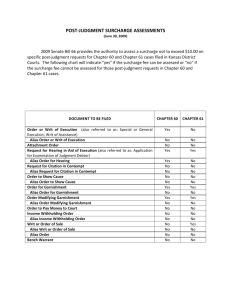

MANUAL GARNISHMENT & OTHER WITHHOLDING DOCUMENTS:

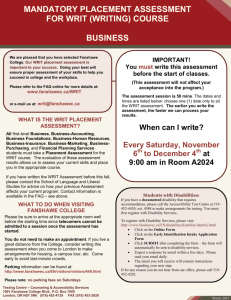

advertisement