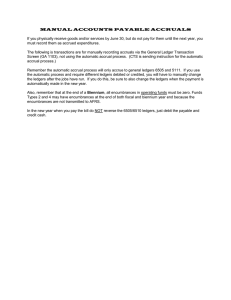

MANUAL ACCOUNTS PAYABLE ACCRUALS

advertisement

MANUAL ACCOUNTS PAYABLE ACCRUALS If you physically receive goods and/or services by June 30, but do not pay for them until the next year, you must record them as accrued expenditures. The following is transactions are for manually recording accruals via the General Ledger Transaction Screen (GA 1103), not using the automatic accrual process. Remember the automatic accrual process will only accrue to general ledgers 6505 and 5111. If you use the automatic process and require different ledgers debited or credited, you will have to manually change the ledgers after the jobs have run. If you do this, be sure to also change the ledgers when the system automatically generates the payment in the new year. Also, remember that all Account 001 encumbrances must be zero at the end of a fiscal year. All other funds may have encumbrances. In the new year when you pay the bill do NOT reverse the 6505/6510 ledgers in Account 001, just debit the payable and credit cash. In other funds reverse GL 6505 to GL 6510 in the new year. MANUAL ACCOUNTS PAYABLE ACCRUALS The following is a list of transaction codes to use for the various types of accounts payable accrued in one year and paid in the next year at the end of the Fiscal Year. FUND TYPE 1 FUND TYPE 1 (Single year appropriations in Fund 001) Outside Vendors Interest Payable 304 Accrual In One Year 300 6505/5111 6505/5112 Construction Contract Pay. 306 Due to Fed. Government Due to Other Governments Due to Other Funds Due to Other St. Agencies Other Accrued Liabilities 420 400 6505/5151 402 6505/5152 404 6505/5153* 407 6505/5154* 6505/5199 305 6505/5117 421 FUND TYPE 1 (Biennial appropriations - Fund 057, 758) Outside Vendors 300 6505/5111 Interest Payable 304 6505/5112 305 Construction Contract Pay. 306 6505/5117 Due to Fed. Government 400 6505/5151 Due to Other Governments 402 6505/5152 Due to Other Funds 404 6505/5153* Due to Other St. Agencies 407 6505/5154* Other Accrued Liabilities 420 6505/5199 421 Payment In Next Year 801R 5111/4310 5112/4310 008 6505/6510 308 5117/4310 008 6505/6510 412 5151/4310 413 5152/4310 406 5153/4310* 409 5154/4310* 5199/4310 008 6505/6510 303 5111/4310 6510/6505 5112/4310 6510/6505 308 5117/4310 6510/6505 401 5151/4310 6510/6505 403 5152/4310 6510/6505 405 5153/4310* 6510/6505 408 5154/4310* 6510/6505 5199/4310 6510/6505 In the new year you need to collect your reimbursement from the treasurer for the above payments but these transaction codes do not report on the Vendor Payment Report (GA 3231). Use the CR 2356 to track all 4310 activity not included on the VPA report. Because this report only shows AFRS transaction codes, use the attached conversion sheet to identify which transaction codes to look for on the CR 2356 report. FUND TYPE 3 Outside Vendors Interest Payable 304 Construction Contract Pay. Due to Fed. Government Due to Other Governments Due to Other Funds Due to Other St. Agencies Other Accrued Liabilities 420 Accrual In One Year 300 6505/5111 6505/5112 306 6505/5117 400 6505/5151 402 6505/5152 404 6505/5153* 407 6505/5154* 6505/5199 305 421 Payment In Next Year 303 5111/1110 6510/6505 5112/1110 6510/6505 308 5117/1110 6510/6505 401 5151/1110 6510/6505 403 5152/1110 6510/6505 406 5153/1110* 6510/6505 409 5154/1110* 6510/6505 5199/1110 6510/6505* *Requires a due to/from indicator in subsidiary field. MANUAL ACCOUNTS PAYABLE ACCRUALS FUND TYPE 2 and 4 Outside Vendors Interest Payable 304 Construction Contract Pay. Due to Fed. Government Due to Other Governments Due to Other Funds Due to Other St. Agencies Other Accrued Liabilities 420 Accrual In One Year 300 6510/5111 6510/5112 306 6510/5117 400 6510/5151 402 6510/5152 404 6510/5153* 407 6510/5154* 6510/5199 305 421 Payment In Next Year 303 5111/1110 5112/1110 308 5117/1110 401 5151/1110 403 5152/1110 406 5153/1110* 409 5154/1110* 5199/1110 * Requires a due to/from indicator in subsidiary field. Note the accruals use GL 6510 not 6505 and therefore you need no reversal of 6505 to 6510 in the new year. Following are a couple of suggested methods of tracking payables at year end. 1. As you receive the invoices, put the appropriate documents together and accumulate in one spot. Periodically—say once a week—one person sorts them by account code structure. They then prepare a GAT form to record the accrual in month 99. At the same time changing the transaction code on the payment document to generate the reversal of the accrual when the check is produce in JULY of the new year. 2. As you receive the invoices, put the appropriate documents together and give to one person. They then change the transaction code on the payment document immediately, writing on the document the general ledgers generated, and making a copy of the document. Save these copies in a central place. This way you write the check to pay the invoice immediately in JULY of the new year. Then, before the end of month 99, sort the copies of the paid documents by account code structure and prepare a GAT to record the accrual.