Document 11043150

advertisement

LIBRARY

OF THE

MASSACHUSETTS INSTITUTE

OF TECHNOLOGY

coey

I

Evaluation of an Ad Hoc Procedure for Estimating

Parameters of Some Linear Models

A. Ando and G.M.

Kaufmati

MASS.

ir^CT.

Tc

OCT 30

1'

94-64

DEWEY

MASSACHUSE

50 MEMORIAL DRIVE

CAMBRIDGE, MASSACHUSETl

LIDRA:

COPY

I

Evaluation of an Ad Hoc Procedure for Estimating

Parameters of Some Linear Models

A. Ando and G.M.

Kaufman.

MASS. INST. TcCH.

94-64

j

OCT 30

^9P4

Authors are Associate Professor of Economics and

Finance, University of Pennsylvania and Assistant

Professor of Industrial Management, Massachusetts

Institute of Technology. The contribution of Ando

to this paper was supported by a grant from the

National Science Foundation.

The authors acknowledge the contribution of Mr. Bridger Mitchell of

Massachusetts Institute of Technology, who prepared

the computer program for calculations reported in

this paper.

Y\A

NOV

,,

,

I.

9

1965

LlBRAKlE-S

Economists and other users of statistical methodology often posit a

probabilistic model of some real world phenomenon which has more unknown parameters than there are sample observations.

In such cases it is usually impossible

to jointly estimate all parameters from the sample data.

Even in those instances

where there are well established estimation procedures when the number of sample

observations n is larger than the number of parameters r, these methods are

generally inadequate when n < r^ as the necessary calculations cannot be carried

out.

Furthermore, when n is only "slightly larger" than r, such estimates often

prove to be unreliable in more than one sense.

One particular example of such a problem that frequently occurs in analysis

of psychological and of economic data is this:

the researcher posits a linear

regression model as defined in (2) below with r-1 independent variables but

only n <

r

observations on the dependent variable.

Since the standard least

squares procedure cannot be applied, he may ask the following seemingly reasonable question:

"What subset of the r-1 independent variables should

for inclusion in a "new" model to which

I

I

select

can apply the standard least squares

procedure?"

Our purpose here is to demonstrate that one frequently used ad hoc method

for determining such a subset by ordering simple sample correlation coefficients

can be highly misleading.

Any procedure which uses

to both determine the structure of the model

a

given set of sample data

to be tested and to estimate param-

eters of this model is intuitively unsettling.

Here we present tables which

quantitatively demonstrate how dangerous such ad hoc methods can be.

Ad Hoc Use of Simple Correlation Coefficients to Determine Model Structure

Consider an r-dimensional Independent Multinormal process defined as one

that generates independent

r

~(1)

x

random vectors x

1

,x

(J)

with identical

densities

4'^(2ikh)

=

(2

^)-ir

e"^(3S-li)''^(2i-y.)

|h|2

(1)

h is PDS

We wish to estimate parameters of the conditional distribution of

x^

,...,x^

'

when neither ^ nor

vector sample observations x

"^

h is

^x

~(k)'

xj^

given

known with certainty from a set of n

,...^x^"

.

Alternatively, we may consider

an r-dimensional Normal Regression process defined as a process generating

independent scalar random variables according to the model

;p>,

'i

the X.

s

+ iiz A^^^i.

^^^""^

(2)

are known numbers which in general may vary from one observation to

the next,' and the e.s are independent random variables with identical normal

J

fj^(e|0, h)

=

(2n)"

Suppose now that we have n observations, and let

(1)

^2

(3)

.

be a matrix of observations of "independent" variables together with an

additional column of I's.

If the rank of X X is singular the following method,

or a slight variation of it, is often employed to make standard least squares

"work":

1.

Using the n sample observations, compute r-1 sample statistics

p., i=2,...,r, where p.

coefficient between

x,

is

the simple sample correlation

and x.

>

>

2.

Relabel variables X2,...,x

3.

Choose an integer r* < rank (X X).

4.

Restructure the model, eliminating from consideration

so that

relabelled variables x .,.,...,' x

r*+l'

.

jp-]

[po]

...

>

|p

[•

(Henceforth we call the

r

initial model, "Model A" and the restructured model, "Model B".)

5.

Assuming that Model B is an adequate approximation to Model A

use X X to estimate parameters of the conditional distribution

of X, given the values of relabelled variables X2,<...^x^^,

3«

Simulation Study

Model B is a strongly biased approximation to Model A, and the magnitude

of the bias is a function of the joint distribution of the r*-l largest simple

sample correlation coefficients.

Analytical expressions for this distribution

and for the distribution of the sample multiple correlation coefficient in

Model B are in general extremely complex and unwieldy.

Hence we have resorted

-

to simulation!

4

-

in order to numerically determine the salient features of Model B.

The steps in this simulation were:

1.

We assumed that:

(a)

the data generating process is a Model A as defined in (2)j

(b)

the dependent variables

x!"

, > . .

yX

,

y*'-''^

and the independent variables

j=1^2^..,,n, are mutually independent random

variables identically distributed uniformly on [0^ 1],

2.

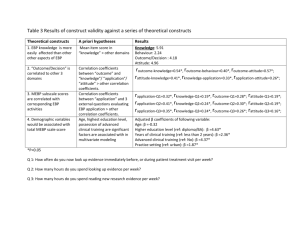

For each (n, r) pair, n=10(2)20, 30, 40, 50, and r=10(5)50, 50(10)100,

150, 200 we generated 50 sets of n observations each.

3«

For each set of n observations we used the ad hoc procedure out-

lined in section

2

to calculate the five largest simple sample

correlation coefficients and Model B multiple correlation coefficients

for Model B's with m=2, 3, 4, and 5 independent variables.

4.

Regarding each of the five sets of 50 simple sample correlation

coefficients as a set of sample observations we then calculated the

sample meanjp.| and sample variance V(|p.|) of the absolute value of

each of the. five largest simple sample correlation coefficients.

results are tabulated in Tables

1

and 2.

'Ames and Reiter [1] performed a somewhat similar experiment in a

different context:

they drew 100 economic time series at random from the

Historical Statistics of the United States and then computed the sampling

distributions of correlation and autocorrelation coefficients of the series

drawn, finding that "correlations and lagged cross-correlations are quite high

for all classes of data.

E.g., given a randomly selected series, it is possible

to find, by random drawing, another series which explains at least 50 per cent

of the variances of the first one, in from 2 to 6 random trials, depending

on the class of data involved." [1], p. 637.

The

|

5.

We follow a similar procedure with the sample multiple correlation

coefficients.

In Table 3 the mean R

of the square of 50 sample

multiple correlation coefficients for model B's with a constant

term plus m=2, 3, k, and

5

independent variables are tabulated.

The tables given us a reasonably accurate ideal of the order of magnitude

of Model B sample correlation coefficients and of the five largest simple sample

correlation coefficients whatever the distribution of the independent variables-so long as they are mutually independent and have finite mean and variance. Tl

Tables 2 and 4 of the sample variances of the

|p

|

and of sample multiple

.

correlation coefficients show that variations in Tables

to sampling error are practically negligible;

of

Ip-,1

for n= 10 and r= 10

is

1

and 3 entries due

e.g. the coefficient of variation

less than .001 as calculated from Tables

1

and 2.

Evaluation

Examination of Tables

1

procedure outlined in section

shown in Tables

1

and 3 illustrate clearly that not only is the

2

biased, but that bias of an order of magnitude

and 3 entries will occur with extremely high probability.

For

'In order to assess the effect of assuming that the data generating process

generates values of mutually independent but uniformly distributed random

variables, we duplicated the experiment for n=

and r= 10 under a different

assumption:

each sample observation was generated by summing 10 values of mutually

independent, identically uniformly distributed random variables. This spot check

using an approximately normal data generating process revealed no differences to

the third significant digit between values generated under this assumption and

values tabled in Tables 1, 2, 3, and 4.

_1_L

_

2

''One interesting feature of Table 1 is that for given r and i, |p.

decreases almost exactly proportional to 1/n. This is most pronounced for

i=2.

-

example^ for n=10^ r=10^

n=

f

^=

}

\po\-

population values of

|p.|

|p^2l

= "61^

6 -

with sample variance of only „0172 and for

with sample variance of only

even when the

i=2,...,r are controlled to be 01

One effective way of dealing with the problem is to reformulate it in

Bayesian terms so that we may systematically incorporate information the researcher

possesses from sources other than the sample into the analysis.

In [2] we indicate

how Bayesian estimation of the mean vector and variance-covariance matrix of a

multinormal process may be done even when the dimensionality of the process is r

and there are only n < r sample observations available.

And in [3] we show how

Bayesian estimation can be done when the data generating process is one frequently

occurring in econometric analysis--a set of simultaneous linear equations with

stochastic components--and there are less vector observations than parameters.

[1]

Ames^E. and Reiter S.;, "Distributions of Correlation Coefficients in Economic

Time Series," Journal of the American Statistical Association , 56 (1961),

pp. 637-656,

[2]

Ando, Albert and Kaufman, Gordon M. ,"Bayesian Analysis of the Independent

Multinormal Process-Neither Mean nor Precision Known-Part I,' Massachusetts

Institute of Technology, Alfred P« Sloan School of Management, Working

Paper No, 41-63.

[3]

Ando, Albert and Kaufman, Gordon M. ,'^ Bayesian Analysis of the Reduced Form

System, "Massachusetts Institute of Technology, Alfred P, Sloan School

of Management, Working Paper No. 79-64,

rooaovOiA

O-grOtOoO

lA-tONt-o

OOvONJtn

TOO»r«-cy.in

t<\

^

r^

vOMooor*

>tT>u^oao

in-vjooh*

-*-*C*%iAO

.n-iosr«-vo

-«-<ooo

iT,

cr>

-«-tr-4oo

^^-ijyiaor'-

o

'-«

(\l

-<

O

vO

r^

--H

t>a

.-><

00

-*•

N o

^

-*

u> vO

r* -* -• c^

-H -^

'-'

-t

i-t

^

^

i-M

(MiAOO'^O

r~t

^

o f^

o>

(*>

.-«vOOr>--4

r»fN4<7,,ocn

f>4^^^^

r^'Nr»inr<>

-< f^ -r -a- <N

^•

r» >^ rvj

r>j rg ~«

o

^^

in vO rg c^

'>i 00 in

ro rvj

o

i>J

(*\

^^^

O

rvjrsj^^^

O

<«>

(O

(*\

4

>0 vO O^ r*

CT> fO oo in

rg eg

,-,

^

t«N in

c^ r^

ro rg

<\i

fsj

fn

(V4

-^

o

o*

^

O

-H <o

m

^

r<^

r'>

cn -^

O* >0

,-, -^

(J»

(*^

^

(Nj

•

o

o

o

O

om

oo

00 -4

(*>

•*«««

o» rg vO

in —< 00 \0

"NJ rg ^H -H

^

f«%

CO vO

^ o

r>

rg rg -H

nj 4- ON 4- in

<0 r»

in r-t

•* fO CO rg (M

o

o

^

eg

n

<j-

m

\o

O

4

o

M

-H

--I

-1

oooo^f^in

r-'HoovO^

'Mrg,^^^,^

fOrgpg.-<,i^

r*-vOor>»in

f^vOOr-in

ng,n-<(><0

AAAAA

Oinrg<>i*.

roojrg-H-*

A.-.^.

m

r~ r* oo in r»

vO >j

<o

r\4 ^^ f-t

in 00 oo in

>0 >J -» rg ro

in o» in og (y>

-g —

,'^J ,-Nj

f* ^J'

rg <o

in

in rg o»

ro rg rg rg .^

o

(t%

<*\

^

o

m o

«^ >o

Qo

C^ 04 (N rg ..H

o

m

o

o> r- ,» CO in

oo rg CO >^ -4

f>

rg rg rg

in CO f\j 00 o*

'-« CO 0* in rg

-» CO rg rg rg

r- o> in

o»

rg 00 in -4

-» CO rg f\i rg

QO in -# CO On

On CO On >0 CO

CO (O CNJ rg pg

CO r- o» in -«

CO 00 CO On \^

>*• CO CO rg rg

CO

>» fO «! CO

0^ •»

(O CO

in f>j

^» rg

in r«. rg <0 CO

in ^^

«o <o

(O <^ On On rg

r» nO oo rg 00

nO in

ro

>0 00 >0 CM CM

00 >o

in

nO in

.^

o o

•#•

vO CO in

CO CO eg pg

oo

in

-4 00 oo

in in r«- ^H lO

«o »n

<o

o

fvi

M'-«-|^-4

(*>

O

nj •^ nO «o rCO

(O <o

>o in

lo <o

•

o in

m M

rg in -»

.<•

vO

in rg On

<n rg rg f\j -<

in r» oo

rH 00 r- r-t

CO (O

«0

<-•

vO

/>

»

-gp^™«r--ao

m

«o r^ «o

lA eg <o

r*

in >* <n «o rg

o^

r>j

>J

>OoaoinfO

-« 00 in rin

oo vO

rn rg rg ,^ .^

O

J>

>J

f^

CO rg

>i -*

-« _»

O O 30 >J >o

^ ^ r^ ^

^

•^ro^o.O

>^r'it/\m.fl

"^^JOr^in

On »n fN" <o

-H

ON in

in •* «o CM rg

f*-

~t

^

^

^ -«

Oao-«oco

aofV(>iA(*>

rgoj,-^rHr^

in <*%

in

0» 0« rg >0 -«

<«% lo rg rg

^

^

fOf\jrg-<-(

-^ -*• >J- C> 00

«o 00 c*\ (^ .o

CO rg rg

-^

r»

-*

^

'-•uiu^r^>-i

I

**•••

(*> r- f^ 00 >0

>» >o

r~ ,»

ro rg rg -•

^

r-i

c<^rgrg-Hr-»

.v-<'<~v—

O rS

vO CO CO

O»r»\0«>O-*

f^

o

St

-* x» r—

f>4

-< r-

rgrg,-<-«^

f^ CO rH (Jv

rg in

r>. ro

ro iM rg r-< -.^

o

-«-«-*oo

r^ rO xO (*^

CO J^ ro <—*

-» r^ -» rH

r» >» rg

Ai -• -•

-I

-St

t>i-<-^-<-i

^

:>j

inOOrOO

'^ -t

est

-O -t ~i r\

r-f -O -* r>4

r>t -* -* -^

.'n

O

NJ r^ 4^ "M -H

>i -< -H -< r-<

c'N

(«>a04oac>

'>J-»-<-«0

-*ooin(NO

oo

r*%

^ o

-J-Lnvooo

>0(n-»oo

-* M ~* ^ a

r- -o vo rro —« 0»

-* --i r-i

(M ~i

O

x>Nrr»ao«o

^o«^-*c^3^

-i-«-»oo

o

o

* ^

"-^

.»

r~ in

o» -H r- <o

ro rg oj rg

o

O

rin

o

^

(*>

4 ^

r»-

o

O

O4

00 >o

>t r~ CM 00 in

>J-

<o <o CM rg

m

*

o

m «o

^

§

oooo oooo

'^oooo

^

>-*

a>

-f

cr\

^

•t

^

OrHOoft

oooo oooo OOOO oooo

oooo ^i/>vOf^

^vTVin^O

-f

a00j-<0

-^^r<%C>

oooo oooo

O oo

oo

o o-« -H

rg 0»

r- ao

(niNvAvO

o»

-•

oo

.

O -*

_,

-

iS\

O

\0 yO

fO -«

iM

-•

r~ a>

-«

tn^r-r*

\f\

t^

r»CT»Of>4

(NJO^^O

(M

OO

O

OO

O

o

OrH

O -H N

-^

-H

r-*

o o

'-*

OO-HrM

O

O

O -<

O

OO

-H CO

-I -«

OO—'-^

0'^<-H'-«

rHO'tT*

ODO'HCM

x\Oir»vO

-4-«0(M

O^^^

a>'-«(<>-*

^H^^OQ0

Op^,-|rH

OOOfO^

in'-^f*-r*

rgo^ooo

>->

oooorxj-^

f^

c^^^<^-*

rginr-flo

Os'HfO^

O^fHrH

-t o\ ~i

oo-«-«

^

00

in

o-r

ON

CO

^AirOO

^,-4^^

00000>0

p^OiAr*

ao r^

vO'-^'^'^

>-«inr»o»

<f\

,H^>-HrH

'^rou>r^

ofo-^iA

^^^^

o^^^ ^^^^

>^f>inf^

^

^ ^ _,

lAifxo^iA

{*>c<>fO<-^

-r-f^oj

r^-H^rg

,-«^^rg

*r»o»>-i

»r>oO'^-*

o^oiNcA

0-i-«-«

o>«OflO'^

r-*

r^

•

CO

-t 'C

^

^^

•

•

•

^ O

-t r^

,t r* (> -H

P-l

rH rH

fVJ

'-4

-t

<j\

^,Hp-t.H

cnoooo

<MO<*^<o

or-rg-H

^r^rgrg

^.-(pjjvj

^r»ong

^flOr^tn

^^^^

-H-^rjrg

(O^Of>4

-j-rg^r*

.^rgogrg

^r^r\jrg

ooroin

iao^^nj-^

^1

'^

i

1

1

2

no. 95-64

no. 96-64

PAMrcTTirn

CANCELLED

.f'SmQ''!

""Date

Due

ir-bH

3

laao D03 TDD 2bD

3

TOfiD

3

TDfiD

DD3

flbT

21fl

1751801

DD3 TDD ED3

''Ran

mmiiimi

0D3 TOO 511

-

iiiifilii

TDfiD 0(

TOfiD

3f'llf[...,

3

^DflO

3

TOAD 003

DD3 TDD 4?!

flhT

4S7

""'''

liiiiiiiiiyjijniiiiiii

3 TOfiO 003 fibT SD7

<1i'bH

<\^-bH

3

TOflO

003 TOO

Mfl4

3

TOfiO

003

4b5

3

TOflO

003 TOO

4bfl

3

TOflO

003

4fll

9v^6W

fibT

q~l^&>H

flbT

f 7 '^^l

3

TOflO

003

flbT

531

^

'\%