Document 11039464

advertisement

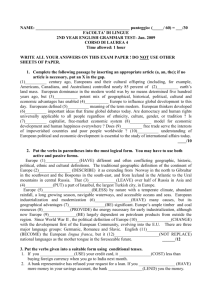

2*p^l BANKING AND THE INFORMATION UTILITY* Martin Greenberger, Associate Professor Sloan School of Management and Project MAC Massachusetts Institute of Technology 124-65 MASS. INST. TECH I: 21 INSTITUTE OF TECHNOLOGY 50 MEMORIAL DRIVE [BRIDGE, MASSACHUSETTS 0213 Qop<*\ ]_ BANKING AND THE INFORMATION UTILITY* Martin Greenberger, Associate Professor Sloan School of Management and Project MAC Massachusetts Institute of Technology 124-65 Prepared for presentation to the National Automation Conference of the American Bankers Association, San Francisco, March 8-10, 1965. This talk was typed and edited at an on-line terminal of the M.I.T. time-shared computer using the typset and runoff commands developed by J.H. Saltzer. Work reported herein was supported by Project MAC, an M.I.T. research program sponsored by the Advanced Research Projects Agency, Department of Defense, under Office of Naval Research contract number nonrReproduction in whole or in part is permitted 4102(01) for any purpose of the United States Government. . . RECEIVED NOV 9 Mf/f PAGE BANKING AND THE There 25 to 30 is a INFORMATION UTILITY very high probability that within years transformed into the a vast banking probably industry electronic information identities under the depends on the attitude and role assumes as its mode of doing metamorphos i that business will be system of banking incipient Park 2. Progressive fires in the halls of 90 kindled Avenue, by ABA's special the committee on automation; 3. Scattered brush fires throughout the banking community, such as the recent study by Bankers Trust pointing immediate the to practicality of terminating check flow at the paying bank; Bonfires ignited by communications the industry called with a match bi -payment-by-phone and a lighting fluid known as Touch-Tone; o 1 computer fanning by 5„ Flame the IBM manufacturers with a technology that calls Tele-Processing and others call on-line real-time systems; 6„ A within It a modern s. This conference and its two predecessors; 1 may management undergoes as evidenced by: k or transformation. The metamorphosis is already in its 1. next the national and international scope. Today's banks may not maintain their 2 credit 15 card blaze years from which the has local spread charge stages, PAGE 3 individual of accounts stores, to the credit of company-wide geographically dispersed firms, to the multi-purpose cards oil companies, of hotel chains and to the purpose documents of general American Express/ Diners Club, Carte Blanche* and Bank of America, to semi-automatic credit bureaus like Telecredit in Los Angeles, to the still more comprehensive citywide, statewide, and nationwide computerized systems currently under di scuss ion; 7 Sparks from an accelerated speed up in the velocity of money and a hotly competitive money market. I choose metaphor the burning, of not to be inflammatory, but simply to dramatize the dream that many of us have had of a complete conflagration of checks and Maybe that does seem inflammatory to some of you. But most of us paper currency is highly flammable in that its volume of flow has been and is the biggest headache of Many is the tired vice president who has to sense the exponentially increasing banking cash. operations today. refreshed awoken after dreaming of the cremation of the check,, dream? It great deal of technical expertise to see Can elimination of the check be more than does not require a that There it can, legal are a problems,, be to sure, especially in the context of present laws (signatures, valid documents, etc.), I shall Clarke has to say about them. and the physical hardware What a it takes is to But the engineering displace network of simple, placed at retail outlets around the on-line to a complex of what be interested to hear central checks inexpensive country credit and files John know-how are ready, terminals connected stored on PAGE flexible computer systems with memory. cheaper. Memories relatively are fast large, cheap Terminals like the Touch-Tone random and to cost comparisons/ access are getting telephone set fairly cheap, and they will get cheaper too. When l» are comes it electronic communication will win hands down over proof and transit. wrote something about the possibility of an I credit exchange last May in Atlantic, the automated part as of a broader discussion of the concept of an information utility. The ramifications extend far beyond the automatic payment of John bills. opportunities meeting, I considered Case practical and some details believe he may continue July last on that notions several years ago at this at theme Joseph Halina covered the communication side of two years ago at this meeting, banking the of today, system the John Cocke discussed similar IBM; and I ideas go back much further than that, know that the basic although I am not the that the one to try to trace them. Let me mention just a word about credit instrument of the future may take the universal credit card, key. is It plastic figuratively speaking, by insertion terminal, First c there John Cocke has called encoded an form the card into a it stored in the files of the credit simple identifies the vendor, The amount of the and sale remote money The exchange. carries the account number of the owner, money a unlocks, that the current contents of the customer's is the is box card terminal entered PAGE into the terminal 5 and the computer does a fast turnaround to be sure that the customer's balance and credit adequate for comsummation of safety measures range from a into the face of the card, to a computer rating transaction. the are Possible photograph of the owner pressed program that recognize the owner's voice and detect an imitation. event of serious uncertainty or risk, the computer an on-line interrogation before it makes the In conducts evaluation. its From the individual's point of view / can the advantage of a single credit card over the check book, wallet/ and plethora of cards many of Operationally there are carry now us few small a needs problems. of a money key depends on ready access to discussion no The concept information in a central file and requires communicating and processing each separate transaction real in But time. time is not justified for purchase of than the cost of negligible transactions a toll call information will credit exchange, as, a real newspaper, any more a message Furthermore, content. for of justified for is require cost the with a when J,G. rushes Wichita from New York to visit his ailing mother off at the Wichita Florist for Such long-distance larger threshold a transactions amount long-distance telephone for call certain communication example, demand a urgency or information content than a demands local to stops flowers. proportionately justification, normally distant and cheery bouquet of of call. just a as a greater PAGE fall 6 There are several ways that transactions whose amounts below threshold levels may be handled, can Some accumulated locally and transmitted by batch store and forward procedure,, the traditional delayed a Others may be paid by cash There manner. in no reason why be in all traces of coins and paper currency must be erased from this system of the future. J„G„ is presents his card to a terminal at Wichita Bank and requests $100 to cover his he The town. in is transaction $100 distance connection, whereas flowers may A not. charge service small long a transaction $5 a while expenses warrants the for the makes the transaction profitable to the Wichita Bank. There alternative cashless is one science fiction. Let me call with the money kev It . is solid his identity and together with other him with money card of equivalent produced by a with $100 in cash, the terminal J.G.'s money key is inserted into is exchange, out. entered, a working the information on Instead of va1ue The card special machine at the bank which may and the same with amount static an on-line of the this credit machine, be is one exchange. the inquiry is made at the debit is registered^ that the Wichita Bank provides J a on characteristics. presenting G. device state electronically retains dynamic information balance of its owner, like money card as constrasted it a a sounds that $100 credit and the new money card pops Again the bank makes an appropriate charge PAGE 7 The nice thing about the money card is that it replaces a wallet-full of bills pocket-full and single document that need never be "broken". simply inserts customer's the card with coins of The into a retailer specially a engineered device that he has on the premises and enters the amount of a purchase. amount this If balance electronically recorded on the card, simultaneously with the balance transmit the exchange account terminal of a the purchase is also inside the device, and it is same on via local his bank. money card on-line own retailer credit his to can terminal or the He normally does this at the end A few merchants of the business day. credited is The amount, his the A money card belonging to approved and the balance debited. the retailer than less is take their money cards home with them at night and slip them under their pillows as they fall off to sleep* Notice that the money card differs from the money not only in carrying connection requiring own its to balance, credit the requiring real time communications, a limitation. be noted by discovers the blocked. When the a loss, exchange This advantage money key is misplaced, credit and exchange use of also but as after the loss has been its discovered, not and not is also can owner soon as the key is thereafter the The misplaced or stolen money card, on hand, may be used repeatedly by in loss its key, holder unlawful but only balance on the card at the time of the loss. other the up This to well the property PAGE the money card shares with cash. a its lawful The vendor whether exchange coded such as his birth owner, the vendor. could be made more like It traveler's check by making the the also can card has 8 characteristics of intelligible to date, from learn been credit the reported missing. Whether he would or not depends on where the liability lies If lies with the owner, it the money card is, essentially variable cash, ticket, is after the If, the liability lies with the vendor, been reported, money card like a reusable check, Like real a loss has then the traveler's check, a cannot bounce because of overdrawn funds if c its balance it was produced legitimately and covers the sale, I think the main difficulty with the concept of card, outside of the legal thorns, is not money a problem the of designing the card itself, but rather the related problem of designing the special device that processes the card. device must be simple enough to be within the of small retailers, cost This reaches yet complicated enough to make tampering next to impossible. A device that was credits to the customer's card instead rigged of register to debits, without the benefit of corresponding charges to the retailer's card„ would be a counterfeiting machine unparalleled in the annals of crime. We could go on to discuss ways of safeguarding counterfeiting, but this digression and the notion of important to the has a already money realization of card an been is a in automated against lengthy no way credit PAGE exchange. anything at all If realization, it is our stands own inertia, way the in of 9 its built up over many years of getting used to checks and cash, We can piace the blame with our laws, but they reflect our attitudes, subject to little lag. Attitudes can change quickly, takes is one group to lead the way and make from Let me try to draw an analogy history that is still M.I.T. convened a a All it success of it. some recent very About six the making. in under however, the duress of economic and competitive pressures. a years faculty committee to study the ago, long-range computational requirements of the Institute and recommend future course of action. find near unanimity, but this one was an exception. in faculty a computer large terminals spread committee, during There developed deliberations an overwhelming consensus that very you seldom At a place like M.I.T particularly with system throughout M, I.T„ the needed laboratories, offices, a on-line more or 100 a and classrooms around the Institute. The proposed method for operating the system was called sharing. time processing in It a is fundamental The way. completely define his requirements for does not submit the run to merger on fed to Instead, a the a computer a dispatching batch tape with other serially runs; with the user enters his requirements computer from his terminal. customary from different user run in batch does advance; intermediary and runs the user directly He does not enter them are not he for not absent. to all the at PAGE 10 but develops once, them gradually with the computer's The computer provides with him intermediate detects his errors as he makes them. him over vast programming library a a period of that Although time,, a It help. results makes available to constructed been has and large number of users are active at separate terminals simultaneously, computer the gives each the impression that it is continuously accessible responsive. and immediately between man and machine has This a big payoff contexts/ commercial as well as I kind i relationship of in ntel lectual variety a of , think it is fair to say that the idea of time sharing was considered "far out" by most people as recently as 1959, even in the academic and scientific communities* held a lecture series to celebrate the M In Centennial, T I 1961 we The subject of the series was Management and the Computer of the Future. McCarthy John conclusions of time-shared computer reviewed systems, emphatically for starting work computers, Robert Fano automated library, and spoke enthusiastically, a committee faculty the reasoning the in Licklider J,C„R„ immediately commented on on persuasively, range of future possibilities,, be listening attentively, on argued interactive prospects large number of other a paper a and for an participants and authoritatively on Computer users appeared to but managements in the computer and communication industries were yet to be convinced of the potentialities for a vast new market, PAGE 11 relevant events Since 1961 several Corbato F.J. developed and group his the at taken place, Computation Center have supervisory program called CTSS a M.l.T.'s current computer into converted that time-shared a operation. J.C.R Licklider joined the Advanced Research Projects Agency of the Department of Defense to campaign computers interactive country. And encouraged by Licklider M.I.T. formed Project Machine-Aided Cognition) CTSS and a MAC (Mul with computer multi-access operation, ti Fano was that intended time Project MAC began alias director. as not of Department, Computer, -Access the promise the Defense Robert for throughout and support from the financial substantial Using sharing time and energetically sharing for in the summer of 1963. Today the around M.I.T. and its environs. 35 provision for distributed About half of the terminals There are also graphical input computer-aided engineering response times, no permitted to be active more terminals and computer special some of teletypewriters and the other half are IBM 1050 selectric typewriters. a help the equipment, serves over 100 terminals additional are model with computer, same M.I T„ is 30 once. to facilitate maintain To of with few terminals output and design,, than at a good terminals the Communication are between by voice-grade telephone lines via private established for this purpose. branch exchange The computer is with the Bell System switched network and with which also the was linked Western PAGE 12 Union International Telegraph network, TELEX services are available. so that both TWX Demonstrations of Norway. and Buenos Aires,; Project By next year at this time the number of active MAC terminals may have increased by computer system, now on order, for multi-access operation, by then. Planning for a identical systems system new their for universities, companies, is own Corporation, Carnegie Tech, or California, of the Rand Corporation, Motors, General Electric, Wes nghouse, of Technology, Dartmouth Newman. College, As you would expect, major are mobilizing and reorganizing for now Development Stanford University, Cal Tech, ti other advanced in System University the Many establishments operation in ordered have use. These include; c running cooperative a who research and have time sharing systems stages of construct on expressly designed that was should be installed and the A new factor of five. venture with Bell Telephone Laboratories four MAC the computer have been held at terminals in California, Great Britain, and and Beranek, Bolt, & manufacturers computer the Institute Case IBM, General blossoming market they now see ahead The story is far from over, could still turn out to short-lived dream, nothing be But that computation Interactive more than possibility is a infinitely remote to those of us who have been working regularly terminal,, I could no old-style computation than more I conceive could imagine of lovely, at returning trading in a to my PAGE 13 telephone for within 10 carrier pigeon. a years from the time began in earnest, My guess is that interactive wi using sharing time on computation entrenched as the dominant mode of research, work that 1 1969, by firmly be 1 computer the in engineering, and education throughout the country. Automatic credit could probably will not because of inertia. It customer, its will come, move in legal barriers however. benefits fast, as retailer, but financial and convenience Its the to just and the to its other economic incentives are too striking to be overlooked by our entrepreneurial society. Within 15 years it may already be challenging checks for sovereignty. Let us speculate on the form the development will Automatic credit bureaus will scope. in has a take. expand increase in number and information They will find that supplying credit limited potentials and that consummating transactions is logical and profitable way to grow. the customer's cooperating take over liability and begin to trade information with banks and other credit operations. networks They will Gradual ly, connect the computers enterprises, and new will and communication memories organizations will of be created to forge the links and provide compatibility, As the system evolves, more companies and begin to appreciate the economic advantages stores of eliminating their receivables and credit activities. Customers will paying monthly bills by Touch-Tone, mightily the consequent reduction in and check writing will be enjoying and book PAGE 1U They will be using separate balancing. each bill, plus another for will welcome the opportunity to general -purpose card that pays credit exchange. money key. It the customer bank their trade dialing cards for account. and they itemized the This card will be an early eventually be the same will carries to identify credit when he goes shoppingo for one bill of the form of the these in instrument himself that establish and The customer will applaud its replacing the onerous packet of credit cards he totes around today. By now the credit exchange will be feeling the need for greater liquidity* Since the customer key with him at all times, is carrying his money the credit exchange can encourage him to pay for his purchases as he makes them by offering an instant discount,, It future consummation date for can also to specify transaction the of proportionate reduction in discount has remarked, him permit Putnam As at a a Livingston the time value of money is certain to attract greater attention as automatic credit systems bloom. On the other side of the requesting the automatic assignment accounts in the credit exchange. network at a With high state of development, will salaries of little reason to mail out pay checks. shift, employees ledger, the network. communication companies wi credits distributed to the proper accounts like messages 1 1 have nighttime During the Payroll their to their computer systems will feed the payroll into the information be directly will through be a PAGE 15 message switching center. eliminated their receivables, employees frequently, Since they perhaps companies will even daily, This will make it easier for service. themselves discounts instant of Ultimately, companies will send wage as rates it avail purchases. credit the to only on an basis and not regularly; for example, when an special to making pay to a employees when exchange, and then communicate with able be have will exception employee is promoted. Thus the flows of money into and out of the of economy our will tend become to units more smoother, continuous/ and more synchronized with the physical flows of goods and services and the productive rise to them. Float will vanish and of the economy will In change the from give that fluctuations cyclical be dampened. ultimate a processes automated movement transfer of information. of system, documents Bank accounts of money to flow will electronic an individuals and corporations will become electronic records containing data on future earnings, to facilitate credit ratings and payroll processing, as as well data on past accumul at ions, Frequent statements will be transmitted to subscribers with detailed listings of transactions, transactions will be A complete historical maintained audits and error checks, The in file of all electronic electronic records form wi 1 for 1 be conveniently accessible to persons with the authority to see them, and inaccessible to others. PAGE 16 The fact is that money is basically i nformat on, the banking industry is what Oettinger called it conference: this at a Financial July last Information Banking and finance are very important System". of Fiduciary "A and i components very big information business that includes: education, statistical research/ engineering medical surveys, marketing, diagnosis, management control, communications, security and commodity trading, publishing* libraries, design, traffic control, federal fiscal operations, and numerous other intellectual, political activities,, economic, continuing The rapid and monetary and growth information processing technology is going to have impact on all of these activities,, higher levels of automation, and links major a share to discussed I Atlantic article will provide the necessary data mutual their for The information utility that advantage. of they reach higher and As they will want communication establish and in the interfaces and make cooperation economically attractive,, Early forms of the information utility are various stages of budding. Items: experiments like Project MAC at MIT and researchers future in the sharing educating present power computers, and are pushing forward the state (2) the bringing extending KEYDATA time it from System of sharing the smallest liquor dealer; Charles into largest (3) the in time (1) are already Adams of interactive of art; Associates commercial government the arena agency the QUICKTRAN Service to of is and the IBM PAGE 17 has been given national publicity fu.l-page in advertisements, and this is just the start of at IBM; (k) sharing time the TRADIVAC System is planning to accept match orders to buy and sell securities over from counter newspaper brokers and everywhere,, and electronic an expects to be profitable as soon as volume exceeds 70*000 shares per day; (5) the company-wide computer systems of American Metropolitan to mention just a and Westi nghouse, Life,, are continuing to create competitive pressures; T, brandishing is preparing regulatory for honing and sheath; while (7) remove to another communications industry has been working with few,, A T (6) C multi-edged its government the Airlines, & swords some of the giant in the consulting a firm to test the temperature of the market. If these are pointers indicate for banking? but a and The crystal ball few things seem clear. the Checks,, composed elaborately certificates of indebtedness that gradually wither and disappear. greater certainty, internally stabler. more sophisticated The in money-market activities, level is titles we Float credit and cards* ownership of have clouded, still bills* they do treasured lags and the commercial his money in will economy will become customer will become investment and demand deposit out and possibly turn down. and will Income and expenditure streams flow will also vanisho assume what future* the to behavior balances and will PAGE 18 Some of these prospects sound fines handling and in paper Others seem costs, is dwindling a the structure of change, will rates loans the process of underwriting new issues will change, and indeed the entire nature of banking will change, finance and will My sketch of the future has deliberately left blank change. the identity of the credit utilities, and it exchanges and These are information the about has said very little paying what to whom. will change, operations negotiating for things government regulation interest procedures the But way the services and service charges will change, market will bank for customer,, of Laws are going to change,, change/ operating in base the to judge tomorrow on the basis look today. will ominous; and increased competition from loans, this reduction consequent a sanity return to a who questions, open remain open questions until the participants will be they and begin to take their places on the starting line. In enjoy many ways bankers have a They have industry confidential a relationship good understanding of finance. They and They are international affairs. large volumes of information. the ways of networks, They already running lead. a with whole the accustomed through of American knowledgeable are And they customers, their branch processing to familiar are and in with corespondent banking and membership in the Federal Reserve. Bankers are on carefully a cultivated threshold. reputation In the for past is conservatism their and PAGE 19 deliberation. out In the future is their urgent need claim and pursue a The chairman of Agemian/ it with purpose and foresight. conference year, Charles postulated as the last of his five laws of prudent this last thinking that "those who lean too far into the fall flat on their faces". advice comment. stake to for the reckless The practical computer Yet today we might add a future wisdom enthusiast small codicil: Those who do not bend forward, when moving into a stiff gale, will land on their backs; and those who do not look up to see where they are going/ neither will they see who is ahead of needs will this no