Document 11159525

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium

Member

Libraries

http://www.archive.org/details/optimismdeadlineOOyild

Technology

Department of Economics

Working Paper Series

Massachusetts

Institute of

OPTIMISM, DEADLINE EFFECT,

AND

STOCHASTIC DEADLINES

Muhamet Yildiz

MIT

Working Paper 04-36

August 2004

RoomE52-251

50 Memorial Drive

Cambridge,

02142

MA

This paper can be downloaded without charge from the

Social Science Research

Network Paper Collection

littp://ssrn.com/abstract=61

1946

at

MASSACHUSETTS INSTITUTE

OF TECHNOLOGV

DEC

7 200*!

LIBRARIES

i

Optimism, Deadline

Effect,

and Stochastic

Deadlines*

Muhamet

Yildiz

MIT

August, 2004

Abstract

Under a firm deadline, agreement

until the deadline.

I

in bargaining

propose a rationale

is

often delayed

for this deadline effect that

naturally comes from the parties' optimism about their bargaining

power.

is

I

then show that the deadline effect disappears

stochastic and the offers are

made

Key words: optimism, deadline

if

the deadline

arbitrarily frequently.

effect,

bargaining

JEL Numbers: C72, C73.

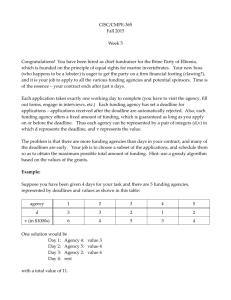

Introduction

1

When

last

there

is

a firm deadline, the agreement

minute before the deadline.

is

often delayed until the very

This "deadline

effect" is

served in a wide range of laboratory experiments as well as

ations (See

e.g.,

commonly

ob-

real-life negoti-

Roth, Murnighan, and Schoumaker (1988)). For example,

*This paper stems from

my

dissertation submitted to

Graduate School of Business,

Stanford University, and some of the ideas here are also expressed in an earlier working

paper

(Yildiz, 2001).

I

thank

my

advisor Robert Wilson.

and John Ktnnan.

1

I

also

thank Thomass Helmann

the unions and employers reach "eleventh-hour agreements" just before the

unions' deadline to strike. Litigants often reach a "settlement on the cour-

thouse steps." In these and

many

other real-life negotiations the parties re-

portedly hold overly optimistic views about their relative bargaining power

(Babcock and Loewenstein (1997)). Such optimism has long been recognized

as a major factor in bargaining delays (see,

I

propose a rationale for the deadline

optimism about their

parties'

The

Hicks (1937)). In this paper,

effect that naturally

relative bargaining power.

the deadline effect disappears

relative bargaining

e.g.,

if

power may

the deadline

is

I

stochastic

comes from the

then show that

and the

parties'

shift quickly.

rationale for the deadline effect

as follows. Consider

is

and B, negotiating under a firm deadline

d*,

which

two

parties,

A

the last date at which

is

they can strike a deal. After a deadline, they can no longer negotiate, and

each party receives his disagreement payoff, which

is,

at d*

,

the cost of delay

high. Hence, at d*

is

,

is

presumably low. That

a wide range of agreements

are possible as outcomes of bargaining. For example,

if

party

A

has a strong

bargaining position that allows him to set the terms of trade, leaving the

other party no other option than that of accepting or rejecting these terms,

then they reach an agreement in which

gains from trade

if

B

is

and

leaves

B

A

B

indifferent to disagreement.

bargaining power, they

may

extracts almost

all

of the large

almost indifferent to disagreement. Similarly,

in such a strong position, then

and leave

A

strike

extracts

all

the gains from trade

Depending on the

any deal that

is

in

parties' relative

between these two

extreme points. Therefore, a party's share in an agreement at d*

affected

by

his relative bargaining power. Hence, at

negotiation, each party

his share in a possible

may have

any

is

greatly

earlier date in the

very high or very low expectations about

agreement at

d*

,

about bis relative bargaining power at

depending on his

d*

.

level of

optimism

In case of excessive optimism,

these expectations will be so high that, unless waiting until the deadline

too costly, there will be no agreement at the

moment

parties' expectations. Therefore, the players wait

is

that could satisfy both

and reach an eleventh- hour

agreement just before the deadline. The cost

may be

gain from trade

lost

due to the deadline

Now consider an environment

stochastic. Formally,

may be

in

very high; half of the

effect.

which the deadline

assume that the deadline

is

is

not fixed but rather

a random variable with a

continuous cumulative distribution function. For example, consider a market

may

that does not necessarily close sharply at 5:00pm but

in

close at

any time

between 4:50pm and 5:10pm. For another example, consider a labor con-

tract that does not expire at a fixed date but expires

event happens,

e.g.,

when the

when a

certain

random

inflation rate exceeds a certain threshold.

commits

yet another example, consider a union that

For

to a strike that will

be triggered by such a random event, rather than automatically starting at

a fixed date. Assume that the factors which determine

may change

power

quickly, so that

parties' bargaining

whether a party has a strong bargaining

position today does not have an impact on the probability of that party hav-

ing a strong position tomorrow.

Assume

opportunities to strike a deal.

In such an environment, 1

have frequent

also that the parties

I

show that the

deadline effect disappears, and the parties reach an agreement immediately.

An

intuition for this result

the parties find

it

very

is

Consider a date

as follows.

likely that there will

explained above, the perceived cost of delay

is

deadline

is

at which

be no more negotiations. As

high at

t*

,

and the parties may

be highly optimistic about their shares in an agreement at

when the

t*

t*

.

Nevertheless,

stochastic, the ex-ante probability that the parties will

face the deadline before such a date t*

must be very

high.

2

not willing to wait until

sufficiently earlier date, the parties are

Hence, at a

t*

to realize

their expectations because that incurs a very high risk of receiving the

1

that

2

is

In the formal model,

is

I

also

make an assumption

low

to rule out any anticipated deadline

implicit in players' beliefs.

This

is

because the ex-ante probability that the deadline arrives before the date

at least as high as the conditional probability of that event at t*

be very high. But the former probability

the the deadline arrives before the date

is

,

which

is

t*

+1

assumed to

approximately the ex-ante probability that

£*, for

the dates

t*

and

very close in real-time and the cumulative distribution function

f+

is

1

are

assumed to be

continuous.

payoff of disagreement.

On the other hand,

the parties expect to have

if

many

opportunities to strike a deal in the future and parties are not pessimistic

about their bargaining power in the future, then their expectations about the

future are high. Hence the perceived cost of delay

limits the scope of the individually rational trade.

in a possible agreement are not affected

is

That

relatively small.

Then, the parties' payoffs

much by

their bargaining power.

Therefore, the parties' optimism about their bargaining power induces only

low

levels of

optimism about their shares. 3

There are arbitrarily close stochastic deadlines to any deterministic dead-

The above

line.

results describe quite different equilibrium behavior

such two similar environments.

mism

under

While a deterministic deadline and

opti-

naturally lead to delaying of agreement until the deadline, under any

nearby stochastic deadline, there

environment

From

is

will

be immediate agreement whenever the

sufficiently variable.

a theoretical point of view, the above two results extend the

cri-

tique in Yildiz (2003) of the literature that explains the bargaining delays

by optimism, using informal arguments that

fit

to a two period model,

excessive optimism leads to a delay. In Yildiz (2003),

mism

The

is sufficiently

first

persistent, then there will

result in this

showed that

I

opti-

be an immediate agreement.

paper shows that optimism naturally leads to the

—just as

deadline effect under a deterministic deadline!

it

leads to a delay in

a two period model. The second result shows that, nevertheless,

slight uncertainty

if

when

about the deadline so that

be an immediate agreement

it is

if

there

is

stochastic, then there will

in the continuous-time limit, the limit case that

attracted most of the attention in bargaining literature.

In the continuous-time limit, the players' relative bargaining power

allowed to shift back and forth instantaneously.

In practice, however, the

factors that determine players' relative bargaining power

suddenly and that often. Hence, optimism

3

Although

this intuition

is

may

do not change that

lead to the deadline effect

valid also for multilateral bargaining,

some delay when there are many

parties (Ali, 2002).

is

it

may

not prevent

even under a stochastic deadline. Therefore, from a practical point of view,

one must interpret the

last result as follows:

the deadline effect disappears

when there is sufficient uncertainty about the deadline relative to how quickly

the players get a chance to strike a deal and

how

quickly their relative bar-

gaining power changes.

A

firm deadline

is

often imposed

upon

them from dragging out the negotiations

negotiators in order to prevent

indefinitely. Ironically,

such dead-

themselves sometimes entice parties to delay the agreement.

lines

happens because of the

such a deadline

effect

that will happen at a

then one

parties' optimism,

by imposing a deadline that

random time and

is

may be

is

beyond the

If this

able to avoid

triggered by an event

parties' control.

The

uncertainty about the timing of the deadline must be high enough so that,

during the period at which such an event happens, the parties will have

many

opportunities to strike a deal and their relative bargaining power will

potentially change

many

times.

Spier (1992) shows that, in a pre-trial negotiation with incomplete in-

formation, the settlement probability will be a U-shaped function of time,

consistent with the deadline effect.

model that explains the deadline

Ma

effect.

and Manove (1993)

also develop a

In that model, the delay

and a party can wait as much as he wants before making an

opponent has to wait for his

fer waits until the deadline

In their model, there

is

made and

it is

is

offer.

Then, the party who

and makes a

his

make an

of-

it offer.

between the times an

offer

may not go through. This

model may not disappear when the

accepted. Hence, a late offer

Indeed, Roth, Murnighan, and Schoumaker

deadline becomes stochastic.

is

to

costles

and

offer,

minute take-it-or-leave

also a stochastic delay

suggests that the deadline effect in that

(1

last

is

is

988) informally discuss a possible explanation based on the idea that there

no cost of delay except

about the deadline. 4

''Roth

for a cost at the

When

end due to a

the deadline becomes stochastic, the deadline

and Ockenfels (2002) consider a similar model

by the possibility that the

slight uncertainty

last offer

may

in

which the delay

is

motivated

not go through. They use this model to explain

effect disappears in

some models while remains

intact in

some

other.

Hence

one can use stochastic deadlines to test these models.

Model

2

There are two

among themselves

dollar

N=

6

risk averse agents, i,j

who want

{1,2},

before a deadline; the set of

all

to divide a

feasible expected

place on a

U — {(u ,!?) G [0, lplu + u 2 < 1}. The negotiation takes

grid T = {0,1,2,...} of index-times t that approximates the

continuum

[0,

1

utility pairs is

r

(t,

=

k)

Each index

oo) of real times r.

where

t/k,

The

grid.

1

a large integer that measures the fineness of the

is

A;

corresponds to a real time

t

players' time preferences

and the deadline are given by the

time and do not depend on the grid. Each player's

r

is

e

_rT

x where r

discount rate

I

is

>

(£,

d

if

=

<

k)

2

,

—

At t

0.

.

if

and only

d,

The

with probability

d*

)

d,

if

deadline

1 for

F

the negotiation automatically ends and

is

some

is

d*

said to be deterministic

S

[0,

oo).

6 U;

if

game.

Given any

each player

i

t

,

<5*u );

6

iV;

otherwise, the

is

is

i

offers

Notice that,

if

At each

t

with

an alternative v

=

game ends yielding

game proceeds

—

real

time

to date

t

+ 1,

F (t (t,k)

before the recognition at

r'

\d

>

t'))p\ to the event that

observed in p-Bay auctions but not

firm; in

said

is

which case the game ends yielding payoff vector

and any history with

the deadline effect

10 minutes.

2

1

assigns probability (1

e-Bay, the deadline

Amazon can be

i

the other player accepts the offer, then the

a payoff vector S u = ((5'n

unless r (t + 1, k) > d, in

(0, 0).

The deadline

and

if

continuous.

Nature recognizes a player

t

why

rl k

will analyze the following perfect-information

(w 1 u

t,

e~

model the deadline as a positive random variable d with cumulative

to be stochastic

r

=

denoted by 5

each agent gets payoff of

I

from getting x at

measures the real-time impatience. The index-time

distribution function F.

only

utility

real

Amazon, auction may not end

if

in

Amazon

auctions.

In

there was a bid in the last

there are uncertainty about the entry, then the deadline in

considered stochastic. Incidentally, the results here can also be extended

to auction environments.

6

i

be recognized at date

will

about

t,

where

on r

this event conditional

(t,

E

p\

<

k)

his probability assessment

[0, 1] is

d.

Everything above

is

common

knowledge.

This model

it

is

similar to that of Yildiz (2003)

allows a stochastic deadline.

dom bargaining breakdowns,

(1987), Merlo

and Wilson

Its

only difference

the discounting

is

that

due to the ran-

is

the Rubinstein-Stahl framework

(e.g.,

Binmore

(1995)) also allows stochastic deadlines. In that

framework, the discount rate

is

When

.

is

usually taken as constant over time, and

it

thereby assumed that the deadline has an exponential distribution. This

paper does not impose any such restriction on deadlines because that would

rule out the critical class of stochastic deadlines that

istic deadlines.

however,

is

Its

that

it

approximate determin-

main departure from the Rubinstein-Stahl framework,

allows the players to hold subjective beliefs about which

player will be recognized

and when, and these

beliefs possibly differ

from

each other.

A

player's bargaining

power

is

determined by the recognition process; a

the present value of the temporal monopoly

player's equilibrium payoff

is

rents he expects to extract

when he

is

recognized (Yildiz, 2003, 2004).

The

differences in players' beliefs about the recognition process reflect their opti-

mism

date

or pessimism about their bargaining power. The level of optimism for

t is

measured by

=

Vt

The

= p\ + Pt ~

1-

players' probability assessments for date

t

agree

players are weakly optimistic (resp., pessimistic) for

?/t

<

0).

The main

focus in this paper will be

t

when y =

when y >

do not update

player

is

is

0.

The

(resp.,

t

on the case that the players

remain (weakly) optimistic throughout the game, although

Notice also that p\

t

it is

not assumed.

a constant. This reflects the assumption that players

their beliefs about the future events as they observe

recognized at a given date. This independence assumption

in order to rule out the delays that are

unrelated to the deadline

effect.

due to learning

is

which

made

(Yildiz (2004)),

Equilibrium

3

One can

iteratively eliminate all conditionally

dominated strategies to reach

an essentially unique subgame-perfect equilibrium. The equilibrium

is

unique for

all

own

In this section,

I

a

trivial

(The continuation values are

as the present value of continuation payoffs at

expectations.)

may be

subgame-perfect equilibria; there

multiplicity of equilibria in knife-edge cases.

computed

unique

any player at the beginning of

in the sense that the continuation value of

any date

is

will derive

using the player's

t,

a difference equation that

determines these continuation values and describe the equilibrium behavior

and the conditions that determines whether players reach an agreement

at

any given date.

Let VJ be the continuation value of a player

t

<

conditional on that r (t,k)

when r (t,

k)

>

any date

the players share a

(t,

k)

<

the surplus or the perceived

d,

t is

St

If

at the beginning of a date

the continuation values are identically zero

Conditional on r

d.

size of the pie at

d;

i

common

=

v?

+ v2

t

.

set of beliefs, St is identically 1.

may be higher

players' subjective beliefs are allowed to differ in this paper, St

or lower than

For each

1.

qt

write also

t,

=l-F(T(t + l,k)\d>T(t,k))

for the conditional probability that the deadline

t

+

1

given that the deadline

then payoffs at

t

+

1

Since the

by the

is

not reached at

is

t.

not reached at index time

At date

players discount

t

effective discount factor of Sqt

The discounted

-

value 8qt St+i of the next period surplus determines whether players reach an

agreement

at

t

in equilibrium

if

they have not yet agreed.

Consider the case that 5qt St +i

>

1.

Since each player

counted payoff of Sqt Vt +1 from delaying agreement beyond

i

expects a dis-

t,

an agreement

l

at

t

must give

5<ltV£-i

=

at least 5qt

Sq t St +i

>

1.

V +l

z

t

to each player

i,

requiring a

Hence the players cannot agree

at

sum

t

of 5qt V*+1

+

in equilibrium.

This case

i

is

at the beginning of

and the surplus

Now

The

called the disagreement regime.

continuation value of player

t is

is

St

=

consider the case 5qt S +i

<

t

5qt St+ i.

1.

(1)

Now

an agreement

at

t is

possible but also necessary for equilibrium whenever the inequality

This case

is

called the agreement regime.

other player j

i

offers j this

is

willing to agree to

When

a player

%

— 5q V^+1

rest, 1

t

,

is strict.

recognized, the

is

any division that gives j at

amount and keeps the

not only

least Sqt

for himself,

VJ+1

t

;

an amount

more than 5q V?+1 his continuation value from delay. (The latter

amount would be his share if he were not recognized.) The continuation

that

is

t

value of player

V;

i

,

at the beginning of

= P\{1- 5q VJ+l +

(1

)

t

- pi)

t is

now

5qt Vi+l

= p\ (1 - 5q St+l + 5q

t

In that case, the surplus at the beginning of

S =

t

4

l

.

t is

+ y {l-5q St+ i).

t

(2)

t

I will

show that optimism and a deterministic deadline

near future lead players to wait until the last date to

effect

disappears and there

stochastic

and the

Proposition

e

VJ+1

Deadline Effect

In this section,

t*

t

)

=

-rd'

but this deadline

immediate agreement whenever the deadline

is

offers are

settle,

made

frequently

(i.e.,

k

is

1 Let there be a deterministic deadline at

some

d*

> 0, and let

Assume that

(t,

k)

<

(1 -f-^„)

>

1.

Then, in equilibrium, the players disagree at each

d*} be the last date before the deadline.

at t*.

is

large).

max{i|r

and reach an agreement

in the

t

<

t*

Proof.

regime at

each

<

t

t*

and S =

since q =

,

t*,

and there

will

£**"*&.

5

>

r

t»

1

t

1,

0,

+

=

5qt *St *+i

yt *

(1

—

S >

e~

t*

Td '

(1

yt .)

>

=

t

1

t

*

t

l

1

each

1 for

<

t

t*

by the hypothesis.

a simple generalization of Example

1 is

an agreement

is

Moreover, for

+y

5*

S = 5S +i =

^Sf will hold,

at t, so long as 5 ~ Sf > 1- But

the equality

+

Hence, there

0.

5qt *Sf+i)

be a disagreement regime

Proposition

is

—

Firstly, since qt *

of Yildiz (2003). It

based on the basic observation that the recognized player just before the

deadline has a great bargaining power, as he makes a take-it-or-leave-it

If

the deadline

not too far away and the players are sufficiently optimistic

is

about being recognized and dictating a very favorable settlement at

it is

hypothesized in Proposition

before

t*

agreement until the

This behavior

is

last

The next

many

when

will delay

the

and

is

commonly observed

in real-

under which the deadline

effect dis-

the deadline becomes stochastic.

e

>

the deadline be stochastic

0, there exists

in equilibrium before real-time

(i.e.,

let

F

be continuous).

k such that the players reach an agreement

for each k

e

ing two conditions are satisfied:

(i)

yt

>

>

k whenever either of the follow-

for each

t,

or

(ii)

yt

= Y (r (t, k))

k for some continuous function Y.

is,

if

the deadline

is

agreement in continuous-time

tions

be no feasible agreement

experiments.

result provides conditions

Then, given any

That

will

then predicts that the players

called the deadline effect

Proposition 2 Let

all t,

then there

—as

date before the deadline and settle at the last date.

world negotiations and in

for

1,

t*

that satisfies both players' (highly optimistic) expectations. Under

this hypothesis, Proposition 1

appears

offer.

above

is satisfied.

stochastic, then there will

limit, so long as either

be an immediate

one of the two condi-

Such conditions are not superfluous because the play-

ers' beliefs (particularly their

pessimism)

may reflect an

anticipated deadline,

and thus considerations about a deterministic deadline may be disguised as

pessimistic beliefs.

pessimistic about

To

t),

see this, note that

when

yt

<

the analysis remains unchanged

10

(i.e.,

if

when

players are

we instead assumed

commonly

that the players

with probability

believed that, at

and no player

p\

each player

t,

recognized with probability

is

recognized

is

i

—yt

.

Hence,

a deterministic deadline at a date d* can be implicitly incorporated in players'

by assuming that yt

beliefs

= —1

each

for

>

with r(t,k)

t

d*

Condition

.

(ii)

by

rules out such possible incorporation of deterministic deadlines in beliefs

jumps

ruling out sudden

one only needs to rule out sudden drops in the

below. Condition

out,

random

variable

all

Proof of Proposition

agreement regime.

2,

is

t

(tk,

k)

€

for the proof

consistent with empirical evidence for

is

I will

For each

2.

show that

limfe^,*,

log (2) /r] for each k,

[0,

be the

k, let tk

r

k)

(tk,

=

and hence

the only limit point of the sequence r

Since

0.

date with an

first

Stk

it suffices

is

to

tk

5-q

the inequality

>

By

0.

=

is

5

show that

.

Consider

(1),

Stk =

tk

(

bounded

Let r* be any limit point

(tk, k).

of this sequence, and consider a subsequence that converges to r*

any k with

by the

optimism (Babcock and Loewenstein (1997)).

players' persistent

by

optimism

considerations about deadlines are captured

This condition

d.

level of

which states that the players are optimistic through-

(i),

makes sure that

with this intuition,

in level of optimism. Consistent

J!

ft

t

5

*(l-F(r (t k

,

k)))

Stk >

1;

(3)

J

due to the

fact that there

is

a disagreement regime at

0.

Hence,

=

—

A

(l-F(T(t

k

1

will

show that 1/A k converges

e-

to

rT "

k ,k)))Stk

th

lim 5

fc

and

therefore, r*

=

0.

Towards

St k

as there

is

5

tk

<

1.

(4)

{)

proving that

1,

=

<

-

—>oo

=

1,

this goal, note first that

=l + yt

an agreement regime at

k

(1

tk,

-

5qtk Stk+1 )

which

11

also implies that 5qt k Stk +\

(5)

<

1.

I

1.

consider the two conditions separately. First assume

[If

= 1 + Vt

S*»+i

>

5qtk+1 Stk +2

Stk+1 = 5qtk+l Stk+2 > 1- If 5qtk+1 Stk+2 <

- 5qtk+1 Stk + 2 ) > 1, as ytk+1 > 0.] Hence, by (5),

then

1,

+\ (1

k

Stk +i >

Then,

(i).

Stk <2-5qtk

1,

then

(6)

.

Thus,

< (l-F(T(t k ,k)))(2-5qtk )

^4fc

= 2(l-F(r(t

Since

F

Ak >

Now

converges to

by

1

<

assume

>

Vt k +i

to

be

by

0,

(ii)

then

0,

and similarly

=

that Y{t*)

are covered,

By

bound

Ak

for

1.

=Y (r

yt k +i

1,

(ifc,

is

Ak <

—

t,

be delays

shows.

=

1, fc)

r*, the

—

now

1

it suffices

in the limit.

If

when

is

1.

0.

But,

1,

&))

<

if

this case occurs infinitely

Y (r*) >

by continuity of F,

imphes that

A k < Stk <

1

+

y (r*) <

y tk -+

1-

0,

AH

showing

the cases

complete.

there

is

no deadline, condition

—

(i)

guaranties im-

qtS as the discount rate for

model with time varying discount

One

cannot, however,

may

rates, as Proposition 1

in other sequential bargaining models, equilibriumi

5=1, and

1).

1.

>

clear that

not greater than

=

part of the proposition from Yildiz (2003) because there

in such a

As

ous near

first

+

(tfe

and thus 1/A&

obtaining a bargaining model with no deadline.

deduce the

-M,fc)))-.

(Recall that linifc^oo^

1,

mediate agreement. Moreover, one can take 5t

date

r

limfc_ 00

It is

(i).

implies that

+

(ifc

<

yt fc +i

(5), this yields

and the proof

Yildiz (2003),

that

>

k))

= Y (r

By

A*

fc

Assume ytk > 0. If we also have

implying the bound in (6), which has just proven

Hence, assume

0.

<

F(r*)

1 yielding

Stk +i >

sufficient.

often, then ytk

—

=

without assuming

Stk <

(5),

1

(£&, fc)

(4), this implies that

to find an upper

Vt k

,fc)))-J(l- JP(r(t

continuous and lim^oo r

is

last expression

Since

fc

is

discontinu-

hence one cannot use a continuity argument. (With a

stochastic deadline, each 5 t

—

>

1

as k

—

12

oo.)

Conclusion

4.1

These deadlines often entice the

Parties often negotiate under a deadline.

parties to wait until the deadline to

that such a deadline effect

may

make a

last

minute agreement.

I

show hat one may avoid

the deadline effect, by making the deadline stochastic,

deadline contingent upon an event that will

so that parties have

many

show

naturally arise from the parties' optimism

about their bargaining power. More interestingly,

order this to succeed there

I

must be

happen

i.e.,

at a

sufficient uncertainty

by making the

random

date.

In

about the deadline

opportunities to strike a deal and their relative

bargaining power has a potential to change during the period in which they

may

face the deadline.

References

[1]

Ali, S.

ases:

[2]

Nageeb M.

Waiting To

(2003): "Multilateral Bargaining with Subjective BiSettle,"

Stanford University, mimeo, 2003.

Babcock, Linda and George Loewenstein (1997): "Explaining Bargaining Impasse:

The Role

of Self-Serving Biases,"

Journal of Economic

Perspectives 11, 109-126.

[3]

Binmore, Kenneth (1987): "Perfect Equilibria in Bargaining Models,"

in

The Economics of Bargaining,

ed.

by K. Binmore and

P.

Dasgupta.

Oxford, U.K.: Basil Blackwell, 77-105.

[4]

Hicks,

John

(1932):

The Theory of Wages.

New York:

Macmillan Pub-

lishing Co.

[5]

Ma, Ching-to Albert and Michael Manove

(1993):

"Bargaining with

Deadlines and Imperfect Player Control," Econometrica 61, 1313-1339.

13

[6]

Merlo, Antonio and Charles Wilson (1995):

"A Stochastic Model

of

Sequential Bargaining with Complete Information," Econometrica 63,

371-399.

[7]

Roth, Alvin, Keith Murnighan, and Francoise Schoumaker (1988): "The

Deadline Effect in Bargaining: Some Experimental Evidence," American

Economic Review

[8]

78, 806-823.

Roth, Alvin and Axel Ockenfels (2002): "Last-Minute Bidding and the

Ama-

Rules for Ending Second-Price Auctions: Evidence from eBay and

zon Auctions on the Internet," American Economic Review,

92, 1093-

1103.

[9]

Rubinstein, Ariel (1982): "Perfect Equilibrium in a Bargaining Model,"

Econometrica 50

[10]

Spier,

97-110.

,

Kathryn E.

Review of Economic

[11]

Stahl,

[12]

Yildiz,

I.

"The Dynamics of Pretrial Negotiation," The

(1992):

Studies, 59 (1), 93-108.

(1972): Bargaining Theory (Stockholm School of Economics).

Muhamet

"Sequential Bargaining without a

(2001):

Prior on the Recognition Process,"

MIT

Common

Department of Economics

Working Paper No. 01-43.

[13] Yildiz,

Muhamet

(2003):

"Bargaining without a

Agreement Theorem," Econometrica

[14]

Yildiz,

Muhamet

Economics

14

f]

7

'

Prior

— An

71, 793-811.

(2004): "Waiting to Persuade,"

119, 223-248.

Common

Quarterly Journal of

Date Due

MIT LIBRARIES

3 9080 02618 0445