Document 11082196

advertisement

a

of t&°;

—

DHD28

.M414

9*

ALFRED

P.

WORKING PAPER

SLOAN SCHOOL OF MANAGEMENT

TRANSACTIONAL RISK, MARKET CRASHES,

AND THE ROLE OF CIRCUIT BREAKERS

Bruce C. Greenwald*

Jeremy C. Stein**

First Draft:

March 1989

This Draft:

October 1990

WP # 3226-90-EFA

MASSACHUSETTS

TECHNOLOGY

50 MEMORIAL DRIVE

CAMBRIDGE, MASSACHUSETTS 02139

INSTITUTE OF

TRANSACTIONAL RISK, MARKET CRASHES,

AND THE ROLE OF CIRCUIT BREAKERS

Bruce C. Greenwald*

Jeremy C. Stein**

March 1989

First Draft:

October 1990

This Draft:

WP # 3226-90-EFA

Forthcoming, Journal of Business

*

**

Bell Communications Research

Sloan School of Management, M.I.T.

We thank Jim Gammill, Hank McMillan, Andre Perold, Robert Schwartz, Eric Sirri,

Larry Summers, an anonymous referee and seminar participants at the CFTC, the

SEC, the Federal Reserve and the Western Finance meetings for helpful comments.

Transactional Risk, Market Crashes, and the

Role of Circuit Breakers

Bruce

Greenwald*

C.

Jeremy

C.

First Draft:

Stein**

March 1989

This Draft: October 1990

Forthcoming, Journal of Business

*

**

Bell Communications Research

Sloan School of Management, M.I.T.

We thank Jim Gammill, Hank McMillan, Andre Perold, Robert Schwartz, Eric Sirri,

Larry Summers, an anonymous referee and seminar participants at the CFTC, the

SEC, the Federal Reserve and the Western Finance meetings for helpful comments.

s

Abstract

We develop a pair of models that illustrate how imperfections in

transactional mechanisms can lead to a market crash. Neither market orders nor

limit orders allow traders to condition their demands on the full information set

When volume shocks are sufficiently

needed to achieve a Walrasian outcome.

large, the deviations from Walrasian prices and allocations are large also.

Properly designed and implemented, circuit breakers may help to overcome some of

these informational problems, and thereby improve the market's ability to absorb

large volume shocks

I

.

Introduction

accounts

Many

of

market

stock

the

crash

October

of

point

1987

to

market microstructure factors as playing an important role in the dramatic

For example, Grossman and Miller (1988) write:

events of those few days.

".. .both markets had by then become highly illiquid and

virtually incapable of supplying immediacy at the low cost their

That illiquidity was evidenced in

users had come to expect

the spot market by (1) the virtual impossibility of executing

market sell orders at the bid quoted at the time of order entry,

and (2' the delays in executing and confirming trades on Monday

afternoon and again, after the opening on Tuesday." (p. 632)

.

.

.

(Greenwald and

In our interpretation of the Brady Task Force Report,

Stein (1988)), we also emphasized the breakdown of market-making as one of

the

characteristics

key

prevent

breakdown

can

working:

under more

attractive

However,

of

would

prevent

system

market-making

the

Walrasian

circumstances,

ordinary

opportunities,

if

normal

the

We

crash.

the

is

argued

that

adjustment

prices

from

failing,

mechanism

falling

value

of

from

perceiving

buyers,"

"value

type

this

too

buyers

far.

may

be

deterred from placing orders because they view the "transactional risk" as

extremely high- -they are very unsure as to the prices at which their orders

We concluded that such transactional risks may justify

will be executed.

the use

According to this view,

"circuit breakers."

of

circuit breakers

are not intended to prevent a rapid fundamental Walrasian price adjustment,

but rather to

facilitate

it,

by reducing transactional risks and thereby

encouraging value buyers to bring their demands to market.

This paper presents a pair of market microstructure models designed to

elaborate

upon

and

clarify

the

informal

arguments

made

in

our

earlier

paper.

The models appear to fit with many of the stylized facts about the

crash,

and

they

have

quite

specific

implementation of circuit breakers.

implications

for

the

design

and

-

2

-

The models are closely related to the one seen in Grossman and Miller.

Like Grossman and Miller,

is,

as

disseminated to the investing public (or "value buyers")

in two stages,

Because

whole.

a

receive the shock,

smaller

group

second stage,

of

they examine how an informationless supply shock

public

entire

the

after

delay,

a

immediately

prepared

to

first stage be temporarily absorbed by a

it must in the

competitive,

not

is

market

risk-averse,

does

Only

makers.

in

the

public buy some of the new supply

the

from the market makers.

There is one key respect in which the models here differ from Grossman

Their primary focus

however.

and Miller,

first stage

on the

is

of

this

transmission sequence, and their second stage is, by assumption, completely

Walrasian

in

and market makers

value buyers

nature:

effectively submit

complete demand curves to a hypothetical auctioneer, who then sets a market

Hence there

clearing price.

is

is

scope for transactional risk- -everyone

no

assured of receiving a price-quantity pair that they view as optimal.

In contrast,

price.

submit market

must

buyers

1

value

the second stage of the models here is less efficient:

Consequently,

that

orders

there

is

uncontingent

are

on

execution

the

transactional risk--there is a possibility

that these orders will be executed at an unattractive price level.

The main point being made here

first

stage

of

transmission

is

sequence

transactional risk in the second stage.

reluctant

to

come

to

market

to

feeds back to the market makers.

the

first

stage,

knowing

that

that

absorb

large volume

a

will

tend

As a result,

some

of

the

to

shock in

increase

the

the

value buyers will be

shock.

This

in

turn

They will shy away from large volumes in

such

difficult to unload to the public.

amounts

will

The end result

subsequently

is

a

be

very

"microstructure-

induced crash" --the outcome of the two- stage transmission sequence is very

different from what would happen in a hypothetical world where

buyers were able

to

meet

the

volume

shock instantaneously in

a

the value

Walrasian

fashion, without using the market-making mechanism as a temporary conduit.

-

context of our models,

In the

than

an

risk-bearers

of

economy.

the

in

informational

-

a

market crash is really nothing more

volume

the

This

imperfection- -the

conditioned on an

fact

among

shock

inefficiency

important variable,

primary purpose of

the

allocation

inefficient

3

can

market

that

namely

potential

the

traced

be

orders

to

cannot

execution price.

the

2

an

be

The

circuit breaker mechanism should thus be to improve

a

information available

market participants at the time

to

they submit

their orders.

In Sections

so,

we

assume

considered.

II

that

This

and III,

traders

use

assumption

consistent

with

the

buyers"

make

little

to

we

observed

use

develop our two simple models.

only market orders

makes

the

tendency

of

limit

of

--

limit

analysis

many

orders.

large

In

In doing

orders

are

not

and

is

tractable,

real

world

Section IV,

we

"value

use

our

first model to shed some light on the question of why limit orders do not

play

a

more

discuss the

important

role

in

market

stabilization.

In

Section

V,

we

implications of the models with respect to both the stylized

facts about the October 1987 crash, and to the design and implementation of

circuit-breaker trading mechanisms.

II.

Model #1

a)

Model Description

This model features

and

Section VI concludes.

"value

buyers,"

two

each

of

types of traders:

whom

has

competitive market makers

constant

utility with a risk aversion coefficient of one.

absolute

The

risk

aversion

market makers

are

"myopic maximizers" - -at each point in time, they only look one period ahead

in

changing

demands.

their

formulating

(This

substantive.)

anything

simplifies

timing

The

of

mathematics without

the

the

model

diagrammed

is

below:

Time

Time

1

Time

2

Competition among

market makers for

value buyer orders

leads to price = P 2

News about

fundamentals

Supply shock s of

risky asset hits

market, is absorbed

by n 1 market

Price = P a

makers.

emerges.

This

activates a random

number n 2 of value

buyers, each of

whom submits a

market order d.

Fundamentals

3

Liquidation of

asset, more news

about fundamentals

Anyone holding

asset gets

F - f2 + f 3

.

.

E,F = f,.

EjF = 0.

At time

the

1,

entire supply shock

information about

model)

it

is

important

This leads to a price P :

s.

(indeed,

s

it

is

.

Since ? 1 conveys

perfectly informative about

P lt

1

s

in

this

They submit market

arouses the attention of the value buyers.

orders at time

lower

group of n x risk-averse market makers must absorb the

based on the magnitude of the price decline at time l--the

the

larger

feature

of

is

the

the

model

reacting to the price signal

is

is

a

placed by

order

that

the

number

random variable.

interpretations that can be given to n 2

.

value

each

buyer.

buyers

value

of

An

n2

There are a variety of

The most literal one is that not

all value buyers are monitoring the market at all times,

so that a fraction

of them are "asleep" and miss the price signal at time

1.

it

may be

speed,

that not

all

buyers are able

to

place

their orders

and some are unable to get an order in before time

developed

in

the

next

section

expands

on

this

Alternatively,

idea,

2.

with equal

(The model

allowing

for

two

leads

to

separate times at which value buyer orders can be executed.)

The

uncertainty

surrounding

the

realization

of

n2

-

-

5

transactional risk for value buyers placing orders at time

is the realized n 2

execution price

here

the more total orders are placed,

,

P2

of

uncertainty

more

imply

s

distribution of n 2 is taken to be independent of

it

likely that a high

is

and the higher is the

should be pointed out that there is no assumption

values

large

that

It

.

The larger

1.

s

s.

about

However,

n 2 --the

in reality,

increase the conditional variance of n 2

does

.

This was certainly the case in October 1987, when larger order flows led to

purely mechanical problems

made

it

difficult

more

predict what proportion of orders placed at a

to

given time would be executed promptly.

magnitude of

s

that

telephone and computer backups)

(such as

If

relationship between the

this

and the variance of n 2 were incorporated into the model,

the

results would just be accentuated.

Time

3

introduced into the model only as

is

the equilibrium.

gets

payoff

a

about

News

F.

device for tying down

anybody holding a unit of the risky asset

At this time,

of

a

value

the

of

F

(i.e.

about

news

"fundamentals") arrives slowly over the course of time--F is represanted as

f2 +

f3

,

where

f2

is

learned at time

and f 3 is learned at time

2

These

3.

news innovations are taken to be normally distributed, with mean zero.

Gate

2

innovation has variance

a\

The

.

date

3

innovation

thought of as occurring over a longer interval of time)

is

The

(which may be

normalized to

have variance of unity.

b)

Solution for Non-Stochastic n ?

As a benchmark,

case where

n2

is

it

is

useful to first work through the model for the

non-stochastic,

model can be solved backwards.

holding a total supply of

(s

takes

and

At time

-

n 2 d)

2,

denoted by n 1m2

,

is

the

fixed value

n2

.

The

the market-makers will be left

initial supply shock,

--the

that has been absorbed by the value buyers.

for the market makers,

on

less any

The aggregate demand function

given by:

-

(1)

n^

-

- F,)

(£,F

77,

v

n,(f2

-

{F)

P2

-

6

)

Setting this demand equal to the supply that is held by the market makers

leads to the price that emerges at time

(2)

2:

2—

P, - f, +

The next question to address

the determination of

is

submitted by the value buyers at time

the market orders d

The demand of an individual value

1.

buyer is given by:

,„,

(3)

.

d

-

E,(F-P,)

[s-n,d]

V,(F-P2

n,

)

Note that there are two potential sources of uncertainty for value buyers-not only are they uncertain about the terminal value of the asset, they are

also

unsure

particular

about

case,

concerns the time

the

price

equation

2

(2)

P2

which

at

tells

by the value buyers from looking at P 1

that

us

fundamental news

f2

they

.

the

will

only

buy

it.

In

uncertainty

this

in

P2

Everything else can be inferred

.

Equation (3) can be solved to yield the Nash equilibrium market order

made by each value buyer, predicated on the conjecture that all other value

buyers are behaving the same way:

(4)

d

'

^

Knowing how value buyers will behave, market makers can then formulate

their strategies at time

(2)

gives:

1.

Plugging value buyer demand back into equation

7

-

(5)

P2

-

^—

f2

time

At

competition among market makers

1,

for

the

supply shock

s

leads to a price of:

.

Pi . EiP2

(6)

JH1II2L

-

,a

_i_

^]

+

E

In the special case of a non- stochastic n 2

,

the use of market orders

in this framework still leads to a Walrasian outcome by time 2:

of P 2 — f2

as well as the distribution of the supply shock,

s

-

the price

n 1 + n2

n 2 d* = n 2 s and njm 2 =n

with

attained in the

s

,

are all exactly the same as would be

idealized situation where both the market makers and the

buyers

were

auctioneer at

time

value

:

n 1 +n 2

n : +n 2

able

2.

3

submit

to

Intuitively,

entire

their

this

is

demand

nothing new is learned about

an

to

because value buyer demands

are driven by the conditional mean and variance of (F-P 2 )

stochastic,

curves

(F-P 2 )

at

time

When n 2 is non-

.

Thus a value

2.

buyer can predict exactly ahead of time the single point on his Walrasian

demand

curve

market

order.

there

is

a

that

will

be

relevant,

Consequently,

temporary price

can

submit

Grossman-Miller

the

drop

and

at

time

1,

that

result

quantity

is

as

a

reproduced:

when the market makers must

briefly absorb all of the supply shock by themselves, but by time

2,

the

transmission is complete,

c)

Solution when n 2

Stochastic

is

Things change quite dramatically when n 2 becomes stochastic.

the variance of n 2 by o\

.

The price at time

2

will now be given by:

Denote

P7

(7)

-

f

[n, d

-Li-

+

•

-

s]

Now there is more uncertainty for a value buyer trying to guess at

time

1

price

the

information

at

about

realization of n 2 d,

which an order will be

revealed

of

2

or

total number of value buyers.

market

1

-specif ically

is

the

upon

order

1

2

-

Thus

new

,

the

,

it

no

is

the single relevant point on

A trader is likely to regret the size

Walrasian demand curve.

time

his

time

at

(F-P 2 )

longer possible for someone to guess at time

their time

With a„ >0

executed.

learning

price

the

at

which

was

it

executed.

The magnitude of this transactional risk depends on the size of

individual

orders

a

is

happening

in

the

market

and

d

is

On the other hand, when there

transactional risk will be small too.

small,

is

much

not

If

d.

large supply shock that calls for large d's,

transactional risk will

be heightened.

The market order placed by an individual buyer can be calculated as:

,

,

(8)

_,

d

-

E.(F-P2

[s-n2 d]

)

A comparison of equation (8) with equation (3) highlights the effect

of randomness in n 2

identical.

.

However,

When

when

ct£

aj

n 2 is nonstochastic)

=

(i.e.,

is

non-zero,

,

the two are

increased responsiveness by any

given value buyer makes transacting more risky for his peers, and tends to

make

from

the

responsiveness

by

them shy away

increased

a

other words,

In

market.

given

value

buyer

non-zero a 2

for

imposes

a

,

negative

externality on all other potential value buyers.

This

responding

negative

externality

aggressively

to

a

prevents

large

value

voluiie

buyers

shock.

as

a

Equation

group

(8)

from

can

be

9

-

-

rearranged to give an expression for equilibrium value buyer demands:

°" (d

(8')

Figure

}

+(n

1

+ir2

)d -g

,

illustrates

1A

dependence of

the

relationship to the one seen in the Walrasian case.

of d

compares

this

The limiting behavior

for large and small volume shocks can be summarized as follows:

Proposition

As s

(9)

1

When

value of n 2

seen with

large,

the

:

- 0,

As s

(10)

d' -

d

- »,

a

£_-•

-s

volume

the

,

m

—

(9)

3

[

-4

shock

that only

market

3

]

relatively

is

non-stochastic

transmission

n2

is

mechanism

shock,

forced

thus

allocation of risk-bearing.

when

However,

.

increases with the cube

makers

small,

and

breaks

the

thereby determining

plots E(P 2 ) against

without

equals

s,

P 2 as

volume

down- -rather

its

root of

to

swallow

s.

shock

mean

very

a

taking an amount

The much smaller

the

is

absorbing

than

value buyers wind up

remainder- -an

group of

inefficient

The price consequences of this misallocation

can be obtained by plugging the equilibrium value of

obtains

n2

states that the outcome is very close to the Walrasian one

constant proportion of the

(7),

and

on s,

d*

a

d*

back into equation

function of the supply shock

s.

Figure IB

and again compares the relationship to the one that

transactional

risk.

As

can be

seen,

large

volumes

are

associated with increased deviations of prices from "fundamental" Walrasian

levels

-

10

-

Model #2

III.

In the above model,

risk

solely

driven

is

uncertainty as

by

fact

the

value

total

the

to

the relationship between volume and transactional

buyer

affected by volume.

hit

value buyers

volume

large

market

the

shocks,

next model

The

at

once,

exacerbating

the

flow at

order

liquidity- -the extent to which a unit of time

not

volume

greater

that

2

implies

time

more

Market

2.

order flow moves prices- -is

demonstrates

that when not

also be

liquidity may

all

impaired by

The

inefficiencies.

allocational

timing of the model is outlined below:

Time

Time

1

Time

2

Orders of fast

value buyers

arrive, are

executed at P 2

E 2 F=f 2

Supply shock of

s, absorbed by

market makers,

leading to P 2

This activates

n f "fast" value

buyers who

submit market

orders d f and

n s "slow" value

buyers who

submit market

orders d s

.

Time 4

3

Orders of slow

value buyers

arrive, are

executed at P 3

E 3 F=f 2 +f 3

.

Asset pays

F=f 2 +f 3 +f

<,

.

.

.

,

.

EiF-0.

again,

Once

time

there

But now,

1.

random number of value buyers submit market orders at

a

is

further complication, because not all of the

a

uncertainty concerning the number of value buyers

nf

of

are

them

"fast"

and

submit

their

orders

"slow," and don't get their orders in until time

assumed that n f and n s

common variance of

are

fast

knowledge,

or

df

and

slow,

or

a\.

ds

.

are

It

uncorrelated,

is

by

3.

with means

resolved right away-time

while

2,

ns

For simplicity,

of

nf

and n s

are

it is

and a

,

also assumed that buyers know whether they

therefore

This

is

can

assumption

submit

is

demands

conditional

unrealistic -- it

is

more

on

this

likely

-

the

that

will

trades

their

themselves

investors

be

simplifies

uncertainty about the exact time

some

and

executed,

-

that

uncertainty

this

adds

further

However, allowing value buyers to know their execution

transactional risk.

time

face

11

analysis,

the

only

and by ignoring another type of risk,

makes the argument for a crash scenario excessively conservative.

At time 4,

the

asset is liquidated,

the

fundamental value

As

F.

arrives in each period,

market makers.

variance

The

Once again,

a\.

previous

the

some

model,

that holding the asset is always

so

time

in

and everyone holding it receives

time

and

2

innovations,

3

and

f2

about

news

risky to the

f3

,

both have

final piece of news,

the variance of the

F

f4

is

,

normalized to unity.

Solution

b)

The same backward solution technique applied in the previous section

can be used here.

arrived,

At time

3,

will

inventory

market-maker

so

all of the orders of

be

(n f d f + n s d s )

[s

(n f d f

-

will have

+

ns ds )

P2

can

]

.

Consequently, the price will be given by:

(11)

P,-f2

At

[n f d f + n.d. - s]

S-2

f, + -!-£-i

+

time

market-maker

2,

inventory

is

[s

-

nfdf

]

.

Thus

be

determined as:

,

,

(12)

P, -

[s -

,

EAP,)

,

— —

nfdf VAP,)

-

In order to evaluate

variance of P 3 as of time

]

(12),

2.

one needs to find the conditional mean and

To do

so,

One

source of risk to market

they only have partial

information at this time

and variance of n s are given by n s and

makers at time

2

is

that

recall that the conditional mean

about the total value buyer order flow.

a\.

If the number of slow orders,

turns out to be unexpectedly small, P 3 will be unexpectedly low.

ns

,

12

-

Taking these facts into consideration leads to:

[r^d,

_

2

2

'

The

iTs d s -

*

*

s]

[s -

_

n fdf

term

on

2

2

(a D d s /n )]

ni

Ox

last

2

2

[o , +

]

the

hand

right

side

of

represents

(13)

premium built into P 2 by market makers for holding the supply

time

suggested

As

2.

fundamental risk,

order flow,

above,

risk

this

not

-

risk

n £ d£

at

]

only

on

remaining uncertainty about future

but also on the

a\,

depends

premium

[s

the

a*-

Now consider things from the point of view of a value buyer deciding

how large an order to place at time

1.

If he

is

slow trader,

a

he faces

the same type of transactional risk as was seen in Model #l--the execution

price P 3 depends on the magnitude of the uncertain order flow n f d f + n s d s

However,

time

2

also

time

2

is

trader,

things are even worse.

on an uncertain order

sensitive

much more

to

flow,

variations

in

nfdf

the

.

The price at

But the price

order

flow

at

than the

This can be seen explicitly by comparing the derivatives

3.

and dP 2 /d(n f d f )

liquidity at times

(14)

a fast

is

depends

price at time

dP 3 /d(n s d s )

if he

.

dPjd(n.d.)

3

and

which can be thought of as measures of market

respectively:

2

[1 + o f +

dP,

i

/3 1

2

,

'

d(n f d f

The reason that prices at time

2

2

(o n d s

/n

2

)}

flj

)

2

are much more sensitive

to variations

in

order flow is because market makers still face another period of order flow

risk after time

a

2,

and hence are very unwilling to smooth prices.

This is

feature that was absent from Model #1, where market makers were only hit

with one uncertain order flow.

13

-

Thus transactional risk at time

in

Model

Now

#1.

simultaneously:

in addition,

response

(i.e.

(i.e.

pronounced than it was

externality

effects

working

uncertainty about n f means that aggressive

high d f )

imposes risks on other fast traders;

uncertainty about n s means that aggressive slow trader

high

a

a

is even more

adverse

two

are

as before,

1)

fast trader response

and 2)

there

2

ds )

makes

the

market

"illiquid"

at

time

2,

and

thereby exacerbates the effect of n f d f -type risk.

These effects can be seen explicitly when the demand of fast traders

is calculated:

dt

(15)

Now

the

E,(F-P.)

-

V1 {F-P2

d|

fact

and

that

2

^[{s-nfdf (l*o 5

2

?

n tl + f) + a n dj(l

2

)

d^

(o

2

*

n d'

s

o

z

f

/n

2

+

(a n dl/nl))

))

-

n sds

2

]

2

terms both appear in the denominator of (15),

aggressive

responses by either type

negative externalitv effect

that blunts

the

reflecting

of value buyer have

a

demand of fast value buyers.

This results in the following limiting behavior:

Proposition

2

:

_i

(16)

As s

(17)

As

-

°°,

dj - Aj s

s -

°°,

d' -

3

,

where k is

1

a

constant.

i

In

words,

Model #1.

the

However,

k2 s

9

,

where k2 is a constant.

limiting behavior

the

of

slow buyers

is

fast buyers face even more risk,

as

described

in

and their ability

14

-

to assume a

-

portion of the supply shock is even more impaired than before.

Why Don't Value Buyers Use Limit Orders?

IV.

Thus far, the formal analysis has simply assumed that value buyers are

restricted to placing market orders that are uncontingent on the execution

And it is the transactional risk inherent in these market orders

price.

Hence a natural question to ask is

that drives the results of the models.

this:

do

sorts

of

limit orders represent a way for value buyers

described

risk

transactional

them

enabling

thereby

above,

circumvent the

to

to

transmit their demands to the market more forcefully?

Other authors have argued that limit orders will not be appropriate

Grossman and Miller, as well as Rock (1987)

for certain types of traders.

point out that since limit orders carry a risk of non-execution,

be

avoided by traders with

valuable

but

perishable

a

neither

However,

information.

inside

those with

or by

high demand for immediacy,

they will

of

these

suggests that limit orders will not be used by the sorts of value

papers

buyers in our models.

In order to motivate the use of market orders by our value buyers,

focus

on a different drawback of limit orders:

that

fact

the

we

they leave

traders exposed to innovations in fundamentals that occur between the time

Before proceeding to the

an order is placed and the time it is executed.

formal

argument,

violence

to

pension

and

should

we

observed

funds)

absorption capacity,

do not

basis.

4

who

1987

Furthermore,

crash.

5

What

we

attempting

not

are

investors,

institutional

comprise

much

of

economy's

the

to

we

are

a

follows

not

aware

of

any

evidence

do

(e.g.,

risk

appear to make much use of limit orders on

suggests that limit orders played

October

that

Major

reality.

mutual

regular

emphasize

a

that

meaningful stabilizing role during the

is

rationalization of these observations.

meant

simply

to

be

a

theoretical

-

15

-

The tradeoff between market and limit orders is easiest to see in the

Recall equation (7), which gives the execution price

context of Model #1.

received by a trader placing a market order:

\n 7 d - s)

Market orders are risky because n 2 is uncertain- -traders do not know

at the time an order is placed how many other orders will be executed along

impounds

market orders

However,

with theirs.

time

the

innovation

news

2

also have

an advantage,

This

perfectly.

f2

that P 2

in

is

a

direct

consequence of the competition among market makers for these orders.

Limit orders face a different sort of risk.

submits

limit order to buy at a price P L

a

what the realization of n 2

his

a

at time

1,

too high

time

2

a

relative

to

time

However,

fundamentals.

2

A

Walrasian demand curve with limit orders,

because the limit orders are not conditional on time

fundamental news.

2

limit orders suffer from an adverse selection problem:

Consequently,

trader

he can be sure that no matter

he will not pay more than that price.

,

execution price mav be

trader cannot replicate

,

If,

a

buy

order is more likely to be executed at the limit price P L when bad news has

arrived between time

1

and time

2.

a limit buy order

Or said differently,

involves giving away a put option on fundamentals.

orders

Limit

fundamentals

is little

is

o\

are

low.

thus

attractive

when

the

variance

of

Conversely, market orders are preferred when there

uncertainty regarding the number of traders arriving at any given

time--i.e., when a^ is low.

Proposition

For

relatively

3

any

The appendix proves the following proposition:

:

PL

,

and

any

volume

shock

s,

there

exists

sufficiently large so that a limit buy order at price

expected profits.

PL

a

value

of

o\

yields negative

16

-

formalizes

proposition

The

unprofitable for large values of

-

notion

the

a\

so does the range of

As a\ increases,

.

become

orders

limit

that

prices for which rational traders will be unwilling to leave limit orders

on specialists'

books.

This logic may help explain the relative paucity

7

of limit orders in day-to-day trading.

It is more difficult to understand why limit orders should not play an

augmented role in a crash situation.

execution price

while

the

might

expect

However,

this

there

are

a

orders

risk associated with market

balance

the

in

reasons

number of

rises

effectively

also

tip

to

fundamental risk stays constant

If

during

to

like

times

using

of

favor

believe

that

seen

those

one

rises,

orders.

limit

risk

fundamental

October

in

1987.

Enough volume, even if it is known not to contain private information, can

such

about

questions

raise

fundamentals

as

the

adequacy of clearinghouse

Furthermore,

collateral and the stability of other financial institutions.

a

realistic

more

model

than

ours

might

allow

the

for

that

fact

market

participants do not know for sure that all the volume is informationless

Duffee

presents

(1989)

possibility

that

lot

a

such

of

wherein

model,

a

news

arrived.

has

large

In

signals

volume

Duffee'

s

model,

the

large

volume shocks are associated with increased uncertainty about fundamentals.

Finally,

it

should

noted

be

what

that

matters

for

fundamental risk over a given interval of time- -the

order

is

placed

information.

and

If,

as

when

was

can

be

removed,

or

case

in

October

1987,

it

the

limit

orders

is

time between when an

reconditioned

large

volume

on

new

causes

backups and delays throughout the system, this can increase the exposure of

those using limit orders.

Of course,

role

in

none of this

accommodating

large

is

meant to argue that limit orders play no

volume

shocks.

However,

the

arguments

presented above do suggest that limit orders alone may not easily solve all

the

problems

that are evident

in our models with

just market orders.

To

17

-

-

the extent that limit orders are used,

is quite possible

it

that they will

be used timidly, with limit buy orders placed at levels well below current

prices

V

.

Implications of the Models

The Crash of October 1987

A.

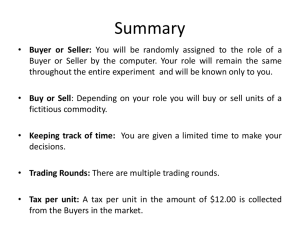

Taken together,

two models suggest a couple of reasons why large

the

volume shocks may tend to increase transactional risks and possibly result

in a "crash" of the normal transmission mechanism:

lead to more uncertainty about

Large volume shocks

1)

aggregate value buyer response at any

the

given point in time, so that even if market-maker behavior is unchanged, an

investor faces

order,

and

volume

Large

2)

market makers

risk with respect

more

smooth

to

shocks

can

also

This

prices.

fluctuate more with given variations

"

execution price of a given

the

to

make

more

it

order

for

effect makes prices

illiquidity"

in

dangerous

thereby exacerbating

flow,

the first problem.

models

The

appear

to

Tuesday October 19 and 20,

accord

closely with

1987.

In the

events

the

overall market decline of almost 23% for the day.

have

to

indeed,

indicated

an

attractive

many placed market

orders

at

and

last hour of trading on Monday,

heavy selling volume pushed prices down approximately 12%,

seem

of Monday

These price levels would

opportunity

the

resulting in an

end of

value

for

the

day.

buyers,

and

However,

the

execution price for most of these orders must have come as an unpleasant

surprise- -because

of

the

large

number

of

overnight

orders,

the

market

opened up on Tuesday some 12% above Monday's close.

The

returned

market

to

subsequently

about

the

same

reversals in perspective,

magnitude

to

the

previous

reversed direction,

level

as

Monday's

so

that

close.

by noon

(To

put

it

had

these

note that each 12% leg is roughly comparable in

record

one

day

fall

of

12.8%

on

October

28,

Throughout

1929.)

submitting orders

traders

morning,

Tuesday

virtually

contemporaneously received "fills" at vastly differing prices, both on the

exchanges

and with

magnitude

of

Monday's

drop,

it

is

and

reversals

the

impossible

seem

that

prices

transactions

Even more

over-the-counter stocks.

than

variability

the

with

reconcile

to

overall

the

a

in

Walrasian

model of adjustment to changing fundamentals.

began

investors

As

risks

tremendous

the

inherent

appeared

market

The

evaporated.

support

buying

transacting,

realize

to

in

be

to

in

danger of collapsing completely before many corporations announced buybacks

thereby setting themselves up

afternoon,

on Tuesday

last resort

"value buyers

as

of

.

In addition to the dramatic market-wide reversals,

a variety of other

evidence supports a view of the crash as at least partly non-Walrasian in

Blume

example,

For

nature.

MacKinlay

,

Terker

and

that

find

(1989)

on

Monday October 19, NYSE stocks in the S&P 500 index declined an average of

attribute

difference

this

than NYSE

more

points

percentage

seven

to

greater

stocks

not

the

in

the

index

Information"

Order

imbalances

sell-side

They

index.

for

stocks

B.

Circuit

of

Role

The

Breakers:

Timely vs.

of

implications

"Full

Execution

Our

First,

present

models

the

in

have

two

trading,

all

design

between

the

of

and

and

that

and prices.

everyday

an

costs

trading

benefits

argument is also made by Ho,

Schwartz (1990).

that

illustrate

models

inefficient allocations

the

sorts

of

some

level

this

Thus

for

of

market

risk

leads

is

to

important consideration in

environment

reducing

risk

transactional

transactional

one

architecture.

should

be

transactional

the

tradeoff

risk.

This

Schwartz and Whitcomb (1985) and Bronfman and

As these papers suggest,

there are a number of dimensions

19

-

-

One example

along which the tradeoff might take place.

which

trading

allowed

is

place

take

to

is

8

continuously.

the degree

Another

the

is

extent to which trading takes place in a spatially fragmented setting,

opposed

centralized

the

to

fragmentation/centralization issue

in

is

trading

as

The

here.

turn related

automated

should

degree

what

To

automation:

considered

one

to

questions about

to

systems

used

be

to

aggregate data across spatially separated markets, and to enable traders to

condition their orders on better information? 9

second important feature of our models

The

that

is

the magnitude

of

transactional risk can increase dramatically when the market is confronted

This

with abnormally large volume.

is

implies that a trading mechanism that

"optimal" under everyday circumstances may no longer be well-suited for

handling extremely

volumes.

large

system

A

market and limit orders may represent

a

essence,

something

it may make sense to switch to an

At such times,

purpose

transactional risk,

In

on a day-in,

"circuit breaker" trading mechanism.

basic

The

immediacy)

(e.g.,

but it can nonetheless involve too much transactional risk

when volume is very high.

alternative,

trading with

good balance between transactional

risk and other desirable characteristics

day-out basis,

continuous

of

the

in an effort

trading halt

closer

much

Thus

process occurs.

any

of

to

it

is

circuit

to

be

reduce

to

stimulate value buyer responsiveness.

designed as

should be

the

should

breaker

hypothetical

a

time

during which

full- information

Walrasian

inappropriate to think of circuit breakers as

"sand in the gears" that aims to slow down a fundamental price adjustment;

rather,

their

aim

is

to

patch

up

the

transmission

apparatus

so

that

Walrasian price adjustment can be facilitated.

According to Model #1, one goal of

a

circuit breaker system should be

to help make potential value buyers aware of the

to

large

shocks.

On the exchanges,

this

response of other traders

could be accomplished

>y

having

20

-

-

trading briefly and open their order books

specialists halt

for

general

inspection.

Model

further

#2

suggests

execution

sequential

that

trades

of

at

rapidly oscillating prices may not be the best way for the market to digest

is,

an open period during which orders

have

trades--that

It may instead be preferable to "pool"

a large volume shock.

could be

with a

submitted,

promise that all orders submitted during that period would be executed at

the same price

.

types

These

alternative

of

mechanisms

trading

wholly unknown to stock markets.

On the NYSE,

specialist can delay the

a

During

opening of his stock if he is faced with a large order imbalance.

the

trading halt,

may announce

he

attract additional buy or

sell

clearing prices

trial

In both cases,

periodic "batch" auctions to clear accumulated orders.

net

result

diminish

to

is

importance

the

in an effort

to

European stock markets use

Some

orders.

not

course,

of

are,

of

market

the

makers

the

as

a

transmission device, and to shift the emphasis to direct trade between end

buyers and sellers

contrast between these alternative mechanisms and the continuous

The

typically

trading

tradeoff:

Under

.

seen

between

that

execution

timely

circumstances,

normal

orders

market

uncontingent

equity markets

U.S.

in

the

a

fundamental

information

full

informational

execution.

due

loss

relatively

probably

is

and

illustrates

to

traders

small:

there

may

prices

prices

be

little

that

to

However,

mechanism.

problems

the

with

longer

provide

execution prices.

extreme

continuous

When this

from

gained

be

under

associated

no

prevail when their order

very

is

an

trading

case,

are

much

information

it

submitted.

alternative

circumstances,

accurate

the

using

is

the

can

simply by

anticipate with a good deal of precision their execution prices,

looking at

using

Thus

trading

informational

greater:

about

current

subsequent

may be worthwhile to accept

21

-

some

loss

timeliness

in

order

in

allow each

to

responses on the responses of others.

-

trader

condition his

to

10

A number of criticisms have been raised concerning circuit breakers.

traders enter the market voluntarily, so

One is the "free trade" objection:

how can shutting it down possibly make anybody better off?

Our emphasis on

the negative externalities present in a market crash provides an answer to

Even though rational agents will continue to trade in the

this question.

absence

of

circuit breaker,

a

Intervention that leads to

a

aggregate

the

outcome

inferior one.

an

is

broader distribution of the volume shock can

improve efficiency.

Another objection is that the very existence of circuit breakers might

somehow cause

large

declines

to

feed

According

themselves.

on

to

this

"gravitational", or "magnet" theory, if it is known that the market will be

shut

down after,

say,

selling pressure,

a

10%

investors

as

them in a temporarily

try

to

for

were

in

effects

and

effect,

find

no

futures

significant

lead

further

to

shutdown leaves

the

Empirically,

Kuserk et al

Treasury bond and commodity

can

fall

get out before

illiquid position.

not much support for this theory.

data

initial

an

drop,

however,

there

is

study transactions

(1989)

markets where price

evidence

limits

gravitational

of

n

Finally,

some

observers

have

suggested

that

than

rather

adopting

the exchanges should force market makers to dramatically

circuit breakers,

increase their capital positions. While this would have no direct effect on

it would

the magnitude of transactional risk,

by

reducing

shocks.

and

need

the

However,

Miller

(1988)

capital

to

capital

depends

to

quickly

presumably lessen its impact

value

mobilize

buyers

to

such an approach may be very inefficient.

point

out,

there

market -making activities,

(loosely speaking)

is

and

an

opportunity

the

on average

cost

absorb

As Grossman

to

devoting

appropriate

amount

demands

immediacy.

for

large

of

such

It

22

-

makes

no

sense

for

market

makers

-

aside

set

to

absorb the very largest volume shocks,

enough capital

if such capital

to

easily

unnecessary 99%

is

Circuit breakers have the advantage of only coming into play

of the time.

when there are extremely large shocks, without imposing any cost at other

times

The

Brady

report

advocated

installation

the

In May of 1988,

although it did not go into detail about their design.

Working

Treasury,

Group

the

on

Financial

Markets

Federal Reserve,

(composed

CFTC

the

of

and the

,

breakers,

circuit

of

officials

SEC)

from

the

the

also endorsed the

adoption of circuit breakers in their interim report to the President.

The

It recommends

Working Group report is more specific than the Brady Report.

coordinated, cross-market trading halts after Dow Jones declines of 250 and

Consistent with

400 points.

the

logic

outlined above,

bulk of

the

the

Working Group's discussion centers on procedures for active dissemination

Order imbalances for all major stocks

of information prior to reopening:

are

to

provided.

be

publicized.

Further

orders

Tentative

can

then

quote

be

indications

submitted,

indications will be made available as needed.

and

then

are

to

subsequent

(Appendix A,

page 2)

be

quote

The

Working Group's recommendations were subsequently adopted, and the circuit

breakers described above remain in place

also

recently

endorsed

Confidence Panel

(1990).

by

the

Like

NYSE's

the

today.

Market

12

Circuit breakers were

Volatility

Working Group report,

and

the

Investor

NYSE study

also emphasizes the importance of information dissemination during trading

halts

23

VI

.

Conclusions

continuous

trading

involving

market

and

limit

orders

sacrifices some degree of informational efficiency for timeliness.

Under

A

system

ordinary

of

circumstances,

the

informational

loss

is

small- -prices

evolve

gradually, and traders can thus predict with confidence the levels at which

their orders will be executed.

However, when volume shocks are large,

the

informational problem worsens and the deviation from Walrasian efficiency

When this occurs, it may make sense to temporarily switch to

is magnified.

an

alternative

orders

to

be

transactional

made

switch compromises

participants

contingent

the

mechanism- -a

on

a

larger

"circuit

breaker" - -that

information

set,

ability of the market to provide

even

allows

if

this

immediacy to all

-

2k

Appendix

Proof of Proposition

3:

The proposition is proven in the context of Model #1.

applies for Model /2.

Assuming that all other traders use market orders,

an individual trader faces a time

(A.l)

P

2

-

f

2

+

A similar argument

(n d

pricing function of:

s).

-

£

n

2

l

This is just equation (7) in the text.

Using the results of Proposition

1,

this can be rewritten as:

(A. 2)

P

=

2

f

2

+

on 2

-

0,

where a

a(s) and

shock

The expected return to

s.

fi

0(s) are both increasing functions

-

a

can be expressed as:

(A. 3)

R L = E(f 2

-

P

L

|P

L

> P

2

)

limit order at price

P,

of the volume

,

denoted by Rt,

That is,

P

L

—

?

2

a

limit buyer has his order executed at

^en

This ha PP ens

-

f

<

2

P

L +

-

on 2

.

P,

if and only if

Thu9 R can be written as

L

the following double integral:

»

P

+/9-an

L

R L = /[/(f

(A. U)

2

P

-

2

L

)h(f

2

)df

2

]g(n 2 )dn 2

.

-00*00

where

h(

and

)

respectively.

P

L

density

the

+£-an 2

R L - /[/f 2 h(f

The first term is

increased.

are

)

functions

of

and

£7

The

2

)df

oc

2

]g(n 2 )dn

2

-

P

P

L

+^-on 2

)df ]g(n )dn

L /[/h(f 2

2

2

2

and

decreases

second term is

the

limit price times the probability that

without

bound

as

second,

as

a\

is

Since this probability cannot exceed unity,

the second term must be smaller in absolute magnitude than P,.

2

.

negative

the order will be executed.

fixed P^,

n.

This integral can be broken into two parts:

*

(A. 4')

g(

Thus for a

•

a* is increased,

the first term will eventually dominate the

ensuring that R is negative.

L

This verifies the proposition.

-

26

1.

Limit orders are discussed in Section IV of the paper.

2.

Ho, Whitcomb and Schwartz (1985) and Bronfmen and Schwartz (1990), using

models quite different from the one presented here, also demonstrate that

transactional risk can affect traders' order placement decisions and lead

A key distinction between our work and these

to inefficient outcomes.

others is that we focus on the relationship between large volumes and

transactional risk, rather than simply on the existence of transactional

risk per se in everyday trading.

3.

Note that since all traders (including

efficient risk sharing involves m 2 = d*

4.

One piece of evidence concerning the relative unimportance of limit

A

orders comes from the brokerage commissions of NYSE specialists.

specialist acts as a broker when other traders leave limit orders in the

In 1986, specialists

specialist's book that are subsequently executed.

participated as commission earning brokers in only 12.7 percent of twice

See the Report

total NYSE volume (the sum of all purchases and sales.)

of the Presidential Task Force on Market Mechanisms (1988), (page VI-5).

5.

Given the large price declines that occurred in the last hour of trading

on Monday October 19, and the apparent consensus that much of these lasthour drops were due simply to an exhaustion of market-maker capital (as

opposed to news about fundamentals) one might have expected that a huge

thereby

flow of limit orders would have been submitted overnight,

In actuality, this

stabilizing prices at or above Monday closing levels.

The Task Force report notes that "the

does not appear to have occurred.

vast majority of orders to buy at the market's open were market

This observation is consistent with the price

orders..." (page III - 22

patterns seen on amany stocks. A typical example is provided by the NYSE

That stock fell 9%

stock denoted "number 11" in the report (page VI -38).

It recovered this entire loss at

in the last hour of trading on Monday.

However, there was

the open on Tuesday morning, opening up almost 11%.

not enough buying support at this level to sustain the price, and it fell

almost 24% by 11:30 a.m., to a point roughly 13% below Monday's close.

Evidently, there were not enough limit orders on the specialist's books

to stabilize the price anywher near Monday's close.

)

6.

market

makers)

are

identical,

.

This assumes that when the market price falls, outstanding limit buy

orders are executed at their limit prices, rather then at the more

Although this assumption is generally true,

favorable new market price.

NYSE Rule 127 provides some protection

there is an important exception.

for limit orders that are executed as part of a block transaction crossed

The Task Force Report describes the rule

on the floor of the exchange.

as follows (page VI-10):

The rule requires that unless (i) the trade is to be executed at a

price no more than one eighth below the bid or one eighth above the

offer, and (ii) both sides of the cross consist solely of public

customers, then the member with the block cannot execute part of it

by selling to or buying from the specialist's book at limit prices

For instance, if the stock price is

away from the cross price.

-

27

-

currently bid at 20 and the firm intends to cross a block of stock

at 19 : /2 and limit orders to buy are on the specialist's book at

19 7 /8, 19 3 /4 and 19 5 /8, the firm intending to cross the block cannot

execute part of the order by selling stock to the specialist's book

Thus, the person with a limit

at prices from 20 down to 19 5 /8

order on the book at or near the market cannot suffer an immediate

paper loss, as he would if his order was executed as part of a

series of transactions immediately preceding a cross occurring at a

The person with the order on the book

price away from the market.

will benefit by generally receiving an execution at the cross price.

.

7.

8.

Thus an immediate corollary of the proposition is that in a world where

value buyers use only limit orders, volume shocks can generate large

deviations from Walrasian prices, provided a\ is big enough.

Bronfman and Schwartz contrast the transactional risk properties of call

continuous markets.

vs.

9.

1

Maier,

these questions.

See Cohen,

Schwartz and Whitcomb (1986) for detailed treatment of

Because circuit breakers do involve some cost in terms of timeliness,

their use is justified only to the extent that the extra time really does

enable transactional risk to be reduced in a way that cannot be

Some observers have

accomplished in a continuous trading setting.

reacted to the events of October 1987 and October 1989 by suggesting

improvement that would make the continuous trading system work in a more

Miller's (1990) proposal for "contingent limit

Walrasian fashion.

To the extent that such

orders" can be thought of in this spirit.

proposals can be successful in reducing transactional risk without a halt

in trading, the case for circuit breakers is weakened.

11.

See however, McMillan (1990) who argues that a gravitational effect was

at work on the S&P 500 futures market prior to a trading halt during the

October 13, 1989 "minicrash"

12.

However,

These 250 and 400 point thresholds have not yet been reached.

there are other smaller "circuit breaker" type mechanisms in place that

More modest declines have lead to temporary

have come into play.

shutdowns of futures trading on the Chicago Mercantile Exchange, as well

as to the diversion of program trades in S&P stocks to "sidecar" files.

It is not clear that the latter technique meets any of the criteria for

an effective circuit breaker discussed above.

28

-

-

References

and

Terker,

MacKinlay,

Craig,

Marshall,

Imbalances and Stock Price Movements on October 19

Journal of Finance (September 1989), 827-848.

Bruce,

and 20,

Blume,

"Order

1987,"

.

and Schwartz, Robert, "Order Placement and Price

Bronfman, Corinne

Discovery in a Securities Market", mimeo School of Business New York

University, 1990.

,

,

Cohen, Kalman, Maier Steven, Schwartz, Robert and Whitcomb, David, The

Microstructure of Securities Markets 1986 (Englewood Cliffs, New

Jersey: Prentice Hall).

Duffee, Greg, "Market Liquidity and the Information Content of Order

Flows," mimeo, Harvard University, 1989.

Greenwald, Bruce and Stein, Jeremy, "The

Recommendations "

the

Behind

Reasoning

(Summer 1988), 3-23.

Perspectives

,

Task Force Report: The

Economic

Journal

of

.

"Liquidity

and

Miller,

Merton,

and

Sanford,

Grossman,

Structure," Journal of Finance XLIII(July 1988), 617-633.

Market

.

David,

Robert and Whitcomb,

Schwartz,

Thomas,

Decision and Market Clearing under Transaction Price

Journal of Finance (March 1985) 21-42.

Ho,

"The Trading

Uncertainty,"

Betsey and Gordon, J.

Kuhn,

Eugene,

Moriarty,

Gregory,

Kuserk,

Douglas, "An Analysis of the Effect of Price Limits on Price Movements

in Selected Commodity Futures Markets," CFTC Research Report #89-1,

July 1989.

"The Effects of

McMillan, Hank,

Breakers on Liquidity and Price

Analysis, SEC 1990.

500 Futures Market Circuit

Discovery," Office of Economic

S&P

Market Volatility and Investor Confidence Panel, report to the Board

of Directors of the New York Stock Exchange, June 1990.

Miller, Merton, "Index Arbitrage and Volatility," paper prepared for

Market Volatility and Investor Confidence Panel, June 1990.

Presidential Task Force on Market Mechanisms: Report Submitted

January 1988

Rock,

Kevin,

Explanation

"The Role of the

for Certain Price

Specialist's Order

Anomalies," mimeo,

Book:

A

Harvard

Possible

Business

School, 1987.

Working

1988.

Group

on

Financial

Markets:

Interim

Report

Submitted May

Figure 1A

Value Buyer

Demand

as

a

Function

V» air asian case

Transactional risk case

of

Supply Shock

Figure IB

Prices as

a

Function of Supply Shock

W air a si an case

Transactional risk case

?96&

;70

}-U>-°\)

SEP

9 1991

3

TOAD DQTObTbO

1