Economic Feasibility Study (EFS) Presented by: Sandy McGough Office of Financial Management

advertisement

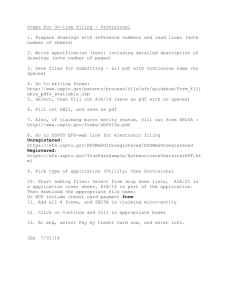

Economic Feasibility Study (EFS) Presented by: Sandy McGough Office of Financial Management Economic Feasibility Study (EFS) An EFS helps determine if accepting or disbursing electronic funds is economically feasible: Electronic funds may include, but are not limited to: •Automated clearing house (ACH) transfers •Credit cards •Debit cards •Wire Transfers An EFS documents both the benefits and costs to: The agency Other state agencies The general public as a whole. An EFS demonstrates the net benefit of a proposed project. Why is an EFS required? RCW 43.41.180 states that: • OFM is authorized to approve the use of electronic and other technological means to transfer both funds and information whenever economically feasible. • No state agency may use electronic or other technological means, including credit cards, without specific continuing authorization from OFM. State Administrative and Accounting Manual (SAAM) Chapter 40: • Requires that agencies prepare an EFS. The EFS is the tool used to help the agency and OFM determine whether or not the project is economically feasible. Required Components of an EFS Forms required: •Business Case •Cost Benefit Analysis •Supporting Documentation (as necessary) These forms & other resources are available on OFM’s E-Commerce Resources webpage: http://www.ofm.wa.gov/resources/ecommerce.asp.