Dealing with Dutch Food Retail….. Commercial insights and which pitfalls to avoid

advertisement

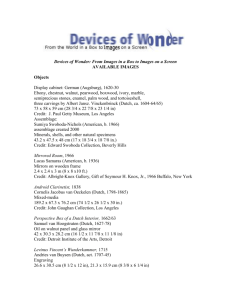

Dealing with Dutch Food Retail….. Commercial insights and which pitfalls to avoid Board Bia Head Office, Clanwilliam Court, Lower Mount Street, Dublin 2 22 April 2009 Pim Haasdijk, Green Seed The Netherlands Table of contents • • • • • • The Dutch Retail Scene…..a brief overview Who are the main players?....brief account profiles Entering the Dutch market Ø Setting the Scène Ø Strategy Ø (Launch) Preparation Ø (Trade) Introduction Ø Launch How do we work? The Daniels Group case Summary: The 9 key drivers for successful exports Welcome to the world of The Green Seed Story Our story began providing help exclusively for British food & drink companies, as the ‘Food From Britain International Network’. Since we started business in 1984, we have assisted over a thousand of clients growing brands and selling products internationally. Today the ‘Green Seed Group’ services food and drink companies from around the world. We are a unique network of 12 privately-held sales & marketing consultancies covering 19 countries across Europe, North America and Australia. The Green Seed concept Through our specialist international food and drink expertise we create value for our client’s brands and products. Harvest Grow Incubate Seed We help business to grow, from the seed to the fruit offering growth strategies for each phase of the product life-cycle The Dutch retail scene Developments in Dutch retail Internationalisation Increasing concentration Development Own labels Innovation → UK Fascia as brand Own label is gaining share in many main product groups Private label value share per supergroup Food open markets 29.1 30.3 Totaal Gemeten Groepen (1.2%) 20.6 21.4 Houdbaar (0.8%) 16.2 16.5 Dranken Houdbaar (0.3%) 21.7 23.6 Kruidenierswaren (2%) 27.3 27.6 27.8 28.8 Zoetwaren & Snacks (0.3%) Diepvries (1.1%) 49.1 51.7 Vers (vast gewicht) (2.5%) 23.6 23.7 Drogmetica (0.1%) 5.9 6.3 Personal Care (0.4%) 42.2 42.2 Papier (0%) 20.2 20.6 Home Care (0.4%) Tabak (-0.4%) ( ) = % growth vs. PY Source: AC Nielsen 2008 1.1 0.7 2007 2008 Own label developments OL share rapidly increasing • • • Stronger need for retailers to position store format Development of premium own labels Desire of retailers to decrease power of A-brand suppliers Characteristics of Dutch supermarkets Average selling space of 750 m2 – Small assortments (1 facing → high order frequency) – Listing means de-listing – Small outer cases – Just in time (JIT) logistics – Short order lead time - The total supermarket turnover was € 30 bln 4,800 supermarkets Average turnover of € 7,928 per m2 Retail margins No listing fees VAT rate on food products is 6% 19% VAT on non-food and high alcoholic drinks Formula 1 (other supermarkets) Formula 2 (Albert Heijn) (RSP-VAT) – buying price = profit margin (RSP-VAT) – buying price = profit margin Profit margin / (RSP-VAT) = profit margin in % Profit margin / RSP = profit margin in % Market shares within Retail Market Share within Total Food Retail NL 2008 Aldi 9% Lidl 5% Other 5% Albert Heijn 30% Super de Boer 7% C1000 13% Super Unie 31% Source: AC Nielsen 2008 Who are the main players? 100% subsidiary of Ahold Euro 7,48 billion (+ 7,9%, 2007) 30.0 % market share (2008), Market Leader / innovator Growth Success: Market leader in size and innovation. Strong focus on OL development à increasing OL segmentation with focus in Premium 753 stores (2008), 200 franchise 2006: + 23 Konmar stores 2008: + 56 C1000 stores -> market share > 30% Multi format : Albert Heijn (686), AH XL (27), AH to go (40) Positioning Make everyday grocery affordable and the special available Up-market full service supermarket Middle of the market -> improved price image Pricing is at / slightly above average Strong focus on fresh products Wide and deep Assortment (12.000 sku’s) Customer profile - High education scale - 1 + 2-persons HH, focus more on young families with children - Welfare class A and/or B Suppliers strategy - Low & High involvement = Buying & Merchandising - Euroshopper = international => via AMS - Exclusive suppliership for OL Centralized Logistics - (Nieuwegein, chilled and slow movers; Geldermalsen, slow movers; Pijnacker, Tilburg, Zaandam, Zwolle, fresh products; Culemborg, cheese) - VVM (today for tomorrow) 30.7% market share - Plus 6.1 % - Jumbo 5,0% - Koopcom 4.4 % Boni-Markten, Boon, Co-op, Deen, Dekamarkt, Jumbo, Em-Té, Golff, Hoogvliet, Jan Linders, Nettorama, Poiesz, Sanders Supermarkten, Sligro, Spar, Sperwer (Plus), Vomar Voordeelmarkt Number of Stores 1910: - Plus 278 (++) - Jumbo 117 (+) - Sligro 200 retail stores (Golff, Meermarkt + EM-TE) and 50 cash & carry) - Koopcom 90 stores Central buying organisation 2007 : 15 members July 2008 : new member Koopcom (Drik v/d Broek bedrijven, +4,4 %, 90 stores) National and Regional multiples Multiples regionally very strong Positioning - Full service supermarkets + discount - Every member has its own characteristics Logistics - Through warehouses for dry-grocery, frozen and chilled foods - Central depots or per member Euro 4,09 billion 13.2% market share (2008) 2008 : AHOLD sold all 73% shares => got 56 C1000 stores 2008: CVC capital partners 443 stores (2007) -> 387 (2008) = 90% Independent entrepreneurs (franchise) Mission; help the customer save money, time and troubles during the daily shopping in a pleasant way Market follower Full service supermarket Wide and undeep assortment -> more upgrading : quality & fresh & innovation -> increasing focus on OL Customer profile - families with children -> also more focus 1 + 2 pers. HH - social class C and D Logistics Decentralised → 5 depots (Gieten, Raalte, Breda, Woerden, Eindhoven) Central chilled distribution center Euro 2,08 billion 2008: Laurus -> Super de Boer N.V. 2008: Casino increased their share to a total of 63,3% 2006: Laurus sold off - Konmar stores to Albert Heijn (29) and Jumbo (12) - Edah (223) stores to Sperwer (Plus) and Sligro (EMTE and Golff) 6.8% market share Number of stores 305 > 50% franchise Policy “full service to their shoppers” Wide and deep assortment Customer profile - High education scale - 2-pers. HH and families with childeren - Welfare class A and/or B Logistics Beilen, Den Bosch, Veenendaal en Drachten Hard Discount • (2006) 9.6% ->(2007) 8,9% market share • 442 stores • Customer profile: - social class C and D - also “Fun” shoppers • 4. 0% market share • 249 stores • Customer profile: social class C and D • 100% subsidiary of Aldi North, Germany • Positioning as hard discounter • Very small and undeep assortment with many fancy labels (± 800 a 850 SKU’s) • Logistics - 7 depots • Largest discounter network of Europe • Positioning as hard discounter • Small and undeep assortment • “Value for money” strategy • Logistics - 4 depots Entering the Dutch market Entering the Dutch market Setting the scène Dutch vs. UK Retail scene – similarities: • • • • High trade concentration – high buying power Coalition vs. conflict model Severe price competition Focus on Adding Value / Category Growth e.g. no listing fees • Focus on (Premium) Own Label • Sophisticated Logistic infra-structure (Central deliveries, JiT, IT-driven) • Risk avoiding vs. entrepreneurial attitude Entering the Dutch market Setting the scène Dutch vs. UK Retail scene – differences: • • • • Clear retail leader vs. followers More limited resources for Category management Lower price points Relative small outlets à impact on assortments, packaging, logistics • Importance multiples vs. franchise chains (discipline) Entering the Dutch market Setting the scène • • • • • • Very open trading mentality à no mental nor logistic barrier Good (English) language skills Strong focus on UK developments High food retail concentration à 5 players > 90% share Increasing focus on OL (chilled, ambient and frozen) Diversification in OL (price defensive, standard, Premium & Organic) • Clear preference for direct commercial approach • Exclusive supply vs. non-exclusivity • Foreign suppliers to adapt to (IT) systems and procedures Entering the Dutch market Strategy • Internal SWOT-analysis à company’s success drivers • Customer selection + understanding profile • Strategic decision OL vs. brand à resources (human, financial, time path) • In-direct vs. direct à OL per definition direct • Logistic infra structure à adapt to local needs Entering the Dutch market Preparation Just knocking on the door is not enough anymore….so DO YOUR HOMEWORK FIRST à Understanding customer(s) + commercial environment 1. Market share and mentality 2. Fascia concept + positioning à their consumer, multiple vs. franchise 3. Commercial strategy à pricing, assortment, promotional, assortment revision time slots 4. Buying structure + trading conditions 5. Logistics à depot + ordering structures, administration procedures, EDI / GDSN + crate systems 6. Regulations: VAT, Packaging tax costs etc. Entering the Dutch market Preparation DO YOUR HOMEWORK à Understanding local consumer in relation to product concept 1. Brand vs. OL 2. Comprehensive market assessment à – Development of category – Competition à pricing, investments, outer case specs – Available space à assortment, pack design, outer case specs 3. Product concept testing à qualitative / quantative Entering the Dutch market Preparation DO YOUR HOMEWORK à Simulate commercial viability 1. Distribution scenarios vs. account investments 2. Rate of sale projections 3. Pricing / margin strategy 4. Sales forecast yr 1, 2 and 3 Profitability analysis per account Entering the Dutch market Introduction to Trade 1. Initial contacting 2. You did your home work à Dutch market + retailer understanding and UK experience…. but NL ≠ UK 3. You understand THEIR concept , problems & needs 4. Company credentials + product concept 5. Present business case based on assumptions: • Distribution levels • Assortment composition (no. of SKU’s) • Investments (support plan) • Other underlying assumptions e.g. rate of sale, pricing/margin contribution, product ranking vs. competition etc. • Trading conditions (payment terms, overriders) 6. Present Supply Chain incl. ordering structure (lead times, warehousing and data exchange) Entering the Dutch market Introduction While presenting…… 1. Be ambitious but realistic in objectives 2. Discuss openly relation between distribution and investments 3. Focus on your added value 4. Rather than just attacking competition …. 5. Convince preferably based on hard facts While discussion conditions…… 1. Include immediately all conditions / costs….avoid surprises afterwards 2. Keep the lead rather than reacting à defensively Entering the Dutch market Launch 1. Base your critical launch time plan on retailer specific time slots 2. Product administration (GDSN, manual product spec sheets incl. palletization 3. System set-up: • EDI + supply chain à build up direct contacts with logistic managers • GDSN • VAT regulation / packaging tax How do we work? How to go about in exports? Ø Ø Ø Ø Ø Ø Ø Ø Trade & Consumer Insight Opportunity Assessment Trends & Developments Scanner Data (Nielsen) Ø Brand Planning Trade & Consumer Promotion Event Management Public Relations Ø Ø Ø Ø Ø Ø Ø Market Entry Strategy Product Proposition Evaluation Sales & Profitability Projections Partner Search & Introduction Sales Strategy & Planning Broker Selection and Management Channel & Category Planning Key Account Management “We Advise, We Execute & We Deliver” How does the Green Seed Group assist? • An international network giving access to key export markets in Europe, North America and Australia • A consistent approach for our clients across the different markets • Sales and marketing is what we do; is what we are good at • Your commercial international projects: – we will manage it for you, with you – you have a direct relationship with your clients – You score “We Advise, We Execute & We Deliver” A case study from the UK Daniels Group Launch of freshly squeezed juices in leading Dutch department store HEMA followed by….chilled premium cheesecakes to leading Dutch retailer ALBERT HEIJN Who is Daniels Group ? • Makes chilled, fresh, natural foods without compromising on taste • Manufactures in brand & private label for major UK & European retailer & foodservice • currently operates over 7 owned manufacturing sites in the UK • Is committed to growing our Business in Europe both through UK Export & in potential manufacturing acquisition & set-up on the continent • Annual turnover > £ 219 million Daniels Group is committed to developing 5 core categories 1. Chilled Ready Meals 2. Soup 3. Fresh prepared fruit 4. Fresh Drinks 5. Traditional chilled puddings / desserts Brand & OL consumer understanding Development expertise Working with Green Seed offices Daniels has more than doubled the size of our Export business in two years (previously static) £7.500 £8.000 £7.000 £6.000 Development plan with GS Offices £5.000 PLAN £3.825 £3.307 £4.000 PLAN ACT £3.000 £1.830 £2.000 £1,343 £1.000 Sales Revenue £000’s £1.453 ACT. ACT. 2005 2006 ACT £0 2007 2008 2009 2010 Daniels Group Client briefing Department store chain Hema changed 2007 strategy within Food and Beverage, emphasizing more on healthy and fresh concepts. Hema was interested in finding a chilled juice supplier who was able to supply according to these new objectives and targets. Green Seed's response Utilizing its broad manufacturer’s network, GreenSeed The Netherlands introduced Hema to Daniels PLC’s drink division. GreenSeed The Netherlands was asked by Daniels to coordinate the development and launch of a new juices and smoothies range, in line with Dutch consumer preferences and Hema’s new strategy. GreenSeed The Netherlands dealt with the pre-launch preparation, organising factory visits, labelling, logistics and marketing for the launch. The results A range of currently 10 SKU’s were launched successfully at Hema in both Retail and Foodservice (in-house restaurants). New drink line extensions are being prepared to be launched soon. Albert Heijn tray bakes – launched Sept 08 Same Dutch retailer was looking for something new & different in mainstream desserts fixture Key considerations in developing a range of desserts for the Dutch market UK & OTHER EUROPEAN DESSERTS INFLU. AB1 HIGH BASKET SPEND DRAW TO AH, PREMIUM, INNOVATION CLASSIC DUTCH DESSERTS SERVES 2, 4, 6 + TABLE PRESENTABLE THAT FINISHING TOUCH / FEEL INVOLVED DUTCH FAVOURITES STROOP WAFFLE BITTER KOEKJES GRIESMEEL PUDDING VLA CONSUMER DUTCH FRUITS & ING. FAMILIARITY OCCASSION EASTER ’09 SUCCESS / LEARNINGS EVENT HOT THE HOT or COLD COLD FAMILIAR UNKNOWN OR FAMILIAR & APPROACHABLE MAIN FOCUS HISTORIC AS EXP. HOT NEW CATEGORY Albert Heijn Cheesecake – launched Easter into the entire +700 store estate Key rules for successful exports 1. Understand your potential customer and the competitive environment 2. Invest in time and resources 3. Get local advice 4. Go step by step, market by market 5. Invest in sales people, not just linguists 6. International project needs full support from company top management 7. Develop and implement support programmes: get your product off the shelf 8. Have patience! 9. Do your homework properly = Be Committed Thank you! “We Advise, We Execute & We Deliver”