Retaining Loyalty to Irish Brands November 2013

advertisement

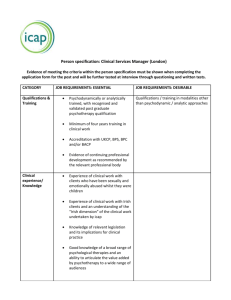

Retaining Loyalty to Irish Brands November 2013 Contents Background ............................................................................................................... 1 Research Methodology ........................................................................................... 1 Consumer and Shopper Context........................................................................... 2 What is an Irish brand for Irish Consumers? ........................................................... 5 Why do they buy Irish Brands? ................................................................................ 9 Barriers to choosing Irish brands ........................................................................... 11 What this all means for Irish brands owners ........................................................ 14 Conclusion ............................................................................................................... 23 Background Bord Bia’s 2013 report on Retaining Loyalty to Irish brands is the third piece of work by the state agency on this important topic for Irish brand owners. The first study in 2009 was exploratory around how Irish consumers defined what an Irish brand was and what made it more likely that they chose an Irish brand. The 2011 report identified 3 different consumer typologies when it came to their allegiance to Irish brands: totally loyal, conditionally loyal and not loyal. The 2013 goes further and in particular explores the dramatic impact of the change in retail landscape (rise of the discounters) on the whole issue of Irishness. In many ways the discounters have reframed the debate on Irishness by making it a cornerstone of their strategy in the Irish market. Research Methodology The 2013 work on Retaining Loyalty to Irish brands has 3 main components: Workshop with Irish Brand Owners Quantitative Online study Qualitative discussion groups Dublin Bord Bia started by speaking with a number of Irish brand owners to understand the issues from their perspective and what elements they felt were most impacting on their business. They also helped us identify topics to discuss with consumers and shoppers. 1 Bord Bia conducted quantitative research in July 2013 using on line methodology with 400 people aged 18 to 54 who were responsible for the main household shop: In addition Bord Bia conducted qualitative groups in Dublin with opinion leading consumers to get a more in depth analysis of the key drivers of Irish brand purchasing. The results presented here are the consolidation of both the quantitative and qualitative shopper and consumer interactions. Consumer and Shopper Context To understand the context in which consumers and shoppers make decisions on choosing Irish brands we have to look at the broader environment that they find themselves. Ireland has experienced a recession since 2005 which has impacted directly on consumers household budgets. An Irish League of Credit Unions study in 2 2013 found that in relation to disposable income, 27% of people agreed that they are very worried about how they will manage in 2013. A further 42% said “I should be okay but I’ll need to manage my household budget very closely”. The findings from the Growing Up in Ireland study published in November 2013 found that two-thirds of families with young children say the recession has had a very significant effect on them, with 43 per cent having had to cut back on basics and a quarter finding it very difficult to make ends meet. Clearly, shoppers feel the economic pressures to get the best value and to shop around. But the impact of recession reaches even beyond consumers’ pockets to their minds. The psychological impact of recent times is that consumers have lost trust in the traditional institutions of the state such as banks, church and government. Even the food industry has lost consumers trust – the recent equine DNA revelations has implications beyond the products affected. Consumers have become more concerned about what it is in their food and where it comes from. The single biggest change since Bord Bia began work in this area in 2009 are consumers shopping habits: over 60% now say they shop in German owned discount stores at least once per month. 74% 65% 61% 52% 38% 11% Mults used at least once a month 3 In focus groups consumers told us they valued the contribution these discounters made to helping them control their household budget. Shopper reported that the discounters have helped to bring the price down from previous “rip off” Irish brands that were charging more because they were Irish. Discounters help to keep the market competitive and offers shoppers added value. The quality of discounters products were perceived to have improved with shopper commenting that their products can often be better than the main retailers’ and they have lots more Irish products. These discount operators, Aldi and Lidl, are putting Irishness at the heart of their communications. In particular Aldi with its “Love Ireland, Like Aldi” campaign has been seen as leading the way on Irishness. In qualitative groups a high recall of Aldi’s campaign was noted. Alde’s television advertising showing the local farmer behind the product really struck a chord with shoppers. There is noticeable shift in consumer opinion that the discounters are doing more good for local producers and Ireland than the main retailers. Shopper believe they are supporting Ireland (but at competitive prices) via shopping in the discounters. 4 What is an Irish brand for Irish Consumers? For 82% it is simply products that are sourced and manufactured here. For a further 17% it is about brands that have been around a long time. These brands have become part of daily life so you get some heritage brands misclassified as Irish simply through familiarity and comfort. What is an Irish Brand? Where does an Irish brand come from? Interestingly there is an almost even split in consumers: just over half say Republic of Ireland and almost half say “Island of Ireland”. Where is an Irish brand from? 5 Not surprisingly iconic Irish brands are attributed by consumers to be indisputably Irish Indisputable Irish Brands Other well known and loved brands equally get a high scoring: But supporting the finding that some brands, by virtue of their longevity in the market, are misattributed as being Irish we found several examples: Lyons tea, no longer packed in Ireland, was described by 69% of consumers as being an Irish brand. 6 Conversely some fully home grown Irish brands despite being manufactured here are not seen as Irish. For examples Goodfellas pizza which is manufactured in Naas is “not Irish” according to 71% of consumers. Home grown—not perceived Irish Is buying Irish important when you shop? For the majority of Irish consumers Irish is an important consideration when they shop with only 11% of consumers saying it is not important. Is buying Irish important? 7 However there is a significant apathetic middle ground of disengaged shoppers. These tend to be younger (under 35 years of age). Encouragingly 3 out of 4 say they are more likely to purchase a product if they notice it is Irish. This is a huge opportunity for Irish brands to tap into this positive propensity among Irish shoppers to pick up clearly labelled Irish brands. 8 This propensity to select a brand based on its Irish credentials does vary by category with commodities such as meat, cheese and milk in particular, scrutinised for their Irish sourcing. Packaged goods like chocolate and soups are among those where the Irish messaging is not as top of mind. Nevertheless a brand could use its Irish credentials to differentiate from competitors in its category. Why do they buy Irish Brands? When we asked shoppers what motivated them to choose Irish brands the overwhelming reason was the economy and jobs. The older they got the more important that was for them. 9 But this pressure to buy Irish to benefit the economy also leads to feeling of guilt. 23% said “I feel guilty when I do not buy Irish” so there is some negativity and push back by consumers. More positive motivators for buying Irish included a perception that Irish brands are the best quality and Irish brand are “better suited to Irish people” reflective of the knowledge local brands have of local tastes and palates 10 Barriers to choosing Irish brands So whilst consumers are positive to buying Irish and being identifiable as Irish encourages pickup there are some significant barriers to choosing Irish brands: Firstly the retailers have contributed to blurring the lines and confusion. Lidl’s recent defence of its labelling “Produce of Ireland” vs. “Produced in Ireland” demonstrates how difficult consumers find it to correctly identify what they perceive to be an Irish product. Previous debates on Irish smoked salmon vs Smoked Irish salmon also demonstrate consumer frustration with the semantics of the food industry. Retailer behaviour such as Aldi putting the tricolour on Northern Ireland products and uncertainty about who makes private label brands contributes to this confusion. Irish sounding names on non Irish products eg Kavanagh’s porridge, Fallons Tea, Glensallagh ham are seen by consumers as being designed to mislead them. All this contributes to the consumer feeling uncertain and suspicious and 2 in 3 saying there are misleading claims about Irishness. 11 12 The myriad of on pack symbols endorsing Irish has led to confusion over their meaning and significance and how a brand qualifies for such symbols. However, symbols communicating Irish credentials on pack do influence shopper’s propensity to purchase those brands: 13 But the biggest barrier to Irish shoppers choosing Irish brands is the perception that Irish brands are more expensive – 2 in 3 think they are more expensive and only 2 in 10 think Irish brands are good value. 14 What this all means for Irish brands owners Firstly, you need to think about your category. For commodity categories like meat and dairy it is a huge issue and consumers actively seek out Irish messaging. So you need to assess if being Irish is core to your category. Even if on first glance Irishness is not central to your category this does not necessarily mean that it is not appropriate for you to highlight your Irishness in such categories. It may be a differentiating strategy for you – you might be the only brand to say ‘I’m Irish’. For example the brand Folláin in the jam category achieved brand standout by highlighting its Irishness in a category dominated by imported brands. Secondly, you need to consider what life stage your target market is. Irishness is something that over 35s value more – at their life stage they are acutely aware of the economic impact. So if this audience is core for you this could be a very motivating message. Most importantly you need to think about your brand and its relationship with consumers and what part Irishness plays in your brand mix. Your brand relationship will be a mix of rational and emotional cues to consumers. What part does Irishness play in both the rational and emotional aspects of your brand? It may be part of underpinning your rational relationship in talking about product quality or the provenance of your ingredients or local employment. Or it may be part of the emotional side of your brand evoking the Irish side of your brand’s personality or tone of voice. Below are some examples of brands that have done this. But if you are using your brand’s Irishness to appeal to consumers you need to make sure it is not done in a way that provokes guilt feelings for them as this leads to a more negative relationship with your brand. 15 Here are some examples of how different brands have used their Irishness as part of their branding strategy: The research shows consumers are losing trust and want transparency: they want to know what’s in their food and where it comes from. Glenisk is a brand built on a core philosophy of the benefits of organic farming. It sets out a vision for an Organic Ireland including educating consumers about the benefits. It builds the Irishness of its brand around its core of organic and the story of the Cleary family and the inter-generational effort. It does transparency through its “Meet our Farmers” campaign. 16 Another example is Keoghs with their spud nav which puts traceability at the heart of the brand. A promise to consumers that every bag of crisps can be traced back to the field where the potatoes were sown – trace my crisps. “Our crisps are made from 100% Irish potatoes grown and cooked on our family farm” is a confident statement around the provenance of the brand . 17 Sometimes your Irishness is expressed in the tone of voice your brand uses. For example Broderick Brothers who make a range of cakes and bars talk in a colloquial fashion: “What’s the crack?” and eejit jokes that only an Irish audience would understand. The whole persona of the brothers and their humour based interactions are quintessentially Irish in character. Some Irish brands imply their Irishness rather than overtly say “we’re Irish”. For example Barry’s tea with their name campaign, where they used distinctly Irish names. 18 Consumers like to know the story behind the brand – where their food comes from, what’s in it, who made it etc. Glenilen is an example of a brand that tells the story of the people behind the brand – the care they take. They talk about the cows, the milk, the purity and simplicity of the ingredients, handmade. The values that surround the brand support this: solar panels, harvesting rainwater, returnable bottles for milk are all initiatives to show the company lives the brands values. They don’t scream Irish but they build their brand around core values of natural goodness and authenticity. 19 Another way to market your Irishness is using your brands heritage. An example is Flahavans porridge – it’s been around for over 200 years with 7 generations of the family involved in the business. But even with a heritage brand you need to keep your brand relevant and contemporary. There is a harking back by consumers to traditional ways of life in a recession. Bord Bia’s recent Consumer Lifestyle Trends report called this trend “keeping it real”. 20 Appealing to Local Tastes: We saw that one of the reasons consumers are motivated to choose Irish brands is their belief that these brands appeal to a local palate, that these brands understand local Irish tastes and that their product formulation is more acceptable. Tayto is an example of this phenomenon. So your unique locally customised taste might be the Irishness in your brand. 21 There are more explicit ways to say you are an Irish brand like using an Irish or even Irish sounding brand name eg Folláin, Lily O’Brien’s, iASC. But beware – it may limit you in export markets through its difficulty in pronouncing and its translation. 22 Using Brand Ambassadors: Using brand ambassadors is another way to market your Irishness – using local heroes who personify what your brand is about. But there is some risk involved in personality endorsing – if their reputation gets tainted so does yours. Conclusion In talking to shoppers and consumers we have discovered that Irishness is important to Irish consumers and it influences their purchase behaviour. But Irish consumers are under economic pressure in these recessionary times and they perceive that Irish brands are more expensive. Retailers and manufacturers create confusion for consumers on what is an Irish brand and so put barriers in the way. Your brand can help consumers by clearly indicating your Irishness through a range of mechanics. But using Irishness alone will not be enough. You need to deliver the product quality, the value and then build the Irishness into the fabric of your brand – both at a rational and emotional level. So the job to be done is not just about retaining Loyalty to Irish brands it about retaining loyalty to your brand. 23 Retaining Loyalty to Irish Brands November 2013 For further information please contact info@bordbia.ie or Tel: 01 6685155