1HH 9B mn KBHll

advertisement

MIT LIBRARIES

3

1060 DQTDlSat.

7

mmm

9B

i

KBHll HftRHl

iHltemn

9.. 1-

;

;

..:

-:

'

Sii

jwnfuai.unif'

hm

:

lm

i

r

1HH

3 fuBSASIEs] g

^W

<?

ao.SG3

working paper

department

of economics

OPTIMAL INCENTIVE CONTRACTS IN THE

PRESENCE OF CAREER CONCERNS:

THEORY AND EVIDENCE

Robert Gibbons

Kevin J. Murphy

Number 563

August 1990

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

OPTIMAL INCENTIVE CONTRACTS IN THE

PRESENCE OF CAREER CONCERNS:

THEORY AND EVIDENCE

Robert Gibbons

Kevin J. Murphy-

Number 563

August 1990

MEXICO: REAL PER CAPITA INCOME

(INDEX 1980-100)

1978

1982

1983

19B4-

MEXICO: THE REAL WAGE

1985

IN

1986

1987

1988

1989

1990

MANUFACTURING

(INDEX 1980=100)

110

105 -

100 -

1970

1980

1982

1984

1986

1988

1990

OPTIMAL INCENTIVE CONTRACTS IN THE PRESENCE OF

CAREER CONCERNS: THEORY AND EVIDENCE*

Robert Gibbons

MIT and NBER

Kevin

J.

Murphy

University of Rochester

First Draft: July, 1989

This Revision: August, 1990

Abstract

—

This paper studies career concerns concerns about the effects of current

performance on future compensation and describes how optimal incentive

—

contracts are affected when career concerns are taken into account. Career concerns

arise frequently: they occur whenever the market uses a worker's current output to

update its belief about the worker's ability and competition then forces future wages

(or wage contracts) to reflect these updated beliefs. Career concerns are stronger

when a worker is further from retirement, because a longer prospective career

increases the return to changing the market's belief.

In the presence of career concerns, the optimal compensation contract

optimizes total incentives the combination of the implicit incentives from career

concerns and the explicit incentives from the compensation contract. Thus, the

explicit incentives from the optimal compensation contract should be strongest

when a worker is close to retirement We find empirical support for this prediction

in the relation between chief-executive compensation and stock-market

performance.

—

*

We are very grateful to Bengt Holmstrom, David Kreps, Meg Meyer, and Jean Tirole for substantial advice and

this paper's long gestation. We are also grateful for helpful comments from David Card,

encouragement during

Henry Farber, Seonghoon Joon, Eugene Kandel, Alan Krueger, Bruce Meyer, Sherwin Rosen, Michael

Wiesbach, and Jerold Zimmerman, and from seminar audiences at BU, Harvard (Kennedy School), Kentucky,

Northwestern, NYU, Oxford, Princeton, Queen's, Rochester, Yale (S.O.M.), and the 1989 summer meetings of

the Econometric Society and of the NBER Labor Studies Group. Richard Sloan and Kathleen Jones provided

able research assistance. Financial support from the following sources is also gratefully acknowledged: the NSF

(grants 1ST 86-09691 and SES 88-09200), and the Industrial Relations Section at Princeton University

(Gibbons); and the John M. Olin Foundation and the Managerial Economics Research Center, University of

Rochester (Murphy).

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium

Member

Libraries

http://www.archive.org/details/optimalincentiveOOgibb

OPTIMAL INCENTIVE CONTRACTS IN THE PRESENCE OF

CAREER CONCERNS: THEORY AND EVIDENCE

Robert Gibbons and Kevin

J.

Murphy

Introduction

1.

—concerns about

This paper studies career concerns

on future compensation

— and describes how optimal

career concerns must be taken into account.

whenever the

(internal or external) labor

belief about the worker's ability

the effects of current

performance

incentive contracts are affected

when

Career concerns arise frequently: they occur

market uses a worker's current output

and then bases future wages on these updated

to update its

beliefs. In

such

a setting, the worker will want to take actions the market cannot observe, in an attempt to

increase output and thus influence the market's belief; in equilibrium, however, the market will

anticipate these actions

and so draw the correct inference about

Career concerns are stronger

output.

when

a

worker

is

further

ability

from the observed

from retirement, because a

longer prospective career increases the return to changing the market's belief.

further

from retirement thus

is

willing to take

more

A worker who is

costly unobservable actions in an attempt to

influence the market's belief.

Career concerns were

first

discussed by

Fama

(1980),

who argued

that incentive

contracts are not necessary because managers are disciplined through the managerial labor

market: superior performances will generate high

Holmstrom (1982) showed

effects,

it is

typically

that although

wage

offers;

poor performances, low

offers.

such labor-market discipline can have substantial

not a perfect substitute for contracts: in the absence of contracts, managers

work

too hard in early years (while the market

is still

assessing the manager's ability)

Robert Gibbons and Kevin

J.

Murphy

and not hard enough in

concerns can

We

later years.

contracts are necessary to provide

In this paper,

we add

August, 1990

2

conclude from Fama's and Holmstrom's work that

managers with optimal incentives.

contracts to the

Fama-Holmstrom model.

We

show

that career

create important incentives, even in the presence of incentive contracts.

still

Accordingly, in the presence of career concerns, the optimal compensation contract optimizes

total incentives

—

explicit incentives

the combination of the implicit incentives

from

the

from career concerns and the

compensation contract. Because the implicit incentives from career

concerns are weakest for workers close to retirement, explicit incentives from the optimal

compensation contract should be strongest for such workers, while for young workers

it

could

be optimal for current pay to be completely independent of current performance.

Our formal model examines

the career concerns that arise

from competition among

current and prospective employers in an external labor market, but career concerns also arise in

internal labor markets, in

among

two ways.

supervisors within the

external labor market.

First,

same

Second, even

competition

division) can

if there is

distinguish between effort and ability. Although

we

mimic

within a firm (or even

the competition

we

study in the

only one supervisor, career concerns arise

promotions are based on a worker's assessed

labor markets,

among divisions

ability but the supervisor

we do

expect analogous results to hold:

not

cannot perfectly

model career concerns

Implicit incentives

if

in internal

from promotion

opportunities should be weakest for workers close to retirement and stronger where promotion

opportunities are plentiful rather than scarce (as in expanding organizations).

Current pay

should be most sensitive to current performance for workers close to retirement and for

workers with no promotion opportunities (such as workers

at the

top of the corporate hierarchy

or other job ladder, and workers in declining organizations). 1

In addition to analyzing the characteristics of optimal incentive contracts in the presence

of career concerns, this paper also examines the empirical support for the career-concerns

1

Rosen (1986) makes a similar observation in the context of elimination tournaments or promotion ladders:

win an early round can be big even if the prize for winning that round is small, because winning

the incentive to

also buys entry to subsequent rounds with larger prizes.

Robert Gibbons and Kevin J. Murphy

model

in a particular setting: the relation

We

market performance.

example, that each

compensation for

CEOs more than

10% change

CEOs

between chief-executive compensation and stock-

study longitudinal pay and performance data on a large sample of

(CEOs) and

chief executive officers

August, 1990

3

find empirical support for the model.

in shareholder wealth corresponds to

less than three years

1.5% changes

in cash

three years from retirement.

from compensation

issues associated with

wage

contracts, our

from career concerns and the

model incorporates several of

Of

concerns are to

arise, the fourth is

these five elements of the model, the

something like

explicit

the fundamental

determination: incentives, learning, market forces, contracts, and

risk aversion.

fifth (or

estimate, for

from retirement, but only .9% pay changes for

In order to analyze both the implicit incentives

incentives

We

it) is

necessary

if explicit

first

three are necessary if career

incentives are to be considered, and the

necessary so that optimal contracts do not completely eliminate

career concerns. Other models of career concerns

and MacLeod and Malcomson (1988)

not risk aversion or contracts. 2

—such

as

Fama

(1980),

Holmstrom

(1982),

—

incorporate incentives, learning, and market forces, but

Other dynamic agency models

— such

as

Lambert (1983),

Rogerson (1985), Murphy (1986), Holmstrom and Milgrom (1987), and Fudenberg,

—

Holmstrom, and Milgrom (1987)

learning or market forces.

Holmstrom (1982)

—

incorporate incentives, contracts, and risk-aversion, but not

Finally, other

dynamic insurance models

— such

as Harris and

incorporate risk-aversion, contracts, learning, and market forces, but not

incentives. 3

2

Career concerns are related to the "ratchet effect" that arises in dynamic models of regulated firms, such as

and Tirole (1985), Baron and Bcsanko (1987), and Laffont and Tirole (1988). These models

ignore the market forces analyzed in this paper because there does not exist a market of prospective regulators,

but the assumption that the regulator cannot commit to ignore information once it has been revealed has a

similar effect. Lazear (1986) and Gibbons (1987) study the ratchet effect in models of the employment

relationship, but also ignore market forces because the worker's private information concerns a firm-specific

Freixas, Guesnerie,

such as job difficulty. Aron (1987) and Kanemoto and MacLeod (1987) study the ratchet effect in

models of the employment relationship that include market forces because the worker's private information

attribute,

concerns a worker-specific attribute, such as

3

Holmstrom and Ricart

ability.

Costa (1986) extend the Harris-HolmstrOm model by adding an observable action

based on private information, as opposed to the unobservable action based on symmetric information considered

here. MacDonald (1982) and Murphy (1986) analyze the effects of learning and market forces on job

assignment, rather than on insurance contracts.

i

Robert Gibbons and Kevin J. Murphy

Theoretical Analysis

2.

Consider a worker

who works

stochastic production process in

y =

l

+

Ti

+

al

et

worker and

mean mo and

In period

periods.

which output

(y t )

is

the

sum of

The

variance o^.

is

exponential

assume

U(wi,

We

w

t

the

error terms are

r\

Normally distributed with

is

Normally distributed with mean zero and

employers are risk-neutral but

tj.

that the

worker has the following

utility function:

(2.2)

where

that

(n.),

symmetric (but imperfect) information about the worker's

variance c^, and are independent of each other and of ability,

We

the worker's ability

(t{):

prospective employers believe that

all

worker controls a

the

t,

.

Before production begins, there

ability: the

T

for

worker's non-negative effort (aO, and noise

(2.1)

August, 1990

4

is

the

...,

wT

wage paid

assume further

assumption that

g'"

a 1;

;

period

in

that g(a t )

>

is

...,

is

aT )

t

=

-

exp (

and g(aO

convex and

is

-r{£[=1

5

lA [w

a (monetary)

satisfies g'(0)

=

t

g(a t )]})

-

measure of

0, g'(°°)

=

°°,

,

disutility

and

g'"

>

of

effort.

0.

(The

a sufficient condition for certain maximization problems to be

concave and for several intuitwe comparative-static results

to hold.)

Note

that (2.2) is not the

additively separable exponential utility function often encountered in the literature: (2.2) implies

that the

worker

is

(computed using

market.

Our

indifferent

among

all

deterministic

wage streams with

5 as the discount factor), just as if the

results are similar in spirit but

and

that the

worker has no access

worker had access

more complicated

conventional assumptions that the worker's exponential

to credit; see the

constant present value

utility

to a perfect capital

to express

function

is

under the more

additively separable

Appendix. Given our empirical focus on

Robert Gibbons and Kevin J. Murphy

CEO pay,

however,

no access

to credit.

To keep our

(i.e.,

are linear

to

theoretical analysis simple,

(Al) short-term

possibilities:

term

seems more reasonable

it

August, 1990

5

CEO needs

no rather than has

we make two assumptions

about contracting

assume

one-period) contracts are linear in output; and (A2) long-

(i.e.,

Our assumption

multi-period) contracts are not feasible.

is

that the

obviously convenient:

we wish

that short-term contracts

to formalize the idea that contractual incentives

should be strong when career-concern incentives are weak, and the strength of the contractual

incentives

is

easily

summarized by

and Milgrom (1987) demonstrate

model much

that a

(but lacking the uncertainty about the agent's ability,

the optimal contract is linear.

(In the

Holmstrom-Milgrom argument extends

Our assumption

(again, in the

exist but

r\)

can be reinterpreted so as

Appendix, we discuss the extent

The idea

at

to

our model

ensure that

which

to

the

our model.)

assumption

that this

must be Pareto-efficient

renegotiation-proof.

to

like the single-period version of

that long-term contracts are not feasible

Appendix)

Holmstrom

the slope of the linear contract. Furthermore,

is

We show

equivalent to assuming that long-term contracts

each date; that

that contracts

can be reinterpreted.

is,

long-term contracts must be

should be renegotiation-proof has been widely

accepted in recent work; see, for example, Dewatripont (1989) on contracting under adverse

selection,

Fudenberg and Tirole (1989) on contracting under moral hazard, and Hart and

Moore (1988) on incomplete

implementation).

mimics

In our model, renegotiation

the effect of competition

We now derive the

state the results for the

4

contracting under symmetric information

among

(i.e.,

Nash

between the worker and a single employer

the current

and prospective employers. 4

optimal compensation contracts for the two-period case and then

T-period case.

Another potential role for long-term contracts is consumption-smoothing; see Lambert (1983), Rogerson

Murphy (1986). Fudenberg, Holmstrom, and Milgrom (1987) show, however, that if the agent has

perfect access to credit then the optimal long-term contract is equivalent to a sequence of optimal short-term

contracts. In our model, the fact that the worker needs no access to credit, as described in connection with (2.2),

eliminates this consumption-smoothing role for long-term contracts.

(1985), and

Robert Gibbons and Kevin J. Murphy

August, 1990

6

The Two -Period Model

The timing of the two-period model

is

as follows.

At

the beginning of the first period,

prospective employers simultaneously offer a worker single-period linear

form wi(yi) =

is

ci

+

biyi.

no need for employers

The worker chooses

period, the firm

the

{i.e.,

wage

contracts of the

(Recall that information is symmetric, although imperfect, so there

to offer

most

menus of contracts

attractive contract

in

order to induce workers to self-select.)

and begins production. At the end of the

the first-period employer) and the market

(i.e.,

first

prospective employers)

observe yi and then simultaneously offer the worker single -period linear wage contracts of the

form W2(y2) = C2 + b2y2- These second-period contract offers

on

yi,

depend implicitly

because first-period output will convey information about the worker's

described below.

The

force of our assumption (A2), however,

can depend on first-period output only in

commitment

most

will of course

at the

beginning of the

first

this implicit

period.

is

ability, as

that second-period contracts

manner, rather than explicitly through

Once

again, the

worker

is free to

choose the

attractive contract.

Given these compensation contracts (where,

for

now, the parameters

ci, bi, C2,

are arbitrary), the worker's expected utility (from the perspective of the first period)

following function of

(2.3)

From

-

first-

E { exp

and second-period

(-r[ci

+ bifa+ai+ei)

-g(ai)]

-

and

rS[c 2

is

the

a2:

+ b 2 (r|+a2+£2) -gte)])

}

the perspective of the second period, however, after ai has been chosen and yi has been

observed, the worker's expected

(2.4)

effort, ai

and b2

-

utility is

exp (-rS-^C! + biyi

-g(ai)] )•

E { exp

( -r[c 2

so the worker's second-period effort choice problem reduces to

+ b 2 (ii+a2+e2) -gte)])

|

yi }

,

Robert Gibbons and Kevin J. Murphy

"£*

(2.5)

-

E { exp

August,

7

+ b 2 (r,+a 2 +e 2 ) -g(a 2 )])

( -r[c 2

|

yi }

1

990

•

3|C

The worker's optimal second-period

g'(a 2 )

(2.6)

= b2

effort, a 2 (b 2 ), therefore satisfies the first-order

condition

.

Competition among prospective second-period employers implies that the contract the

worker accepts for the second period must earn zero expected

profits, so (after

normalizing the

price of output to unity), c 2 (b 2 ) satisfies

c 2 (b 2 )

(2.7)

Using

=

(l-b 2 )E{y 2

yi }.

|

worker's first-period output equals the

ability

of the worker's second-period output given the

(2.1), the conditional expectation

and the optimal second-period

sum of

effort

the conditional expectation of the worker's

induced by the contract:

E{y 2 |y 1 }=E{T1 |y 1 }+a2 (b 2 ).

(2.8)

To compute

the conditional expectation of the worker's ability, the market

must extract the

relevant information about the worker's ability from the observed first-period output, and this

requires a conjecture about the worker's first-period effort.

Suppose the market conjectures

become

that the worker's first-period effort

to pure-strategy equilibria.)

(1970), the conditional distribution of

(As will

r\

Using well known formulas from DeGroot

given the observed first-period output yi

Normal with mean

na\

ai.

clear below, in equilibrium the market's conjecture about the worker's effort is correct.

We restrict attention

(2.9)

was

-

i

\

mi(yi,ai)=

J m°

+

CT

—

-j-°

<rz

(yi

-

+ a

2

Sl)

I

is

then

Robert Gibbons and Kevin J. Murphy

August, 1990

8

and variance

(2.10)

°i

=

+ a e2

c£

We

include &\ in the notation

—a +

convenient to define Z\

i

m^yi,

ai) for expositional clarity in

tne conditional variance of

°"c>

T|

+

e2

what follows.

It is

given the observed

also

first-

period output yi.

Substituting the appropriate expressions into (2.4) yields the worker's expected utility

(from the perspective of the second period) for an arbitrary b2, given first-period output

The market thus believes

(2.11)

-

E{exp

that the optimal second-period slope, bj,

( -r[c 2 (b 2 )

=

where the righthand

distributed with

-

side of (2.11)

mean

u.

is

Optimizing

(2.1 1)

-

I

yi }

g(a*(b 2 ))

-|rb^ ])

derived using the observation that

if

x

is

,

Normally

and variance a2 then

E{exp(-kx)} =exp(-ku + ^k2a 2 )

(2.12)

maximizes

+ b 2 (r,+a2(b 2 )+ e2 ) -g(a*(b 2 ))])

exp ( -rim^y^aO + a*(b 2 )

y^

and implicitly differentiating

.

(2.6) yields the first-order condition for b2, the

optimal second-period slope: 5

(2.13)

b2

=

1

5

Note

+rl

2

2

g"[ai(b 2)]

Lazear and Rosen (1981), who derive it

more general (static) utility function U(w-g(a)). Thus, (2.13)

and approximately optimal more generally.

that (2.13) is identical to the result given in footnote 8 in

using a second-order Taylor approximation to the

is

precisely optimal given (2.2)

Robert Gibbons and Kevin J. Murphy

Using the assumption

concave, so (2.13)

uncertainty (L^

).

that g'"

>

0,

straightforward to

it is

that D2 is

independent of

yi,

of implicit incentives from career concerns, because

output on the second-period contract

given in

show both

(i.e.,

it

and

implies that the effect of first-period

the career-concern effect)

is

limited to the intercept

(2.7).

yi, the worker's first-period incentive

(2.14)

(r)

which greatly simplifies the analysis

Given the optimal second-period contract derived above, with

on

that (2.11) is strictly

as well as that b2 decreases with both risk-aversion

is sufficient,

Note also

August, 1990

9

-E{exp

(-r[ci

problem

is to

choose

ai to

its

implicit

dependence

maximize

+bi(Ti+ai+e 1 )-g(ai)] -r6[C2(b|) + bJ(Ti+aJ(bJ)+e2) -g(a*(b*))])}.

Substituting (2.8) and (2.9) into (2.7) yields

c 2 (b2)= (l-bl)

(2.15)

(<£

m

2

+ a (yi-ii)

*„*A

+a2(b2)

„* + „?

: + °s

'

V

The

worker's optimal first-period effort, ai (bi), therefore satisfies the first-order condition

(2.16)

The

g'( ai )

=

bi

+

5

g2

=

bl

+

5 (1-bJ)

total incentive for first-period effort,

— —

JL

denoted by Bi,

=

Bi

is

thus the

.

sum of

the explicit

incentive from the first-period compensation contract, bi, and the implicit incentive from career

concerns, 8(l-b2)a^/(c^+c^).

(2.13),

The career-concerns

incentive

and increases (decreases) with the uncertainty about

Note

that the expressions

period effort, ai, as given.

is

positive, since

ability (production),

0<b2<l from

c^

(c^).

above take the market's second-period conjecture about

Thus, (2.16) characterizes the worker's best response to

conjecture. In equilibrium, the market's conjecture

must be

first-

this

correct, but the necessary fixed-

Robert Gibbons and Kevin J. Murphy

point computation

conjecture

is trivial

August, 1990

10

because (2.16) does not depend on

Therefore, the equilibrium

aj.

is

ai=a?(bi)

(2.17)

.

Competition ensures

(A2), expected profits

that firms earn zero

must be zero

in

expected

Because of assumption

profits.

each period. Hence,

d(bi) = (l-bi)E(yi) = (l-bi)[mo+af (bi)]

(2.18)

Substituting ai(bi) and Ci(bi) into (2.14) and applying (2.12) yields the worker's expected

utility

(from the perspective of the

(2.19)

-

period) for an arbitrary bj:

first

exp( -r[m + af (bi)

-

g(a?(bi))]

-

r5[m + a*(b*)

.exp(ir2[(B 1+ 5b2) 2 S?

where Bi

sum of explicit and

reflects the

first-period slope, bi

„, m

.

(2.20)

bi

,

where

z] =

*

is

+

r

-

the variance of

r\

+

this

generalized in the T-period model, so

comparing the three terms

The

first

g

,

1u *,

5 (l-b2)

Z\ g"[af(bi)]

The main conclusion from

to the result.

2B 5b*al])

1

,

implicit incentives, as defined in (2.16).

1

2

a Q + a|

g(aj(b?))])

The optimal

thus satisfies the first-order condition

=

1

-

-

o£

r 5

2

b* a g"[at(bi)]

+ cl

*

:

:

1

+

z] g"[a?(bi)]

r

e\.

two-period model

we

is

that bi

<

give only the intuition here.

in (2.20) to the single

term

— og

b2

As

.

is

This result

is

apparent from

expression in (2.13), three effects contribute

in (2.20) reflects a

noise-reduction effect: learning about the

Robert Gibbons and Kevin J. Murphy

August, 1990

11

2

worker's ability causes the conditional variance of output to decline over time (Z 2

optimal tradeoff between insurance and incentives shifts towards the

tl] g"[a2(b2)]} < b2

(2.16);

it

•

The second term

so the

I.]),

—

over time

/

1

{ 1

+

from

in (2.20) is the career-concerns effect, familiar

implies that optimal explicit incentives are adjusted to account for career-concerns

incentives by imposing a lower pay-performance relation

third

latter

<

term

when

human-capital-insurance effect: risk-averase workers with

in (2.20) reflects a

uncertain ability want insurance against low realizations of ability; in our

must take the form of a reduction

The worker's demand

optimal for

The career-concerns

difficulties for

this

for human-capital insurance can be quite strong.

worker against low realizations of

negative slopes (bi < 0) even

model

insurance

in the slope of the first-period contract.

total first-period incentives to

incentives. 6

The

career concerns are high.

when

be negative (B\ < 0)

ability

if

the benefits

In fact,

from insuring

exceed the benefits of providing positive

effect in (2.20) suggests that optimal contracts

total

our analysis. Negative

it is

the

effort

can have

incentives are positive, but this possibility creates no

total incentives, in contrast, require a reinterpretation

of

the first-order condition (2.16). In order to handle the possibility of negative total incentives in

a simple way,

we

we now assume

that effort

continue to assume that g(a)

is

can be either positive or negative and that

convex and

satisfies g'(0)

=

0, g'(°°)

interpret negative effort as hiding or stealing output; our assumptions

activities are increasingly difficult

The

the margin, as

may be

on

°°,

and

g(a)

g'"

imply

>

= -°°;

0.

We

that such

realistic.

T-Period Model

The

now

on

=

g(-°°)

three equations that

be written as follows:

summarize the workings of the competitive labor market can

First, the zero-expected-profit constraint in

period

t is

6

Suppose, for example, that there is no noise in production (i.e., g\ = 0). Then first-period output perfectly

2

reveals the worker's ability, so a\ - 0. Since there is no uncertainty in the second period (i.e., 1\ = af + a =

0), the optimal slope is b 2 = 1, which imposes substantial human-capital risk on the worker: second-period pay

moves one-for-one with the worker's actual ability, and not at all with the market's assessment of the worker's

2

ability based on first-period output (because C2(b2) in (2.15) is zero). If 5 = 1 and g(a) = [a ]/2 then the total

first-period incentive is

B = bj = (1

x

-

r

al

)/(!

+ ro 2 ), which

clearly can be negative.

Robert Gibbons and Kevin J. Murphy

cl

(2.21)

=

(l-b

l

)E{y

l

August. 1990

12

lyi,... I y,.i}.

Second, the conditional expectation E{y t lyi,..., y t _i)

E{y t lyi,..., y t.i) =

(2.22)

where

and

m^

is

mn

+

at

is

,

the market's expectation of the worker's ability as of the beginning of period

a t is the market's conjecture

about the effort the worker will supply in period

t.

t,

Finally,

the market's conditional expectation of the worker's ability, given the observed history of prior

outputs (yi,

...,y t -i)

and

its

conjectures about prior effort levels

(a.\, ...,a t _i), is

t-i

a2

m .i(yi,

(2.23)

t

...,y t .i; ai, ...,a t .i)=

m

+

cx

2

cr

+

2

£(y T

aT )

-

*

(t-l)g 2

Substituting these three equations into the worker's utility function (2.2) and applying

from a sequence of contracts with

(2.12) yields the worker's expected utility

(bi,

...,

arbitrary slopes

by) and associated intercepts given by (2.21), given the market's effort conjectures

(&i, ...,ar)

and the worker's effort choices

(ai,

...,

a t ).

(See the Appendix for this

computation, as well as the others omitted below.) The worker's optimal effort level in period

t,

at

,

then solves a first-order condition analogous to (2.16):

(2.24)

g'(af)

= b +

t

IS^It

dat

= b +

T=t+i

Naturally, a t depends on b t and (b l+ i,

...,

t

2

y-t(l-bt)

by), but not

:

o^

x=t+l

on

(bi,

...,

f~—

(ai

worker's expected utility from the sequence of contracts with slopes (bi,

...,

written as

B

t

b t -i).

=

In equilibrium, the market's conjectures are correct: (ai,

-

+ (T-l)a 2

...,ar)

,

...,

ay

).

The

br) can then be

Robert Gibbons and Kevin J. Murphy

(2.25)

-

exp(

-r [

August, 1990

1

1 5^

(mo + a?

+ \ r2

z

g(af ))]

-

t=i

For now, take

Bi from

(b2,

(2.24),

<

...,

B =

2 26 >

-

:

i

which solves the

—^x

1

+rz'

1

bl=

(2 27)

-

T-T7X

i

1

' 1

B,) 2

o 2]).

t>i

affect only a*.

Since

g'(ai

)

=

to the first-period total

first-order condition

ra 2

g"(a?)

l

fiH B t

-

J:l*.

+rztg"(ai)

;

g"(ai)

Applying (2.24) then yields the optimal

£ (5

+

t=i

convenient to optimize (2.25) with respect

bx),

2

t=i

bx) as given. Recall that changes in

...,

it is

incentive, Bi(b2,

£ 5*-* BO 2 o

[(

.

1

,

*/

first-period contract slope bi (b2,

st-i(l-bt)

2

"

l+rZig"(ai)

bj),

2

;'

ot+(t-l)a„

t=2

ra 2

,

•..,

I 8»-l B

g"(af)

t

t=2

1

+

r

I

2

g"(a*)

Finally, using (2.27) recursively yields the optimal slopes (bi

working backwards

to bi(b2,

...,

,

...,

b-r),

bx).

We now provide a partial characterization of the optimal slopes

bx for

all

t

Appendix

<

T; that

sensitivity

those

t

b* < bx for

(in fact,

all

t

<T

We

:

t

=

1, ...,

T) b t <

:

suspect that the optimal slopes typically increase

we have been unable

is sufficient

of pay to performance

more than

{b t

contractual incentives are strongest for those about to retire. (See the

for the derivation.)

monotonically with

result that

is,

beginning with br and

is

for our empirical work, in which

greater for

x years from retirement,

to construct a counter-example), but the

CEOs

where

less than x years

we show

that the

from retirement than for

x equals two, three, or four years.

Robert Gibbons and Kevin J. Murpiiy

August, 1990

14

Evidence on Career Concerns for Chief Executive Officers

3.

Testing our model involves estimating the pay-performance relation between the agent's

compensation

(i.e.,

the wage, w, in our model's notation)

and the principal's objective

(i.e.,

output net of the wage, y-w) and detecting changes in the estimated pay-performance relation

(i.e.,

the slope of the compensation contract, b) as the

data necessary to analyze the model

is difficult

and-file workers that contain data

(measured

or firm level).

consider the agency relationship between the shareholders and the

shareholder-CEO relationship

is

data on the

(i.e.,

CEO's compensation

measured with available

by the market value of the

Third, under the assumption that

data: shareholders desire to

firm's

common

stock. 7

Although the managerial labor market

is

model require uncertainty about

firm

The assumption

is strictly

We

-

common

maximize

objective that

their wealth, as

measured

compensation

policies,

The career-concerns

the worker's ability, but

in

which

to investigate

may

not be ideally

it

effects analyzed in our

most CEOs are long-time employees

that well diversified shareholders are risk neutral with respect to the returns of

correct only

when

is

8

an attractive laboratory

characteristics and effects of incentive

suited for an investigation of career concerns.

7

to

are publicly available in corporate proxy statements issued in

shareholders are approximately risk neutral, the principals have a

many of the

managers

take actions that increase shareholder wealth). Second, detailed longitudinal

conjunction with annual shareholders' meetings.

easily

of a

an archetypal principal-agent relationship: widely

diffuse shareholders, through delegation of authority to the board of directors, hire

supply effort

CEO

We focus on this particular agency relationship for several reasons.

publicly held corporation.

First, the

because existing longitudinal datasets for rank-

on wages seldom also contain data on performance

at the individual, divisional,

We

worker nears retirement. Obtaining the

any given

the firm's returns are uncorrelated with market returns.

ignore debt by focussing on shareholder wealth instead of the combined wealth of shareholders and

bondholders; Smith and Warner (1979) argue that explicit bond covenants are designed to mitigate the agency

problems between managers and bondholders.

Robert Gibbons and Kevin J. Murphy

CEO,

before being appointed

so shareholders (as well as potential alternative employers)

have precise information about the

CEO

compensation

employers

who

ability of a

our model

in

August, 1990

15

is

new CEO. 9

determined by a competitive market of prospective

CEO's managerial

The

ability.

fact that

join another, coupled with the likely existence of large

capital, suggests that a

We

competitive market of the kind

of a newly appointed

different

new

information

is

CEOs rarely leave oneFigure 2to

amounts of organization-specific human

we assume may

not exist. 10

believe that these issues do not pose substantial problems for our empirical

analysis, for the following reasons.

ability

In addition, the expected level of

continuously revise their bids for the CEO's service as

revealed regarding the

may

from the

skills

CEO

First,

because the

skills

is

unlikely to yield precise information about the

performance as CEO. Furthermore,

quickly, both because

it is

difficult to isolate the

determine firm performance and because (as

environment

ability in the

required to pilot a corporation are quite

required at lower levels in the organization; the performance of an

individual as vice president, for example,

individual's potential

shareholders are likely to be uncertain about the

may renew

this uncertainty

not be resolved

CEO's contribution from other

we

factors that

discuss below) a change in the firm's

the shareholders' uncertainty about the

previous environment had

may

CEO's

ability,

even

if his

become known.

Second, our assumption of a competitive market of prospective employers implies that

a

CEO

receives the full benefit from an increase in the market's estimate of his managerial

ability (and bears the full cost

unchanged, however,

if

from

Our

a decrease in the estimate).

we assume instead

that the

CEO receives

qualitative results are

(bears) some, rather than

of the increased (decreased) rent associated with changes in the market's estimate of his

One model

relationship

9

that

would predict such rent sharing

between the

CEO

and

his shareholders,

is

a bilateral-monopoly

where the rent

to

ability.

model of

be divided

is

all,

the

the return

The median CEO in our sample of nearly 3,000 CEOs described below worked in his firm 16 years before

ascending to the top position.

10

Note, however, that Fama's (1980) and Holmstrom's (1982) early work on career concerns for top

managers relies exclusively on just such a managerial labor market to provide managerial incentives.

•

Robert Gibbons and Kevin J. Murphy

on the CEO's organization-specific

compensation contract under

same kinds of

(implicit

and

August, 1990

1

this

capital: in

each period, the slope of the CEO's linear

new formulation of our model would be determined by

explicit) incentive considerations that arise in

but the intercept would be determined by bargaining

constraint implied

power rather than

the

our original model,

the zero-expected-profit

by a competitive market of potential employers. 11

A Longitudinal Sample of Chief Executive Officers

We

following

in

test the

implications of our career-concerns model using data constructed by

chief executive officers listed in the Executive Compensation Surveys published

all

Forbes from 1971

These surveys, derived from corporate proxy statements,

to 1989.

include 2,972 executives serving in 1,493 of the nation's largest corporations during the fiscal

years 1970-1988, or a total of 15,148 CEO-years of data. In order to distinguish

to retirement

left their

from

CEOs

with longer horizons,

we

initially restrict

CEOs

our analysis to

close

CEOs who

firms during the 1970-1988 sample period, using data from the 1990 Forbes survey

to identify

CEOs whose

last fiscal

year was 1988.

This subsample includes 1,631 CEOs,

representing 916 firms and 8,786 CEO-years.

Our model assumes

executive

is

appointed

CEO position

that a

CEO,

is

CEO experiences something like the following career path: an

paid based on the performance of his firm, and remains in the

until retirement, at

which point his career ends.

by presenting results that suggest

We begin our empirical analysis

that such a career path is typical.

Figure

histograms describing the frequency distributions of tenure in the firm, tenure as

age,

all

measured

at the

date the

CEO

leaves office, for the 1,631

during the 1970-1988 sample period. Panels

A

and

B

of Figure

CEOs

1

show

1

presents

CEO, and

leaving their office

that,

upon leaving

If the sole objective of this paper were to deepen our understanding of CEO compensation then we would

have developed this rent-sharing model rather than the competitive-market model developed above. We think it

likely, however, that career concerns arise for many workers other than CEOs and that the competitive-market

model applies more naturally than does the rent-sharing model for many of these other workers. Thus, in

choosing to develop the competitive-market model we were in part attempting to convey this larger potential

scope of the career-concerns model.

Robert Gibbons and Kevin J. Murphy

average

office, the

CEO has

been

position for over ten years.

in his firm for

Panel

60% were

normal retirement age:

August, 1990

1

C shows

almost thirty years and has been in the

most executives leave

that

between 60 and 66 when they

their position near

31% were

and

left,

CEO

ages 64 or

65.

There

either steps

also evidence

is

down

from other sources

that

when

the typical

into retirement or continues to serve the firm in a reduced, semi-retirement

capacity. Vancil (1987) estimates that

75%

CEOs remain

of departing

This evidence seems inconsistent with the hypothesis that

directors.

firm, since

CEOs

ill

on

their firms' boards

of

CEOs move from firm

to

joining rival firms are unlikely to maintain close relationships with their

former employers. Vancil finds that an additional 6.4% die while in

because of

CEO leaves office he

health.

In our

own

sample,

we

their firm during the

sample period became

period.

we

In addition,

office;

CEO

We found that fewer than 6%

Who

post-departure Who's

appeared in Who's

Who

absence of these data

Figure

remaining as

their firms

are

from

Panel

1

is

of these

1.4% joined law firms or

information on

40%

prior to their departure);

who

left

of another sample firm by the end of the

searched (the 1985 edition of) Who's

after leaving their firm; another

others resign

find that only 36 of the 1,631 (2.2%)

Who

in

departure information on the subset (of about half) of our 1,631 departing

firms before 1985.

many

we

CEOs joined

universities.

of the departed

America

for post-

CEOs who left their

another corporation

We were unable to find

CEOs

(most of

whom

believe that the most likely cause for the

retirement or death.

also presents a histogram describing the frequency distribution of years

CEO for the 8,786 CEO-year observations from the subsample of CEOs leaving

during the sample period: Panel

CEOs

in

one of their

D shows that about half the CEO-year observations

last three full fiscal

years in office. Note that the distribution in

D is not representative of the full population,

the sample period can have at

longitudinal dataset.

most 18 years

since

CEOs who

—

left in office

the

leave their firms during

number of years covered by our

Robert Gibbons and Kevin J. Murphy

Figure

is

1

based on

all

CEOs

1,631

In our empirical work,

period.

August, 1990

18

leaving office during the 1970-1988 sample

however, we analyze first-differences and eliminate

observations with missing pay and performance data; this leaves 1,292

CEO-year observations.

corporations, or 6,737

In

what follows we refer

subsample as the completed-spells subsample. Table

completed-spells subsample.

been

in his position for

three to four years.

Column

(1)

shows

presents

1

that the average

He receives

90% comes

consumer price index

1

in the

subsample has

form of a base salary and

in the

and subsequent analyses are adjusted for

for the closing

month of the

1988-constant dollars. Adjusted for inflation, the average

We

CEO

statistics for the

annual compensation (excluding both grants of and gains from

annual bonus. All monetary variables in Table

by 6.6% per

summary

to the latter

almost nine years, and will continue in his position for an additional

exercising stock options) of $616,300, of which

inflation (using the

CEOs representing 785

CEO's

fiscal year) to represent

salary

and bonus has grown

year.

matched the Forbes compensation data

performance data obtained from the Compustat data

in 1988-constant dollars (although the

median

is

files.

Average firm

only $2.2

(in

We define the change in shareholder wealth, AV

market value of common stock

(in millions) at the

inflation-adjusted rate of return

The sample average change

on

common

beginning of the

sales

exceed $4

t,

firms in the completedas the inflation-adjusted

fiscal

year multiplied by the

stock (including splits and dividends):

in shareholder wealth is a

billion

Shareholders have realized

billion).

average inflation-adjusted returns of 1.8% over the sample period

spells subsample).

and stock-price

to fiscal-year sales

$56 million loss with

AV =V .ir

t

t

t.

a standard

deviation of $1.9 billion.

Columns

(2)

and

(3)

of Table

1

report the

same summary

statistics for

two subsamples

of the completed-spells subsample: column (2) consists of CEO-year observations in which the

CEO is in his

Panel

and

A

last three full fiscal years;

shows

that

CEOs

their position than

column

(3) consists of the

complementary subsample.

near retirement are older and have served longer in both their firm

CEOs

with

many

years remaining.

Panel

B shows

that

CEOs

near

Robert Gibbons and Kevin J. Murphy

August, 1990

19

CEOs

retirement are better paid than

with

many

years remaining.

deviations of pay changes and percentage pay changes are higher for

performance (and hence more variable) as

CEOs

CEOs

near retirement;

we

pay becomes more sensitive

interpret these results as indirectly supporting the hypothesis that

to

The means and standard

C

approach retirement. Panel

shows

that

average firm size (as measured by either sales or market value) and average firm performance

(as

measured by

similar in the

The

change

either the

in shareholder

wealth or the shareholders' rate of return) are

two subsamples.

last

row of Table

shows

1

that

CEOs

with

many

years until retirement are over-

represented in the early years of the sample. This over-representation

CEOs

methodology: the completed-spells subsample includes only

is

a direct result of our

actually leaving office

between 1970 and 1988, so there cannot be any CEO-year observations with more than three

years remaining in the last three sample years, 1986-88.

An Empirical Specification for CEO

describes the optimal linear relation between compensation and output in

Our model

period

w

t,

t

Contracts in the Presence of Career Concerns

and y t

.

We

assume

that shareholders seek to

maximize

their wealth,

and we

consider two alternative empirical representations of output, yt in terms of shareholder wealth,

,

V

t.

First,

one could interpret y as the change

t

compensation contract

linear

w (yt) = c

t

t

+

in shareholder wealth in period

bty t simply

t;

w = c + b AV

becomes

t

one could interpret output y t as end-of-period firm value, y =

t

t

V

t.

t

t.

in this case, the

Alternatively,

In an efficient capital

market, beginning-of-period firm value equals the conditional expectation of end-of-period firm

value:

=

yt

-

(3.1)

V _i

t

E{y

= E{y

t lyi,...,

w

t lyi,...,

yt-i),

t

=

ct

y

t

_i).

Therefore, the change in shareholder wealth in period

and the linear compensation contract

+ b t [AV t +E{y t lyi,..., y t-i}].

w

t

=

ct

+

biy t

becomes

t is

AV

t

Both approaches share the feature

that the coefficient

approaches yield qualitatively similar

largely because

it is

more

August, 1990

20

Robert Gibbons and Kevin J. Murphy

tractable (as will

AV

is

t

b t consequently, the two

;

what follows, we take the second approach,

In

results.

on

become

clear below).

Substituting (2.21) and (2.22) into (3.1) yields

w

(3.2)

but (3.2)

is

m

=

t

+

t _i

+ b AVt

at

t

not convenient to estimate because

variable that depends on

all

m

t

_!

is

an individual-specific time-varying

prior realizations of output, as described in (2.23).

Because we

interpret y t as end-of-period firm value, however, the first-difference of (3.2) is a

Substituting (2.22) into the definition of change in

tractable empirical specification:

shareholder wealth,

lagged version of

m

(3.3)

AV = y

t

E{y

-

t

t -i

=

m

t _2

L

= yn

t _i

<$

+

y t -i}, yields

lyi,...,

AV

this expression,

oi+(t-l)a

2

-

a t-i

-

AV

t

=y

t

at

CEO

t

effort

t

t

and

this year's

a2

,

o^+(t-l)a

2

which suggests the empirical specification

Aw

(3.5)

where

ot t

= Aa

t,

(3 t

t

=

oc

t

+

pt

AV

= b and y

t

,

t

t

+

f

Yt

t -i.

Substituting the

AVu

Aw = Aa + b AV +

t

m

t

and

AV _i

t

,

<&

i

o^+(t-l)a 2

bt-

>t-l

CEO compensation are a

last year's

wealth:

(3.4)

-

m -2, into (2.23) then yields

Thus, the first-difference of (3.2) implies that year-to-year changes in

function of the change in

more

AVM

,

change

in

shareholder

Robert Gibbons and Kevin J. Murphy

we

In our model,

August, 1990

21

take the worker's total career to be fixed.

A

worker with fewer

periods remaining therefore has worked for more periods, so the market has a more precise

belief about his ability.

career lengths

(i.e.,

As Panel

completed durations

on the empirical specification

remaining

in a

of exposition,

state these

monotonically with

HI

.

(3.5),

CEO's career and

we

A of Figure

t;

the

1

illustrates,

in office).

we

however,

CEOs

have heterogeneous

In formulating testable hypotheses based

therefore distinguish between the

number of years already spent

hypotheses for the case

in

number of

For ease

in office (tenure).

which the optimal slope b

t

years

increases

analogous hypotheses can be derived from the result that b t < bj

CEO constant, the

increases as tfie CEO nears retirement.

Holding tenure as

slope of the compensation contract, pt

,

Career concerns provide fewer incentives as the CEO nears retirement, so

by current compensation increase.

the incentives provided

H2. Holding years remaining as

contract,

CEO

constant, the slope of the compensation

p increases with tenure as CEO.

t,

The optimal

relation between pay and current performance in part reflects

with incentives to

the trade-off between the goal of providing the

increase shareholder wealth and the goal of providing efficient risk-sharing

for the risk-averse CEO. The optimal pay-performance relation increases

when the variance of output decreases, since at the same pay-performance

CEO

CEO bears less risk as variance decreases. The CEO's true

managerial ability becomes estimated more precisely as tenure increases;

consequendy, the variance of y t decreases and the pay-performance relation

relation the

increases as the

H3

.

Holding tenure as

CEO's

CEO

tenure increases.

constant, the coefficient

period t-1, yt decreases as the

,

CEO

on shareholder-wealth change

in

nears retirement.

on the change in shareholder wealth in period t-1 has two

and -b t_i. The first term reflects the effect of

AV _i on the updated estimate of ability in period t; this effect depends only

on tenure as CEO and is independent of years to go. The second term

The

coefficient

components,

a£/(a^+(t-l)cr£)

t

decreases as the CEO nears retirement

concerns provide smaller incentives.

H4. Holding years remaining as

shareholder wealth in period

CEO

t-1,

{i.e.,

b

t _i

increases) since career

constant, the coefficient on the change in

y decreases with tenure as

t

,

CEO.

Robert Gibbons and Kevin J. Murphy

Both

22

a^/(of+(t- 1 )al)

and -b

August, 1990

decrease as tenure increases because the

t _i

estimate of managerial ability becomes

Performance Pay and Years Left as

Hypothesis HI predicts

performance

hypothesis

will

more

precise.

CEO

that the relation

be higher for executives close

between

CEO

A

to retirement.

pay changes and current

way

simple

to evaluate this

estimate a regression that allows the pay-performance relation to vary with

is to

years remaining as

CEO:

18

Aw = a + pAV +

(3.6)

it

it

^p

I T (CEO has x years

left) it

*AV

,

it

T=0

where (CEO has x years

remaining in his career

left)i t is

a

dummy

in fiscal year

performance relation increases as the

least four potential

CEOs

measure

analysis, since

CEO

salaries,

(3.6) directly,

AVj

t,

is

net of

>

the

-

however.

payments

th

CEO

has x years

the slope of the pay-

>

Pi

\

-

•> PisFirst,

to the

There are

at

our empirical

CEO, while our

before these payments. This difference has a negligible effect on our

compensation

Second, while Aw; t should include

on

nears retirement, Po

problems with estimating

is

if

Under Hypothesis HI,

t.

definition of shareholder-wealth change,

theoretical

variable equal to one

is trivial

all

compared

to

changes

in the

value of the firm.

forms of compensation, the Forbes surveys include data

bonuses, and some minor additional forms of compensation but do not include data

on grants of stock and stock options. To the extent

that a

CEO's holdings of stock

in the firm

increase with tenure, stockholdings will act to increase incentives as career-concern incentives

decrease, so our estimates of the change in the pay-performance relation as the

retirement

may

concerns.

To

underestimate the shareholders'

the extent that

however, our estimates

compensation

CEOs

may

total

CEO

nears

response to the issue of decreasing career

decrease their stock holdings as they near retirement,

simply reflect the effort to provide incentives through

to replace those formerly

induced through stock ownership.

Robert Gibbons and Kevin J. Murphy

August, 1990

23

A third problem with direct estimation of (3.6), as noted in connection with Table

that

CEOs

1, is

near retirement are over-represented in the later years of the completed-spells

subsample, so the estimates of the p x's from (3.6) for the

CEO

subsamples will reflect secular

trends in incentive compensation in addition to the effects of career concerns.

Appendix Figure Al, the

relation

As shown

in

between pay and performance has increased over the past

decade, so the estimate of p T 's for

CEOs

near retirement are likely to he biased upward.

Fourth, and perhaps most important, (3.6) assumes that the relation between pay and

CEOs

performance differs across

remaining as

performance

—

CEO

One

in shareholder

firm value

Awt/AVO

may

decline with firm size both because the variance of

wealth increases with firm size and because the CEO's direct effect on

may decrease

We

years

potentially important source of heterogeneity is firm size: the

optimal pay-performance relation

changes

number of

does not allow for other sources of heterogeneity in the pay-

(3.6)

relation.

(and within a CEO's career) only by the

show below

with firm

size.

connection with Table 3) that the pay-performance relation

(i.e.,

varies significantly with firm size but that the pay-performance elasticity

(i.e.,

Aln(w t)/Aln(V t))

is

(in

almost invariant to firm

related heterogeneity

size.

We

therefore attempt to control for size-

by converting the regression variables

to logarithmic

changes and then

estimating an elasticity form of (3.6) that allows the pay-performance elasticity to vary across

years:

1988

Aln(w

(3.7)

it)

=

Van (n

a+

th

year

dummy)i t

n=1972

1988

18

+

[Po

+^Pt(CEO

has x years

left) it

year

th

year dummy)i t ]*Aln(V iL),

Aln(Vjt)=ln(l-i-ri t ) is the continuously accrued rate of return

dummy)i

t

is

a

dummy

logarithmic change in the

12

p n (n

n=1972

T=0

where

+ ]T

variable equal to one if n=t.

CEO's

salary and

bonus

(in

We

on

common

stock and (n*

define Aln(w; t ) as the annual

thousands). 12

We also used a more comprehensive measure of compensation that includes fringe benefits, and contingent

(but non-stock) remuneration.

The

qualitative results from these regressions are similar to those presented in the

Robert Gibbons and Kevin

J.

Murphy

24

August, 1990

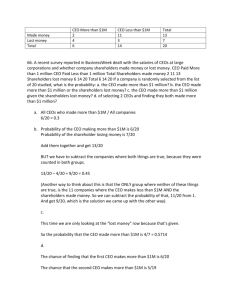

Figure 2 depicts the estimated pay-performance elasticities from (3.7) for

grouped based on

or

their years

CEO. (To

remaining as

more years remaining have been pooled.) The

.06,

which

is

CEOs

simplify the figure, observations with 15

figure

drawn assuming

is

CEOs

the average of the 17 estimated year coefficients.

a year effect of

in their final year,

second-to-last year, or third-to-last year have estimated pay-performance elasticities of .179,

.199,

and .184, respectively. Each of these estimated

estimated elasticity for

CEOs

elasticities is significantly

higher than the

year (.120) or sixth-to-last year (.115); no

in their fifth to last

other pairs of coefficients in Figure 2 (including pairs involving the highest estimated elasticity

for

CEOs in

5%

their eleventh-to-last year) are significantly different at the

Figure 2 suggests

that, in general,

pay-performance

level.

elasticities are

higher for

CEOs

nearing retirement, but also suggests that separate coefficients based on years remaining as

CEO are estimated with large standard errors.

correspond to

we

CEOs

Since the only significant differences in Figure 2

in their last three years vs.

CEOs

with more than three years remaining,

divided the completed-spell subsample into two groups and estimated the following

regression:

1988

Aln(wi t) = ao + ai (Few Years

(3.8)

Left)it

+

^^(n

111

year

dummy)i

t

1988

+

[Po

+

P!(Few Years

Left)i t

+ ]£Pn(n th

year

dummy) ]*Aln(V;

it

t ),

n=1972

where (Few Years

Left)it is a

dummy variable

years of his career in fiscal year

Column

(1)

if

the

i

CEO

lh

is in

the last three

t.

of Table 2 reports estimates of regression (3.8) for the completed-spells

subsample.

CEOs

category.

The (unreported) estimated

interactions range

equal to one

serving in their last three years as

from .02

CEO are assigned

coefficients

to .20, indicating that

to the

"Few Years

on the (Shareholder Return)* (Year)

CEOs

with

many

years remaining receive

between .2% and 2.0% raises for every 10% return realized by shareholders.

tables, but the significance levels are generally

additional measures of compensation.

much

Left"

The

lower, reflecting the noisiness of the data on these

Robert Gibbons and Kevin J. Murphy

25

Return*(Few Years Left) coefficient

is

August, 1990

also positive, suggesting that

remaining receive an additional .44% raise for every

Return*(Few Years Left) coefficient

is

10%

CEOs

with few years

return realized by shareholders.

highly significant (t=3.0), which

we

The

interpret as

empirical support for the Hypothesis HI.

Our

arbitrary,

Few Years

definition of

Left

— CEOs

and we re-estimated the regression

definitions of

Few Years

in their last three years

column

is

admittedly

(1) of

Table 2 for three alternative

Left: executives in their last one, two,

and four years as CEO. The

in

estimated Return*(Few Years Left) interaction coefficient

significant except

—

when Few Years

Left

is

defined as

CEOs

is

positive in all cases and

in their final year;

we

believe this

insignificance reflects both small sample size and non-performance-related payments

CEOs in

is

made

to

their last year.

The

hypothesis:

results in

CEOs whose

performance

remaining

Table 2 support hypothesis HI, but also support an alternative

total stay in office is

elasticities than

until retirement.

do

CEOs who

only a few years

may have

higher pay-

stay in office longer, independent of years

We tested this alternative hypothesis by repeating the regressions in

Table 2 for the subsample of

CEOs who had

None of the qualitative results

spent at least five years in office upon retirement.

in Table 2 are changed, suggesting that our results are not driven

by cross-sectional (negative) correlation between

total

time in office and the pay-performance

elasticity.

Performance Pay and

Hypothesis

performance

CEO Tenure

H2

predicts that, holding years remaining as

elasticity increases

less uncertainty.

which includes controls

for

CEO

variable that equals one

the

CEO is in

with shareholder return.

constant, the pay-

with tenure because managerial ability becomes estimated with

We test this hypothesis in

if

CEO

the regression reported in

tenure: the

new

regressors are

his first four years as

Our model

column

"Low

(2)

of Table

Tenure," a

CEO, and Low Tenure

2,

dummy

interacted

predicts a negative coefficient on the

(Low

Robert Gibbons and Kevin J. Murphy

Tenure)*(Return) interaction.

26

The

positive (but insignificant) coefficient in

Under

inconsistent with this hypothesis.

however, the pay-performance relation

Holmstrom, 1982)

as

T| t+ i

=

Ti

t

+

v t>

that

August, 1990

is

managerial ability

(2) is

a plausible alternative formulation of the theory,

not predicted to increase with tenure: suppose (as in

is

not a fixed parameter

r\

but rather varies over time

where the innovations v are independent and Normally

distributed.

t

steady state, the market's uncertainty about the CEO's ability

independent of the CEO's tenure.

column

Thus, hypothesis

H2 would

is

In the

time-invariant and so

not be a prediction of this

alternative model.

Estimates Based on the Full Sample

The completed-spells subsample of 1,292 CEOs

their firm during the

who

actually leave

1970-1988 sample period represents only about half of the 1,900

(11,359 CEO-years) in the

full

sample

observations with missing data).

subsample include

(6,737 CEO-years)

CEOs

still

(after constructing first differences

CEOs

in the full

sample but not

in the

serving at the end of the 1988 fiscal year and

CEOs

and eliminating

completed-spells

CEOs

of firms that

were deleted from the Forbes survey. 13 Data from these additional observations are useful for

two reasons.

First,

although

corresponds to one of his

tell

we cannot

last three

tell

whether the CEO's

years in office, for

many CEO-year

whether he has more than three years remaining as CEO.

additional observations can be used to estimate

more

(3) of

observations

CEOs who do

can

2.

(2) for the full

not leave their firms during the sample period.

regression contains two additional explanatory variables: "Can't Tell If

A

we

Second, data from these

Table 2 reports results from the re-estimation of column

sample of CEOs, including

13

observed year

precisely the year effects and shareholder

return*year interactions in columns (1) and (2) of Table

Column

final

Few Years

The

Left," a

of 623 firms were deleted from the Forbes surveys during the 1970-1988 sample period. Of

"going concerns" as of 1989, 290 were acquired by or merged with another firm (127 of these

were acquired or merged within two years of the Forbes delisting), and 56 liquidated, went bankrupt, or went

these,

total

277 are

private.

still

Robert Gibbons and Kevin J. Murphy

27

August, 1990

dummy variable that equals one if the CEO-year observation

on a

CEO who does not belong

dummy variable with

(2)

to the completed-spells

is in

the last three years of the data

subsample, and an interaction of

Shareholder Return. The results are similar to those reported

in

this

column

and are consistent with the primary implication of the career-concerns theory: the pay-

performance

elasticity increases as the

CEO approaches retirement.

Years Remaining and Pay for Lagged Performance

Hypotheses

H3

H4

and

predict that the relation between current

CEO pay changes and

the previous year's performance should decline with both years remaining as

We re-estimated

tenure.

CEO and CEO

the regressions in Table 2 after including lagged shareholder return

and interactions of lagged return with Few Years Left,

dummy variables. The magnitude

Low

Tenure, and the seventeen year

and significance of the coefficients reported

in

Table 2 were

not affected by including lagged performance, reflecting the low correlation between current

and past stock

returns.

The

coefficients

on the new interaction terms

Years Left) and (Lagged Return)*(Low Tenure)

hypotheses

H3 and H4 are not

—were

—(Lagged Return)* (Few

insignificant in all regressions. Thus,

supported by our data.

Performance Pay and Expected Years Left as

CEO

In formalizing the theory of optimal contracts in the presence of career concerns, we^

assume

that the

CEO's

final year is

known with

certainty, but

executives retire earlier or later than they were expected to

on optimal

CEO

explicit incentives

than on the

CEO's

may

therefore

retire.

depend more on

actual years remaining (as

it

The

seems

likely that

many

effect of career concerns

the expected years remaining as

measured

after retirement has

been

observed).

As shown

in Panel

C of Figure

1

,

many

executives leave their position

age 64 or 65. One estimate of the expected years remaining

until the

CEO reaches

65.