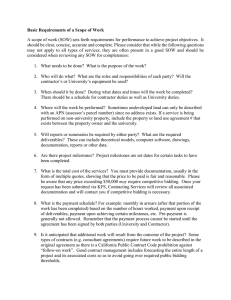

GAO DEFENSE CONTRACTING Contract Risk a Key

advertisement