Update & Review October 2004

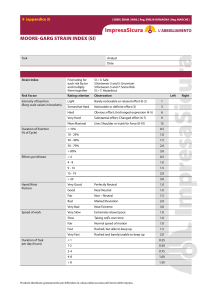

advertisement