Supplemental Materials for “Welfare and Optimal Not for Publication

advertisement

Supplemental Materials for “Welfare and Optimal

Trading Frequency in Dynamic Double Auctions”

Not for Publication

Songzi Du

Haoxiang Zhu

December 22, 2015

1

1

A Model with Multiple Dividend Payment

In the model of Du and Zhu (2015), we have assumed that the asset pays a single liquidating

dividend at an exponentially-distributed time. In this section we consider a more general

multi-dividend model. We derive a linear equilibrium and show that our conclusions of

optimal trading frequency in the single-dividend model generalizes to this multi-dividend

model. That is, under scheduled information arrivals, the trading frequency is never higher

than information arrival frequency. But for stochastic information arrivals, the optimal

trading frequency can (far) exceed the information arrival frequency.

1.1

Model setup

The multi-dividend model is specified as follows.

1. Dividends are paid at times T1 , T2 , T3 , . . ., which follow a (homogeneous) Poisson process with intensity r > 0. We set T0 ≡ 0.

2. Before the K-th dividend is paid, shocks to dividends come at news times TK,0 , TK,1 , TK,2 , . . ..

We assume TK,0 = TK−1 and either:

(a) TK,k − TK−1 = kγ for a deterministic constant γ (scheduled arrivals of news); or

(b) {TK,k −TK−1 }k≥1 is a Poisson process with intensity µ (stochastic arrivals of news).

At time TK,0 = TK−1 and immediately after the (K − 1)-th dividend is paid, the

dividend and private values are “renewed:”

2

DTK,0 ∼ N (0, σD

),

wi,TK,0 ∼ N (0, σw2 ).

(1)

Subsequently at time TK,k , k ≥ 1, the common dividend and the private values are

shocked according to:

2

),

DTK,k − DTK,k−1 ∼ N (0, σD

wTK,k − wTK,k−1 ∼ N (0, σw2 ).

(2)

Trader i observes his private values and receives signals Si,TK,k on the dividend shocks:

Si,TK,k = DTK,k − DTK,k−1 + i,TK,k , where i,TK,k ∼ N (0, σ2 ).

(3)

If TK,k0 is the last news time before the dividend is paid (TK,k0 ≤ TK and TK,k0 +1 > TK ),

then each trader i receives vi,TK,k0 ≡ DTK,k0 + wi,TK,k0 per each unit of his asset at time

TK .

2

3. Before the K-th dividend is paid, traders trade at time TK−1 , TK−1 + ∆, TK−1 + 2∆, . . .

If the K-th dividend is not yet paid at the t-th double auction (TK ≥ TK−1 + t∆),

then let zi,TK−1 +t∆ be trader i’s inventory before trading in the t-th double auction; his

post-trading inventory is

zi,TK−1 +(t+1)∆ = zi,TK−1 +t∆ + x∗i,TK−1 +t∆ .

(4)

If the t-th double auction is the last one before the K-th dividend is paid (TK−1 + t∆ ≤

TK < TK−1 + (t + 1)∆), then zi,TK = zi,TK−1 +(t+1)∆ .

Here the trading time starts at the dividend time TK−1 , instead of the next integer

multiple of ∆. This assumption is made for analytical simplicity but is not critical

for our results. Integer trading time can be incorporated by adding a discount factor

0

e−β((t −t+1)∆−τ ) in front of E[Vi,0 (zi,t0 ∆ + xi,t0 ∆ )] in Equation (5).

Traders have discount rate β > 0. A time discount is necessary for a model with infinitely

many dividends. Trader i’s conditional utility at time t∆ is (without loss of generality,

suppose T1 ≥ t∆):

Vi,t∆ (zi,t∆ ) =

" ∞ Z 0

(t −t+1)∆

X

E

re−rτ e−βτ (vi,t0 ∆ (zi,t0 ∆ + x∗i,t0 ∆ ) + E[Vi,0 (zi,t0 ∆ + x∗i,t0 ∆ )]) dτ

t0 =t

(5)

τ =(t0 −t)∆

Z

(t0 −t+1)∆

−

re

τ =(t0 −t)∆

−rτ

Z

τ

e

−βs

−r(t0 −t+1)∆

Z

−βs

e

ds dτ + e

s=(t0 −t)∆

s=(t0 −t)∆

!

(t0 −t+1)∆

ds

λ

(zi,t0 ∆ + x∗i,t0 ∆ )2

2

#

!

−(r+β)(t0 −t)∆ ∗

∗

−e

xi,t0 ∆ pt0 ∆ Hi,t∆ .

In the first term of the above equation we integrate over the payment time of the next

dividend. If this dividend is paid in the interval [t0 ∆, (t0 +1)∆), then trader i has an expected

continuation value of E[Vi,0 (zi,t0 ∆ +x∗i,t0 ∆ )], i.e., he “goes back” to time 0 with initial inventory

zi,t0 ∆ + x∗i,t0 ∆ and renewed realizations of dividend and private values. In the second term we

integrate the discounted expected time during period t0 when the dividend is yet to be paid.

The third term is the expected payment during period t0 .

3

By simplifying the integrals, we can rewrite the conditional utility as:

Vi,t∆ (zi,t∆ ) =

(6)

" ∞

X

r(1 − e−(r+β)∆ )

0

(vi,t0 ∆ (zi,t0 ∆ + x∗i,t0 ∆ ) + E[Vi,0 (zi,t0 ∆ + x∗i,t0 ∆ )])

E

e−(r+β)(t −t)∆

r

+

β

t0 =t

!

#

1 − e−(r+β)∆ λ

−

(zi,t0 ∆ + x∗i,t0 ∆ )2 − x∗i,t0 ∆ p∗t0 ∆ Hi,t∆ .

r+β

2

Note that the term E[Vi,0 (zi,t0 ∆ + xi,t0 ∆ )] in the above expression is an unconditional expectation. At the moment that the pending dividend is paid, signals regarding the that dividend

expire and new signals of the new dividend are yet to arrive.

1.2

Derivation of equilibrium strategy

For any K, traders face the same decision problem at time TK + t∆ as they do at time t∆, so

it is natural that they use a strategy that is independent of TK . Without loss of generality,

let us focus on K = 0, i.e., before the payment of the first dividend. To reduce algebra

clutter, in this model we assume the total inventory Z = 0 to eliminate constant terms. For

derivatives market, Z = 0 by definition.

Suppose that traders use the linear strategy:

xi,t∆ (p) = asi,t∆ − bp + dzi,t∆ ,

(7)

where si,t∆ is the total signal as defined in the main text.

Since the continuation value at t∆ now contains a term E[Vi,0 (zi,t0 ∆ + x∗i,t0 ∆ )], we will

first calculate its derivative with respect to zi,0 . Again, since E[Vi,0 (zi,t0 ∆ + x∗i,t0 ∆ )] is an

unconditional expectation, we take the unconditional expectation of (6) to pin down this

derivative.

Given the simplifying assumption Z = 0, we have E[Dt∆ + wi,t∆ | zi,0 ] = 0, E[p∗t∆ | zi,0 ] =

4

0,

∂p∗t∆

∂zi,0

= 0, and E[zi,t∆ | zi,0 ] = (1 + d)t zi,0 . Therefore,

" ∞

X

∂ E[Vi,0 (zi,(t+1)∆ )]

r(1 − e−(r+β)∆ )

∂ E[Vi,0 (zi,0 )]

=E

e−(r+β)t∆

(1 + d)t+1

∂zi,0

r+β

∂zi,(t+1)∆

t=0

! #

−(r+β)∆

1

−

e

(1 + d)t+1 λzi,(t+1)∆ zi,0

− e−(r+β)t∆

r+β

#

" ∞

−(r+β)∆

X

∂

E[V

(z

)]

r(1

−

e

)

i,0 i,(t+1)∆ =E

e−(r+β)t∆

(1 + d)t+1

zi,0

r

+

β

∂z

i,(t+1)∆

t=0

−

1−e−(r+β)∆

(1 + d)2

r+β

λzi,0

1 − e−(r+β)∆ (1 + d)2

(8)

We conjecture

∂ E[Vi,0 (zi,0 )]

= hzi,0

∂zi,0

(9)

for some constant h. Substituting this expression back to (8), we get

h=

1−e−(r+β)∆

(1 + d)2

r+β

(rh

1 − e−(r+β)∆ (1 + d)2

− λ),

(10)

i.e.,

h = −λ

(1 − e−(r+β)∆ )(1 + d)2

.

r + β − r(1 + d)2 − βe−(r+β)∆ (1 + d)2

(11)

Suppose 0 < 1 + d < 1 (which we verify later), then (8) defines a contraction mapping, so

∂ E[Vi,0 (zi,0 )]

is the unique fixed point for Equation (8).

the above solution of

∂zi,0

Suppose t∆ ≤ T1 . Under the single deviation principal, trader i’s first order condition at

time t∆ is:

"

∞

1 − e−(r+β)∆ X −(r+β)k∆

E (n − 1)b

e

(1 + d)k rvi,(t+k)∆ + (rh − λ)(zi,(t+k)∆ + x∗i,(t+k)∆ )

r+β

k=0

#

!

∞

X

P

− p∗t∆ −

e−(r+β)k∆ (1 + d)k−1 d p∗(t+k)∆ − xi,t∆ Hi,t∆ ∪ { j6=i sj,t∆ } = 0,

(12)

k=1

where

zi,(t+k)∆ + x∗i,(t+k)∆ = asi,(t+k)∆ − bp∗(t+k)∆ + (1 + d)zi,(t+k)∆

(13)

= (asi,(t+k)∆ − bp∗(t+k)∆ ) + (1 + d)(asi,(t+k−1)∆ − bp∗(t+k−1)∆ )

+ · · · + (1 + d)k−1 (asi,(t+1)∆ − bp∗(t+1)∆ ) + (1 + d)k (xi,t∆ + zi,t∆ ),

5

n

p∗t∆ =

Using the notation s̄t∆ =

P

1≤j≤n

a X

sj,t∆ .

nb j=1

(14)

sj,t∆ /n, the first order condition can be rewritten as:

(n − 1)b(1 − e−(r+β)∆ )

"

1

·

−(r+β)∆

1−e

(1 + d)

!

!

1−αX

a

αsi,t∆ +

sj,t∆ − s̄t∆

n − 1 j6=i

b

∞

X

1

rh − λ −(r+β)k∆

(1 + d)k

k

+

e

(1 + d)

−

a(si,t∆ − s̄t∆ )

r+β

−d

−d

k=0

#

rh − λ

+

(xi,t∆ + zi,t∆ ) − xi,t∆ = 0,

(1 − e−(r+β)∆ (1 + d)2 )(r + β)

r

r+β

(15)

where we have used the the identity:

1+

∞

X

e−(r+β)k∆ (1 + d)k−1 d = 1 +

k=1

e−(r+β)∆ d

1 − e−(r+β)∆

=

.

1 − (1 + d)e−(r+β)∆

1 − (1 + d)e−(r+β)∆

(16)

Rearranging the terms gives:

(n − 1)b(1 − e−(r+β)∆ )(λ − rh)

1+

xi,t∆

(1 − e−(r+β)∆ (1 + d)2 )(r + β)

(17)

= (n − 1)b(1 − e−(r+β)∆ )

"

1

r n − nα

a

r nα − 1

·

si,t∆ +

s̄t∆ − s̄t∆

1 − e−(r+β)∆ (1 + d) r + β n − 1

r+β n−1

b

(λ − rh)e−(r+β)∆ (1 + d)

a(si,t∆ − s̄t∆ )

(r + β)(1 − (1 + d)e−(r+β)∆ )(1 − (1 + d)2 e−(r+β)∆ )

#

λ − rh

−

zi,t∆ .

(1 − e−(r+β)∆ (1 + d)2 )(r + β)

−

On the other hand, our conjectured strategy implies:

xi,t∆ = a(si,t∆ − s̄t∆ ) + dzi,t∆ .

(18)

Matching the coefficients of si,t∆ , s̄i,t∆ and zi,t∆ in (17) with those in (18) gives:

a=

r

b,

r+β

6

(19)

(n − 1)b(1 − e−(r+β)∆ )(λ − rh)

(1 − e−(r+β)∆ (1 + d)2 )(r + β)

(1 − e−(r+β)∆ )(nα − 1)

(n − 1)b(1 − e−(r+β)∆ )e−(r+β)∆ (1 + d)(λ − rh)

=

−

,

1 − e−(r+β)∆ (1 + d)

(1 − (1 + d)e−(r+β)∆ )(1 − (1 + d)2 e−(r+β)∆ )(r + β)

1+

(n − 1)b(1 − e−(r+β)∆ )(λ − rh)

(n − 1)b(1 − e−(r+β)∆ )(λ − rh)

1+

d=−

.

(1 − e−(r+β)∆ (1 + d)2 )(r + β)

(1 − e−(r+β)∆ (1 + d)2 )(r + β)

(20)

(21)

Solving these equations gives:

d=−

1

2e−(r+β)∆

q

−(r+β)∆

−(r+β)∆

2

−(r+β)∆

2

−(r+β)∆

) + 4e

,

(nα − 1)(1 − e

) + 2e

− (nα − 1) (1 − e

(22)

b=

(nα − 1)(r + β)

(23)

2(n − 1)e−(r+β)∆ (λ − rh)

q

−(r+β)∆

−(r+β)∆

2

−(r+β)∆

2

−(r+β)∆

· (nα − 1)(1 − e

) + 2e

− (nα − 1) (1 − e

) + 4e

.

Direct computations show that d satisfies:

(1 − e−(r+β)∆ )(1 + d)2

1+d

=

.

−(r+β)∆

2

1−e

(1 + d)

nα − 1

(24)

Therefore, (10) becomes:

h=

1+d

(rh − λ),

(nα − 1)(r + β)

so

h=

−λ

(nα−1)(r+β)

1+d

and

λ − rh =

−r

,

λ

1−

(1+d)r

(nα−1)(r+β)

(25)

(26)

.

(27)

Proposition 1. Suppose that nα > 2, which is equivalent to

1

<

2

n/2 + σ2 /σD

7

r

n − 2 σw

.

n σ

(28)

There exists a perfect Bayesian equilibrium in which at time TK + t∆, trader i submits the

demand schedule

(λ − rh)(n − 1)

r

si,T +t∆ − p −

zi,T +t∆ ,

(29)

xi,t∆ (p) = b

r+β K

(r + β)(nα − 1) K

where

b=

d=−

(nα − 1)(r + β)

(30)

2(n − 1)e−(r+β)∆ (λ − rh)

q

−(r+β)∆

−(r+β)∆

2

−(r+β)∆

2

−(r+β)∆

) + 4e

,

· (nα − 1)(1 − e

) + 2e

− (nα − 1) (1 − e

1

2e−(r+β)∆

q

−(r+β)∆

−(r+β)∆

(nα − 1)(1 − e

) + 2e

− (nα − 1)2 (1 − e−(r+β)∆ )2 + 4e−(r+β)∆ ,

(31)

−λ

h=

(nα−1)(r+β)

1+d

−r

.

(32)

The period-t equilibrium price is

n

p∗t∆

1.3

X

r

=

si,t∆ .

(r + β)n i=1

(33)

Optimal trading frequency

∗

Let zi,t∆

be the equilibrium inventory of trader i at time t∆. The equilibrium welfare

conditional on the initial inventory is the fixed point W (·) that solves:

"

W ({zi,0 }) = E

∞

X

1 − e−(r+β)∆

t=0

r+β

−(r+β)t∆

e

r

n

X

∗

∗

vi,t∆ zi,(t+1)∆

+ rW ({zi,(t+1)∆

})

i=1

n

λX ∗

(z

)2

−

2 i=1 i,(t+1)∆

#

!

{zi,0 } .

(34)

We first recall that

∗

zi,(t+1)∆

t

X

0

=

(1 + d)t−t a(si,t0 ∆ − s̄t0 ∆ ) + (1 + d)t+1 zi,0 .

(35)

t0 =0

∗

Because zi,(t+1)∆

is squared in (34) and

Pn

i=1

8

∗

E[vi,t∆ zi,(t+1)∆

| {zi,0 }] depends only on

Pn

i=1 (zi,0 )

2

as

Pn

i=1 zi,0

= 0, we conjecture that

W ({zi,0 }) = L1

n

X

(zi,0 )2 + L2 ,

(36)

i=1

for constants L1 and L2 .

Substituting this conjecture into (34) and matching the coefficients, we get:

∞

X

1 − e−(r+β)∆

λ

2(t+1)

2(t+1)

rL1 (1 + d)

− (1 + d)

e

L1 =

r

+

β

2

t=0

(1 − e−(r+β) )(1 + d)2

λ

1+d

λ

=

rL1 −

=

rL1 −

,

(1 − e−(r+β)∆ (1 + d)2 )(r + β)

2

(nα − 1)(r + β)

2

−(r+β)t∆

(37)

(38)

i.e.,

−λ/2

L1 = h/2 =

"

L2 = E

∞

X

1 − e−(r+β)∆

t=0

r+β

e

−(r+β)t∆

r

n

X

(nα−1)(r+β)

1+d

∗

vi,t∆ zi,(t+1)∆

−r

.

+ rL1

i=1

λ

−

2

(39)

n

X

∗

((zi,(t+1)∆

)2 − (1 + d)2(t+1) (zi,0 )2 ) + rL2

i=1

!

#

∗

((zi,(t+1)∆

)2 − (1 + d)2(t+1) (zi,0 )2 ) {zi,0 } ,

n

X

i=1

(40)

i.e.,

" ∞

!

#

n

n

X

X 1 − e−(r+β)∆

X

λ

−

rh

r+β

∗

∗

E

e−(r+β)t∆ r

vi,t∆ zi,(t+1)∆

−

L2 =

(zi,(t+1)∆

)2 {zi,0 }

β

r

+

β

2

t=0

i=1

i=1

n

r+β

1+d

λ − rh X

(zi,0 )2 .

+

β (nα − 1)(r + β) 2

i=1

(41)

Define

e

zi,τ

r(nα − 1)

=

(λ − rh)(n − 1)

n

si,τ

1X

−

sj,τ

n j=1

!

.

(42)

Under this definition, we have:

∗

e

∗

e

zi,(t+1)∆

− zi,t∆

= (1 + d)(zi,t∆

− zi,t∆

).

9

(43)

Thus,

!

#

n

X

λ

−

rh

∗

∗

vi,t∆ zi,(t+1)∆

−

(zi,(t+1)∆

)2 {zi,0 }

(44)

2r

i=1

i=1

" t=0

!

#

∞

n

n

X

X

X

λ

−

rh

e

e

=E

(1 − e−(r+β)∆ )e−(r+β)t∆

vi,t∆ zi,t∆

−

(zi,t∆

)2 {zi,0 }

2r

t=0

i=1

i=1

#

"∞

X

λ − rh e

∗

(zi,t∆ − zi,(t+1)∆

)2 {zi,0 }

−E

(1 − e−(r+β)∆ )e−(r+β)t∆

2r

" ∞ t=0

#

n

X

X

−(r+β)∆ −(r+β)t∆ λ − rh

e

=E

(1 − e

)e

(zi,t∆

)2 {zi,0 }

2r

t=0

i=1

"∞

#

!

n

n

X

X

X

1

+

d

λ

−

rh

1

+

d

λ

−

rh

e

− E

(1 − e−(r+β)∆ )e−(r+β)t∆

(zi,t∆

(zi,0 )2 ,

)2 {zi,0 } +

2r

nα

−

1

2r

nα

−

1

t=0

i=1

i=1

∞

X

E

(1 − e−(r+β)∆ )e−(r+β)t∆

"

n

X

where the first equality follows from Lemma 1 of Du and Zhu (2015), and the second equality

follows from Lemma 2 of Du and Zhu (2015) and from

n

X

1−αX

αsi,t∆ +

n − 1 j6=i

!

i=1

=

n

X

i=1

1

n

n

X

sj,t∆

!

e

zi,t∆

−

sj,t∆

λ − rh e 2

(zi,t∆ ) =

r

n

X

αsi,t∆ +

i=1

1−αX

n−1

sj,t∆ −

j6=i

λ − rh e

zi,t∆

r

e

zi,t∆

= 0.

j=1

Therefore,

λ − rh

L2 =

2β

1+d

1−

nα − 1

X

∞

n

X

−(r+β)∆ −(r+β)t∆

e

(1 − e

)e

E[(zi,t∆

)2 ],

t=0

(45)

i=1

and (using Equation (27))

W ({zi,0 }) =

−λ/2

(nα−1)(r+β)

1+d

+

1.3.1

−r

n

X

(zi,0 )2

i=1

λ/(2β)

1−

(46)

(1+d)r

(nα−1)(r+β)

∞

n

X

1+d X

−(r+β)∆ −(r+β)t∆

e

1−

(1 − e

)e

E[(zi,t∆

)2 ].

nα − 1 t=0

i=1

Scheduled arrivals of information

Suppose that new information arrives at time 0, γ, 2γ, . . .. For simplicity of notation, we use

the shorthand W for E[W ({zi,0 })]. We also write W (∆) to emphasize the dependence of W

10

!

e

zi,t∆

on ∆.

Proposition 2. For any integer l ≥ 1, we have W (γ/l) < W (γ). If the traders are ex-ante

symmetric, i.e., zi,0 = 0 for every trader i, then as n → ∞, the optimal l∗ → 1, where l∗

maximizes W (lγ) over integer l ≥ 1.

Proof. Let ∆ = γ/l where l ≥ 1 is an integer. We have:

n

X

i=1

!2

n

X

r (nα − 1)

1

e

e 2

E[(zi,kγ

)2 ] = (k + 1)

E[(zi,0

) ] = (k + 1)

E

si,0 −

sj,0

2

2

(λ

−

rh)

(n

−

1)

n

i=1

i=1

j=1

!2

2 X

n

n

2

2

X

(1 + d)r

r (nα − 1)

1

= (k + 1) 1 −

E 2

si,0 −

sj,0

2

(nα − 1)(r + β)

λ

(n

−

1)

n

i=1

j=1

2

(1 + d)r

σz2 ,

(47)

≡ (k + 1) 1 −

(nα − 1)(r + β)

n

X

n

X

2

2

where in the second line we have used Equation (27), and in the last line we define σz2 as in

the main text.

We can then simplify (46) to:

W ({zi,0 }) =

−λ/2

(nα−1)(r+β)

1+d

−r

n

X

(zi,0 )2

(48)

i=1

∞

(1 + d)r

1+d X

λ

(1 − e−(r+β)γ )e−(r+β)kγ (k + 1)σz2 .

1−

1−

+

2β

(nα − 1)(r + β)

nα − 1 k=0

Since 1 + d is decreasing in ∆, it is easy to see that

1

(nα−1)(r+β)

1+d

−r

is decreasing in ∆, and that

1−

(1 + d)r

(nα − 1)(r + β)

1+d

1−

nα − 1

is increasing in ∆. Therefore, W ({zi,0 }) above is increasing in ∆ = γ/l for positive integer l.

Now suppose ∆ = lγ, l ≥ 1. We have

n

X

e

E[(zi,t∆

)2 ]

= (tl + 1) 1 −

i=1

11

(1 + d)r

(nα − 1)(r + β)

2

σz2 .

(49)

The above expression is same as Equation (50) below, for the case when news come at

Poisson times, by setting l = µ∆. The proof of the second part of this proposition follows

from the proof of Proposition 3 below.

1.3.2

Stochastic arrivals of information

Suppose that new information arrives according to a Poisson process with intensity µ > 0.

Proposition 3. Suppose traders are ex-ante symmetric: zi,0 = 0 for every trader i.

1. The optimal ∆∗ is strictly decreasing in the intensity µ from ∞ (as µ → 0) to 0 (as

µ → ∞).

2. As n → ∞, the optimal ∆∗ → 0.

Proof. Similar to (47), we have here:

n

X

e

E[(zi,t∆

)2 ]

= (t∆µ + 1) 1 −

i=1

(1 + d)r

(nα − 1)(r + β)

2

σz2 .

(50)

We can then simplify (46) to:

W ({zi,0 }) =

=

−λ/2

(nα−1)(r+β)

1+d

n

X

(zi,0 )2

− r i=1

∞

λ

(1 + d)r

1+d X

(1 − e−(r+β)∆ )e−(r+β)t∆ (t∆µ + 1)σz2 .

+

1−

1−

2β

(nα − 1)(r + β)

nα − 1 t=0

−λ/2

(nα−1)(r+β)

1+d

n

X

(zi,0 )2

− r i=1

(1 + d)r

1+d

∆µe−(r+β)∆

λ

+ 1 σz2 .

+

1−

1−

2β

(nα − 1)(r + β)

nα − 1

1 − e−(r+β)∆

(51)

The first term vanishes since by assumption zi,0 = 0 for every i.

We first observe that for the ex-ante symmetric case optimizing W over ∆ is equivalent

to optimizing W̃ over ∆, where:

1+d

(1 + d)r

∆µe−(r+β)∆

W̃ ≡ log 1 −

+ log 1 −

+ log

+1 .

nα − 1

(nα − 1)(r + β)

1 − e−(r+β)∆

12

(52)

For Part 1 of the proposition, we calculate:

∂2

log

∂µ∂∆

∆µe−(r+β)∆

+1

1 − e−(r+β)∆

< 0,

(53)

which implies that ∆∗ must decrease with µ. As µ → 0, ∆∗ → ∞ because 1 + d decreases

∆e−(r+β)∆

with ∆. As µ → ∞, ∆∗ → 0 because 1−e

−(r+β)∆ decreases with ∆.

Part 2 of the proposition follows from the fact that (1 + d)/(nα − 1) → 0 as n → ∞.

2

Heterogeneous Trading Speeds when Slow Traders

Trade Once

In this section we study the trading strategy and welfare with a single fast trader who trades

whenever the market is open, and a sequence of slow traders who trade only once; this is the

limiting case of the heterogeneous speed model from the main text of Du and Zhu (2015) as

M → ∞ and Γ → ∞ such that M/Γ → m for a positive constant m. As in Du and Zhu

(2015), speed is defined by how frequently a trader accesses the market; here the fast trader

is infinitely faster than the slow trader. We analytically prove that the fast trader prefers the

highest feasible trading frequency to make profits from intermediation, whereas traders who

access the market infrequently would prefer a slower trading frequency to provide liquidity

to each other.

As before, trading happens at times {0, ∆, 2∆, . . .}. There is one fast trader who trades in

every period; we refer to this trader as i. The remaining are “slow traders” who sequentially

arrive on the market at times 1/m, 2/m, 3/m, . . .; that is, they arrive at the uniform rate of

m > 0 per unit of clock time. Thus, between times (t − 1)∆ and t∆, nS ≡ m∆ slow traders

arrive at the market. Let Tj be the arrival time for the j-th slow trader, i.e., Tj = j/m.

For concreteness, we may interpret the fast trader as a market maker or a high-frequency

trader who accesses the market all the time, and the slow traders as individual investors or

small institutions who trade infrequently. For tractability, we assume that each slow trader

participates only in the next immediate double auction after he arrives. Strictly speaking,

∆ must take values in {1/m, 2/m, 3/m, . . . } for m∆ to be an integer, but for expositional

simplicity we will solve the trading strategies and welfare for generic ∆ and only later use

the integer constraint when necessary.

To isolate the main insight of this section about heterogeneous speeds, we use a much

simpler information structure. Specifically, fast and slow traders receive no signals about the

13

dividend D; thus, they all value the dividend at E[D], which is normalized to zero. Besides

tractability, symmetric information regarding the asset fundamental value sets our model of

this section orthogonal to recent models of high-frequency trading in which fast traders also

have information advantage.1 Each slow trader j has an initial inventory zj,Tj drawn i.i.d.

from a distribution with mean 0. The fast traders start with zero inventory at time 0 but

gradually accumulates inventory by trading with slow traders over time. Finally, fast and

slow traders incur quadratic inventory costs with coefficient λF /2 and λS /2 respectively.

In each trading period t ∈ {1, 2, 3, . . . }, nS = m∆ slow traders and one fast trader trade

in a double auction. (No slow trader has arrived at time 0, so there is no trading at time

0.) Let xj,t∆ (p) be slow trader j’s demand schedule in period t, and let xi,t∆ (p) be the fast

trader’s demand schedule in period t. The market-clearing price p∗t∆ in period t is given by:

X

xj,t∆ (p∗t∆ ) + xi,t∆ (p∗t∆ ) = 0,

(54)

j∈C(t∆)

where j is summed over the set C(t∆) of all slow traders who are present in period t.

Conditional on no dividend payout before period t ≥ 1, the utility of a slow trader j who

trades in period t is:

Vj,t∆ =

−x∗j,t∆ p∗t∆

+

∞

X

t0 =t

= −x∗j,t∆ p∗t∆ −

e

−r(t0 −t)∆

1 − e−r∆ λS

∗

2

−r∆

∗

·

(zj,Tj + xj,t∆ )

(1 − e

)E[D]xj,t∆ −

r

2

λS

(zj,Tj + x∗j,t∆ )2 ,

2r

(55)

where x∗j,t∆ ≡ xj,t∆ (p∗t∆ ).

Conditional on no dividend payout before period t ≥ 1, the fast trader i’s utility is:

Vi,t∆

∞

X

1 − e−r∆ λF

∗

∗

−r∆

∗

∗

2

=

e

−xi,t0 ∆ pt0 ∆ + (1 − e

)E[D](zi,t0 ∆ + xi,t0 ∆ ) −

·

(zi,t0 ∆ + xi,t0 ∆ )

r

2

t0 =t

∞

X

1 − e−r∆ λF

2

−r(t0 −t)∆

∗

∗

∗

=

·

(zi,t0 ∆ + xi,t0 ∆ ) ,

(56)

e

−xi,t0 ∆ pt0 ∆ −

r

2

0

t =t

−r(t0 −t)∆

where x∗i,t0 ∆ ≡ xi,t0 ∆ (p∗t0 ∆ ), zi,0 = zi,∆ = 0 and

zi,(t0 +1)∆ = zi,t0 ∆ + x∗i,t0 ∆ .

(57)

The definition of perfect Bayesian equilibrium is also the same as that in Definition 1 of the

1

See, for example, Biais, Foucault, and Moinas (2015), Jovanovic and Menkveld (2012), and Hoffmann

(2014).

14

main text. The derivation of a linear equilibrium is similar to that in the homogenous-speed

model, and the details are provided in Section 2.1.1.

Because we are interested characterizing the optimal speed for each group of traders, it is

necessary to separately calculate fast traders’ welfare and slow traders’ welfare. The welfare

of the fast and slow traders are, respectively:

"

#

∞

∞

X

λF (1 − e−r∆ ) X −rt∆ ∗

WF (∆) = E −

e

(zi,(t+1)∆ )2 −

e−rt∆ x∗i,t∆ p∗t∆ ,

(58)

2r

t=1

t=1

∞

X X

λS

λS

,

(zj,Tj + x∗j,t∆ )2

WS (∆) = E

−(e−rTj − e−rt∆ ) (zj,Tj )2 + e−rt∆ −p∗t∆ x∗j,t∆ −

2r

2r

t=1

j∈C(t∆)

(59)

where all strategies, prices, and inventories are the equilibrium ones shown in Section 2.1.1.

We are interested in ∆∗F that maximizes the fast trader’s welfare and in ∆∗S that maximizes the slow traders’ welfare.

Proposition 4. For any values of r > 0, λS > 0, λF > 0 and m > 0, WF (∆) strictly

decreases with ∆ whenever ∆ ≥ 2/m. Thus, the optimal ∆∗F that maximizes WF (∆) satisfies

∆∗F ≤ 2/m.

Proof. See Section 2.1.

Proposition 4 reveals that the fast trader’s preferred trading frequency allows no more

than two slow traders in each round. If we impose the natural restriction that ∆∗F m must

be an integer, then there are exactly two slow traders in each round. (In existing models

of double auctions, a linear equilibrium does not exist with only two traders. See Kyle

(1989), Vives (2011), and Rostek and Weretka (2012). It is also the case here.) Intuitively, a

fast trader prefers a high-frequency (and thin) market because he extracts a higher rent by

intermediating trades among slow traders across time. Note that because the fast trader’s

preferred trading frequency is already as high as feasible, the slow traders’ preferred frequency

must be weakly lower than the fast trader’s preferred frequency.

Pinning down the slow traders’ preferred trading frequency analytically turns out to be

more difficult. Nonetheless, there is a clear and intuitive tradeoff. On the one hand, a

higher trading frequency allows slow traders to quickly realize the gains from trade induced

by inventory shocks. On the other hand, a higher trading frequency reduces the number of

traders in each round, which makes the market thinner and increases the price-impact costs.

The optimal trading frequency for slow traders should strike the best balance between the

two effects.

15

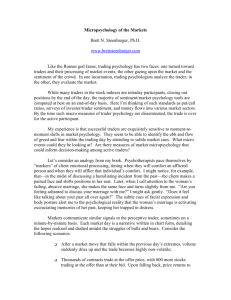

Figure 1: WF (∆) and WS (∆)/m as functions of ∆. Baseline parameters: r = 0.5, m =

10, λF = λS = 1, E[(zj,Tj )2 ] = 1.

Welfare

Slow traders' welfare

2

Fast trader

Welfare

0

Slow trader

-2

1

1

2

3

4

5

Δ

-4

1

2

3

4

5

-1

-6

Δ

-8

-10

-12

-2

-14

r=1

r=0.5

r=0.25

r=0.125

Figure 1 shows the fast and slow traders’ welfare as functions of ∆. In the left-hand

graph of Figure 1 we plot WF (∆) and WS (∆)/m. As predicted by Proposition 4, the fast

trader’s welfare WF (∆) peaks at a ∆ < 0.2 and rapidly decreases with ∆ if ∆ > 0.2. The

slow traders’ welfare, WS (∆), peaks around ∆ = 0.67, implying 6 or 7 slow traders in each

round, and decreases slowly with ∆ when ∆ > 0.67. The slow traders clearly prefer a lower

trading frequency than the fast trader does.

In the right-hand graph of Figure 1 we plot WS (∆)/m for different values of r. The

graph shows that the ∆∗S that maximizes WS (∆) increases as r decreases. If r = 1, ∆∗S is

around 0.5, implying about 5 slow traders in each round; if r = 0.125, ∆∗S is around 1.3,

implying about 13 slow traders in each round. As intuition suggests, the more imminent is

the dividend payment (a higher r), the more costly it is for the slow traders to delay trades,

and the higher is the preferred trading frequency of slow traders.

2.1

2.1.1

Proof of Proposition 4

Characterizing the equilibrium

We first derive the equilibrium strategy of the slow traders. Let bF and bS be the slopes of

the fast trader and slow trader’s equilibrium demand schedule, respectively. A slow trader

j’s first order condition (by differentiating Vj,t∆ in (55) with respect to p∗t∆ ) is:

−

xj,t∆ (p∗t∆ )

λS

∗

∗

+ (bF + (nS − 1)bS ) −pt∆ −

(zj,Tj + xj,t∆ (pt∆ )) = 0,

r

16

(60)

i.e.,

xj,t∆ (p∗t∆ )

bF + (nS − 1)bS

=

1 + (bF + (nS − 1)bS )λS /r

where

bS =

λS

λS

∗

∗

− zj,Tj − pt∆ ≡ bS − zj,Tj − pt∆ , (61)

r

r

nF bF + (nS − 1)bS

.

1 + (nF bF + (nS − 1)bS )λS /r

(62)

We conjecture that the fast trader uses the strategy

xi,t∆ (p; zi,t∆ ) = −bF p + dF zi,t∆ .

(63)

Without loss of generality let us specialize to period 1 with an arbitrary inventory zi,∆ .

Assuming that the fast trader uses strategy (63) from period 2 and onwards, and that the

slow traders use their equilibrium strategy (61) in every period, we will construct strategy

(63) such that the fast trader has no incentive to deviate from strategy (63) in period 1. By

the single deviation principle, this gives the equilibrium strategy of the fast trader.

Under our assumption about the traders’ strategies from period 2 and onwards, we have

for t ≥ 1:

X

1

bS (−λS zj,Tj /r) + dF zi,(t+1)∆ ,

(64)

p∗(t+1)∆ =

b F + nS b S

j∈C((t+1)∆)

and

zi,(t+2)∆ = zi,(t+1)∆ + x∗i,(t+1)∆

= zi,(t+1)∆ − bF p∗(t+1)∆ + dF zF,(t+1)∆

X

−bF

−bF

dF zi,(t+1)∆ + dF zi,(t+1)∆

= zi,(t+1)∆ +

bS (−λS zj,Tj /r) +

bF + nS bS

b F + nS b S

j∈C((t+1)∆)

X

−bF

n S bS

=

bS (−λS zj,Tj /r) + 1 +

dF zi,(t+1)∆ .

(65)

b F + nS b S

bF + nS bS

j∈C((t+1)∆)

Therefore, the fast trader in period 1 has the following effect on the future prices and

17

inventories:

∂(zi,(t+1)∆ + x∗i,(t+1)∆ )

∂xi,∆

∂x∗i,(t+1)∆

∂xi,∆

∂p∗(t+1)∆

∂xi,∆

=

=

=

n S bS

1+

dF

bF + nS bS

t

n S bS

1+

dF

bF + nS bS

t−1

n S bS

1+

dF

bF + nS bS

t−1

,

(66)

n S bS

dF ,

bF + n S bS

(67)

dF

.

bF + n S bS

(68)

The fast trader’s first order condition at period 1 is:

"

−x∗i,∆ + nS bS

"

#

∞

∗

∂(z

+

x

)

i,(t+1)∆

1 − e−r∆ X −rt∆

i,(t+1)∆

e

E −λF (zi,(t+1)∆ + x∗i,(t+1)∆ )

| zi,∆ , p∗∆

∗

r

∂x

i,∆

t=0

(69)

−

p∗∆

−

∞

X

"

e

−rt∆

E

∂x∗i,(t+1)∆

t=1

−

∞

X

"

e−rt∆ E

∂x∗i,∆

∂p∗(t+1)∆

t=1

∂x∗i,∆

#

p∗(t+1)∆ | zi,∆ , p∗∆

##

xi,(t+1)∆ | zi,∆ , p∗∆

= 0,

i.e.,

"

−x∗i,∆

+ nS bS

t

∞

1 − e−r∆ X −rt∆

n S bS

e

1+

dF (−λF E[zi,(t+1)∆ + x∗i,(t+1)∆ | zi,∆ , p∗∆ ])

r

bF + nS bS

t=0

(70)

∞

X

t−1

−rt∆

e

1+

nS bS

nS bS

dF

dF E[p∗(t+1)∆ | zi,∆ , p∗∆ ]

b

+

n

b

b

+

n

b

F

S

S

F

S

S

t=1

#

t−1

∞

X

n

b

d

S

S

F

−

e−rt∆ 1 +

dF

E[x∗i,(t+1)∆ | zi,∆ , p∗∆ ] = 0,

b

+

n

b

b

+

n

b

F

S

S

F

S

S

t=1

−p∗∆ −

i.e.,

2t

∞

nS bS

1 − e−r∆ X −rt∆

+ nS b S

e

1+

dF

(−λF (zi,∆ + x∗i,∆ ))

r

b

+

n

b

F

S S

t=0

∞

2(t−1)

X

n S bS

nS bS dF

dF

−p∗∆ −

e−rt∆ 1 +

dF

·

(zi,∆ + x∗i,∆ )

b

+

n

b

b

+

n

b

b

+

n

b

F

S

S

F

S

S

F

S

S

t=1

#

2(t−1)

∞

X

n

b

d

n

b

d

S

S

F

S

S

F

−

e−rt∆ 1 +

dF

·

(zi,∆ + x∗i,∆ ) = 0,

b

+

n

b

b

+

n

b

b

+

n

b

F

S

S

F

S

S

F

S

S

t=1

"

−x∗i,∆

18

(71)

i.e.,

"

−x∗i,∆ + nS bS −

1 − e−r∆

·

r

λF

1−

2e−r∆

−p∗∆ −

1−

e−r∆

nS bS

d

bF +nS bS F

1+

e−r∆

1+

∗

nS bS

d

bF +nS bS F

2 (zi,∆ + xi,∆ )

(72)

#

d2F nS bS

(zi,∆ + x∗i,∆ ) = 0,

2 ·

(bF + nS bS )2

i.e.,

"

1

−x∗i,∆ + nS bS −

e−r∆

nS bS

d

bF +nS bS F

(73)

2

1−

1+

#

λF (1 − e−r∆ ) 2e−r∆ d2F nS bS

+

(zi,∆ + x∗i,∆ ) − p∗∆ = 0.

·

r

(bF + nS bS )2

Matching the coefficients with (63), we have

bF =

n S bS

1 + nS bS λ̂F /r

,

(74)

and

dF = −

λ̂F

bF ,

r

(75)

where

1

λ̂F ≡

1−

=

e−r∆

1+

nS bS

d

bF +nS bS F

2re−r∆ d2F nS bS

−r∆

)+

2 · λF (1 − e

(bF + nS bS )2

1

1 − e−r∆ 1 −

nS bS

bF +nS bS

And recall that

bS =

·

λ̂F bF

r

2 ·

λF (1 − e

−r∆

2e−r∆ λ̂2F b2F nS bS

)+

r(bF + nS bS )2

bF + (nS − 1)bS

.

1 + (bF + (nS − 1)bS )λS /r

(76)

!

.

(77)

Lemma 1. Suppose that nS > 1. There is a unique set of λ̂F > 0, bS > 0 and bF > 0 that

solve Equations (77), (74) and (76). In this solution we always have λ̂F < λF .

Proof. Taking λ̂F as given and solving Equations (74) and (77), we get unique positive

19

solutions bS (λ̂F ) and bF (λ̂F ) by Lemma 2.2

By expanding the denominator on the right-hand side and moving it to the left-hand

side, we can simplify Equation (76) to:

λF − λ̂F

λ̂F

e−r∆

=

1 − e−r∆

λ̂F bF (λ̂F )

2−

r

!

λ̂F bF (λ̂F )

n2S bS (λ̂F )2

.

r

(bF (λ̂F ) + nS bS (λ̂F ))2

(79)

Equation (74) implies that λ̂F bF (λ̂F )/r < 1. Thus, any solution λ̂F to Equation (79) satisfies

λ̂F < λF .

Lemma 2 shows that (2−λ̂F bF (λ̂F )/r)λ̂F bF (λ̂F )/r is increasing in λ̂F ; and that nS bS (λ̂F )/(bF (λ̂F )+

nS bS (λ̂F )) is also increasing in λ̂F . Hence the right-hand side of Equation (79) is increasing

in λ̂F , while the left-hand side of Equation (79) is decreasing in λ̂F . It is easy to show (using

Lemma 2) that limλ̂F →0 λ̂F bF (λ̂F )/r = 0, and hence the right-hand side of Equation (79)

is close to 0 when λ̂F is close to zero, while the left-hand side of Equation (79) is negative

when λ̂F is close to zero. Therefore, Equation (79) has a unique positive solution λ̂F .

Lemma 2. Suppose nS > 1. For any λS > 0 and λ̂F > 0, there exist unique bS > 0 and

bF > 0 that satisfy

bS =

(nS − 1)bS + bF

,

1 + ((nS − 1)bS + bF )λS /r

bF =

nS bS

1 + nS bS λ̂F /r

.

(80)

Moreover, as λ̂F increases (holding all else constant), for the (bS , bF ) that satisfies the

above equation: (2 − bF λ̂F /r)bF λ̂F /r strictly increases and bF /(nS bS + bF ) strictly decreases.

Proof. For the simplicity of notation, let us use n1 ≡ nS , n2 ≡ 1, λ1 ≡ λS /r and λ2 ≡ λ̂F /r.

We first want to show the existence and uniqueness of bi > 0, i ∈ {1, 2}, that satisfy

bi + (λi bi − 1)(B − bi ) = 0,

2

(81)

In fact, we have the following explicit solution:

q

λS (2nS − 1) + λ̂F nS (3nS − 2) − λ̂2F (nS − 2)2 n2S + λ2S (1 − 2nS )2 + 2λS λ̂F nS (nS (2nS − 3) + 2)

bF = r

,

2λ̂F nS (λS + λ̂F nS )

q

λS (1 − 2nS ) + λ̂F (nS − 2)nS + λ̂2F (nS − 2)2 n2S + λ2S (1 − 2nS )2 + 2λS λ̂F nS (nS (2nS − 3) + 2)

bS = r

.

2λS λ̂F (nS − 1)nS

(78)

20

where B ≡ n1 b1 + n2 b2 . Solving for bi in (81), we get:

p

2 + λi B − λ2i B 2 + 4

bi =

,

2λi

(82)

(The quadratic equation has two solutions, but only the smaller one is the correct solution.3 )

Thus, B must solve the following equation:

B=

2

X

i=1

p

2 + λi B − λ2i B 2 + 4

.

ni

2λi

(83)

To show that (83) has a unique positive solution B, we rationalize the numerators of (83)

and rewrite it as

!

2

X

2

p

0 = B −1 +

ni

.

2 2

2

+

Bλ

+

λ

B

+

4

i

i

i=1

Under the conjecture that B > 0, we have

0 = f (B) ≡ −1 +

2

X

i=1

ni

2

p

.

2 + Bλi + λ2i B 2 + 4

(84)

2

−1 > 0, and f (B) → −1 as B → ∞.

It is straightforward to see that f 0 (B) < 0, f (0) = n1 +n

2

Thus, Equation (84) (and hence Equation (83)) has a unique positive solution B.

We now turn to the second statement of the lemma. When λi increases (holding all

else constant), the B that solves (84) must decrease, which means that Bλj (j 6= i) must

decrease

√ and hence Bλ√i must increase for the B that solves√(84); thus bi λi (2 − bi λi ) =

λ2i B 2 +4

2+λi B−

2

·

λ2i B 2 +4

2−λi B+

2

must increase and

bi

B

=

2+λi B− λ2i B 2 +4

2Bλi

must decrease.

The above two lemmas prove the existence and uniqueness of the linear equilibrium, as

summarized in the following proposition.

Proposition 5. Suppose that nS ≡ m∆ > 1 and nF = 1. There exists a perfect Bayesian

equilibrium in which every slow trader j in every period t ≥ 1 submits the demand schedule

λS

xj,t∆ (p; zj,Tj ) = bS −p −

zj,Tj ,

r

√

3

If bi =

2+λi B+ λ2i B 2 +4

,

2λi

then we would have bi > B, which contradicts the definition of B.

21

(85)

and the fast trader submits the demand schedule

xi,t∆ (p; zi,t∆ ) = bF

λ̂F

−p −

zi,t∆

r

!

,

(86)

where bS > 0, bF > 0 and λ̂F > 0 are the unique (and always existing) positive numbers that

satisfy

bF + (nS − 1)bS

,

1 + (bF + (nS − 1)bS )λS /r

n S bS

bF =

,

1 + nS bS λ̂F /r

(87)

bS =

λ̂F =

1

1 − e−r∆ 1 −

nS bS

bF +nS bS

·

λ̂F bF

r

(88)

2 ·

2e−r∆ λ̂2F b2F nS bS

−r∆

λF (1 − e

)+

r(bF + nS bS )2

!

.

(89)

Moreover, we have λ̂F < λF .

2.1.2

Proof of Proposition 4

The fast trader’s starting inventory in period t in equilibrium is

∗

zi,t∆

t−1

X

nS bS λ̂F bF

−bF

1−

=

bF + nS bS t0 =1

(bF + nS bS )r

!t−1−t0

X

bS (−λS zj,Tj /r),

(90)

j∈C(t0 ∆)

the period-t equilibrium price is

p∗t∆ =

X

bS

(−λS zj,Tj /r)

bF + nS bS

(91)

j∈C(t∆)

t−1

X

bF

nS bS λ̂F bF

+

bF + nS bS t0 =1 (bF + nS bS )r

nS bS λ̂F bF

1−

(bF + nS bS )r

!t−1−t0

X −λS zj,Tj /r

,

nS

0

j∈C(t ∆)

and the amount of trading by the fast trader in equilibrium in period t is

∗

xi,t∆ (p∗t∆ ; zi,t∆

)=

X

−bF

bS (−λS zj,Tj /r)

bF + n S bS

(92)

j∈C(t∆)

λ̂F nS bS

+

r

bF

bF + n S bS

2 X

t−1

t0 =1

22

nS bS λ̂F bF

1−

(bF + nS bS )r

!t−1−t0

X

j∈C(t0 ∆)

bS (−λS zj,Tj /r).

Define

κ≡1−

nS bS λ̂F bF

(bF + nS bS )r

(93)

and

σw2 ≡ E[(−λS zj,Tj /r)2 ].

(94)

From the characterization of the equilibrium inventory and price above, we have:

∗

E[(zi,(t+1)∆

)2 ]

=

∗

E[xi,t∆ (p∗t∆ ; zi,t∆

) · p∗t∆ ] = −

bF

bF + n S bS

2

nS b2S σw2

1 − κ2t

,

1 − κ2

bF nS b2S σw2

λ̂2F b4F n2S b3S σw2 1 − κ2(t−1)

+

,

(bF + nS bS )2 (bF + nS bS )4 r2 1 − κ2

(95)

(96)

2

] for every j and t.

where σw2 = E[wj,t∆

Therefore, the fast trader gets:

#

∞

∞

X

λF (1 − e−r∆ ) X −rt∆ ∗

∗

e−rt∆ xi,t∆ (p∗t∆ ; zi,t∆

)p∗t∆

e

(zi,(t+1)∆ )2 −

WF (∆) = E −

2r

t=1

t=1

2

1

1

−r∆

− 1−e−r∆

λF (1 − e

)

bF

κ2

2 2 1−e−r∆

=−

.

nS bS σw

2

2r

bF + n S bS

1−κ

1

1

e−r∆

λ̂2F b4F n2S b3S σw2 −r∆ 1−e−r∆ − 1−e−r∆ κ2

bF nS b2S σw2

+

−

e

1 − e−r∆ (bF + nS bS )2 (bF + nS bS )4 r2

1 − κ2

!

b2F nS b2S σw2

λF (1 − e−r∆ ) λ̂2F b2F nS bS e−r∆

e−r∆

+

=−

(bF + nS bS )2 r

2

(bF + nS bS )2 r (1 − e−r∆ )(1 − e−r∆ κ2 )

"

+

e−r∆

bF nS b2S σw2

.

1 − e−r∆ (bF + nS bS )2

(97)

Applying Condition (89) to the last equation, we get:

WF (∆) = −

b2F nS b2S σw2 λ̂F (1 − e−r∆ κ2 )

bF nS b2S σw2

e−r∆

e−r∆

+

(bF + nS bS )2 r

2

(1 − e−r∆ )(1 − e−r∆ κ2 ) 1 − e−r∆ (bF + nS bS )2

b2F nS b2S σw2 λ̂F e−r∆

e−r∆

bF nS b2S σw2

+

(bF + nS bS )2 r 2 1 − e−r∆ 1 − e−r∆ (bF + nS bS )2

!

e−r∆

bF nS b2S σw2

λ̂F bF

1−

=

1 − e−r∆ (bF + nS bS )2

2r

=−

=

r(λF − λ̂F )σw2

2nS λ̂2F

,

(98)

where the last line follows from Equation (79).

23

Applying the explicit expressions for bF (λ̂F ) and bS (λ̂F ) in Equation (78), we have

F (nS , λ̂F ) ≡

=

!

λ̂F bF (λ̂F )

n2S bS (λ̂F )2

(99)

r

(bF (λ̂F ) + nS bS (λ̂F ))2

q

2

(2nS − 1)λS + nS λ̂F − λ̂2F (nS − 2)2 n2S + λ2S (1 − 2nS )2 + 2λS λ̂F nS (nS (2nS − 3) + 2)

λ̂F bF (λ̂F )

2−

r

2(λS + nS λ̂F )

p

(2nS − 1)y + nS x − x2 (nS − 2)2 + y 2 (1 − 2nS )2 + 2xy(nS (2nS − 3) + 2)

=

≡ F (nS , x),

2(y + x)

where x ≡ nS λ̂F /λF < nS , and y ≡ λS /λF .

We can rewrite Equation (79) as

1

nS − x

= r∆

F (nS , x).

x

e −1

(100)

Taking log of both sides in Equation (100) and differentiating with respect to ∆, we get

(recall nS = m∆):

1

1

−

−

nS − x x

m

rer∆

∂ log(F )

dx

∂ log(F ) dx

+

= − r∆

+

,

m+

d∆ nS − x

e −1

∂nS

∂x d∆

i.e.,

dx

=

d∆

rer∆

er∆ −1

)

1

m − ∂ log(F

m

nS −x

∂nS

,

∂ log(F )

1

1

+

+

nS −x

x

∂x

+

(101)

and

1

2 dx

m

−

−

+

nS − x x d∆ nS − x

!

1

∂ log(F )

1

1

2 nS + nS −x − ∂nS

1

≤m

−

−

+

,

1

nS − x x

nS − x

+ 1 + ∂ log(F )

d log(WF )

=

d∆

nS −x

2

S −x)σw

since WF (∆) = r(n2λ

and

2

Fx

We calculate:

rer∆

er∆ −1

x

(102)

∂x

≥ 1/∆ = m/nS .

p

(−1 + 2nS )y + (3nS − 2)x + x2 (nS − 2)2 + y 2 (1 − 2nS )2 + 2xy(nS (2nS − 3) + 2)

∂ log(F )

p

=y

> 0,

∂x

2x(y + x) x2 (nS − 2)2 + y 2 (1 − 2nS )2 + 2xy(nS (2nS − 3) + 2)

p

(3 − 2nS )y − (nS − 2)x + x2 (nS − 2)2 + y 2 (1 − 2nS )2 + 2xy(nS (2nS − 3) + 2)

∂ log(F )

p

=

> 0.

∂nS

2(nS − 1) x2 (nS − 2)2 + y 2 (1 − 2nS )2 + 2xy(nS (2nS − 3) + 2)

(103)

24

F)

To show that d log(W

< 0, it suffices to show that the second line of (102) is negative,

d∆

which is equivalent to

3−

∂ log(F )

∂ log(F )

x

− (2nS − x)

>x

.

nS

∂nS

∂x

(104)

Using the expressions in (103), it is straightforward to show that (104) holds whenever

0 ≤ x < nS , nS ≥ 2 and y > 0.

Therefore, the WF (∆) is decreasing in ∆ whenever ∆ ≥ 2/m.

References

Biais, B., T. Foucault, and S. Moinas (2015): “Equilibrium Fast Trading,” Journal

of Financial Economics, 116, 292–313.

Du, S. and H. Zhu (2015): “Welfare and Optimal Trading Frequency in Dynamic Double

Auctions,” Working paper.

Hoffmann, P. (2014): “A dynamic limit order market with fast and slow traders,” Journal

of Financial Economics, 113, 156–169.

Jovanovic, B. and A. J. Menkveld (2012): “Middlemen in Limit-Order Markets,”

Working paper.

Kyle, A. S. (1989): “Informed Speculation with Imperfect Competition,” Review of Economic Studies, 56, 317–355.

Rostek, M. and M. Weretka (2012): “Price Inference in Small Markets,” Econometrica,

80, 687–711.

Vives, X. (2011): “Strategic Supply Function Competition with Private Information,”

Econometrica, 79, 1919–1966.

25