it

was

In Farhi and Werning (2006)

considered.

of savings distortions and welfare gains for general

consumption processes.

Appendix

Proof of Proposition 3

Part

(a).

The proof

parallels the proof of Proposition 2 closely. First note that since prefer-

ences are recursive an incentive compatible allocation satisfies

yz\e\a,

Va>{z\9')>v,{z\9')

(43)

so that truth-telling maximizes continuation utility after any history of reports.

Let

v„{z\

e*)

=

A'v^iz*, e')

for

t

>

r and

2*

^

z"

Va{z\

e^)

=

Va{z\e')

iox

t

>

T and

0*

^

F

so that condition equation (22) with c

met

is

for all 0^

with

t

>

r with

= w{^c{z^),^'<CE[h{z^^\er+iW{z^^\d^+')

v,.{z\e^)

I

So that

ity

Va'^z^.O'')

=

Va'{z'^,9'^) for all

equation (43) evaluated at

z'^

9'^.

6^

^

6'^

I

(22), the inequal-

a,V,^^e^

CE[h{z^+\er+,)v^{z^+\e^+')

I

i;<,.(^^r)

=

solve

(j,Vi,r,^i)

Using the recursion equation

>

^^"""^

A

implies

CE[A'{s^+')h{z^+\er+i)v,^{z^^\e-^')

for all histories

Let

.

and reporting plans

a.

at+uz\0^]

Hence,

W{Ac{z^),Cn^'{s^^')h{z^+\er+,)v,4z^'-\e^^')

I

<l,^^r])

>W{Ac{sn,A'is^-'')CE[h{z-+\er+x)v,{z^^\e^+')\at+,,z\e^])=v,{z\9^).

28

Collecting the inequalities,

we have shown that

<

Vc{z\e^)

Thus, a*

=

Va'{z\e^)

in period

^;^.(^^^*)

r

z\9\a,

for all

optimal from period r onward and delivers the same continuation utility as pre-

is

viously.