UK Foodservice Trends & Implications for Suppliers

advertisement

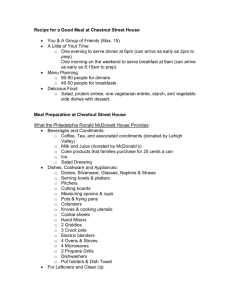

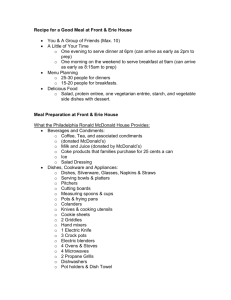

UK Foodservice Trends & Implications for Suppliers Remember…. UK accounts for 43% of Irish food & drink exports in 2009 Economic Overview Gross Domestic Product Average Earnings UK GDP declined by 5.2% in Q3 09 vs. YA Growth rates in average earnings, excluding bonuses, has dropped to 1.9% (JJA 09) Unemployment rate rose to 7.9% (JJA 09) Unemployment Rate Inflation Consumer Confidence Consumer Price Index dropped to 1.1% in September 09, which is below the target inflation growth rate of 2.0% Consumer confidence index improved from -16 in August 09 to -10 in September 09 Total OOH Sales declined sourcing to a decline in Traffic SALES -2.5% YE Sep 08: £46.4 Billion YE Sep 09: £45.3 Billion TRAFFIC -2.8% YE Sep 08: 12.5 Billion YE Sep 09: 12.1 Billion AVE IND SPEND +0.3% YE Sep 08: £3.72 YE Sep 09: £3.73 Av. Number of Items +2.6% Price/Item -2.2% Total OOH: Components of Spending- YE Sep 09 vs YA QSR gained Traffic share whereas the Workplace and Travel & Leisure lost share 1.7 6.1 6.1 1.6 6 6.1 7.4 7.2 14.2 13.7 22.2 21.7 42.4 43.8 YE Sep 08 YE Sep 09 Commercial Vending College/Uni Pubs FSR inc Cafe Travel & Leisure Workplace QSR Traffic Distribution by channel Domino‘s, Mc‘Donalds & KFC the winners in downturn Components of Sale – YE Sep 09 vs. YA Total QSR Sales +11.0% Sales +1.5% Traffic +0.4% Ind Spend +1.2% Traffic +6.7% Ind Spend +4.1% Sales +9.6% Traffic -2.0% Ind Spend +11.8% Sales +10.7% Traffic +5.0% Ind Spend +5.4% Total Sales +3.9% Sales -0.2% Traffic -2.6% Ind Spend +2.5% Traffic +4.3% Ind Spend -0.5% Sales +11.2% Sales -2.0% Traffic +2.4% Ind Spend -4.3% Traffic +7.2% Ind Spend +3.7% Menurama - Price • The average dish price (across all courses) is £6.16, a 4.1% year-on-year increase and a 1.3% increase over the preceding 6 months. This is counterbalanced by a continued increase in the availability of promotional menu meal deals • A 3 course restaurant meal (without alcohol) = £19.93 – 33.7% more than it would for a pub meal (£14.91) • Between July‘08-’09 the average pub starter price in – Pubs 10.6% – Restaurants 2.2% increase – Hotels 9% increase Average Dish Price – All Channels All figures are in £ except percentages Jul ‘05 Jan ‘06 Jul ‘06 Jan ‘07 Jul ‘07 Jan ‘08 Jul ‘08 Jan ‘09 Jul ‘09 Percentage Change Over Past Year Starter 4.03 4.08 4.27 4.72 4.82 4.74 4.70 4.88 5.24 11.5% Main Course 7.70 7.86 7.93 8.28 8.49 8.59 8.73 8.86 8.95 1.5% Dessert 3.43 3.45 3.55 3.75 3.81 3.89 3.97 4.05 4.48 9.8% Snack 3.91 3.90 4.16 4.17 4.29 4.33 4.32 4.52 4.58 3.7% Average Total Menu 5.41 5.45 5.72 5.79 5.93 5.91 5.92 6.08 6.16 2.4% Note: Data includes all food category types (snacks, side orders, specials, children's meals, main course, desserts etc) but not drinks Menurama – Menu Structure • Main course breakdown: • Main course (excl burgers and pizzas) chicken breast is most popular followed by fish & chips, rump steak, combination dishes and sausages & mash • Seafood : Salmon, Prawn, Tuna, Scampi & Haddock • Fewer changes in range and price to children’s menus compared with adult menus • Desserts: ice cream, cheesecake, sundae, brownie & chocolate cake • Weight decreases are especially evident amongst fillet, rump & sirloin steaks over the past year 1. Meat 2. Poultry 3. Fish/Seafood Menu Structure cont • Cuisine type: 1. ‘Generic’ 2. British / American - pubs & hotels 3. Italian & American - restaurants • The frequency of dishes marked as containing nuts, wheat or gluten free are considerably lower than those marked as suitable for vegetarians both as a true reflection of dish properties but also due to the relative newness of these concepts in the dining arena OPPORTUNITY Promotional Activity • Continuation of heavy brand promotion amongst the large chain operators such as Wetherspoon, TRG, Pizza Express etc http://www.toptable.com/en-gb/venues/offers/?l=7 • But where will this madness end??? Innovation • Menu innovation is still alive and well - 45.2% of Menurama dishes were new • Imaginative new dishes include Scream’s Quorn & Chianti lasagne, Old Orleans’ Catfish bites and Chef & Brewer’s Shropshire Blue And Quince Tart • Other forms of innovation….packaging, presentation etc OPPORTUNITY Back to the drawing board There are opportunities – you just have to have the right proposition Top 20 Main Courses 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Back Beefburger / Cheeseburger Pizza Chicken Breast Fish & Chips Rump Steak Chicken Burger Combo Sausage & Mash Sirloin Steak Risotto 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. Roast Chicken Sunday Lunch Beef Lasagne Platter Rib Eye Steak Chicken Pasta Steak & Ale Pie Scampi & Chips Tomato Pasta Pork Ribs New Dishes: By Course 100% 90% 80% Main Course Side Order 70% Dessert Starter 60% Snack Light Meal 50% Children's Meal (All courses) Meal Deal (Adults) 40% Breakfast Sharing Dish 30% Meal Deal (Children) Nibbles 20% 10% 0% New Dishes Existing Dishes New Dishes: By Outlet Type 100% 90% Pub Restaurant 80% Hotel Restaurant Bar Restaurant 70% Pasta House Restaurant & Bar 60% Budget Hotel Pizza Restaurant 50% American Diner Bar & Grill 40% Café Bar Fish Restaurant 30% Road House Tapas Bar Steakhouse 20% Other 10% 0% New Dishes Other = Irish Bar, Vodka Bar, In-Store Restaurant, Noodle Bar Existing Dishes New Main Course Dishes By Protein: Red & White Meat 100% 90% Beef 80% Fish & Seafood Chicken Pork 70% Lamb Unspecified 60% Ham Bacon 50% Mixed Duck 40% Gammon Veal 30% Chorizo Pancetta Guineafowl 20% Other = Bison, Ostrich, Pigeon, Pepperoni, Prosciutto, Salami, Turkey, Venison, Wild Boar Other 10% 0% New Dishes Existing Dishes