Document 11159538

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium IVIember Libraries

http://www.archive.org/details/nonparametricestOOhaus

HB31

.M415

kfif*.::zrt.-

2_

working paper

department

of economics

NONPARAMETRIC ESTIMATION OF EXACT

CONSUMERS SURPLUS AND DEADWEIGHT LOSS

Jerry A. Hausman

Whitney K. Newey

No.

93-2

Dec.

1992

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

'

NONPAEAMETRIC ESTIMATION OF EXACT

CONSUMERS SURPLUS AND DEADWEIGHT LOSS

Jerry A. Hausman

Whitney K. Newey

No.

93-2

Dec.

1992

1S93

NONPARAMETRIC ESTIMATION OF EXACT CONSUMERS SURPLUS AND DEADWEIGHT LOSS

by

Jerry A.

Hausman and Whitney

K.

Newey

Department of Economics, MIT

October 1990

Revised, December 1992

This research was supported by the NSF.

Helpful comments were provided by T. Gorman,

Jewitt, A. Pakes and participants at several seminars.

Sarah Fisher-Ellison and

Christine Meyer provided able research assistance.

I.

Abstract

We

apply nonparametric regression models to estimation of demand curves of the type

most often used

in applied research.

From the demand curve estimators we derive

estimates of exact consumers surplus and deadweight loss, that are the most widely used

welfare and economic efficiency measures in areas of economics such as public finance.

We

also develop tests of the

demand.

We work

symmetry and downward sloping properties of compensated

out asymptotic normal sampling theory for kernel and series

nonparametric estimators, as well as for the parametric case.

The paper includes an application to gasoline demand.

interest here are the shape of the

from a te« on

gasoline.

Empirical questions of

demand curve and the average magnitude of welfare

In this application

loss

we compare parametric and nonparametric

estimates of the demamd curve, calculate exact and approximate measures of consumers

surplus and deadweight loss, and give standard error estimates.

sensitivity of the welfare

We

also zmalyze the

measures to components of nonpeirametric regression estimators

such as the number of terms in a series approximation.

Keywords:

Consumer surplus, deadweight

loss,

consumer

tests, nonpsirametric estimation.

Authors:

Professor Jerry A. Hausman

Professor Whitney K. Newey

Department of Economics

Department of Economics

MIT

MIT

Cambridge,

MA

02139

Cambridge,

MA

02139

Introduction

1.

Nonparametric estimation of regression models has gained wide attention

few years

the past

Nonparametric models are characterized by a very large

in econometrics.

numbers of parameters.

in

Often they may be difficult to interpret, and their usefulness

We

applied research has been demonstrated in a limited number of cases.

in

apply

nonparametric regression models to estimation of demand curves of the type most often

used

applied research. After estimation of the demand curves,

in

we

will then derive

estimates of exact consumers surplus and deadweight loss which are the most widely used

welfare and economic efficiency measures

We

also

in

areas of economics such as public finance.

work out asymptotic normal sampling theory for the nonparametric

case, as well as

the pau-ametric case (where except in certain analytic cases the results are not known).

The paper includes an application to gasoline demand.

interest here are the shape of the

from a

taix

on gasoline.

Empirical questions of

demand curve and the average magnitude

In this application

of welfare loss

we compare parametric and nonparametric

estimates of the demand curve, calculate exact and approximate measures of consumers

surplus and deadweight loss, and given estimates of standard errors.

sensitivity of the welfare

such as window width

where p

level.

aind

number of terms

.u"^)

= e(p

,u'^)

are initial prices,

The case

EV(p

where

,p

y

r

=

,p ,y)

1

also analyze the

measures to components of nonparametric regression estimators

in a series

The definition of exact consumers surplus

CS(p

We

- e(p

is

based on the expenditure function:

,u'^),

are new prices, and

p

approximation.

is

u*"

the reference utility

corresponds to the case we focus on here, equivalent variation:

= e(p

,u

)

- e(p ,u

)

= y - e(p

,u

denotes income, fixed over the price change.

),

It

is

also easy to carry out a

similar analysis for compensating variation.

The measure of exact deadweight loss (DWL) used corresponds to the idea of the

in

consumers surplus from imposition of a tax

compensated

less the

teix

under the implicit assumption that they are returned to the consumer

(1974) definition of deadweight loss

where

equivalent variation the definition of exact

DWL(p

h(p,u)

is

,p ,y)

= EV(p

,p ,y) - (p

is

p

- p

DWL

is

the vector of taxes.

Then, for

is:

-p )'h(p

,u

)

= y - e(p

,u

)

the compensated, or Hicksian, demand function and

Marshallian (market) demand function.

it

a lump sum

Here we use the Diamond-McFadden

loss (also called the excess burden of taxation).

DWL

revenues raised,

See Auerbach (1985) for a discussion of the various definitions of deadweight

mamner.

where

in

loss

- (p -p )'q(p

q(p,y)

is

,y),

the

Thus, to estimate exact consumers surplus or exact

necessary to estimate the expenditure function and the compensated function

demand which are related by the equation,

5e(p,u)/ap. = h.(p,u).

(Shephard's Lemma).

The expenditure function and compensated demand curve

on the market, or Marshallian, demand curve,

aire

estimated from observable data

q.(p,y).

Various approximations h"'ve been proposed for estimation of the exact welfare

measures.

is

Willig (1976) demonstrated that the Marshallian

measure of consumers surplus

often close to the exact measures, and he derived bounds as a function of the income

share.

Various authors have also recommended higher order Taylor-type approximations to

the exact welfare measures.

Limitations of the approximation approach are that they do

not yield measures of precision given that they

Eire

most cases and the approximations may do poorly

specify a priori.

(1981)

in

based on estimated coefficients

some situations which are

Deaton (1986) discusses these problems

in

more

detail.

Also,

in

difficult to

Hausman

demonstrated that while the approximations may often do well for the consumers

surplus measure, they often do very poorly in measurement of DWL; Small and Rosen (1981)

also demonstrated a similar proposition in the discrete choice situation.

Two approaches have

been proposed to estimation of the exact welfare measures from

estimation of ordinary demand functions.

Hausman

(1981)

demonstrated that for many

widely used single equation demand specifications, the necessarily differential equation

could be integrated to derive the expenditure function and also the compensated demand

function.

He was also able to derive the sampling distribution for the measures of

consumers surplus and DWL, given the distribution of the estimated demand coefficients.

Vartia (1983), instead of using an analytic solution to the differential equations,

proposed a variety of numerical algorithms which estimate consumers surplus and

any desired degree of accuracy.

DWL

to

While the Vartia approach can be applied to a wider

range of situations, no correct sampling distribution has been derived for the estimated

welfare measures, although some approximate results are given

in

Hayes and Porter-Hudak

(1986).

Both the Hausman approach and the Vartia approach can be applied to multiple price

changes and are path independent for the true demand function.

The various approximation

approaches do not share the path independence property which cam lead to perplexing

computational results and has led to much theoretical misunderstanding

literature.

Here,

we

in the

appropriate

consider nonparametric estimation via an unrestricted estimator

that uses some, but not

all

the implications of path independence.

us to test path independence,

i.e.

symmetry of compensated demands, and impose further

more

implications of path independence to construct

efficient estimators.

The Hausman and Vartia approaches begin with Roy's

demand function with the

Our approach allows

identity which links the ordinary

indirect utility function:

q.(p,y) = -[av(p,y)/ap.]/Ov(p,y)/ayl,

where

v(p,y) is the indirect utility function.

The partial differential equation from

this equation can be solved along an indifference curve for a unique solution so long as

the initial values are differentiable.

and

p(l)

= p

and

,

let

y(t)

Let

denote a price path with

p(t)

be compensated income, satisfying

Differentiating with respect to

y

p(0) = p

V(p(t),y(t))

= V(p

,y).

gives

[av(p(t),y(t))/ap]'sp(t)/at + [av(p(t),y(t))/ay]sy(t)/at = o.

Hausman notes that

this equation can be converted into an ordinary differential equation

by use of the implicit function theorem and Roy's identity.

denote the equivalent variation for a price change from

compensated income

is

Alternatively, this equation follows immediately

of

S(t,y).

Hausman

p(t)

S(t,y)

to

p

.

= y -

e(p(t),u

)

Then, since

y - S(t,y),

5S(t.y)/5t = -q(p(t), y-S(t,y))' Sp(t)/at.

(1.1)

Let

solves this equation for

S(l,y)

=

0.

from Shephard's Lemma and the

definition

some widely used demand curves.

The

solution gives both the expenditure function and indirect utility function, while the

right-hand side of this equation gives the compensated demands.

Vartia's numerical solutions to the differential equation also arise from equation

(1.1).

(s

=

To

solve

N),

it

Vartia uses a numerical method of Collatz.

and defines

S(t^^^)

=

S

He orders

=

t

1

- s/N,

s

iteratively by

S(t^) - .5[q(p(t^^j),y-S(t^^j)) + q(p(t^).y-S(t^))]' [p(t^^^)-p(t^)]

This algorithm consists of averaging the demand at the last price

and multiply this average by the change

in price.

eind

the current price

By the envelope theorem, the product

of the price change times the quantity equals the additional income required to remain on

the same indifference curve.

Intuitively,

dy = q*dp, where y

is

updated at each step of

the process, rather than holding y constant which the Marshallian approximation to

consumer surplus does.

One can also use alternative numerical algorithms to solve

s

equation

(1.1),

that

may

lead to faster methods.

We use an Buerlisch-Stoer algorithm

from Numerical Recipes that does not require solution to the

implicit equation in

Vartia's algorithm, has a faster (quintic) convergence rate that Vartia's (cubic), and in

our empirical example leads to small estimated errors with few demand evaluations.

The possible shortcoming of

and the Vartia approach

is

all

applications to date of both the

Hausman approach

that the parametric form of the demand function

is

required.

most applied situations, the exact parametric specification of the demand curve (up to

In

unlinown parameters) will not be known.

may

Thus, commonly used demand curve specifications

well lead to inconsistent estimates of the welfcire measures

misspecified.

This problem

is

if

the

demand curve

is

potentially quite important, especially in the case of

measuring deadweight loss which depends on "second order" properties of the demand curve.

See

Hausman

(1981) for a discussion of the

second order properties and their effect on

estimates of the deadweight loss.

Varian (1982 a,b,c) has proposed an alternative approach based on the revealed

preference ideas of Samuelson (1948) and Afriat (1967, 1973) which

is

is

nonparametric, but

only able to estimate upper and lower bounds on the welfare measures.

nonparaimetric approximation approach

bounds, because

many

is

very interesting, but

it

Varian'

often yields rather wide

price observations per individual are required for tight bounds.

Furthermore, use of sampling distributions to measure the precision of the estimates

problematical.

Here,

we

is

use a nonparametric cross-section demand analysis analysis,

imposing enough homogeneity across individuals and smoothness of the demand function that

we can estimated

it

by nonparametric regression.

consumers surplus and

DWL

sensitivity of the welfare

We

construct point estimates of exact

as well as precision estimates of the welfare measures.

measure to the amount of smoothing used

regression can be analyzed straightforwardly.

in

The

the nonparametric

Estimation

2.

Our estimator of consumer surplus

with

q(p,y)

is

obtained by solving equation

(1.1)

numerically

We

replaced by an estimator obtained from nonparametric regression.

also allow covariates

w

to enter the

demand function

these covariates are region and time dummies.

will

work

In our empirical

q(p,y,w).

In other contexts they

might be

demographic variables.

We

will try to minimize the dimension of this

nonparametric

function by restricting

w

to enter in a parametric way.

denote a one-to-one

function with range equal to the nonnegative orthant of

one-to-one function of

and

(p,y),

further discussed below.

We

t(x)

let

Let

k

IR

T(g)

such as

,

g

T(g) = e^,

x

denote a "trimming" function, to be

assume that the true value of the demand function

will

a

is

given by

g^Cx.w) = r^Cx) + w'p^,

qQ(p.y.w) = T(gQ(x,w)),

(2.1)

T"^(q) = ggCx.w) + e,

where

q

E[c|x] =

E[T(x)we'l =

0.

denotes observed quantity and the expectations are taken over the distribution

of a single observation

excluded from

q,

from the

so that

k

We assume here

data.

is

specification for the regression of

assumed to be a function of a partially linear

is

T

(q)

estimator of the demajid function will be

an estimator of

g^^,

that a numeraire good has been

the number of goods, minus one.

Thus, the true demand function

is

0,

on

p, y,

and

w.

A corresponding

q(p,y,w) = T(g(x,w)) = T(r{x)+w'3),

such as the kernel or series estimator discussed below.

estimate exact consumer surplus nonparametrically by substituting q(p,y,w)

for

where

g

We

q(p,y)

This specification does not restrict the joint distribution of the data, unlike previous

is imposed.

work on partially linear models (e.g. Robinson, 1988), where E[e|p,y,w] =

A precise description of g (x,w), for nonnegative t, is as the mean-square projection

of

Pr

E[q|x,w] on functions of the form

= E[x{x)li4)]/Pr{d), where !(•)

{id)

w'g for the probability distribution

denotes the indicator function.

r(x) +

in

equation

w

version of the paper set

A

Let

kernel estimator

mean and

equal to its sample

v

has

= h

h

q,

of

-k-1

E[B(z)|x]

J'K(v)dv =

a bandwidth parameter,

>

In

z

z,

For a matrix function

and possibly other variables.

w,

y,

h

Also, let the data be denoted by

K(v/h).

1.

elements, satisfying

k+1

and other regularity conditions discussed below,

K, (v)

t(x) =

in this

a locally weighted average that can be described as follows.

is

be a kernel function, where

J<(v)

The empirical results reported

and solving numerically.

(1.1)

,

where

B(z),

1

and

z includes

a kernel estimator

is

E[B(z)|x] = J:.",B(z.)K. (x-x.)/5:.",K. (x-x.).

^j=l

h

^j=l h

J

J

J

To estimate the

pau'tially linear specification in equation (2.1),

coefficients of

w

in

we

"partial out" the

a way einalogous to that in Robinson (1988).

The estimator of

g

IS

g(x.w) = f(x) + w'^.

(2.2)

P =

where

[Ii"ii^i(

x.

=

V^^"^

'

^i^^^

V^^"^

'

''i^^' ^'^li^i'^i^

V^fw

A convenient kernel that we consider

t(x.).

fed - v'v),

v'v <

x.l)(T'^q.)-E[T"%)

x.

)).

in the

empirical work

is

I

otherwise

,

where the

constcint

C

is

chosen so

JK(v)dv =

1.

This

is

a multivariate Epanechnikov

The asymptotic theory requires kernels with integrals over

even powers of

v

J<(v)

of certain

equal to zero, that are often called "higher order," and are useful

for reducing asymptotic bias

in

kernel estimation.

Therefore,

we

empirical work a kernel of the form

(2.3a)

I

'

K(v) =

(2.3)

kernel.

f(x) = E:lT"^(q)|x] - E[w|x]'p,

Kiv) = ^(v^)^{v2)(12 - 6v^ - 6v^ + Sv^ + lOv^v^ + 5v^),

also consider in the

for our one dimensional price (k =

It

is

application.

1)

known that the choice of bandwidth

well

In the empirical

nonparametric regression.

can have important effects on

h

work we consider a data based choice of

mean square

equal to a "plug-in" value that minimizes estimated asymptotic

also consider the sensitivity of the results to the choice of bandwidth.

we

empirical work

also allow the kernel to be data based in that

h,

error, and

In the

we normalize by the

estimated variance of price and income, although the theory does not allow for data-based

bandwidth or kernel.

A

series estimator is the predicted value

from a regression of the log of gasoline

consumption on some approximating functions for

one-to-one, smooth transformation as above, let

matrix of functions of

K

combinations of

IT.

,<j)

^1=1

(x.,w.)0 (x.,w.)']

regression of

11

T

g(x,w) =

(2.4)

where

y =

•

(i}',^')'

<f>

y.

on

K

is

.<b

=

(<p

(x.,w.)T

1

1

A

(x.,w.).

Ax,w)'y

K

(x,w) =

''1=1

-1

(q.)

K

Let

(x).

11

the idea being that

x,

^'^(x)'-;;

)'

w,

is

I,

®(^

x

For

w.

denote a

^(x))

j.(x)

a

to be approximated by linear

and

y =

be the the coefficients from a

with

g

t(x) =

1

is

+ w'3.

4>

This estimator can also be

(x).

satisfying equation (2.2) with the kernel

E[B(z)|x] =

coefficients of the least squares regression of

Power

r(x)

=

and on

y

series estimator of

conditional expectation estimator replaced by

splines.

(x)

partitioned conformably with

interpreted as "partialling out"

Two important

<f>

(x)' ,w'

(q.)

^1

and

p

B(z.)

on

4>

(x)'t)_,

<p

(x.).

where

tj^,

are the

types of approximating functions are power series and regression

series are

formed by choosing the elements of

powers of the individual components of

x.

Power series

aire

^

(x)

to be products of

easy to compute and have

good approximation rates for smooth functions, although they are sensitive to outliers

and local behavior of the approximation, and can be highly collinear.

The collinearity

problem can be overcome to some extent by replacing the powers of individual components

with orthogonal polynomials, which does not effect the estimator but may lead to easier

Regression splines are piecewise polynomials of order

computation.

x

For univariate

points.

in

[0,1]

with evenly spaced knots

regression spline approximating functions are

(x-(j-<i-l)/(K-<x])

j

,

i

<x

+ 2,

where

regression spline can be formed from

components of

(v)

all

a.^,(x)

= l(viO)v

= x

Also, the

a+1),

1

in

order to place the knots.

power

a

x,

cross-products of univariate splines

in the

is

not as fast

Unlike power series, the range

In practice,

be constructed by dropping from the data any observation where

range.

=

The spline approximation rate for very smooth functions

x.

must be known

x

(j

join points),

For multivariate

.

as power series, but they are less sensitive to outliers.

of

,

(i.e.

with fixed join

<x

such a known range could

x

is

not in some

spline sequence above can be highly collinear, but this

can be alleviated by replacing them with their corresponding B-splines:

e.g.

known

problem

see Powell

(1981).

Series estimators are sensitive to the numbers of terms in the approximation.

the empirical

work we choose the number of terms by cross-validation, and

different numbers of terms to see

how the

substituting the estimated

demand function

As

be a price path with

1,

let

p(t)

denote the solution to equation

S(y,w,g)

also try

results are affected.

Returning now to estimation of consumer surplus, our estimator

in Section

In

in

(1.1)

equation

(1.1)

p(0) = p

is

constructed by

and integrating numerically.

emd

p(l)

with demand function

Then consumer surplus at particular income and covariate values

y

= p

.

Also,

let

q(p,y) = T(g(x,w)).

and

w

respectively, with a corresponding estimator, is

Sq = S(yQ,WQ,gQ),

(2.5)

where

g

is

S = S{yQ,WQ,i).

a kernel, series, or other nonparametric estimator.

A corresponding

deadweight loss value and associated estimator can be formed by subtracting the "tax

receipts," as in

Lq = Sq

(2.6)

L =

- (p'-p°)'T(g(p'.yQ.WQ)).

§ -

(pV)'T(i(p\yQ.WQ)).

A summary measure for consumer surplus can be obtained by averaging over income

In addition,

values.

it

may sometimes be

of interest to average over different prices,

To set up such an average

to reflect the fact that individuals face different prices.

u

let

u,

index price paths, so that

with

and final prices

initial

p(t,u)

p(0,u)

is

the price at

and

For example,

for covariates.

distribution, or

y_^

solution to equation

= T(g(x,w)).

q(p,y)

means across

z,

w

and

(1.1)

u,

y

and

w

for the price path

z

Also, let

w

for income and

y

might be drawn (simulated) from some

might be the actual observations.

p(u,t)

y

at

The average surplus and deadweight

aind

loss

we

Let

S(z,g)

w

with demsind

,

be the

consider are weighted

form

of the

Mq = E[w(z)S(z,gQ)l/E[w(z)],

(2.7)

,

and values

u

for price path

e [0,1]

respectively.

p(l,u)

denote a single data observation that includes

t

A = JT^Ij^i^^^i'^^/"'

" = L^i^^^^-^^-

Xq = Mq - E[u(z){p(l,u)-p(0,u)>'T(gQ(p(l.u),yQ,WQ))]/E[u(z)l,

A = A - ir^Ej"^u(z.){p(l,u.)-p(0,u.)}'T(i(p(l,u.).yQ..WQ.))/n.

It

is

interesting to note that the consumer surplus estimator

than the deadweight loss estimator.

dimension (the variable

t

in

which depends on the value of

surplus and deadweight loss

In particular,

p(t)),

g

is

like

2

different convergence rates.

2

thaui

Similarly, average

will be the same, both being the

faster

an integral over one

and so has a faster convergence rate

at a particular point.

may have

where their convergence rates

S

may converge

L,

consumer

One important case

parametric

l/ViT

rate, is

It is known from the work on semiparametric estimation that integrals or averages

converge faster than pointwise values, e.g. Powell, Stock, and Stoker (1989). The fact

that one-dimensional integrals converge faster than pointwise values has recently been

shown

in

Newey

(1992a) for kernel estimators.

10

when the

initial

be that where the initial price for each individual

the tax rate

all

is

An example would

and final prices and income have sufficient variation.

the same across individuals.

the price they actually faced, and

is

In this

case averaging will take place over

the arguments of the nonparametric estimates, which

is

known from the semiparametric

estimation literature to result in Vn-consistency (under appropriate regulairity

conditions).

So far, our nonpaircLmetric consumer surplus estimators have ignored the residual

T

(q) - gp,{p,y,w).

econometrics, and

This approach

is difficult

One can ignore the residual

it

is

Hausman

individual heterogeneity.

consistent with current practice in applied

is

Even when

is

e

measurement error and not

all

shows that

(1985)

measurement error and heterogeneity

heterogeneity

in

is

is all

heterogeneity,

it

Brown smd Walker

for some value of

V

(e.g.

specification of

contains

possible to separate out

may

be possible to interpret the demand function

Suppose that

c = e(p,y,w,v)

of prices, income, covariates and a taste variable

independent of price and income.

value of

is

it

not identified in our nonparametric, linear in residual specification.

e(p,y,w,v)

as shown by

it

if

residual.

parametric, nonlinecir models, but the aunount of

as corresponding to a particular consumer type.

function

more information about the

to improve on without

if

c =

v

for

then

e

=

demand as

In

(1990).

g(p,y,w)

(r(p,y,w)v).

general

3

Nevertheless,

if

will

depend on

c(p,y,w,v)

where

p

v

and

is identically

y,

zero

can be interpreted as the demand function for that

In the rest of the

T(g (p,y,w)),

measurement error or to evaluation

c(p,y,w,v)

v,

for some

paper we stay with the

corresponding to an interpretation of

at a particular

consumer type.

c

as

4

3

They showed that for T(q) = q the residual c must be functionally dependent on p

and y. Also, Brown has indicated to us in private communication that the same result is

tr

true

for T(q) = e

.

4,

An alternative approach recently suggested by Brown

consumer surplus over different consumer types, when

one-to-one function of

v.

11

sind

Newey

c(p,y,w,v)

is to average

an estimable,

(1992)

is

3.

Asymptotic Variance Estimation

Under regularity conditions given

To be

asymptotically normal.

specific,

-^

Vn<r"-(B - 0^)

will be

9

•nV"^^^(e - e.)

O

n

-^

l/iVna-

V

a series estimator there will be

(3.2)

V

and

a i

such that

a =

N(0,

is

while in other cases the

slower than

1/v^

by

o-

—

>

0.

For

1).

and kernel estimators will have the same asymptotic

V

converging to

which

),

0,

such that

n

In the v^-consistent case the series

variance, with

V^

N(0. V^).

The "full-average," v^-consistent case corresponds to

convergence rate for

estimators will be

denote any one of the estimators

G

let

For a kernel estimator there will be

previously presented.

(3.1)

in Section 6, ail of the

from equation

In other cases the

(3.1).

two

estimators generally will not have the same asymptotic variance, and the series estimator

weaker property of equation

will satisfy the

convergence.

(3.2), that

does not specify a rate of

Exact convergence rates for series estimators

for v'iT-consistency, although

it

is

still

For large sample inference, suppose that there

/V

(V

If

)

-£-»

1

then

it

VnW'^^^le - G^)

n

Consequently, a

(3.4)

G ±

1-a

>x

/J

-^

N(0,

is

an estimator

large sample confidence interval will be

,Vv n /n

.„.

.

,

12

V

of

V

in

follows by equation (3.2) (and the Slutzky

1).

'^a/2

Despite this

be used for asymptotic inference.

theorem) that

(3.3)

not yet known, except

possible to bound the convergence rate.

lack of a convergence rate, equation (3.2) can

equation (3.2).

au~e

where

^

is

.„

the

1

- <x/2

form large sample hypothesis

also use equation (3.4) to

To form large sample confidence

of

V

a formula for

V.

This procedure

is

tests.

intervals, as in equation (3.4), an estimator

V

For kernel estimators, one method of forming

needed.

is

n

One could

quantile of the standard normal distribution.

n

V

would be to derive

and then substitute estimators for unknown quantities to form

cr

V

.

not very feasible, because the asymptotic variances are quite

complicated, as described in Section

6.

we use an

Instead

knowing the form of

(1992a), that only requires

method that just uses the form of

Q.

alternative method,

from Newey

For series estimators we also use a

,..,,.

6.

The asymptotic variance estimators for kernel and series estimators have some common

features.

In

each case,

(3.5)

V

= Z^.^jj^./n,

''1=1

n

ni

where the estimates

\{i

are constructed in the following way.

.

variance will be based on the form of the surplus estimator, as

(3.6)

where

G = jr^5:."^a(z..i)/n,

a(z,g)

is

ecu-lier,

and

w(y)

a function of a single observation

is

(3.7)

g

a weight function.

corresponding to each case

in

u = l-^^uiyJ/n,

g = g(x,w) = r(x) + w'p,

specification

Also, in each case, the

is

z

and the partially linear

the kernel or series estimator described

The specification of

a(z,g)

and

is

e =

S:

a(z.,g)

= S{yQ,WQ,g);

e =

L:

a(z.,g)

= S(yQ.WQ.g) - (pV)'T(g(p\yQ,WQ));

e =

fi:

a(z.,g)

= w(y.)S(z.,g);

e =

A:

a(z.,g) = u(y.){S(z..g) - (p(l,u.)-p(0,u.)]'T(g(p(l,u.),y.,w.))>,

(j(y)

13

=

1;

(j(y)

where

For both kernel and series estimation,

(p,y).

which accounts for the variability of

the variability of

we can

that

^

(3.8)

where

in

y.

0)

The

g.

component

first

.

is

that

is

the image of

have two components, one of

will

a(z.,g)

in

z.

x

evaluated at the

auid

and the other for

tj(y.),

the same for both kernel and series, so

specify

= 0^ +

.

ni

0^ = w ^a(z.,g) - e -

!/>?,

subscript on

n

aui

term

iji.

w'p

g{x,w) = r(x) +

denotes

g(p,y,w)

"Z

"-R

and

\jj.

0?

is

(J

^e[w(y.) - w],

an asymptotic approximation to the influence on

is

The term

,a(z.,g).

r"

'^1=1

of the

will account for the estimation of

!L.

observation

i

can be

It

g.

1

constructed from an asymptotic approximation to the influence on

observation in

The

suppressed for notational convenience.

of the

6

th

i

taking a different form for kernel and series estimators.

g,

For kernel estimators the idea for forming

differentiate with respect to the

developed in Newey (1992a),

.,

observation in the kernel estimator.

i

is

to

This

calculation amounts to a "delta-method" for kernels, and leads to an estimator that

is

robust to heteroskedasticity and has the same form, no matter what the convergence rate

of

G

is.

(3.9)

To describe the estimator,

h''(x)

=

J

h

J

^j=l

u

1

J

G^ = 3[Ej=ia(Zj.ip)/n]/ap|p^^,

=

j:.",K. (x-x.)/n,

^j=l h

J

1

h

1

ip(x,w) = E[T"^(q)-w'p|x] +

1

5=0_,

.

w'p

= 5:."^T.(w.-E[w|x.])(w.-E[w|x.])/n,

0| =

The term

r(x)

f(x)

J

a[n"^j;.",a(z.,{f + 5K.«-x.)r^<h^ + S{T~hq.)-vf'.p}KA'-x.) + w'.p)/n]/a5|

1

M

denote a scalar and

= j:",<T"^(q.)-w.'p}K. {x-x.)/n,

J=l

A.

5

let

(J

A.

'{A. -

in

L^jA ./n

+ g'^M

T.{w.-E[w|x.])(T ^q.)-i(x.,w.))>.

an asymptotic approximation to the influence of the

on the average of

a(z.,g),

while the second term in

14

ifi.

is

th

i

observation in

a fairly standard

i

delta-method term for estimation of

For series estimators the Idea

approximation were exact.

-'.•-'

p.

to apply the "delta-method" as If the series

Is

This results

in

correct asymptotic inference because

accounts properly for the variance, while the bias

To describe the estimator,

conditions.

G^ = a[E "

(3.10)

a(z

it

small under appropriate regularity

is

let

g^(x.w) = /(x,w)'r.

g )/n]/arL _;,

^^ = ir^G^Z"V(x.,w.)[T"^(q.)

Z = j:."^^'^(x.,w.)/(x.,w.)'/n.

- g(x.,w.)],

ACT

Here

is

\Jj.

a standard "delta-method" term for ordinary least squares estimation of

r.

/nCT

For either kernels or series, the main difficulty

the derivatives

G

and

A.

or

G

in

computing

ifi.

is

calculating

For each of the estimators described

.

in Section

1

2,

it

is

possible to derive analytical expressions for these derivatives, but the

expressions are so complicated as to make them almost useless for calculation.

these derivatives can be calculated by numerical differentiation.

requires evaluation of

J]._

many different values

for

a(z.,g)/n

Instead,

This calculation only

of

which

g,

is

quite

feasible, peirticularly for series estimators.

A procedure analogous

to that for the series estimator can be used to construct a

consistent asymptotic variance estimator for exact consumer surplus for any parametric

specification of the

dememd

depend on the parameters

9(5]._.a(z.,y)/nl/3y

1—

that

I

1

For a parametric specification,

function.

-y

demand

of the

In this case

function.

G

can be calculated by numerical differentiation.

_*

will

a(z,9r)

=

Then, supposing

"*tf

=

Vn(.y - r.)

Y.

,* (z.)/v'n + o

^1=1

1

and that

(1)

p

*T

is

an estimator of

1

*

(z.),

we

1

can form

(3.11)

ijj.

1

=

IJK

1

+ ir^G^*T.

1

Asymptotic inference for parametrically estimated exact consumer surplus could then be

carried out as described above for

V

n

as in equation (3.4).

15

Demand Conditions

Testing Consumer

4.

Tests of the downward slope and symmetry of Hicksian (compensated) demands provide

useful specification checks for consumer surplus estimates, aind are of interest in their

own

Here we consider tests that are natural

right as tests of consumer theory.

by-products of consumer surplus estimation.

surplus

An implication of symmetry

is

that consumer

independent of of the price path, which can be tested by compairing estimates

is

The downward sloping property can be tested by comparing

based on different price paths.

new

the demand at the

demand

price with compensated

at the initial price, which is easily

computed from the consumer surplus estimate.

Path independence can be tested by comparing consumer surplus for the same income

To describe

and covariates but different price paths.

path

p

with

(t),

p'^(O)

= p

and

= p.

p-^(l)

Let

this test, let

w

covariates

1,

...,

J)

should converge to the same limit.

comparing the different estimators.

Let

chi-square.

TT =

n

(4.1)

n

vector of

is

I's.

income

f$

(s,

c V

s,)'.

J

i

*.

=

A simple way

f.7,^

(i/»t

1

1

Then the test

n(II

is

and

y^,

that

all

S.,

to construct this test is by

,1,^\'

ip-.y.

=

minimum

n =j:.

=r " ,*.*'./n.

* A'

Q

1

^1=1

1

1

ft.

Let

e

denote a

- S«e)'n"^(S -

fl'e),

jl

= (e'n"^e)"^e'n"^fl.

will be

X^U-l).

S

J

statistic is given by

Under the symmetry hypothesis the asymptotic distribution of this test statistic

The estimator

(j

This implication can be tested by

an estimator of the joint asymptotic variance of

T =

(4.2)

(t),

denote the corresponding estimator from equation (3.7), and

0.

1

Here

p

An implication of symmetry of compensated demand

.

index a price

denote the equivalent

S.

variation estimator described above for the price path

j

may be

of interest in its

16

own

right.

By the usual minimum

x

1

chi-square estimation theory, under symmetry of compensated demands

as asymptotically efficient as any of the estimators

-1

1

variance matrix

(e'n

e)

S

will be at least

it

with an estimated asymptotic

.,

This efficiency improvement leads to the question of an

.

This question could be answered, in part, by deriving the optimal way

efficiency bound.

to average over all different price paths, a question outside the scope of this paper.

The downward slope of compensated demands can be tested by testing for nonnegativity

of

(p^-p )'[T{g^(.p .y^.w^)) - T(g|^(p ,yQ-S{yQ,WQ,gQ),WQ)]

To describe

incomes, cind covariates.

denote different values, let

§

this test, let

p.,

over several different prices,

p.,

w

y.^.,

(j

.,

=

J)

1

denote the corresponding equivalent variation

.

estimates, and

(4.3)

e^.

=

- p°)'[T(i(p^.,yjQ,w^.Q)) - T(i(p°.yjQ-Sj..w^.Q))],

(p^.

An implication of convexity of the expenditure function

approach of Section

Let

4.

9 = (9

^i^'*

^^^lI

be as described in equation (3.7), for

ijr:

Alternatively,

if

w(z) =

the income values

distinct then the asymptotic covariances between the

n =

5^._ diag((i/».)

distribution of

,...,(01.)

9

that the limit of

is

9

)/n

9

9

.

let

« = Ej^i

will be zero, so that

Thus, the hypothesis

Q/n.

a nonnegative vector can be tested by applying multivariate

A particularly

tests of inequality restrictions developed in the statistics literature.

simple test would be to reject

if

min .{v^9

J

./n..) ^ k

J

for some

k.

The size of

minimum

of vector of

zero normals with variance matrix equal to the correlation matrix implied by

is

possible to combine these two types of tests, of

17

this

JJ

test could be calculated by simulating the distribution of the

It

=

are mutually

y.

normal with variance

is

and

1

a(z,g)

The asymptotic approximation to the

will suffice.

then that

is

that each of these estimators

can be constructed via the

(p^.-p°)'[T(g(pJ,y^.Q,w.Q))-T(g(p°,y.Q-S.(y.Q.w.Q,g),w.Q)].

(i^.,...,i/i.)' (i^.,...,i/».)/n.

J).

1

This hypothesis can be tested using an estimator of the

should have a nonnegative limit.

asymptotic variance matrix of

is

=

(j

mean

Q.

symmetry and of downward

sloping compensated demand, into a single test of consumer

S

and

into a single vector

6

The

(§',§').

values could be stacked in the

(§',§')'

corresponding way, and an estimator of the varieince of

outer product of the stacked vector of

^

demand theory, by "stacking"

values.

Also,

formed as the average

would be possible to

it

consider versions of these tests based on the consumer surplus averages of equation

Furthermore,

(2.7).

it

should be possible to give these tests some asymptotic power

against any alternative to demand theory by letting

a

way

size in such

that different price paths and income and covariate "cover" all values in their

These extensions are beyond the scope of this paper.

support.

An Application

5.

grow with the sample

J

to Gasoline

Demand

To estimate the nonparametric and parametric demand functions for gasoline, we use

data from the U.S. Department of Energy.

The

first three

waves of the data were

collected in the Residential Energy Consumption Survey conducted for the Energy

Information Agency of the Department of Energy.

and 1981 at the household

level.

Surveys were conducted in 1979, 1980,

Gasoline consumption

we use average household

is

gallons consumed per month.

in

our analysis

is

the weighted average of purchase price over a month.

quite high during

shock.

$.

1983

most of

kept by diary for each month;

The gasoline price

Note that gasoline prices were

this period in the U.S. because of the second (Iranian) oil

Gasoline prices averaged between $1.34-1.46 for these 3 years where

Income

$).

$50,000.

is

we use

1983

divided into 12 categories with the highest category being over $50,000 (in

Here we used the conditional median for national household income above

Lastly geographical information

is

given by 8 census regions.

patterns differ significantly across regions of the U.S..

were collected by the Energy Information Agency

18

The

last three

in the Residential

Average driving

waves of data

Transportation Energy

Price and income were collected

Consumption Survey for the years 1983, 1985, and 1988.

in the

same manner as the

(The upper limit on income changed in the

earlier surveys.

surveys; however the technique used to estimate income in the top category remained the

same)

Note that the (real) gasoline price

that by 1988

had decreased to

it

before the first

divisions

oil

shock

were used.

levels,

fell

throughout this period so

about $0.83, approximately equal to prices

In the latter surveys,

in 1974.

Since

in the U.S.

we are unable

to

map

9,

rather than

8,

census

the earlier 8 region breakdown into 9

we use

regions, or vice-versa, in the empirical specifications

different sets of

indicator variables depending on the survey year.

we have

Overall,

18,109 observations which should provide sufficient observations to

Our empirical approach

do nonparametric estimation and achieve fairly precise results.

is

to do both the nonparametric and parametric estimation with indicator variables both

for survey year and for regions.

In the

specifications.

Thus,

we have 20

indicator variables in our

parametric specifications, we allow for interactions, most of

which are found to be statistically significant which

to be expected given our very

is

However, we decided to use the same set of indicator variables

large sample.

in

both the

nonparametric and parametric specifications to make for easier comparisons.

We

give four types of nonparametric estimates, using the Epanechnikov kernel

from

equation (2.3), the normal higher order kernel from equation (2.3a), a cubic regression

spline with evenly spaced knots, and

specification,

where

T(g) = e

.

power

series.

We

Also, the covariates

use a log-linear demand

w

that allow for different region and survey year effects.

are

indicator variables

In the results

evaluate demand and consumer surplus at a fixed value for

We

20

w

we present we

equal to its sample mean.

tried several different bandwidths for the kernel estimators, based on the

smoothness of the graphs discussed below.

The Epanechnikov kernel estimates used a

bandwidth of

.82

of

used to form

r(x),

order kernel

in

for the coefficients

equal to

equation (2.3a),

h = .82,

3

w,

and

h = .55, and

we used bandwidths

19

of

t(x) =

h = .45.

h = .55

1.

The bandwidths were

For the normal, higher

and

h = .45

for both

the nonpeirametric part and the coefficients of

w.

For the series estimates, we used cross-validation to help choose the number of

terms.

Cross-validation

is

the

sum of squares

observation using coefficients estimated from

a cross-validation criteria

estimates.

is

known

of prediction errors

all

other observations.

from predicting one

Minimizing

minimum asymptotic mean-square error

to lead to

Table 5.1 reports the criteria for splines and power series that are additive

in (log) price

and income.

No interactions were included because they were never found

to be significant, either in a statistical sense or in

terms of lowering the

cross-validation criteria.

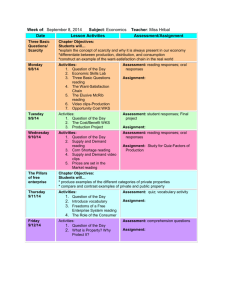

Table

5.1:

Cross-validation for Series Estimators

Power series

Cubic spline, evenly spaced knots

CV

Knots

832

826

842

857

1

2

3

4

5

6

7

8

9

922

903

834

824

825

1

2

3

4

5

6

7

8

9

801

797

784

801

782

10

CV

Order

900

823

791

804

801

The criteria are minimized at

7

or

order power series.

knots and 8

9

suggests that one should choose a number of knots that

is

greater than the mean-square

error minimizing one, so the bias goes to zero faster than the variance.

we prefer

8

or

9

knots and an

knots were similar to those for

large, so

we do not report them.

8,

8

or

9

The theory

order polynomial.

For this reason

The results for

9

except that the estimated standard errors were very

Instead

we report

results for

6,

7,

and

8

knots.

For purposes of comparison we also report results for standard parametric forms for

the demand function.

The specification of the demand function

20

is:

Inq.

(5.1)

where

y

=

tIq

+ "njlnp + Tl2^ny +

household income, p

is

dummies discussed above.

.01

is

w'^

w

gasoline price, and

The estimated income

while the estimated price elasticity

To check on the

+ c,

is

sensitivity of our estimates,

are the 20 region and time

-0.80

we

with standard error

.37

elasticity is

with standard error

.09.

also estimated a "trcinslog" type of

parametric specification where we allow for quadratic terms

in log

income and log price

The income-price

as well as an interaction term between log income and log price.

interaction term has no estimated effect, but the quadratic terms do have an effect on

The sum of squared errors decreases from

the estimates.

decrease of 0.26%, but a traditional F statistic

is

degrees of freedom due to the large sample size.

8900.1

to

8877.0

which

is

a

calculated to be 16.1 with three

The estimated

elasticities for the

log-linear and log-quadratic model are quite similar at the median gasoline prices,

$1.23:

the log-linear price elasticity

log-quadratic model price elasticity

is

is

-0.81 at all income levels while the

approximately -0.87 with very

The two specifications do have different

across income levels.

higher gasoline prices.

The log linear model price

a single parameter, remains at -0.81 across

all

little

variation

elasticities at lower and

elasticity, since it is estimated as

gasoline prices while the log-quadratic

model, which has a variable price elasticity, has an estimated elasticity of

approximately -0.64 for gasoline price of $1.08 (the first quartile price) while the

log-quadratic model has an estimated elasticity of -1.14 at a gasoline price of $1.43

Since the results for log quadratic translog specification are

(the third quartile).

only approximately similar to the simpler liner specification,

both of the parametric specifications

Figures

1-3

in

we present

results for

what follows.

show the estimated nonparametric

log

demand with respect

to log price,

evaluated at mean income, for the parametric, Epanechnikov kernel, and spline

specifications.

We do

not give graphs for other income values because the graphs have

21

similar shape and the spline results discussed below strongly suggest that the log

additive in log price aind log income, in which case the shape of log

function

is

will not

depend on income.

demand

demand

There are interesting differences between the parametric and

nonparametric estimates, with the nonparametric estimates having a much more complicated

shape than the parametric ones.

generally

for

downward

h = .82

find kernel

sloping over the range of the data.

looks "too smooth," and the one for

subsequent analysis

spline

we

In Figure 2

we

demand function

will use

is

h = .55

demand curves that are

In our opinion the

h = .45

demand curve

looks "too rough" so in the

as our preferred bandwidth.

The shape of the

qualitatively similar to that the kernel estimate, although the

demand function does slope up very

slightly at

some points on the graph.

We

tested

whether this upward slope indicates a failure of demand theory using the test for of

downward sloping compensated demand described

a price chauige from

up, our

$1.39 - 1.46,

N(0,1) statistic

.90.

which

This value

above.

For

8 knots (our preferred number)

is

the range over which the demand curve slopes

is

not statistically positive at any

conventional (one-sided) critical value.

We next estimate

the exact consumers surplus, here the equivalent variation, across

our different estimated demand curves.

gasoline:

We

an increase from $1.00 to $1.30

$1.00 to $1.50 per gallon.

gasoline prices and a

50

consider two sets of price changes for

(in

1983 $) per gallon and an increase from

The starting price of

cent increase

is

$1.00

corresponds roughly to

well within the range of the data.

1992

We

estimate the equivalent variation for these prices changes at the median of income.

present the estimates in Table 5.2.

Estimated standard errors are given

in

We

parentheses,

and were calculated using the formulas given earlier.

The conventional significance levels may not be appropriate here, because we have chosen

the interval based on the estimated demand function.

However, the conventional

critical values should provide a bound when the test statistic is maximized over

choice of interval, with our test being an approximate maximum.

22

Yearly Equivalent Variation Estimates

Table 5.2:

$1.00-1.30

Parametric Estimates

1.

442.00

282.34

Log linear model

(

2.

$1.00-1.50

2.07)

285.44

Translog quadratic model

(

2.31)

(

444.16

3.90)

(

3.03)

Epanechnikov Kernel Estimates

3.

4.

h = .45

h = .55

$281.31

4.36)

(

$445.09

$284.00

$447.41

(

5.

h = .82

4.11)

4.11)

(

445.42

279.87

(

4.46)

(

3.58)

(

3.59)

Normal, Higher Order Kernel Estimates

6.

h = .45

286.44

450.14

7.07)

(

(6.56)

7.

h = .55

284.36

(

445.35

5.35)

6.34)

(

Cubic Spline Estimates

8.

(

9.

4.93)

(

282.30

7 knots

(

10.

444.63

284.58

6 knots

8 knots

441.72

5.82)

(

4.68)

447.80

287.12

(

6.31)

4.77)

(

6.04)

Power Series Estimates

11.

12.

8th order

9th order

287.31

4.76)

(

448.64

287.27

448.55

(

Note that

all

(

4.75)

(

the nonparametric estimates are quite close.

5.91)

5.88)

A choice of different

nonparametric estimator assumptions leads to virtually the same welfare estimates.

Surprisingly, although the graphs

show quite different shapes for parametric and

nonparametric estimates, the welfare estimates are quite similar.

A Hausman

test

statistic based on the difference of the kernel estimate and the difference of their

estimated variances, which

is

is

valid if the disturbance

is

homoskedastic,

is

not significant for a two-tailed tests based on the normal distribution.

23

1.3,

which

We

from a

also estimate the deadweight loss

rise in the gasoline tax of either $0.30

or $0.50 which would induce the corresponding rise in gasoline prices.

We base our

estimate of deadweight loss on the equivalent variation measure of the compensating

variation.

The results are given

Table 5.3:

in

Table 5.3:

Yearly Average Deadweight Loss Estimates

Parametric Estimates

1.

$1.00-1.30

Log linear model

26.92

(

2.

$1.00-1.50

Translog quadratic model

62.50

3.13)

(

75.30

27.07

(

6.77)

3.15)

(

7.24)

Epanechnikov kernel estimates

3.

4.

5.

h = .45

$27.70

h = .55

h = .82

$33.41

(5.65)

(8.68)

27.94

36.90

(5.01)

(7.97)

22.89

37.10

(3.88)

(6.80)

$36.38

$33.09

(6.47)

(14.06)

Normal, higher order kernel estimates

6.

7.

h = .45

h = .55

$31.62

47.61

(5.72)

(8.92)

28.60

51.05

(5.03)

(8.65)

38.68

46.84

(5.37)

(8.77)

35.72

46.95

(5.27)

(8.94)

34.92

48.66

(5.21)

(8.80)

34.86

48.74

(5.38)

(8.86)

Cubic Spline Estimates

8.

9.

10.

6 knots.

7 knots

8 knots

Power Series Estimates

11.

12.

8th order

9th order

The estimates of

DWL

are very similar across bandwidths for the kernel estimator, but are

sensitive to the use of a higher order kernel.

We

give

more credence

to the higher order

kernel estimates, because of their theoretically better property of having smaller bias

24

relative to

mean-square error, and their similarity to the spline estimates.

results are sensitive to the

number of

knots.

We prefer

The spline

the results for the larger

number of knots, because they are theoretically preferred and the results seem

sensitive to choice between

We do

7

and

8

than to

6

and

7.

find rather large differences between the nonparametric and parametric

estimates of deadweight

loss.

The estimated differences between the nonparametric

estimates and the log linear parametric estimates are

particular, the nonparametric estimates

in

the range of 40-507..

These are economically significant

differences, with the ratio of

DWL

nonparametric specifications.

The differences are also

to tax revenue varying widely

between parametric and

statistically significant:

test of based on the log-linear and normal kernel specification is

the larger price change and bandwidth

and bandwidth

.45.

In

seem to be somewhat smaller for the larger price

change and larger for the smaller price change.

Hausman

to be less

.55

and

is

5.18

A

-10.14

for

for the smaller price change

Thus, efficiency decisions on which commodities to tax and the size

of the tax might well depend on the rather sizable differences in the estimated

efficiency cost changes

from the increased taxes.

'!'),'

25

J

6.

Asymptotic Distribution Theory

In this section

we

give results for the kernel estimator of consumer surplus at

particular income and covariate values, and for power series.

The conclusions for other

These results show

cases will be described, without full sets of regularity conditions.

that the standard error formulas given earlier are correct, and describe the asymptotic

properties of the estimators, without overburdening the reader.

Let

Precise conditions are useful for stating the results.

and

g(p,y,w)

the image of

be a set of

r(x(p,y)) + w'p.

denote

p(t,u)

on

Let

W

and

[O.llxli,

p

(t,u)

be the support of

11

be the support of

w.

solving equation (LI).

The conditions

function over the set

Z = TxyxW.

will involve

Let

llgll

.

partial derivatives of all elements of

V =

Also, let

is

be

[y,y]

evaluated in

_

i

.119

»

g(p,y,w)/5(p,y,w)

i

where

II,

Z€£.,c—

denotes any vector of

d B(z)/5z

B(z),

p([0,llx1i)

supremum norms for the demand

= sup

J

for a matrix function

T =

u,

values that includes those where the demand function

y

= 3p(t,u)/St

all distinct

order

£

Let "a.e." denote almost everywhere with

B(z).

respect to Lebesgue measure.

Assumption

00,

T(g)

1:

and

W,

11,

V

and

x(p,y)

Z

are compact,

is

[O.llxlJ,

continuous a.e. and for

outside

We

"y

z.,

Hgn"?

are one-to-one and three times continuously differentiable with

nonsingular Jacobians on their respective domains,

differentiable on

contained in the support of

and

T

C = sup.^

= [Y+C+e,y-C-c],

p(t,u)

does not include zero.

^,

e

Also,

u{y)

t(x)

identically equal to one for series estimators.

26

j

,

is

bounded and

w(y} =

for

> 0.

will derive the results under an i.i.d. assumption

Let

twice continuously

^^^^^|T(gQ(p(t,u),y,w))'p^(t,u)

for some

specified in the following result.

is

and certain moment conditions

be a trimming function that will be

y

^

-1

Assumption

2:

bounded density

^q^x),

Assumptions

earlier format,

E[IIT

is i.i.d.,

z.

1

we

and

4

(q)ll

<

]

x

oo,

is

continuously distributed with

E(t(x)(w-E[w|x])(w-E[w|x])'

is

]

nonsingular.

and 2 are useful for both the kernel and series results.

Following the

The next three

will first give results for kernel estimators.

assumptions are more or less standard conditions for kernel estimators.

Assumption

on

(q)ll

|x]f (x)

is

bounded,

There

4:

is

a positive integer

1,

and for

Assumption

E[w|x]

is

J"K(u)[®.%]du =

all j < s,

5:

There

R

to all of

K(u)

is

k+1

differentiable to order

f

f^v^x),

d s s + 2

on

is positive.

X(u)

is

twice continuously

zero outside a bounded set,

is

R

d

and extensions of

(x)r_(x),

and

f

E(T

(q)|x]

(x)E[w|x]

is

k+1

.

income and covariate value,

it

is

necessary to introduce a

denote the solution to equation

-T(gQ(p(t),yQ-S(t),WQ))'p^{t),

x(p(t),y -S(t)),

and partition

S(l)

x(t)

at the truth,

(1.1)

= 0,

where

= (x (t),x

p^(t)

(t)' )'

,

i.e.

the solution to

= 5p(t)/at.

where

x

.t

= C(t)«exp{-r C(v)'[ag„(p(v),y -S(v),w ))/ay]dvK

•'o

27

at a particular

more notation.

little

Let

<(t)

An example

the Gaussian one used in the application.

To describe the result for the kernel estimator of consumer surplus

S(t)

and

are continuously

Assumption 4 requires that the kernel be a higher order, bias-reducing type.

of such a kernel

JKtujdu

0.

a nonnegative integer

such that

bounded, bounded away from zero

fp,(x)

such that

s

differentiable, with Lipschitz derivatives,

=

t(x)

and zero outside a compact set on which

z e Z,

Assumption

4

-1

E[IIT

3:

(t)

Let

is

x(t)

Let

dS/dt =

=

a scalar.

= T (gQ(p(t).yQ-S(t).WQ))'p^(t).

e(t)

Let

x(t) = x(t(T)) = (t.x^U))'.

Assumption

D

domain

zero;

6:

=

E[ee' |x]

ii)

let

x

is

(t)

p{t)

can be extended to a function with

one-to-one with derivative bounded away from

is

for

> 0,

t)

{0,y'

aind

partitioned

)

),

|x=x(T)+(0,3r))f (x(T)+(0,r))>dT

x(p(D),[y,y]),

x„(t)

such that

>

x(t) = (t,x (t)'

4

Note that

7)

CWt)).

continuous a.e. and for some

is

(1+E[llell

from zero on

is

(which will exist by Assumption 6 below),

(t)

C(t) =

and

such that

[-tj.I+t)]

-„><sup

and

There

i)

conformably with

S

x

be the inverse function of

t(T)

^^^

x

<

m.

from Assumption

y

f

iii)

bounded away

is

1.

differentiable by the inverse function theorem and the chain rule,

2

K{r) = /[JKCv.u+lSx (T)/5T]v)dv] du.

The asymptotic variance of consumer

surplus at a point will be

Vq =

Let

Xl(0£t(T):£l)K(T)fQ(x(T)r^ St(T)/St ^E[{<:(t)' e}^ X=x(T)]dT.

I

denote the indicator function for the set

1(A)

I

I

The following result gives the

A.

asymptotic distribution of the kernel estimator of consumer surplus evaluated at a

particular income and covariate value.

Theorem

with

na-^^^^/llnCn)]^ -^

addition

/ln(n)

n(r

—

/ln(n)

—

>

m

and

no-

and

oo,

>

For our application, where

ncr

1-6

If Assumptions

1:

k =

—

n<r^^

then for

m,

>

kernel be at least sixth order.

1,

0.

w(y) = l(y = y^),

are satisfied, for

-^

V

0,

in

then

Vnc^^^CS-S^)

equation

(3.5),

a-

V

the conditions on the bandwidth

These conditions require that

The normal kernel used

28

-S

^

—

<r

s > 5,

c =

(r(n)

N(0. V^).

If

K_.

are that

i.e.

in the application is

that the

such a

in

sixth order kernel.

The asymptotic distribution of a kernel estimator of deadweight

income and covariate value

straightforward to derive.

is

Because the "tax receipts" term

depends on the demand function evaluated at a particular point,

(p

-p )'T(g(p .y^.w-))

it

will have a slower convergence rate tham the

will

loss at a particular

dominate the asymptotic distribution.

consumer surplus "integral," and hence

Then standard results on pointwise

convergence of kernel regression estimators can be applied to obtain, for

(k+l)/2,,~

Vq =

Also,

means

,

—

d

.,,_,

>

,.

= x(p

.y^,),

.

N{0, Vq),

[J-J<(u)^du]fQ(x^)"^-

E[{(p'-p°)'T {g^{x\w^))c)^\x=x\

straightforward to show consistency of the asymptotic variance estimator, by

is

it

,

(L - Lq)

n

x

those used to prove Theorem

like

1.

As previously noted, average consumer surplus and deadweight loss will be

^-consistent

initial

if

and final prices are allowed to vary.

In this case the

asymptotic distribution will be the same for both kernel and series estimators.

This

asymptotic distribution will be described below.

Some of the conditions need

Assumption

from

zero.

Let

llgll

(x,w),

E[e.c'. |x.,w.]

7:

bounded and has smallest eigenvalue that

be as defined above except that the supremum

.

amd

Assumption

X

let

8:

<p,

nondecreasing

in

the order

is

to be modified for series estimators.

is

from zero on

denote the support of

{x)

X

K

is

bounded away

taken over the support of

x.

consists of products of powers of the elements of

order as

increased,

is

is

x

that are

increases, with all terms of a given order included before

a compact rectangle and the density of

X.

29

x

is

bounded away

The condition that the density

The next condition

variance of a series estimator.

Assumption

E[w|x]

and

r (x)

9:

C

a constant

bounded away from zero

is

such that for

is

order

are bounded in absolute value by

This smoothness condition

is

useful for controlling the bias.

is

all

d

integers

C

on

2),

all

orders on

X

the partial derivatives of

X.

undoubtedly stronger than necessary.

apply second order Sobolev norm approximation rates

and derivatives up to order

useful for controlling the

are continuously differentiable of

and there

d

is

(i.e.

It

is

used in order to

approximation of the function

where a literature search has not yet revealed such

approximation rates for power series except under this hypothesis.

Also, results for

regression splines are not given here because multivariate Sobolev approximation rates do

not seem to be readily available for them.

Average equivalent variation and deadweight loss will be ^-consistent under

certain conditions that

we now

Let

describe.

t.

denote a random variable that

is

1

uniformly distributed on

y.-S(t.,z.,g

),

x.

=

x{p.,y.).

Let

= S(t,z,g

)

=

p(t.,u.),

10:

T

E[a)(y.)]

C'^(x,w)

=

(gQ(p(t,u),y-S(t,z),w))'p^(t,u).

Conditional on

is

y.

and

=

a(x,w)

w =

S(t,z)

p.

?(t,z)

E[tj(y.)^(t.,z.)|x.=x,w.=w]

f(x|w)

Let

z.,

= C(t.z)«exp{-r C(v,z)'gQ (p(v,u),y-S(v,z),w))dv>,

and for the density

(x|w)

and independent of

C(t,z)

Assumption

f

and

[0,1]

is

w,

x

f(x|w)

is

of

continuously distributed with bounded density

x.

given

w,

zero outside the support of

a(x,w) =

f(x|w),

bounded.

and

= f(x|w) ^f'^(x|w)E[tj(y.)C(t.,z.)|x.=x,w.=w].

30

and

C^(x,w) = E[C^(x,w)|x] + (w-E[w|x])'M ^E[(w-E[w|x])' C^Cx.w)].

= u

\l/j

u(y.)S(0,z.,g

-^1+0)

)

Then the asymptotic variance of

^i

^l

l(j}(.y.)

will be

- w] + w" c'^(x.,w.)'c..

E[\Jf:*lr.'

].

Under an additional condition we can also derive the asymptotic variance of

deadweight

We

loss.

consider here only the case where there

requirement, by the condition that the final price

Conditional on

11:

bounded density

Let

T. =

cj

f

w,

and

(x|w),

= x(p

x.

i//*^