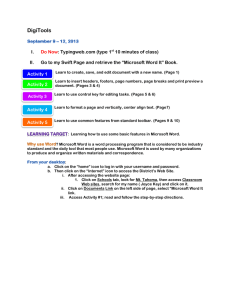

Starting a New Software Business in an ... Wang Yaming By

advertisement