GB State of the Nation – Dublin – September 16 2010

advertisement

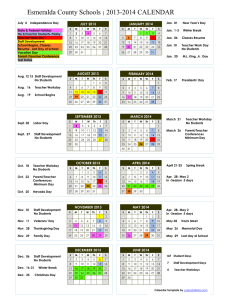

GB State of the Nation Bord Bia – Dublin – September 16 2010 Edward Garner Communications Director The Agenda > – A sense of proportion returns – Tesco – Never complacent – Asda – Price and/or Quality – Sainsbury‟s – Striking a Balance – Morrisons – „Fresh for less‟ – Waitrose – Ethical extremism – Discounters – Threat postponed – M&S – Always the Bridesmaid – Home Delivery -M 20 ar - 08 18 A pr -M -08 1 5 a y-J 08 u 13 n-0 - 8 1 0 Ju l -A -08 07 ug -S -08 05 ep-O 08 02 ct-N 08 30 ov -N -08 28 ov -D -08 25 ec-J 08 2 2 an -F -09 22 eb-M 09 19 ar -A 09 17 pr -M -09 1 4 a y-J 09 u 12 n-0 - 9 0 9 Ju l -A -09 06 ug -S -09 04 ep-O 09 01 ct -N -09 29 ov -N -09 27 ov -D -09 24 ec-J 09 2 1 an -F -10 21 eb-M 10 18 ar -A 10 16 pr -M -10 1 3 a y-J 10 u 11 n-1 -J 0 0 8 ul -A -10 ug -1 0 23 Grocery Price Inflation – Kantar Worldpanel Calculation 12 w/e periods year-on-year 8.9 8.1 6.8 5.8 4.5 4.5 4.8 9.2 8.7 9.1 8.3 8.18.3 8.5 8.8 8.1 7.0 5.9 5.0 4.1 3.4 3.1 2.8 2.6 2.8 2.4 1.5 1.2 1.2 Based on year-on-year comparisons of price paid for over 75,000 identical products including promotions and in the proportion that British households are purchasing them 1.5 1.7 2.2 Grocery (RST) 12we 8 Aug 2010 (KWP P09) 12 we growth 12 we inflation 4% 3% 08 Aug 10 5% 11 Jul 10 13 Jun 10 16 May 10 18 Apr 10 21 Mar 10 21 Feb 10 24 Jan 10 27 Dec 09 29 Nov 09 01 Nov 09 04 Oct 09 06 Sep 09 09 Aug 09 12 Jul 09 14 Jun 09 17 May 09 19 Apr 09 22 Mar 09 22 Feb 09 25 Jan 09 28 Dec 08 30 Nov 08 02 Nov 08 05 Oct 08 07 Sep 08 10 Aug 08 % change Market Growth & Inflation Growth continues to increase as inflation rises to 2.2% 10% 9% 8% 7% 6% 3.8% 2% 2.2% 1% 0% 12 w/e periods 13-Jun-10 11-Jul-10 08-Aug-10 16-May-10 21-Mar-10 18-Apr-10 21-Feb-10 29-Nov-09 27-Dec-09 24-Jan-10 01-Nov-09 06-Sep-09 04-Oct-09 09-Aug-09 12-Jul-09 17-May-09 14-Jun-09 19-Apr-09 25-Jan-09 22-Feb-09 22-Mar-09 28-Dec-08 02-Nov-08 30-Nov-08 05-Oct-08 07-Sep-08 13-Jul-08 10-Aug-08 15-Jun-08 20-Apr-08 18-May-08 23-Mar-08 Sales Growth £% Total Grocers Year-on-Year £% Changes 50 40 30 20 Economy OL 10 Premium OL 0 -10 -20 0 Aug 08 2010 Jul 11 2010 Jun 13 2010 May 16 2010 Apr 18 2010 Mar 21 2010 Feb 21 2010 Jan 24 2010 Dec 27 2009 Nov 29 2009 Nov 01 2009 Oct 04 2009 Sep 06 2009 Aug 09 2009 Jul 12 2009 Jun 14 2009 May 17 2009 Apr 19 2009 Mar 22 2009 Feb 22 2009 Morrisons Jan 25 2009 20 Dec 28 2008 Sainsbury's Nov 30 2008 40 Nov 02 2008 Asda Oct 05 2008 60 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Latest 12-wk % Change Total Grocery Budget Own Label Trends - 4-weekly £m 120 +2% 100 Tesco 80 -9% +5% -2% Premium Own-Label Sales Trends Latest 12-wk % Change 90 70 +4% 60 50 40 -4% 30 -2% 20 10 +15% Tesco Finest Sainsbury's Taste the Difference Asda Extra Special 2010 2009 2008 2007 2006 2005 2004 2003 2002 0 2001 Sales (Expenditure £m) 80 Morrisons The Best The Agenda – A sense of proportion returns > – Tesco – Never complacent – Asda – Price and/or Quality – Sainsbury‟s – Striking a Balance – Morrisons – „Fresh for less‟ – Waitrose – Ethical extremism – Discounters – Threat postponed – M&S – Always the Bridesmaid – Home Delivery Long-Term Share of Till Roll Grocers 34 32 30 28 26 22 20 18 16 14 12 10 8 6 4 2 Tesco Asda Sainsbury's Morrisons Total 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 0 1993 Share (Expenditure) 24 Latest Quarter Till Roll Totals - Share of Total Grocers Tesco Asda Sainsbury's Morrisons 31.0 30.8 17.2 16.9 15.9 16.1 11.4 Co-operative 11.6 5.5 6.4 3.9 Waitrose 4.1 3.0 Aldi 3.0 Lidl 2.3 2.4 Independents 2.2 2.3 Iceland 1.7 1.8 2.7 Somerfield 1.2 Netto 0.7 0.7 Farm Foods 0.5 0.6 12 w/e 09 Aug 09 12 w/e 08 Aug 10 08-Aug-10 11-Jul-10 13-Jun-10 16-May-10 18-Apr-10 21-Mar-10 21-Feb-10 24-Jan-10 27-Dec-09 29-Nov-09 01-Nov-09 04-Oct-09 06-Sep-09 09-Aug-09 12-Jul-09 14-Jun-09 17-May-09 19-Apr-09 22-Mar-09 22-Feb-09 25-Jan-09 28-Dec-08 30-Nov-08 02-Nov-08 05-Oct-08 07-Sep-08 10-Aug-08 13-Jul-08 15-Jun-08 18-May-08 20-Apr-08 23-Mar-08 24-Feb-08 27-Jan-08 30-Dec-07 02-Dec-07 04-Nov-07 07-Oct-07 09-Sep-07 12-Aug-07 15-Jul-07 17-Jun-07 20-May-07 22-Apr-07 25-Mar-07 Tesco Share Change - 12 week share year-on-year change 0.8 0.6 0.4 0.2 0.0 -0.2 -0.4 -0.6 -0.8 Jul 27 2008 Aug 10 2008 Aug 24 2008 Sep 07 2008 Sep 21 2008 Oct 05 2008 Oct 19 2008 Nov 02 2008 Nov 16 2008 Nov 30 2008 Dec 14 2008 Dec 28 2008 Jan 11 2009 Jan 25 2009 Feb 08 2009 Feb 22 2009 Mar 08 2009 Mar 22 2009 Apr 05 2009 Apr 19 2009 May 03 2009 May 17 2009 May 31 2009 Jun 14 2009 Jun 28 2009 Jul 12 2009 Jul 26 2009 Aug 09 2009 Aug 23 2009 Sep 06 2009 Sep 20 2009 Oct 04 2009 Oct 18 2009 Nov 01 2009 Nov 15 2009 Nov 29 2009 Dec 13 2009 Dec 27 2009 Jan 10 2010 Jan 24 2010 Feb 07 2010 Feb 21 2010 Mar 07 2010 Mar 21 2010 Apr 04 2010 Apr 18 2010 May 02 2010 May 16 2010 May 30 2010 Jun 13 2010 Jun 27 2010 Jul 11 2010 Jul 25 2010 Aug 08 2010 Tesco Private Label Weekly Sales £m 35 30 25 20 15 10 5 0 Value Finest Jul 27 2008 Aug 10 2008 Aug 24 2008 Sep 07 2008 Sep 21 2008 Oct 05 2008 Oct 19 2008 Nov 02 2008 Nov 16 2008 Nov 30 2008 Dec 14 2008 Dec 28 2008 Jan 11 2009 Jan 25 2009 Feb 08 2009 Feb 22 2009 Mar 08 2009 Mar 22 2009 Apr 05 2009 Apr 19 2009 May 03 2009 May 17 2009 May 31 2009 Jun 14 2009 Jun 28 2009 Jul 12 2009 Jul 26 2009 Aug 09 2009 Aug 23 2009 Sep 06 2009 Sep 20 2009 Oct 04 2009 Oct 18 2009 Nov 01 2009 Nov 15 2009 Nov 29 2009 Dec 13 2009 Dec 27 2009 Jan 10 2010 Jan 24 2010 Feb 07 2010 Feb 21 2010 Mar 07 2010 Mar 21 2010 Apr 04 2010 Apr 18 2010 May 02 2010 May 16 2010 May 30 2010 Jun 13 2010 Jun 27 2010 Jul 11 2010 Jul 25 2010 Aug 08 2010 Tesco Private Label Weekly Sales £m 35 30 25 20 15 10 5 0 Value Finest Tesco Discount Brands Tesco Household Income Signatures 39 37 35 33 31 29 27 25 £0 - £9999 pa £10000 £19999 pa £20000 £29999 pa 52 w/e Aug 10 2008 £30000 £39999 pa £40000 £49999 pa 52 w/e Aug 09 2009 £50000 £59999 pa £60000 £69999 pa 52 w/e Aug 08 2010 £70000 + Tesco Year-on-Year £% Changes 80 60 40 Value OL 20 Premium OL 0 -20 -40 25- 22- 22- 19- 17- 14- 12- 09- 06- 04- 01- 29- 27- 24- 21- 21- 18- 16- 13- 11- 08Jan- Feb- Mar- Apr- May- Jun- Jul- Aug- Sep- Oct- Nov- Nov- Dec- Jan- Feb- Mar- Apr- May- Jun- Jul- Aug09 09 09 09 09 09 09 09 09 09 09 09 09 10 10 10 10 10 10 10 10 12 w/e periods - Total Grocery Average Price per pack in Tesco Discount between Value and Promoted Own Label 1.68 1.34 £ price per pack 1.25 1.09 0.85 0.71 Value Discount brands PROMOTED Standard own label FULL PRICE Standard own label PROMOTED Brands FULL PRICE Brands RST (grocery) 12w/e Aug 08 2010 The Agenda – A sense of proportion returns – Tesco – Never complacent > – Asda – Price and/or Quality – Sainsbury‟s – Striking a Balance – Morrisons – „Fresh for less‟ – Waitrose – Ethical extremism – Discounters – Threat postponed – M&S – Always the Bridesmaid – Home Delivery and versus or 08-Aug-10 11-Jul-10 13-Jun-10 16-May-10 18-Apr-10 21-Mar-10 21-Feb-10 24-Jan-10 27-Dec-09 29-Nov-09 01-Nov-09 04-Oct-09 06-Sep-09 09-Aug-09 12-Jul-09 14-Jun-09 17-May-09 19-Apr-09 22-Mar-09 22-Feb-09 25-Jan-09 28-Dec-08 30-Nov-08 02-Nov-08 05-Oct-08 07-Sep-08 10-Aug-08 13-Jul-08 15-Jun-08 18-May-08 20-Apr-08 23-Mar-08 24-Feb-08 27-Jan-08 30-Dec-07 02-Dec-07 04-Nov-07 07-Oct-07 09-Sep-07 12-Aug-07 15-Jul-07 17-Jun-07 20-May-07 22-Apr-07 25-Mar-07 Asda Share Change - 12 week share year-on-year change 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 -0.1 -0.2 -0.3 -0.4 Retailer Price Track - Total Grocery 110 105 95 90 85 Strong price focus Tesco Asda Sainsbury's Morrisons 2010 2009 2008 2007 2006 2005 80 2004 Price Index 100 Grocery Share at Round Pound Prices - £% - Asda 14 12 10 £2 8 £1 £3 £4 6 4 2 0 Aug 08 2010 Jul 11 2010 Jun 13 2010 May 16 2010 Apr 18 2010 Mar 21 2010 Feb 21 2010 Jan 24 2010 Dec 27 2009 Nov 29 2009 Nov 01 2009 Oct 04 2009 Sep 06 2009 Aug 09 2009 Jul 12 2009 Jun 14 2009 May 17 2009 Apr 19 2009 Mar 22 2009 Feb 22 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Grocery Share at Round Pound Prices £1/2/3/4 - £% 26 Asda 26 Netto 20 Somerfield 20 Co-operative 18 Morrisons 18 Tesco 16 Sainsbury's 12 Independents 8 Lidl 8 M&S 4 Waitrose Aldi 12 w/e Aug 08 2010 1 “UK‟s biggest Pound Shop” Trading Indices - Asda 52 w/e Aug 08 2010 Broad Areas indexed on Total Groceries Total Total Total Total Total Total Total Toiletries Healthcare Household Ambient Groceries Alcohol Fresh+Chilled Frozen 121 112 111 102 97 96 94 Weak performance in Fresh Year-on-Year Expenditure Trends - % change Asda Total Alcohol 6.7 Total Toiletries 4.5 Total Ambient Groceries 4.0 3.9 Total Household TOTAL GROCERIES 2.9 Total Fresh+Chilled 1.2 Total Healthcare 1.0 52 w/e 08 Aug 10 Total Frozen -0.4 No v-0 30 8 -N o 28 v-08 -D ec -08 25 -Ja n-0 22 9 -F eb -0 22 -M 9 ar0 19 -A 9 pr09 17 -M ay -0 14 -Ju 9 n-0 9 12 -Ju l-0 09 9 -A ug -09 06 -S ep -09 04 -O c 01 t-09 -N ov -09 29 -N o 27 v-09 -D ec -09 24 -Ja n-1 21 0 -F eb -1 21 -M 0 ar10 18 -A pr10 16 -M ay -1 13 -Ju 0 n-1 0 11 -Ju l-1 08 0 -A ug -10 02 - Net switching - Spend (£000s) Net Switching Volumes to Asda 50000 40000 30000 20000 10000 0 -10000 -20000 -30000 -40000 12 weeks ending Sainsbury's Tesco Waitrose Morrisons Oct 08 2006 Nov 05 2006 Dec 03 2006 Dec 31 2006 Jan 28 2007 Feb 25 2007 Mar 25 2007 Apr 22 2007 May 20 2007 Jun 17 2007 Jul 15 2007 Aug 12 2007 Sep 09 2007 Oct 07 2007 Nov 04 2007 Dec 02 2007 Dec 30 2007 Jan 27 2008 Feb 24 2008 Mar 23 2008 Apr 20 2008 May 18 2008 Jun 15 2008 Jul 13 2008 Aug 10 2008 Sep 07 2008 Oct 05 2008 Nov 02 2008 Nov 30 2008 Dec 28 2008 Jan 25 2009 Feb 22 2009 Mar 22 2009 Apr 19 2009 May 17 2009 Jun 14 2009 Jul 12 2009 Aug 09 2009 Sep 06 2009 Oct 04 2009 Nov 01 2009 Nov 29 2009 Dec 27 2009 Jan 24 2010 Feb 21 2010 Mar 21 2010 Apr 18 2010 May 16 2010 Jun 13 2010 Jul 11 2010 Aug 08 2010 Total Asda Promotions % Outlet Turnover 40 38 36 34 32 30 28 26 24 I choose my main store because prices are low Asda 126 Farm Foods 106 Tesco 105 Netto 105 Morrisons 104 Aldi 103 Lidl 101 Somerfield 91 Iceland 89 Co-operative 84 Independents 83 Sainsbury's 82 M&S 82 Waitrose 59 On-line Questionnaire - Outlet Share Index 52 w/e Jul 11 2010 The Agenda – A sense of proportion returns – Tesco – Never complacent – Asda – Price and/or Quality > – Sainsbury‟s – Striking a Balance – Morrisons – „Fresh for less‟ – Waitrose – Ethical extremism – Discounters – Threat postponed – M&S – Always the Bridesmaid – Home Delivery Value Values Retailer Price Track - Total Grocery 107 106 105 103 102 101 100 Sainsbury's 2010 2009 2008 2007 2006 2005 99 2004 Price Index 104 Total Grocery Budget Own-Label Trends £% within Outlet 8 Asda 7 6 5 Tesco 4 3 Sainsbury's Morrisons 2 1 0 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Premium Own-Label Sales Trends 12 wk y-o-y trend -4% 90 External & Internal Competition 70 60 50 40 30 20 10 Tesco Finest Sainsbury's Taste the Difference Asda Extra Special 2010 2009 2008 2007 2006 2005 2004 2003 2002 0 2001 Sales (Expenditure £m) 80 Morrisons The Best Value Values Sainsbury's Sainsbury's Baseline Weekly 3 Point Centred Moving Average Aug 08 2010 Jul 11 2010 Jun 13 2010 May 16 2010 Apr 18 2010 Mar 21 2010 Feb 21 2010 Jan 24 2010 Dec 27 2009 Nov 29 2009 Nov 01 2009 Oct 04 2009 Sep 06 2009 Aug 09 2009 Jul 12 2009 Jun 14 2009 May 17 2009 Apr 19 2009 Mar 22 2009 Feb 22 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Share (Expenditure) Sainsbury's Share of Till Roll Grocers 19 18 17 16 15 14 13 12 Trading Indices - Sainsbury 52 w/e Aug 08 2010 Broad Areas indexed on Total Groceries Total Total Total Total Total Total Total Healthcare Toiletries Fresh+Chilled Alcohol Household Ambient Groceries Frozen 121 117 108 105 94 92 72 Year-on-Year Expenditure Trends - % change Sainsbury's Total Alcohol 12.4 Total Household 6.1 Total Toiletries 4.9 4.6 TOTAL GROCERIES Total Ambient Groceries 4.1 Total Fresh+Chilled Total Frozen Total Healthcare 3.0 0.9 0.6 52 w/e 08 Aug 10 Sainsbury Share Index I actively seek out fair trade products I am prepared to pay more for organic food The nutritional labeling on food & drink products has an effect on what I buy I try to buy environmentally friendly products I am more likely to buy a HBA product if it is made of more natural ingredients It is important to me what brand I buy The brand name of the clothes I wear is important to me I regard myself as a connoisseur of food and wine I regularly use different types of media to keep up with the latest fashion trends If usual item is not available than I buy another size rather than change brands I am willing to travel further to shop at the supermarket I prefer I try to buy local product whenever I can My diet is very important to me I/my partner enjoy cooking to entertain friends and family I am always looking out for health & beauty products with new added benefits My style is influenced by celebrities or people I see in TV or in magazines I restrict how much sugary food I eat I regularly take active exercise I often treat myself/family to a meal out I make a shopping list before I go out and stick to it Share indexed on All Shoppers – 52 w/e Jul 11 2010 138 130 119 117 116 114 113 111 110 110 108 107 107 107 106 106 106 106 105 105 Fairtrade Feb-06 Mar-06 Apr-06 May-06 Jun-06 Jul-06 Aug-06 Sep-06 Oct-06 Nov-06 Dec-06 Jan-07 Feb-07 Mar-07 Apr-07 May-07 Jun-07 Jul-07 Aug-07 Sep-07 Oct-07 Nov-07 Dec-07 Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Jul-08 Aug-08 Sep-08 Oct-08 Nov-08 Dec-08 Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Fairtrade Prepacked Bananas Market Share 100 90 Sainsbury 80 70 60 50 40 30 Total Grocers 20 10 0 Fairtrade Shares 39 Sainsbury's 18 Co-operative 13 Tesco 11 Waitrose Asda 6 Morrisons 6 M&S 4 2 Somerfield Independents 1 Lidl 1 Iceland 1 Netto 0 Farm Foods 0 Aldi 0 Share of Fairtrade - 52 w/e Jun 13 2010 Eggs 60 40 30 May 20 2007 Jun 17 2007 Jul 15 2007 Aug 12 2007 Sep 09 2007 Oct 07 2007 Nov 04 2007 Dec 02 2007 Dec 30 2007 Jan 27 2008 Feb 24 2008 Mar 23 2008 Apr 20 2008 May 18 2008 Jun 15 2008 Jul 13 2008 Aug 10 2008 Sep 07 2008 Oct 05 2008 Nov 02 2008 Nov 30 2008 Dec 28 2008 Jan 25 2009 Feb 22 2009 Mar 22 2009 Apr 19 2009 May 17 2009 Jun 14 2009 Jul 12 2009 Aug 09 2009 Sep 06 2009 Oct 04 2009 Nov 01 2009 Nov 29 2009 Dec 27 2009 Jan 24 2010 Feb 21 2010 Mar 21 2010 Apr 18 2010 May 16 2010 Jun 13 2010 Jul 11 2010 Aug 08 2010 Not-Caged Eggs Market Share 100 90 80 Sainsbury’s 70 Asda Tesco 50 Morrisons No v-0 30 8 -N o 28 v-08 -D ec -08 25 -Ja n-0 22 9 -F eb -0 22 -M 9 ar0 19 -A 9 pr09 17 -M ay -0 14 -Ju 9 n-0 9 12 -Ju l-0 09 9 -A ug -09 06 -S ep -09 04 -O c 01 t-09 -N ov -09 29 -N o 27 v-09 -D ec -09 24 -Ja n-1 21 0 -F eb -1 21 -M 0 ar10 18 -A pr10 16 -M ay -1 13 -Ju 0 n-1 0 11 -Ju l-1 08 0 -A ug -10 02 - Net switching - Spend (£000s) Net Switching Volumes to Sainsbury's 50000 40000 30000 20000 10000 0 -10000 -20000 12 weeks ending Tesco No v-0 30 8 -N o 28 v-08 -D ec -08 25 -Ja n-0 22 9 -F eb -0 22 -M 9 ar0 19 -A 9 pr09 17 -M ay -0 14 -Ju 9 n-0 9 12 -Ju l-0 09 9 -A ug -09 06 -S ep -09 04 -O c 01 t-09 -N ov -09 29 -N o 27 v-09 -D ec -09 24 -Ja n-1 21 0 -F eb -1 21 -M 0 ar10 18 -A pr10 16 -M ay -1 13 -Ju 0 n-1 0 11 -Ju l-1 08 0 -A ug -10 02 - Net switching - Spend (£000s) Net Switching Volumes to Sainsbury's 50000 40000 30000 20000 10000 0 -10000 -20000 12 weeks ending Asda No v-0 30 8 -N o 28 v-08 -D ec -08 25 -Ja n-0 22 9 -F eb -0 22 -M 9 ar0 19 -A 9 pr09 17 -M ay -0 14 -Ju 9 n-0 9 12 -Ju l-0 09 9 -A ug -09 06 -S ep -09 04 -O c 01 t-09 -N ov -09 29 -N o 27 v-09 -D ec -09 24 -Ja n-1 21 0 -F eb -1 21 -M 0 ar10 18 -A pr10 16 -M ay -1 13 -Ju 0 n-1 0 11 -Ju l-1 08 0 -A ug -10 02 - Net switching - Spend (£000s) Net Switching Volumes to Sainsbury's 50000 40000 30000 20000 10000 0 -10000 -20000 12 weeks ending Morrisons No v-0 30 8 -N o 28 v-08 -D ec -08 25 -Ja n-0 22 9 -F eb -0 22 -M 9 ar0 19 -A 9 pr09 17 -M ay -0 14 -Ju 9 n-0 9 12 -Ju l-0 09 9 -A ug -09 06 -S ep -09 04 -O c 01 t-09 -N ov -09 29 -N o 27 v-09 -D ec -09 24 -Ja n-1 21 0 -F eb -1 21 -M 0 ar10 18 -A pr10 16 -M ay -1 13 -Ju 0 n-1 0 11 -Ju l-1 08 0 -A ug -10 02 - Net switching - Spend (£000s) Net Switching Volumes to Sainsbury's 50000 40000 30000 20000 10000 0 -10000 -20000 12 weeks ending Waitrose No v-0 30 8 -N o 28 v-08 -D ec -08 25 -Ja n-0 22 9 -F eb -0 22 -M 9 ar0 19 -A 9 pr09 17 -M ay -0 14 -Ju 9 n-0 9 12 -Ju l-0 09 9 -A ug -09 06 -S ep -09 04 -O c 01 t-09 -N ov -09 29 -N o 27 v-09 -D ec -09 24 -Ja n-1 21 0 -F eb -1 21 -M 0 ar10 18 -A pr10 16 -M ay -1 13 -Ju 0 n-1 0 11 -Ju l-1 08 0 -A ug -10 02 - Net switching - Spend (£000s) Net Switching Volumes to Sainsbury's 50000 40000 30000 20000 10000 0 -10000 -20000 12 weeks ending Lidl Aldi Netto No v-0 30 8 -N o 28 v-08 -D ec -08 25 -Ja n-0 22 9 -F eb -0 22 -M 9 ar0 19 -A 9 pr09 17 -M ay -0 14 -Ju 9 n-0 9 12 -Ju l-0 09 9 -A ug -09 06 -S ep -09 04 -O c 01 t-09 -N ov -09 29 -N o 27 v-09 -D ec -09 24 -Ja n-1 21 0 -F eb -1 21 -M 0 ar10 18 -A pr10 16 -M ay -1 13 -Ju 0 n-1 0 11 -Ju l-1 08 0 -A ug -10 02 - Net switching - Spend (£000s) Net Switching Volumes to Sainsbury's 50000 40000 30000 20000 10000 0 -10000 -20000 12 weeks ending Somerfield The Agenda – A sense of proportion returns – Tesco – Never complacent – Asda – Price and/or Quality – Sainsbury‟s – Striking a Balance > – Morrisons – „Fresh for less‟ – Waitrose – Ethical extremism – Discounters – Threat postponed – M&S – Always the Bridesmaid – Home Delivery Morrisons Morrisons Baseline Weekly 3 Point Centred Moving Average Aug 08 2010 Jul 11 2010 Jun 13 2010 May 16 2010 Apr 18 2010 Mar 21 2010 Feb 21 2010 Jan 24 2010 Dec 27 2009 Nov 29 2009 Nov 01 2009 Oct 04 2009 Sep 06 2009 Aug 09 2009 Jul 12 2009 Jun 14 2009 May 17 2009 Apr 19 2009 Mar 22 2009 Feb 22 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Share (Expenditure) Morrison Share of Till Roll Grocers 14 13 12 11 10 9 8 Morrisons - Shoppers vs. Spend 730 720 Spend £ 710 700 690 680 670 660 60 61 27 x 52 weekly periods ending Aug 08 2010 62 % of Households 63 64 08-Aug-10 13-Jun-10 18-Apr-10 21-Feb-10 27-Dec-09 01-Nov-09 06-Sep-09 12-Jul-09 17-May-09 22-Mar-09 25-Jan-09 30-Nov-08 05-Oct-08 10-Aug-08 15-Jun-08 20-Apr-08 24-Feb-08 30-Dec-07 04-Nov-07 09-Sep-07 15-Jul-07 20-May-07 25-Mar-07 28-Jan-07 03-Dec-06 08-Oct-06 13-Aug-06 18-Jun-06 23-Apr-06 26-Feb-06 £m Shopping Missions - Trolley Full Store Sales 500 400 300 200 100 0 Annual Till Roll Totals Expenditure Trends 15 Co-operative 13 Waitrose Iceland 8 Morrisons 8 5 Sainsbury's Tesco 4 Total Grocers 4 Asda 4 Hard Discounters 4 Independents Somerfield 0 -44 52 w/e Aug 08 2010 y/y % Change Morrisons Turnover Growth 52 w/e Jul 11 2010 - % chg 10 9 8 7 6 5 4 3 2 1 0 ABC1 C2DE Trading Indices - Morrisons 52 w/e Aug 08 2010 Broad Areas indexed on Total Groceries Total Total Total Total Total Total Total Fresh+Chilled Ambient Groceries Household Toiletries Alcohol Frozen Healthcare 104 102 100 93 93 86 80 Year-on-Year Expenditure Trends - % change Morrisons Total Alcohol 8.7 Total Toiletries 8.6 Total Fresh+Chilled 8.5 Total Household 8.4 TOTAL GROCERIES 7.6 Total Ambient Groceries 7.2 Total Frozen 0.5 52 w/e 08 Aug 10 Total Healthcare -2.8 Trading Indices - Morrisons 52 w/e Aug 08 2010 Market Sectors indexed on Total Groceries Fresh Fish Chilled Bakery Products Fresh Meat Canned Goods Biscuits Fresh Poultry+Game Hot Beverages Chilled Convenience Pet Care Savoury Home Cooking 128 121 118 115 109 109 107 107 106 105 The Fish Index 250 Waitrose Fish Trading Index 200 150 Sainsbury Morrisons Tot Grocers Tesco Total Co-op Somerfield 100 Asda 50 Lidl Netto Farm Foods Iceland 0 30 35 Aldi Tot Indepts 40 45 50 ABC1% 55 60 65 70 52 w/e Jul 11 2010 75 Reasons for Store Choice - Morrisons Like Cafe Restaurant 146 Has Butchery Counter 131 Has Fresh Fish Counter 114 Has A Delicatessen 109 Always Low Prices 104 Has In Store Bakery 103 Good Value For Money 102 Like Store Layout 101 Friendly Staff 101 Good Product Range 99 Less Queuing 93 Like Own Label Goods Sells Clothing+CDs etc On-line Questionnaire - Outlet Share Index 52 w/e Jul 11 2010 91 73 The Agenda – A sense of proportion returns – Tesco – Never complacent – Asda – Price and/or Quality – Sainsbury‟s – Striking a Balance – Morrisons – „Fresh for less‟ > – Waitrose – Ethical extremism – Discounters – Threat postponed – M&S – Always the Bridesmaid – Home Delivery Waitrose Waitrose Baseline Weekly 3 Point Centred Moving Average Aug 08 2010 Jul 11 2010 Jun 13 2010 May 16 2010 Apr 18 2010 Mar 21 2010 Feb 21 2010 Jan 24 2010 Dec 27 2009 Nov 29 2009 Nov 01 2009 Oct 04 2009 Sep 06 2009 Aug 09 2009 Jul 12 2009 Jun 14 2009 May 17 2009 Apr 19 2009 Mar 22 2009 Feb 22 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Share (Expenditure) Waitrose Share of Till Roll Grocers 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 12 w/e Periods 08-Aug-10 11-Jul-10 13-Jun-10 16-May-10 18-Apr-10 21-Mar-10 21-Feb-10 24-Jan-10 27-Dec-09 29-Nov-09 01-Nov-09 04-Oct-09 06-Sep-09 09-Aug-09 12-Jul-09 14-Jun-09 17-May-09 19-Apr-09 22-Mar-09 22-Feb-09 25-Jan-09 28-Dec-08 30-Nov-08 02-Nov-08 05-Oct-08 07-Sep-08 10-Aug-08 13-Jul-08 15-Jun-08 18-May-08 20-Apr-08 23-Mar-08 24-Feb-08 27-Jan-08 30-Dec-07 02-Dec-07 04-Nov-07 07-Oct-07 09-Sep-07 12-Aug-07 15-Jul-07 17-Jun-07 20-May-07 22-Apr-07 25-Mar-07 Waitrose Year-on-Year Trends - Till Roll £% 20 18 16 14 12 10 8 6 4 2 0 Waitrose Share Index I regard myself as a connoisseur of food and wine I am prepared to pay more for organic food I actively seek out fair trade products The brand name of the clothes I wear is important to me I try to buy environmentally friendly products I try to buy local product whenever I can It is important to me what brand I buy I/my partner enjoy cooking to entertain friends and family I am more likely to buy a HBA product if it is made of more natural ingredients I regularly take active exercise I stick with a brand I usually buy than try something I am not very sure of I find the amount of recycling now too confusing I have a pastime/hobby that is an important part of my life I am willing to travel further to shop at the supermarket I prefer I am always looking out for health & beauty products with new added benefits The way I look is extremely important to me I try to lead a healthy lifestyle If usual item is not available than I buy another size rather than change brands I regularly use different types of media to keep up with the latest fashion trends I think I will be doing more of my grocery shopping online in the future Share indexed on All Shoppers – 52 w/e Feb 21 2010 212 181 162 158 140 135 133 127 126 123 123 122 122 120 119 118 115 115 114 113 Organic Total Organic Products £m‟s 100 80 60 40 Annualised Value = £1bn Latest 52 weeks 8% decline 20 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 0 Organic Trading Indices 455 Waitrose 148 Sainsbury's 94 Tesco 87 M&S Asda 57 Co-operative 57 Morrisons 56 50 Independents 38 Somerfield 32 Lidl 25 Aldi Farm Foods Netto Iceland 18 5 0 Share of Organic Indexed on Total Grocery Share - 52 w/e Jun 13 2010 Reasons for Store Choice - Waitrose Has Fresh Fish Counter 144 Has Butchery Counter 142 Has A Delicatessen 130 Less Queuing 122 Friendly Staff 115 Good Product Range 107 Like Store Layout 107 Like Own Label Goods 99 Good Value For Money 95 Has In Store Bakery 93 Like Cafe Restaurant 89 Always Low Prices Sells Clothing+CDs etc 59 47 On-line Questionnaire - Outlet Share Index 52 w/e Jul 11 2010 Reasons for Store Choice - Low Prices Asda 126 Farm Foods 106 Tesco 105 Netto 105 Morrisons 104 Aldi 103 Lidl 101 Somerfield 91 Iceland 89 Co-operative 84 Independents 83 Sainsbury's 82 M&S 82 Waitrose 59 On-line Questionnaire - Outlet Share Index 52 w/e Jul 11 2010 Trading Indices - Waitrose 52 w/e Jul 11 2010 Broad Area Total Total Total Total Total Total Total Fresh+Chilled Ambient Groceries Household Alcohol Frozen Toiletries Healthcare Market 126 91 89 85 58 48 40 Market Sector Fresh Fish Chilled Bakery Products Chilled Drinks Chilled Convenience Fruit+Veg+Salads Sweet Home Cooking Fresh Meat Hot Beverages Fresh Poultry+Game Frozen Confectionery Packet Breakfast Savoury Home Cooking 237 165 161 139 138 119 116 115 115 108 106 105 Chilled Gravy+Stock Fresh Stuffing Mixers Chilled Olives Chilled Prepared Fish Chilled Salad Accomps Hand Wash Products Vegetable in Jar Fresh Soup Chilled Rice Chilled Pate+Paste+Spread Ambient Olives Tonic Water Liquid+Grnd Coffee+Beans Chilled Cooking Sauces Chilled One Shot Drinks Canned Lemonade Wet/Smoked Fish Chilled Vegetarian Ginger Ale 765 658 524 480 477 465 446 417 382 336 279 272 266 257 251 242 240 239 231 227 The Agenda – A sense of proportion returns – Tesco – Never complacent – Asda – Price and/or Quality – Sainsbury‟s – Striking a Balance – Morrisons – „Fresh for less‟ – Waitrose – Ethical extremism > – Discounters – Threat postponed – M&S – Always the Bridesmaid – Home Delivery Aldi Lidl Netto 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 Share (Expenditure) Long-Term Share of Till Roll Grocers 4 3 2 1 0 Kwik Save 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 Share (Expenditure) Kwik Save Share of Till Roll Grocers 12 10 8 6 4 2 0 Kwik Save + Discounters 08-Aug-10 11-Jul-10 13-Jun-10 16-May-10 18-Apr-10 21-Mar-10 21-Feb-10 24-Jan-10 27-Dec-09 29-Nov-09 01-Nov-09 04-Oct-09 06-Sep-09 09-Aug-09 12-Jul-09 14-Jun-09 17-May-09 19-Apr-09 22-Mar-09 22-Feb-09 25-Jan-09 28-Dec-08 30-Nov-08 02-Nov-08 05-Oct-08 07-Sep-08 10-Aug-08 13-Jul-08 15-Jun-08 18-May-08 20-Apr-08 23-Mar-08 24-Feb-08 27-Jan-08 30-Dec-07 02-Dec-07 04-Nov-07 07-Oct-07 09-Sep-07 12-Aug-07 15-Jul-07 17-Jun-07 20-May-07 22-Apr-07 25-Mar-07 Kwik Save + Discounters Combined Market Share £% 7 6 5 4 3 2 1 0 -20 Heavy Buyer Medium Buyer Light Buyer All Buyers 08 Aug 10 11 Jul 10 13 Jun 10 16 May 10 18 Apr 10 21 Mar 10 21 Feb 10 24 Jan 10 27 Dec 09 29 Nov 09 01 Nov 09 04 Oct 09 06 Sep 09 09 Aug 09 12 Jul 09 14 Jun 09 17 May 09 19 Apr 09 22 Mar 09 22 Feb 09 25 Jan 09 28 Dec 08 30 Nov 08 02 Nov 08 Actual Contribution (000,000s) Aldi 160 140 120 100 80 60 40 20 0 Iceland Iceland Baseline Weekly 3 Point Centred Moving Average Aug 08 2010 Jul 11 2010 Jun 13 2010 May 16 2010 Apr 18 2010 Mar 21 2010 Feb 21 2010 Jan 24 2010 Dec 27 2009 Nov 29 2009 Nov 01 2009 Oct 04 2009 Sep 06 2009 Aug 09 2009 Jul 12 2009 Jun 14 2009 May 17 2009 Apr 19 2009 Mar 22 2009 Feb 22 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Share (Expenditure) Iceland Share of Till Roll Grocers Iceland Share of Till Roll Grocers 2.5 2 1.5 1 0.5 0 ICELAND AND FARM FOODS – SHARE BY SECTOR Fresh & Chilled gaining share from Frozen Value Share (%) Grocery Sector Value Share 2.5 2.8 40.6 37.9 4.3 42.7 3.7 36.5 Toiletries Household Healthcare Frozen 27.1 24.5 29.6 24.3 4.9 5 2009 2010 20.2 25.9 Fresh & Chilled Ambient 32.5 33.5 Alcohol 2009 2010 Kantar Worldpanel Total Grocery – 12 w/e to 08 Aug 2010 vs 09 Aug 2009 Somerfield Somerfield Baseline Weekly 3 Point Centred Moving Average Aug 08 2010 Jul 11 2010 Jun 13 2010 May 16 2010 Apr 18 2010 Mar 21 2010 Feb 21 2010 Jan 24 2010 Dec 27 2009 Nov 29 2009 Nov 01 2009 Oct 04 2009 Sep 06 2009 Aug 09 2009 Jul 12 2009 Jun 14 2009 May 17 2009 Apr 19 2009 Mar 22 2009 Feb 22 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Share (Expenditure) Somerfield Share of Till Roll Grocers 5 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 Co-operative Co-operative Baseline Weekly 3 Point Centred Moving Average Aug 08 2010 Jul 11 2010 Jun 13 2010 May 16 2010 Apr 18 2010 Mar 21 2010 Feb 21 2010 Jan 24 2010 Dec 27 2009 Nov 29 2009 Nov 01 2009 Oct 04 2009 Sep 06 2009 Aug 09 2009 Jul 12 2009 Jun 14 2009 May 17 2009 Apr 19 2009 Mar 22 2009 Feb 22 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Share (Expenditure) Co-operative Share of Till Roll Grocers 7 6.5 6 5.5 5 4.5 4 3.5 3 The Agenda – A sense of proportion returns – Tesco – Never complacent – Asda – Price and/or Quality – Sainsbury‟s – Striking a Balance – Morrisons – „Fresh for less‟ – Waitrose – Ethical extremism – Discounters – Threat postponed > – M&S – Always the Bridesmaid – Home Delivery M&S M & S Baseline Weekly 3 Point Centred Moving Average Aug 08 2010 Jul 11 2010 Jun 13 2010 May 16 2010 Apr 18 2010 Mar 21 2010 Feb 21 2010 Jan 24 2010 Dec 27 2009 Nov 29 2009 Nov 01 2009 Oct 04 2009 Sep 06 2009 Aug 09 2009 Jul 12 2009 Jun 14 2009 May 17 2009 Apr 19 2009 Mar 22 2009 Feb 22 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Share (Expenditure) M&S Share of Retailer ShareTrack Grocers 6 5 4 3 2 1 0 Share of Total Grocers Fresh+Chilled Tesco Sainsbury's Asda Morrisons 30.3 30.6 18.1 18.0 15.8 15.5 12.6 13.3 Co-operative 5.2 5.8 M&S 5.8 5.8 Waitrose 5.1 5.5 Aldi 2.4 2.4 Lidl 2.1 2.1 Somerfield 3.5 1.6 Iceland 1.4 1.5 Independents 1.3 1.2 Netto 0.6 0.6 Farm Foods 0.3 0.4 52 w/e 09 Aug 09 52 w/e 08 Aug 10 Trended Loyalty Breakdown Waitrose £% 19.8 25.2 55.0 10-Aug-08 20.4 26.2 53.3 09-Aug-09 M&S £% 20.6 46.3 41.5 42.4 13.7 11.3 13.6 10-Aug-08 09-Aug-09 08-Aug-10 26.8 42.0 52.7 08-Aug-10 52 w/e periods High Loyal (>50%) 44.4 44.8 Medium Loyal (>20%) Low Loyal (>0%) 12 w/e Periods 08-Aug-10 11-Jul-10 13-Jun-10 16-May-10 18-Apr-10 21-Mar-10 21-Feb-10 24-Jan-10 27-Dec-09 29-Nov-09 01-Nov-09 04-Oct-09 06-Sep-09 09-Aug-09 12-Jul-09 14-Jun-09 17-May-09 19-Apr-09 22-Mar-09 22-Feb-09 25-Jan-09 28-Dec-08 30-Nov-08 02-Nov-08 M&S Year-on-Year Growth Trends - RST £% 7 6 5 4 3 2 1 0 -1 -2 -3 The Agenda – A sense of proportion returns – Tesco – Never complacent – Asda – Price and/or Quality – Sainsbury‟s – Striking a Balance – Morrisons – „Fresh for less‟ – Waitrose – Ethical extremism – Discounters – Threat postponed – M&S – Always the Bridesmaid > – Home Delivery Total Internet Lifestage Signatures 9 8 7 6 5 4 3 2 1 0 Pre-Family Young Family Middle Family 0-4 Years 5-9 Years 52 w/e Aug 10 2008 Family 10+ Years Older Empty Nesters Dependents 52 w/e Aug 09 2009 52 w/e Aug 08 2010 Retired Grocery Internet Household Income Signatures 12 10 8 6 4 2 0 £0 - £9999 pa £10000 £19999 pa £20000 £29999 pa 52 w/e Aug 10 2008 £30000 £39999 pa £40000 £49999 pa 52 w/e Aug 09 2009 £50000 £59999 pa £60000 £69999 pa 52 w/e Aug 08 2010 £70000 + Till Roll - Duplication by Tesco Internet Buyers Sainsbury's Internet 8.8 489 14.4 Asda Internet 450 3.7 Waitrose Internet Tesco 75.3 308 111 Sainsbury's 37.9 81 Asda 38.4 79 8.6 Waitrose Morrisons 27.9 Brand Buyers also Buying 76 66 Duplication Index 12 w/e Aug 08 2010 What does this tell us about the future? 0 Jul-10 May-10 Mar-10 Jan-10 Nov-09 Sep-09 Jul-09 May-09 Mar-09 Jan-09 Nov-08 Sep-08 Jul-08 May-08 Mar-08 Jan-08 Nov-07 Sep-07 Jul-07 May-07 Mar-07 Jan-07 Nov-06 Sep-06 Jul-06 May-06 Mar-06 Jan-06 Nov-05 Sep-05 Jul-05 May-05 Mar-05 Jan-05 Nov-04 Sep-04 Jul-04 May-04 Nationwide Consumer Confidence Index 120 100 80 60 40 20 Source: ONS Series ABQI / ABZV 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 1972 1971 1970 1969 1968 1967 1966 1965 1964 1963 Food and Drink as a Proportion of UK Household Expenditure % 25 20 15 10 5 0 edward.garner@kantarworldpanel.com twitter edgarner