Document 11158481

advertisement

M.I.T.

LIBRARIES

-

DEWEY

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium IVIember Libraries

http://www.archive.org/details/geographicconcenOOelli

(Tewey

working paper

department

of economics

GEOGRAPHIC CONCENTRATION IN U.S. MANUFACTURING

INDUSTRIES: A DARTBOARD APPROACH

Glenn Ellison

Edward L. Glaeser

94-27

Aug.

1994

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

GEOGRAPHIC CONCENTRATION IN U.S. MANUFACTURING

INDUSTRIES: A DARTBOARD APPROACH

Glenn Ellison

Edward L. Glaeser

94-27

Aug.

1994

.>riAS3A0HUSE-|TS liNSTiTUTE

OF TECHNOLOGY

OCT

2 1 1994

LIBRAFttES

Geographic Concentration in

U.S. Manufacturing Industries:

A

Dart board Approach^

Glenn Ellison

Mjissachusetts Institute of Technology

Edwaxd

L. Glaeser

Harvard University and

NBER

August, 1994

^E}-mail:

gellison@mit.edu.

We

would

like to

thank Richard Caves, Sara Fisher

Ellison, Bill

Miracky, Wally MuUin, Peter Reiss and Jose Scheinkman for helpful comments, and Matt Botein,

Rajesh James, Bruce Sacerdote and Jacob Vigdor

for research assistance.

Both authors thank the

National Science Foundation (SBR-9310009 and SBR-9309808) and the Harvard Clark Fund for

financial support.

94-27

Abstract

This paper discusses the prevalence of Silicon Valley-style localizations of individual

manufacturing industries

in the

cations by throwing darts at a

United States. Several models in which firms choose

map

are used to test whether the degree of localization

greater than would be expected to arise randomly

graphic concentration.

The proposed index

controls for differences in the size distribution

all

is

available.

of the degree of geographic concentration across industries

can be made with more confidence.

most

is

and to motivate a new index of geo-

of plants and for differences in the size of the geographic areas for which data

As a consequence, comparisons

lo-

We

reaffirm previous observations in finding that

al-

industries are localized, although the degree of localization appears to be slight in

about half of the industries in our sample.

in describing patterns of concentration, the

We

explore the nature of agglomerative forces

geographic scope of localization, and the extent

to which agglomerations involve plants in similar as opposed to identical industries.

Introduction

1

The concentration

of the computer industry in Silicon Valley and of the auto industry in

Detroit are two of the

more famous examples of the geographic agglomeration

The economics

a single industry.

literature motivated

drawn the attention both

vibrant. Agglomerations have for years

practical concerns

by these examples

of firms in

both old and

is

of urban planners with

and of economists who wish to understand them simply because they

are a striking feature of the economic landscape.

More

recently, they

have been regarded

also as a potential source of insights into the nature of the increasing returns

economies which drive the new theories of growth and international trade.

and external

As a

result,

researchers primarily interested in international trade, growth, industrial organization, and

business strategy have joined geographers and urban economists in investigating geographic

concentration.^

This paper

concerned with measurement issues relevant to work in

is

Our "dartboard approach"

map

into a useful set of models of

location choice in the presence of agglomerative forces. In doing so,

we wish

we have two main

goals.

to look formally at whether most industries are truly localized. Second, and

more importantly, we wish

to use the models to guide the development of

facilitate future research into

We

new

tools for

hope that the index of localization we propose

will

a range of topics involving cross-industry comparisons,

e.g.

the measurement of localization.

how

these fields.

to studying concentration consists essentially of extending the

analogy of firms choosing locations by throwing darts at a

First,

all

patterns of agglomeration compare in different countries,

how

levels of concentration

have evolved over time, and whether cross-industry patterns provide insights into the nature

of the forces which cause agglomeration.

That

Silicon Valley-style agglomerations

been noted by a number of authors (see

is

be more the rule than the exception has

Krugman

e.g.

a careful reexamination of whether this

may

(1991a)).

indeed the case.

Our

The

our dartboard approach (and the motivation for a reexamination)

first

goal

is

to provide

defining characteristic of

is

that

we wish

to reserve

the term "localized" for industries exhibiting levels of concentration beyond those which

would be observed

if

manner. In doing

so,

the U.S.

vacuum

firms

had chosen the locations of

we take

'For samples of woik in these

a completely random

as exogenous the discreteness of plants.^

cleaner industry (S.I.C. 3635) about

of the four largest plants.

their plants in

Given

this,

fields see

75%

we do not want

For example, in

of the employees work in one

to regard the industry as being

Florence (1948), Hoover (1948), Fuchs (1962), Carlton (1983),

Henderson (1988), Enright (1990), Porter (1990), Krugman (1991a), and Jaife et. al. (1993).

^ We do not mean to say that the determinantion of plant sizes is not a topic with interesting implications

for

understanding increasing returns, just that

it is

usefully separated

agglomeration.

1

from the measurement of interplant

localized simply because

75%

of

employment

its

is

contained in four states. Also, even

firms did choose locations for their plants by throwing darts at a

map, one should recognize

Our

that several of the plants by chance might appear to form a cluster.^

term geographic concentration

concentrated only

if it

displays

manufacturing.'' For example,

just because

is

in

New

12%

of

all

is

some agglomeration beyond the

we do not want

employment

Our primary focus

We

will

use of the

regard an industry as

overall concentration of U.S.

to call the newspaper industry concentrated

in the industry is in California

and an additional

9%

York. Despite this more stringent definition of localization, our results strikingly

reaiRrm the belief that localization

s) for

we

further restricted in that

if

in this

widespread.

is

paper

is

on the development of a new index (and other

tool-

the measurement of the degree to which industries are geographically concentrated.

believe that a useful index of geographic concentration

must measure something which

parisons across industries.

is

interesting to economists

must have two properties:

it

and allow one to make com-

Such comparisons are not only of descriptive

interest,

but are

the substance of most inquiries into the nature of geographic concentration.^ Interindustry (or intertemporal) comparisons are problematic with previously defined indices because

the comparisons are greatly affected (in ways which are not completely understood) by

variations in industry characteristics

We

and data

availability.^

motivate our index with an analysis of two models of location choice: one based

on the idea that

spillovers {e.g. localized

locate together, and the other based

type of natural advantage

knowledge spillovers^)

may

lead firms to wish to

on the idea that firms want to locate wherever some

{e.g. access to

raw materials)

is

present.

Both models are capable

of accounting for geographic concentration, and they are likely important to varying degrees

'^In fact,

will hit in

one only needs to thiow 6 darts at a

some

state.

map

of the U.S. before

Such random agglomerations would be

it is

less likely to

most

occur

if

likely that at least

two

transportation costs or

other "centrifugal" forces give firms a desire to locate away from their competition.

*

We thus

use the term as a

synonym

for

what Henderson (1988) and Krugman (1991a)

opposed to what they term urbanization or geographic concentration.

We

call localization as

hope that our use of localization

and geographic concentration as interchangeable terms does not create confusion. Again, we do not wish

imply that the overall agglomeration of industries

is

not an interesting topic, just that

it is

to

usefully separated

from an examination of intraindustry agglomeration.

^For example,

Krugman

(1991a) discusses whether high tech industries are more concentrated than other

industries to investigate the importance of knowledge spillovers and compares the U.S. auto industry with its

European counterpart to discuss the potential impact of European integration. Earlier comparative works

include Florence's (1948) study of U.S. and British industries and Fuchs's (1962) discussion of changes in

the U.S. between 1929 and 1954.

*A representative set of these indices are those of Creamer (1943), Florence (1948), Enright (1990) and

Krugman (1991a). Florence's observation that industries with larger plants are more concentrated is a

particularly clear

^See

example of the

Krugman (1991b)

for

difficulties in interpreting

comparisons.

a discussion of other spillovers.

in different industries.

it is difficult

New York

is

the wine industry where

to separate manufacturing from the growing of grapes and

Our

in California.

is

(Our best example of natural advantage

best example of spillovers

78%

of

employment

the fur industry where 334 plants in

is

(most in Manhattan) employ 77% of the industry's workforce.*) The main point

of our analysis

is

not that these models can both account for geographic concentration,

but rather that regardless of which mechanism generates geographic concentration in a

particular industry

we can

control for the

the set of geographic areas for which data

coincidence that

we

feel

number and

is

size distribution of plants «ind for

available in the

same way.

somewhat comfortable that our index may

It is

because of this

control for these factors

in the real world as well.

While the paper is concerned largely with methodology, we try also to provide as detailed

a description as space allows of geographic concentration in U.S. manufacturing industries.^

After

we

all,

the ultimate test of an index

is

whether

it

provides enlightening results. First,

many

industries

what others have

identified

discuss overall levels of concentration, with one observation being that

are only slightly concentrated (with a substantial fraction of

as concentration being attributable to the discreteness of plants.) Next,

we

discuss briefly

which industries are concentrated. Subsequently, we explore the nature of the

other forces) causing agglomeration along a

state,

number

spillovers (or

of dimensions: using data on county,

and regional agglomeration to investigate the geographical scope; looking

their influence

is felt

at

whether

within narrowly defined industries or whether these spillovers act more

broadly; and examining the degree to which the agglomeration of plants occurs internally

within firms.

Models of Location Choice

2

In this section

we develop

several simple models of location choice. These models will be

used to construct a test of whether observed levels of geographic concentration are greater

than would be expected to occur randomly, and to motivate our subsequent proposal of an

index of geographic concentration.

As a practical matter, the data available for measuring geographic concentration

ly consists of

e.g.

we may

a breakdown of an industry's total employment by some geographic subunits,

find state-by-state

employments

for

an industry in the U.S. or country-by-

'Fuchs (1957) provides an excellent discussion of the industry.

^The raw data for most of our calculations is from the 1987 Census of Manufactures.

some length

to

typical-

fill

in

missing state-industry employment data so that we

manufacturing industries.

each 4-digit industry.

We

We

may

have also estimated the Herfindahl indices of the plant

hope that

this

data

may

We

have gone to

analyze the complete set of

prove useful in future work as well.

size distributions for

,

We

country employments in the European Community.

model

which a geographic whole

in

shares xi,X2,..

, x\f

given industry's

(e.g.

the U.S.)

employment located

employment

M subunits which have

assume the shares

5i , sj,

•

in each of these subunits are also available.

data, a natural measure of the degree to which

the overall pattern of

divided into

is

We

of aggregate employment.

therefore consider an abstract

employment

•

•

-sat

of a

With such

from

in the industry departs

is

M

»=1

We

feel

that such a measure

is

of economic interest in that

involve significant fractions of an industry's employment.

this

measure throughout

because

2.1

We

it

A

will

this

it

We

emphasizes departures which

will focus

paper both because the measure

is

on modifications of

of economic interest, and

prove easier to work with than, say, Gini coefficients.^"

Simple Model

begin with a simple model we will use to ask whether the concentration of employment

within industries

greater than would be expected

is

pendent random manner.

would be expected

We

if all

plants were located in an inde-

view the "random" choice of the model as reflecting what

an industry lacking both agglomerative forces (such as spillovers) and

in

centrifugal forces (such as transportation costs with dispersed

Consider an industry consisting of

We

industry's employment.

write

H

N

demand).

business units having shares zi,Z2,. ..,zn of the

JZjZJ. Suppose that each business unit chooses a single location for

within a country which

of total

is

divided into

As a model

employment. ^^

unit chooses a single location for

the country. Formally,

we suppose

all

M

Pi,P2i---',PM

whether

this

^

.

.

.

,

all

of

its

operations

geographic areas having shares xi,X2,..

of

random

of

its

location,

.

,xm

we imagine that each business

employees by throwing a dart at the

map

of

that the geographic areas in which the firms choose to

locate are independent identically distributed

on the values 1,2,

^=

for the industry Herfindahl index^^ defined by

random

M with probabilities Pi,P2,

•

•

•

Vciriables

,Pm-

Vi,V2,...,vn, each taking

We can

think of the probabilities

describing the relative sizes of the states on the map.

model can describe the geographic concentration of U.S.

In trying to test

industries,

we

will

'"Florence (1948) provides a lengthy argument for a similar measure.

''Note that our definition

differs

from the conventional use of the term both in that we

will usually

think of plants rather than firms as the business units in question and in that market shares are shares of

employment rather than shipments.

'^We think of the industry as being small

relative to the country so that the {xi}

regardless of the location decisions of the business units in the industry.

can be treated as fixed

usually take

=

p,-

i, for all

random

so that the

i,

location process would on average produce

a pattern of employment shares for the industry matching that we have assumed to prevail

^^

in the aggregate.

Let us

now examine the degree

of localization such a model would produce.

of the industry's employment located

in

geographic unit

i

is

variable equal to one

if

Si

The

fraction

N

= 53 ZjUji,

J=l

where

random

the Bernoulli

Uj, is

normalized measure, G, we

will refer to as the

and only

if Vj

=

i.

Define a

raw geographic concentration of the industry

by

r

""-

Proposition

The

on

fact that

H

1

characterizes the

.

.

.

•

1-E.x?

raw geographic concentration produced by

1

on plant

,PAf )

sizes

may be hard

to

is

G

this

model.

depending only

not only interesting, but also

come

by.

In the model above,

E{G) =

(pi,

=^,)'

details of the plant size distribution

useful in that detailed data

For

-

we get such a simple answer with the expected value of

and not on any

Proposition

E.(^.-

=

{x\,..-i

xm)

1-E.p?^

±c ^ +

"

,

E.(p.-^.)'

;

1-E.x?2

•

1-E.x?

this reduces to

E{G) = n.

Proof

The

of a

result follows

from a straightforward calculation using the

sum of random variables is

the

sum of the expectations

fact that the expectation

regardless of whether the

random

variables are independent.

{l-Yix])E{G)

= EiY^isi-Xif)

i

i

= Y^Eiisi-pi + p,-x,)')

t

=

J3Var(5,)

+ X:(p.-x.)^

'^We emphasize that by doing so we are taking

even though this

may be thought

as given the concentration of aggregate employment,

of as resulting from (nonindustry-specific) interiirm spillovers.

interested in exploring intra-industry localizations, not in the fact that there

in the state of

Wyoming.

is

virtually

We

are

no manufacturing

Using

=

Si

XIj

-s^jWit

aJid that the Uji for j

=

1,2,

.

.

.

N

,

are independent Bernoulli

random

we have

variables

t

i

j

«

J

i

«

i

I

as desired.

QED.

To help

get

some

intuition for this result,

=

of limiting cases (assuming that p,

^

areas, the limit as

this case the

^^

—

>

0.

i

sizes of the

With only a

and

G

be

will

if

First, for

all i).

business unit j

is

zero. Next, for

why

finite

number

located in area

i

of firms

The

and

we can

value of

holds in a couple

it

any fixed

set of geographic

number

of small firms. In

i, of the industry's

any fixed firm

geographic areas become arbirarily small,

of two darts hitting any geographic unit.

zj

help to note

law of large numbers dictates that a fraction

imagine that the

max,i,

may

describes an industry with an infinite

be in geographic unit

will

x, for

it

employment

size distribution

i.e. let

M—

oo with

in the limit ignore the probability

— i,)^

(«,

will

otherwise. Hence,

then be approximately

we can

see that the

sum

of squared deviations will approach the Herfindahl index.

The

If

result also gives us

our

first

intuitive interpretation of a

measure of concentration.

an industry has raw concentration G, we can think of the distribution of employment

the industry as being as concentrated as would be expected

each had a fraction

if

^

randonily selected locations

G of the industry's employment.

In testing whether a set of industries exhibits excess geographic concentration,

useful also to

know the variance

for the expectation,

of

G in this model.

The expression

is

it is

not as simple as that

and depends also on the fourth moment of the distribution of business

unit sizes.

Proposition 2 For {pi,p2,...,PM)

The

in

result follows

=

(xi,I2,...,xm) in the model above

from a straightforward but tedious calculation, which we omit.

Two Models

2.2

We now

of Localization

two additional models of the location decision process, each of which

discuss

Is

capable of explaining localization in excess of that predicted in the simple model above.

The models

thus be useful in developing an index of the extent to which an industry

will

exhibits excess geographic concentration.

The models concern

location choices which are influenced not only by aggregate

em-

ployment, but also by the "natural advantages" to locating in certain areas and by localized

intraindustry "spillovers."

helpful

it is

terms.

first

to recast the dartboard

Specifically

unit

when

it

suppose that in an industry

locates in area

7r7 is

like that

its profits,

in

more economic

described above, each business

and that the

profits received

by the

take the form

i

=

logTTfc,-

where

these factors should be incorporated,

model of the previous section

unit locates in whichever state maximizes

A:"*

how

In order to discuss

log7i7+ffci,

a measure of the average profitability of area

i

and

fjt,

is

a random variable

reflecting idiosyncratic elements of the suitability of the area to the firm in question (because

of fixed firm characteristics, preferences of its

site, etc.). If

then

it is

we assume

that the

{(-ki)

a standard result that firm

/;'s

location

=

i)

Our standard dartboard model can be obtained

in aggregate

takes the form

search for a

a random variable with

T,-

— _ 14

as a special case

affect their

employment, and that the positive

Wi = n. With

=

vjt is

its

and have the Weibull distribution,

are independent

Prob{ujt

have no distinguishing features which

management, the success of

by assuming that the states

average profitability other than differences

spillover of aggregate

employment on

profits

this specification

Prob{t;jt

Because this dependence of average

=

i}

profits

= =-^— =

x,-.

on aggregate employment leads to location

choices which on average recreate aggregate agglomeration given the error structure

have assumed, we shall take

"Sec McFadden

it

as a starting point for our subsequent models.

we

^^

(1973).

'^Rather than thinking of this dependence as reflecting aggregate spillovers,

such a relation indirectly by assuming that the profitability at each potential

it is

site

also possible to obtain

b

independent and ex-

ante identical, bnt that larger states have more sites to choose from (proportionally to their aggregate

employment) so that the best location

in

a larger state

is

on average superior.

A Model

2.2.1

Our

first

of Natural Advantage

model of industry localization

motivated by the observation that the business

is

units in an industry will appear to be clustered whenever their location decisions are influ-

enced by factors which can be regarded as giving a "natural" advantage to certain of the

geographic areas.

Our

of the industry in

is

prototypical example

is

the wine industry. Clearly, the localization

due to California's climatic natural advantage

in large part

in

grapes. Similarly, the concentration of industries which import or export bulky

ties in coastal states reflects

growing

commodi-

a natural advantage in access to transportation.^^

Perhaps

because such factors so straightforwardly lead firms to cluster together they have generally

They

received less attention than spillovers in discussions of industry localization.

are,

however, an essential component of a complete description of agglomeration.

The

to

is

simplest

way

to add natural advantage to the location choice model described above

assume that firm

when

profits

fc's

it

logXfc,

locates in state

=

but with the average profitability of state

variable reflecting all of the

affect profits in the

ways

same way

in

are again of the form

logx7-f-€fci,

i,

Wi,

now taken

to be a nonnegative

which nature has chosen to make state

for all plants). Conditional

probability that each business unit locates in state

The

i

larger are the differeces between the p's

:'

and the

i

random

unique (which

on a realization of the {t^}, the

is

I's,

the more

we can think of locational

patterns as being influenced by natural advantage.

We

analyze a specification of this model in which the importance of natural advantage

neatly parameterized by a single constant 70 G

is

levels {Wi} are

and Var(p,)

=

independent of the

7oXt(l

—

Xi).^^

{cjti},

and that

=

1

of

by assuming that the state

their distribution

Note that when 70

we obtain our standard dartboard model

70

[0, 1],

=

random

0,

there are no

locations.

each Pi has the largest possible variance given

is

its

such that E{pi)

common

a

=

x,

shocks and

At the other extreme, when

mean and support,

probability one the dlflferences in state characteristics are so extreme that

will cluster in

profit

all

so that with

business units

single state.

To explore the

level of

mediate 70 and how

this

raw geographic concentration such a model produces

depends on the structure of the industry,

'^One formal study of such an

effect is

it is

for inter-

helpful to restate

Cailton (1983), which finds that energy prices are an important

determinant of plant location decisions in several industries.

'^For example, one could assume that tT

^.

1;,

=

=

(with probability one) and Var(T;i)

x,

-(-

•;

with the

= 7oz;(l — z,)8

{i/,}

being

mean

Another example

zero

is

random

variables with

given later in this section.

We

the model using a dartboard metaphor.

location as a two stage process. In the

first

can think of the business units' choices of

stage nature chooses (from

some

set of possible

dartboards) a single dartboard on which the geographic areas have sizes Pi,P2,---,PM,

reflecting the

importance and allocation of comparative advantage across the areas (the

larger areas being those with greater average profits).

units, being influenced

by the same

levels of

In the second stage,

all

business

comparative advantage, independently throw

darts at this board to choose their locations.

The

following proposition shows that the expected raw concentration

is

linearly increas-

ing in 7o and again depends on the distribution of the plant sizes only through

Proposition 3 In

the two stage

H.

model of comparative advantage described above

E{G) =

fQ

+ il-fo)n.

Proof

Using the result of Proposition

we have

1

(1

We

have assumed that E{pi)

=

and Var(p,)

Xi,

=

7oii(l

—

x,).

Hence,

(l-^x^EiG) = ^(l-J3x? + 7oXi(l-x.)) + 5:7ox.(l-x.)

1

t

t

= ^(l-7o + (7o-l)^x?) + 7o(l-^x?)

t

i

<

as desired.

QED.

For concreteness,

above

is

it

may

help to note that one specification satisfying the conditions

obtained by assuming that the {x7} are independent random variables with Wi

having a chl-square distribution with 2^^^Xi degrees of freedom. The induced distribution

of p,-

= ^' _

'

2^j *>

is

then /?(i^^x,-, ^r?^(l

TO

TO

**More generally the same distribution

distribution of (pi,...,pm)

(1972,

p.

is

— x,)), and

for pt

b

hence has mean

231) for a description of this distribution.

and variance 7oXi(l —

~

r(

'~'"

'ii, A).

The joint

{^-^xi,...,—^xm)- See Johnston and Kotz

The density function is f(yi,...,yM-i) =

obtained whenever x7

Dirichlet vnth parameters

x,-

A

2.2.2

Model of

Our second model

spillovers

We

may

Spillovers

of industry localization

is

motivated by the idea that externalities or

lead firms to desire to locate their plants near other plants in the industry.

use the term spillovers quite broadly here to refer to technological spillovers, gains

from interfirm trade, the

essentially

i is

factors,

one might assume that the

etc.

-

in the industry.

profit of business unit k if located in

of the form

log

where

knowledge on the location of spinoff firms,

any forces which lead firms to choose locations near other firms

To model such

area

effect of local

as before Vj

=

TTki

log7f(a:., vi,...,

the location of plant

is

Vi.i,Vi+i,VM)

+

ffci,

This formulation allows average profits within

j.

a state to be affected generally by both the aggregate employment and the location of

the other plants in the industry (but not by state characteristics).

we again examine a simple parametric

tractable and to aid interpretation,

this model. In particular,

we consider

=

logTTi,-

where the

{cjt/}

are Bernoulli

indicator for whether V(

independent of the

To motivate

=

i,

To make

+

log(l,)

random

and the

€

for 70

^

[0, 1] profit

-

ejk/(l

the emalysis

specification of

functions of the form

Uti){-00)

+

€fc,,

variables equal to one with probability 70,

{ejtt}

are again independent

WeibuU random

ua

is

an

variables

{ejt/}.

this formulation, note that the first

term log(i,)

is

the same dependence

of profits on aggregate

employment necessary to reproduce (on average) the pattern of

aggregate employment.

The second

for tractability.

profit

First,

expression involves two main assumptions

we have assumed that the

depends only on whether they are

different areas. Second, rather

of the spillovers,

either strong

we

in the

effect of plant

same

area, not

made

largely

Vs location on plant

fc's

on the distance between

than assuming a continuous distribution for the magnitude

take the spillovers to have an extreme two point support - they are

enough so that firms k and

i

wUl have negative

infinity profits if they locate

apart, or they are nonexistent so that k^s profits are independent of

^'s

location.

As the

probability that any pair of firms has such a crucial spillover between them, 70 clearly

indexes the importance of spillovers. ^^

In this spillover model, one needs to

of the business units.

We

be more careful

assume the the business units choose locations

dained order, and that each firm in turn maximizes

"Note

in specifying the decision processes

its profits

in

some

preor-

conditioning oidy on the

that in a violation of accepted practice are using 70 to represent a completely different parameter

here than in the previous model.

We

have

made

this decision to

concentration of the two models wUl turn out to be identical.

10

emphasize that the predicted mean

location decisions of the firms which have

moved

We

previously.

shall

assume

also that the

indicator variables {eke} for whether spillovers exist between pairs of firms are symmetric

and

transitive in the sense that

we have

this case, the process

cfc/

=

1 =J> e/jt

specified

is

=

=

and €«

1

1

and

=

e/„,

1 ::^ Cfcm

a rational expectations equilibrium

firm earns nonnegative profits and the resulting distribution of locations

the order in which the business units

make

Note that

their choices.

again our standard dartboard model, and for 70

=

1 all

1.^° In

which each

independent of

is

for 70

in

=

=

the model

firms wiU cluster in a single area.

To analyze the geographic concentration such a model produces

it

helps again to think

of the firms' location choices in terms of a dart throwing metaphor. Each business unit

represented by a dart which will be thrown to choose a location. In the

randomly decides to weld some of the darts together into

clusters,

first

(with

cluster.

all

In the second stage, each cluster of welded darts

with the distribution

variables, each taking

on the value

thrown independently

i

and

produced by

all £

this

/ k?^

.

.

.

,

u;v are identically distributed

€ {1,2,...,M} with probability

i

that the {vj} are not independent; instead

all

same

darts in a cluster hitting a single point).

In this model, the business units' locations ui,

7o for

is

is

stage, nature

of her decisions being such that each pair of darts has probability 70 of being in the

welded

is

it is

i,.

random

Note, however,

straightforward to show that Corr(ufc,,u/,)

=

Proposition 4 characterizes the raw geographic concentration

model.

Proposition 4 In

the

model of spillovers described above

E{G) =

^o

+ il-lo)H.

Proof

«

«

i

i

j

i

j

j,k,j^k

i

i

},k,j^k

j,k,j^k

i

^"Note that we have not fully spedAed the joint distribution of the {ek/}. The proposition below

to

all

distributions with the properties above.

To

the case of the {ckt} being perfectly correlated, so that with probability 70

interdependent and with probability

^'The reader may note that

this

1

is

— 70

all

will

apply

see that at least one such joint distribution exists consider

all

the firms are completely

of their profits are independent.

the only property of the joint distribution which

is

necessary for

the proposition, and hence the proposition applies to any formulation of the interdependent profits which

induces this correlation in location choices.

11

The

now

desired result

follows

from the substitution

Z^j^jt ZjZk

=

(I3j ^j)^

~5Zj

z]

= I- H.

QED.

The most notable

feature of the result in Proposition 4

is

that our model of spillovers and

our model of natural advantage yield identical functional forms for the relationship between

the expected level of geographic concentration and the other industry characteristics (the

plant size distribution and the sizes areas for which

employment breakdowns are

available).

This coincidence motivates the index of concentration proposed below. The coincidence of

the results of Propositions 3 and 4 also

tells us, in

some

sense, that

we cannot

comparative advantage from spillover theories based only on the mean

distinguish

levels of geographic

concentration.^^

Real world location decisions are likely to be affected by both natural advantage and

by spUlovers, so

it

is

probably worth noting that a combination of the two factors also

raw concentration which

produces a

level of

same way.

Specifically, consider

where

in the first stage

and Var(p,)

=

7ix,(l

is

a three stage model (we give only the dartboard version)

Nature chooses (pi,P2,

—

related to the industry characteristics in the

x,); in the

•

•

•

iPm) fro™ a distribution with E{pi) =

i,

second Nature randomly welds each pair of darts with

probability 72; and in the third the welded clusters are independently thrown at a dartboard

in

which the states have

Proposition 5 In

with 70

=

7i

+

72

The proof is

3

An

sizes {pi,P2,

the three stage

•

iPm)-

model above

- 7i72-

similar to those of the previous propositions

each of

M geographic areas,

^^The theories wiU

fully specified either

full joint

H=

si, 53,

J2j=:i ^] of

differ in their predictions for higher

.

.

.

s\f of an industry's

employment

the industry plant size distribution.

moments

of G. Recall, however, that

model (leaving out the higher moments of the {p.}

in the natural

we have not

advantage model

distribution of the {ckt} in the spillover model). Varying these elements, each

produce a range of predictions

theories

therefore omitted.

the shares ii,i2,...,XAf of total employment in each of

those areas, and the Herfindahl index

and the

is

Index of Geographic Concentration

Suppose we axe given data containing the shares

in

and

on such grounds

will

for

be

Var(G). For this reason, we do not

fruitful.

12

feel

model can

that attempts to distinguish the

As a convenient index of the degree

to which an industry

is

geographically concentrated we

propose the use of a measure 7 defined by

_G-H

We

-

_

-

Zfiijs,

-

believe that this index has a

number

of attractive features. It reflects a property which

''-

^^^

l-H

- Ei^i x?)Ef=i

(\-TK,

x?¥1 - T^_, z?

(i-E,^ix?)(i-Ef=,^^)

x.)^

(1

4

naturally meaningful in emphasizing large deviations from the distribution of aggregate

is

employment. Because E{f)

it is

=

clearly interpretable as

when data

is

generated by our standard dartboard model,

measuring excess concentration beyond that which would be

expected to occur randomly. Finally and most importantly the index allows us to easily

perform meaningful comparisons of the degrees of concentration in different industries,

comparing a U.S. industry with

e.g.

its

counterpart in another country, or comparing

concentration using 3- and 4-digit industry definitions.

To

plants

justify such comparisons,

is

we note simply

that

if

the location decision process of

accurately described by either or both of the natural advantage and spillover

models of the previous section then

Eil)

i.e.

the index

is

=

^_g

=

70,

an unbiased estimator of the fundamental parameter which describes the

That the index controls

strength of natural advantage or spiUovers.

size distribution of plants

subunits for which data

is

and (subject to the caveat below)

available in both of these

modes

for the

number and

for the sizes of the geographic

gives us

some hope that

it will

allow us to compju-e the strength of these forces in real world industries as well.

In

making the

transition from the models to the real world one caveat

is

necessary with

regard to comparisons based on differing geographic subunits. Each of our models takes

an extreme view of the geographic scope of the forces which produce localization.

example, when spillovers are important they are assumed to accrue only

in the identical geographic subunit. In practice, spillovers

declines

so

more smoothly and provides some

when the areas

reflect

would

likely

if

For

the firms locate

have an

effect

which

benefit to locating in nearby areas as well (more

in question are smaller). If

we estimate 7 using county

level data,

it

will

only the added probability of pairs of plants locating in the same county, while a 7

estimated from state level data will

of the pair locating in the

same

reflect

the typically larger increase in the probability

state.'^

^^The location decision process of the natural advantage model depends heavily on the definition of

the subareas, and thus the conditions under which

subunits are less obvious.

One case

we can compare estimates based on

in which such comparisons are completely justified

13

is

different geographic

that of the

gamma-

,

The

fact that

we can regard 7

interpreted in light of

as a parameter estimate clearly suggests that

standard error.

its

What

this

standard error

determined given the assumptions we have made so

a feature of our paper that this

is

true) the results

should be

however, can not be

is,

we consider

In particular, (and

it

on mean concentration above have been

derived without ever specifying the higher

moments

model or

{e«}

joint distribution of the indicators

far.

it

of the {Wi} in the natural advantage

in the spillover

A

model.

straightforward

calculation of the standard errors gives

Var(7

-

=

70)

S S

(l_JJ2)(l_yx^)2

The covariance terms wiU depend on the

To

unspecified elements of the models.

give a

the magnitude of one of the sources of measurement error in our calculations of

feel for

7's,

ZjZkZtZ^CovinjiUki^lHrtimr).

we

will present later

standard errors (obtained from simulations) from one complete

specification - a natural advantage

model where the distribution of the

aissumed to be Dirichlet with parameters

(i^xi, ^-^12, ...

(pi,P25

•

•

,Pm)

•

is

^^/^xm).'^*

Data

4

By

design, the data requirements for this paper are fairly simple.

tion of employment across a set of geographic areas for

indices of firm

tries is

and plant employment shares

a

require the distribu-

set of industries

for those industries.

the finest one possible given data availability

We

Our

and the Herfindahl

definition of indus-

constraints - the 459 manufacturing

industries defined by the 4-digit classifications of the Census Bureau's 1987 S.I.C. system.

Given

we

this decision,

on the

settled

finest

geographic areas for which we

felt

we could

obtain reliable employment breakdowns - the 50 states plus the District of Columbia.

distributed {77} described at the end of Section 2.2.1.

Our

we can legard natures choice of a

In this model,

dartboaid as leaulting from an assignment of a probability (or more precisely of an independent gammadistributed xT) to each square inch of the country, with the probability of a dart hitting each state (or other

summing the

subunit) being obtained by

the state.

More

probabilities of its hitting each of the square inch plots within

formally, suppose that geographic area 1

xii,--,*ir of total employment (with

zu

with parameters (i=^iii,

^*2.

parameters

'"^'

(

xi,

'"""

.

.

. ,

^=?^*ir,

H

\-

•

.

^~''

Ta,...

,

is

divided into subareas 11, 12,

= n). When

^^'m)< (p>» +

x\r

^xm). Note that

(pu

•

•

when using

arises in defining the

standard errors.

the variance of the ex ante distribution from which the {pi) are

..

._..„„ „.

^

•

.

,

Ir with shares

,Pm)

,Pm)

is

is

Dirichlet

Dirichlet with

in that natural

we would expect

to find

coarser subdivisions.

^*One question of interpretation

'

•

.

extreme as well

advantatges of nearby square inches are likely to be spatially correlated, so again

larger 7's

.

Pir,P3,

+Pir,P3,

this specification is

.

'^

.

We

Do we

treat

7 as an estimate of

drawn or as an estimate of the ex post

take this latter interpretation, drawing {p.} for which this expression

to 7 from the conditional distribution induced

by the

Dirichlet.

14

is

equal

source for

of this data

all

is

the 1987 Census of Manufactures, although despite our simple

data requirements the process of constructing the data

we have

filled in is

is

quite involved. While the data

by necessity speculative, we hope that our data may be helpful to others

in the future.

Our construction of

state-industry employments relies on the Census of Manufactures'

employments and on the reported

listings of state-industry

ployment

filling

in

each state and in each

2-, 3-,

and

totals for

4-digit industry.

A

manufacturing em-

very substantial data

procedure was necessitated by two limitations of the raw data. First, employment in

any state-industry with fewer than 150 employees

is

omitted from the raw data (presumably

to save space). Because states with less than 150 employees contain a nontrivial fraction

some

of employment in

more importantly, to protect the

reports state-industry

Second, and

confidentiality of individual responses the

Census often

desirable to

it is

employment only

fill

in these

as falling into one of five categories corresponding

employments of 100-249, 250-499, 500-999, 1000-2500, and the unfortunately low top-

to

code of

2500-1-.'^^

employment

of

numbers.

industries,

90%

of

To

give

some idea of the magnitude of these

in each of these cells to its lower

employment

in the

To complete our data

restrictions, simply setting

bound unequivocally

identifies the location

median industry and 80% on average.

set,

we have

filled in

data for

all

2-,

3-,

and

4- digit state-

employments using the census data and the adding up constraints across

industries and across subindustries within states.

Our algorithm

is

states within

based on the idea of

imposing the upper and lower bounds of the reported ranges, and adjusting employments

within the ranges to try to satisfy the adding up constraints in both directions. Data for

state-industries with less than 150 employees

the

is filled

by a similar procedure which uses also

number of "missing" establishments created by the nonreporting of these

details are given in

rely

More

Appendix A.^^

Throughout most of the paper we

and thus

cells.

will

think of plants as the business units of the model,

on a Herfindahl index Hp of the employment shares of plants to control

size distribution of business units.

While the Census does not publish

for the

this information

it

does make available for each 4-digit industry the total employment and the total number of

^^Fortunately,

employment

in

many topcoded

cells is relatively small,

because the largest state employ-

ments tend to occur in states with several firms so that withholding restrictions do not apply.

^'An alternate approach used by several past authors, e.g. Enright (1990), is to reduce the number of

topcodes by obtaining data from the County Business Patterns (which does not have an identical sample,

but which has a much higher topcode) and use means of ranges, dropping industries where topcodes can

not be avoided or where the ranges are too large. Drawbacks of such an approach are that the important

information in the adding up constraints (and often the existence of small state-industries)

and that industries with interesting agglomerations often end up being dropped.

15

is

being ignored,

plants in each often

employment

size ranges.'^^

Subject to disclosure rules, the total number

of employees within the plants of a size category

somewhat more of a problem here than

it is

is

also usually reported.

in the construction of the state

The withholding is

employments because

primarily the shares of the largest plants which are obscured by the nondisclosure rules.

For each industry we used the data to estimate a

step procedure: employees were

first

sum

of squared plant shares using a two

allocated between the classes where data was withheld,

and a Herfindahl index was then estimated by a procedure similar to that recommended

by Schmalensee (1977), but taking into account the additional information available here

in the

form of the category divisions. To get a rough idea of the magnitude of the resulting

measurement errors we conducted

tests of

our algorithm on simulated data. The details of

the data construction and of the simulations are reported in Appendix B.

The

simulations

A

suggest that measurement errors are not likely to substantially bias our results.

list

of our estimated plant Herfindahls

A

is

given in Appendix C.

firm level Herfindahl index, Hj^ was taken directly from the Census of Manufactures'

The data

Concentration Ratios in Manufacturing.

the top 50 firms rather than on

459 industries, with the values

for the

remaining

We

are based

444 of the

drop these industries whenever our analysis uses

is

0.068 and that of

interesting to note as an aside that following Scherer (1975) one

ratio of these

number

for

fifteen (highly concentrated) industries

Hf. In the restricted sample of 444 industries, the mean of Hj

It is

on shares of shipments of

employment, and are available

all firms'

withheld because of disclosure rules.

0.025.

complete

two concentration measures

for

may

an industry as an estimate of the

of plants operated by the large firms.^* In doing so,

we

find

Hp

is

use the

effective

a mean across industries

of 3.8 plants/firm and a median of 2.7, figures roughly comparable to those reported by

Scherer twenty years ago.

The

ratio takes

on

its largest

value, 30.1, in S.I.C. 2813, industrial

gases.

Finally, for

our analysis of the geographic scope of concentration we obtained a dataset

of 1987 county level employments for 3-digit industries.

by

mean

dataset had been constructed

County Business Patterns data using an algorithm which consists

filling in

using

The

plant sizes for

all

nondisclosed employments.^^

Some comparisons

largely of

of this data

with our primary dataset are given at the end of Appendix A.

^^The ranges

ue

those determined by the lower bounds of

1, 5, 10,

20, 50, 100, 250, 500, 1000,

and 2500

employees.

^'The estimate

is literally

valid only

if

each firm's activities are divided evenly between the same number

of plants.

29

See Gardocki and Baj (1985)

16

Basic Results on Geographic Concentration

5

In this section

we

We

industries.

describe the patterns of geographic concentration in U.S. manufacturing

begin at the broadest level with a discussion of whether any geographic

concentration exists before moving on to discuss a few aspects in a

little

more

Are Industries Geographically Concentrated?

5.1

The

most crucial question one must ask before further studying the geographic con-

single

centration of industries

is

whether geographic concentration

While a number

really exists.

of previous writers have noted that localization appears to be widespread,

for the first

is

detail.

time formal

tests of the

we

present here

more stringent hypothesis that the extent of localization

greater than that which would be expected to arise randomly.

We

begin with what

is

clearly the

most compelling application of our simple dartboard

model, assuming that the plants in an industry are the business units choosing their locations in an independent

random manner. The

with the difference between

sition 2. For the fuU

and

Hp being

is

0.28, respectively.

The simple dartboard model

mean

that

E{G) = Hp,

heteroskedastic with a variance given in Propo-

sample of 459 industries we find that the means of

the G's should have a

is

G and

prediction of the model

G

and Hp are 0.77

predicts that the sample average of

of 0.28 and a standard deviation of 0.0005, so this diflference

highly significant indicating that there

is

excess localization relative to

random

location

choice.

Looking at the industry-by-industry estimates the prevalence of excess localization

which previous authors have noted

G exceeds

is

strikingly confirmed.

The

level of

raw concentration

that which would be expected to arise randomly in 446 of the 459 industries.^"

In fact, the

flip

side of this result

- that

in only 13 industries are plants

tributed than would be expected at random -

need to be near

final

consumers

is r<u-ely

is

interesting in that

it

tially

briefly

dis-

an overwhelming force in location decisions.

Before discussing patterns of geographic concentration in more detail,

comment

more evenly

indicates that the

we would

like to

on an alternate application of the dartboard model which might poten-

account for higher levels of concentration. Specifically, one could apply the model by

assuming instead that the firms

in

an industry are the business

units, with each choosing

common location for all of its plants. While this extreme is plainly counterfactual, it

may provide a more reasonable test for the hypothesis that locations are random in some

a

instances.

it

For example, for a number of years Maytag had exactly two plants in which

manufactured washing machines, and both of these were located in Newton, Iowa. The

^^The difference between

in

which the difference

is

G and

positive,

Hp

is

larger than twice its standard deviation in 369 of the 446 industries

and none of the 13 industries

17

in

which the difference

is

negative.

two location decisions were not independent, and given that the entire industry (SIC 3633)

consists of only 18 plants, treating

them

as independent observations might lead to a mis-

leading conclusion that locations are unlike those expected from independent

random dart

throws.

Looking

for

which

first

at the overall level of concentration,

Hj was

available the

we note that

means of G and Hj are 0.074 and

for the

444 industries

0.068, respectively.

While

the overall level of concentration appears to be approximately that predicted by the theory,

there

is

a difference between correctly predicting the overall

A

predicting the pattern of concentration across industries.

firm-random location theory

= Qo +

Gi

otifJfi

+

is

equation are given in Table

Each of the

1.

and an F-test of the

statistic of at least 10,

177.8, also rejecting strongly.

more demanding

and

test of the

obtained by estimating the parameters in the regression

and testing whether qo

ft

level of concentration

The model

=

and qi

equalities

=

1.

OLS

rejected individually with a

is

an

joint hypothesis yields

thus

fails

estimates of this

t-

^2,442 statistic of

to account for pattern of concentration

across industries, which should not be surprising given that

we know

that multiplant firms

do often choose multiple locations. The comparison does provide some intuition

for the

degree to which manufacturing industries are localized: they are approximately as localized

as would be expected

at

if

units as large as firms' operations in each industry chose locations

random.

Table

1:

Test of the Firm- Random Location Theory

Equation: Gi

Parameter

=

Qo

+ QiHji +

fi

CoefF. Estimate

Std. Error

0.047*

0.005

0.394*

0.057

Constant

R? = 0.09

*

indicates significance at the

5.2

Levels of Geographic Concentration

From

the previous section

industries

is

is.

It

seems

we

try to use our models to get

likely that the

vary greatly from industry to industry.

across industries

level.

that the degree of localization in U.S. manufacturing

not zero. In this section

concentration there

will

we know

1%

feel for

how much

agglomerative forces reflected in our models

We

therefore begin by imposing no structure

and simply computing the index 7 defined by

18

a

(2) for each of the

459

4-

digit industries in

our sample.^^ Recall that 7 can be interpreted either as the probability

with which any pair of plants choose their locations jointly or as a measurement of the

importance of natural advantage

in location choice.

A

complete

list

of the 7's

we

find

is

contained in Appendix C.

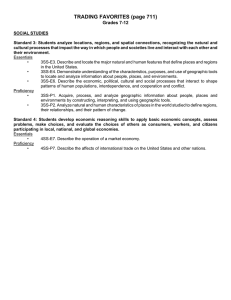

A

1.

histogram illustrating the frequency distribution of these 7's

In the figure, each bar represents the

The

of width 0.01.

The

bar

tallest

number

is

of industries for which 7 lies in an interval

mean

of 0.051 and a

Approximately 43% of the industries have 7 < 0.02, while 26% have 7

that

large are these values? Recall that

Ha

similar level of concentration

would

result

weak so that

production would be no more concentrated than

that

it

no

justification for

<

in

standard deviation. To get a

computed standard

mind

that

errors

feel for

if

not for the fewness of plants,

At the other extreme, we

0.10,

and 0.10

To provide some

is

0.02.

both to

shall refer to

one views locations as being generated by

if

7/G

is

a parameter estimate with a nontrivial

Among

The means

1.0 are 0.024, 0.041,

-

industries with

Hp <

for industries with

and 0.072,

Hp

0.02 the

falls

we

into a

of intervals, both for

of

respectively.

of geographic concentration. Table 2

number

mean

in the ranges 0.02

intuition for the importance of accounting properly for

when constructing an index

all

random agglom-

lists

industries

sample of those in the upper quartile of raw geographic concentration.

the frequency

and

for the sub-

We

can think of

the fraction as a rough measure of the portion of raw concentration which

attributable to

it

feel

by simulating a special case of our natural advantage model -

the estimated stcindard errors

with which

sites.

the size of this uncertainty in our measurements,

that of Dirichlet-distributed state sizes.^^

-

A

7 < 0.01 we can think

were scattered at 100 equal sized

if it

0.02.

a random process, an individual industry's 7

0.05, 0.05

7.

7 > 0.05 as "very localized". This category contains 119 industries.

The reader should keep

is

legitimately

some form of spillovers/natural advantage rather than to randomness. The

table indicates that the

^'

E{G) =

would be an appropriate description of such a pattern, and we apply

industries with

eration

0.05.

any definition of the phrase "not very localized," we

these and to the other 88 industries with 7

-

0.026.

from completely independent random location

of agglomerative forces as being sufficiently

is

0.01.

an industry has many equal sized plants (so

if

decisions by I/7 equal sized plants. Hence, for the 118 industries with

While there

>

median of

the natural advantage and spillover models both predict that

0),

and

that corresponding to values of 7 between

is

distribution appears to be quite skewed, with a

How

presented in Figure

two components are comparable

Note that we assume here and throughout the

rest of the

in

magnitude and that there

is

paper that the plants are the business units

choosing locations.

^^The computation requires

purpose,

we took the plant

also a

sizes to

more complete

specification of the plant size distribution.

For this

be those used as an intermediate step to the Herfindahl calculation.

19

I

Figure

1:

Histogram of 7

Histogram of

Gamma

4-Digit Industries

100-

90-

80-

70-

M

60-

•o

C

-5

"'^

5

40-

30-

20-

10-

0-1-

J

WPF

i/^Mhn^ WS

0.1

0.2

i

fffW

m

0.3

Gamma

20

i

ftii

0.4

ft

^i

I

ift

irii

II

0.5

Mill

II II II

0.6

great variation in the

all

mix between them.

In roughly one third of the industries (both over-

and among the industries with high raw concentration) the

units and that

some

clusters

appear at random accounts

fact that plants are discrete

for at least as large

a part of

measured raw concentration as do actual agglomerations of plants. Our index may then

somewhat

give a

than would a discussion of

different picture of geographic concentration

raw concentrations.

Table

2:

Raw

Concentration Attributable to Spillovers/Comparative Advantage

Fraction of Industries with

Range

5.3

lIG

in

Range.

High

G

Industries

All Industries

Less than

0.03

0.03

0.00 - 0.25

0.09

0.10

0.25 - 0.50

0.22

0.16

0.50 - 0.75

0.32

0.19

0.75 - 1.00

0.33

0.53

Patterns of Concentration

An attempt

to explore formally the industry characteristics which tend to be associated

with localization

present a few

In Table 3

tries of

is

more

well

beyond the scope of

this

paper ."'^

We

would, however,

tables concerning the geographic concentration in different industies.

we summarize the

levels of

geographic concentration of the 4-digit subindus-

each 2-digit manufacturing industry. For each 2-digit industry, the table

fraction of subindustries which fall in the not very localized (7

very localized (7

>

<

lists

0.02), intermediate,

the

and

0.05) ranges. High levels of geographic concentration are most preva-

lent in the tobacco, textile,

plastics,

like to

and leather industries and most rare

and fabricated metal products

in the paper,

rubber and

industries.

In hopes that the forces affecting geographic concentration might be clearest at the

extremes, Table 4

index 7.

lists

the 15 most and the 15 least localized industries in terms of the

As Krugman (1991a) has previously noted,

accounting for extreme concentration.

there

The most concentrated

is

no obvious

single factor

industry, furs,

is

probably

explained both by the local transfer of knowledge from one generation to the next, and

as a response to buyers' search costs.

weight.

The next most concentrated,

Furs also have an unusually high ratio of value to

wine,

may be

largely attributable to the natural

'For interesting work on this topic see Henderson (1988) and Enright (1990).

21

Table

Concentration by 2-digit Category

3:

#

2-digit industry

of 4-digit

Percent of 4-digit industries with

subindustries

7 < 0.02

47

7 €

[0.02,0.05]

7 > 0.05

20.

Food and kindred products

49

21.

Tobacco products

4

22. Textile mill products

23

9

13

78

31

13

42

45

17

29

47

24

13

69

8

23

17

53

47

14

71

14

14

31

38

24

38

23. Apparel

24.

and other

products

Lumber and wood products

25. Furniture

26.

textile

Paper and

27. Printing

and

fixtures

allied

products

and publishing

Chemicals and

29.

Petroleum and coal products

5

60

30.

Rubber and misc.

15

73

31. Leather

plastics

and leather products

32. Stone, clay,

33.

products

11

and glass products

Primary metal industries

34. Fabricated metal products

35

100

28.

allied

18

40

27

36

64

26

58

27

15

26

39

35

27

38

61

32

8

35. Industrial

machinery and equipment

51

49

26

26

36. Electronic

and other

37

41

46

14

18

28

33

39

and related products

17

47

41

11

manufacturing ind.

18

44

22

33

37. Transportation

38. Instruments

39. Miscellaneous

electric equip.

equipment

22

advantage of California in growing grapes. The concentration of

oilfield

machinery

Houston/Galveston area) may be partially attributable to the location of

The

list

of the 15 least concentrated industries

industries certainly

final

consumers

is

also

is

do not stand out as being those

production.

something of a mixed bag. The

which spreading out to be close to

in

important, and the Bst contains several industries,

and small arms ammunition, where raw concentration

oil

(in the

is

e.g.

substantial, but

out to be concentrated in a few very large (randomly scattered)

vacuum

cleaners

employment turns

plants."'''

Scope of Geographic Concentration

6

In this section

First,

we

we examine two

different aspects of the scope of geographic concentration.

discuss the scope in the sense of industrial definition,

phenomenon which

is

principally a

is

characteristic of broad industry classes as well. Next,

i.e.

whether concentration

exists at the level of individual industries or

we

whether

it

discuss the geographic scope of

concentration, comparing data at the county, state, and regional levels.

Industry Definition

6.1

Table 5 provides a simple look at the concentration of

2-, 3-,

and

raw geographic concentration increases steadily as we move to

the increase in 7 appears to

level.

come more abruptly

as

This naturally raises two questions of scope.

4-digit industries.

finer industry definitions,

we move from the

Is

While

2-digit to the 3-digit

there any correlation in the location

decisions of firms which share ordy a two digit industry class, or

the concentration of

is

a consequence of the localization of its 3-digit subindustries? Are

2-digit industries entirely

location decisions influenced as strongly by the locations of plants belonging to different 4digit industries within the

to their

own

same

3-digit class as

4-digit industry? In this section,

questions and apply

it

they are by the locations of plants belonging

we develop a framework

to our data.

Consider an industry with r subindustries having shares wx^w^.,

industry employment. Write

Yl^j=i

WjH'

H^

for the plant Herfindahl of the

for the plant Herfindahl of the broader industry.

their locations in a

manner which

is

between the firms they represent) being 7j

if

(i.e.

Hp simply because

this

is

.

.

,'Wr

of the overall

subindustry, and

H=

Suppose that plants choose

when Hp

is

larger, so the list

where we have made the largest errors

23

that a crucial spillover exists

mind that the

both the inherent uncertainty of analyzing random dart throws and errors

larger

.

both darts correspond to plants within the

^^In interpreting these latter cases the reader should keep in

is

j*''

nearly identical to that of our spillover model, but that

the probability of any pair of darts being welded together

Each of these components

for addressing such

may

in

errors in measuring

in filling in

contain

Census nondisclosures.

many

measurement.

7 include

industries with large

Table

4:

Most and Least Localized Industries

15

Most Localized Industries

Hv

G

7

0.007

0.63

0.63

0.041

0.50

0.48

2252. Hosiery, n.e.c.

0.008

0.44

0.44

3533. Oil and Gas Field Machinery