Coastal Communities and Climate Change: A Dynamic Model of Risk Perception,

advertisement

Coastal Communities and Climate Change:

A Dynamic Model of Risk Perception,

Storms, and Adaptation

by

Travis Read Franck

Submitted to the Engineering Systems Division

in partial fulfillment of the requirements for the degree of

Doctor of Philosophy in Technology, Management, and Policy

at the

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

September 2009

c

⃝Travis

Franck, 2009. Licensed under the Creative Commons

Attribution-Noncommercial-Share Alike 3.0 US License.

The author hereby grants to MIT permission to reproduce and distribute publicly paper

and electronic copies of this thesis document in whole or in part.

Author . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Engineering Systems Division

September 2, 2009

Certified by . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

John D. Sterman

Jay Forrester Professor of Management and Engineering Systems

Thesis Supervisor

Certified by . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Henry D. Jacoby

Professor of Management

Thesis Supervisor

Certified by . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Robert J. Nicholls

Professor of Coastal Engineering

Thesis Supervisor

Accepted by . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Nancy Leveson

Professor of Engineering Systems and Aeronautics & Astronautics

Chair, ESD Education Committee

2

Coastal Communities and Climate Change:

A Dynamic Model of Risk Perception,

Storms, and Adaptation

by

Travis Read Franck

Submitted to the Engineering Systems Division

on September 2, 2009, in partial fulfillment of the

requirements for the degree of

Doctor of Philosophy in Technology, Management, and Policy

Abstract

Climate change impacts, including sea-level rise and changes in tropical storm

frequency and intensity, will pose significant challenges to city planners and coastal

zone managers trying to make wise investment and protection decisions. Meanwhile,

policymakers are working to mitigate impacts by regulating greenhouse gas emissions.

To design effective policies, policymakers need more accurate information than is

currently available to understand how coastal communities will be affected by climate

change.

My research aims to improve coastal impact and adaptation assessments, which

inform climate and adaptation policies. I relax previous assumptions of probabilistic

annual storm damage and rational economic expectations—variables in previous studies that are suspect, given the stochastic nature of storm events and the real-world

behavior of people. I develop a dynamic stochastic adaptation model that includes

explicit storm events and boundedly rational storm perception. I also include endogenous economic growth, population growth, public adaptation measures, and relative

sea-level rise.

The frequency and intensity of stochastic storm events can change a region’s longterm economic growth pattern and introduce the possibility of community decline.

Previous studies using likely annual storm damage are unable to show this result.

Additionally, I consider three decision makers (coastal managers, infrastructure

investors, and residents) who differ regarding their perception of storm risk. The

decision makers’ perception of risk varies depending on their rationality assumptions.

Boundedly rational investors and residents perceive storm risk to be higher immediately after a storm event, which can drive down investment, decrease economic

3

growth, and increase economic recovery time, proving that previous studies provide

overly optimistic economic predictions. Rationality assumptions are shown to change

economic growth and recovery time estimates.

Including stochastic storms and variable rationality assumptions will improve adaptation research and, therefore, coastal adaptation and climate change policies.

Thesis Supervisor: John D. Sterman

Title: Jay Forrester Professor of Management and Engineering Systems

Thesis Supervisor: Henry D. Jacoby

Title: Professor of Management

Thesis Supervisor: Robert J. Nicholls

Title: Professor of Coastal Engineering

4

Acknowledgments

I have met and been helped by many people on this journey. I appreciate everyone’s

support and encouragement along the way, which made the travels much easier.

My committee was ever challenging and improving my analysis. John was a strong

chair that provided professional and personal guidance, along with the expected superb modeling insights. Jake kept my research focused, well-defined, and he forced

me to always have an eye toward my work’s importance in the broader literature.

Robert “got it” from the beginning, understanding that integrating diverse topics

had value. He redirected my attention toward community resiliency, even before I

had formulated the concept.

MIT is home to many great researchers who are generous with their time. In

the EAPS department, Professor Kerry Emanuel ran his CHIPS hurricane model to

generate storm statistics for each of my three case studies. He was patient while I was

defining my needs and prompt with the results. His data powers the storm portion

of my model.

MIT’s Joint Program on the Science and Policy of Global Change is a world leader

in integrated climate change research. I was fortunate to have their support for both

the two years of my Masters and the four years of my PhD. Along with financial and

administrative support, I have enjoyed working along side so many bright, dedicated

individuals.

Many people provided valuable input in the form of interviews and presentation

feedback. In particular, I would like to thank the US Army Corps personnel, including Don Resio, William Curtis, Nick Kraus, and Katherine White. Their first-hand

knowledge of coastal adaptation projects improved my understanding coastal zone

management in the United States. Richard Zingarelli (MA DCR) and Daisy Sweeney

(FEMA) spent numerous hours helping me understand the finer points of the Na5

tional Flood Insurance Program, and why people do (and don’t) participate. Also, I

would like to thank Geoff Withycombe for making me think twice about my results

and their meaning regarding sustainability. Jan Corfee-Morlot provided me with

important exposure and support, which I value greatly.

Friends and classmates were always there for a coffee or a beer. Over the years,

Kate, Matt, Chris, Amul, John, Chintan, Kawika, and Michael, listened to many joys

and frustrations. I look forward to more drinks and adventures, and to solving the

world’s problem together.

My parents and brother and family have always been there for me, and this PhD was

no exception. Thank you for providing a solid foundation on which I am continually

building upon.

To Misha, my faithful, furry companion that started this educational adventure

with me. You have been a patient and peaceful soul the entire way through, and yes,

you deserve a walk and a treat.

To Marcy, my best friend, my love, and my strongest supporter. As usual, you

went beyond the call of duty, proofreading early chapter drafts late into the night.

Thank you for the emotional support and your undying belief in me. I look forward

to many long years together.

Even with all the help and support I received, there are likely errors in these

pages—those are all mine.

6

Contents

Abstract

1 Introduction

1.1 Motivation for the Research .

1.1.1 Climate and the coast

1.1.2 Behavior and risk . . .

1.2 Present Research . . . . . . .

1.3 Dissertation Overview . . . .

3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

18

18

20

22

23

2 Climate Change and Coastal Adaptation

2.1 Climatic-induced Sea-Level Rise . . . . . . . . . .

2.1.1 Global sea-level rise trends . . . . . . . . .

2.1.2 Relative sea-level rise factors . . . . . . . .

2.2 Climate Change and Tropical Storms . . . . . . .

2.2.1 Tropical storm classification . . . . . . . .

2.2.2 Storm surge . . . . . . . . . . . . . . . . .

2.3 Risk Perception and Decisions . . . . . . . . . . .

2.3.1 Perception anecdotes . . . . . . . . . . . .

2.3.2 Perception literature . . . . . . . . . . . .

2.3.3 Risk perception and climate adaptation . .

2.4 Coastal Adaptation Economics . . . . . . . . . .

2.4.1 Vulnerability studies . . . . . . . . . . . .

2.4.2 Adaptation studies . . . . . . . . . . . . .

2.4.3 Storm representation in adaptation studies

2.4.4 Handling of uncertainty and sensitivity . .

2.4.5 Global data sets for economic studies . . .

2.5 Coastal Adaptation Options . . . . . . . . . . . .

2.5.1 Public adaptation in the United States . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

25

25

26

28

30

32

32

33

33

34

35

36

36

38

42

43

44

45

48

.

.

.

.

.

53

53

58

58

63

64

.

.

.

.

.

.

.

.

.

.

3 Model Description

3.1 Introduction and Overview . . . .

3.2 Sea-Level Rise Forcing . . . . . .

3.2.1 Global sea-level rise . . . .

3.2.2 Relative sea-level rise . . .

3.2.3 Sea-level rise and land loss

7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3.3

3.4

3.5

3.6

3.7

3.8

3.9

3.10

3.11

Storm Events . . . . . . . . . . . . . . . . . . . . . . .

3.3.1 Storm arrivals . . . . . . . . . . . . . . . . . . .

3.3.2 Storm intensities . . . . . . . . . . . . . . . . .

3.3.3 Storm surge . . . . . . . . . . . . . . . . . . . .

Risk Perception . . . . . . . . . . . . . . . . . . . . . .

3.4.1 Perception of storm events . . . . . . . . . . . .

Economy . . . . . . . . . . . . . . . . . . . . . . . . . .

3.5.1 Capital . . . . . . . . . . . . . . . . . . . . . . .

3.5.2 Capital adjustment . . . . . . . . . . . . . . . .

3.5.3 Price of output . . . . . . . . . . . . . . . . . .

3.5.4 Labor . . . . . . . . . . . . . . . . . . . . . . .

Housing Stock . . . . . . . . . . . . . . . . . . . . . . .

3.6.1 Housing adjustment . . . . . . . . . . . . . . . .

3.6.2 Rental price adjustment . . . . . . . . . . . . .

Population . . . . . . . . . . . . . . . . . . . . . . . . .

3.7.1 Births and deaths . . . . . . . . . . . . . . . . .

3.7.2 Immigration and emigration . . . . . . . . . . .

3.7.3 Community attractiveness feedbacks . . . . . .

3.7.4 Evacuation and return . . . . . . . . . . . . . .

Public Coastal Adaptation . . . . . . . . . . . . . . . .

3.8.1 Perception of public adaptation . . . . . . . . .

3.8.2 Coastal managers’ protection choice . . . . . . .

3.8.3 Estimating the benefits of public adaptation . .

3.8.4 Public adaptation height . . . . . . . . . . . . .

3.8.5 Levee construction . . . . . . . . . . . . . . . .

3.8.6 Levee costs . . . . . . . . . . . . . . . . . . . .

3.8.7 Beach nourishment construction . . . . . . . . .

3.8.8 Beach nourishment costs . . . . . . . . . . . . .

3.8.9 Public adaptation maintenance and effectiveness

3.8.10 Public adaptation breaching . . . . . . . . . . .

Flooding and Damage Representation . . . . . . . . . .

3.9.1 Long-term RSLR damage . . . . . . . . . . . .

3.9.2 Storm damage representation . . . . . . . . . .

Private adaptation . . . . . . . . . . . . . . . . . . . .

3.10.1 Insurance . . . . . . . . . . . . . . . . . . . . .

3.10.2 Infrastructure mitigation . . . . . . . . . . . . .

Wetlands and RSLR Response . . . . . . . . . . . . . .

4 Case Study Communities

4.1 Introduction . . . . . . . . . . . . . . . . .

4.2 Cape Cod . . . . . . . . . . . . . . . . . .

4.2.1 Land constraints and development

4.2.2 Wetlands . . . . . . . . . . . . . .

4.2.3 Public adaptation decisions . . . .

4.3 Miami-Dade County . . . . . . . . . . . .

8

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

67

68

68

68

69

70

75

76

82

100

102

110

114

123

126

128

128

129

133

137

138

138

141

142

143

148

150

151

152

154

155

156

157

160

161

164

165

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

169

169

172

172

173

174

175

4.3.1 Land constraints and development

4.3.2 Wetlands . . . . . . . . . . . . . .

4.3.3 Public adaptation decisions . . . .

4.4 St. Mary Parish . . . . . . . . . . . . . . .

4.4.1 Land constraints and development

4.4.2 Wetlands . . . . . . . . . . . . . .

4.4.3 Public adaptation decisions . . . .

4.5 Determining Initial Parameters . . . . . .

4.5.1 Relative sea-level change . . . . . .

4.5.2 Coastal slope . . . . . . . . . . . .

4.5.3 Storm distributions . . . . . . . . .

4.5.4 Economic parameters . . . . . . . .

4.5.5 Land and development parameters

4.5.6 Insurance and mitigation . . . . . .

5 Reference Scenario Results

5.1 Introduction . . . . . . . . . . . . . . . .

5.2 Reference Scenario . . . . . . . . . . . .

5.3 Reference Behavior . . . . . . . . . . . .

5.3.1 Reference SLR and storms . . . .

5.3.2 Perception of storms and damage

5.3.3 Gross economic output . . . . . .

5.3.4 Capital . . . . . . . . . . . . . . .

5.3.5 Population and labor . . . . . . .

5.3.6 Adaptation responses . . . . . . .

5.4 Community Comparison . . . . . . . . .

5.5 Monte Carlo Analysis . . . . . . . . . . .

5.5.1 Economic growth rates . . . . . .

5.5.2 Economic recovery time . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6 Sensitivity to Assumptions

6.1 Sensitivity to the Rationality Assumption . . .

6.1.1 Rationality Monte Carlo Results . . . . .

6.1.2 Rationality and economic growth rates .

6.1.3 Rationality and economic recovery time .

6.2 Sensitivity to Coastal Planner Rationality . . .

6.2.1 Monte Carlo Results . . . . . . . . . . .

6.3 Sensitivity to SLR Scenarios . . . . . . . . . . .

6.3.1 SLR and economic growth rates . . . . .

6.4 Sensitivity to Storm Scenarios . . . . . . . . . .

6.4.1 Storms and economic growth rates . . .

6.5 Parametric Sensitivity Analysis . . . . . . . . .

9

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

175

176

177

178

178

179

180

180

181

182

183

185

188

190

.

.

.

.

.

.

.

.

.

.

.

.

.

193

193

193

195

196

197

201

203

211

217

221

226

227

229

.

.

.

.

.

.

.

.

.

.

.

233

233

248

249

250

252

253

256

259

260

263

265

7 Policy Scenario Results

7.1 Disaster Relief Policies . . . . . . . . . . .

7.2 Disaster relief scenario behavior . . . . . .

7.3 Disaster Relief Monte Carlo Results . . . .

7.4 Disaster relief and economic growth rates .

7.5 Disaster relief and economic recovery time

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8 Discussion and Conclusion

8.1 Importance of Stochastic Storms . . . . . . . . . . . . .

8.1.1 Storms increase economic growth rate variance .

8.1.2 Storms allow for recovery time studies . . . . .

8.1.3 Storms generate important economic dynamics .

8.1.4 Storms change development patterns . . . . . .

8.1.5 Storm frequency and intensity interact . . . . .

8.1.6 Storms are more important than SLR . . . . . .

8.2 Implications of Bounded Rationality . . . . . . . . . .

8.2.1 Rationality and adaptation studies . . . . . . .

8.2.2 Rationality and economic growth rates . . . . .

8.2.3 Optimistic rationality assumptions . . . . . . .

8.3 Disaster Relief and Economic Growth Rates . . . . . .

8.4 Generalizing Insights . . . . . . . . . . . . . . . . . . .

8.4.1 Application to communities in other regions . .

8.4.2 Application to different adaptation models . . .

8.4.3 Aggregating to the nation-scale . . . . . . . . .

8.4.4 Integrating into a general equilibrium model . .

8.5 Possible Research Extensions . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

269

269

270

274

275

276

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

279

280

280

281

282

283

283

284

285

286

287

287

291

292

292

294

295

297

298

Bibliography

303

Abbreviations

313

Glosssary

315

A Storm Data Scripts

319

B Interviews

B.1 General Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B.2 Questions for the US Army Corps of Engineers . . . . . . . . . . . . .

B.3 Interviewees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

323

323

324

326

C Model Documentation

329

10

List of Figures

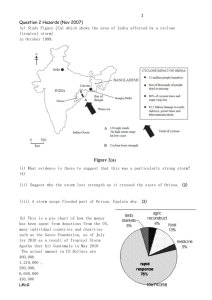

2-1

2-2

2-3

2-4

2-5

2-6

Rates of Relative Sea-level Rise in US . . . . . . .

New Orleans Population (1940–2007) . . . . . . .

New Orleans Population (1995–2007) . . . . . . .

Illustration of SLR and Subsidence . . . . . . . .

US Army Corps of Engineers Initial Project Steps

US Army Corps of Engineers Project Phases . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

30

37

38

47

48

49

3-1

3-2

3-3

3-4

3-5

3-6

3-7

3-8

3-9

3-10

3-11

3-12

3-13

3-14

3-15

3-16

3-17

3-18

3-19

3-20

3-21

3-22

3-23

3-24

3-25

3-26

3-27

3-28

3-29

High-level FRACC Model Diagram . . .

Sea-level Rise Structure . . . . . . . . .

Global Sea-level Rise Paths . . . . . . .

Cumulative RSLR Structure . . . . . . .

Annual RSLR Rates . . . . . . . . . . .

Perceived Storm Frequency Structure . .

Perceived Frequency of Storms Behavior

Capital Stock Structure . . . . . . . . .

Capital Adjustment Structure . . . . . .

Land Availability Function . . . . . . . .

Economic Output Trend Structure . . .

Return to Capital Structure . . . . . . .

Aggregate Demand Structure . . . . . .

Price of Output Structure . . . . . . . .

Labor and Jobs Structure . . . . . . . .

Housing Stock Structure . . . . . . . . .

Housing Adjustment Structure . . . . . .

Population Trend Structure . . . . . . .

Return to Housing Structure . . . . . . .

Rent Adjustment Structure . . . . . . .

Population Structure . . . . . . . . . . .

Occupancy Attractiveness Structure . . .

Occupancy Attractiveness Function . . .

Job Attractiveness Structure . . . . . . .

Job Attractiveness Function . . . . . . .

Storm Attractiveness Structure . . . . .

Storm Attractiveness Function . . . . . .

Fraction Willing to Evacuate Function .

Levee Construction Structure . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

54

60

61

63

64

71

74

77

84

86

87

90

97

100

104

111

117

120

124

125

127

131

131

132

132

134

134

135

144

11

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3-30

3-31

3-32

3-33

3-34

3-35

3-36

Levee Cost Structure . . . . . . . . . . . . .

Beach Nourishment Construction Structure .

Breaching Structure . . . . . . . . . . . . . .

Fragility Curve . . . . . . . . . . . . . . . .

Water Depth-Damage Function . . . . . . .

Flood Insurance Structure . . . . . . . . . .

Wetland Succession Structure . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

149

151

155

155

159

163

166

4-1

4-2

4-3

4-4

4-5

4-6

4-7

4-8

4-9

Map of Cape Cod Region . . . . . . . . . .

DIVA Segments for Cape Cod . . . . . . . .

Map of Miami-Dade County . . . . . . . . .

DIVA Segments near Miami-Dade County .

Map of St. Mary Parish in Louisiana . . . .

St. Mary Parish near New Orleans . . . . .

USACE Coastal Defense for St. Mary Parish

PDF of Storm Intensities . . . . . . . . . . .

CDF of Storm Intensities . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

172

172

175

175

178

178

181

186

187

5-1

5-2

5-3

5-4

5-5

5-6

5-7

5-8

5-9

5-10

5-11

5-12

5-13

5-14

5-15

5-16

5-17

5-18

5-19

5-20

5-21

5-22

5-23

5-24

5-25

5-26

5-27

RSLR for Miami-Dade . . . . . . . . . . . . . . . . . . . . .

Storm Pattern for Miami-Dade . . . . . . . . . . . . . . . .

Perceived Frequency of Storms for Miami-Dade . . . . . . .

Perceived Fractional Storm Damage for Miami-Dade . . . .

Gross Output Causes for Miami-Dade . . . . . . . . . . . . .

Total Capital for Miami-Dade . . . . . . . . . . . . . . . . .

Perceived Relative Return to Capital for Miami-Dade . . . .

Cumulative Storm Damage for Miami-Dade . . . . . . . . .

Mitigated Capital for Miami-Dade . . . . . . . . . . . . . . .

Capital Investment for Miami-Dade . . . . . . . . . . . . . .

Marginal Productivity of Capital for Miami-Dade . . . . . .

Effect of Aggregated Demand on Investment for Miami-Dade

Long-run Expected Growth Rate for Miami-Dade . . . . . .

Effect of Land Availability on Investment for Miami-Dade .

Population for Miami-Dade . . . . . . . . . . . . . . . . . .

Population Flows for Miami-Dade . . . . . . . . . . . . . . .

Community Attractiveness for Miami-Dade . . . . . . . . . .

Community Attractiveness Causes for Miami-Dade . . . . .

Evacuees Population for Miami-Dade . . . . . . . . . . . . .

Labor Force and Jobs for Miami-Dade . . . . . . . . . . . .

Public Adaptation Height for Miami-Dade . . . . . . . . . .

Public Adaptation Breaching for Miami-Dade . . . . . . . .

Fraction of Infrastructure Mitigated for Miami-Dade . . . . .

Fraction of Flood Insurance Coverage for Miami-Dade . . . .

Gross Output for Miami-Dade . . . . . . . . . . . . . . . . .

Gross Output for Cape Cod . . . . . . . . . . . . . . . . . .

Gross Output for St. Mary Parish . . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

196

198

199

200

202

203

204

205

205

206

207

207

208

209

212

213

214

215

216

216

218

219

220

220

223

223

223

12

5-28

5-29

5-30

5-31

Fraction of Developable Land for Communities . . . . . . .

Effect of Land Availability on Investment for Communities

Gross Output Monte Carlo Results for Communities . . . .

Recovery Time for Reference Scenario by Community . . .

.

.

.

.

.

.

.

.

224

224

227

231

6-1

6-2

6-3

6-4

6-5

6-6

6-7

6-8

6-9

6-10

6-11

6-12

6-13

6-14

6-15

6-16

6-17

6-18

6-19

6-20

6-21

Perceived Frequency of Storms for Rationality Scenario . . . . . . .

Perceived Fractional Damage from Storms for Rationality Scenario .

Perceived Relative Return to Capital for Rationality Scenario . . .

Total Damaged Capital from Storms for Rationality Scenario . . . .

Marginal Productivity of Capital for Rationality Scenario . . . . . .

Marginal Cost of Capital for Rationality Scenario . . . . . . . . . .

Total Undamaged Capital for Rationality Scenario . . . . . . . . . .

Employed Labor for Rationality Scenario . . . . . . . . . . . . . . .

Employed Labor, Jobs, Labor Force for Reference . . . . . . . . . .

Employed Labor, Jobs, Labor Force for Rationality . . . . . . . . .

Community Attractiveness for Rationality Scenario . . . . . . . . .

Storm Risk Attractiveness for Rationality Scenario . . . . . . . . .

Job Attractiveness for Rationality Scenario . . . . . . . . . . . . . .

Perceived Relative Return to Labor for Rationality Scenario . . . .

Effect of Aggregate Demand on Jobs for Rationality Scenario . . . .

Monte Carlo Results for Rational Scenario . . . . . . . . . . . . . .

Recovery Time for Rational Scenario by Community . . . . . . . .

Monte Carlo Results for Degrade Protection Scenario . . . . . . . .

Monte Carlo Results for SLR Scenarios . . . . . . . . . . . . . . . .

CDF of Storm Intensity Comparing GCMs for Miami-Dade . . . . .

Monte Carlo Results for Storm Scenarios . . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

235

236

237

238

238

239

240

241

242

243

243

244

245

246

247

248

251

254

257

261

262

7-1

7-2

7-3

7-4

7-5

7-6

Relative Aggregate Demand for Disaster Relief Scenarios . . . . . .

Effect of Aggregate Demand on Capital for Disaster Relief Scenarios

Gross Output for Disaster Relief Scenarios . . . . . . . . . . . . . .

Total Storm Damage for Disaster Relief Scenarios . . . . . . . . . .

Monte Carlo Results for the Disaster Relief Scenarios . . . . . . . .

Recovery Time for Disaster Relief Scenarios for SMP . . . . . . . .

.

.

.

.

.

.

271

272

272

273

275

277

13

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

THIS PAGE INTENTIONALLY LEFT BLANK

14

List of Tables

2.1

2.2

2.3

2.4

Wind Speed Ranges for Saffir-Simpson Categories

Saffir-Simpson Storm Surge Ranges . . . . . . . .

LACPR Planning Objectives . . . . . . . . . . . .

LACPR Performance Metrics . . . . . . . . . . .

.

.

.

.

32

33

50

51

3.1

3.2

3.3

Endogenous and Exogenous Variables . . . . . . . . . . . . . . . . . .

Global SLR Scenarios . . . . . . . . . . . . . . . . . . . . . . . . . . .

Storm Surge in FRACC . . . . . . . . . . . . . . . . . . . . . . . . .

56

59

69

4.1

4.2

4.3

4.4

4.5

4.6

4.7

4.8

4.9

4.10

4.11

4.12

4.13

4.14

Qualitative Dimensions of Communities . . . . . . .

Initial Parameters for Communities . . . . . . . . .

Subsidence Rate for Communities . . . . . . . . . .

Coastal Slope for Communities . . . . . . . . . . .

Storm Frequencies by Region, GCM, and Climate .

Initial Population for Communities . . . . . . . . .

Labor Force Participation for Communities . . . . .

Initial GDP per capita for Communities . . . . . .

Land Area of the Communities . . . . . . . . . . .

Fractions of Land Area Developable and Developed

Land for Communities . . . . . . . . . . . . . . . .

Fraction of NFIP Compliance . . . . . . . . . . . .

Fraction of Infrastructure Pre-1990 . . . . . . . . .

Fraction of Insurance Coverage . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

170

171

182

182

185

186

187

188

188

189

190

191

191

192

5.1

5.2

5.3

5.4

5.5

5.6

5.7

Sample Storm Pattern for Miami-Dade . . .

Sample Storm Distribution for Miami-Dade

Sample Storm Pattern for All Regions . . .

Monte Carlo Results for Communities . . . .

Monte Carlo GDP to No Storms . . . . . . .

Economic Growth Rate Comparison . . . . .

Economic Recovery Time Comparison . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

197

197

222

226

227

229

230

6.1

6.2

6.3

6.4

Economic Growth Rate Comparison . . . . .

Economic Recovery Time for Rationality . .

Economic Growth Rate Comparison . . . . .

Normalized Gross Output for SLR Scenarios

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

249

250

255

256

15

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6.5

6.6

6.7

6.8

6.9

6.10

6.11

T-test Results for SLR Scenarios . . . . . . . . . . .

Economic Growth Rates SLR Scenarios . . . . . . . .

Storm Frequency of Storm Scenarios for Miami-Dade

T-test Results for Storm Scenarios . . . . . . . . . . .

Storm Frequencies by Region, GCM, and Climate . .

Economic Growth Rates SLR Scenarios . . . . . . . .

Sensitive Parameters Rank Ordered . . . . . . . . . .

7.1

7.2

7.3

T-test Results for Disaster Relief Scenarios . . . . . . . . . . . . . . . 274

Economic Growth Rates for Disaster Relief Scenarios . . . . . . . . . 276

Economic Recovery Time for Disaster Relief Scenarios . . . . . . . . . 277

16

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

257

259

260

261

263

264

266

Chapter 1

Introduction

Coastal communities must adapt to climatic changes throughout the current century and beyond. Climate change impacts, including sea-level rise (SLR) and changes

in tropical storm frequency and intensity, will pose significant challenges to city planners and coastal zone managers. Meanwhile, national and international policymakers

are working to mitigate future climate impacts by regulating greenhouse gas emissions. To define more effective policies, policymakers need more accurate information

to better understand how coastal communities will be affected by climate change.

To inform the policy decision making process, researchers develop tools and models

to understand and analyze coastal adaptation. These coastal models, like all models,

are based on assumptions about the how society makes choices and how the climate

system will behave in various scenarios. It is important to better understand if

and how the assumptions shape study results and, by extension, influence policy

recommendations.

This research aims to improve the methodology used to conduct coastal impact

assessments, which will provide better information to policymakers as they craft climate policies. Of particular interest are previous assumptions of probabilistic annual

storm damage and rational economic expectations. These assumptions are suspect

given the stochastic nature of storm events and the real-world behavior of people.

17

This research focuses on two main questions:

• What are the important community dynamics if storms are modeled more explicitly?

• What are the implications for adaptation studies if a boundedly rational, disequilibrium model is used?

This dissertation demonstrates a new assessment methodology that incorporates

variables previously not explored in past studies: boundedly rational risk perception and stochastic tropical storms. These assumptions are examined in a unique

simulation model with endogenous economic development. Including these variables

provides a more realistic interpretation of events affecting coastal communities.

1.1

1.1.1

Motivation for the Research

Climate and the coast

Future climatic changes are inevitable. The response of the Earth’s natural systems

to human-caused greenhouse gas forcing will require society to adapt to the resulting

changes in weather patterns and coastal conditions. For coastal communities, these

climate conditions will translate into an increase in relative sea level and changing

tropical storm patterns. Local coastal zone managers will need to implement protective measures to regulate the coastline as these changes take hold.

Coastal zone planning is a complex process that requires managers to prioritize

many different factors and interests across stakeholder segments. For example, managers must consider cities’ needs to zone for industrial, commercial, and residential

spaces (McCune, 2009). Additionally, they must also consider how their decisions

impact nearby natural ecosystems, such as local wetlands (Axtman, 2009). The complexity of these issues is compounded by the dynamics of the system in which they are

18

embedded—for example, infrastructure developers change their investment decisions

in response to urban planning choices, like levee construction and zoning laws.

Previous research has examined two main coastal impacts: SLR and storms. SLR

has been studied more extensively, including studies of potential impacts (e.g., vulnerability studies of Titus, 1988; Nicholls, 2002; Ericson et al., 2006) and studies of

how society might react (e.g., adaptation studies of Yohe et al., 1996; Titus et al.,

1991; Fankhauser, 1995; Anthoff et al., 2006). These studies explore SLR scenarios

that range from 0.18 m to 1.5 m of global SLR by 2100 (Meehl et al., 2007; Rahmstorf, 2007). The models often include projections of economic growth with exogenous

growth rates, or growth rates defined outside the model.

Storm impacts are sometimes included in SLR adaptation studies because of their

potential to cause damage. Most studies calculate the annual probable storm damage

by multiplying the likelihood of an event by the damage by that event (Hinkel et al.,

2009). Damaged infrastructure is then removed from the community at that constant

expected annual rate. The result is a smooth removal of a capital, instead of a sudden

reduction caused by a distinct storm event. The dynamics of storm events, including

the potential for large storm damage, evacuations, and subsequent change in economic

and population recovery, are lost in the analysis, especially if the model is driven by

exogenous economic growth rates.

Tropical storms may become more intense and/or more frequent as global atmospheric and sea-surface temperatures rise (Emanuel, 2005). It is important for coastal

managers to be able to examine and understand the underlying risks associated with

such a trend. Explicit storm representation will be important for future coastal adaptation studies.

19

1.1.2

Behavior and risk

The way people understand and perceive risk underlies planning for and adapting to

climatic threats. A large literature in psychology and behavioral economics suggests

that coastal communities may not respond to these climate threats in a rational

manner (i.e., maximize their well-being when making decisions) because of limited

or poor understanding of risk (Tversky and Kahneman, 1974; Kydland and Prescott,

1977; Kunreuther and Pauly, 2006). Instead, decision makers within communities

may act according to their perceived risk of storms and coastal flooding, reflecting a

more boundedly rational decision process that uses limited information.

For example, many property owners in Gulfport, Illinois, situated along the Mississippi River, believed they were protected by the presence of a levee system surrounding their town. In the summer of 2008, the levee broke and flooded the land

behind it. Though residents had been eligible for flood insurance through the National Flood Insurance Program (NFIP), only 28 of 200 property owners had actually

purchased policies. They had not perceived a risk of levee failure and felt they did

not need insurance. Town officials, who had promoted the protection provided by the

levee, reinforced this belief (Mattingly, 2008; Webber and Fisher, 2008). The actions

were taking even though hundreds of levees failed along the Mississippi River in 1993

(Larson, 1996).

As with flood risk, the public also poorly understands hurricane risk. State officials

in hurricane-prone Florida worried that residents would be ill prepared for the 2008

hurricane season due to the relatively quiet hurricane seasons of the previous three

years (Cave and Almanzar, 2008). Officials believed people had forgotten the storms

of 2004 even though the probability of a storm hitting a community in Florida had

not changed. With time, the public’s awareness of the risk had faded. Without the

awareness of likely storm damage, officials feared citizens were not taking normal

precautionary measures, such as keeping an emergency food pantry at home.

20

These anecdotes are supported by academic research. Tversky and Kahneman

(1974) studied the human tendency to forget the likelihood of an event or disaster.

Kydland and Prescott (1977) described how flood plains could be developed under

circumstances that are economically suboptimal. Kunreuther and Pauly (2006) found

that property owners did not internalize the risk of flooding when deciding whether

to build homes or buy flood insurance.

Previous coastal adaptation studies have assumed that decision makers are rational

agents who make decisions in contexts with no uncertainty. In these studies, decisions

to build protection mechanisms are based on optimized benefit-cost analysis studies.

Fankhauser (1995) developed an optimization framework that assumed that an agent

with perfect foresight (i.e., certainty) could choose the optimal degree of protection

in the model’s first time-step. Additionally, the framework assumed no feedbacks

between adaptation decisions and capital investments.

These assumptions are unlikely to be appropriate when viewed through the lens

of behavioral economics, risk analysis and management, and climate change. Global

adaptation studies could be improved by relaxing the assumption that agents make

rational decisions. For example, Hallegatte (2006) provides an initial study of how

some of these assumptions influenced New Orleans after Hurricane Katrina. His study

highlights the need to design coastal protections in a manner that protects current

infrastructure but does not attract more investment, which would ultimately put more

people and property at risk.

Community decision makers will be designing policies that will change the behavior

of a community’s investors and residents. Coastal adaptation studies should include a

reasonable behavioral representation of the community’s actors to better understand

policy implications.

21

1.2

Present Research

This work focuses on how the assumptions of integrated coastal adaptation models

can influence policy analysis. I extend previous climate change adaptation frameworks by relaxing many limiting modeling assumptions. I develop a dynamic simulation model to explore how risk perception and climatic threats affect adaptation in

coastal communities. The model highlights the feedbacks among important processes

that determine economic development and coastal adaptation performance (e.g., how

risk perception influences capital investment), and is not intended to predict coastal

development precisely. The goal of the research is to improve future global coastal

adaptation studies and, therefore, future adaptation policies.

The Feedback-Rich Adaptation to Climate Change (FRACC) model follows system

dynamics methodology (Sterman, 2000), consisting of stochastic nonlinear differential

equations solved by simulation. The model includes components such as:

1. Global and relative SLR scenarios

2. Stochastic storm events and climate scenarios

3. Risk perception of storm frequency by investors

4. Storm damage and evacuation

5. Population growth including immigration and emigration

6. Private investment in capital and housing

7. Coastal adaptation including levees and beach nourishment

8. Fragility of coastal defenses, including levee breaching

9. Wetland succession

These components interact with each other, producing the system’s behavior. In

this system, a community’s economic development depends on the amount and rate of

SLR, storm events, the performance of coastal adaptation measures, and the reaction

of investors and residents to these factors and events.

22

The model has a broad system boundary, integrating economic processes, stochastic

tropical storms, limited foresight, and poor risk perception. The decisions in the

model are made by three separate “agents”: adaptation planners who understand

climate science and probability, and investors and residents, who are represented as

having boundedly rational perception of storm events.

I developed the FRACC model because we need a dynamic feedback model to examine how storms and decision making influence the outcomes of adaptation studies.

Previous models did not have endogenous economic adjustment mechanisms (i.e., economic processes defined in the model), and instead used exogenous economic growth

rates (i.e., assumed external economic processes).

By including an endogenous economy and stochastic storms, the model provides an

opportunity to study a community’s economic resiliency to storm events. The FRACC

model illustrates that under some circumstances, economic growth may stagnate and

decline after SLR and storm events. Stagnation depends on model assumptions,

including bounded rational versus rational agents. The possibility of economic decline

reflects the challenges that coastal communities face in the real world.

1.3

Dissertation Overview

The next chapter provides additional context and background for this research and

includes a discussion of previous climate and adaptation studies along with specific

information about coastal management practices in the United States. Chapter 3

presents the FRACC model equations and assumptions and describes the components

and their feedbacks. Chapter 4 provides details about three different US coastal

communities, which serve as case studies to test the model. Chapter 5 presents

base case model results. Sensitivity tests are presented in Chapter 6, including the

implications of rationality assumptions and tropical storm distributions. Chapter 7

explores a policy scenario, demonstrating the use of the model for policy analysis.

23

Chapter 8 concludes the dissertation with a discussion of the results, including their

implications for policy and for global coastal adaptation studies.

24

Chapter 2

Climate Change and Coastal

Adaptation

This chapter provides an overview of climate change and coastal adaptation literature. The first section covers the scientific aspects of coastal adaptation to climate

change—namely sea-level rise (SLR) and storms. The next section considers how people perceive risks associated with natural disasters, which has important implications

for coastal adaptation research. Previous economic studies are discussed next, highlighting the assumptions that are changed later in this dissertation. The final section

presents various techniques for protecting coastal communities against climatic risks,

including practices that are common in the United States.

2.1

Climatic-induced Sea-Level Rise

Contrary to public perception, SLR is not the same around the world. Different

communities will experience varying amounts of SLR depending on local conditions.

The actual height of SLR in a particular region is referred to as the “relative sealevel rise” (RSLR) of the region. RSLR is the sum of the global SLR trend, plus the

location-specific uplift and subsidence factors. While the next section discusses the

important factors increasing SLR and RSLR, Chapter 4 defines in more detail the

rates of subsidence and uplift for the communities in this dissertation.

25

2.1.1

Global sea-level rise trends

Climate change and the resulting higher global temperature increase long-term

rates of global SLR. The four major sources of global SLR are 1) thermal expansion

of oceans, 2) alpine glacier melt, 3) melting of the Greenland ice sheet, and 4) melting

of the Western Antarctic Ice Sheet (WAIS) (Gornitz, 1995).

Thermal expansion refers to the effect of warmer global temperatures on the oceans.

As the oceans warm, the water expands and the same number of water molecules occupies a larger volume. Thermal expansion is a slow process because it is a consequence

of mixing the different layers of the ocean, and each layer has a different time constant

for mixing. The long time constant for deep-water mixing means that the oceans will

expand for centuries to come, even if the global air temperature were stabilized today. This is often called the “commitment to sea-level rise” (Nicholls and Lowe, 2004;

Solomon et al., 2009).

The second main contributor to global SLR is glacial melt. There are two sources of

glacial melt: Mountain glaciers and the large ice sheets in Greenland and Antarctica.

During the 20th Century, many mountain glaciers melted, and their runoff flowed

through rivers into the oceans. The new mass of water, which was previously stored

on land, raises the global sea-level. The World Glacier Monitoring Service surveys

mountain glaciers annually and has found that mountain glaciers are receding at a

rapid rate (World Glacier Monitoring Service, 2007).

Greenland and the Western Antarctic Ice Sheet (WAIS) are both melting but the

rate of melting and their net additions are actively debated. Greenland appears to

be melting along both its perimeter and its interior. The rates of melting are more

extensive than previously thought, according to satellite and land-based instruments

(van de Wal et al., 2008). There is also a process of “lubrication” in which the

melt water flows between the glacier and the bedrock, increasing the rate of ice flow

toward the ocean. This appears to be a seasonal phenomenon, but is currently poorly

26

understood (Joughin et al., 2008).

Researchers previously disagreed about whether Antarctica experienced a net change

in ice mass. Some researchers wondered if the continent’s interior gained ice faster

than its perimeter melted; however, Velicogna and Wahr (2006) used satellites to

measure the continent’s mass and discovered a net loss. Now it appears that both

the WAIS and Greenland ice sheets are net contributors of water to the oceans.

The Greenland and Antarctic ice sheets pose a large uncertainty risk in global

SLR predictions. The Intergovernmental Panel on Climate Change’s (IPCC) Fourth

Assessment Report (AR4) published estimates for future SLR. Their estimate for

2090–2099 is 0.18–0.58 m (Meehl et al., 2007). This range includes SLR caused

both by melting mountain glaciers and thermal expansion, but does not include the

impact of the Greenland and WAIS ice sheets. Instead, the IPCC stated that up to

an additional 0.2 m of SLR could occur by 2100 due to “large ice sheet melt,” scaling

up recent discharge rates as a function of global mean temperature. The final range

of SLR estimated in the IPCC AR4 is 0.18–0.78 m by 2100 (90 percent confidence

interval).

When the IPCC released its study, researchers suggested that their global SLR

estimates were too optimistic and that the risk of larger SLR was much greater. Pfeffer

et al. (2008) state that a likely range of SLR by 2100, including increased ice dynamics,

is 0.8–2.0 m. They acknowledge that their study contains large uncertainties. Their

study agrees with Rahmstorf (2007), who also estimates a higher SLR range of 0.5–

1.4 m by 2100, using IPCC AR4 temperature projections.

Projections of SLR by 2100 may vary, but the rate of global SLR in the next

hundred years (2000–2100) will likely be faster than in the previous hundred years

(1900–2000). The IPCC reports that the recent rates of 3.1 mm/year (1993–2003

average) exceeded the average 1.8±0.5 mm/year from 1961 to 2003. It’s important

to consider that these historic rates may not reflect the actual amount of change

27

to date. Measured SLR rates might be lower than would naturally occur because

humans have entrapped water inland in reservoirs, preventing a significant volume of

water (0.55 mm/year) from reaching the ocean (Chao et al., 2008).

Going forward, the annual rate of SLR will depend significantly on the stability of

the large ice sheets (Overpeck et al., 2006). Additionally, a recent study concluded

that contributions from WAIS may not spread uniformly throughout the oceans,

causing higher SLR than the global average in only some coastal areas, such as the

southern US (Mitrovica et al., 2009). Uneven distribution of ice sheet melt could

mean that regions in the United States face higher levels of SLR than any current

estimate, which explained further in the next section.

2.1.2

Relative sea-level rise factors

The actual rise in sea-level for a particular location, or relative sea-level rise (RLSR),

will likely vary from the global mean SLR. Local trends can offset or exacerbate the

global rate. For this reason, it is important to use the RSLR rates when planning

coastal management strategies for protection or retreat.

The location-specific forces influencing RSLR include 1) plate tectonics, 2) isostatic

adjustments, 3) uneven landmass in the Northern Hemisphere, and 4) sediment compaction (Emery and Aubrey, 1991). Plate tectonics is the shifting of the Earth’s

plates either closer or farther apart. Either process can change the shape and size

of an ocean basin. For example, if two plates on either side of an ocean basin are

moving away from one another, the ocean basin will become wider, which results in

a lowering of that ocean basin’s sea-level.

Isostatic adjustments include post-glaciation rebound. During an ice age, ice sheets

weigh down the Earth’s crust, pushing polar ends of the plates down while lifting the

opposite end. The action reverses as the ice retreats at the end of an ice age. Today

the Earth’s crust continues to rise and fall due to the retreating of glaciers from

28

the last glacial period, approximately 10,000 years ago. While tectonic rebound is a

slow process, the rise will be an important factor to offset global SLR in some US

communities.

The uneven distribution of land changes the shape of the layer of water covering the

Earth. If land were evenly distributed, the water would evenly distribute. Instead, the

gravitational pull of the large area of land in the Northern Hemisphere attracts water

and raises the RSLR as compared to the South Hemisphere (Emery and Aubrey,

1991). Mitrovica et al. (2009) recently discussed how water from the WAIS might

impact RSLR, noting that it will be unevenly distributed across the Earth. The mass

of large ice sheets currently attracts ocean water, raising the relative sea level nearby.

As a large ice sheet melts, the decrease in mass will lower relative sea level for land

within approximately 2,000 km, even with the addition of melt water. Instead, the

relative sea level will rise disproportionately for locations farther from the ice sheet.

In the case of the melting WAIS, the Northern Hemisphere will experience relatively

more SLR than locations in the Southern Hemisphere. The gravitational effect has

largely been ignored in SLR studies, with the exception of Katsman et al. (2008) who

generated SLR scenarios the Northeast Atlantic with gravitational effects.

Along with plate tectonics and other large-scale forces, land may be sinking because of small-scale trends at specific locations. Pumping resources from underground