Craft Beer North America Study

advertisement

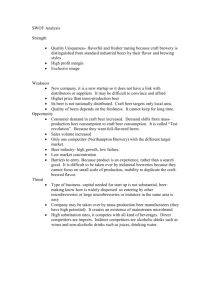

Craft Beer North America Study This study was commissioned by Bord Bia to assist the growing number of craft beer and craft cider makers assess the opportunities and operating framework of the North American market. Phase 1 The objective is to provide background consumption levels and information on the purchasing behaviour of various states to determine which are the best states or regions for Irish craft breweries to do business in the United States and Canada The US beer market is dominated by domestic brands and has remained stagnant over the last number of years. The craft beer category has grown by 500% in value over the last 10 years and quadrupled its market share in that same timeframe. The US market is highly regulated and there is a three tier system in place which prevents a company owning a stake in more than one of the three tiers. Each state is responsible for their own regulations in relation to the sale and distribution of alcohol, meaning that the US beer market has 51 (50 states + Washington DC) sets of laws relating to the pricing, distribution, labelling etc. of alcohol. There is further information and data in this report on beer consumption (value, volume), market share, industry structure and distribution. The surge in popularity of craft beer, has meant that the number of breweries has increased significantly in the past few years. There are thousands of breweries currently operating in the US and thousands more in planning. California has the largest number of breweries and 76% of craft beer consumed is done so in just 12 of the 50 states. The full report documents the growth in the craft beer market by volume, % increase and market share, and identifies the leading domestic craft breweries in the US. Data is also available on production and consumption by state. Imported beer represents 13% of total beer consumed in the US and Ireland is the 5th largest source of imported beers. The imported beer category is dominated by large, global brands. The west coast is dominated by the imported beer from Mexico, while European imports appear to be more popular along the east coast. The full report details the country of source of beer imported into the US and identifies where the largest growth is occurring and the brands dominating the market. The Irish Diaspora presents a high potential segment of the market for Irish craft breweries to target. This report contains further information on the potential of New England and New York as a market for Irish craft beer and identifies key targets for breweries looking to enter the US market. Cider is a high growth category within the beer market and is becoming a more socially acceptable beverage in the US. Cider drinkers typically migrate from wine and spirits and so are new entrants to the beer market. 98% of the market is owned by only 10 brands. Further information on the US cider market including, leading cider brands, market growth figures, sales volumes and a profile of the typical cider drinker in the US. The Canadian beer market is dominated by just two companies, In line with population figures, beer consumption is concentrated within Ontario and Quebec (61%). The overall beer market in Canada is declining, however in certain provinces; growth can be seen in the imported beer category. Full details on consumption trends by province can be found within the full report as can an overview of the markets where the growth in imported beer can be seen. Phase 2 The objective is to deep dive into one state where the opportunity seems strongest for craft breweries from Ireland This state has 23% of the population claiming Irish heritage and craft beer owning almost 10% of the total beer market. There are five leading brands of beer in the state which account for a 76% share of the overall beer market. These larger brands have seen a drop in consumption between 2012 and 2013. A breakdown of the demographic of the state can be found in the full report alongside information relating to beer consumption by brand. The report also provides information on the top craft breweries in the state and S.W.O.T analysis on a number of relevant breweries. The craft movement in this state has been driven by social media and local events/promotions. Craft beer is associated with high quality products, sustainability and local products are important. There is significant growth in bars that specialise in craft beer. Craft beer drinkers are typically looking for something “new” which can be positive at first, but means there is tough competition to stay relevant. Most liquor stores are independently owned as there is legislation restricting the ownership of more than three stores. Liquor stores are mainly large shops which carry every brand. A comprehensive overview of the on-trade and off-trade environment is included in the full report which identifies leading bars and liquor stores who specialise in craft beer. A guide on craft beer pricing for MA is also included. The relationship with the importer is governed by a contract and typically involves a long-term commitment. An agent is an alternative to an importer who holds an importer licence. In this instance, the brewery is responsible for all sales and marketing activity. There is a guide to selecting an importer in the full report. Distributors purchase product from importers and sell it into retail or foodservice. Selecting the right distributor is crucial as this relationship is governed by law and can be difficult to terminate. A distributor will work with many brands, which means getting their attention can be difficult. Having a sales and marketing resource in-market can be important in demonstrating a company’s commitment to a market. A comprehensive guide to attracting and working with a good distributor can be found in the report with an overview of the leading distributors operating in MA. There are other considerations to be taken into account when exporting craft beer to the US. Included in the report is an overview of legal, logistical, and currency considerations that should be taken into account. To get access to the full report, please email info@bordbia.ie