Document 11159485

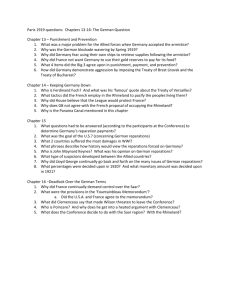

advertisement