Document 11158489

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium

Member

Libraries

http://www.archive.org/details/heterogeneitystrOObena

HB31

.M415

b>

i

working paper

department

of economics

HETEROGENEITY, STRATIFICATION, AND GROWTH

Roland Benabou

MIT, NBER and CEPR

No.

93-4

Dec.

1992

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

HETEROGENEITY, STRATIFICATION, AND GROWTH

Roland Benabou

MIT, NBER and CEPR

No.

93-4

Dec. 1992

'

:

;

'j

Heterogeneity, Stratification, and

Growth

Roland Benabou

MIT,

NBER

and CEPR.

June 1992

This version

I

am

Tirole,

-

December 1992

grateful to Olivier Blanchard, Ricardo Caballero, Peter

Yoram Weiss and

especially Julio

gratefully acknowledged. All errors are

my

Rotemberg

own.

Diamond, Steven Durlauf, John Heaton, Jean

for helpful discussions.

Financial support from the

NSF

is

Abstract

We

examine how economic

stratification affects inequality

where heterogeneous agents interact through

borhood

effects)

stratified into

We

study economies

goods or externalities (school funding, neigh-

and economy- wide linkages (complementary

growth and welfare when families are

integrated.

local public

and growth over time.

skills,

homogeneous

knowledge

local

spillovers).

We

compare

communities and when they remain

Segregation tends to minimize the losses from a given amount of heterogeneity, but integra-

tion reduces heterogeneity faster. Society

may

thus face an intertemporal tradeoff: mixing leads to slower

growth in the short run, but to higher output or even productivity growth

occurs in particular

cases of segregation

which structure

is

when comparing

and integration.

more

local

in the long run. This tradeoff

and national funding of education, which correspond to

More

efficient over short

generally,

we

identify the key parameters

special

which determine

and long horizons. Particularly important are the degrees of

complementarity in local and in global interactions.

Introduction

1

In the United States a family's income, assets, education level, ethnic background and lifestyle can be

predicted quite accurately from

its

zip code -and this in spite of the great diversity of the

American

population. 1 This strong degree of social and economic segregation, epitomized of late by the spread of

gated communities,

as

is

reflected in wide disparities in the funding

primary and secondary education or law enforcement.

It

and quality of

local public services, such

also manifests itself in the increasingly different

types of behavior and values to which the young are exposed during their formative years.

The production

of goods and services thus brings together on the factory floor and at the office workers

on the one hand, managers and professionals on the other, whose upbringing and

are

becoming increasingly disparate. Could

human

levels of

capital

and outcomes

this polarization of educational opportunities

be a contributing factor not only to the widening inequality in income and wealth observed over the

decade, but also to the slowdown of productivity growth?

One

reads for instance in the

MIT

last

Commission's

Report on Industrial Productivity:

"American and foreign students

not only in their average scores on standardized tests

differ

but also in the dispersion of those scores around the mean. The Japanese aim at bringing

students to a high

.

.

common

level of

competence, and they are largely successful; as a result

.new entrants to the Japanese work

In the U.S.

learn.

work

force,

force are generally literate, numerate,

employers have discovered high rates of

with basic mathematics and reading in workers with high school diplomas

of

(

The

young Americans are technologically

Made

in

in

literate

illiteracy

.

.

.

and

difficulty

Only a tiny fraction

and have some knowledge of foreign

is

of course

much more heterogeneous than

societies.

the Japanese. But this greater heterogeneity

good part endogenous, precisely because any exogenous differences

historical factors, immigration, or just plain luck) are magnified

1

and prepared to

America, (1989))

U.S. workforce

may be

all

Weiss (1989) provides a comprehensive and

in

human

by economic or social

lively description of the "clusters"

capital (due to

stratification.

In

used in commercial and political marketing.

fact,

a more diverse population

may

increase the value of integration, as

it

accelerates the homogenization

of the labor force. Motivated by these observations, this paper investigates the relationship between the

extent to which an

and

its

The

economy

is

stratified into

homogeneous communities,

its

degree of income inequality,

growth performance over time.

central question

efficient:

is

the following: given a heterogeneous population, which social structure

segregation by income and education, or integration?

is

more

includes as a special case the issue of

It

We

whether public education should be funded locally or nationally.

formalize these issues in a simple

but quite general growth model with both economy-wide linkages (such as complementarity

in

production

or knowledge spillovers) and local, community-level externalities or public goods (such as locally funded

schools or neighborhood effects).

We

show that the answer to the question raised above depends on two

basic effects, which can give rise to an interesting intertemporal tradeoff.

The

first effect

measures how

gating disparate levels of

human

efficient

each social structure

is

at processing heterogeneity,

capital into the production of goods and, ultimately,

show that when family background and community quality are complements

in

i.e.

at aggre-

new knowledge.

We

a child's education, a segre-

gated economy tends to have smaller instantaneous losses, hence faster growth, for any given amount of heterogeneity.

it

The second

effect is

dynamic: because an integrated society

is

better at reducing heterogeneity,

converges faster to a homogeneous outcome-or in the presence of shocks, converges to a

distribution of skills

and income. Integration thus

delivers

much

generations. Is this effect important enough for mixing to be

of

more

its

less

unequal

payoff over the course of several

efficient in

the long run, even

when

it

leads to losses in the short run?

We show

that the answer tends to be affirmative, so that integration at

eventually raises everyone's income.

It is

first

hurts the better off but

then Pareto improving, without need for redistribution, provided

agents have a low enough discount rate. Conversely, increased segregation leads to:

distribution of income;

(ii)

(i)

a widening in the

a short-lived burst of growth, benefiting mostly the better off households;

a decline in the economy's long-run level of output, or even in the long-run growth rate.

these results remain even as

all

(iii)

Remarkably,

global complementarities linking together rich and poor families

become

»

vanishingly small.

Of course,

stratification

is

much

need not be the case that mixing

it

remains more

efficient if the degree

is

preferable in the long run. For instance,

that

of complementarity between agents' levels of human capital

stronger in local interactions than in global interactions. Intuitively, this

knowledge at the community

we show

means that

level (e.g. in schooling) entail sufficiently greater losses

than

disparities in

at the aggregate

level (e.g. in production).

What

paper

this

stratification

offers

But

as

we move

Thinking about extreme

the spillover

is

closer to the

show that one cannot even

(the geometric

helps to clarify

It also

some

issues of aggregation

combined with heterogeneity. In models with a representative agent,

spillovers are specified.

cases, this

may seem obvious;

minimum, to some

identify -as

is

which

it is

arise

how

becomes

naturally the equilibrium will be different

average, or to the

common

when

irrelevant

to models with heterogeneity, the choice of aggregator

and arithmetic averages) without

rate, as well as the

practice- the

significantly

maximum

mean

of

all

agent's actions.

if

But we

of the logs and the log of the

mean

changing the economy's long run growth

normative conclusions about the efficiency of stratification and integration. One must

beyond rough intuitions and pin down the key parameters which determine how heterogeneity

therefore go

affects

thus a framework in which the costs and benefits of different degrees of

can be spelled out.

externalities are

crucial.

is

The aim

growth.

is

not only to clarify the properties implicitly embodied in the specifications of

previous models, but also to provide a guide for future empirical work on spillovers and neighborhood

or peer effects.

2

In addition to the overall degree of returns to scale

community and economy-wide inputs

role played

by the three

interactions,

in the

production of

elasticities of substitution

and between

all

human

and the

capital,

which operate within

relative weights of family,

we bring

local interactions, within global

three inputs.

This paper draws on previous work by Benabou (1991), Tamura (1991a,b) and

(1992).

Benabou (1991) demonstrated that

In a sense our effort

is

similar, in

mapping between various forms

to light the crucial

in

Glomm

and Ravikumar

a general equilibrium context, agents' incentives to segregate

a macroeconomic and dynamic context, to Arnott and Rowse's (1987) study of the

of peer effects

and optimal school

structure.

themselves due to the presence of local externalities or public goods can have important effects on aggregate

productivity and welfare, even with perfect capital markets. But the model was static, hence not suited

to study

growth or the idea that the merits of integration and segregation may look very

Being a model with ex-ante identical agents,

short and in the long run.

whether due to

issue of inequality,

could also not address the

it

conditions or ongoing shocks; nor could

initial

different in the

it

capture the notion of

homogenization over time.

Tamura

human

(1991a) studies endogenous growth

capital spillover,

and shows two main

to decreasing returns, heterogeneity slows

long run the

economy converges

to a

when heterogeneous agents

results.

issue of

how

in a general class of

by an economy- wide

because individual accumulation

First,

down growth. Second,

this effect

is

is

subject

only temporary, as in the

homogeneous outcome. Tamura uses simulations to demonstrate the

vanishing impact of heterogeneity. In this paper

dynamic path,

are linked

we provide

models with both

stratification affects growth,

local

and to answer

it

analytical solutions for the economy's entire

and global

spillovers.

by showing how the

This allows us to raise the

losses per unit of dispersion,

the convergence speed and their interaction differ under segregation and integration.

Glomm and Ravikumar

(1992) compare growth under private and public education. In a private system

parents buy education for their

own

children

and there are no

spillovers. In

Glomm and Ravikumar show

a nationally funded public good, generating again a global spillover.

a private system offers students better incentives to invest in

long-run growth rate.

economy

to

grow

by heterogeneity

adults'

growth.

human

If

also provide

in

is

human

capital,

is

that

and thus leads to a higher

an example where heterogeneity can cause a public education

faster for a while; but they

do not analyze why

this is so.

We make

clear the role played

each system's performance. Most importantly, we show that when children's ability or

capital

there

They

a public system education

is

subject to

random

shocks, public education

may

in fact lead to faster

long-term

even a very small amount of complementarity in the production sector, a move to public

education can be Pareto improving, provided families' intergenerational discount rate

is

low enough. In

any case, both private and nationally funded education systems dominate locally funded public education,

which has neither the incentive properties of the former nor the homogenization properties of the

latter.

Finally, this

paper

is

also closely related to Durlauf (1992)

and

S.

Cooper (1992), through a shared

how community

concern about the effects of stratification in a dynamic, stochastic economy. Durlauf shows

formation and local funding of education can generate path-dependence in lineage income, trapping some

families in pockets of poverty while others enjoy growth. S.

his model,

Cooper (1992) incorporates redistribution

into

by allowing communities linked through production externalities to vote on cross-subsidies. Our

main concern here

how

is

stratification affects the

growth performance and

efficiency of the

whole economy,

with particular emphasis on the potential tradeoff between the short and the long run.

Section 2 presents a model of education and production which motivates and sets

It

basic problem.

then shows how similar issues arise in several other models, and provides a general framework in which

to study them. Section 3

in

up the

examines how heterogeneity

affects short

an integrated economy. Section 4 shows how randomness

and long run growth

in innate ability magnifies

in

a segregated and

the long-run effects

of stratification. Section 5 considers the model's implications for the efficiency of nationally funded public

education, locally funded public education, and private education.

forms used in the text are generalized

2

2.1

in

Appendix A; proofs

Local and Global Interactions in

A

First

Section 6 concludes.

are gathered in

Human

the accumulation of

in production.

functional

Appendix B.

Capital

Model: Education and Production

We first consider the most natural channels through which group-specific

ities arise in

The

There

is

human

capital: local

and economy-wide complementar-

funding of education, and imperfect substitutability

a continuum of overlapping generation families

i

€ 0, of unit measure. During each

period adults work, consume, and spend time rearing their single child. At time zero, the adult

of dynasty

i

faces the following problem:

member

maximize

=

Uq

Eq

2~Jp

<u ( c <)

subject to:

i

<=o

(1)

c\

=

(2)

y>

= v\w\

ft«

(3)

and h

l

given.

There are no

She spends a fraction

v\

{l-ri)y\

= K-ci-ai-riWiEiy-*

+1

human

financial assets, only

endowment

of her unit time

The term

the rest to helping her child learn.

h't in (3)

unpredictable component of the child's innate ability

in the

production of

human

capital

is

is

At time

capital.

t,

adult

i

at work, earning the hourly

has

human

capital h\.

wage w\, and devotes

could also be due in part to inherited ability; the

represented by the

a local public good, which

i.i.d.

shock Q. The other input

financed by taxing the labor income of

is

local residents. Per capita expenditures are therefore:

E\=ri.YJ =

(4)

Ti.

r ydm\(y)

Jo

where m\

at time

t:

is

the distribution of income and

city,

suburban town,

state, etc.

secondary schooling. But law enforcement,

To

simplify the model,

we

shall take

Y

'

t

its

average, in the

The most obvious

community

and voting choices

"ceteris paribus"

both the fraction of time

3

This in shown in Section

and tax

rates in

will lead, in equilibrium, to

Tamura

5.2;

on some new

is

belongs

primary and

u\

spent working and the tax rate

If

effects

r\ to

agents have logarithmic preferences,

such invariant rules. 3 But these are really

in the political

economy

.

the values of u and T are given in Proposition

(1991a) and

good

i

libraries, etc., are also relevant.

assumptions by which we abstract from the issues explored

literature, in order to focus

to which family

skill-enhancing public

be constant over time and independent of community composition.

their decisions

fl|

Glomm and Ravikumar

6.

Log-utility also leads to constant investment

(1992) respectively. Voting models of education with variable

tax rates are analyzed by Perotti (1990), Saint-Paul and Verdier (1991) and Fernandez and Rogerson (1992),

among

others.

,

We now

turn to the production sector. All workers take part in the production of a numeraire good,

performing complementary tasks or specializing in imperfectly substitutable intermediate inputs.

total

output

is:

Y =

(5)

t

where

fi t

v(i h^dn {h)\'~

X

=v-Hu

t

denotes the distribution of

human

and managers

will

mean

positively

(6)

lagging wages for basic workers.

and the same

on the economy-wide

but

level of

t

finite.

human

is

will

advances in knowledge

Such interdependence

Given

(5),

any worker's

capital:

,

true for any community's level of per capita income:

is

Y =J\dm\(y) = v-(H )i-(j °°h^1

i

(7)

large,

= vw\ = v(H )$(h\) st1

y\

This complementarity

etc. Conversely, lagging

seems quite plausible, especially as we allow a to be arbitrarily

wage and labor income depend

4

production or clerical workers

insufficiently skilled

drag down the productivity of engineers, managers, doctors,

scientists, engineers

(7>1

capital in the whole labor force Q.

meant to capture the idea that poorly educated,

by

Thus

t

i

dfi\(h?)

=

v •(//,)'•

(L\)^

o

where

fi\

is

the distribution of

human

capital in

community

to increase with the level of skills. Incorporating (4)

and

£l\

Note that a

.

(7) into (3), the

>

1 is

required for income

accumulation of

human

capital

takes the form:

(8)

where a

=

Equation

(8) involves

4

We

6,

=

(1

-

6)(a

both a

-

l)/<r,

h\

+1

7

=

= e-c -(h\nL\f(H y

t

t

(1

-

8)/a

,

with

local linkage L\, because public

a+

/?

+7 =

1

and

=

k

(1

Tamura (1991b)

offers

6

u) (vt)

1

-6

.

goods are funded by community income, and a

develop in appendix a variant of Ethier's (1982) model of specialization which leads to (5) and

proof of Proposition 6.

-

(6)

below; see the

a model leading to an aggregate production function closely related to

Kremer (1992) and R. Cooper (1992) study equilibrium and optimal task assignment

in firms or production teams.

(5).

global linkage

H

= Y /is,

t

t

because

workers are complementary in production. Both are

all

CES

aggregates,

with the same elasticity of substitution. As workers become better substitutes, communities become

interdependent:

/?

rises

and 7

falls.

This model allows us to ask the following questions.

Is it

more

maximizing aggregate output and growth, to have the population

=

(L\

h\) or

mix into

identical, integrated

takes a short-run or long-run perspective?

transfers to richer families?

These

Suppose that households are

of public education funding

reflects the

income of

communities (L\

Can

then more

stratify into

homogeneous communities

Does the answer depend on whether one

for the specific

more

directly policy-relevant

where each community's school budget

where expenditures uniformly

reflect national

model developed above, we show that similar

a wide class of models from the growth and

human

capital literatures.

a Puzzle

aggregate income clearly matters

rise to

a model with local and economy-wide interactions

either production or education uses

if

some nationally

provided public good, such as defense or infrastructure. Second, technological spillovers a la

Lucas (1988)

y\

—

•

R&D,

it

(h\)

a

may

(H

affect workers' productivity, leading to individual

b

t

)

will again

knowledge directly

.

As long

as the accumulation of

be affected by

H

t

.

if

new human

spillovers to

Romer

in schooling or

(1991a) assumes that the aggregate level of

capital: h\ +1

=

(h't )

a

(H

b

t

)

.

be confined to a smaller sphere than the whole econ-

only because geographical distance limits frequency of interaction. Indeed, sociologists have long

described, and economists recently modelled, a variety of channels through which a community's

capital

(1986)-

production functions of the type

knowledge uses produced resources,

Tamura

Alternatively,

affects the generation of

One would expect some knowledge

omy,

manner.

by education and income. Which system

local funding,

efficient:

There are many potential channels which can give

First,

t

from the point of view of

integration be Pareto improving even without compensating

or national funding,

its residents,

More Models and

like (8).

H )t

efficient,

issues can also be rephrased in a

income? Before answering these questions

2.2

=

in fact geographically segregated

is

issues arise very naturally in

less

makeup

affects the educational

outcome of

its

8

young people.

These sources of

human

"social capital"

(Loury (1977), Coleman (1990)) include: peer

effects

between students of

and Besley (1991)); the

or within the school (Banerjee

good

or bad, as well as networking contacts for the

mery

(1990));

and crime or other

activities

different ability in the classroom

fact that neighboring adults provide role models,

young (Wilson (1987), Streufert (1991) and Montgom-

which interfere with education. There

empirical evidence of such peer or neighborhood effects; see

Benabou (1991)

is

also a fair

amount

of

for a brief review. In contrast

to fiscal spillovers, pure neighborhood effects can generally not be remedied by simply improving access to

capital markets or

by redistributing income across communities. 5

Of course any combination

But

likely.

aggregate

their

H

efficient -in

t

common

of the channels discussed here and in the preceding section

feature

is

possible, even

is

the presence of a local aggregate L\ and perhaps an economy-wide

in the production function for

new human

capital.

The

question then arises again:

is it

more

the sense of increased output and in the Pareto sense- for society to stratify into homogeneous

clusters, or for

each community to

reflect the

nation-wide distribution of

human

capital?

Naturally, one expects the answer to depend on the form which interactions take.

prising extent to which this

is

true, introduce the idea of local elasticity of substitution,

empirical flesh to the discussion of non-fiscal spillovers,

(1992a) investigates whether

To show

human

let

the sur-

and give some

us consider the following example.

Borjas

capital externalities operate within ethnic groups. Using longitudinal

data, he estimates the model:

\og(h\ +1 )

(9)

where

h\ +l

capital;

is

a son's

and L\

is

level of

=

human

"ethnic capital"

,

5

a and

/?

capital,

+ (3\og(L\) + control

measured as

variables

his hourly wage; h\

defined as the geometric average of

in the father's ethnic group: log(L{)

Borjas estimates both

alog(/ij)

= / °° \og(h)dfj,\(h).

Finally,

r/J

is

+

is

human

r)\.

his father's level of

human

among

adults

capital levels

an unpredictable individual shock.

to be between .25 and 0.30 and statistically significant. 6

Benabou (1991) shows that they can lead

to inefficient self-stratification even in a representative agent

model with perfect

capital markets.

6

Borjas also uses years of education instead of log-wages.

The remarks made below concerning

the consequences of

These results are very interesting

in

and of themselves, adding to the body of evidence that group

interactions influence the acquisition of skills.

But they

(narrow) point of view of maximizing aggregate income,

also raise the following question.

is it

more

together, study together, etc., or that they remain separate?

to answer this question. Unfortunately,

we

answer a priori: for any values of a and

is

exposed to his own group's average

shall see that

7

efficient

that ethnic groups mix,

One might hope

human

capital than

the long-run the two paths converge to the same level

if

if all

a

is

always higher

accumulation

+ (3 <

will

now be

generally

segregation, especially in the long run. In this instance, the

the

mean

of the logs and the log of the

mean can be

This point

each child

1.

more

common

log(/

hdfi't (h)).

under mixing than under

quite misleading: with heterogeneous agents, Jensen's

in fact

is

efficient

=

capital

practice of not distinguishing between

inequality implies that both individual and the economy's growth rates

which the externality operates.

if

are exposed to the population average. In

operates through the geometric average, one had used the arithmetic average: log(L{)

later on, capital

live

(9) constrains the

But suppose that instead of assuming that ethnic

This conclusion seems rather distressing.

As we show

i.e.

the

to use Borjas' estimates

by using a geometric average,

the path of total labor income

/?,

From

depend on the aggregator through

independent of the stratification

issue:

if

there

is

heterogeneity within each ethnic group, an equation like (9) will be misspecified unless the particular

aggregator which

it

imposes happens to be the correct one.

These remarks demonstrate the importance of the

elasticity of substitution

among

individual inputs into

is

developed below.

this parameter, rather

than constraining

the production of a peer effect or neighborhood externality; the underlying intuition

It will

it

therefore be quite important in empirical

to either one or infinity as

is

usually done.

work to estimate

8

within-group inequality and inter-group mixing are quite general, and apply to that specification as well.

This question

is

not purely hypothetical; one suspects, and Borjas' (1992b) later work indeed tends to indicate, that

"ethnic capital" really arises from neighborhood effects combined with ethnic segregation.

One

(9) the

could specify L| as a

group's variance (A|)

2

CES

index and estimate

its elasticity t

from a non-linear regression, or more simply include

of log-human capital. Its coefficient will provide

10

an estimate of — 1/e; see Section

3.1

in

2.3

A

General Framework

common

Recognizing in the various examples discussed above a

underlying structure, we shall consider

from here on the general model of knowledge accumulation:

h\+1

(10)

where

Q

is

a random shock, h\

economy-wide index of human

parental

is

= F(Clh\,L\,H

t)

human

capital,

and L't

capital. In general, equation (10)

is

,

H

t

and an

are respectively a local

not a purely technological assumption,

but a reduced form which already embodies a variety of market and non-market interactions: equilibrium

wages, financing of local public goods, technological spillovers, peer effects in schooling, etc.

examples incorporated at most one

local

externalities can be reduced to (10),

The two

and one global

where L\ and

levels of interaction in (10)

H

t

open up the

link at a time, but

we

discuss below

how

heterogeneity. It

The

possibility of

human

value, positive or negative, of a

CES

capital inputs in L\

h'^

t

(J°°

While

H

t

individual

is

i

more homogeneous work-

t.

and

H

t

respectively.

We

and global

level,

therefore specify

<WoV~

computed over the whole population, L\ only

belongs at time

equalized,

h^dMh)Y"

1

H =

(12).

is

het-

averages, with potentially different elasticities of substitution:

L\=(j°°

(11)

When

an intertemporal tradeoff.

force in the next generation. Intuitively, heterogeneity causes greater losses at the local

the external effects as (symmetric)

multiple

net loss, positive or negative, represents the efficiency cost of local

must be weighted against the

the less substitutable are individual

earlier

are appropriate composite indices.

erogeneous families share the same school or community, or when some input into education

the rich lose and the poor gain.

Our

Depending on the context

a country.

11

reflects the

this

composition of the group

fi{

to which

can be a school, a community, a region, even

We

will

show that the

Figure

indicated on

costs of heterogeneity in L\

we allow them

1,

substitutes rather than complements,

H

—00,

H =

t

and

max{h\,i £

The

fi}.

t

and inequality

is

As

are indeed measured by 1/c and l/<r.

to take any values -even negative ones.

a source of gains.

spans the whole range from a Leontieff technology,

t

H

9

As

In that case agents are

1/cr decreases

from +00 to

H = min{h\,i G fl}, to a "frontier" technology,

latter case corresponds to the

t

model of Murphy,

Shleifer

and Vishny (1991),

where the best innovation becomes embodied into the next generation of technology or know-how. Similarly

we

at the local level,

allow

cases between peer effects of the type "one

all

models where the best individual

may

(

sets the standard.

More

bad apple

bunch" to

spoils the

generally, the accumulation of

human

role

capital

involve several interactions at each level, say:

h \+\

10 ')

H\

For instance,

>

-

costly (l/o !

t

i

0)

= F{Q\IA

l

t

,...L Kt \Hi tt ,...HNtt )

could arise from complementarity in the production of goods, which makes heterogeneity

and

priced through wages, while i72 ,t could be associated to the generation of non-rival,

is

non-excludable new ideas, where inequality

is efficient

(I/02

<

But

0).

all

local

and global

spillovers will

matter only through two weighted averages: we show in appendix that (10') reduces to (10), where L\

and

H

are appropriately defined. Finally, another important specification

t

function for

new human

(with either

j3

equal one.

To

or

The

capital.

is

that of F(-), the production

assumes the multiplicative form

literature almost universally

zero), constraining the elasticity of substitution between h\, L\

7 equal to

simplify the exposition,

appendix, we generalize F(-) to a

CES

we

retain a

Cobb-Douglas specification

aggregator, and

show how the

for

and

H

(8)

to

t

most of the paper. In

effects of heterogeneity

and

social

structure also depend importantly on the extent to which parental, local and national inputs in a person's

education are substitutes or complements.

For a

measures

The

last

CES

index with constant returns such as (12), or just H(x,y)

(in the

neighborhood of x

property -which

as in (8)) whereas the

det(H")

= #n

y) the

two do not. Indeed, H12

first

2

)

to

7

2

(1

-

(.jr «

+

«

j y

complementarity between inputs, the concavity of

relevant here- remains true with

is

H22 - (H12

=

=

is

any return to

then proportional to 7

i)/cr, but log((if(2±i, ^-)/H(x,y))

12

—

is

1

+

1/<t,

,

1/ct

simultaneously

H and the cost of heterogeneity.

(when the index

scale

)»-»

is

raised to

H\\ and H22

to

some power

7 —

1

—

1/cr

7,

and

simply proportional to 7/17; see Section 3.1.

L = min{hM

1+

£

local

complements,

local

H =

maxfh 1

}

and

global complements

global substitutes

->

«-

o

local

and

local substitutes,

global complements

global substitutes

L = maxfh 1

}

local and global

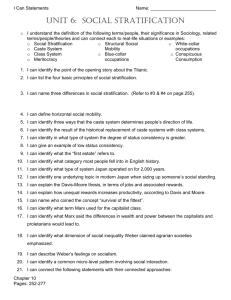

Figure 1: The costs of heterogeneity:

degrees of complementarity 1/e and 1/a.

12A

H

= minfh 1 }

Community Composition

2.4

Given the general model described by (10)-(12), we

mulation and welfare under two regimes of interest. The

composition

is

the

same

endogenous community formation. This

environment leads high and

The same

local public

to

perfect integration, where each

is

is

we do not seek

commu-

basic force

is

work

here:

with d 2 F/dhdL

goods or externalities L\ are strategic complements

make more educated parents

paper to

offer

a theory of

differential sensitivity to the quality of

low-skill workers to segregate as

at

in this

for three reasons.

Benabou (1991) already provides such a model, where a

First,

permit.

perfect stratification, where each type of

as that of the population at large. Intermediate cases of partial segregation

could easily be considered using the same methods; but

their

first is

The second

agent lives in a separate, homogeneous community.

nity's

compare the dynamics of human capital accu-

shall

much

>

0,

in the

as technology and institutions

parental

human

capital h\

production of h\ +l

and

This tends

.

willing to outbid less educated ones for land or housing in a "better"

community. One could thus obtain once again segregation as the only stable equilibrium, sustained by land

rent differentials. Alternatively, one could follow Durlauf (1992) and allow each community's residents to

vote on zoning or

minimum income

requirements. In the absence of significant fixed costs, the rich have no

desire to let in the poor, so this

would again lead to

would require tying oneself to a

specific choice of preferences

elasticity of

stratification.

Implementing either approach, however,

and of the "technology" of segregation:

housing supply in each location, school district boundaries,

costs for a school or a

The second reason

community, mobility

is

feasibility of zoning, size of

many

setup

costs, etc.

that the mixing and sorting regimes correspond to alternative policies: local or

national funding of schools, tracking or busing, mixed income housing, etc.

are

price-

The

last

reason

is

that there

sources of stratification which are unrelated to parents' concern for their children's education:

differences in income, tastes, racial segregation, etc.

We

therefore choose to be agnostic about the causes

of stratification and focus on the growth performances of two "pure" cases which deliver the

complete segregation and complete integration.

13

main

insights:

Stratification

3

and Growth: the Short and the Long Run

Let us start with the simplest possible case. There are two types of agents,

each.

They

differ

only by their

initial

endowments of human

the initial variance of log-human capital.

10

We

In a stratified economy, the local environment

h\ +1

(13)

In an integrated economy,

t

Denoting

.

all

all

= e-(h\) a +P(Ht y,

variables in the integrated

h\ +1

=

local level thus has

human

+ /? to

capital

/?;

from a

the effect of

accumulation

H

will alter

a way which we

make

a,

a

Q=

>

0.

Thus

A2

is

1.

two

effects.

results,

with

= A,B.

level of local externality or public

we

hat,

First,

i

it

good,

Lf = Lf =

have:

=

A, B.

decreases the return to scale on parental

raises the return to scale

on the

local aggregate

human

from

capital

the impact of any given amount of heterogeneity on the economy's growth rate, in

precise below. In other words, one of the

effect of

distribution with small

i

remains unchanged. These changes in the effective technology of

t

mixing

is

A =

y/a(l

—

a)

two

social structures will

be more

efficient

knowledge than the other.

to accelerate convergence to a

'As L\ depends on group composition but not group

same

differences:

(L t y(Ht r,

and correspondingly

at aggregating heterogeneous levels of

The second

same

economy with a

(h\)

Mixing agents at the

the

| log(fto /hf?)

uncertainty:

all

compounds family

agents share in the

(14)

to

abstract from

and B, with measure 1/2

Dynamics and Losses from Heterogeneity

3.1

L

A=

capital:

A

->

size,

homogeneous

any proportions (a,l

—

a) of

society.

A and B

Denoting A*

=

families will lead to

log(h^/h^). More generally, the Taylor approximations used below apply to any

enough dispersion.

14

1

\

in the segregated

\og(h*/hf)

economy and

A«

(15)

two

Intuition suggests that these

less efficient for

effects

=

may

heterogeneity affects growth.

We

t is

is

+ /?)

log(hf/hf)

(13)

we

capital,

but

still

more

investigated below; but

efficient in the

first

A =

t

(hf

A

-f

t

levels of

and agents are complements

but

it

it

human

distribution of

capital.

hf)/2, which brings out the role played by

\

0--1

level of human capital, the right

= 6 + (a + P+y-l) log(A

knowledge are unequal, however, the two bracketed terms

face decreasing returns

case,

The

and any aggregate index of human

economy where everyone had the average

The

is

long run because

be

...

to Jensen's inequality.

heterogeneity

for instance

get:

would be 0- Af +P -AJ and the growth rate \og(A t+ i/A t )

When

may

- ..(.

In a representative agent

side

»

we must determine exactly how

g—

1(+1

have:

A>a'A = A,.

by the degree of inequality

From

we

in the integrated one,

lead to an intertemporal tradeoff: mixing

focus on the per capita stock of knowledge

12

f

•

Consider for instance the segregated economy.

fully described

heterogeneity most clearly.

|

t

any given distribution of human

reduces heterogeneity faster. 11 This issue

capital at time

(a

A =

differences represent the losses caused

a source of gain

if

a

+ /? >

1

or 1/<t

in the

<

0.

differ

t ),

=

log(0).

from A" + ^ and A] due

by heterogeneity when communities

production of the aggregate

We

with 6

hand

H

t

Conversely,

.

shall often focus the exposition

on the

first

should be kept in mind throughout the paper that the model allows for any configuration of

parameters: we do not impose that inequality be bad for growth.

In the general

model

(10)

we

define greater efficiency as increased total

production technology and preferences

It will

since

it is

Ht > Ht

be clear how to go from

unaffected by dispersion,

for

any a >

0,

(e.g.

Section 2.1)

we

and vice-versa

capital. In specific models,

shall also consider aggregate

this arithmetic average to

and

human

a <

any other aggregate index, such as Ht. At

0.

15

given a

output and individual welfare.

therefore not biased toward segregation or integration: as

for

i.e.

is

a logical choice

At > At, At

=

At implies

We

can simplify the expression for the growth rate under heterogeneity by using Taylor approxiFor any A and x,y such that

mations.

log

A

£ i

((

f

(16)

/(

)

\

£-js

^)

f^±\

og

)

A =

can be approximated as

\ \og(x/y)

tf A (A)

l0g

We

(i

see that the drag

Thus \og{Ht /A t )

w -A 2 /2<r and:

to:

*0 + (« + + 7-l)log(i*)-(«(l-a) + ^ +

/?

J

on each economy's growth

is

^^-a

the product of two factors.

be discussed below. The second

is

The

2t

first is

the economy's

the current variance

A2

or

A2

capital distribution.

The Short Run

3.2

We

human

m A(l-A)A 2 /2.

^(A) =

t

efficiency loss per unit of dispersion, to

of the

not too large, the loss function

a e+(a + p + 7 -l)log(A )-{{a + m-^-l3) + l)^--(a + 0) 2t

For the integrated economy, similar derivations lead

(17)

is

first

ask which economy grows faster, for any given amount of heterogeneity. In other words, suppose

that at time

t

—

higher or lower?

previously segregated populations

From

£=

intuition

is

clear:

(19)

is

(a

is

C A 2 /2,

human

C A 2 /2,

capital at

t

=

1

be

with:

+ /?)(l-a-/?) + 7/<7

losses reflect the concavity of the function h a+l3

agents' inputs in the aggregate

reduction in growth

integrated: will

(16), the efficiency loss in the segregated case

(18)

The

become

H, which has weight

7.

l/<7 of

In an integrated economy, the corresponding

where:

£ = a(l-a) + p/e + y/<r,

16

and the complementarity

with a similar interpretation involving returns to scale at the family rather than the community

both local and global

and only

if

C >

4>

<

1,

the education production function

capita

(e

=

is

enough

endowment At Such

.

is

clearly the case

Borjas (1992a), the mixed economy

when 2a

+

>

1,

The

Mixing

is

if

concave in the previous generation's

will

then accelerate growth even

poor do not drag

more vulnerable

hand

if

Lt

is

is

standard, static models of matching.

+7 =

a+

1, it

the short

too far below the per

definition,

mixing

is

in the short run.

13

means that parental human

best understood by showing

By

t

in

human

(e

=

1) as in

to heterogeneity than the segregated one. Finally

education than the economy-wide aggregate

intuition for Proposition 1

L

a geometric average

mixing tends to reduce human capital accumulation

child's

for any given amount of

the local spillover operates through the arithmetic average

(1992). On the other

quite plausible since under constant returns,

important to a

is less

local substitutability so that the

Glomm and Ravikumar

oo), as in

i.e.

= 0(l-2a-0-l/e)>O.

capital under integration than under segregation.

run, provided there

in the short run,

C, or:

(20)

When 2a +

and

elasticities of substitution.

Proposition 1 The mixed economy has higher growth

heterogeneity, if

level,

H

t

:

how

a >

<j>

This case

capital

is

is

more

7.

embodies the

effects at

inefficient if the losses of the rich

work

in

exceed the

gains of the poor, meaning that:

(21)

(A 1

-A

1

[itir -

13

The same

is

)/(H2/2)

(fc?)"]

=

(h*)°

[ctf

r

true for log(Hi/Hi)

[{hW -

(Lof] - (h*)°

- a?] + (A?r

w

fi

(A 2 /2)

((1

•

[ctf

- la -

f - (A?)"]

f + (*? y -24] + Krtr + (^)l

/3)(1

17

[(L

-

1/cr)

+

\jb

- 1/t),

unless 1/<t

-

1/e

is

Ap

-

Tp

sufficiently large.

positive.

is

The

first

It is positive since

term

arises

children from better backgrounds lose

to the per capita average Aq. For small dispersion this

The second term comes from the

It is

more from a given

term

human

(/?/e)

•

term

is

close to

— (3(1 —

it

A a+!3 A 2 /2. The

than mixing; the second one goes

stratification proportional to 2a/?

•

—

in the

/?(1

Because mixing equalizes knowledge

/?)

Aq + ^

•

—

<

up, so Lq

first

and

really matters

A To

-

C =

t

A 2 /2.

<

+ /?/e = —

:

A 2 /2.

if

1/e

The

>

community than

in

0).

a rich

term incorporates the

final

poorly educated agents drag

0,

Aq. For small dispersion this last term

tend to

Summing

opposite direction.

/?)

•

last effects

make

sorting

more

is

efficient

three yields a net impact of

all

<f>-

faster,

the drag on growth due to dispersion eventually becomes

shown by the

smaller in the integrated than in the segregated economy, as

t

•

The Long Run

3.3

what

h*

capital has a larger impact in a poor

well educated agents pull

approximately equal to

decline in La, such as from

approximately equal to 2a/? Aq

is

pure losses from heterogeneity in generating the local spillover Lq

down Lq more than

0).

local inputs (F12

decreasing impact of marginal improvements in local conditions (F22

negative since an extra unit of

one. For small dispersion this

>

from the complementarity of parental capital and

6

is

whether this

effect

is

sufficient for

A

t

to

make up

answer this question, we solve the difference equations (16) and

(1

-

i?')/(l

log (

^

-

R),

\

we

terms

its initial

(17).

in (16)-(17).

A 2 Vfl'-i-<W/?V*-r

„

Denoting

R = a + /? + 7

Rt -(

A2 R

A2

-(a

a + P) 2t

l

c

- c

t

-c:%p<-^ = c -c.%

t

Therefore:

18

-

R- -(a + /?) 2

B*- a 2t

R _ a2

But

handicap and overtake

have:

2

^Gi^)

last

and

Proposition 2 For any 7 >

the gap between the integrated

0,

and segregated economies

is,

for

t

large

enough:

^j„$.^( a +

io g

(22)

/j

+ 7 )«

where:

$=

(23)

(a

+ /?)(l-a-/?) + T /<r

+ /? + 7 - (a + /?) 2

In the long run, the gap shrinks to zero

to a finite limit

R=

if

The two numerators

denominators

1,

a(l

and explodes

total returns to scale

if

R>

if

- a) + 0/e + 7/tr

-«2

/? + 7 - <*

a+

a

1.

R=

a+

+7

are less than one, tends

Equation (23) embodies the main insights of the paper.

represent each economy's instantaneous losses per unit of heterogeneity.

reflect the different speeds of

convergence to a homogeneous society.

The

The two

tradeoff between

incurring the costs of local heterogeneity and reducing the losses from aggregate heterogeneity at a faster

rate

apparent

is

obvious factor

is

in the fact that

$

decreasing in /3/e and increasing in f/o-.

is

But an

additional, less

involved: the difference between the concavity of the technologies faced by a

and by a family, adjusted by the appropriate convergence speeds. This value of

$

for 1/e

=

community

1/cr

=

is

generally positive, as will be seen below.

We

are

now ready

when

to answer the question:

is

the long-run

human

capital stock larger under

mixing than under segregation? Let us start with a useful benchmark case, assuming:

returns; (b)

e

=

a:

heterogeneity

a "neutrality" assumption;

and

H

<

than between the three inputs

t

1:

there

h\,

L

t

,

is

H

more

quality

and

(c) also

seems plausible

education than workers' different

14

When

for

society's general level of

F(h,L,H)

is

a

CES

1,

constant

lA

t

.

substitutability within the composite inputs

Note that the model of Section

three restrictions; in particular, (c) was required for a worker's income to rise with her

Assumption

R=

equally costly or beneficial at the local and economy-wide levels,

is

(c) 1/(7

(a)

2.1

imposed

human

L

t

all

capital.

most alternative interpretations. Parental background, peer group

knowledge or income are

skill levels in

likely to

be poorer substitutes

in

a child's

the production of output or know-how. In the benchmark

function with elasticity A, the relevant comparison

19

is l/<7

<

l/A; see the appendix.

case equation (23) becomes:

>

t-

(24)

at

.xL«

so that integration raises the long-run level of

Figure 2

to,

given

stationary.

< $ and R =

Initially,

The common trend

1.

A

the richer

worsens, but the overall impact

is

to the fact that society remains

and

=

a

—

00. Let

of the rich at

5.6

%. The

A=

1,

or

first raises

initial

course,

it

•

boom

6

t

is

factored out from

all

The

stratified at

variables,

h* /h^ —

7.4; this

common

level

which

is

distribution of income

lower than what

orders of magnitude,

feel for

let

a

=

it

slows

it

.5, /?

=

corresponds to a coefficient of variation of 0.76.

is

rich

.3,

preferable in the long run.

is

when

The

converse

15

is

we show

true for

in

R>

=

.2

and

secession

We now

examine more

16

We shall

come back

to this feature

appendix that decreasing

1.

First, note

the degree of economy-wide linkage 7 tends

and poor are completely independent from one another and when

on. Second,

7

slowdown but higher steady-state output.

of stratification on the economy's long-run performance

arbitrarily small extent.

reduced,

erased two generations later. Integrating a previously segregated society leads

that the steady-state gap (24) remains positive even

when

is

growth by 4.5%, but eventually lowers the steady-state path of the economy by

need not be the case that mixing

The impact

down due

would have been

generally the relative performance of the two social structures, by varying key parameters.

to zero.

time

making them

more heterogeneous. Eventually, even the A's accumulation

to the converse scenario, with an initial growth

Of

$ A 2 /2. 15

favorable and growth accelerates. Over time, however,

had society remained integrated. To get a

e

by

'

agents benefit, while the poorer B's lose.

dynasties' capital stocks converge to a

all

capital

r) >1

what happens when a previously integrated economy becomes

illustrates

<

<j>

human

t

(

is

thus surprisingly different

their fates are linked to

when evaluating each dynasty's

total returns

R<

1

an

welfare later

raise the benefits of integration; the

Third, and most importantly, segregation remains preferable in the long run

Note that (24) allows for inequality to be

beneficial,

i.e.

for

\/a

=

l/t

<

0.

When

all externalities

if

operate through

geometric averages (Tamura (1991a), Borjas (1992a)), (24) shows that mixing and segregation lead to the same steady-state.

On

the other

hand asa

asymptote approaches

+

/3

= l— 7

approaches one, the speed at which the segregated economy tends toward

zero; see the expression for \og,(At/AoR') in appendix.

20

its

lower

hi

hA

A 00

•00

hB

0

t

integrated

stratified

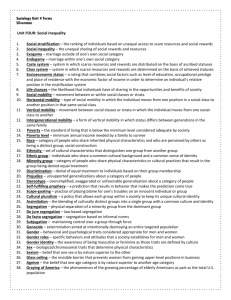

Figure

2:

The

economy

economy

short and long run

effects of stratification

20A

disparities in

knowledge entail

sufficiently greater losses at the

the aggregate level, e.g. in production. Rearranging (23), with

*>0

<

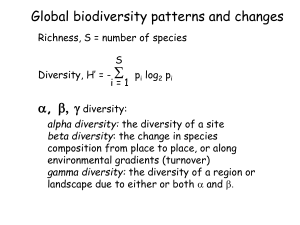

(25)

The two

e

Figure

R=

level, e.g. in schooling,

than at

1:

I_I<(l-lV_L^)

>

o) \l+a

as

regions, illustrated on

community

a-

3, are quite intuitive.

area between the boundary and the two axes; since 1/a

+ /3j

V

<

<

Perhaps most noteworthy

is

the triangular

1/e, heterogeneity creates negative spillovers

at the local level but positive ones at the aggregate level. Nonetheless,

mixed communities lead to a superior

long-run outcome due to the differential combination of returns to scale in accumulation and convergence

speeds discussed

than 1/e. For instance,

is

much

order to overcome this effect and

earlier. In

easier for

it

will

be

efficient for the

good managers to make up

than for students from favorable backgrounds to

Similarly,

qualities

0,

1/<t

must be

managerial and working classes to

sufficiently larger

live separately if it

poorly qualified workers in the production of output,

offset the effect of

weaker schoolmates in peer interactions.

be optimal to sort successive generations of Ph.D. students into departments of

when complementarities

differential

are stronger during graduate studies than they are during research careers.

Welfare and Pareto Optimality

3.4

It is

will

it

for

make $ <

easy to go from the aggregates

segregation:

log(ft^)

=

log(A t )

+

A

t

or

A

log(2/(l

t

+

to each group's path of

e

_2A<

«

))

log(A t )

+

human

capital. For instance,

A« — A^/2. Given a

under

specification of

preferences and of the relationship between skills h\ and income y\, for instance as in Section 2.1,

we

could compute present values of each family's utility or of any planner's social welfare function. But the

main

(0

<

insights are clear even without doing so. First,

<j>

<

$),

and of any

levels.

it

will lead to

more

integration

is

more

a higher value in each period, not only of total

social welfare function

In the

if

which

interesting case

is

where

a

<f>

human

CES

aggregate of individual

<

<

planner has a low enough discount rate. Moreover,

efficient

even

capital,

human

in

the short run

but also of output

capital or

consumption

$, social welfare will be higher under mixing

if

21

individual agents' discount rate p

is

if

the

high enough,

.

Cost of

local

heterogeneity

O

:

<

-•***

,

,:

:

:

:

:

O

>

Cost of global

«*"

heterogeneity

:

1

<D

>

Stratification versus integration

Figure 3:

in the long run

21A

.

integration will be Pareto improving even without any redistribution, because in the long-run

are identical

and share the same

Random

4

it

and to

R >

1

capital Aoo or Aoo

and Long Run Growth

main parameters which determine how heterogeneity

First, the long-run distribution of

implies explosive growth.

which the economy was

agents

us to draw the essential distinction between the short and the long run effects of

identify the

had two drawbacks.

but then

human

Ability, Stratification

The previous model allowed

stratification,

level of

all

stratified

had no

This

effect

growth. But

+ ft >

income was always degenerate -unless a

clearly contrary to the evidence.

is

affects

on the long run growth

rate,

1,

Second, the way in

except again in the case of

increasing returns; see (22).

In this section

we

solve both problems by incorporating

returns to education, as in Loury (1981).

random shocks

Such random draws of luck constitute a permanent source of

inequality, but also of social mobility: the relative rankings of

forever, but will

will

On

have a

to children's ability or uncertain

any two dynasties

will

no longer be preserved

change with positive probability. Because a mixed society "undoes" inequality

less dispersed

the other hand,

it

asymptotic distribution of

may

still

be

human

capital

it

and income than a segregated one.

processing any given

less efficient at

faster,

amount of

heterogeneity.

Under

constant returns, the balance of these two effects will determine which of the integrated or segregated

economies has the higher long-run growth

4.1

rate.

Dynamics

Let the accumulation of

and the shocks

Q

are

human

i.i.d.

capital be given

with log(£J)

~

by

Af(0,s 2 ).

(8),

initial distribution

of

human

of this specification, which builds on

is

t

are defined as in (11)-(12)

log(/i'

)

~

M"(m,

A2

).

We

also

The advantage

Ravikumar's (1992) deterministic model,

22

little loss

already captured by the h\ term.

capital to be log-normal:

Glomm and

H

Assuming independent shocks involves

of generality, since intergenerational correlation of ability

take the

where L\ and

is

that h\

remains log-normally distributed. This allows

if

A

log(/i;)~^K,A 2 ),

t

=

(<r

—

H =

t

consider

{£ h^ <*(*))

human

capital at time

log(A»+i)

(27)

Human

log

°°

aggregates and loss functions to be computed exactly:

hdp

((/

X

t

(h))

//~

AA

=

d/i,(fc))

A(l

-

A)

•

A?/2. Setting

l)/«r yields:

(26)

Now

**(At ) =

then:

CES

capital at time

t

+

1 is

'"

= «P (m, +

t+1. Taking

(^) f ) = A,

logarithms in (8) with L\

e Xp

•

=

= 9 + log(C!) + (a + /?) log(AJ) + 7 (m + 2—1

t

[-§)

h\ (segregation):

.

M)

therefore also log-normally distributed: log(/iJ +1 )

~ A/"(m

t

+i,

A 2+1

),

with

m t+1 =0 + R-m +y(Zf±)£

t

(28)

A?+1

Integration yields similar expressions, with

The

steady-state variance of

expected.

make

We

human

capital

could solve (28) for the

mean

+ /?) 2 A 2 + s 2

=

(a

a

+

replaced by

then

A 2^ =

is

capital

A =f

t

(29)

log

(30)

log

hdfi t (h). Using (26) to (28),

(^f)

(^f)

C=

(a

,

it is

which

m

t

at

(e

is

—

l)/e

added to y (<r

lower than

any point

A 2^ =

in time.

1

But

—

1)/<t.

_/^,g\i

,

as

in order to

better to track once again the behavior of total

we obtain the growth

rates of the

two economies:

e+J + (R-tyog(A )-^-((a + 0)(l-<*-P)+l)

=

9

t

+ j + (R-l)\og(A )-^-(a(l-a) + ^ + l

+ /?)(1 — » — /?) + j/a

respective variances.

<>a

/?

=

t

These expressions are identical to (16) and

factors

*

1

of log-human capital

the losses from heterogeneity appear most clearly,

human

a and

and £

(17),

=

The comparison between

a(l

up to a constant.

— a) +

0/e

+ y/cr

In particular,

for

we recognize the

loss

each economy, multiplied by their

the two social structures' efficiency at aggregating levels of

23

knowledge,

between their capital stocks one period

i.e.

therefore unchanged: log(ii/>li)

To examine

and (A t

,

A

t

);

=

/?(1

- 2a -

-

after starting

1/e)

A 2 /2 =

•

<f>

from the same

A 2 /2.

the impact of stratification on long-term output and growth,

see the appendix.

We

first

initial conditions, is

consider the case where initial

we

solve (28)-(30) for

endowments

(A

t

,At)

are the only source

of inequality.

Proposition 3

The

:

effect

2

of initial inequality. If s

=

then for any j

>

and

t

large enough:

<»»Mr«n^ )£*-£ *

This

is

exactly the

same expression

as in the two-group case, so

all

the results derived previously extend

to this model.

Proposition 4

log(

$

effect

2

of ongoing inequality. If s

>

0,

then for large enough

t:

i

returns, the integrated economy's long run growth rate exceeds that of the segregated

economy

2

•

s /2.

As seen

by a

The

&~l('-±-'M¥kHT=fa-iiv)-H £s)

Under constant

by

:

$ >

unless the cost of local heterogeneity exceeds that of aggregate heterogeneity

margin.

Proposition 4 shows, quite intuitively, that recurrent inequality impacts the two

earlier,

sufficient

economies one

level higher

A2

than

the

same way

A2

vanishes asymptotically.

as

initial dispersion does.

affects long-run levels.

When R <

24

When R =

1,

s

2

1,

s

2

affects long-run

growth rates

impacts long-run levels whereas the

in

effect of

4.2

Discounting and Welfare

Let us

now examine

»

the welfare of individual families, asking in particular whether integration can bring

about a Pareto improvement without redistribution. To derive simple, closed form expressions, we assume

that agents have logarithmic utility and compute the expected present value of log-human capital for

Note that

each family.

if

labor income depends not only on

own human

capital but also on aggregate

productivity, as in (6), this will understate the relative benefit of integration with respect to segregation.

Finally,

in

we use the benchmark

specification 1/e

which direction deviations from

=

1/cr

<

1

and

R=

t,

differences

and ultimately

its

U'

-U'

= E

£>*

P

(

p/3{m

lQg(fcj/AJ)

I

*'o

(1

a~

\l-p'

The

first

term

the

mean

lose

reflects the

distribution of

its initial

l

PS

2

*

+ (W)A

2(1

impact of the

initial

-

2

-p)

endowment;

-

pa)(l

p(a

(A±2

+ /?))

T

l-fa + 0)

\l-pa*

ceteris paribus, dynasties

2

s

)

of the unconditional average of (log)

the expectation of the asymptotic distribution facing each dynasty,

reflects their

\A

))

which start above

made

better off by integration.

sufficiently patient.

1/cr

>

it

makes

human

all

is

always

(through

level

A2

)

capital. Since this

better off to an extent

degree of patience or intergenerational altruism. As p tends to one, so does the fraction

point in time has finite support, integration

'Assuming

2

from integration, while those which start below the mean, gain. The second term

and possibly the growth rate (through

of dynasties

capital at

log(/i' ))

-

do not remain paribus: integration raises the

which

human

endowment. Taking

positive, reflecting the fact that ceteris

is

3.3.

stratified cases yields:

t=o

,

z's

expected intertemporal welfare, conditional on

between the mixed and

(31)

should be clear from Section

this case will pull the results.

Straightforward but tedious derivations allow us to derive family

any time

It

1.

17

0;

Note that

the bias

is

this has

reversed

Since in practice the distribution of

is

for all practical

0.

25

wealth at any

purposes Pareto improving

nothing to do with any insurance

when \/a <

human

effect:

in (31),

if

agents are

dynasty

i's

own

shocks log(Q) are set to their expected value of zero under both integration and segregation.

H^

Let us next examine the role played in this result by the global externality

accumulation paths of rich and poor (due

Suppose that

2.1).

this link

for instance to

Recall from (24) that the asymptotic difference in growth rates

economy converges to

opposing

effects into

in the limit;

down

to zero.

-\og(hj)

+

1-pa

(<r-l\

\

<r

tributes positively to each dynasty's net welfare.

=

2

,

this

is

from

initial

+ f3 tends

$ A 2 /2

•

at

to

1.

between the

which the

stratified

Equation (31) incorporates these two

it

becomes:

\ / />s 2

+

mean

(l-/>)A 2 \j

2(l-p)

of (log)

)\

human

capital

still

con-

endowments are the only source of inequality,

When

factor. Integration is not Pareto

s

initial conditions,

2

>

0,

improving unless richer families receive com-

however, mixing has a growth rate

provided the discount factor

is

effect.

makes almost

all

families better

off,