UK & Ireland Customer Controller +44 (0) 7809 583453 © IGD 2014

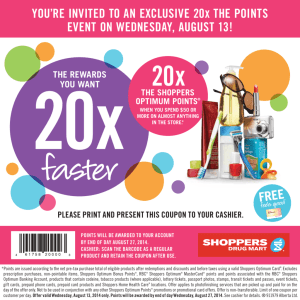

advertisement

graham.mclean@igd.com UK & Ireland Customer Controller +44 (0) 7809 583453 © IGD 2014 IGD is a research and training charity that helps the food and consumer goods industry deliver the needs of the public © IGD 2014 Our sources of thinking © IGD 2014 © IGD 2014 “I think once people discover value for money they will stay with it, and why shouldn’t they?” Chief executive, major UK grocery retailer © IGD 2014 © IGD 2014 The shopper has changed 90% 95% Have used a supermarket in the last month Use 2 or more channels per month 54% 60% Have used a food discounter in the past month 34% shop around different channels for product range 3.9 Have used a hypermarket in the last month The average number of channels used in the last month 24 4.9 times per month people shop for food and groceries channels that shoppers would like to use by 2016-17 vs 3.9 today Source: IGD ShopperVista © IGD 2014 Three points of view Shoppers Shoppers Retailers Suppliers © IGD 2014 Three points of friction Shoppers Chase for loyalty Complexity V efficiency Backing the winners © IGD 2014 Blurring of channels Supermarkets Hypermarkets Foodservice Specialists Online Convenience Discounters © IGD 2014 Why use multiple channels? © IGD 2014 © IGD 2014 Savvy evolution in the past year 24% have been discount requesting shoppers 44% have been reduced-to-clear shoppers 28% have been checkout split shoppers Source: IGD ShopperVista, main grocery shoppers May’14 15% have been set budget shoppers © IGD 2014 Value simplicity % who find it easy to compare prices and find the best value in store 56% 66% Convenience stores 41% want more round £ offers or zones 57% like price marked packs 2012 2014 Base: All main shoppers June’14; all past moth convenience store shoppers Mar-May’14 © IGD 2014 Coupon culture 55% of shoppers say they’ve used COUPONS when food and Recent retailer coupon activity grocery shopping in the last month* Source: IGD ShopperVista, main grocery shoppers May’14; *claim to have done this in the last month © IGD 2014 Multi-store missions Multi-store missions during same trip + 61% of discount shoppers visit 2 or more grocery stores on the same trip 59% of discount shoppers visit another grocery store on their last shopping trip 41% of high street discount shoppers bought food from another store on their most recent shopping trip Base: all main shoppers, May’14; all past moth food discount shoppers Apr-June’14; all past month high street discount shoppers Jan-March’14 © IGD 2014 Discerning discount shoppers % of discounter shoppers extremely satisfied or very satisfied with in-store elements Base: all main shoppers, May’14; all past moth food discount shoppers Apr-June’14 © IGD 2014 Expansion fever Shoppers want ... In food discounters More choice More brands In high street discounters In food discounters In high street discounters 32% say a bigger branded range would encourage them to start, or to shop more, for food & grocery in the channel Base: all main shoppers, May’14; all past moth food discount shoppers Apr-June’14; all past month high street discount shoppers Jan-March’14 © IGD 2014 Online advance 24% 23% 22% Base: All main shoppers xxx 27% 19% © IGD 2014 Online fresh % shoppers who say they prefer to shop certain departments online or in-store Which, if any, of the following would encourage you to buy more FRESH FOOD online? Prefer to buy in-store No preference Prefer to buy online ShopperVista Online Channel Focus; Base: all shoppers who say they prefer to buy fresh in-store rather than online, Feb-Apr’14 © IGD 2014 Trust revival in GB Higher trust Base: All main shoppers Jun’14 © IGD 2014 Top five trends at a glance #1 Simpler pricing and promotions #2 Multi-store trip #3 Discount desire #4 Coupons #5 Fresh categories online © IGD 2014 Where do we go next? Deep understanding Work closely with partners Build an integrated supply chain Teams with the right capability Underpin with effective technology © IGD 2014