Document 11159454

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium

Member

Libraries

http://www.archive.org/details/meanreversioninsOOpote

\AP

working paper

department

of economics

MEAN REVERSION IN STOCK PRICES:

EVIDENCE AND IMPLICATIONS

James M. Poterba

Lawrence H. Summers

No. 457

August 1987

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

MEAN REVERSION IN STOCK PRICES:

EVIDENCE AND IMPLICATIONS

James M. Poterba

Lawrence H. Summers

No. 457

August 1987

OevjeV

MEAN REVERSION IN STOCK PRICES:

EVIDENCE AND IMPLICATIONS

James M. Poterba

MIT and NBER

and

Lawrence H. Summers

Harvard and NBER

December 1986

Revised August 1987

We are grateful to Barry Perlstein, Changyong Rhee, Jeff Zweibel and especially

David Cutler for excellent research assistance, to Ben Bernanke, John Campbell,

Robert Engle, Eugene Fama, Pete Kyle, Greg Mankiw, Julio Rotemberg, William

Schwert, Kenneth Singleton, and Mark Watson for helpful comments, and to James

Darcel

Matthew Shapiro, and Ian Tonks for data assistance.

This research was

supported by the National Science Foundation and was conducted while the first

author was a Batterymarch Fellow.

It is part of the NBER Programs in Economic

Fluctuations and Financial Markets.

,

*-*>

oose

j:t. l

August 1987

Mean Reversion in Stock Prices: Evidence and Implications

ABSTRACT

This paper analyzes the statistical evidence bearing on whether transitory

components account for

a

large fraction of the variance in common stock returns.

The first part treats methodological

return components.

issues involved in testing for transitory

It demonstrates that variance ratios are among the most

powerful tests for detecting mean reversion in stock prices, but that they have

little power against the principal interesting alternatives to the random walk

The second part applies variance ratio tests to market returns for

hypothesis.

the United States over the 1871-1986 period and for seventeen other countries over

the 1957-1985 period, as well as to returns on individual firms over the 1926We find consistent evidence that stock returns are positively

1985 period.

serially correlated over short horizons, and negatively autocorrelated over long

horizons.

prices have

The point estimates suggest that the transitory components in stock

a

standard deviation of between 15 and 25 percent and account for

more than half of the variance in monthly returns.

The last part of the paper

discusses two possible explanations for mean reversion:

time varying required

returns, and slowly-decaying "price fads" that cause stock prices to deviate

from fundamental values for periods of several years.

We conclude that

explaining observed transitory components in stock prices on the basis of movements in required returns due to risk factors is likely to be difficult.

James M. Poterba

Department of Economics

Massachusetts Institute of Technology

Cambridge, MA 02139

(617) 253-6673

Lawrence H. Summers

Department of Economics

Harvard University

Cambridge, MA 02138

(617) 495-2447

This paper examines the evidence on the extent to which stock prices

exhibit mean-reverting behavior.

The question of whether stock prices contain

transitory components is important for financial practice and theory.

For

example, consider the question of investment strategy.

movements

If stock price

contain large transitory components then for long-horizon investors the stock

market may be much less risky than it appears when the variance of single-period

returns is extrapolated using the random walk model.

Market folklore has long

suggested that those who "take the long view" should invest more in equity than

those with a short horizon.

Although harshly rejected by most economists, this

view is correct if prices exhibit mean-reverting behavior.!

Furthermore, the

presence of transitory price components suggests the desirability of investment

strategies involving the purchase of securities that have recently declined in

value.

Important transitory components in stock prices could also impart some

logic to economic agents'

reluctance to tie decisions to current market values.

Corporate managers often assert that their common stock is misvalued and claim

that it would be unwise to base investment decisions on its current market

price.

A common procedure among universities and other institutions that rely

on endowment income is to spend on the basis of a weighted average of past

endowment values.

Harvard University spends out of endowment according to

preset trend line regardless of the market's value.

understand if stock prices follow

a

a

Such rules are hard to

random walk, but make sense if prices con-

tain important transitory components.

As a matter of theory, evaluating the extent of mean-reversion in stock

prices is crucial for assessing claims such as Keynes'

(1936)

assertion that

-2-

"all sorts of considerations enter into market valuation which are in no way

relevant to the prospective yield (p. 152)."

If

divergences between market and

fundamental values exist, but beyond some limit are eliminated by speculative

forces, then stock prices will exhibit mean reversion.

Returns must be negati-

vely serially correlated at some frequency if "erroneous" market moves are eventually corrected. 2

reasoning of this type has been used

As Merton (1987) notes,

to draw conclusions about market valuations from failures to reject the absence

of negative serial correlation in returns.

Conversely, the presence of negative

autocorrelation may signal departures from fundamental values, though

it

could

also arise from risk factors that vary through time.

The paper is organized as follows.

Section

1

begins by evaluating alter-

native statistical procedures for testing for transitory components in stock

prices.

We find that variance ratio tests of the type used by Fama and French

(1986a) and Lo and MacKinlay (1987) come close to being the most powerful tests

of the null

hypothesis of market efficiency cum constant required returns

against plausible alternative hypotheses such as the "fads" model suggested by

Shi Tier

(1984) and Summers

even with data spanning

a

(1986).

Nevertheless, these tests have little power,

sixty year period.

They have less than

a

one in four

chance of rejecting the random walk model in favor of alternative hypotheses

that attribute most of the variance in stock returns to transitory factors.

conclude that

a

sensible balancing of Type

critical values above the conventional

Section

prices.

2

I

We

and Type II errors suggests use of

.05 level.

examines the evidence on the presence of mean reversion in stock

For the United States, we analyze monthly data on real and excess New

York Stock Exchange returns since 1926, as well as annual returns data for the

-3-

1871-1986 period.

We also analyze evidence from seventeen other equity markets

around the world, and study the mean-reverting behavior of individual corporate

securities in the United States.

The results are fairly consistent in suggest-

ing the presence of transitory components in stock prices, with returns exhibit-

ing positive autocorrelation over short periods but negative autocorrelation

over longer periods.

Section

3

uses our variance ratio estimates to gauge the substantive signi-

ficance of transitory components in stock prices.

For the United States we find

that the standard deviation of the transitory price component varies between 15

and 25 percent of value, depending on what assumption we make about its per-

sistence.

The point estimates imply that transitory components account for more

than half of the variance in monthly returns, a finding that is confirmed by the

evidence from other countries.

Section

4

addresses the question of whether observed patterns of mean

reversion and the associated movements in ex ante returns are better explained

by fundamentals such as changes in interest rates or market volatility, or as

byproducts of noise trading.

We review several types of evidence indicating the

difficulty of accounting for observed transitory components on the basis of

changes in real

interest rates or risk premia.

Noise trading appears to be

plausible alternative explanation for transitory price components.

Section

5

concludes by discussing some implications of our results and

directions for future research.

a

Methodological Issues Involved in Testing for Transitory Components

1.

A vast literature dating at least back to Kendall

(1933)

has tested the

efficient markets/constant required returns model by examining individual auto-

correlations in security returns.

This literature, surveyed in Fama (1970),

generally found little evidence of patterns in security returns and is frequently adduced

Shi

Her

in

support of the efficient markets hypothesis.

Recent work by

and Perron (1985) and Summers (1986) has shown that such tests have

relatively little power against interesting alternatives to the null hypothesis

of market efficiency with constant required returns.

Several recent studies using new tests for serial dependence, notably Fama

and French (1986a), have nonetheless rejected the random walk model.

This sec-

tion begins by describing several possible tests for the presence of stationary

stock price components,

including those used in recent studies.

We then present

Monte Carlo evidence on the power of each test against plausible alternatives to

the null hyothesis of serially independent returns.

We find that even the best

possible tests have little power against plausible alternatives to the random

walk model when we specify the (conventional) size of .05.

We conclude with a

discussion of general issues involved in test design when the data can only

weakly differentiate alternative hypotheses, addressing in particular the degree

of presumption that should be accorded to our null

hypothesis of serially inde-

pendent returns.

1.1.

Test Methods

Recent studies employ different but related tests for mean reversion.

Fama

and French (1986a) and Lo and MacKinlay (1987) compare the relative variability

of returns over different horizons using variance ratio tests.

(1987)

Fama and French

use regression tests which also involve studying the serial correlation

Campbell and Mankiw (1987), studying transitory com-

in many-period returns.

ponents in real output, use parametric ARMA models to gauge the importance of

As we shall see, each of these approaches involves using a par-

mean reversion.

ticular function of the sample autocorrelations to test the hypothesis that all

autocorrelations equal zero.

The variance ratio test exploits the fact that if the logarithm of the

including cumulated dividends, follows

stock price,

a

random walk then the

return variance should be proportional to the return horizon.

We study the

3

variability of returns at different horizons, relative to the variation over

a

When we analyze monthly returns, the variance ratio statistic

one-year period.

is therefore:

VR(k)

(1)

where R

k

k

=

r

J.

=

2

[Var(R^)/k]/[Var(Rj )/12]

1

R _''

t

1

R

t

denoting the total return in month

i=0

converges to unity if returns are uncorrelated through time.

t. 4

This statistic

If some of the

price variation is due to transitory factors, this will generate negative auto-

correlations at some lags and yield

a

variance ratio below one.

The variance ratio is closely related to earlier tests based on estimated

autocorrelations.

Cochrane (1986) shows that the ratio of the k-month return

variance to k times the one-month return variance is approximately equal to

linear combination of sample autocorrelations.

straightforward to show that

(1)

Using his results,

can be approximated by:

it

is

a

k-1

VR(k) =

(2)

1

+ 2

I

J

(-f )p.

K

j=l

1

11

+

11

.

k

-

2

J

L

Jr

12

(

j=l

)PJ

k-1

.

.

i

I

21 J(\M

12k )p J

+

2

i

j=l

.

I

j=i2

(

k

K

)p

•

Ji

The variance ratio statistic places increasing positive weight on autocorrel-

ations up to and including lag 11, with declining positive weight thereafter.

The small sample distribution of the variance ratio can be inferred from

its relationship to the sample autocorrelations.

that under the null hypothesis of serial

Kendall and Stuart (1976) show

independence, the jth sample autocorre-

lation has (i) an expected value of -l/(T-j), where T denotes sample size,

an asymptotic variance of 1/T,

correlations at other lags.

(3)

e(V

and (iii) zero covariance with estimated auto-

The expected value of VR(k)

fVf^

R<io>.iH*

(ii)

l.rf^f

j=i

-

•

J

J

j=i

is therefore:

The variance ratio statistics reported below are bias-corrected by dividing the

measured variance ratio by E(VR(k)). 5

A second test for mean reversion,

used by Fama and French (1987),

involves

regressing multi-period returns on lagged values of multiperiod returns.

This

test is also designed to exploit information on the high-order autocorrelations

in returns.

Kk

(4)

is

The test is based on whether

A

k

=

i *t

t=2k

{

t

k

)7

1

t-2k

{

K

)2

k

~k

significantly different from zero, where R. denotes the de-meaned k-period

return.

The probability limit of this statistic may be approximated as

combination of autocorrelations:

a

linear

-7-

Pi

'

+

2P

"

P

[

+

2

^k

+

•••

k +

kP

(k -^Pk

k +

(2k-2)p

+

(2k-4)p

2

1

==

£ (i+(3-2k)p 1

+

...

+

+l

(3(k-l)-2k)p

|<

_1

+

•••

+

+

...

+ 2 P|< _

+ k P|< +

2p

+ p

2k-2

2k-l

1

(k-l)P

k+1

+

...

P

2k _ 1

)-

applies negative weight to autocorrelations up to order 2k/3, followed by

j3,

increasing positive weight up to lag

k,

followed by decaying positive weights.

The difficulties that affect the variance ratio also induce small sample bias in

/3.

Fama and French (1987) use Monte Carlo simulations to correct this problem.

;

A third method of detecting mean reversion involves computing a likelihood

ratio test of the null hypothesis of serial

alternative.

independence against

a

particular

A wide range of likelihood ratio tests could be developed for dif-

We present results for two such tests below.

ferent alternative hypotheses.

Power Calculations

1.2

To analyze the power of alternative tests for mean reversion, we consider

the class of alternative hypotheses to the random walk model

that Summers

suggests, where the logarithm of stock prices (p.) embodies both

(p*)

and a transitory (u

)

If

pt

=

p* + u

the stationary component is

(7)

=

u

t

p u

t_1

e

+

1

.

t

a

first-order autoregression

+

v

t

then

(8)

Ap

=

t

t

permanent

component. The transitory component might be due to

variation in required returns, or to some type of pricing fads.

(6)

a

(1986)

(l-L)(l-p L)"

1

1

u

t

We assume that

-8-

denotes the innovation in the nonstationary component, p* -p*

where

e

If v

and

are independent,

e

it

straightforward to show that Ap

is

.

follows

an ARMA(1,1) process since

(l- Pl L)Ap

(9)

(l-p L)e + (1-L)u

=

t

t

1

.

t

This description of returns allows us to capture in

a

simple way the possibility

that stock prices contain transitory, but persistent, components.

p.

6

The parameter

determines the persistence of the transitory component, while its importance

movements is determined by the relative magnitudes of a

in return

2

and a

2

.

We perform Monte Carlo experiments by generating 25,000 sequences of 720

returns; the length of each series corresponds to the number of monthly obser-

vations in the Center for Research in Security Prices' data base.

Each return

sequence is generated by drawing 720 pairs of standard normal variates.

2

set a

=

so that the variance of returns (Ap.) equals

1,

We

2

1

+

2a /(1+p-).

The

share of the return variance accounted for by the stationary component is:

2a

=

5

(10)

(1

+

Pl

2

—

)

+

2a

2

v

We parameterize the return generating process by choosing p

choices determine a

p..

=

2

.

We consider cases where 6 equals .25 and .75.

a

generated with

region for

a

We set

half-life of 2.9 years.

In evaluating power,

ic

these

implying that innovations in the transitory price com-

.98 for both cases,

ponent have

and 6;

6=0

we use the empirical distribution of the test statist-

(no transitory component)

to determine the critical

one-sided .05 test of the random walk null against the alternative

hypothesis of mean-reversion.

The panels of Table

1

report the probability that

each test rejects the null hypothesis when the data are generated by the process

indicated at the column head.

The mean value of the test statistic under the

alternative hypothesis is also reported.

The first row in Table

analyzes

1

autocorrelation coefficient.

size .05 test based on the first-order

This test has minimal power against the alter-

native hypotheses we consider-.

is

a

.059 when one quarter of the variation in returns

from the stationary factor, and .076 when three quarters of return movements

are due to transitory pricing factors.

These results confirm the findings of

Shiller and Perron (1985) and Summers (1985).

The next panel

in Table

ranging from 24 to 96 months.

1

considers variance ratio tests with values of k

The results suggest that the variance ratio tests

are much more powerful than tests based on the first-order autocorrelation coef-

ficient, but still have relatively little power to detect mean reversion for

models with fairly persistent transitory components.

When one quarter of the

variation in returns is due to transitory factors, the power of the variance

ratio tests range between .06 and .075.

Even when three quarters of the

variance in returns is due to the stationary component, the power of the test

never rises above .190.

The variance ratio tests over long horizons have

somewhat more power than the tests over short horizons.

It

appears however that

the power gains from lengthening the horizon are largely exhausted after 48

months.

It will

be useful

in considering the empirical

results below to recall

that in the price fads framework, even when the transitory component in prices

has a half-life of less than three years and accounts for three-quarters of the

variation in returns, the variance ratio at 96 months is .67.

Table

1:

Power of Alternative Tests for Transitory Components

Parameters of Return Generating Process

Test

Statistic

p =

5 =

p =

5 =

.98

.25

Mean Value

Mean Value

Power

of Statistic

.98

.75

Power

of Statistic

First-Order

.059

-.002

,076

-.007

24 months

.067

.973

137

.927

36 months

.069

.952

156

.867

48 months

.071

.935

161

.815

60 months

.073

.920

180

.771

72 months

.075

.906

186

.733

84 months

.073

.894

186

.700

96 months

.071

.884

187

.670

12 months

.067

-.044

137

-.089

24 months

.071

-.080

158

-.158

36 months

.071

-.112

159

-.210

48 months

.066

-.141

144

-.250

60 months

.066

-.167

132

-.282

72 months

.059

-.194

113

-.308

84 months

.059

-.221

097

-.332

96 months

.057

-.250

086

-.354

.076

1.244

240

4.497

Autoccorrelation

Variance Ratio

Return Regression

LR Test

Notes:

Tabulations are based on 25000 Monte Carlo experiments using monthly

returns generated by the indicated process, where 5 indicates the

share of return variation due to transitory components, while p

describes the monthly serial correlation in the transitory component,

-10-

The second panel

in Table

1

shows power calculations for the long-horizon

The results are similar to those for variance ratios.

regression tests.

Regression tests appear to be less powerful than variance ratios against our

alternative hypotheses, however, since the maximum power as the length of the

regression horizon varies is below the maximum power for the variance ratio

For example,

test.

the best variance ratio test against the

=

6

power of .075, while the best regression test's power is .071.

the 6

=

.75 case,

the best variance ratio test has a power of

regression test has

a

power of .159.

It

is

.25 case has a

Similarly,

.187;

in

the best

interesting to note that the power

of the regression tests is maximized with windows of about forty-eight months.

The final panel of Table

1

presents results on likelihood ratio tests.

7

When the data are generated by an ARMA(1,1) model, the Neyman-Pearson lemma dictates that the likelihood ratio test is the most powerful test of the null of

serial

independence against this particular alternative.

The power values asso-

ciated with these tests are therefore upper bounds on the possible power that

any other tests could achieve for a given size.

In practice,

even likelihood

ratio tests will have lower power since we are unlikely to construct the test

for the precise alternative hypothesis that generated the data.

Although the likelihood ratio tests have somewhat more power than the

variance ratio tests,

.078 in the 6 =

absolute power levels are still low.

.25 case and

.240 in the

5

=

.75 case,

the

This provides perhaps the most telling

demonstration of the difficulty of distinguishing the random walk model of stock

prices from alternatives that imply highly persistent, yet transitory, price

components.

Even the best possible tests have very low power.

-11-

Evaluating Statistical Significance

1.3

The preceding discussion highlights the low power of available tests for

the presence of transitory components in stock prices.

One dramatic way of

making this point is to note that using the conventional 5% significance level

in

choosing between the random walk hypothesis and our two alternatives involves

probability of Type

in the best case a 76%

II

error rate would be between .85 and .95.

in most

error.

II

Learner

For most tests,

the Type

(1978) echoes a point made

statistics courses, but rarely heeded in practice, when he writes that

"the [popular] rule of thumb, setting the significance level arbitrarily at .05,

is

...

deficient in the sense that from every reasonable viewpoint the signifi-

cance level should be

decreasing function of sample size

a

How should a significance level be set?

judgment.

Figure

1

(p.

92)."

This is obviously

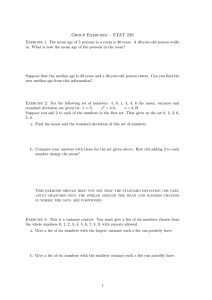

depicts the attainable tradeoff between Type

matter of

a

I

and Type II

errors for the most powerful variance ratio and regression tests, as well as for

the likelihood ratio test against the alternative hypothesis that the data are

generated by an ARMA(1,1) process with three quarters of the monthly return

variation due to transitory price components.

As our previous discussion

suggests, the power curve for the variance ratio test lies everywhere between

the frontiers attainable using regression and likelihood ratio tests.

variance ratio test,

a

.40 significance level

minimize the sum of Type

conventional

Type

I

.05 test,

I

and Type II errors.

is

For the

appropriate if the goal is to

In order to justify using the

one would have to assign three times as great a cost to

as to Type II errors.

Unless one is strongly attached to the random walk hypothesis, significance

levels in excess of .05 seem appropriate in evaluating the importance of tran-

Type

Type

vs.

II

Error

I

Alternative Tests of Mean Reversion

u

u

u

H

H

H

ft

b

i

i

i

i

i

i

i

i

i

i

i

i

i

0.25

i

i

ii

i

i

i

i

i

i

i

i

i

i

Like.

i

i

i

i

i

0.85

Error

I

Ratio

Figure

i

0.65

0.45

Type

Vir. Ratio

i

1

o

Re{.

Beta

-12-

sitory components in stock prices.

the null hypothesis.

We see little basis for strong attachment to

Many plausible alternative models of asset pricing,

involving rational and irrational behavior, suggest the presence of transitory

components.

Furthermore, since the same problems of statistical power which

plague our search for transitory components also complicate the lives of speculators,

it

may be difficult for speculative behavior to eliminate these tran-

sitory components.

The only real solution to the problem of "low power" is the

collection of more data.

In the next section, we try to bring to bear as much

data as possible in evaluating the importance of transitory stock price components.

-13-

2.

Statistical Evidence on Mean Reversion

This section uses variance ratio tests to analyze the importance of sta-

tionary components in stock prices.

We focus primarily on excess and real

returns rather than nominal returns.

Fama and French (1986a) and Lo and

MacKinlay (1987) work with nominal returns, so they are implicitly testing the

hypothesis that nominal ex-ante returns are constant.

8

It seems more natural

to

postulate that the required risk premium is constant, or that the required real

return is constant.

We analyze four major data sets.

The first consists of monthly returns on

the New York Stock Exchange for the period since 1926.

These data have been

used in other studies of mean reversion and are presented in part to demonstrate

our comparability with previous work.

Our second data set includes annual

returns on the Standard and Poor's stock price indices for the period since

1871.

Although these data are less reliable than the monthly CRSP data, they

Third, we analyze post-war monthly

are available for a much longer period.

stock returns for seventeen stock markets outside the United States.

Finally,

we consider data on individual firms in the United States for the post-1926

period to explore both mean reversion in individual share prices, and to study

whether share prices tend to revert to

2.1

a

market average.

Monthly NYSE Returns, 1926-1985

We begin by analyzing monthly returns on both the value-weighted and equal-

weighted NYSE indices from the Center for Research in Security Prices data base

for the 1926-1985 period.

We consider nominal returns on these indices, excess

returns with the risk-free rate measured as the Treasury bill yield, as well as

real

returns measured using the CPI inflation rate.

-14-

The variance ratio statistics for these series are shown in Table

2.

We

confirm Fama and French's (1986a) finding that returns at long horizons exhibit

negative serial correlation, as reflected in values of the variance ratio far

below unity.

The same findings obtain for both real and excess returns.

Typically, the results indicate that the variance of eight year returns is about

four rather than eight times the variance of one year returns.

The point esti-

mates thus suggest more mean reversion in stock prices than the examples of the

previous section where transitory components accounted for three quarters of the

variance in returns.

serial

Despite the low power of our tests, the null hypothesis of

independence is rejected at the .08 level for value-weighted excess

returns, and the .005 level for equal-weighted excess returns.

is

9

Mean reversion

more pronounced for the equal-weighted than for the value-weighted index, but

the variance ratios at long horizons are well below unity for both indices.

The variance ratios also suggest that at horizons shorter than one year,

there is some positive autocorrelation in returns.

The variance of the one

month return on the equal weighted index is only .79 times as large as

be predicted to be given the variability of twelve-month returns.

conclusion applies to the value-weighted index.

it

would

A similar

This finding of first positive

then negative serial correlation accounts for Lo and MacKinlay's (1987a) result

that variance ratios exceed unity in their weekly data, while variance ratios

fall below one in other studies concerned with longer horizons. 1"

An issue that arises in analzying results for the CRSP sample is the sen-

sitivity of the findings to inclusion or exclusion of the Depression years.

A

number of previous studies, such as Officer (1973), have documented the unusual

behavior of stock prices during the early 1930s, and one could make

a

serious

c

o

CM «*

** CD

ID CO

CD

O

«*

CD

in ro

t- «tf

t— CD

ID CO

in **

ro CD

ro ro

o

**

CD CD

CM ro

in «*

CM CD

** ro

O O

o O

O O

O O

O o

O O

D

CO

CO

o

•r-

to

-

x:

+j

c

o

—

—

^-^

*

^-^

^

—

^-^

ID CO

co in

in co

CD CO

in in

in ro

CD CO

00 in

ID ro

T-H

CO

in

ro

CO CO

t- in

ro ro

C~ CO

co

>* ro

o o

o o

O O

o o

o o

o o

CO

>=f

m

to

—

*

t-

o

r-

-

—

*—*

co CM

t- ro

CO

CD CM

in ro

ro

CD CM

in ro

CD

«* CM

id ro

o o

o o

o o

o o

—

.

o

i—

CM

ro

ID

CO CM

CD ro

o o

o o

O

o

o

CO

+J

o

4-

^^

—

-

O

o

o

CL

z

T3

<4-

CD

-M

01

CD

[_

!_

CD

+->

O

in CO

in tCO CM

c

o

rH

I

ID

CM

CD

O O

o O

o O

o

—

in t~

r- CM

CO

CM tr- CM

.—

ID CO

co rr- cm

o o

o O

o o

.—

CO

*-*.

o

>

r-t

CD

o

E o

O)

01

(D

o

cd

cd

Dc

c

o

ro CM

co ro

CO CM

**

t-

CM

CO

00 CM

^—

t~ CM

I"H ro

CD CM

CD

Q

C

o

>

o o

o O

O o

—

*^

,*-»

»

—

CO

CO

*r—

r-

ro

o o

o o

O O

0)

01

ai

01

CD

X

.c

1

—

*~^

crrH

~—

T-< tt— tO) r-l

CD t—

CO eCD I-H

CM r<— fCD i-i

CD

T-*

in t~

CM C—

CD t-H

o o

O o

O o

o o

O o

O O

^^

>=r

rCD

,

^-^

^^»

CM ft—

o

L.

CD

l/>

LU M-

O

•

01

10

T-

c C

3 CD O

c •r-

SZ

CO

(0

4->

-M

>

CL

CO

O

0)

c

•r-

sz 1

O

Q.

01

<D

M-

01

CD

Cl

>»

i— _C

CD

1_

o 3

O

J_

o

u c

CD

c

o

3

O

O

o

c

x:

^:

en

"3-

CD

CO

+j

CO CM

t- ro

CO CM

•r-

CD

L.

>

CM

ro ro

CO CM

CO

i

CO

CO

t-H

co

to

CD

r-

£_

CO

CM

in ro

CO CM

I-H

*r-

+J

z:

-a

^^

*—~.

o

O

CJ

3

cr

r-

+->

£_

CO

CO

•

c:

oi

CO

00

o

•r-

-M

1

-—

ID 00

00 t~

r- CM

<D

o

CO

T3

CD

^-^

o

+->

2

CM CO

CCO CM

E

01

t-

CD

•r-

in

CO

en

ro

+- x: H-

LU

CO

x:

c

l/l

co

c

o

r—

T5

CD

CD

—

r—

3

C

O

o

O

> in

x:

CM

-rJ

CO

o

en

CM

O

to

or

i-i

^-«

co

o

rH

o

-—

^^

CO

CM CO

I-H

r-H

CO CO

CD

CD r-H

.—

*-~.

O CO

ro o

O

o

ID

ro

o

O

t-H

o

T~t

i—"

o o

o

O

t-H

^-%

O

CO

rH O

O rH

rH O

O

O o

o;

c

L.

3

M

•

CD

O

CD

u

•r—

*4-

>

o

c

CO

r-

*-~.

ro

co

C-

s_

CO

>

o

m

i-l

o o

CM

>

ID

t—

r-

o

m

rH

O o

*

s

«*

CD

t—

—

m

o

I-H

CD

O o

rH

o o

D

01

CD

01

CO

1_

•r-

t-t

o o

o o

CD

^^

o

o

in

x:

w

>

-M MCO

l_

a;

C

3

I™

+J

CO

-r-

>

etf>

<*>

<*>

i-H

ID

r-

o

<*?

(1)

CD

ID

—

O

o

CM

CD

CM

CD

-a

o

CM

CD

CM

CO

I_

4->

0)

or

q

CM

<*>

<•*

CM

CD

s_

co

3 CO

C T3

C C

<

u

x:

CD

SZ XI

CD

JZ

CO

c c

o r-

CO

to

"O

CD

+>

c

i.

3

"O

CD

+J

00

c

L.

3

o

"O

CD

CD

4->

oi

to

a;

X! +J

a> <u

sz

CD +J

i- or

x:

a>

•r—

*r-

cu

•r-

c

L3

CD

or

CD

-H

CO

CD

2

1

rCO

C

3 -rr- £

CO

O

CD

CO

CO

Q

> 2

2

i

CD

3

r—

CO

>

2

t/i

CD

0)

3

o

X

LU

<D

i

CO

>

±>

SZ -M

O) CD

T" cc

CD

2

or

I

(/)

I

CO

CD

or

D

<V

-M

CO

c

1_

3

bias

l/l

c

JZ

a> -p

sz

a>

CD

•f-

c

3

CD

cr

(D

+J

i

U)

in

0)

r—

LU

LU LU

z

CD

*->

CO

3 o

IT X

2

i

3

3 !_

o o

r—

CL

CO

CD

I_

CJ

<D

or

i

CO

<D

•r-

r— -M +J

"D

•r—

2

I

CO

{/I

c

CO -1—

3 E

Vo

i

i

m

c

i_

3

i—

CO

cr

lu or

• •

CO

CD

1

•f-

o

z.

an

of

on

+->

!_

CD

t

•T—

co

O

c

(0

c

CD

o c O CD

o C E

oCD E •r-co ro

c

CO 001

CO

CO

X! or > ro

c

o

£-

C

3

c

>*

s_ XI +->

•T—

c 3

o +J - c

£ (D O 3

CO

CD

r-

+-'

CO

<D

X>

in

co in

r- i-h

^*

*-^

o o

o in

CD

CO

•r-

CD

rCl

> £

CD

u

CO

co

-15-

argument for excluding these years from analyses designed to shed light on

current conditions.

included,

The counter-argument, suggesting this period should be

is that the 1930s by

virtue of the large movements in prices contain

great deal of information about the persistence of price shocks.

a

We explored

the robustness of our findings by truncating the sample period at both the

beginning and the end.

Excluding the first ten years of the sample slightly

weakens the evidence for mean-reversion at long horizons.

The negative serial

correlation in nominal returns is virtually unaffected by this sample change,

and the results for both equal-weighted real and excess returns are also quite

robust.

The long-horizon variance ratios for real and excess returns on the

value-weighted index rise substantially, however.

The 96-month variance ratios

are .94 and 1.07 for these two return series, compared with .71 and .54 for the

real and excess returns on the equal-weighted index.

Truncating the sample to

exclude the last ten years of data has an opposite effect on the estimated

variance ratios; the evidence for mean reversion is even more pronounced than

for the full sample period.

The postwar period, another subsample we analyzed,

displays less mean reversion than the full sample or the post-1936 period.

2.2

Historical Data for the United States

The CRSP data are the best available for analyzing recent U.S. experience,

but the low power of the available statistical tests suggests the value of exa-

mining other data as well.

Merton (1987).

This also reduces the data-mining risks stressed by

We therefore consider returns based on the combined Standard and

Poors'/Cowles Commission stock price indices that are available beginning in

1871.

These data have recently been checked and corrected for errors by Jones

-16-

and Wilson (1986); we use the series they report for the pre-1926 period.

We

analyze annual return series for the period 1871-1925, as well as the longer

1871-1985 period.

The S&P data have the advantage of being used relatively

infrequently in studies of the serial correlation properties of stock returns.

We again consider nominal, excess, and real returns.

The results are presented in Table

For the pre-1925 period,

3.

the nominal

and excess returns display pronounced negative serial correlation at long horiFor the real returns,

zons.

however, this pattern is much weaker.

Although the

explanation of this phenomenon is unclear, it appears to result from the jagged

character of the Consumer Price Index series in the years before 1900.

The ex

post inflation rate may prove a particularly unreliable measure of expected

inflation during this period.

for the full

The three lower rows in Table

1871-1985 sample period.

All

3

present results

three return series show negative

serial correlation at long lags, but real and excess returns provide less evi-

dence of mean-reversion than the monthly post-1925 CRSP data.

2.3

Equity Markets Outside the United States

Additional evidence on mean reversion can be obtained by analyzing the

behavior of equity markets outside the United States.

Canada for the period since 1919,

in Britain since 1939,

nations for shorter post-war periods.

and in fifteen other

The Canadian data set consists of monthly

capital gains on the Toronto Stock Exchange.

returns,

We analyze returns in

The British data are monthly

inclusive of dividends, on the Financial Times -Actuaries Share Price

Index.

Results for these two equity markets are shown in the first two rows of

Table

4.

Both markets display substantively important mean reversion at long

ro

-m

i—

1

«tf

ID

CO

O O

o

C- ID

CO

CO *»

O

cn

co cn

ID CM

CO

co cn

CO CM

O

-H

co cn

£- CM

O O

O O

O O

o o

o o

I

ro

O

ID

"3 CO

i—

cn -0

1

c -1—

c

aj

s_

ro

(U

X

O

~o

(J)

1_

c

3

to

-C

w

c

2:

O

*—

"tf

CO

en

co

•

•

—

-Cf

O

CO

i-h en

** CO

o o

O

CO

1-1 en

t- CO

o o

CO ID

CO (D

ID CM

O O

r- ID

ID

CO CM

O

o o

ID ID

in id

t- CM

CD

+J

-C

h-

1

Ol

c

ro

O O

CD

.C

(0

<D

3

CD

F

Q.

C

1—

w

>>

1

>

"1—

.

CO

10

c

in

3

I-H

1/1

r— r— cID

O

O

^

CD CO

^t in

»* CO

•**

00

id in

«* CO

tco

t-

CO

in

co

t- CM

ID

in

CO CM

o o

o o

o o

O O

o o

o o

-W

CO

ro

I-H

in

0)

o

tcn «*

t- CM

si

O

+j

•r-

>

-C

ro

r- i-h

in ro

r-i

C

o

s:

o

w

o o

CM CO

CO i-H

in co

o o

o

co

CM i-H

CO CO

o o

ID ,-H

CM ,-H

CO CM

O

O

I-H

i-H

en cm

CM

"=f

i-H

l-H

CO CM

O O

ZD

r—

w

ro

jr

u

L

o

+->

c

o

r-

2:

4-1

r-H in

en id

in cm

id

in

ID

CO CM

in

co

co

o o

o o

o o

O

i-h

cn cn

cm rcn i-h

id cn

r- rCO i-H

o o

O o

o o

cn

c-

CO

«*

(/)

*r—

X

3

C

CM

0)

c

L.

TJ

CD

0J

a.'

TJ

X!

V)

c

ro

•r~

>

4->

r-

.Q

L.

in

o

.c

-M

1/1

z

c

o

r"

+J

-U

C

3

+->

^

L.

o

CM

ID CM

O O

O O

O

ID

O

CM

i-H

m

<D r-l

C- CM

co

cn «*

CO rH

cm co

cm «*

Cn r-H

o o

o o

o o

o

co

CO

ro

«*

i-h

o o

C c O

(0 Q.

ro

1— c

03

£ I_ O

ro

-C

ai

4->

-C

+j

s

-C

M

C

O

ro

-r—

s

!_

ro

>

ro

en

o

i-h

o o

in

o

I-H

«3-

en

<-i

ID

cn

cn

O

«a-

i-h

in in

ro cn

o o

t- in

«tf cn

o o

in in

ro cn

o o

O

+J

ro

!_

o o

(NJ

(/)

C

c

CD

r-

.Q

L.

co

co

O

s_

OC

ro

O

4->

£_

CO

-—

t-

co

4-1

*—

CO

to

-r—

CD

+J

+->

w

3

>->

(0

•!-

*>

>

CD

CD

?

s

ID

a:

CM

CM

+J

CO

03

co

if)

I_

ro

3 (0

C T3

c c

<

L.

co

*r~

TO

C

c

co

3

+J

ffl

CO

+j r—

L0

w

3

^ C

L.

-M

in

c

L.

3

c

I_

+->

<U

in

CM

1— cn

(0

c

•rE

O

1—

1

1—

tCO

a;

m

c

t_

3

m

or CM

cn

4->

t—

tx

w

(A

CD

X

LU

3

(/)

3

+->

a

£_

r-t

t—

d'

cn

H

1

1

!_

+J

in

CM

I-H

CO

co

<D

CO

1-1

or

I-H

ir-

rr

Ifl

CO

r— cn

co

c

'I—

t-H

1

pH

E t~

O

CD

CO

3

c

*->

I_

in

or co

<v

c1/1

10

CD

-C

10

pH

3

4->

a>

co

in

CO

cn

or i—

1

X

(H

eco

LLI

I-H

UJ

r—

i—

ro

0}

rco

K

I-H

in

CD

-M

o

(0

C

0)

l_

CO

C

w

c

c

(/)

c

in

CD

in

0)

in

CD

c

O

•->

a>

>

•1—

in

CD

L.

c

-r-

r—

£_

p

1

r- "O

c

in

c 2

in

T>

o

cn

CM

CO

i-H

CD

aO^

+J

c

CO

C

S3

•

1— TT CO

> C cn

—CD

> O

£_

c

-

1—

CJ

m

ro

U

M- CL

r-

**

h-

>

CO

•r-

in

o

c

CD

-h

a) •r-

(/)

CC

<u

in

rc

(/)

O

c-

ID

ro

ro

^

^ O

O O

r-

O

4-

ro

12

-C

+J

c

3

cm in

CO ID

in cm

CD

X

ID

•

X5

ro

1

ro

0)

L.

O

O "O

O ^

m

1

o

O

-H

1

Q. a.

CO

c

•r~

TJ

CD

4->

CD

L.

(0

ro

S_

O

a

CD

t_

4J

JZ co

+J TC

in

co

—

'1

-3

CO

C—

tID

in

C- rco to

OD in

O

H

Cin ID

1—1 in

rH

—

s

1

O

*

co cd

tro id

o

1

—

——

1

r—

id

id in

cf>

rsi

c—

CO to

ro id

r\j

O

CM

-

—

tID

00 in

t-

1

o

O

*3

m

—

-1.

1

•>*

ro t—

ro

in ro

m

t-H

ID

CD

t-H

O

O

O

— — — — —

-

CO

r—

ro

n

!_

rc

c

t-H

CO

ro

E

r-

CD

n

C

r—

ro

co

c

1

ro

CO

«3

t—

co

in

CO CO

CD

CO in

O

CO

ro

r-l

<—

in

r- 10

>? in

ro in

(D I—

r- in

CD CO

CO r-l

in

ro CO

O

CO

!-H

m

ro

CM CM

CO t—

O

O

rM

t-H

CO

CO in

CM CM

t— r-H

O

•1-

ro

•M r-

+->

(_

CO

ro

4-1

O

•r—

TO

ro

u-

-M

CT>

•

ro

M

^

3

-w

ro

-

CO

ro

XI

o

c

TO r—

in

CM

co

c

o

(D

CD

ro

»3

ID

CO

"3/

O

o

O

CD

O

«3

ID

«3

ID

cm

CD

*3

r-

r-l

O

rM

O O

O

CO

CD

ID

"3-

CD

"3

ID

r-l

*3-

O

*3 «3

ID

CO »3

in

CD i-l

CO rH

O

O

O

CM

T-H

t-H

r-l

CO

CD

-r-

-C

ID

-C

(—

O

C

ro

c

to

CD

-C

•

CO -r-

o

c

10

I-

r-

M

ro

ro

ro

O

ro

>3

r— *3

CO

en

"3-

O

0)

CO

EC

O O

O

O

O

CO

ro

ro

«3

in ro

CO

CO «3/

O

O

CM

"3

ro

ro

O

«3

O

H O

ID ro

CD

ID «3

ro in

CD

CD

O O

r- CO

r- CD

co

2:

ID

CM

CD

(0

o>

«3

ro

ro

O O

0:

t— *3

ro

t- ro

O

ro «3ID ro

CD ro

O

O O

CD

ro in

CO ro

T-H

r-

O

"3-

ro

CD ro

O

•3

ro

ro ro

O

T-H

ID

in ro

ID ro

in CD

ro t-

O

1—

O

O

in t-H

CO CO

CD

c

o

"3

ID

CM

CD «3

«* LO

t— cm

O O

o o

1-1

ro

Q

CO

CD

c

O

<

ro

ID ID

rM

o

"3-

CO

m

ro

trsi

cm «aCM ID

CO CM

ID «3

en

ro rM

m

ro

un

ID

O

ID

O

>a-

m

CSJ

4-"

L.

ro

ro

c > O

+j

co

ro

O

01

D

1

,

U

ro

u

>

r-

^

T)

-m

!_

<D

CD

£.

t—

CD

-m

-IH

ro

!_

t-H

CD

O

O

u.

c

c

o

ra

CD

-M

co

CT>

ro

rc

t—l

O

i_

<

c

<])

O

CD

C

L

L.

O O

>

-

O TO

c c •rro

3 ro

TO

c

Mrc

>

O

1

CD

to

sz

a>

Ol

t_

ro

CO

•

-1—

JZ

+J

4->

CD CM

ro id

H

ro

i_

CD

o o

o o

0)

CJ

ro

c c

o o

ro

•r-

(0

c

ro

ro

CD

O

m

CO

m

m

CD

t-H

in

t-H

O

rH

rH in

in in

t-H

t-H

CD ID

CO ID

CM t-H

CO in

CD in

CO

f-H

t-H

ro in

»3

ro t-H

m

•>3

t—1

m

m

CD rCO ro

CO rH

t-H

t-H

O

r- co

r- ro

O

ro

j:

r~

>

10

ro

0)

rc

ro

irc

>^

>

JZ

£_

c

ro

!_

a>

c

•I—

j:

4-1

-u

01

C c c •r> C

r- X

CD

CD

b

TO -M

X

01

c CD

TO rH '_ £_ TO

C

ro

C

ro

•

t-H

ro

O

CD

TO SI

a;

•r—

>*

ro

4->

t-H

O

o

ID

ro

"3-

O

i—t

t-H

t-H

rM

CD

CM

"3-

O O

(T3

rID t-H

r- rM

O O

ro

O

ro

ID rM

O O

CO «3CM t-H

f- CM

O O

CD "3CO 1—

r- rM

ro

"3-

CO

CM

O D

rH

in

r-

O

m

O

O

ID

ID in

t-

O

01

JZ.

(D

CD

(0

ro

!_

^

+J

cd

cro

rc

t—

>

d?

d?

<#

c*

dP

<W

d?

0)

Q

0)

CM

r-

CM

r-

rH

in

ID

r— "O

rc

1

ro

cm

CD

CM

CM

ro

+J

CO

.^^

>

rC

O

O)

i

a

CD

r^

1

CO

r;

r-

F

r-

1_

ro

(1)

in

tfl

•v

lf)

CO

CD

rH r—

c

!_

1_

>

M

01

C

"I

O

a:

CJ

=>

-t-'

T-t

+-

CC

•r-

CD

rM

IT.

ID

CD

rH

rM

-C

3

TJ

C C

w

t-H

£_

C

<

rCM

co

CD

CO

CD

*\

ro

ro

ID

CO

CD

t-H

1

rin

CD

^^

>

T—

C

O

CO

m OC

CD

t-H

CO

c

-T-

in

CO

CO

•»—

CO

•r-

ro

r—

Q.

ro

•1-

(0

£

Cl

r—

r—

I_

ro

-r-

^—

0-

r-

Q.

CJ

—

s

ro

c

M- r—

<.

-C

4J

3

O

CJ

*—^

>

>

r—

CD

CO

CD

O

CO

c

t-H •r-

a

ro

1

t-H

CO

ID

CD r—

ID

CO

CD

t-H

1

10

CD

•r-

~^

c

K

rH r—

r—

ro

t-H

ro

>X

+-

a

-M

-r"

ai

-r-

c

Q.

•r—

Q.

ro

ro

ro

—

a. cj

X

CO

CO

CJ

'

TO

rc

C

N

C

CD

-ii

ro

ro

c

J_

>.

ro

ro

TO

0)

to

ro

C

-£

-m

-M

CD

CO

CD

ro

t-H

CO

c

to

c

rc

CO

1

m

r—

ro

CD

ro

4H

rH +j

r-

-r—

ro

•r-

ro

CJ

s —

*

\

•

n

CO

ro

.

r>

CO

CO

OJ

3

-r—

t—

1

CQ

CJ

-

—

(0

•

CD

:o

1

3

—

->

ro

cn

10

CD

W

ro

CD

to

ro

1

ro

>

TO

C

>

-O

3

ro r—

c O

0)

X

> OJ

< —

>

•r-

-r—

CD

a>

c

CD

TJ

D

c O

(D

X

> UJ

—

Dl

ro

<L

1

-

X

to

CD

(J

O

CJ

a>

c

•r-

4J

CT

D

O

i_

ro

CD

TJ

>

0.)

ro

a >

F

<Zl

ro

TO

CD

a.

to

1

E c

c

in

—

c

r

CJ

c

en

r—

TO -w

CD

-

•

•r—

a

CO

-M

a.

4-J

CJ

to

2

Q. 4H

Q.

*

ro

JZ

rc

ro

!_

(D

ro

•r-

>>

r—

O

rc

>

a)

>.

r—

t-H

T3

01

4J

1—

0)

r-

I_ -rrc ro

1

z>

C

4-J

-1—

r,

1/1

TO

ro

*-^

m O

t~

in CO

CD

^^

c

O

O

f-

*^-»

r-

4H

•1—

CO

CO

CD

t-H

1

C

t—

ro

rc

u

>

^-

c

^—

r—

c

*j

O

1

—

*f—

rH

-r-

Z

t-H

*

V,

>- +j

•r-

ID

CO

CD

<J-

•4-

TO

c ai

o c

*J

cr

.0

C

2

4H

ro

'T—

c

I_

3

rc

4->

o

c

r-

a>

I_

cj

>

4-<

M-

0)

c

JZ

to

O

Cro

£_

.c

CO

cr

0)

ro

TO

E

o

+-'

1

4^

c

-r-

CD

O

z>

TO

O C

D.

•r-

-18-

fifteen countries have variance ratios at 96 months that exceed unity, and many

Evidence of positive serial correlation at short hori-

are substantially below.

zons is also pervasive.

In only one country,

one month greater than unity.

Colombia,

is the

variance ratio at

The short data samples make it extremely dif-

ficult to reject the null hypothesis of serial independence for any individual

country.

Nonetheless, the similarity of the results for the majority of nations

supports our earlier conclusion of potentially important transitory price components.

The average variance ratios at each horizon are shown in the last two rows

of the table.

The mean 96-month variance ratio is .754 when all countries are

aggregated, and .653 when we exclude Spain (which is clearly an outlier, pro-

bably because of the unusual pattern of hyperinflation followed by deflation

that it experienced during our sample).

also obtain

a

By averaging across many countries, we

more precise estimate of the long-horizon variance ratios.

The

standard error of the Spain-exclusive average for the 96-month variance ratio is

.142 assuming that the variance ratios for different countries are independent.

If we assume that these statistics have a correlation of

.25,

however,

the stan-

dard error rises to .326, again implying that the null hypothesis of serial

independence would not be rejected at standard levels.

3

The qualitative results

on positive autocorrelation at short horizons and negative autocorrelation at

long lags are,

2.4.

however, supportive of our qualitative findings using CRSP data.

Individual Firm Data

We also consider evidence on mean reversion for individual firms.

It

is

much less plausible on a priori grounds to expect transitory components in the

-19-

relative prices of -individual stocks than in the market as

a

whole.

Arbitrag-

eurs should find the task of trading in individual securities to correct mis-

pricing far easier than taking positions in the entire market to offset persistent misvaluations.

some previous work has suggested that

In spite of this,

individual stock returns may exhibit negative serial correlation.

Miller and

Scholes (1982), for example, show that regressing ex post returns on the

reciprocal of the stock price yields

a

significant negative coefficient.

the reciprocal price is close to the cumulative value of past returns,

Since

this

indicates higher returns after periods of poor performance.

We examine the 82 firms in the CRSP monthly master file that have no

missing return information between 1926 and 1985.

biases in

a

sample of this type.

It

is

There are

a

number of obvious

weighted toward large firms that have

been traded actively over the entire period.

Firms that went bankrupt or began

trading during the sample period are necessarily excluded.

Since the value

weighted NYSE index shows less mean reversion than the equal weighted index,

our sample of 82 large firms might display less mean reversion than a sample of

smaller stocks traded over shorter periods.

For these 82 firms, however, we

compute variance ratios using both nominal and real returns.

Because the

returns on different firms are not independent, we also examine the returns on

portfolios formed by buying one dollar of each firm, and short-selling $82 of

the aggregate market.

R

mt

wnere

R

mt

^

s

That is, we examine properties of the time series R-

tne va ^ ue ~ we "i9hted NYSE return.

t

4

The mean values of the individual firm variance ratios are shown in Table

5.

They suggest some long-horizon mean reversion for individual stock prices

relative to the overall market or relative to

a

risk-free return.

Although the

10

c

o

10

T-

C

i3

+J

+J

cu

C

ro

cu

l_

ro

-r-

>

cu

-D

L0

E

£_

-i—

CO "*

t- >*

CD

c

O

o o

o

CD

ro

c-

*3"tf

o

o o

ID **

CO

CO

^

o

o o

ID

CD

a. -d MCO s_

cr ro *->

o u

c

ro

cu

£_

cu

L0

M4-

c o

O i—

E C

•T—

c

—^ -m

-C

+J

O

O »*

C- O

o o

CD

C

o

ID

CO

CT)

rH

*

•*

00

"

O

in *J

t- o

o o

Lf)

o

o

o o

CO

CD «*

CO

CM LO

CO 00

t-

o

o o

o

CM

r-

o w

cm ro

CO o

o o

co

cm ro

O)

co

o

o o

I-l

c

o

l-<

CD CO

CO

O

o o

2:

o

CO i-l

co ro

CO

O

o o

CO rH

CD ro

en

O

o o

CM CD

ro cm

O)

c

o

o o

o

CO

O

o o

CM CD

CM

O

o o

O

t-H

4-

cu

I_

ro

a.

T3

c

CU

-r-

<—

ro

O

cu

u

c

ro

•r-

L.

ro

cu

-C

+J

M

ro

x

+J

CO

O

o

o o

CM

c

o

en cm

ai

ID

ro

o o

O CM

o o

o

o o

4-<

CM

i—i

CU

i-i

u

C

-D

c

r-

ro

!_

ro

i—i

>

••

CO

CM

-C en

+J l-H

CU

o

-C

ro

c

o

r-l

CM

ro

i-<

o o

O

cr

r-l

CD

-a-

o

c

CM

m cm

ro

o o

o

t-t

«*

ro

CM

«-i

o o

<-<

ro

•r-

c

o

CU

a

<• rCO i-H

en

o

o o

CM t>*

t-H

o

o o

ai

CO

co

c~

«-<

o o

rH O

LU

r- CO

+<

*I—

4ro

1

ro

^—

t—

CU

ro

CU

CU

CU

cr

J-J

cr

ro

CU

o

c

L0

ro

.c

C

£_

3

CO

cr

+-

c

!_

3

CU

+->

cu

cu

i_

0)

U-

Q

cu

o

c

o

o

1

ce

cr

*->

CU

rr

C

s_

3

-H

cu

ro

c

•rE

O

z

L0

LO

cu

CO

•1

rr

u

X o

OJ +J

CU

t-

>

CU

C

o

o

a>

03

L.

CU

c-

x:

>

-t-"

+j

C

ro

!-

x:

D)

TCU

2

>

cu

LO

10

CU

r-

cu

s

x:

cu

ro

>

-M

cu

-o

CU

CU

o.

4J

ro

-r-

<4-

UJ M-

O

in

c

x:

i—

CU

•

+J

c

U

3

O

X o

UJ

O !O. +J

cu

rr

_y

i

c

I3

1

co

3 •r—

O l_

3 ro

C >

T5

4->

ro

LO

>

z

a.

-h

!_

>

>

CU

M

-o

-M

cu

OJ

T3

cu

L0

>

c

3

ro

ro

<

!_

cu

T3

3

E

H- C O

o cu o

0)

CU

2 ^

O) -M o

•1—

ns

CU

C JD +'

(0

CU

> ro l.

•t-'

!_

L0

L0

ro

..

rH CM

to

E

in cu

CO JZ

en +J

en

ro

a.

3

O

ro

t-

x:

•r-

ro

>

.

+J

CO

r-

CO

r-

3

>

c

O

CJ

O

CD

CD CM

CD

T3

!_

ro

CM

CO

LO

QJ

LO

CU

ro

:_

c

cu

3 3 o

CO

o

LO

-—

LO

(0

o

4-

(0

>

a

•r-

CU

!_

(0

+j

CD

E

O

o

M c >

lo

u

c

i-

<D X:

x: -M

x:

c

o

+*

E

CU

cr

£_

4-

cu

L0

c

M

w

O

s

lo

co

c

i3

CU

-C

T3

c c O

o o •f—

4->

I

ID

CM

ro

CU

•o

C

-i-

-20-

point estimates suggest that only twelve percent of the 8-year variance in firm

excess returns is due to stationary factors, the increased precision gained by

studying returns on many independent firms enables us to reject the null

hypothesis that all of the return variation arises from non-stationary factors.

However, there is also much less evidence than for the market aggregate of posi-

tive short-run serial correlation in excess returns, since the one-month

variance ratios are close to unity.

2.5.

Summary

The power calculations of the last section demonstrate the difficulty of

detecting mean reversion in stock prices.

tests, our results are quite striking.

Given the low power of available

The point estimates generally suggest

that over long horizons return variance rises less than proportionally with

time, and in many cases imply more mean reversion than our examples in the last

section where transitory factors accounted for three-fourths of the variation in

Many of the results imply rejections of the null hypothesis of serial

returns.

independence at the .15 level,

a

level

that may not be inappropriate given our

previous discussion of size vs. power tradeoffs.

Furthermore, each of the dif-

ferent types of data we analyze provides evidence of some deviation from serial

independence in stock returns.

Taken together, the results are stronger than

any individual finding.

It

is

interesting to note that there is

a

clear tendency for more mean

reversion in less broad-based and sophisticated equity markets.

The U.S. data

before 1925 show greater evidence of mean-reversion than the post-1926 data,

especially when we recognize that the appropriate comparison series for the

-21-

Standard and Poor's index is the value-weighted NYSE.

The equal-weighted port-

folio of NYSE stocks exhibits more mean reversion than the value-weighted portfolio.

In recent years,

mean reversion is more pronounced in foreign countries

with less sophisticated equity markets than the United States.

-22-

The Substantive Importance of Transitory Components in Stock Prices

3.

Our discussion so far has focused on the strength of the statistical evi-

dence regarding transitory price components.

This section uses our point esti-

mates of the degree of mean reversion in stock prices to assess their substantive importance.

One possible approach would involve calibrating models of the

class considered in the first section.

We do not follow this strategy because

our finding of positive autocorrelation over short intervals implies that the

AR(1) specification of the transitory component is inappropriate.

Instead, we

use an approach that does not require us to specify a process for the transitory

component, but allows us to focus on its standard deviation and the fraction of

the variance in one period returns that can be attributed to it.

We treat stock prices

itory component.

p,

as the sum of a permanent component and a trans-

The permanent component evolves as a random walk and the tran-

sitory component follows

stationary process, A(L)u.

a

may be given two (not necessarily mutually exclusive)

u.

= v..

This decomposition

interpretations.

First,

may reflect "fads", speculation-induced deviations of prices from fundamental

values.

Second,

u.

may be

consequence of changes in required returns.

a

either case, describing the stochastic properties of

u.

is a way of

In

characteriz-

ing the part of stock price movements that cannot be explained on the basis of

changing expectations about future cash flows.

Given our assumptions, the variance of T period returns is:

o*

(11)

where a

is the

=

Ta

2

e

2

is the

+

2(l-p )cA

T

variance of innovations to the permanent price component, a

variance of the stationary component, and p

ation of the stationary component.

is the

2

T-period autocorrel-

Given data on the variance of returns over

-23-

two different horizons T and T', and assumptions about p T and p Jt

equations with the form (11) can be solved to yield estimates of a

-1

Using a

2

R