Document 11048907

advertisement

HD28

.M414

-57

ALFRED

P.

WORKING PAPER

SLOAN SCHOOL OF MANAGEMENT

THE INTERACTION BETWEEN

TIME-NONSEPARABLE PREFERENCES

AND TIME AGGREGATON

by

John Heaton

December 1991

Latest Revision:

3181-90-EFA

Previous Version:

3376-92-EFA

Working Paper No.

MASSACHUSETTS

INSTITUTE OF TECHNOLOGY

50 MEMORIAL DRIVE

CAMBRIDGE, MASSACHUSETTS 02139

THE INTERACTION BETWEEN

TIME-NONSEPARABLE PREFERENCES

AND TIME AGGREGATON

by

John Heaton

December 1991

Latest Revision:

3181-90-EFA

Previous Version:

3376-92-EFA

Working Paper No.

f

FEB

?

1

1992

I

The Interaction Between Time-Nonseparable Preferences

AND Time Aggregation

John Heaton

Department of Economics and Sloan School of Management

M. I.T.

June 1990

Revised December 1991

ABSTRACT

develop and empirically analyze a continuous-time,

representative consumer model in which the consumer has

Within this framework I

time-nonseparable preferences of several forms.

aggregation

and

time

nonseparabilities

in preferences over

show how time

show that the behavior of both

consumption streams can interact.

I

seasonally adjusted and unadjusted consumption data is consistent with a

model of time-nonseparable preferences in which the consumption goods are

durable and in which individuals develop habit over the flow of services

The presence of time nonseparabilities in preferences is

from the good.

important because the data does not support a version of the model that

focuses solely upon time aggregation and ignores time nonseparabilities in

preferences by making preferences time additive.

this paper

linear-quadratic,

In

I

Many helpful comments and suggestions were made by Edward Allen, Toni Braun,

John Cochrane, George Constantinides, Martin Eichenbaum, Ayman Hindy, Chi-fu

Huang, Narayana Kocherlakota, Robert Lucas, Robin Lumsdaine, Masao Ogaki,

Chris Phelan, Paul Romer, Karl Snow, Grace Tsiang, Kei-Mu Yi and and

Duke,

Harvard,

Carnegie-Mellon,

participants of workshops at Chicago,

M.I.T., Minnesota, Northwestern, Princeton, Queen's, Rochester, Stanford,

would especially like to

I

Toronto, Western Ontario, Wharton and Yale.

thank three referees for their very detailed and helpful comments and

suggestions and Lars Peter Hansen for his many suggestions and his constant

gratefully acknowledge financial support from the

encouragement.

I

Greentree Foundation, the National Science Foundation, the Sloan Foundation

This

and the Social Science and Humanities Research Council of Canada.

paper is a revised version of my University of Chicago Ph.D. dissertation.

Any errors are of course my own.

1.

Introduction

There has been an extensive amount of work examining whether aggregate

consumption expenditures are consistent with the restrictions implied by the

income

permanent

hypothesis.

A

strict

interpretation of

this

hypothesis

predicts that aggregate consumption should be a martingale as shown by Hall

(1978).

have

found

example,

implication has been questioned by a number of authors who

This

that

Flavin

consumption changes

(1981),

Hayashi

predictable

are

and

(1982)

Hall

over

time

(see,

Mishkin

and

for

(1982)).

However recently Christiano, Eichenbaum and Marshall (1991) have argued that

there is little evidence against

the martingale hypothesis using aggregate

consumption data, once the fact that the data is time averaged is taken into

account.

If

consumers

frequently,

so

are

that

much finer interval

assumed

make

to

consumption

the martingale hypothesis applies

to

decisions

consumption at a

time averaging of

than observed data,

the

data implies that consumption changes will be predictable.

assumptions,

averaging

time

data

the

implies

that

quite

consumption

Under further

the

first-order

autocorrelation in consumption changes should be 0.25 and information lagged

two

periods

should

not

be

useful

Christiano, Eichenbaum and Marshall

remarkably

consistent

with

(1991)

quarterly

consumption

predicting

in

changes.

show that these implications are

observations

of

seasonally-adjusted

consumption so that rejections of the martingale hypothesis could be due to

the fact that the data is time averaged.

are

sensitive

to

the

data used

in

the

However,

analysis.

I

show that these results

In

particular,

monthly

observations of seasonally adjusted consumption and quarterly observations

of seasonally unadjusted consumption are at odds with the martingale model,

even with an account for the effects of time averaging of the data.

The martingale hypothesis and its

that

exploited

are

Christiano,

by

implications for time averaged data

Eichenbaum

and

Marshall

are

(1991),

derived under the strong assumption that there is a representative consumer

with time-separable preferences over consumption in continuous-time.

preferences

about

assumption

investigations of

In

a

has

effects of

the

time

continuous-time environment

separable

is

from

far

the

preferences over consumption at one

preferences are time-nonseparable

this paper,

preferences,

the

the

most

in

consumption data

assumption that preferences are

it

implies

that

to

I

2

.

show that with the introduction of time-nonseparable

different

is averaged over

be

show that

dynamics

of

monthly

quarterly

and

seasonally

This occurs because over

longer periods of time,

the model's

However as

implications

consistent with a model of time-separable preferences.

the same

time

individual's

an

short periods of time time nonseparabilities are very important.

tend

.

instant are unaffected by consumption

adjusted consumption data can be easily explained.

the data

other

In this setting it seems more reasonable to assume that

the instant before.

In

imposed

averaging of

since

appealing

been

also

This

type of

model

is

I

also

consistent with seasonally unadjusted

consumption data.

In conducting

permanent

income

this study,

model

I

in

time-nonseparable preferences.

derived under very general

that

without

identify

result,

the

I

further

which

the

representative

forms of

several

the

consumer

has

Although the implications of the model are

time-nonseparable preferences,

restrictions upon preferences

preferences of

examine

develop a continuous-time linear-quadratic

it

is

not

possible

consumer using discrete-time data.

specific

forms

of

time

show

I

As

nonseparabilities

to

a

in

preferences.

that

form

first

The

consumption is substitutable over time or

Discrete-time

durable.

are

considered

Hansen

by

and

(1987)

Constantinides

Heal

Singleton

Ogaki

(1988),

is

model

a

of

Sundaresan

and

of

persistence

implies that consumption

(1989).

complementary

is

model

of

The

have

Hansen

and

second

like

(1991),

notion

the

consumption goods

the

type

example.

habit

captures

Eichenbaum

(1985),

for

that

this

Detemple and Zapatero

(1990),

(1973)

versions

and

Dunn

nonseparability

and

preferences

time-nonseparable

of

form

those

Novales

This

preference

over

time.

been

(1990),

time

of

studied

(1990),

by

Ryder

specification

Using seasonally adjusted observations of consumption expenditures on

nondurables and services,

I

show that there is strong evidence for the model

where consumption is substitutable over time (or that the consumption goods

are durable) and that this model reconciles the conflict between monthly and

quarterly

consumption

Further,

data.

I

find

evidence

no

for

habit

persistence alone, however there is some weak evidence for habit persistence

if

habit

is

assumed

to

develop over

the

durable nature of the consumption goods.

show

that

there

is

also

flow of

consumption is substitutable over time.

the

Using seasonally unadjusted data

evidence

very strong

services created by

Also

in

favor

there

is

of

a

model

I

where

evidence for habit

but again the durable nature of the

persistence at seasonally frequencies,

goods must be mode ted.

I

also apply the model to durable goods expenditures.

Using this data

there is strong evidence for habit persistence that forms over the flow of

services from the durable goods.

explain some of

more

the

I

examine whether the model can help to

durable goods puzzles discussed by Mankiw

recently by Caballero

(1990).

I

show

that

the

model

(1982)

and

provides only

a

partial resolution of these puzzles.

The rest of the paper is organized as follows.

the

model

the

seasonally-unadjusted

quarterly

section

III

develop

I

I

inconsistent with monthly seasonally-adjusted data

is

data.

I

model

a

of

discuss

also

results could be due solely to measurement error

In

examine

I

implications of the martingale hypothesis for time averaged data and

show that

and

In section II

the

in

whether

these

consumption data.

time-nonseparable

preferences

capital accumulation and develop its implications for consumption.

I

and

show

that it is necessary to focus upon several specific parametric forms of the

preferences.

section IV

In

time-nonseparable

preferences

these

examples

discuss the implications of two examples of

that

to

notions

capture

In section V

complementarity over time.

applying

I

consumption

I

substitution

of

and

present the empirical results of

Section

data.

VI

concludes

the

paper.

II.

Time-Separable Preferences and Time Aggregation

Consider a situation in which there is a representative consumer with

time-separable preferences over consumption facing a constant interest rate

that equals the consumer's pure rate of time preference.

equation

euler

consumption

is

for

a

the

consumer

martingale

implies

(see,

for

that

example

the

model

implies

that

consumption,

case the

the

marginal

utility

of

Hall

(1978)).

Under

the

with a constant bliss

further restriction that preferences are quadratic,

point,

In this

{c( t

)

:

t=0,

1

,

2,

...},

is

a

martingale.

A

typical

way

to

observations of c(t+l)

investigate

-

c(t)

this

sharp

prediction

is

to

construct

using consumption data observed at quarterly

c(t)l?(t)} =

-

where f(t) denotes the consumer's information set at time

t

Hall

example,

for

(see.

then conducted of whether £{c(t+l)

A test

(for example).

frequencies

is

Flavin

(1978),

and

(1981)

Hayashi

A

(1982)).

potential problem with this approach (as emphasized recently by Christiano,

Eichenbaum and Marshall

(1991))

that the available aggregate consumption

is

data consists of observations of consumption expenditures over a period.

words,

other

time

at

consumption

observed

t

is

In

c(T)dT.

c(t)=J"

If

consumption within the observation interval is not viewed by the consumer as

being perfectly substitutable, then the use of this time averaged data could

lead to spurious rejections of the martingale implication for consumption.

that

fact

The

{c(t )-c(t-l

)

t=0,l,2,

:

problem

could

hypothesis

for

...}

help

to

explain

aggregate

data

follows

autocorrelation

first-order

with

consumption

the

first-order

a

of

some

the

consumption.

moving

This

0.25.

of

averaged

time

is

is

average

of

that

process

aggregation

temporal

rejections

This

implies

martingale

the

exactly what

Christiano,

Eichenbaum and Marshall (1991) find using quarterly data.

Tests of the Model Using Seasonally Adjusted Consumption Data

Il.d

Following Flavin (1982) and Christiano, Eichenbaum and Marshall (1991),

I

assume

that

trend parameter

model:

c(t)

applies

model

the

consumption where

detrended

to

the

is

/j

Table 2.1 gives maximum likelihood estimates of the MA(1)

.

-

=

c(t-l)

9 c(t)

+

6 c(t-l).

where

£{c(t)^}

=

1

and

1

£{c(t)c(T)}

c(t-l),

R(l),

estimates

consumption

MA(1)

=

model

are

for

is

T

t.

restricted

reported

expenditures

with 9

*

for

on

The

to

autocorrelation

first-order

0.25

so

that

the

9

quarterly

per

capita

nondurables

and

services.

implies

9

seasonally

unrestricted are given in table 2.2.

Estimates

In

c(t)

of

-

The

.

adjusted

of

the

both tables

estimated parameters are reported for the period 1952,1 to 1986,4 and 1959,1

The latter subsample was used since this matches the period of

1986,4.

to

the

Likelihood ratio

monthly data.

tests of

restriction

the

that

=

R(l)

0.25 yield probability values of 0.73 for the data set from 1952,1 to 1986,4

and 0.78 for data from 1959,1

This occurs because R{1)

1986,4.

to

is very

close to 0.25 in each case.

information lagged two periods should not

The model also implies that

be useful

in

predicting

z(t-2)

a

set

is

of

the

consumption change

instruments

c(t)-c(t-l) to have a constant mean value

£{[c(t)-c(t-l)-m]z(t-2)} =

(2.1)

zU)

Letting

a

test

[

where

condition

1

,

c( t-2)-c( t-3)

restriction

the

of

function

=

(2.1)

the

(2.1)

of

if

allowing

the model implies that:

of m,

.

using

estimated

is

then

true,

is

and

3^(t),

can be performed using

m

particular,

In

c( t-3)-c( t-4) ,c( t-4)-c( t-5)

(2.1)

parameter

If

.

,

members

are

that

today.

the

,

c( t-5)-c( t-6)

the

GMM

'

,

GMM criterion

and

minimized

]

the

GMM

moment

criterion

function is (asymptotically) a chi-squared random variable with 4 degrees of

freedom.

The resulting P-value of

the

implied test of

(2.1)

is

0.065 for

the data set from 1952,1 to 1986.4 and 0.083 for the data set from 1959,1 to

1986,4.

As

restriction

a

result,

(2.1).

there

This

is

substantial

not

indicates

that

the

evidence

against

time-separable

model

the

is

reasonably consistent with quarterly seasonally adjusted consumption, due to

the

fact

that

the

data

is

time

averaged.

This

success

was

noted

by

Christiano, Eichenbaum and Marshall (1991).

Now

consider

monthly

measures

seasonally

of

expenditures on nondurables plus services

7

.

If

adjusted

consumption

the only difficulty with the

model

time-separable

that

is

results should be robust

0.25

is

time

averaged,

time averaging.

moving average

the

restriction

on

the

Table

parameters

using

R(l)

of

monthly

A likelihood ratio test of the restriction yields a probability value

data.

of

the

intervals of

and

trend

the

with and without

c(t)-c(t-l)

consumption data

different

to

estimates of

reports

2.3

the

essentially

As

zero.

result,

a

model

the

is

inconsistent

with

the

Q

monthly data

This occurs because the first order autocorrelation of

.

the

first difference of monthly consumption is -0.188 with a standard error of

0.052, which is significantly negative.

Tests

II. B.

of

Model

the

Using

Quarterly

Seasonally

Unadjusted

construct

seasonally

Consumption Data

process

The

adjustment

seasonal

of

used

to

adjusted data changes the correlation structure of the observed series in a

way

fundamental

(for

a

discussion of

(1986) and Person and Harvey (1991)).

part

of

the

success of

quarterly data

0.25.

It

is

is

due

the

to

this

issue

fact

for

example,

Miron

This is a serious issue since a large

time-separable model

the

see,

that R(l)

is

with seasonally adjusted

estimated

important to examine whether this result

to

be

close

to

sensitive to the

is

process of seasonal adjustment.

As

a

differences

first

of

pass,

consider

searsonally

dummies removed^.

the

unadjusted

autocorrelation

consumption with

structure

trend

first

seasonal

Table 2.4 gives estimates of the autocorrelation function

using quarterly expenditures on nondurables and services

important things to notice.

data,

and

of

.

There are two

First, unlike the seasonally adjusted quarterly

the first-order autocorrelation is not close

different manner of accounting for seasonality,

to

0.25.

Hence with a

the time-separable model

is

consistent with the data,

not

the fourth

the autocorrelation value at

that

is

note

significantly positive

seasonality in the data and some addition must be made to the

the

of

lag

Second,

This indicates that the use of seasonal dummies does not remove

and large.

all

even at quarterly frequencies.

model to account for this behavior.

11

Measurement Error

I.e.

Before turning to a model based explanation of these different results,

problem

the

measurement

of

Consider

addressed.

a

in

the

consumption

which

the

discrete-time

error

world

in

series

must

version

be

of

the

time-separable model is correct at monthly frequencies, but the monthly data

is

with

contaminated

measurement

i.i.d.

error.

In

this

observed

case,

consumption differences at monthly frequencies would be given by:

12

c(t) - c(t-l) = u (t) + u (t) - u (t-1

(2.2)

is the model error and u

where u

in

measurement error

Notice

.

this

case

consumption differences are negatively correlated

over

Time averaging from monthly to quarterly frequencies eliminates much

time.

of

is the i.i.d.

2

1

that

2

the

effect of measurement

error and hence would explain the different

results using seasonally adjusted monthly and quarterly data.

However,

not

an i.i.d.

very reasonable due

model for measurement error

to

the

methods used

to

in consumption data

construct

the

data.

is

This

point has been stressed in several recent papers Bell and Wilcox (1991) and

Wilcox (1991).

studies.

I

will provide a brief summary of the conclusions from these

A detailed discussion

Wilcox (1991) and Wilcox (1991).

of

these

issues can be

found

in

Bell

and

The

measure of aggregate consumption used

consumption expenditures

National

Product

and

Income

nondurables

on

Accounts.

Bureau

constructed

by

Commerce.

An

consumption

expenditures

the

important

This

Economic

of

ingredient

in

constructed by the Census Bureau.

taken

measure

Analysis

in

is

from

estimates

In estimating

the

U.S.

consumption

is

the

Department

of

of

retail

personal

of

construction

the

monthly

the

is

services

and

paper

this

in

of

personal

retail

sales

the Census

sales,

Bureau receives reports of retail sales from all large retail establishments

every month and from a sample of small

retail

establishments.

companies report in rotating panels every three months.

The

small

The sampling error

Induced by this sampling scheme is an important source of measurement error.

This sampling error is correlated over time for two reasons.

the small retail establishments reporting each month report both

First,

their current month's sales and

their sales for

the

previous month.

The

final estimate of a month's retail sales reported by the Census Bureau are

based

on

reported

sales

the

reporting the following month.

strong autocorrelation

Given their

in

the

by

the

panel

Census

the

that

month

Due to the reporting overlap,

sampling error from one month

information on the methods used

establishments,

of

Bureau

has

in

and

panel

the

there is very

the

to

next.

sampling the small

attempted

to

retail

measure

the

autocorrelation in the sampling error induced by the two month reporting of

each panel.

(see

Bell

Not

surprisingly,

and Wilcox

sampling error

is

the

(1991)).

quite close

to

one

second source of autocorrelation

in

the

the

A

autocorrelation

use of a rotating panel.

is

This

Induces

correlation

between the current month's sampling error and the sampling error 3 months

back.

As

discussed

by

Bell

and

Wilcox

(1991),

the

strong

positive

autocorrelation

implies that

by

induced

sampling

the

practices

first-order autocorrelation in c(t)

the

presence

measurement

result,

measurement

error

in

is

(2.2),

explain

cannot

likely

the

first-differences of monthly consumption.

explain

structure

correlation

the

of

be

to

negative

c(t-l),

very

due

Bureau

small.

correlation

the

to

As

a

the

of

Further measurement error cannot

unadjusted

seasonally

of

-

Census

the

quarterly

consumption data.

A Model with Time-Nonseparable Preferences

III.

A problem with the model of preferences that underlies

for

{c(t)

-

c(t-l

time-separable

)

:

t=0,

1

...}

,2,

preferences

the

is

over

assumption that

consumption

the MA(1) model

the

continuous

in

consumer has

This

time.

assumption implies that the consumer's preferences over consumption at time

t

are unaffected (through preferences) by consumption in the instant before

time

t.

A reasonable alternative

this model

to

is

to allow preferences

to

be time-nonseparable.

In this section,

capital

accumulation

time-averaged

I

present a model of time-nonseparable preferences and

and

derive

consumption.

its

implications

nonseparability

Time

for

observations

of

preferences

is

in

introduced by specifying a mapping from current and past consumption goods

into a process called services.

The representative consumer

have time-separable preferences over services.

services

into

is

a

type

of

is

assumed to

The mapping from consumption

Gorman-Lancaster

12

technology

in

which

the

consumption goods are viewed as bundled claims to characteristics that the

consumer cares about

I

develop

the

implications

of

10

the

model

under

a

very

general

specification of preferences.

show

discrete-time data will

preferences,

This

I

implies

preferences

that

development of the model

that

reveal

not

must

be

further

restriction on

preference

the

restricted

ignore several

I

without

some

in

technical

structure.

way.

In

the

The appendix

issues.

provides a discussion of these issues.

Preferences Over Services and Consumption

III. A.

The preferences of the consumer are assumed to be time separable over a

stochastic

process,

s={s(

t

)

:

Ost<oo}

,

called

services.

representative

The

consumer evaluates s via the utility function:

U(s) s -(l/2)£{X"exp(-pt)(s(t)-b(t))^dt>, p

(3.1)

where

{b(t) Oit<oo}

:

is

a

deterministic process describing

movement and p is the pure rate of time preference

element

of

the

space

£{/ exp(-pt)s(t) dt}

<

>

feasible

of

00

.

services

Under

the

14

I

the

bliss

assume that each

restricted

is

further

deterministic bliss point satisfies / exp(-pt)b(t) dt

assumption

<

oo,

point

such

that

that:

the

the preferences

of the consumer are well defined.

Time nonseparability in the consumer's preferences over consumption is

introduced by making s(t) a linear function of current and past consumption

given by a convolu4:ion between a nonrandom distribution g and consumption

cs{c(t):Ost<co>^^:

s(t) = g»c(t)

(3.2)

where

*

denotes convolution of two distributions.

11

To insure that s(t)

is a

function of current and past consumption, g is assumed to be one sided with

we ight

on

only

convolution

however

in

the

(3.2)

real

given

the

is

For example,

integration.

by

For

line.

integral:

many

s(t)

=

examples,

the

J g(T)c( t-T)dT,

interpretable using standard notions of

need not be

integral

this

nonnegative

the nonseparability could involve a comparison of

current consumption to past consumption as in a model of habit persistence.

g would include a dirac delta function.

In this case,

III.

Capital Accumulation and Equilibrium

B.

The model is completed by assuming that there is a capital accumulation

technology that allows the transfer of consumption over time at the constant

instantaneous rate

p:

Dk(t) = pk(t) + e(t)

(3.3)

where kit)

is

-

c(t),

k(0) given,

the level of the capital stock at time

condition and e(t)

is

the endowment

t,

k{0)

process of the consumption good.

endowment process is also assumed to satisfy £{J exp(-pt)e(t) dt}

assumption and the restrictions on c discussed in the appendix,

£{J"°°exp(-pt)k(t)^dt}

Hansen

(1990),

(1987),

<

CD.

As in Christiano,

Heaton and Sargent

Hansen,

this assumption is used

initial

is an

<

m.

The

This

implies that

Eichenbaum and Marshall (1991),

(1991),

and Hansen and Sargent

instead of a nonnegativity restriction on

the capital stock which would make the model analytically intractable.

Following Hansen (1987) and Sargent (1987)

of

return on capital

is

equal

to

the pure

I

am assuming that the rate

rate of

time preference.

This

restriction on the real rate of interest was also imposed by Flavin (1981)

and Hayashi

(1982).

Christiano, Eichenbaum and Marshall (1991) discuss this

12

J

assumption in the context of the time separable version of this model.

show

assumption

this

that

is

necessary

for

the

model

consumption and capital in a deterministic world.

directly

to

consumption

when

model,

this

positive

is

restrictions on

g,

as

I

in

applied

deterministic

a

These results carry over

services.

to

positive

imply

to

They

The

world

restriction

imposes

set

a

that

of

will discuss in section IV.

The problem facing the consumer is to maximize the objective function

subject to the mapping

(3.1)

(3.3),

(3.2)

and the capital accumulation technology

The Lagrangian for this problem is given by:

by the choice of c(t).

1 = -£-|j" exp(-pt)](l/2)[g*c(t)

(3.4)

-

bU)f

{

-

A(t)U(t)

-

k(0) - pJ"*'k(T)dT - j''e(T)dT + /c(T)dT I

^

L

°

where X{t) is the value of the Lagrange multiplier at time

The

tiO,

first-order conditions for

the

choice of kit)

^

1

t.

and

c(t)

for

each

are given by:

(3.5)

£i-g^»[g*c(t)

-

b(t)];?(t)l

+ E|j-"exp(-pt)X(t+T)dT;3^(t)|- = 0,

and

(3.6)

where g

^3^^

A(t) - pE\s'^exp{-pT)\{t+T]dx\^U)}- =

0.

is given by:

gf ^

j

exp(pt)g(-t) if

t

i

otherwise

Although it is not possible to completely characterize the solution to this

13

problem for general forms of

a

g,

simple

implication for services can be

derived.

Notice

that

EW'lg'cit)

The

good

consumption

of

gives

(3.8)

time

at

A(t)

is

a

martingale,

that

so

b(t)];?(t)| = A(t)/p.

-

side

left

that

Also (3.5) and (3.6) imply that

f{A(t+T) ;?(t)> = A(t).

(3.8)

implies

(3.6)

As

t.

the

marginal

result,

a

utility of a unit

the

implies

model

of

the

that

the

marginal utility of consumption is a martingale and:

-

g'"*[s(t+T)

(3.9)

where

£{u( t+x) ^(

1

t

)

}

b(t+T)] = g''*[s(t) - bit)] + U(t+T). T>0

where

and

=

I

have

substituted

in

.

the

fact

that

g*c(t)=s(t).

Under

assumptions

reasonable

on

g

one-sided forward looking inverse denoted g

s(t+T)

(3.10)

f

Since

t)(

t+x)

13-

(

t

martingale.

and

I

=

}

I

s(t)

forward

-

I.e.

looking,

b(t)

for

Applying g

.

2

}

=

2

cr

to

g

has

a

(3.9) yields:

+ g'"*u(t+T)

(3.10)

x>0,

appendix),

so

implies

that

s-b

is

denote the time derivative of (s-b)[t] as:

assume that £{D^(t)

11

- b(t)

b(t+T) = s(t)

is

g

)

-

the

(see

that

£{s(t+T)

a

continuous-time

D(s-b)[t] = D^(t)

dt.

Implications for Time- Averaged Consumption

The assumption that g

f

has a one-sided inverse also implies that there

14

exists a one-sided inverse of g, g

,

so that the convolution in (3.2)

can be

inverted to yield a mapping from services to consumption:

g^»s = c.

(3.11)

Recalling

that

D[s-b]{t)

D^(t),

=

(3.10)

and

(3.11)

imply

the

following

representation for the first difference of consumption:

(3.12)

Observed

c(t) - c(t-l) = g^*/^_jD?(T)

consumption,

{c(t):

+

g^*[b(t) - b(t-l)].

t=0,l,2,

consumption expenditures over a unit of time:

Averaging

over

(3.12)

a

unit

of

consists

...},

c(t) = J

time,

we

of

averages

of

c(t).

obtain

the

following

general representation for observed consumption:

(3.13)

c(t) - c(t-l) = g^*w{t)

where wit) = S^

t-l

= S^

J"^

T-l

+

g^«{J^_^[b(T)

an MA(1)

is a

b(T-l)]dT>

DC(r)dT

(t-T)DC(T) + J-''"^T-t + 2)D?(T)

t-2

t-l

Notice that w(t)

-

time-averaged martingale difference so that w(t) has

structure" with first-order autocorrelation

of

difference in consumption is obtained by "filtering" w(t)

through

-

c(t-l)

g^.

0.25.

+

[b(t)

The first

-

b(t-l)]

In the special case where c(t) = sit) and b is a constant,

= w(t)

and

(3.13)

c(t)

reduces to the MA(1) model examined in section

II.

15

.

Identification of g with Sampled Data

III.D.

identification issues

There are several

using

of

the bliss point

b(t)

in

(3.13).

If

Inferences about g

The first involves the presence

and observed consumption data.

(3. 13)

in making

an unobservable stochastic process

then the dynamics of consumption

for the bliss point were added to be model,

could be completely explained by this bliss point movement and the mapping

g^

in

is

to minimize

the role of unobservables and to try to explain consumption

based upon the mapping g

As a result,

.

in a deterministic fashion.

nonseparabilities

in

I

assume that the bliss point moves

One way to interpret the introduction of time

preferences

movements to observable variables.

is possible

The strategy taken here

could be set to the identity mapping.

(3.13)

to give an economic

as

is

attempt

an

link

to

bliss

point

An advantage to this approach is that it

interpretation to the required bliss point

movement

Even with the strong assumption that the bliss point is deterministic,

there is a further identification issue.

then (3.13)

-

let b(t) be constant,

implies a continuous-time moving average representation for c(t)

c(t-l) of the form:

(3.14)

c(t)

-

c(t-l) = g^«DC(t).

where g" = h*g^, h(t) =

otherwise.

If

the functions g

t

for te[0,l],

a continuous

and g

to

identify

the

h(t)

= 2 -

record of c(t)

t

for

t

€[1,2]

and h(t) =

c(t-l) were available,

-

then

could be exactly identified.

With the discrete-time data,

is

To see this,

{c(t )-c(t-l

discrete-time

moving

time-averaged consumption differences:

16

):

t=0,

1

,...}, the best we can do

average

representation

for

.

c(t) - c(t-l) = I " G^(J)c(t-j)

(3.15)

where £{c(t)^> =

to

map

and £{c(t)c(T)> =

1

sequence

the

{G

possible

(3.15)

identify

to

We would like to be able

describes

that

g

Of course without further restriction

time-nonseparabilities.

be

t.

function

the

to

}

for x *

completely

the

function

will not

it

However,

g*^.

the

note

that

is exactly the relationship that arises in a discrete-time version of

the model in which the decision interval of the consumer is set equal to the

interval

of

data.

the

discrete-time

the

In

model,

reflects the discrete- time time-nonseparabilities in

Marcet

(1991)

function of g

the

finite

g (t-2),

g (t-3)

of

the L

2

the

sequence

To construct this mapping,

.

all

set

g (t-1),

c

how

shows

linear

projection operator.

g (t) at many values of x.

Note that a(t)

function

constructed

is

let A be the closure

-

is

of

the

Projig

G(j)

preferences.

{G (j)>

combinations

Let a = g

the

lA)

functions

(in L

of

as

2

)

t€lR

a

of

:

where Proj denotes

in general

a

convolution of

Marcet (1991) shows that G (j) is given by:

jV(t+j)a(t)dt

G (j) =

r a(t)^dt

= -a»g''(j)/J'"a(t)^dt

°

(3.16)

~^

= -a*h»g^(J).

where a( t

)

= a(-t

If g'^(j)

)

were an average of the function g^(t) for values of

t

near

j,

then we would expect the discrete-time interpretation to be reasonably good.

However

(3.16)

implies that

the g''(j)

17

is

an average of

the function g^(t)

for

values

all

about

of

t

structure

the

positively

are

would

interpretation

discrete-time

lead

correlated

be

consider

positive

is

over

the

observed

since

The

time.

preferences

that

inferences

poor

to

example,

For

G (1)

case,

this

In

differences

consumption

general,

in

preferences.

of

model.

time-separable

will,

and G (j)

are

time

nonseparable, which they are not.

will not in general allow us to obtain a correct

Since the function G

economic

forms

g^

of

that

I

intuitive

summarize

continuous-time form of g

In

.

that

simple

in

allow for the estimation of the

I

outline two basic forms

capture notions of

In section V,

complementarity over time.

several

time-nonseparability

of

the next section

time-nonseparable preferences

upon

focus

next

types

These restricted forms of g

preferences.

of

preferences,

interpretation of

I

substitution and

show that these preferences do a

good job in explaining the difficulties with the time additive model that

pointed out in section

IV.

Two Polar Cases

II.

of Time-Nonseparabilities

Two specific examples of time-nonseparabilities are of

first

example

time.

In

captures

the

second

Throughout this section,

IV. A.

In

the

preferences

I

the

notion

consumption

example

I

consumption

that

is

is

interest.

The

substitutable

over

complementary

over

time.

assume that the bliss point is constant.

Exponent ial Depreciat ion

continuous-time

are

time

substitutable from one

model

of

separable

would

instant

the

to

18

assumption

section

III,

the

imply

that

consumption

next,

so

that

the

is

that

not

consumer cares a

great

deal

about

timing

exact

the

consumption.

of

natural

A

way

to

introduce time-nonseparable preferences is to assume that consumption can be

easily

substituted

over

periods

short

time

of

or

preferences

that

continuous in the dimension of the timing of consumption.

restriction

preferences

on

in

suggested by Huang and Kreps

continuous-time

(1987)

models

This intuitive

recently

has

and Hindy and Huang

are

been

Another

(1991).

reason to consider preference structures where consumption can be

readily

substituted over short periods of time is that most consumption goods are

relatively durable.

series

examined

in

In particular,

section

II

the nondurables and services consumption

includes

several

components

that

should be

thought of as durable (for example clothing and shoes).

let g be given by:

To capture these ideas,

fO

if

t

<

g(t) =

(4.1)

,

\

Iexp(5t)

The

fact

easily

that

g(t)

substituted

requirement

of

is

t

positive

over

Huang

where

5

<

0.

iO

time

t^O,

implies

and

the

model

satisfies

Hindy

and

Kreps

and

consumption can be

for

(1987)

that

the

Huang

continuity

The

(1991).

consumption good can also be interpreted as a durable good where

5

governs

the depreciation of the good.

To apply the results of section III,

found.

the

The Laplace transform of g

Laplace

transform of

g.

In

Laplace transform of the operator

the mapping g

is given by g (<)

this

case

(D-5).

g^(<)

c(t) = Ds(t) - 5s(t)

19

(3.13)

= 1/giC,) where

C,

As a result,

section III that s(t) is a martingale implies that:

(4.2)

=

of

-

5

the

,

which

must be

g(.C,)

is

is

the

implication of

= D?(t)

-

5s(t).

Note that the goods process has a component that is the time derivative of a

As

martingale.

a

result,

process

consumption

the

not

is

17

stochastic process but is a generalized stochastic process.

can tolerate very erratic consumption

in

this model,

a

standard

The consumer

because the consumer

"consumes" a weighted average of past consumption that is relatively smooth.

In (4.1),

implies that services are constant over time.

the model

consumption is also constant over time and when

consumption is positive.

the

In a deterministic world,

is restricted to be less than 0.

6

model

<

through

1

of

4

this situation

implies that

(4.2)

0,

the assumption that

Further,

assumptions

satisfies

6

In

5

the

implies

<

appendix

that

that

are

required to apply the results of section III.

Using (3.13) the exponential depreciation model implies that:

c(t) - c(t-l) = (D-5)w(t)

(4.3)

= J-^l-5T)DC(t-T) - X^[l+5(l-T)]DC(t-l-T)

As

in

consumption

time-separable

the

follow

an

MA(1).

first

case,

In

this

autocorrelation value need not be 0.25

even positive.

.

.

in

however,

the

the

time-averaged

first-order

time-separable case) nor

The first-order autocorrelation of the first differences in

R(l) =

:

^'^^

2 +

R(l)

case

in

.18

consumption is

(4.4)

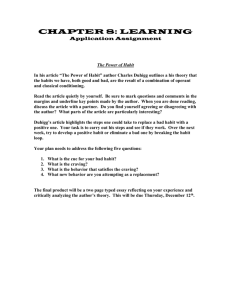

(as

differences

is plotted

"

^

(2/3)5^

in Figure

1.

Note that as 5 goes to

20

-oo,

the value of R(l)

goes

0.25

to

since,

as

5

is

driven

to

the

-oo,

consumption good

instantly perishable and preferences are time separable.

if 5 = -/6

=

(a

becomes

Notice also that

half life of 0.28 periods for the consumption good) then R(l)

and a discrete-time martingale model

would fit

the

consumption data.

This is a further example of the identification problem discussed in section

III.D.

IV. B.

Habit Persistence

Suppose that the consumer cares about

the

level

of

consumption today

relative to an average of past consumption so that the consumer develops an

acceptable level of consumption over time.

has

been

studied,

for

example,

Habit persistence of this form

Constantinides

by

Detemple

(1990),

Zapatero (1991), Novales (1990), Pollack (1970), Ryder and Heal

Sundaresan

Following

(1989).

Constantinides

(1990)

(1973),

model

I

and

and

habit

persistence by assuming that s(t) is of the form:

(4.5)

s(t) = c(t) - a(.-7)S

exp(rT)c(t-T)dT, y<0, 0<a<l

(0,00)

Note

that

the

term

(-r)J" exp(3'T)c(

t-T)dT

is

a

weighted

average

of

past

consumption, and a gives the proportion of this average that is compared to

current consumption to arrive at the level of services today.

model

of

exponential

depreciation,

consumption is complementary over time.

In this example,

(4.6)

g = A -

g is given by:

ttT}

21

habit

persistence

Unlike the

implies

that

.

where A is the dirac delta function and

if

,

(4.7)

t

given by:

is

tj

i

T7(t) =

expiyt)

t

>

The Laplace transform of g in the case is:

that g^iC,)

=

1/giC,)

the operator

(4.8)

=

[D-'jr]/ [D-

D[c(t)

-

lC,-y]/[C,-il-a)y]

(l-a)y]

.

g(C) =

[C,-{l-a.)y]/[C,-y]

which is the Laplace

,

so

transform of

Using (3.13) this implies that:

c(t-l)] = (l-a)y[c(t) - c(t-l)]

-

+ J"^(l-9'T)DC(t-T)

J'^[l+y(l-T)]DC(t-l-T)

.

This continuous-time autoregressive model for c(t) - c(t-l) implies that the

discrete-time observations {c( t )-c( t-1

model

where

Independent

the

of

the

autoregressive

effects of

)

t

:

=0,1,2,

parameter

time-averaging

...} satisfy an ARMA(1,2)

is

given

by

the

data,

habit

induces smoothness into consumption in the sense that

of consumption is positively autocorrelated

time-averaged reinforces this effect.

depreciation,

19

Also,

the habit persistence model

exp[

(

l-a)^]

persistence

the first difference

The fact that consumption is

.

unlike the case of exponential

implies higher order dynamics for

consumption than the time-separable model.

To satisfy the assumptions of the appendix,

the parameters of the habit

persistence model must be restricted such that y<p/Z and y ={\-a)Tr<p/2.

(4.5)

these parameters are further restricted for two reasons.

world of certainty, s is constant (at level

t

is given by:

22

s,

say)

First

In

in a

and consumption at time

c(t) = iexp(y t) -

(4.9)

)[exp{y

(y/^-

-

t)

l]Vs.

•

Notice that if

y<0.

If

=

y

positive

(for

3^

tends to

then c(t)

0,

(by setting a =

large

only if

t)

•

approximately

3'<0.

If

=

expif

20

t

=

consumption

1,

grows

large

For

)

t,

c(t)

is

to

be

this

•

and r >0 implies that y

linearly

geometrically at the rate y

for

[a/(a-l ]s.

)

the appendix is satisfied as long as y <p/2,

3 of

which is again

jt)

_

•

=

positive only if

is

-

s(l

then,

>

r

-

•

expiy tj(l-y/y )s

(y/y )s which

then c(t)

1),

positive, a must be large that one

a

-

»

<

when

and

<

ail.

When

consumption

grows

which allows

a

>

1,

Assumption

0.

This type of explosive consumption path under

.

extreme habit persistence has been emphasized by Becker and Murphy (1988).

the growth

support

To

consumption,

in

consumption since the capital stock at time

k(t) = J'"exp(-pT)c(t+T)dT

(4.10)

When

the

the

endowment

/ exp(-pT)c(t+T)dT

-

e/p,

stock grows along with

is given by:

t

X°°exp(-pT)e( t+T)dT

-

over

constant

is

capital

the

time

level

the

at

stock

that

the

capital

capital

and

consumption

so

.

grows

e,

k(t)

along

=

with

consumption.

restriction

The

deterministic world

that

is

consistent

with a

>

as

1

However in this situation if there is an initial

model,

they will not die out when a

model

the

,

-

problem

empirically.

The

>

1

.

23

long

as

level

of

positive

y

is

in

a

negative.

services in the

and it would be difficult to analyze

assumption that

21

are

a

<

1

in

(4.5)

avoids

this

.

V.

Empirical Results with Time-Nonseparable Preferences

section

this

In

persistence

habit

and

depreciation

results

the

report

I

models

some

must

account

made

be

Eichenbaum and Marshall

Following Christiano,

in

assume

I

,

and

these

consumption

22

(1991)

adjusted

to estimate

In order

trend

the

for

exponential

the

seasonally

to

seasonally unadjusted consumption expenditures.

models

fitting

of

data.

that

the

«

model

applies to detrended services sit)

s (t)

is

the

by

assuming

Given that

trend exp(jit).

is

ji

bliss

the

and

>

/i

This assumption can be

t.

follows

point

the

geometric

mappings from consumption to services are

the

trending consumption c

parameter

that

where

exp(-jit)s (t)

trending level of services at time

directly modeled

linear,

=

inherits

(t)

estimated along with

the

the

rest

trend exp((it).

of

the

trend

The

parameters

each

for

model

Seasonal ly Adjusted Expenditures on Nondurables and Services

V.A.

The exponential depreciation model implies that R(l) is negative if

<

Vs

(see

so

(4.4)),

differences

that the model

monthly

of

becomes more negative,

fact

that

first

the

consumption

R(l)

investigate

autocorrelated.

To

parameterize

moving

the

depreciation

model

'^

(see

consistent with the fact that first

is

negatively

are

autocorrelated.

becomes positive which would

differences

average

(4.3))

quarterly

of

process

implied

-

=

c(t-l)

are

by

the

model,

exponential

the

+

5

positively

depreciation

ec(t)

As

then explain

consumption

exponential

the

as c(t)

|5|

ec(t-l).

This

1

MA(1)

model

can

then be parameterized

down the parameter 6

in

terms of G

and

5,

where 5

through its affect on R(l) given in (4.4).

gives maximum-likelihood estimates of the MA(1)

24

ties

Table 5.1

model using the seasonally

adjusted monthly expenditures on nondurables and services.

value of 5 is -1.36,

The

estimated

implying that the consumption goods have a half-life of

0.51 months.

If a

quarter is used as the basic time interval, the value of

by the monthly estimation is 3*(-1.358) = -4.07.

implied

5

A likelihood ratio test of

of this restriction on the quarterly data versus an unrestricted MA(1) model

gives a P-value of 0.101 for the data from 1952,1 to 1986,4 and a P-value of

0.281

the data from

for

1959,1

to

1986,4.

As a result,

neither data set

rejects this restriction at the 10% significance level and the monthly and

quarterly first-order autocorrelation values can be reconciled with

exponential depreciation model.

simple

a

The exponential depreciation model fits the

first-order negative correlation in monthly consumption differences and time

averaging the data to quarterly frequencies implies a model consistent with

the quarterly data.

Maximum likelihood estimation

23

of the habit-persistence model using the

quarterly consumption series yielded parameter estimates of a that were not

significantly different

differences

in

from

persistence

Habit

zero.

implies

consumption are positively correlated over

aspect of the data is well accounted for by the fact

first

but

time,

this

the consumption

the habit persistence model

In fitting

data is time averaged.

that

that

to

monthly

data the model did very poorly since the monthly data requires a model that

induces negative co.rrelation in the first difference of consumption.

The nonseparability

that people develop a

the fact

that g(t)

instant

to

specify

the

level

is

not

substitutable

persistence

model

25

the

notion

However

implies that consumption from one

>

t

captures

consumption over time.

of acceptable

is negative for

the next

habit

induced by habit persistence

is

24

.

to

A

potentially better way to

first

define

an

intermediate

denoted

service process,

which

s,

captures

the

fact

that

consumption

is

durable or that consumption can be substituted over short periods of time.

The consumer is then assumed to develop habit over the intermediate services

process.

The intermediate service process is generated according to:

sit) = j"exp(5T)c(t-T)dT, 5

(5.1)

Again,

<

.

habit persistence is modeled using (4.5),

except that habit develops

over s instead of consumption directly:

This model

nests

the

exponential

depreciation model

persistence effects to develop much more slowly.

as

habit

persistence

depreciation

(5

with

close

to

autocorrelation of c(t)

depreciation,

-

0<a<l

y<0,

s(t) = s(t) - a(-3-)X°°exp(yT)s (t-T)dT,

(5.2)

exponential

zero)

the

c(t-l)

is

I

and

slow

For

implies

negative.

the

habit

will refer to this model

depreciation.

model

allows

that

Further,

of

first-order

the

for

rates

low

rates

the model satisfies the requirement of Huang and Kreps

of

(1987)

and Hindy and Huang (1991) that consumption be easily substitutable from one

instant to the next.

As 5 is driven to

-oo,

the model approaches the habit

*

persistence model.

Table 5.2 reports results of

the

estimation of

with exponential depreciation model using monthly data

5.2

to

table 5.1

function

in

notice that

adding

the

there

habit

is

some

persistence

depreciation model.

26

the

25

persistence

In comparing table

.

improvement

effects

habit

to

in

the

the

likelihood

exponential

.

formal

A

test

the

of

exponential

depreciation model

habit persistence with exponential depreciation model,

When a =

for

test

the

in

the parameter y is not

likelihood ratio

test

relative

to

the

test of a =

is a

0.

identified and the regularity conditions

break down.

Davies

(1977)

has

suggested a

this situation where the test statistic is found by evaluating the

likelihood

statistic

ratio

at

all

supremum of the resulting values.

possible

values

of

y

taking

and

the

A lower bound on the P-value of this test

can be found by using a chi-square distribution with one degree of freedom

and the likelihood ratio statistic based upon the results of tables 5.1 and

lower

This

5.2.

persistence

to

bound

is

0.067.

exponential

the

As

a

result,

depreciation

the

model

addition

does

not

of

result

habit

in

a

dramatic improvement in the fit of the model

Table

5.3

reports

estimated

half-life

values

for

the

exponential

depreciation and habit-persistence effects using the parameter estimates of

table 5.2.

The half-life of the habit persistence effect is estimated to be

relatively large possibly reflecting longer-run habit formation, which seems

reasonable.

However,

the half-life

is

not precisely estimated.

It

seems

that the degree of habit persistence is difficult to measure with this data

set

In

sum,

there

depreciation model

.

is

strong

evidence

in

favor

of

the

exponential

There is some weak evidence for habit persistence in

conjunction with the exponential depreciation model.

The lack of evidence

for habit persistence alone is due to the fact that the consumption data is

time averaged and this explains the persistence in the first difference of

consumption that the habit persistence model predicts.

27

Seasonally Adjusted Expenditures on Durables

V.B.

examining time-nonseparable preferences

In

Table

goods.

durable

expenditures

on

exponential

depreciation

reports

5.4

consider

to

estimates

of

seasonally-adjusted

using

model

natural

is

it

the

monthly

Notice that the estimated value of 5 is in fact

expenditures on durables.

more negative than the estimate using nondurables and services

(table 5.1)

which implies that the durable goods are less durable than nondurables and

The half-life of the durable good implied by this estimate of 5

services.

months which seems very unreasonable for durable goods.

is 0.42

was first discussed by Mankiw

this puzzle

time

they account

since

averaged

(1982).

raises

which

for

The results of

the

fact

first-order

the

that

the

This puzzle

table 5.4 reinforce

consumption data

autocorrelation

first

the

in

is

difference of consumption.

The

puzzle

series.

presence

since

habit

of

persistence

habit

Table

persistence

5.5

reports

induces

estimates

could

principle

in

smoothness

of

the

into

explain

consumption

the

persistence

habit

this

with

exponential depreciation model using the monthly expenditures on durables.

Notice

first

that

the

log

likelihood

significantly

persistence is added to the exponential depreciation model

5.4

and

5.5)

so

that

there

is

much

more

evidence

when

improves

in

(compare

favor

of

habit

tables

habit

persistence using durable goods. Also notice that the estimate of 5 is much

lower and the impli-ed half-life for the durable good is 1.50 months which is

somewhat more reasonable, but still too small.

The estimates reported in table 5.4 impose a set of restrictions on the

corresponding model for quarterly data.

In particular the implied quarterly

values of 5 and j are three times the values reported in table 5.5 and the

value of a is a third of

the

value reported

28

in

table 5.5.

A

likelihood

ratio test of these restrictions against an unrestricted habit persistence

with exponential depreciation model using quarterly expenditures on durables

results in a P-value of 0.087 for the data from 1952,1

for

data

the

from

1959,1

to

1986,4.

with

As

depreciation for nondurables and services,

1986,4 and 0.358

to

model

the

the model

of

of

exponential

habit

persistence

with exponential depreciation is consistent with time averaging the monthly

data to form the quarterly data.

Cabal lero

in durables

(1990)

has pointed out that there are higher order dynamics

than that captured by the exponential depreciation model.

The

habit persistence with exponential depreciation model captures some of this

evidenced

as

by

the

improvement

likelihood

the

in

function

when

persistence is added to the model, however the model does not do

see

To

job.

this

consider

table

5.6

which

reports

a

habit

complete

likelihood

ratio

statistics and corresponding P-values of tests of the habit persistence with

exponential depreciation model against higher order ARMA models

with

persistence

ARMA(1,2)

model

exponential

for

c(t)

-

depreciation

model

Notice

c(t-l)).

that

implies

the

models provide significant evidence against the model.

be

due

to

lumpy adjustment

and other

costs

of

a

higher

(the

habit

restricted

order

ARMA

This could perhaps

adjustment

as

argued,

for

example, by Caballero (1991).

V.C.

In

Seasonally Unadjusted Expenditures on Nondurables and Services

this

section,

1

examine whether exponential depreciation model

also consistent with the seasonally unadjusted data examined in section

is

II.

Given the weak evidence for habit persistence found with seasonally adjusted

expenditures on nondurables and services,

I

examine whether the seasonally

unadjusted data provides more evidence for habit persistence.

29

As

noted in section

I

the seasonal pattern of consumption requires

II,

the models of section III

that

and

IV be

part of the model for seasonals that

I

modified in some way.

The first

use is formed by assuming that

the

bliss point follows a deterministic seasonal pattern which induces an exact

pattern

seasonal

consumption.

in

Seasonal

bliss

movement

point

used in a similar way by Miron (1986) and Person and Harvey (1991).

continuous-time

problem

there

since

continuous-time

function.

I

that

is

functions

assume

time

continuous

model

that

with

is

an

being

examined

here

dimensional

infinite

class

an

is

of

In the

aliasing

deterministic

match any deterministic discrete-time

that

will

the

bliss

point

follows

corresponding

frequencies

there

been

has

a

seasonal

exactly

to

pattern

the

in

seasonal

frequencies of the observed data.

Since the seasonally unadjusted data is quarterly,

the bliss point

is

assumed to be governed by:

(5.3)

hU)

where

6,6,8

==

Zl

{<t>

and 6

cosi.inj/2)+IB,sin{tnj/2)}

are constants.

This model of b(t) and (3.13)

imply

that:

:5.4)

c(t) - c(t-l) = g^»w(t) + g •B(t:

where

B(t) = Y.I

ia.

[sin(t7rj/2)

+

sin({t-2)nj/Z)]

-P [cosUnj/2 + cos( (t-2)Trj/2)

=

and where a

J

integers,

2a

/tt

J

=

and 8

J

2S /n.

Note

that

]

}

g *B(t),

J

can be represented using seasonal dummies.

30

observed at

the

In order

to capture

the durable nature of the goods and to capture the

first-order autocorrelation noted

negative

intermediate service process s of (5.2).

exponential

depreciation

model

that

table

in

As

in

I

again use

the

the habit persistence with

considered

I

2.4,

above,

consumer

the

is

assumed to compare the current level of s to an average of past intermediate

services.

this case

In

instead of

letting

the habit

stock be a weighted

average of all past consumption, assume that the habit stock is given by the

level

of

the

intermediate service process of exactly one year ago.

In

other words sit) is given by:

s(t) = s(t) - as(t-4)

(5.5)

where

the

transform

basic

of

time

(D-5)/(l-aL*).

]

which

assumed

is

distribution

the

(^-6)/[l-aexp(-4<)

period

for

g

this

Laplace

the

is

to

be

a

case

quarter.

given

is

transfer

The

by:

g^(C)

the

of

Laplace

=

operator

As a result:

c(t) - c(t-l) = J"^(l-5T)D^(t-T) - J'^[l+5(l-T)]DC(t-l-T)

(5.6)

(1

-

aL*)

(D-5)B(t)

+

(1

The

representation given

time-averaged

consumption

have

-

aL*)

in

(5.6)

two

moving-average with a first-order

implies

pieces.

that

The

first

of

(5.6)

is

correct,

then

is

seasonal-autoregressive

second piece is a set of deterministic seasonal dummies.

model

seasonal

adjustment

differences

first

a

of

first-order

structure.

The

Notice that if the

removes

some

of

the

dynamics of consumption that are due to the preferences of the consumer and

31

applying

model

the

to

adjusted

seasonally

data

inferences about the structure of preferences

expenditures

unadjusted

lead

.

29

of

(5.6)

nondurables

on

misleading

to

28

Table 5.7 gives estimates of the parameters

seasonally

will

and

using quarterly

services.

A

likelihood ratio test of a=0 results in a P-value of 0.01% so that there is

strong evidence for the presence of habit persistence

inclusion of seasonal dummies

the

confirms the findings in table 2.4 that

This

this case.

in

Notice that

does not completely remove all seasonal effects.

(5.6)

implies

that first-differences in consumption follow an ARMA(4,1) where all but the

parameters

autoregressive

fourth-order

are

Estimation

zero.

an

of

unrestricted AFIMA(4,1) model for the random piece of the first difference in

consumption yields a

log

likelihood value of

test of the model given in

(5.6)

indicates

that

of

This

0.184.

150.02.

A

likelihood

ratio

against this alternative yields a P-value

model

the

doing

is

a

reasonable

job

in

representing the seasonally unadjusted consumption data.

The estimated value of 5 in table 5.7 is much closer to zero than the