Document 11146117

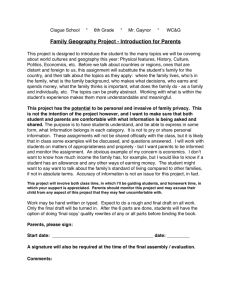

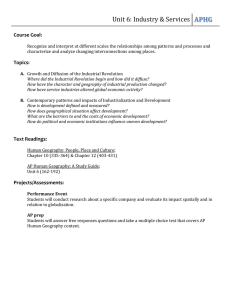

advertisement