CDOs and the Financial Crisis: Credit Ratings and Fair Premia Marcin Wojtowicz

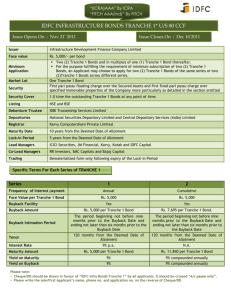

advertisement